23 October 2017 Weekly Analysis

GCMAsia Weekly Report: October 23 – 27

Market Review (Forex): October 16 – 20

U.S. Dollar

Greenback rose against a basket of six major currencies last Friday as the market sentiment were lifted by higher hopes for a US tax reforms. The dollar index was quoted up 0.61% to 93.57 during late trade, its largest daily gain since October 2nd.

Tax reforms proposed by the US President Donald Trump has cleared a critical hurdle on Thursday after Senate Republicans adopted a budget blueprint for the next fiscal year and included a procedure for Republicans to rewrite the tax code without support from the Democratic party.

The reform is expected to boost up inflation, catalyzing more pressure on the US Federal Reserve to raise interest rates gradually. However, gains on the greenback were limited as the Republicans has yet to produce a tax reform bill amid divisions over how the cut will be financed.

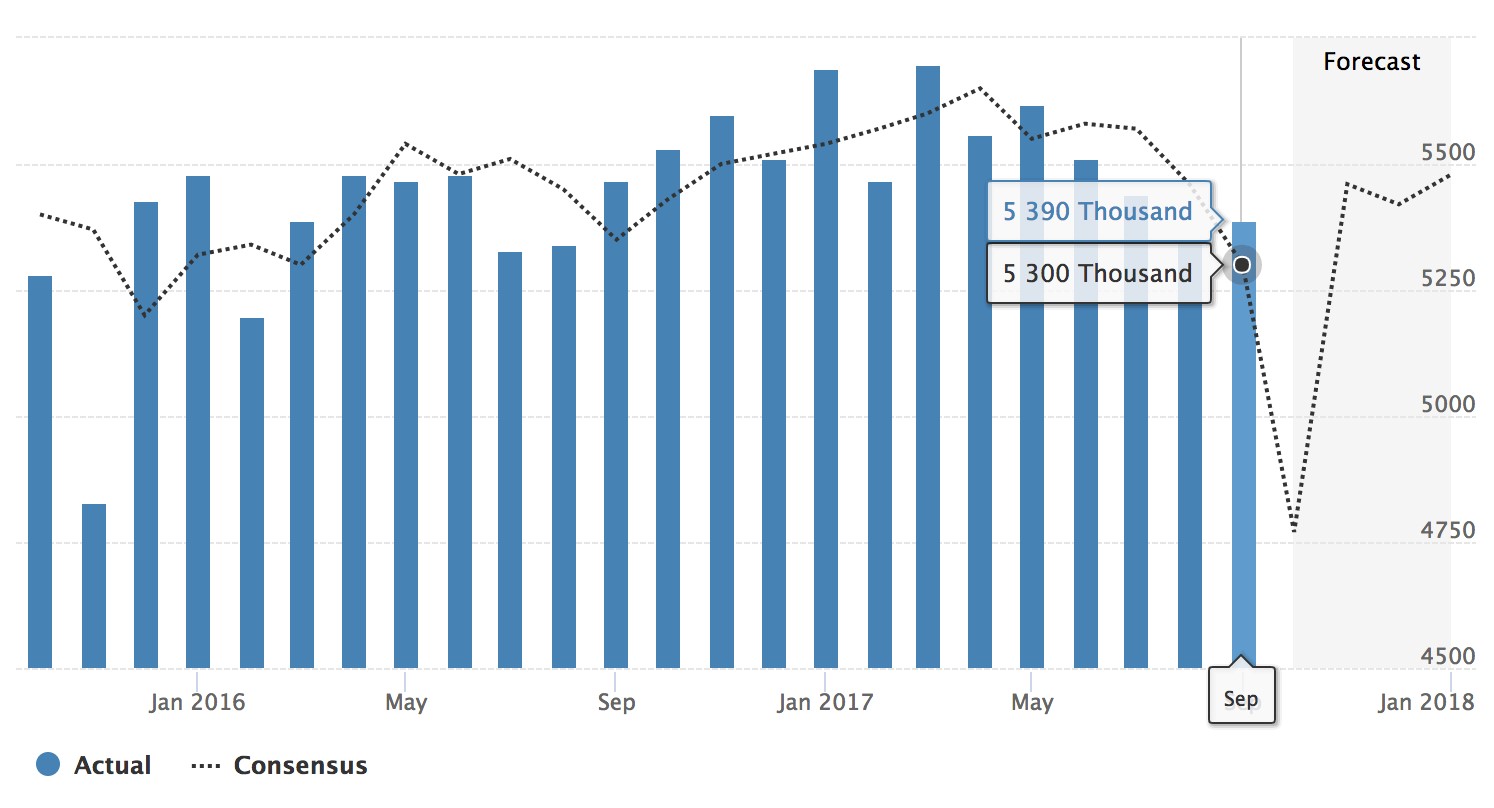

In the economic data front, National Association of Realtors shows that Existing Home Sales for last month rose by 0.7% to a seasonally adjusted annual rate of 5.39 million units, beating economist forecast for a 1% decline to 5.30 million units. Recent upbeat economic data has erased some bearish sentiment on the greenback due to prior sluggish inflation data which were deemed to be non-transitory by some members of Federal Reserve.

U.S. Baker Hughes Oil Rig Count

—– Forecast

US Existing Home Sales for the month of October came in with 5.39 million units, beating consensus forecast for a decline to 5.30 million units.

USD/JPY

