23 September 2022 Morning Session Analysis

Pound Sterling stumbled following BoE interest rate decision.

Pound Sterling, which was widely traded by the global investors, edged down following the expected 0.25% rate hike after the Bank of England (BoE) meeting. As the UK undergoes a vast change of new government, it does not stop the objective of UK central bank with their steady and predictable rate hike, in order to stop the sky-high inflation that continue weighing on the living cost of the British. Yesterday, the BoE take a further tightening step on the interest rate from 1.75% to 2.25%, missing minority of the investors expectation who having the thought of a 0.75% move. The BoE Committee vowed that if the outlook suggests more persistent inflationary pressures, they will react accordingly to cool down the overheating economy, as necessary. Besides, with the elevating of energy bills and rising cost of goods and services, the economy was heading for a second consecutive quarter of falling output, mirroring the UK economy is still struggling in a recession phase. As of writing, the pair of GBP/USD inched down -0.04% to 1.1252.

In the commodities market, the crude oil price dropped -0.06% to $83.40 per barrel as the Greenback value remain elevated, whereby it reduces the willingness of non-US buyer to replenish the oil. Besides, the gold prices depreciated by -0.02% to $1671.40 per troy ounce as the dollar strengthen.

Today’s Holiday Market Close

Time Market Event

All Day JPY Public Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Sep) | 49.4 | 48.3 | – |

| 16:30 | GBP – Composite PMI | 49.6 | 49.0 | – |

| 16:30 | GBP – Manufacturing PMI | 47.3 | 47.5 | – |

| 16:30 | GBP – Services PMI | 50.9 | 50.0 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | 0.8% | -1.2% | – |

