23 December 2022 Morning Session Analysis

Dollar climbed as recession fears wiped off.

The dollar index, which traded against a basket of six major currencies, extended its rally during the US market trading hours as a series of upbeat data put out the market fears against the recession risk. According to the Bureau of Economic Analysis, the US GDP for the third quarter rose 3.2%, beating both the consensus forecast and prior quarter reading at 2.9%. The stronger-than-expected GDP was mainly attributed to the increases in exports, consumer spending, oversea fixed investment as well as the government spending. Following the release of the data, investors rushed into the US dollar market as recession risk faded, while showing a better economic health condition compared to the other region. On top of that, the US Department of Labor also reported that the weekly initial jobless claim increased slightly from 214K to 216K, but still lower than the consensus forecast at 222K. Nevertheless, it is still showing that the US labor market remained resilience, against the market expectation. As of writing, the dollar index rose by 0.23% to 104.40.

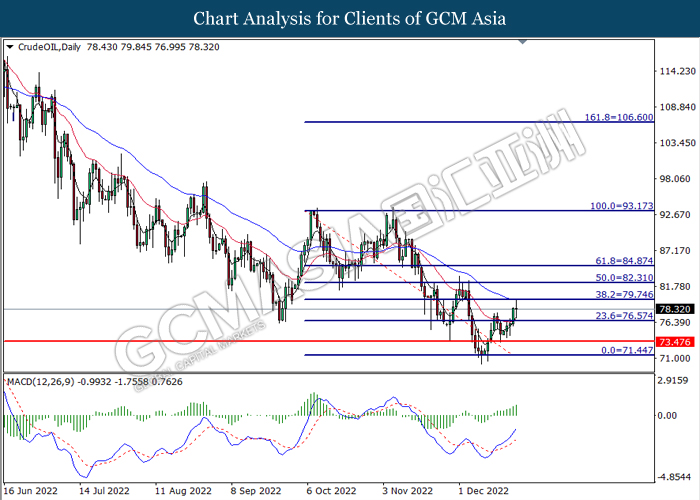

In the commodities market, crude oil price was down by -1.54% to $77.30 per barrel as the cost oil purchase jumped following the appreciation of US dollar. Besides, gold prices depreciated by -1.20% to $1792.55 per troy ounce amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

Early close GBP Christmas

Early close NZD Christmas

Early close AUD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Nov) | 0.5% | 0.1% | – |

