23 September 2022 Afternoon Session Analysis

Yen spiked following Japan intervened the market.

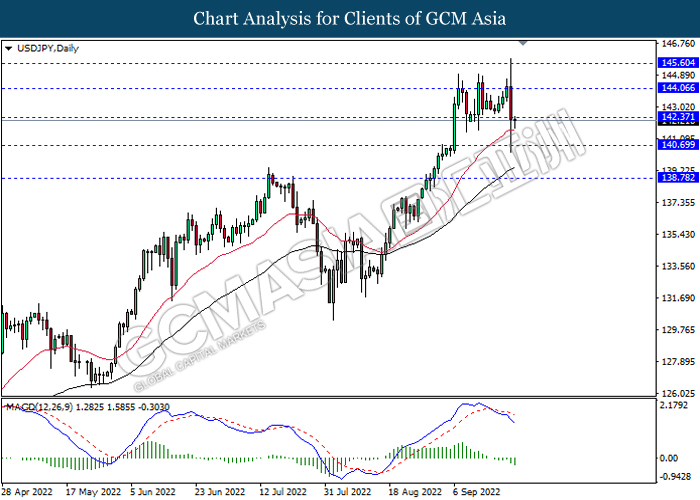

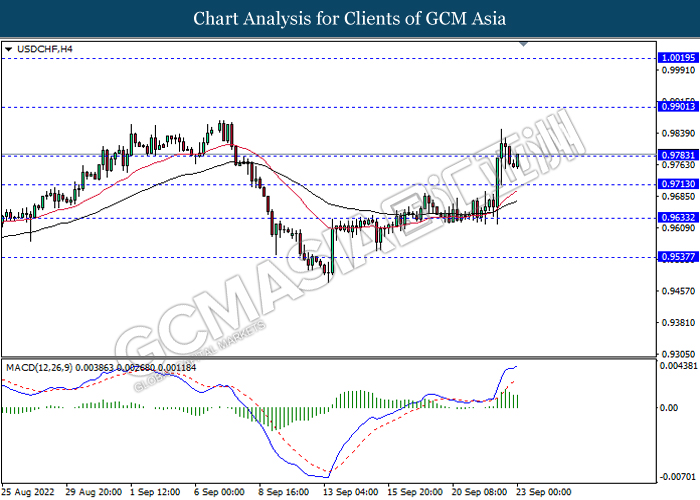

The USD/JPY, which widely traded by majority of investors dived significantly on yesterday amid the intervention of Japan government and central bank. According to Reuters, the Japan government and central bank intervened forex market by buying its nation currency, Yen, in order to support the weakening nation currency. Bank of Japan (BoJ) remained its loosening monetary policy has pressured the value of Yen against US Dollar, which led Japan to intervene the market. Besides that, Prime Minister of Japan Fumio Kishida claimed on yesterday that the government would highly eye on the exchange rate of its currency and they might implement intervention again if necessary. As Japanese currency supported by its government, it prompted investors to shift their capitals toward Yen. On the other hand, the USD/CHF rose on yesterday after the Swiss National Bank (SNB) released its interest rate decision. The SNB hiked its rates by 75 basis point from -0.25% to 0.50%, which meet with the market expectation. As of writing, USD/JPY eased by 0.23% to 142.02 as well as USD/CHF edged up by 0.16% to 0.9783.

In the commodities market, the crude oil price dropped by 0.37% to $83.18 per barrel as of writing over the backdrop of economic recession which driven by rate hike. In addition, the gold price depreciated by 0.11% to $1671.02 per troy ounce as of writing following the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Public Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Sep) | 49.4 | 48.3 | – |

| 16:30 | GBP – Composite PMI | 49.6 | 49.0 | – |

| 16:30 | GBP – Manufacturing PMI | 47.3 | 47.5 | – |

| 16:30 | GBP – Services PMI | 50.9 | 50.0 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | 0.8% | -1.2% | – |