Technical Analysis

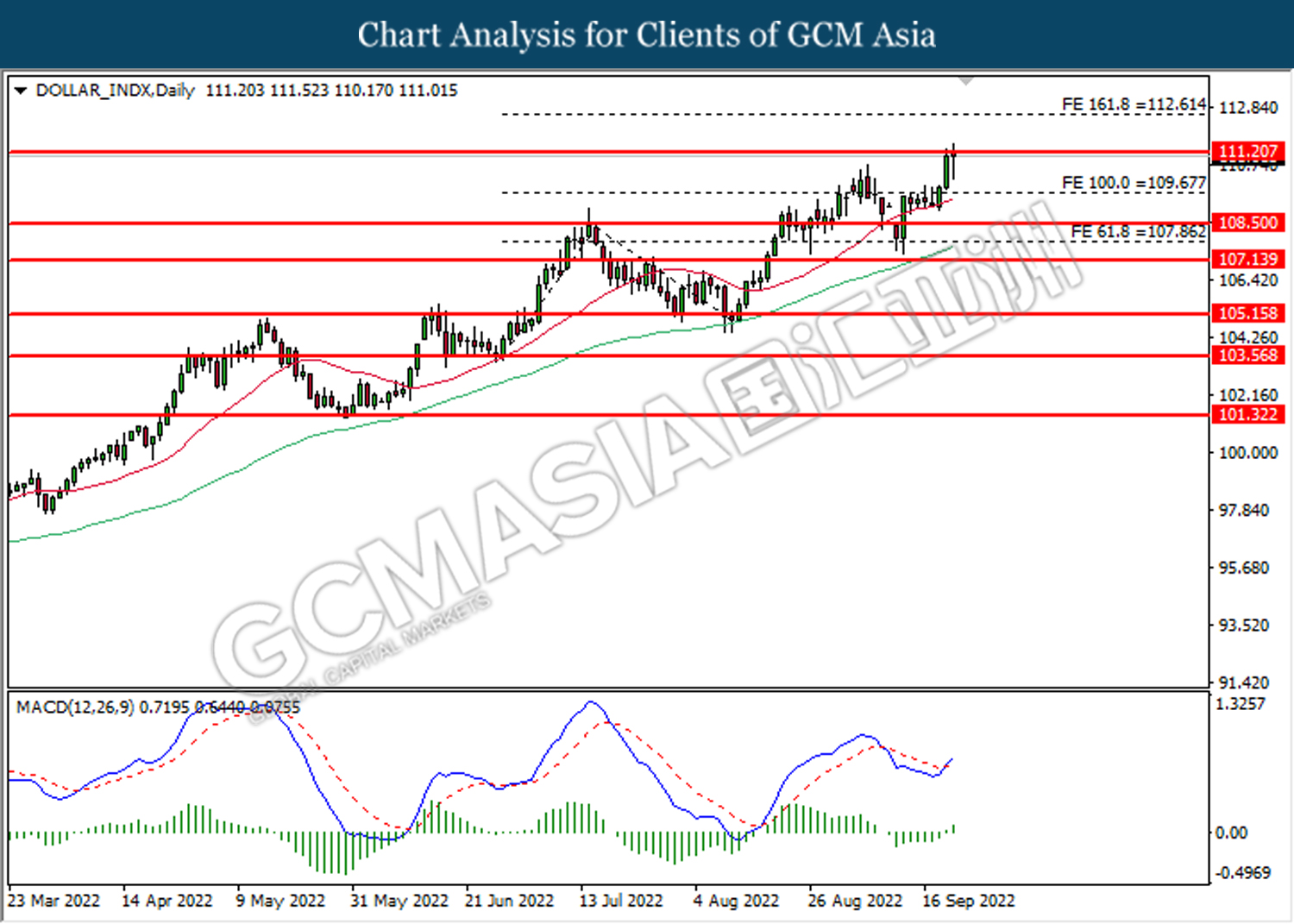

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 111.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