Dollar rose to three-months high against the safe haven yen, with pairing of USD/JPY up 0.88% to 113.52.

EUR/USD

Euro was broadly lower, shedding 0.57% to $1.1784 against the US dollar.

GBP/USD

Pound sterling rose by 0.21% to $1.3185 against the greenback during late Friday trading. Sterling pared some of its prior losses after German Chancellor Angela Merkel said that the Brexit talks is progressing, refuting prior reports which indicate otherwise.

Market Review (Commodities): October 16 – 20

GOLD

Gold prices extended its losses on Friday, pressured by strong greenback due to higher prospect towards US tax reform and better-than-expected housing sector data. Price of the yellow metal settled down 0.59% to $1,282.42 while recording a weekly loss of up to 1.86%.

US dollar received higher demand across the board after US Senate adopted next year’s budget blueprint which will open the doors for an imminent US tax reform. Likewise, a higher sentiment towards an interest rate hike in the future has added further pressure on the gold price as higher rates environment will lift the opportunity cost for holding non-yielding asset.

Crude Oil

Crude oil price settled higher on Friday as political tension in the Kurdish region of Iraq escalates and may pose a threat to its crude supplies. Oil prices settled up 33 cents or around 0.6% to $51.84 while cashing in weekly gain of 0.8%.

Oil exports from the Iraqi’s Kurdish region towards the Turkish port of Ceyhan flows at an average rate of 216,000 barrels per day, versus prior level of 600,000 bpd. The disruption was ignited following Kurdish referendum to announce its independence from Iraq which has sparked regional conflict between respective forces.

