23 August 2022 Morning Session Analysis

Dollar jumped amid the hawkish Fed tone.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its gains yesterday, hitting its highest level in six weeks amid the hawkish comments from the Fed Officials. Over the weekend, Fed’ member Thomas Barkin revealed that the tightening path of the Fed unlikely to change at the moment as their target was to cool down the sky-high inflationary pressures in the US economy. With that, the investors bet on larger rate hike, says 75-basis point, in the September Fed’s meeting, prompting the investors to shift their holdings away from the other currency market toward the dollar market. At this moment, majority of the investors are waiting for the central bank’s key Jackson Hole symposium later this week in order to gauge the further direction of the currency. This is because Jerome Powell is expected to give his long-waited stance on the recent drop in inflation figure as well as the future direction of the monetary policy. As of writing, the dollar index surged 0.73% to 108.95.

In the commodities market, the crude oil price up 0.10% to $91.55 a barrel after Saudi Energy Minister Prince Abdulaziz bin Salman warned that OPEC+ could cut output to deal with challenges. Besides, the gold prices extended its losses by 0.03% to $1735.70 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Aug) | 49.3 | 48.2 | – |

| 16:30 | GBP – Composite PMI | 52.1 | 51.3 | – |

| 16:30 | GBP – Manufacturing PMI | 52.1 | 51.0 | – |

| 16:30 | GBP – Services PMI | 52.6 | 52.0 | – |

| 22:00 | USD – New Home Sales (Jul) | 590K | 575K | – |

Technical Analysis

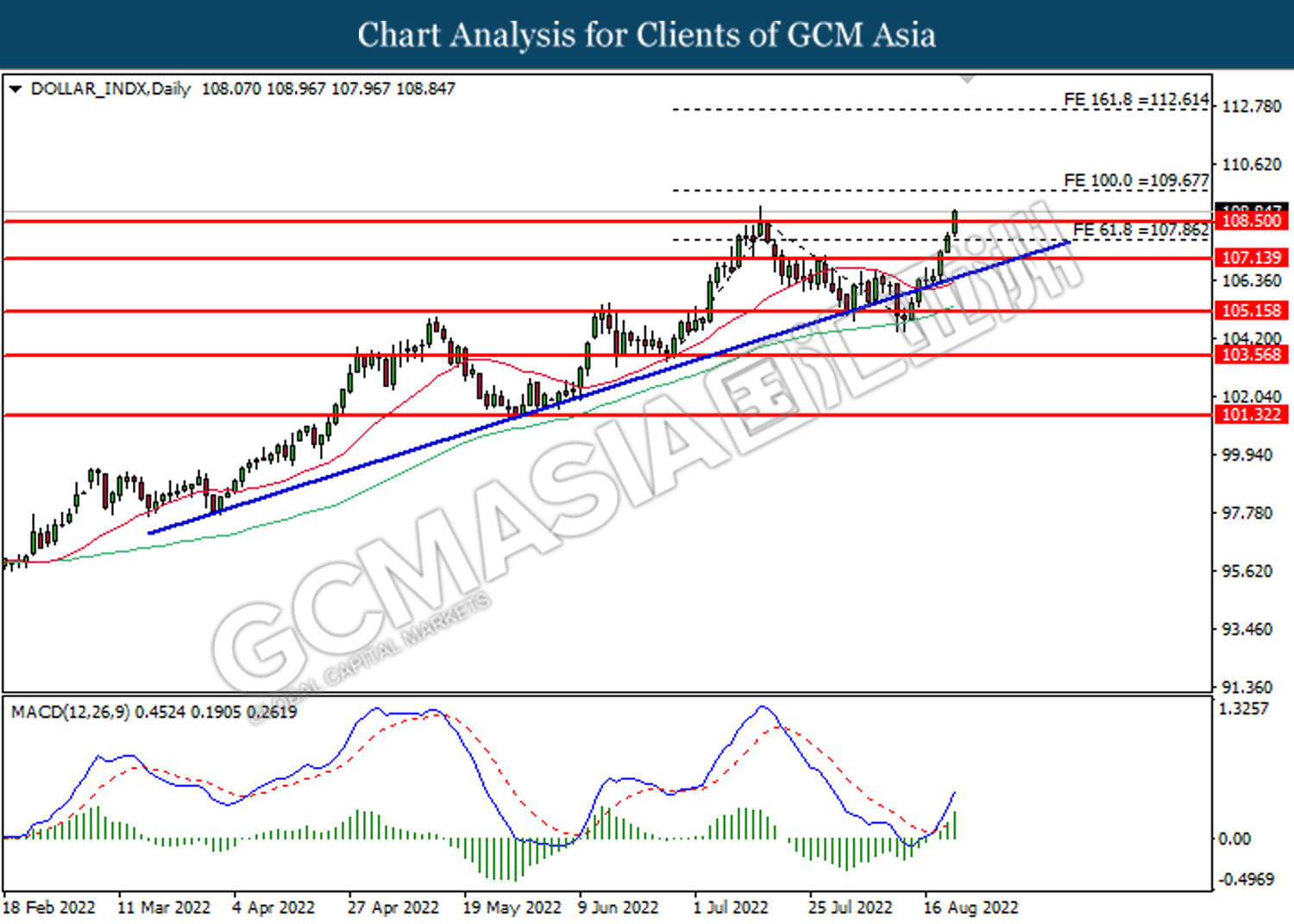

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.50, 109.65

Support level: 107.85, 107.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1800. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