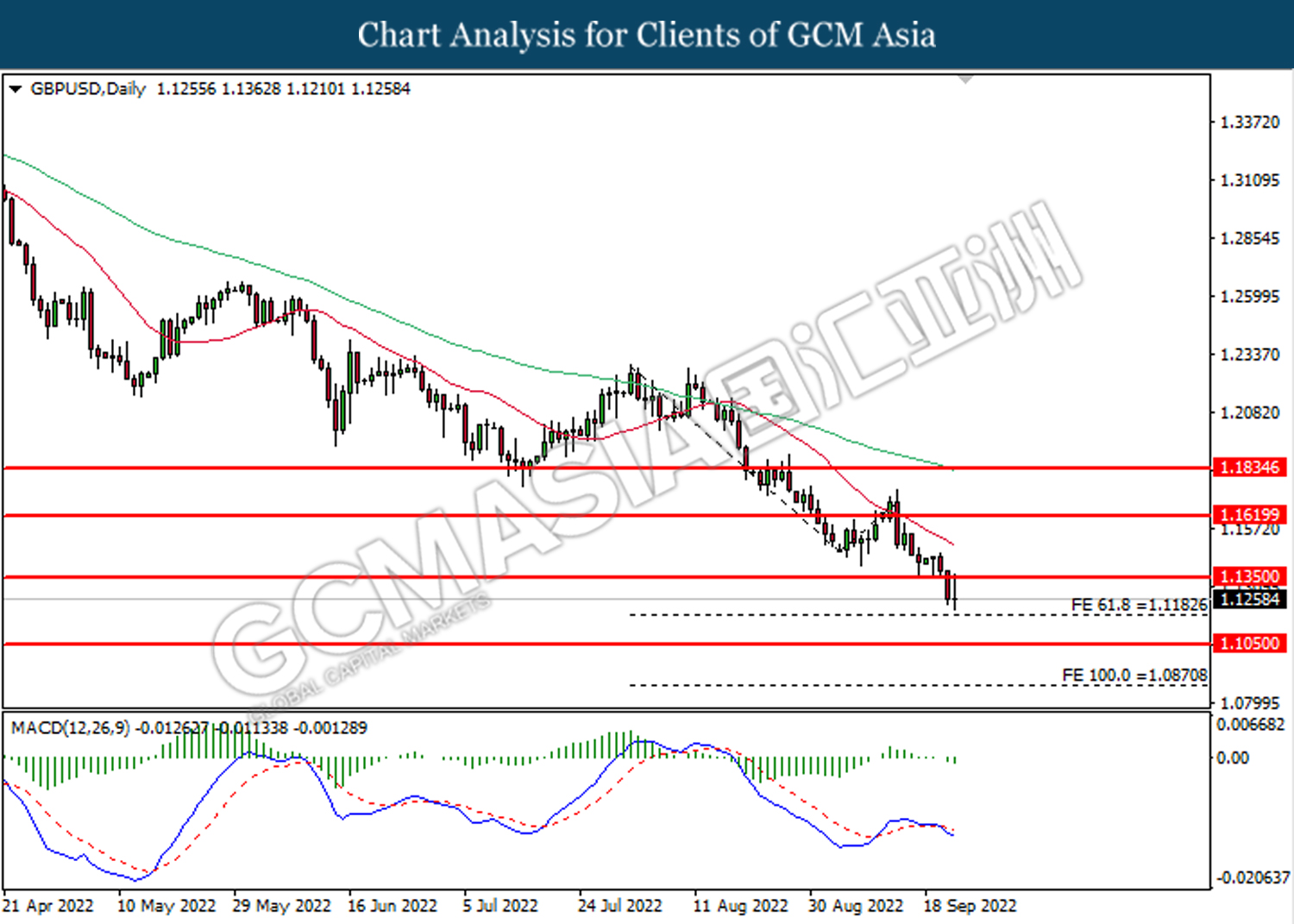

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1350. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