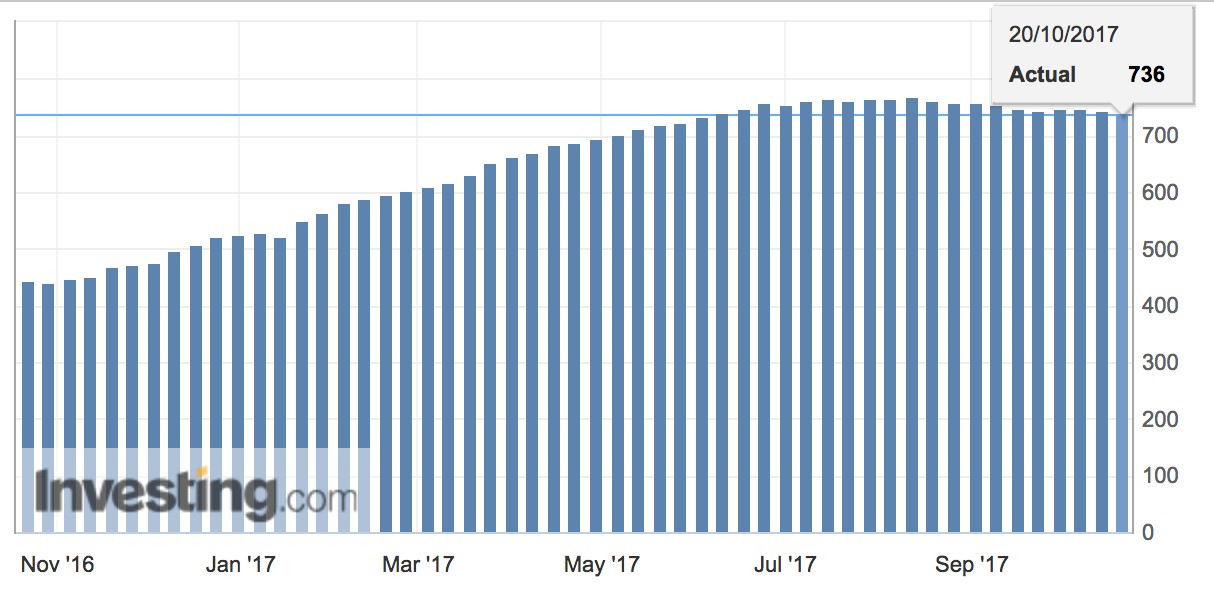

On the other hand, oil prices were further supported after US drilling activity fell for third week in a row, extending its two-months decline. According to the oilfield services firm Baker Hughes, US drilling rigs fell by 7 to a total of 736, its lowest level since June.

In the OPEC front, secretary general from the cartel, Mohammad Barkindo postulate that the oil market is in the reign of balancing with “accelerated pace” and demand will continue to grow rapidly in the coming decades. However, analysts warned that OPEC will need to extend their production freeze agreement in order to yield a significant impact in reducing global supply glut.

U.S. Baker Hughes Oil Rig Count

Active drilling rigs in the United States was down by 7 and the total count is currently at 736.

Weekly Outlook: October 23 – 27

For the week ahead, investors will keep an eye on European Central Bank’s meeting for further details on their plan to scale back its massive stimulus program. Likewise, market participants will also place their focus on US preliminary revision of third quarter growth in order to assess the impact of recent hurricanes on their economic activity and Federal Reserve’s view on monetary policy.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: October 23 – 27

| Monday, October 23 |

Data GBP – CBI Industrial Trends Orders (Oct) CAD – Wholesale Sales (MoM) (Aug)

Events N/A

|

| Tuesday, October 24 |

Data EUR – German Manufacturing PMI (Oct) EUR – Manufacturing PMI (Oct) EUR – Markit Composite PMI (Oct) EUR – Services PMI (Oct) USD – Manufacturing PMI (Oct) USD – Markit Composite PMI (Oct) USD – Services PMI (Oct)

Events N/A

|

| Wednesday, October 25 |

Data CrudeOIL – API Weekly Crude Oil Stock AUD – CPI (QoQ) (Q3) EUR – German Ifo Business Climate Index (Oct) GBP – GDP (QoQ) (Q3) USD – Core Durable Goods Orders (MoM) (Sep) USD – New Home Sales (Sep) CAD – BoC Interest Rate Decision CrudeOIL – Crude Oil Inventories

Events CAD – BoC Monetary Policy Report CAD – BoC Rate Statement CAD – BoC Gov Poloz Speaks

|

| Thursday, October 26 |

Data NZD – Trade Balance (MoM) (Sep) EUR – Deposit Facility Rate EUR – ECB Interest Rate Decision (Oct) USD – Initial Jobless Claims USD – Pending Home Sales (MoM) (Sep)