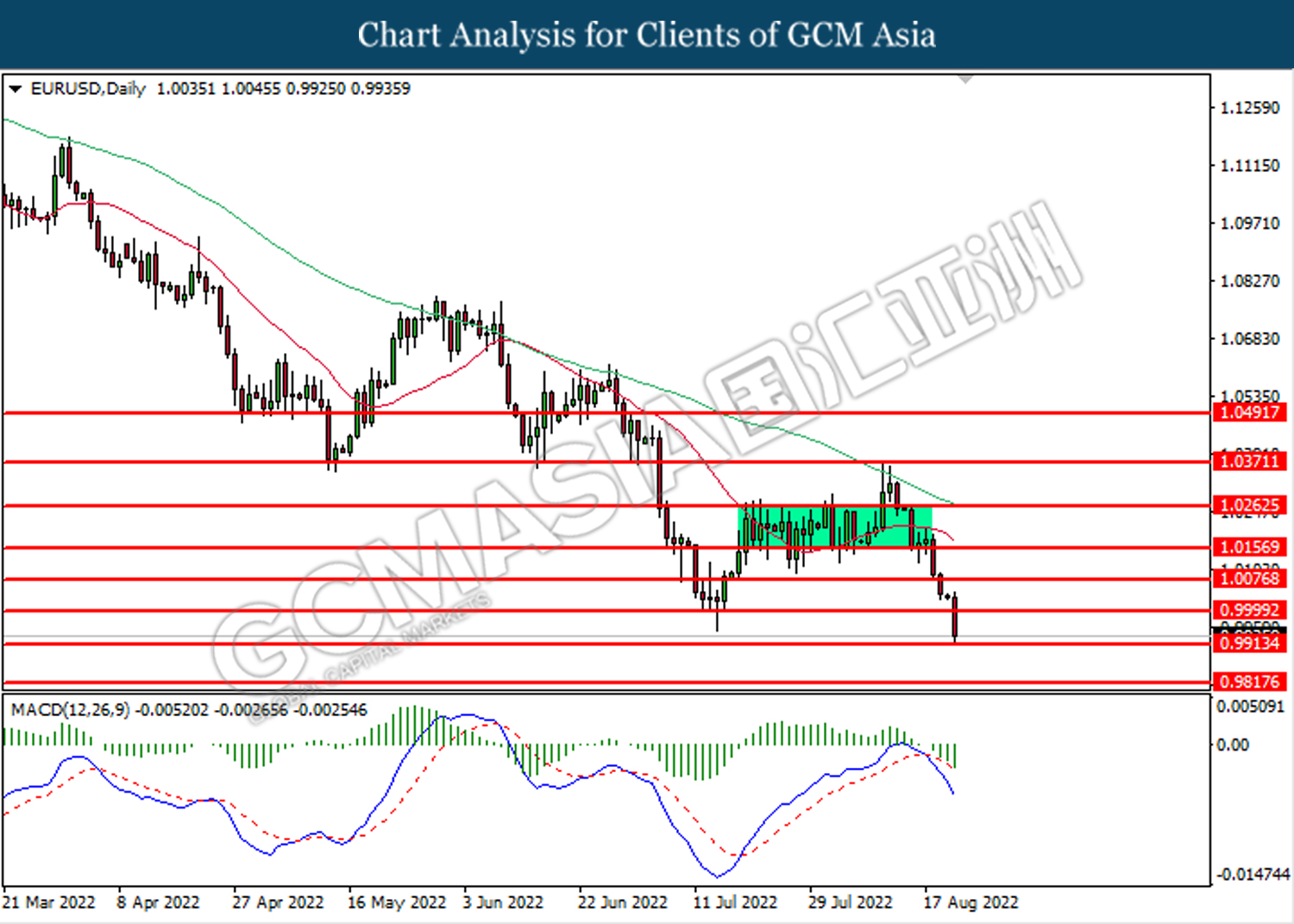

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

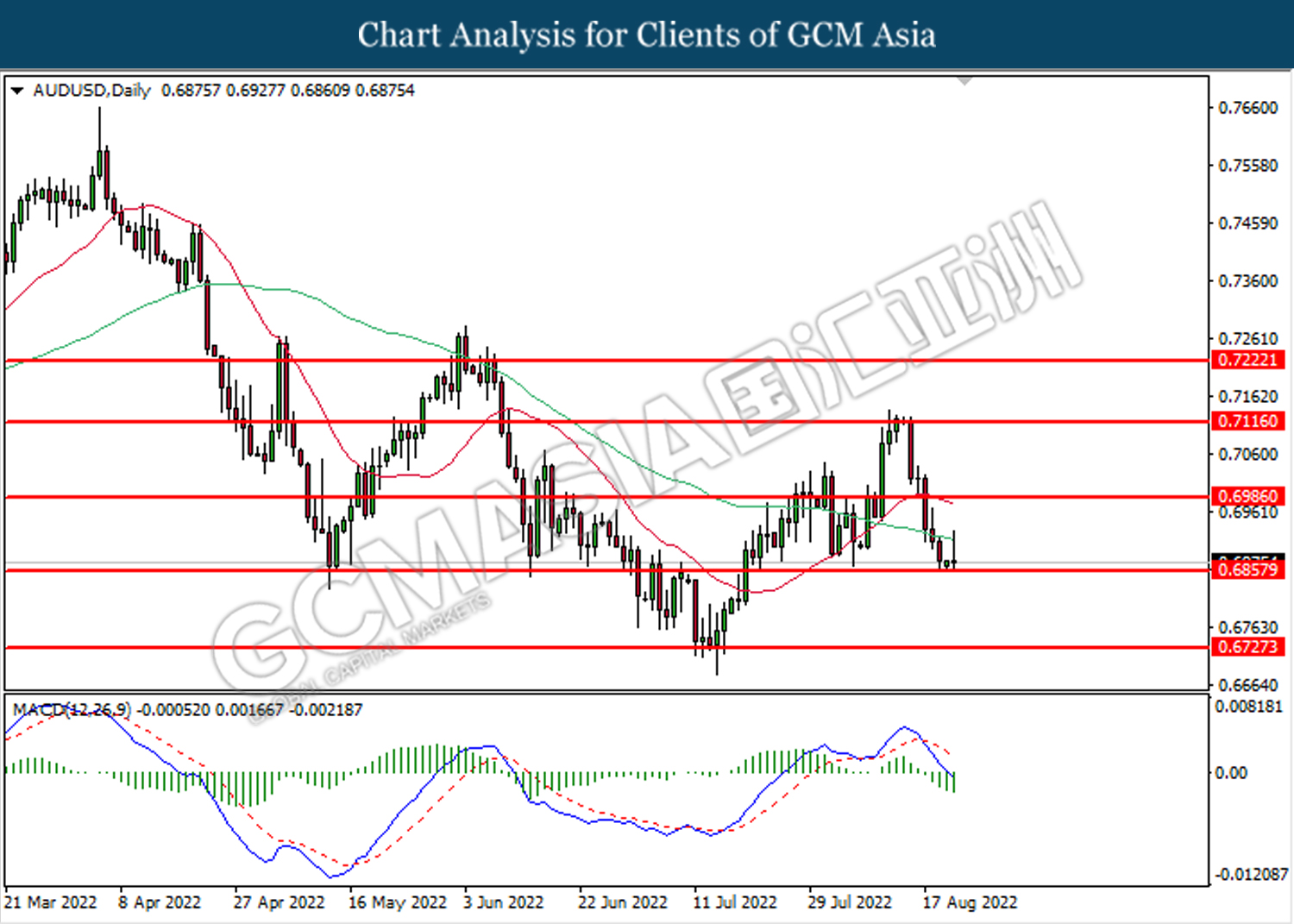