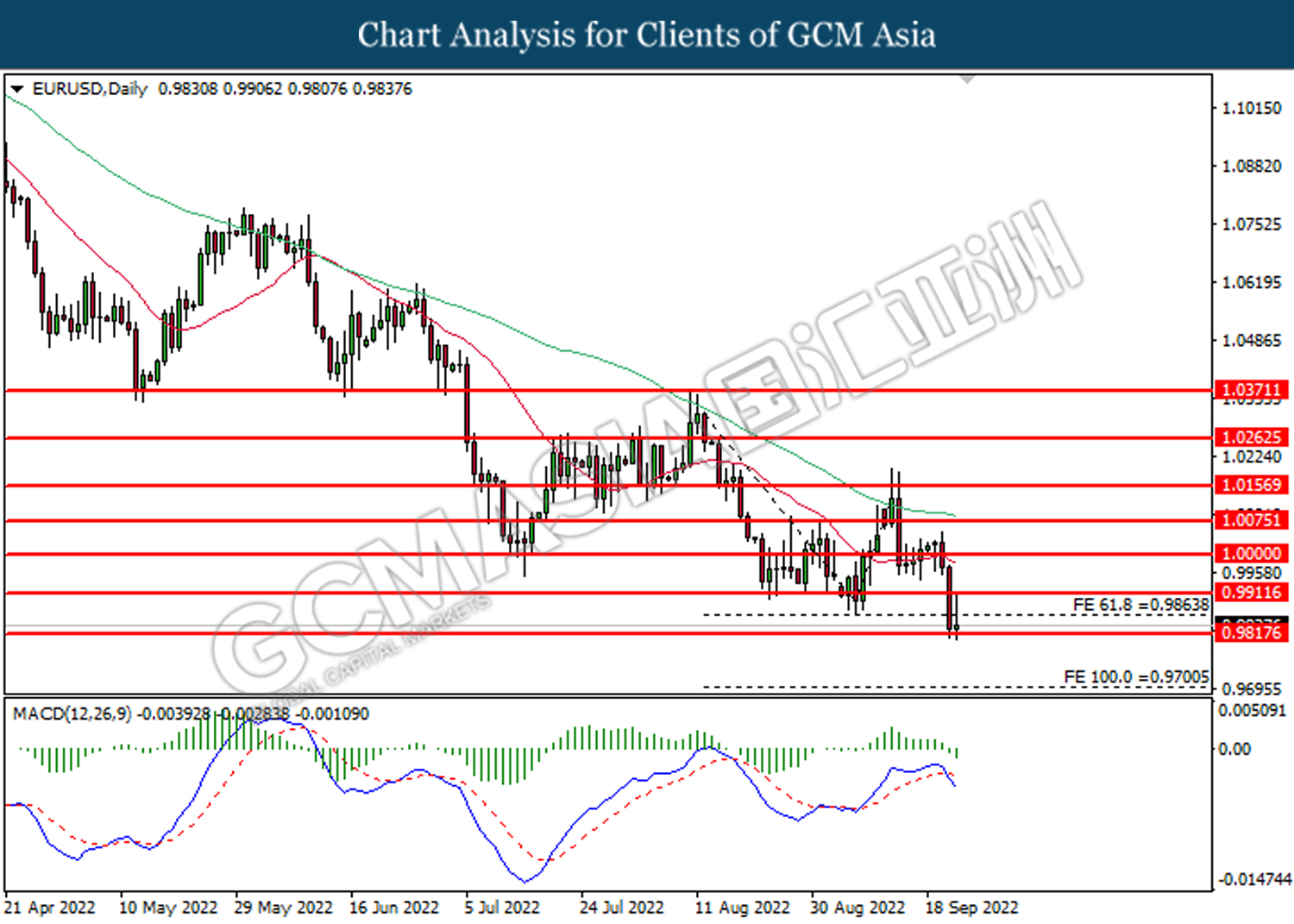

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9820. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the previous support level at 0.9820.

Resistance level: 0.9865, 0.9910

Support level: 0.9820, 0.9700

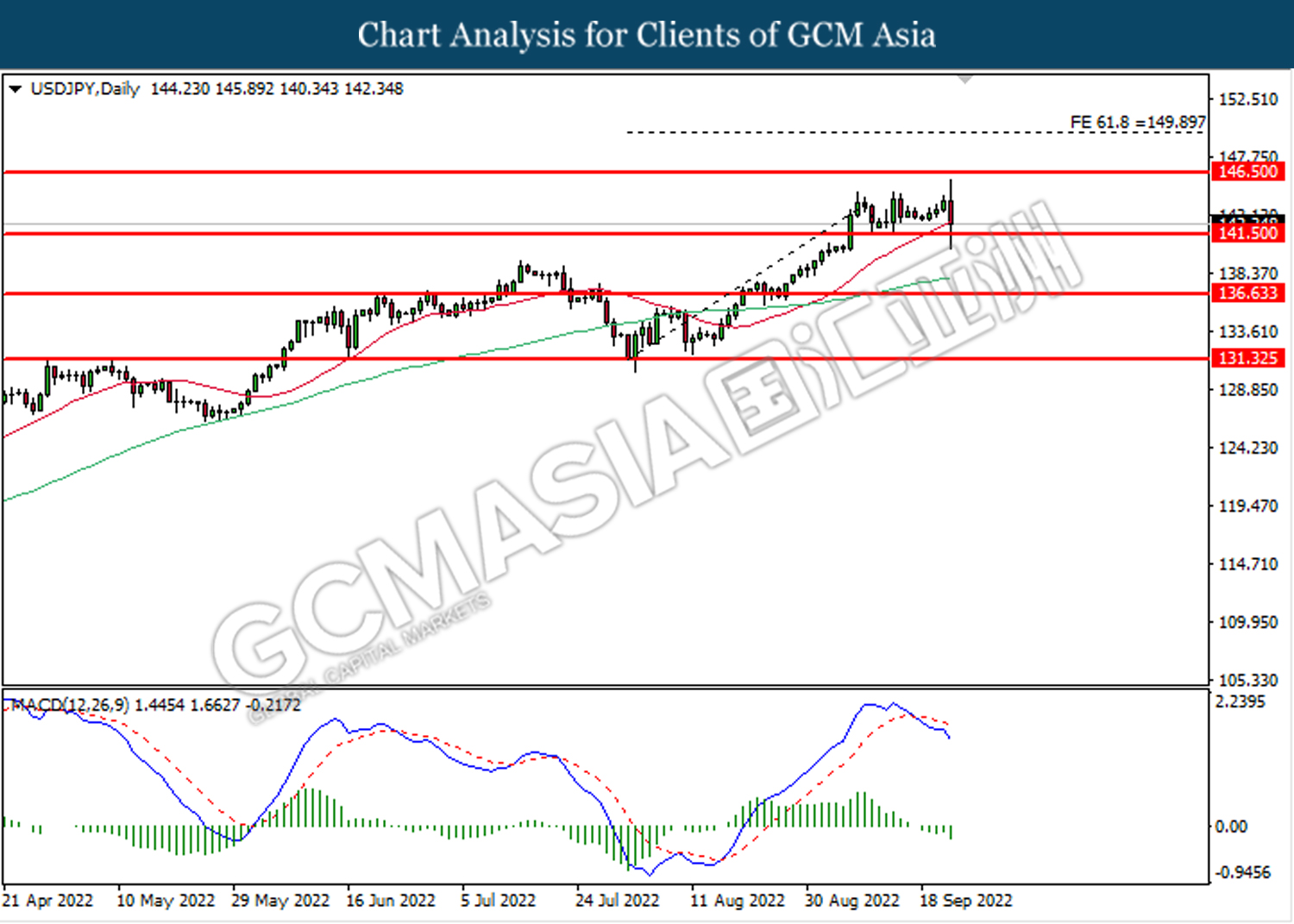

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.50. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

