23 December 2022 Afternoon Session Analysis

Pound Sterling dived over the economy contraction fears rose.

The GBP/USD, which widely traded by global investors slumped on yesterday after the downbeat economic data has been released. According to Office for National Statistics, the UK third quarter GDP has contracted by 0.3%, which exceeding the market forecast of -0.2% contraction. With that, it dialed down market optimism toward economic progression in the UK, which spurring bearish momentum on the Pound Sterling. Besides that, the Bank of England (BoE) has estimated that the UK economy would be facing recession in the fourth quarter during earlier moment, as well as the GDP was anticipated to shrink by 0.3% in the fourth quarter of this year. The spiking inflation that driven by rising tension of Russia-Ukraine was the main factor to cause diminishing of household spending. On the other hand, Pound Sterling has lost its further ground amid the optimistic economic outlook in the US, whereas attracting market participants to shift their capitals toward US market. As of writing, the GBP/USD edged up by 0.02% to 1.2045.

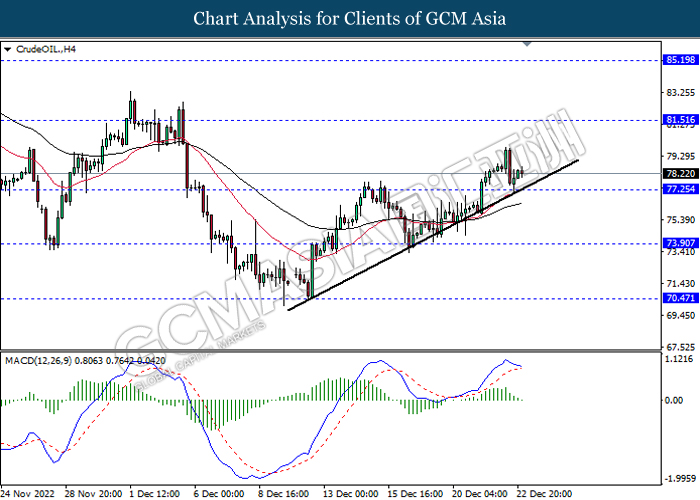

In the commodities market, the crude oil price appreciated by 1.02% to $78.29 per barrel as of writing after a sharp decline throughout overnight trading session over the rising fears of Fed aggressive rate hikes. In addition, the gold price raised by 0.30% to $1792.72 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

Early close GBP Christmas

Early close NZD Christmas

Early close AUD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Nov) | 0.5% | 0.1% | – |