Technical Analysis

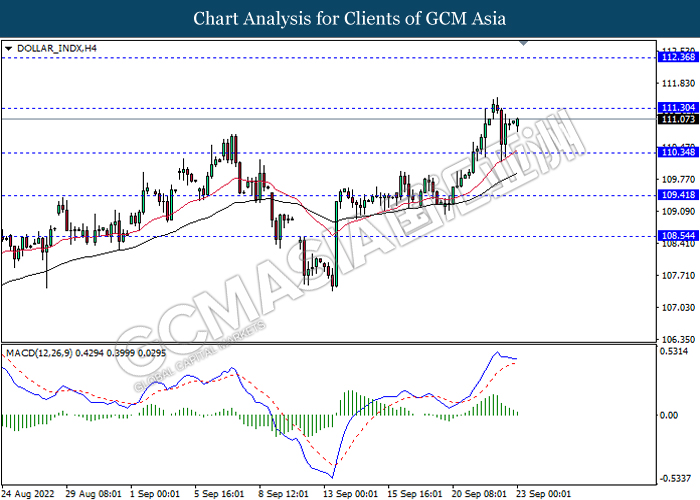

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 111.30, 112.35

Support level: 110.35, 109.40

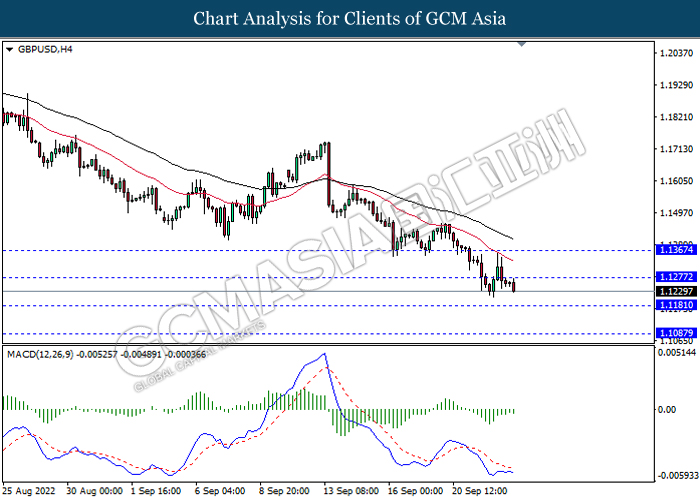

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1275, 1.1365

Support level: 1.1180, 1.1085

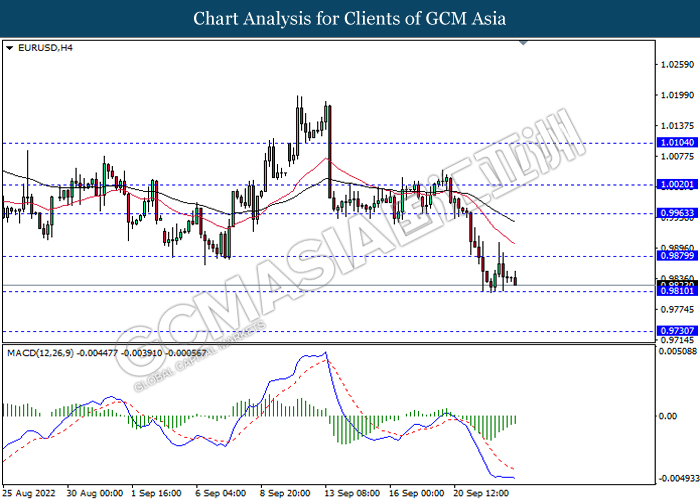

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9880, 0.9965

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 142.35, 144.05

Support level: 140.70, 138.80

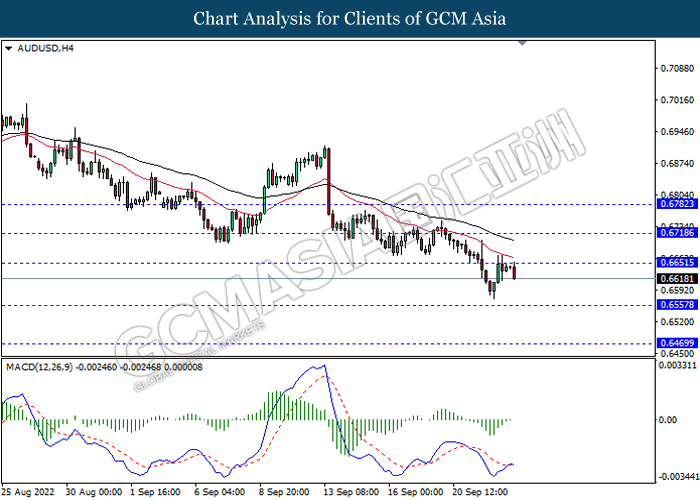

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6650, 0.6720