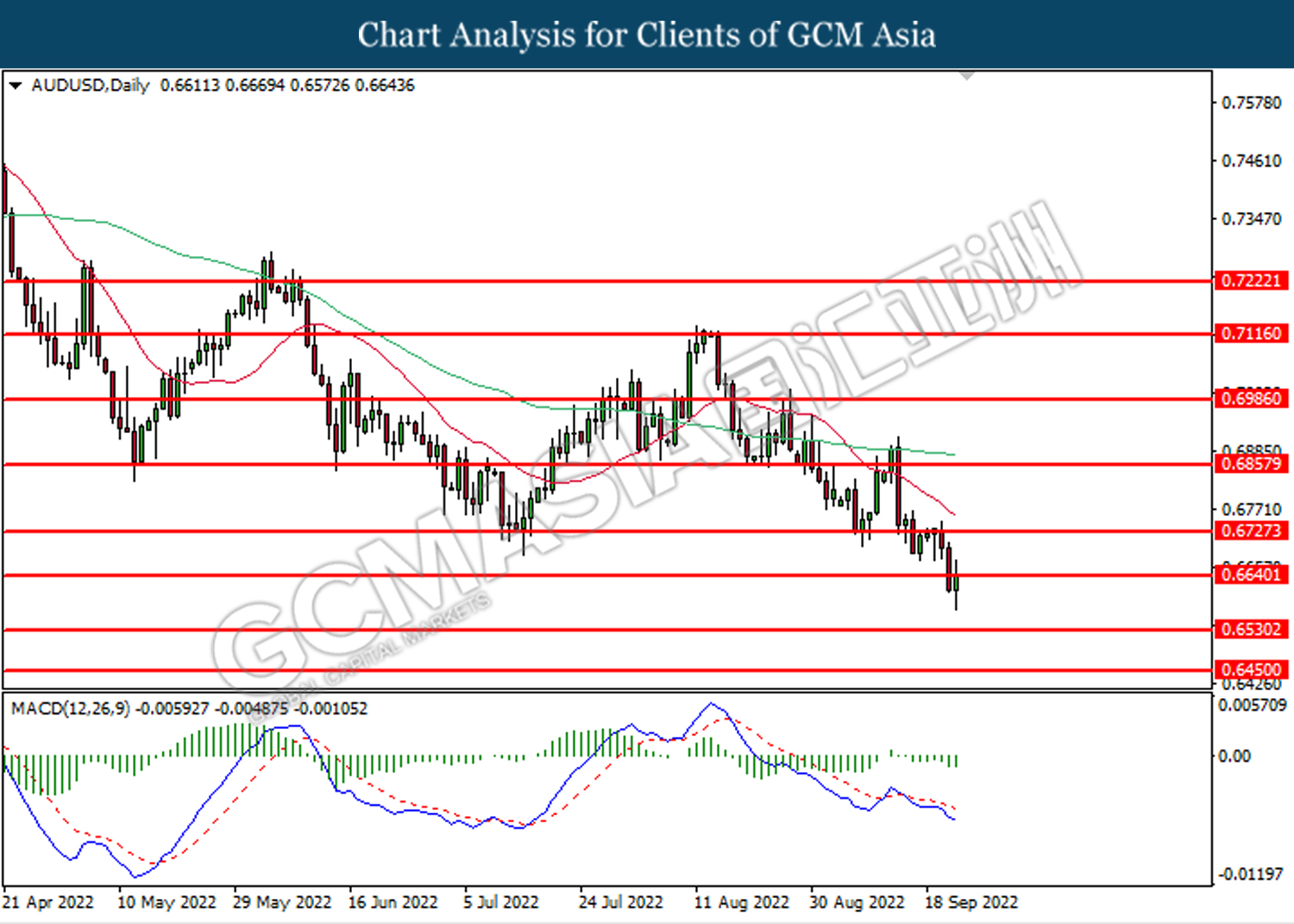

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6640. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6530.