Events EUR – ECB Press Conference USD – FOMC Member Kashkari Speaks

|

|

Friday, October 27

|

Data JPY – National Core CPI (YoY) (Sep) JPY – Tokyo Core CPI (YoY) (Oct) USD – GDP (QoQ) (Q3) USD – Real Consumer Spending (Q3) USD – Michigan Consumer Sentiment (Oct) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: October 23 – 27

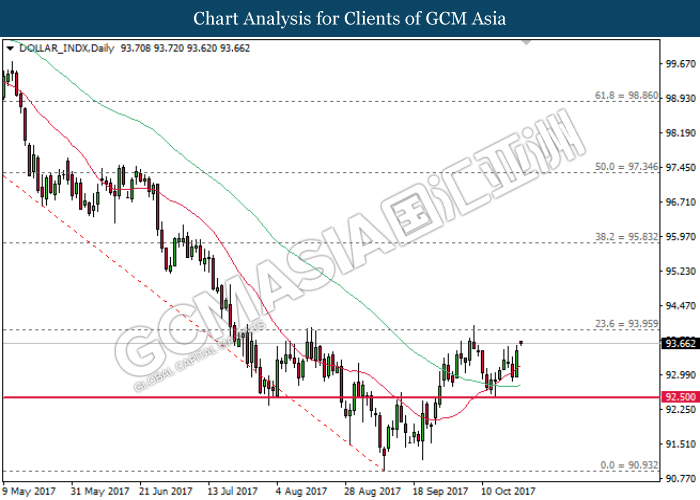

Dollar Index

DOLLAR_INDX, Daily: Dollar index remained supported following prior rebound near the 60-MA line (green). Both MA lines which continues to expand upwards suggests dollar index to advance further up and retest at the strong resistance level of 93.95.

Resistance level: 93.95, 95.80

Support level: 92.50, 90.95

GBPUSD

GBPUSD, Daily: GBPUSD was traded higher following prior rebound near the 60-MA line (green). MACD histogram which illustrate diminishing downward signal suggests the pair to advance further upwards after successfully closing above the 20-MA line (red).

Resistance level: 1.3260, 1.3450

Support level: 1.3020, 1.2820

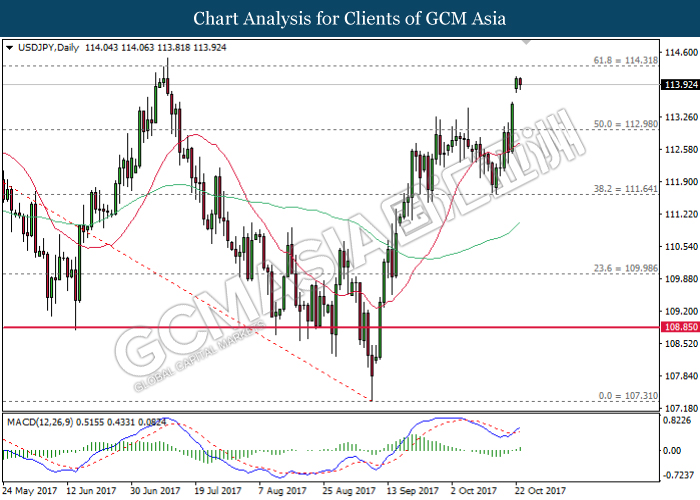

USDJPY

USDJPY, Daily: USDJPY skyrocketed following prior breakout from the strong resistance level of 113.00. MACD histogram which forms a golden cross suggest the pair to advance further up and retest near the strong resistance level of 114.30.