Support level: 0.6555, 0.6470

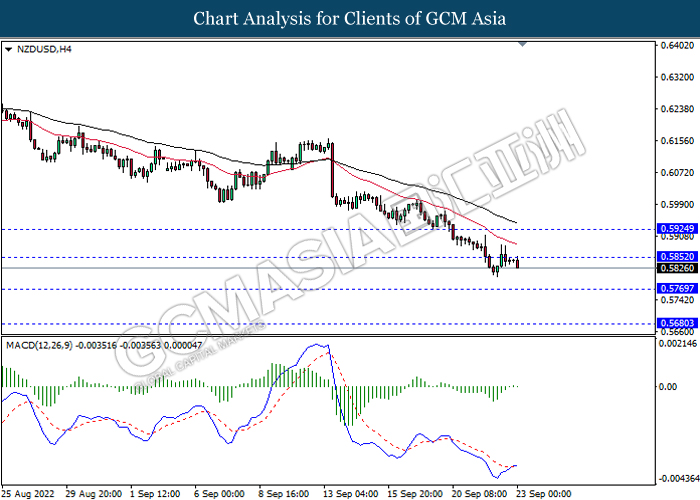

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.5850, 0.5925

Support level: 0.5770, 0.5680

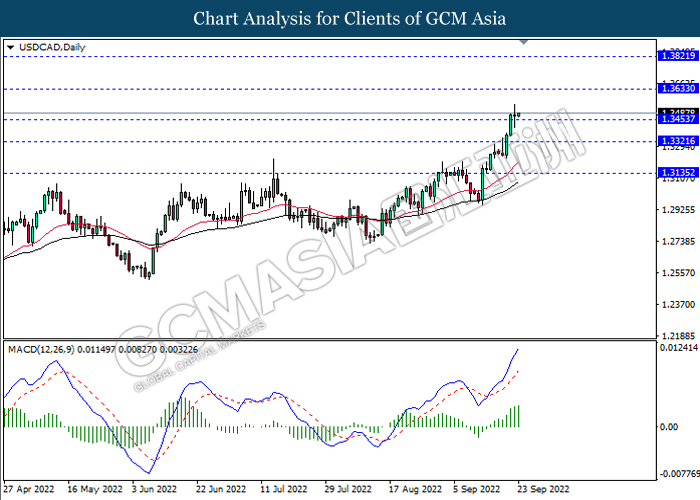

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 1.0020

Support level: 0.9785, 0.9715

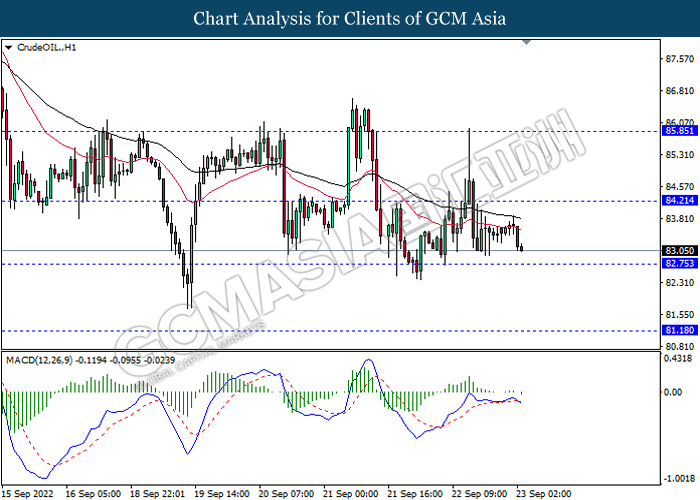

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 84.20, 85.85

Support level: 82.75, 81.20

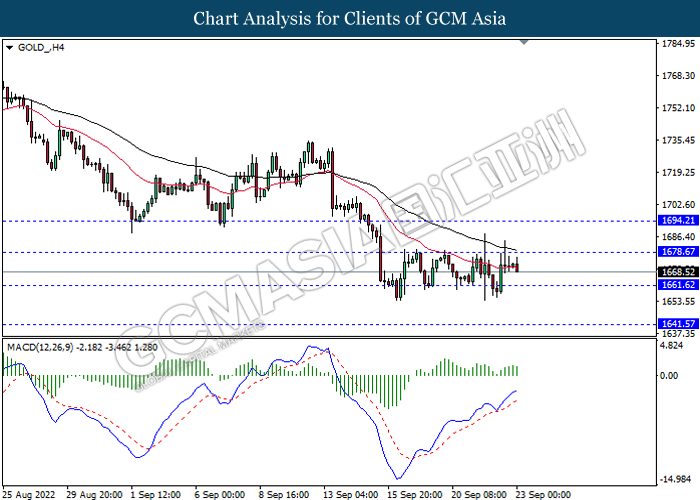

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1678.65, 1694.20

Support level: 1661.60, 1641.55