23 August 2022 Afternoon Session Analysis

Euro dipped following bearish economy prospects in Eurozone.

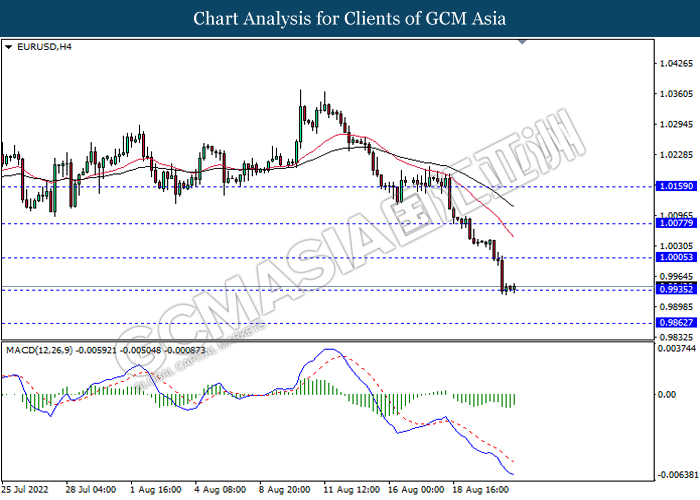

The EUR/USD, which traded by majority of investors slumped on yesterday amid the raising concerns on Eurozone’s economy. According to Reuters, the Bundesbank has given its forecast that the recession in German would likely to increase and the inflation would continue to climb and reach more than 10% in this year, which increased the odds of stagflation risk faced by German. Besides, the European Central Bank emphasized that the high uncertainty of gas supply in winter month might add further pressure upon households and companies, indicating that the economic prospects in Eurozone remained stagnant. The pessimistic economy outlook in Eurozone has stoked a shift in sentiment toward other currencies which having better prospects. Meanwhile, Europe faces another disruption of energy supplies due to damage to a pipeline system bringing oil from Kazakhstan through Russia, suppressing the investors’ confident in Europe economic progression. As of writing, EUR/USD edged up by 0.03% to 0.9944.

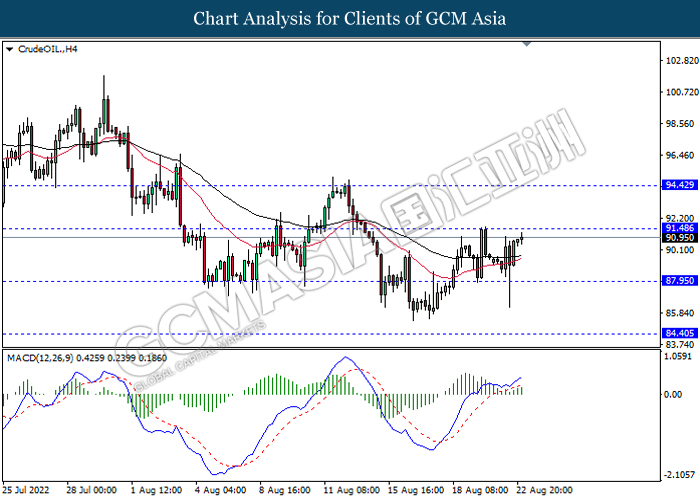

In the commodities market, the crude oil price appreciated by 1.05% to $91.31 per barrel as of writing following the OPEC could diminish oil output in order to adjust recent drop in oil futures. On the other hand, the gold price rose by 0.16% to $1738.15 per troy ounce as of writing. Nonetheless, gold price dropped significantly on yesterday trading session over the appreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Aug) | 49.3 | 48.2 | – |