Resistance level: 114.30, 115.15

Support level: 113.00, 111.65

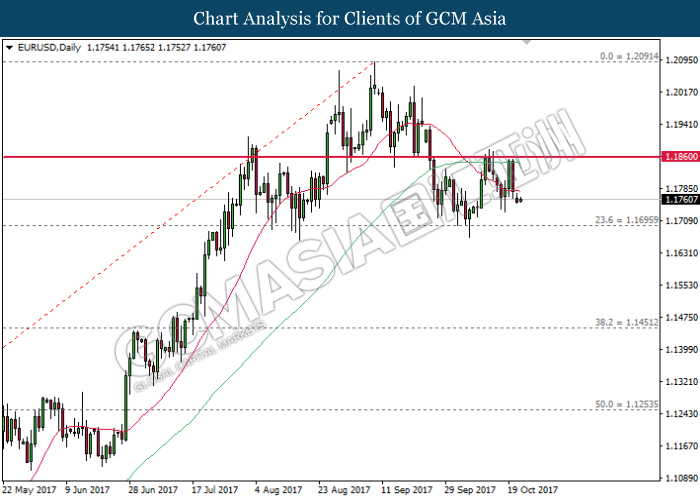

EURUSD

EURUSD, Daily: EURUSD remained under pressure following prior retracement from the strong resistance level of 1.1860. Recent closure below the 20-MA line (red) suggest further downside bias for the pair to fallback towards the strong support level near 1.1700.

Resistance level: 1.1860, 1.2090

Support level: 1.1700, 1.1450

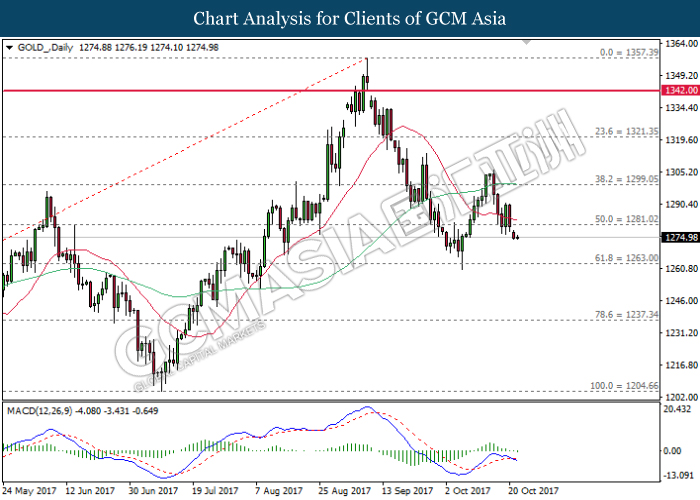

GOLD

GOLD_, Daily: Gold price extended its losses following prior closure below the support level of 1281.00 and both MA lines. MACD histogram which begins to form a death cross signal suggest further bearish momentum for the commodity and advance towards the target of support level near 1263.00.

Resistance level: 1281.00, 1299.05

Support level: 1263.00, 1237.35

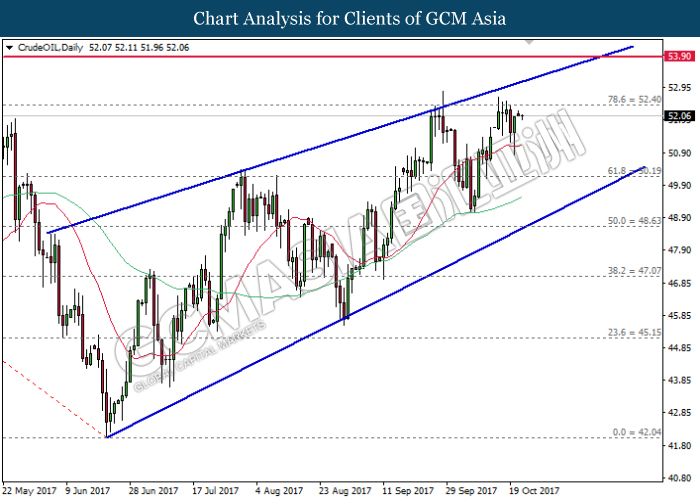

Crude Oil

CrudeOIL, Daily: Crude oil price remains traded within a rising wedge while recently rebounded from the 20-MA line (red). A successful closure above the strong resistance level of 52.40 would suggest further upside bias ahead, towards the upper level of the wedge.

Resistance level: 52.40, 53.90

Support level: 50.20, 48.65