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

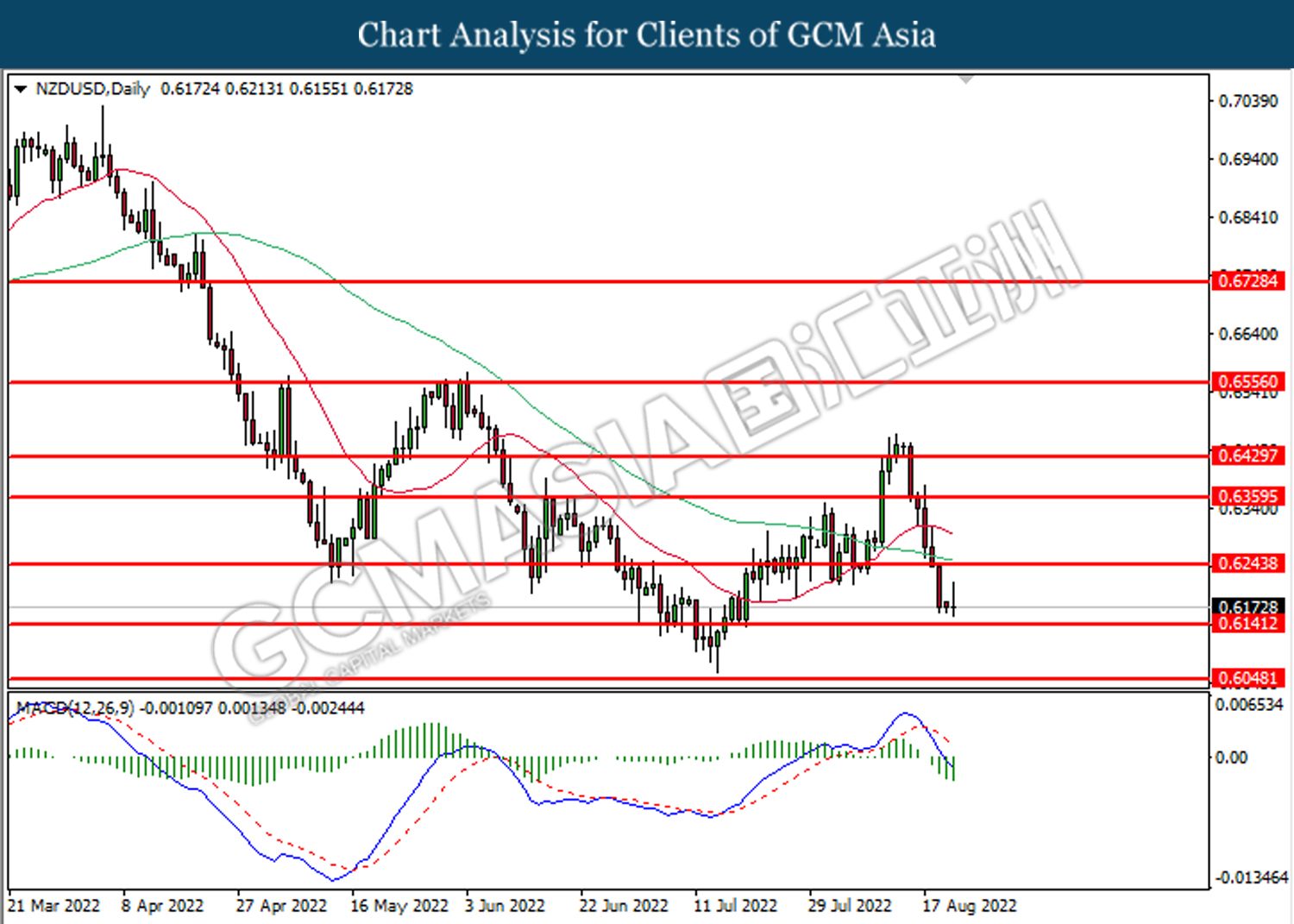

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6245. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6140.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

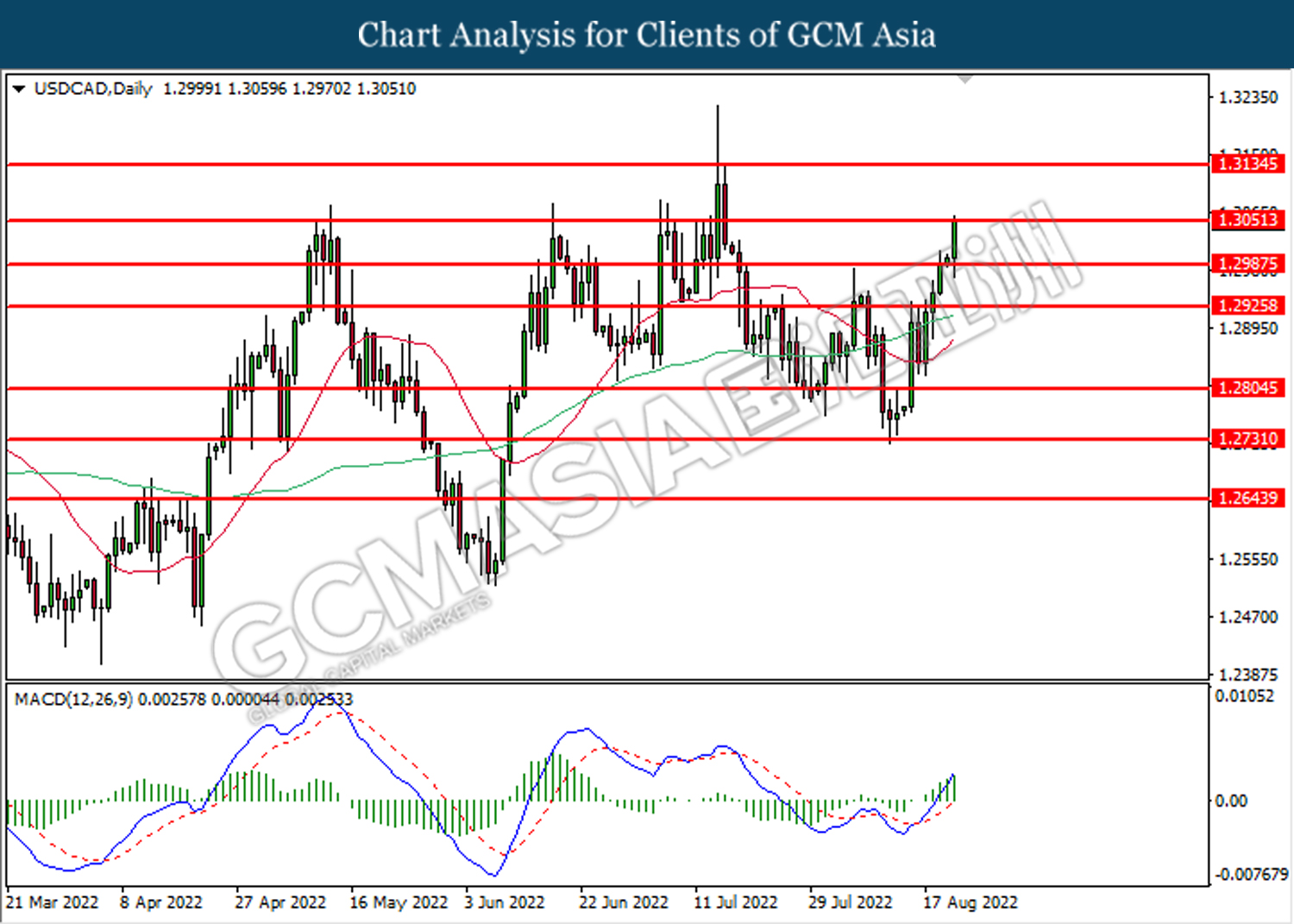

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3050. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