Resistance level: 0.6640, 0.6725

Support level: 0.6530, 0.6450

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.5845. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5775.

Resistance level: 0.5845, 0.5925

Support level: 0.5775, 0.5710

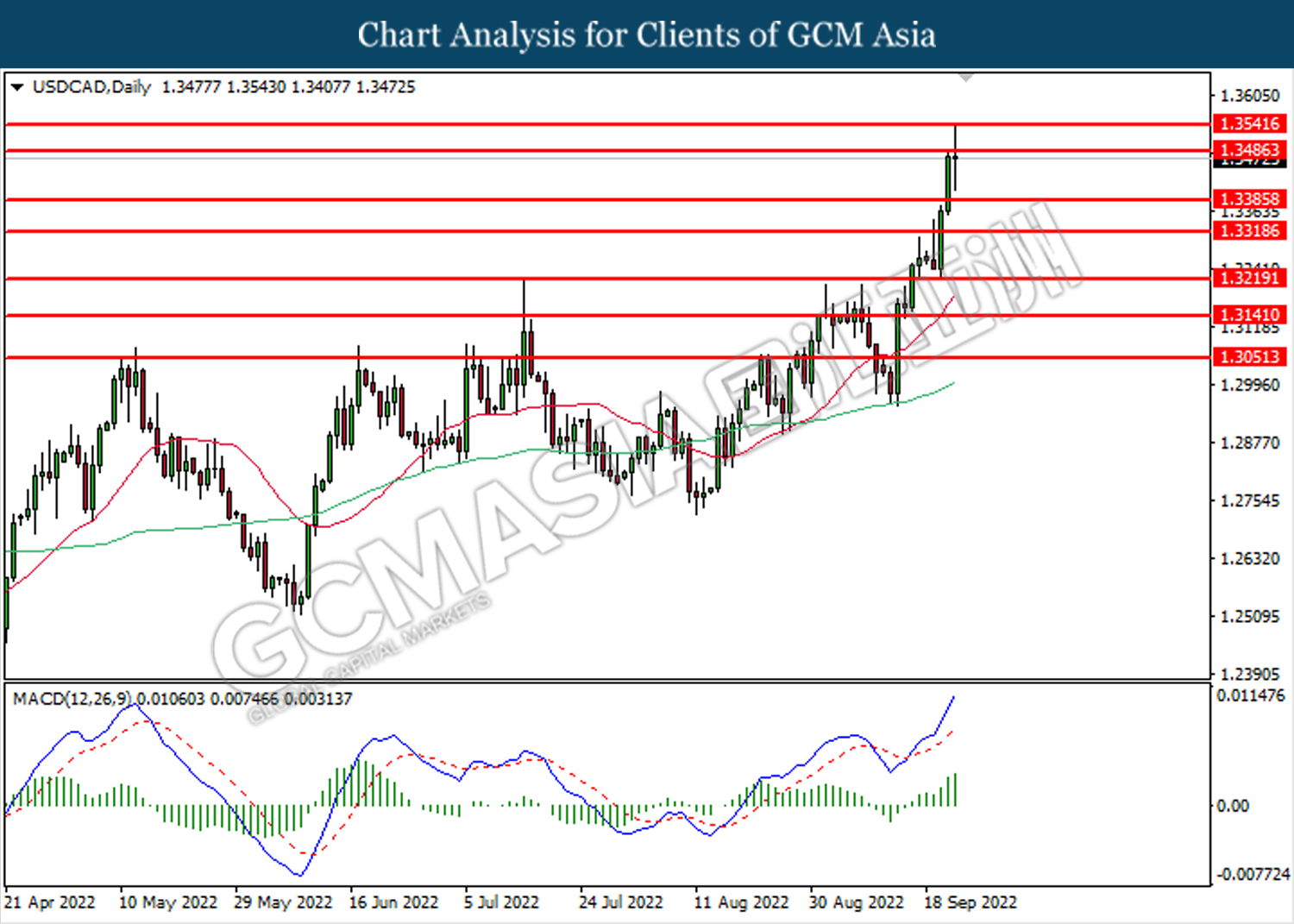

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated bullish momentum suggests the pair to extend gains after its candle successfully closes above the resistance level at 1.3485.