| 21:30 | USD – Core PCE Price Index (YoY) (Nov) | 0.2% | 0.2% | – |

| 21:30 | CAD – GDP (MoM) (Oct) | 0.1% | 0.1% | – |

| 23:00 | USD – New Home Sales (Nov) | 632K | 600K | – |

Technical Analysis

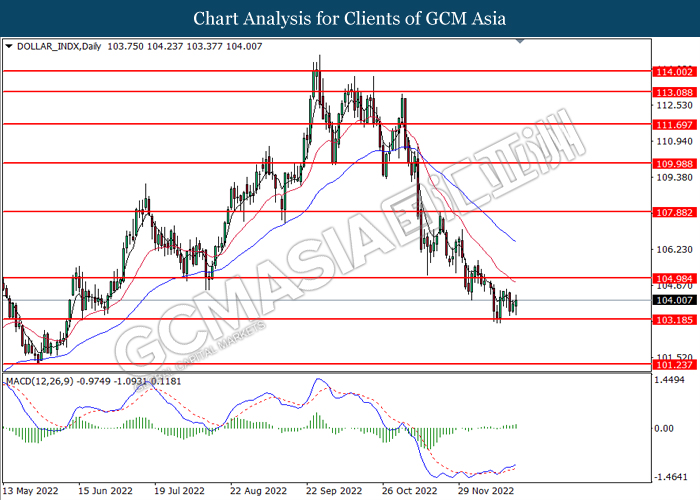

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.20, 101.25

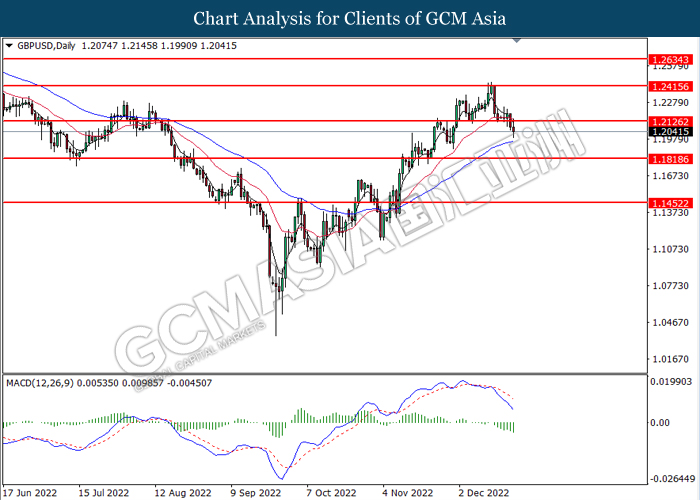

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2125, 1.2415

Support level: 1.1820, 1.1450

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0570. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0675, 1.0780

Support level: 1.0570, 1.0440

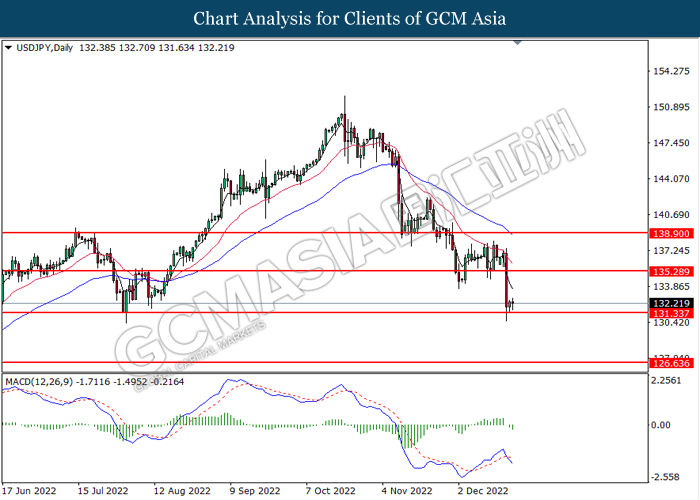

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.35. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.30, 138.90

Support level: 131.35, 126.65

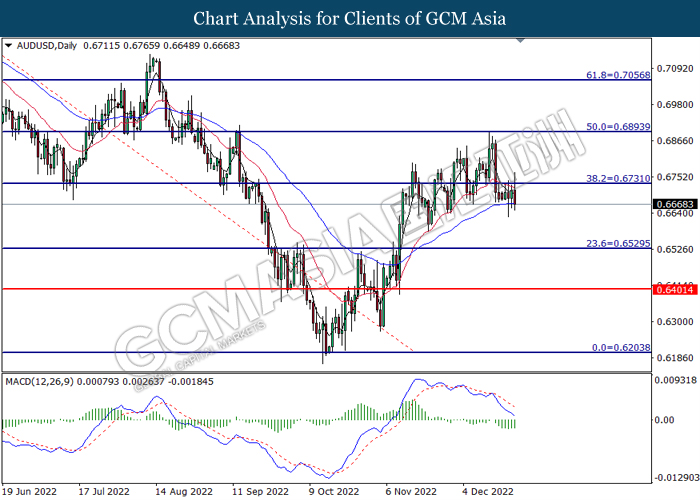

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6730. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6530.

Resistance level: 0.6730, 0.6895

Support level: 0.6530, 0.6400

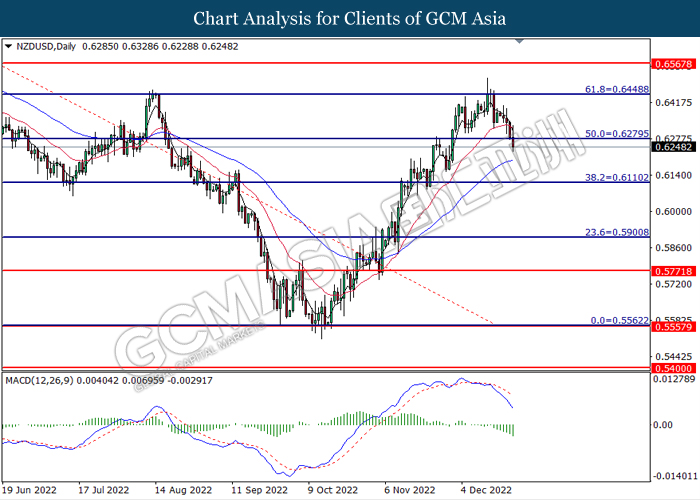

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6280. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6110.