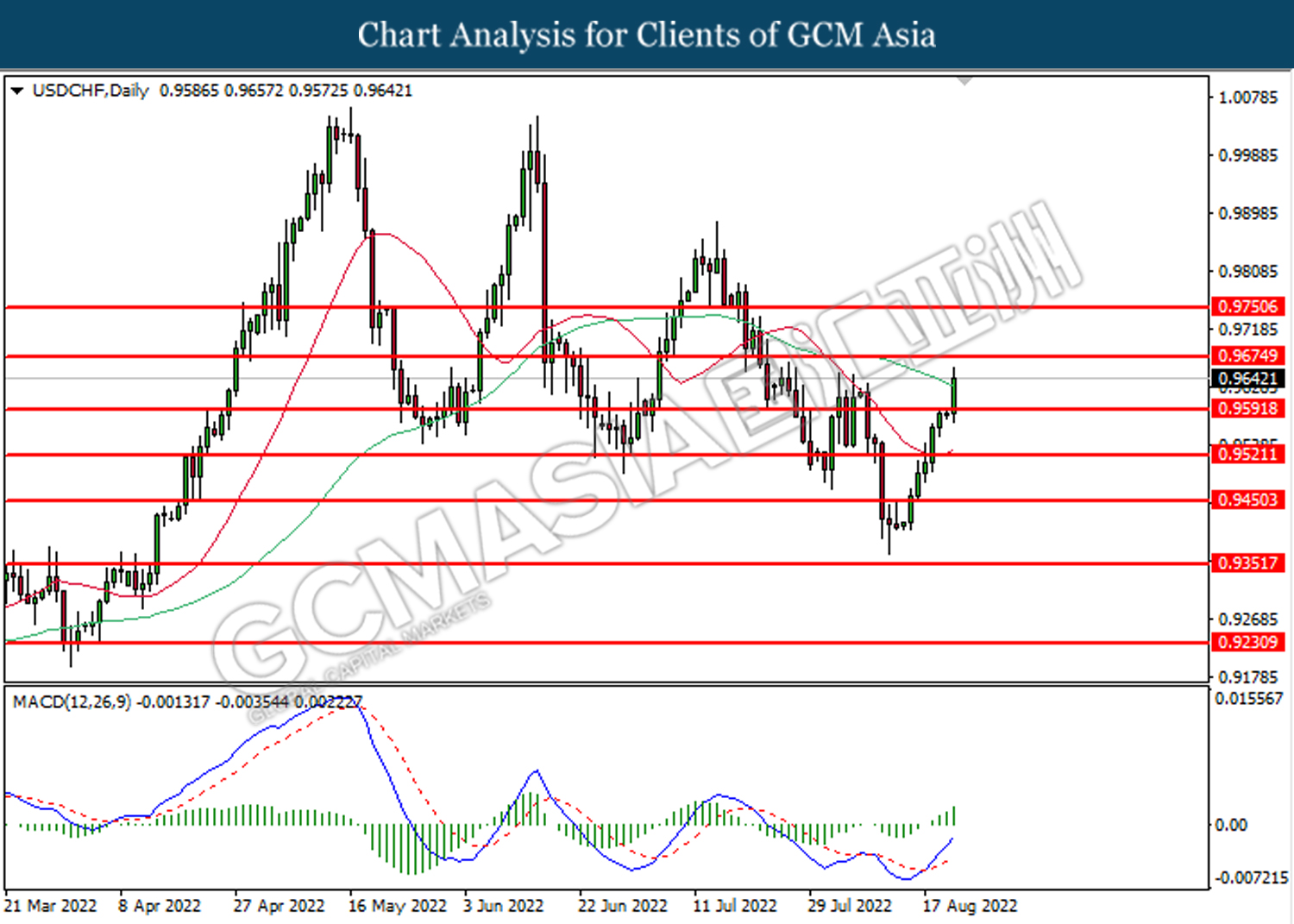

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully close its candle above the resistance level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