Resistance level: 1.3485, 1.3510

Support level: 1.3385, 1.3320

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9750. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.9750.

Resistance level: 0.9750, 0.9825

Support level: 0.9675, 0.9590

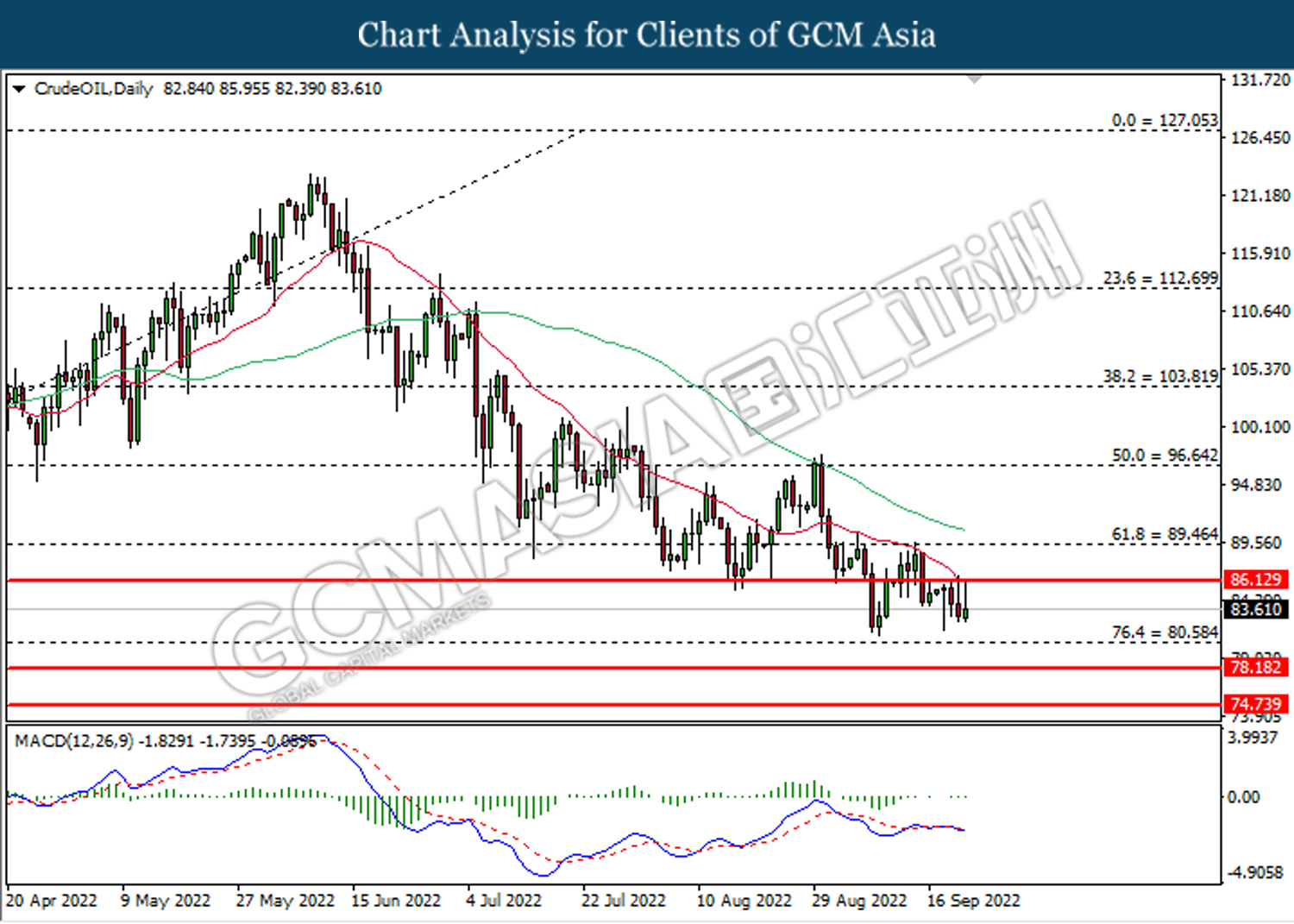