| 16:30 | GBP – Composite PMI | 52.1 | 51.3 | – |

| 16:30 | GBP – Manufacturing PMI | 52.1 | 51.0 | – |

| 16:30 | GBP – Services PMI | 52.6 | 52.0 | – |

| 22:00 | USD – New Home Sales (Jul) | 590K | 575K | – |

Technical Analysis

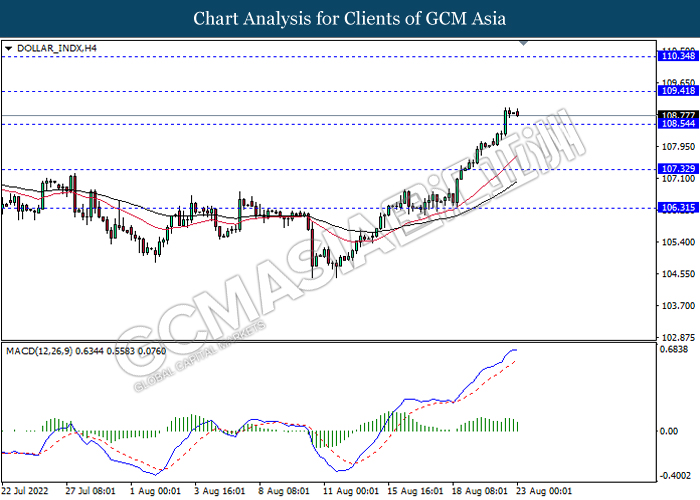

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

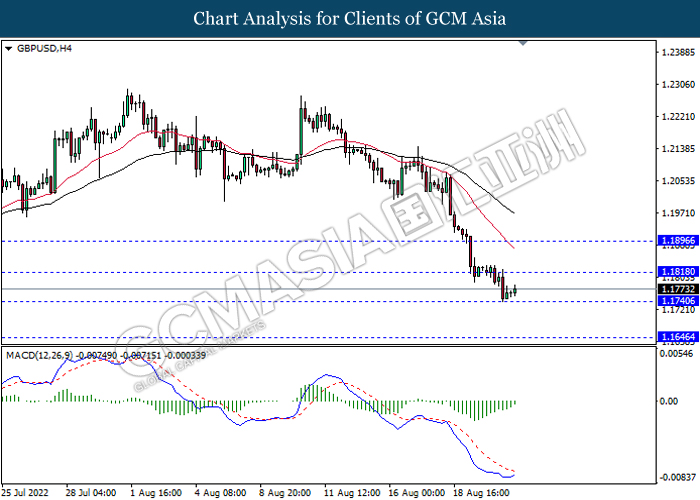

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1820, 1.1895

Support level: 1.1740, 1.1645

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