| 21:30 | USD – Core PCE Price Index (YoY) (Nov) | 0.2% | 0.2% | – |

| 21:30 | CAD – GDP (MoM) (Oct) | 0.1% | 0.1% | – |

| 23:00 | USD – New Home Sales (Nov) | 632K | 600K | – |

Technical Analysis

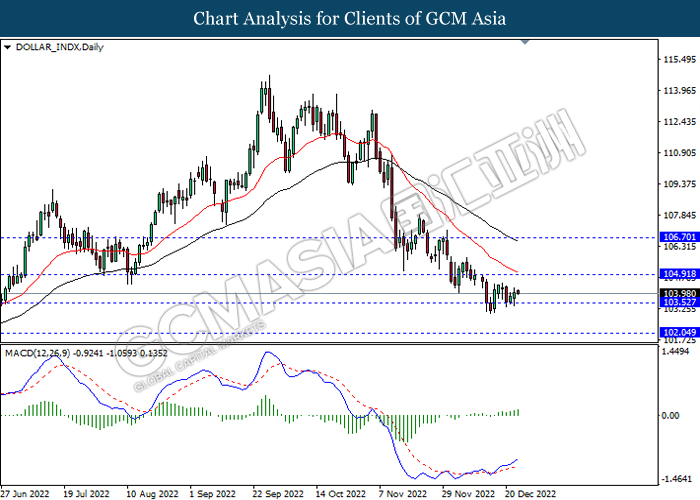

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

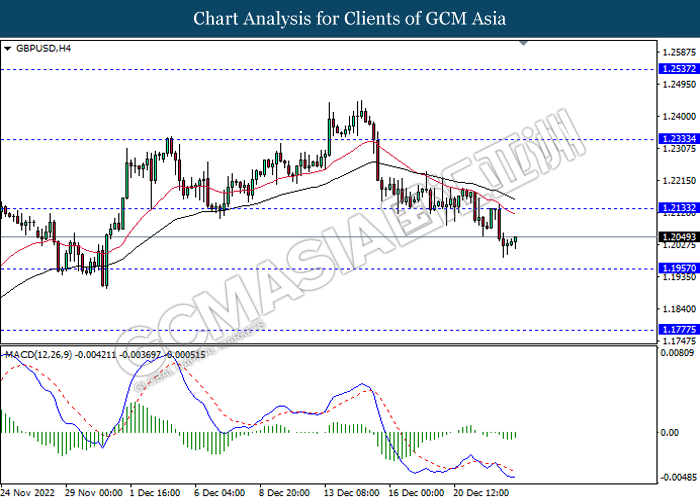

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

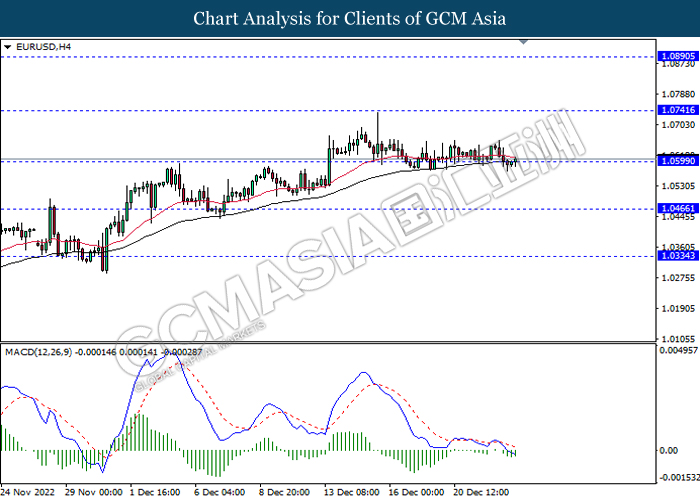

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