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 78.20

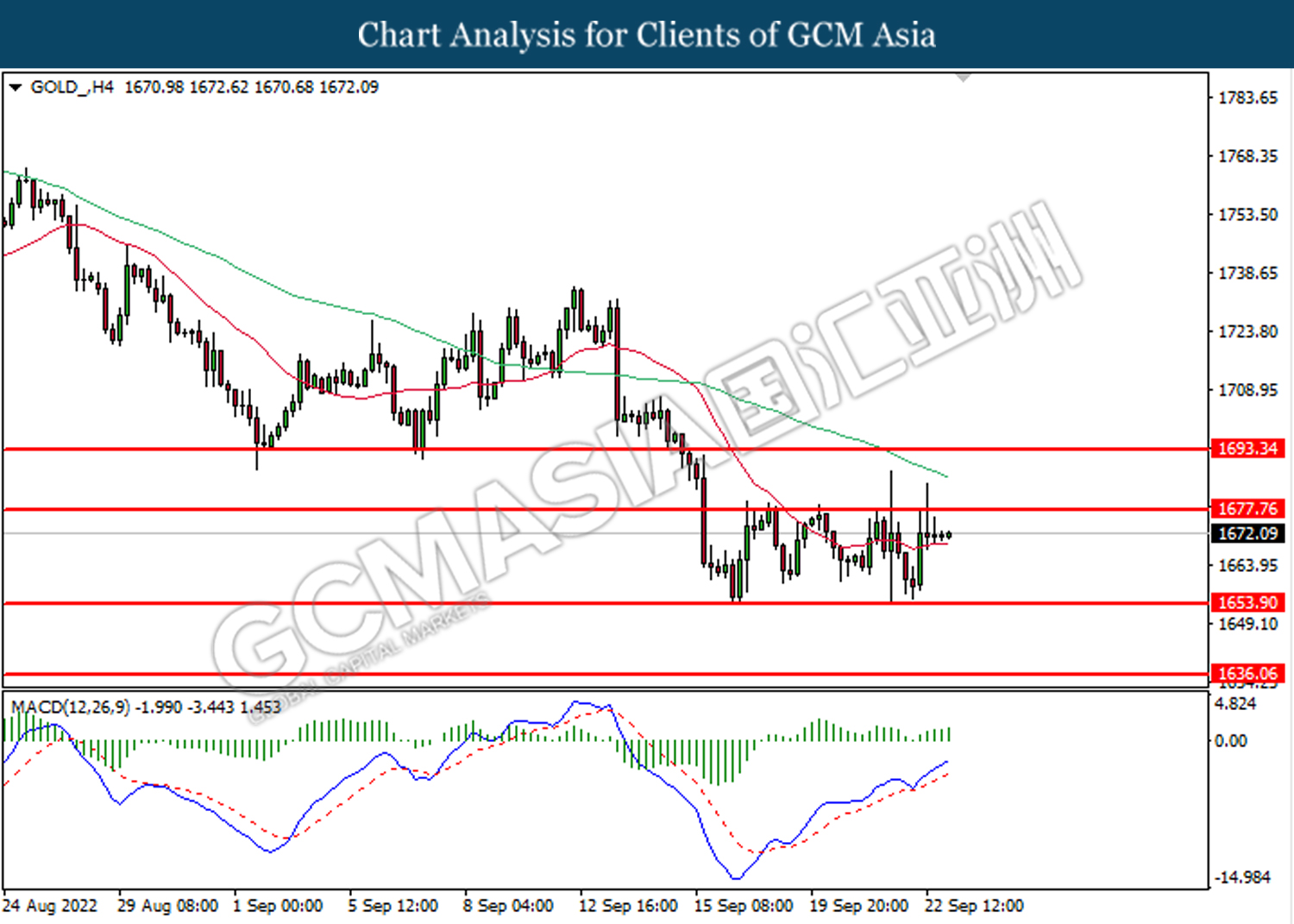

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1653.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1677.75.

Resistance level: 1677.75, 1693.35

Support level: 1653.90, 1636.10