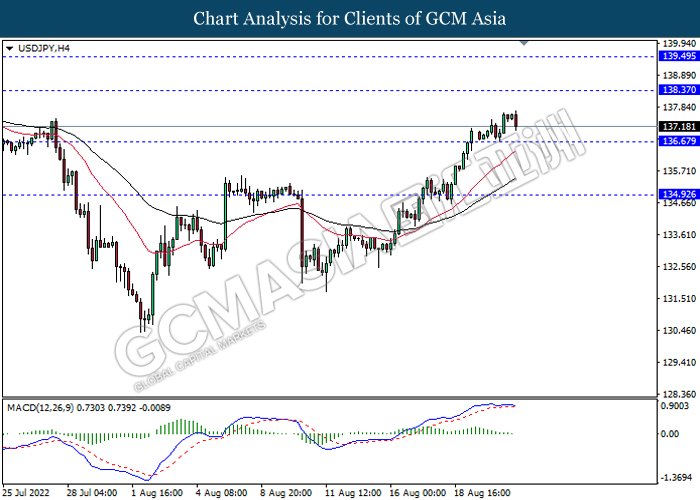

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

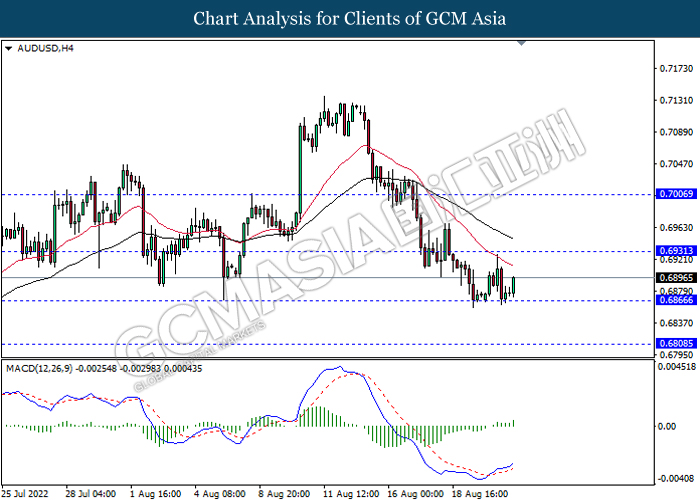

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6810

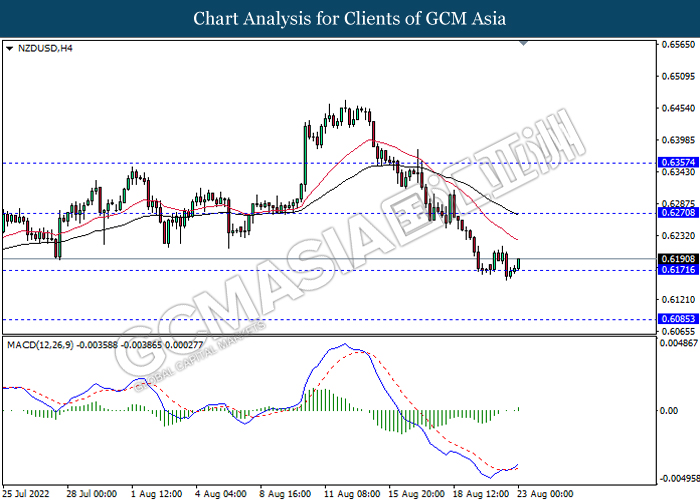

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

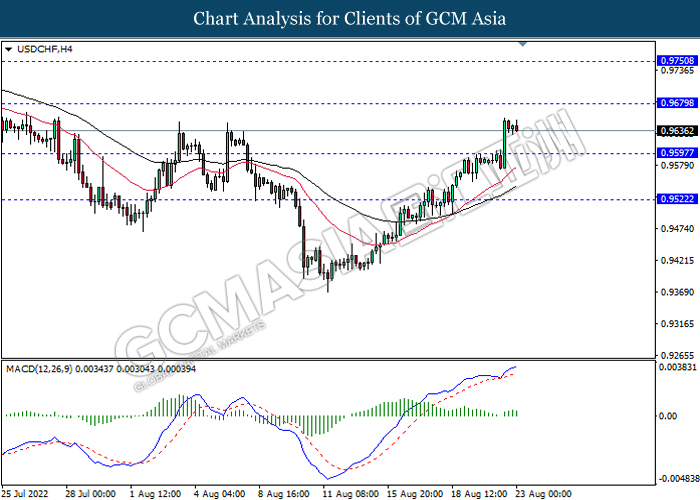

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.40

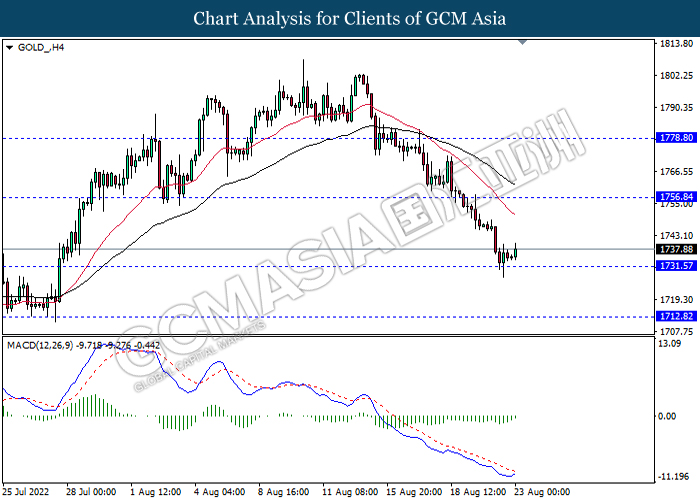

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80