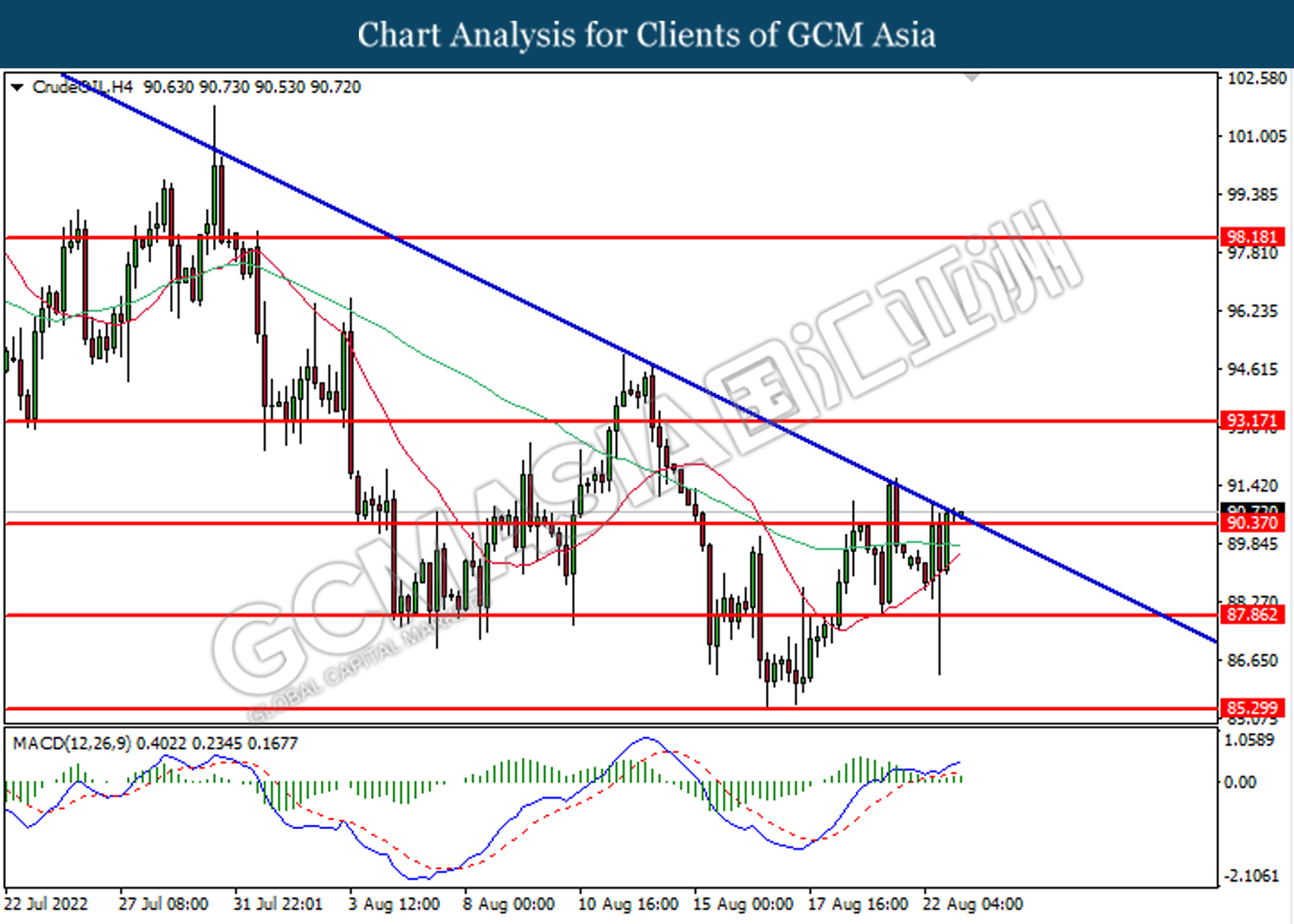

CrudeOIL, H4: Crude oil price was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the downward trendline.