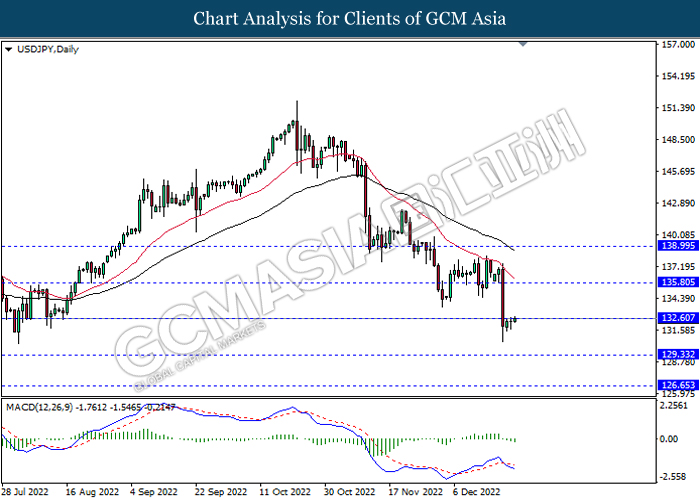

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

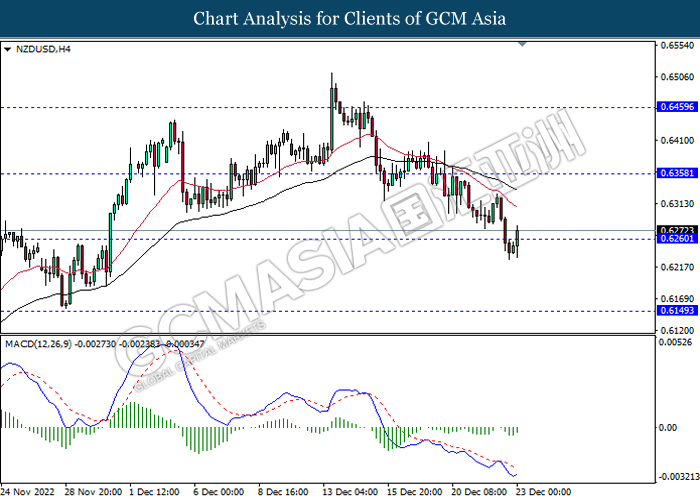

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

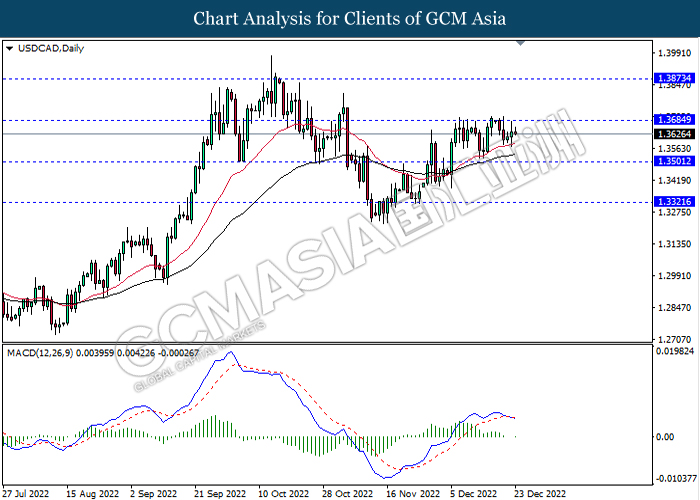

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

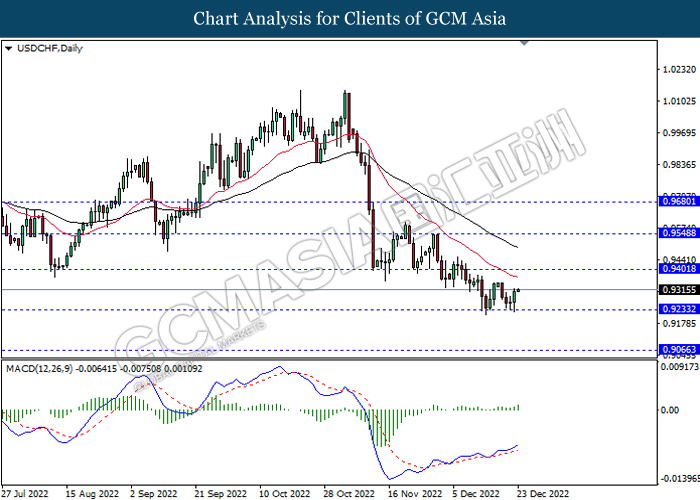

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

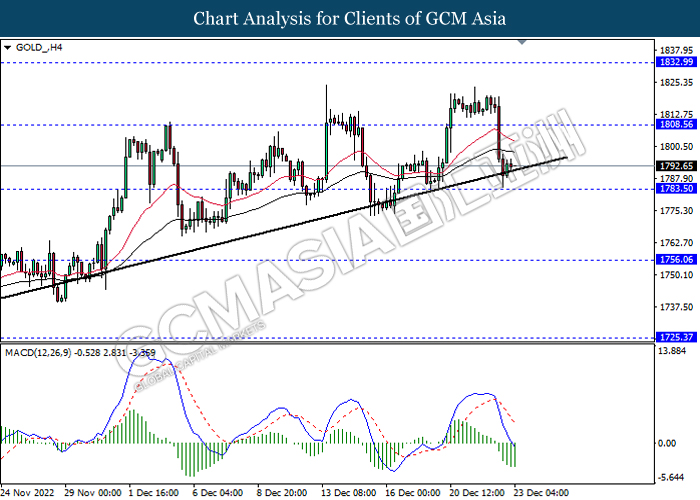

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05