Resistance level: 93.15, 98.20

Support level: 90.35, 87.85

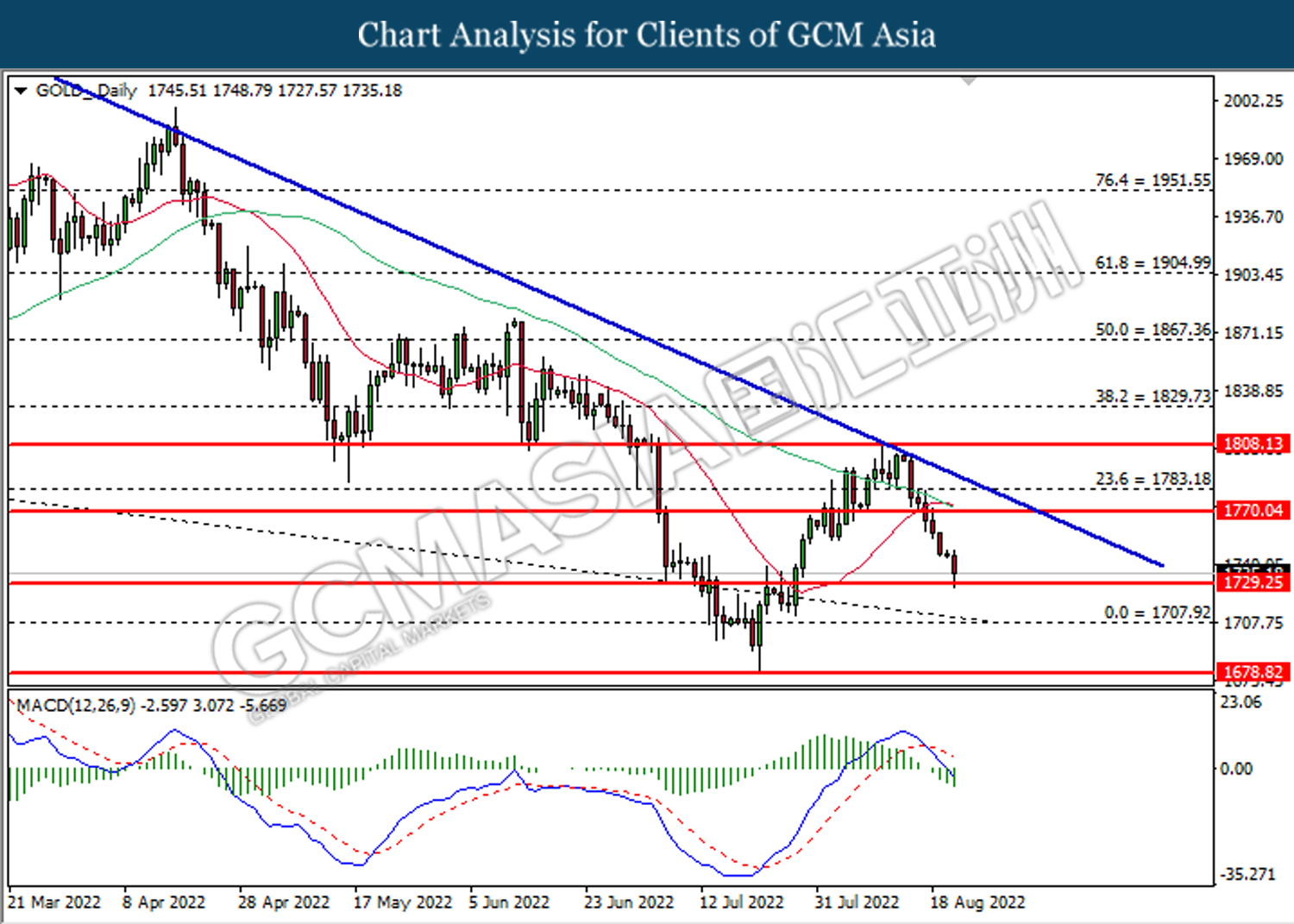

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1729.25. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90