Resistance level: 0.6280, 0.6450

Support level: 0.6110, 0.5900

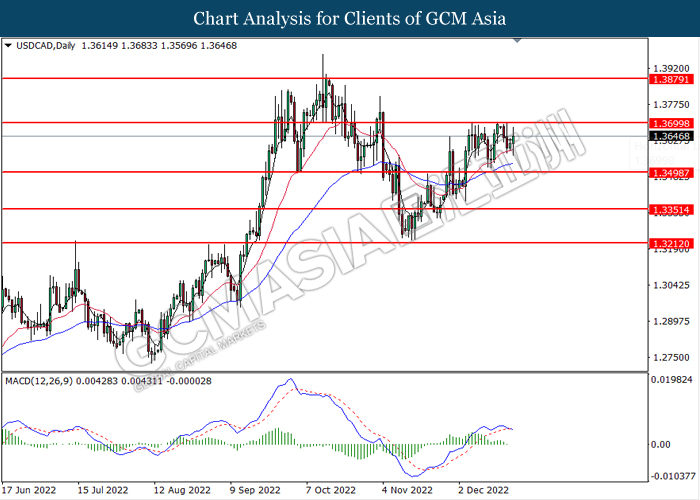

USDCAD, Daily: USDCAD was traded higher following prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

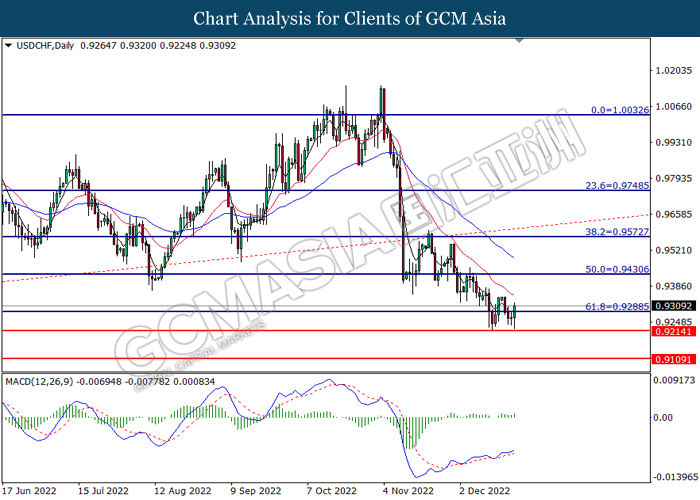

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9290, 0.9430

Support level: 0.9215, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.55. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 79.75.

Resistance level: 79.75, 82.30

Support level: 76.55, 73.45

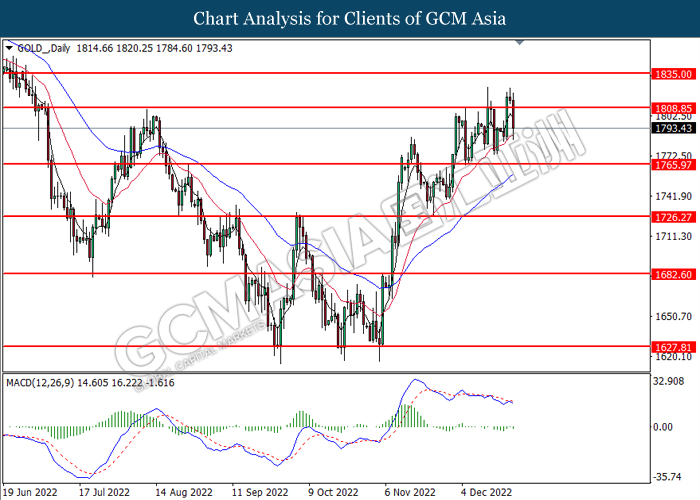

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1808.85. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1765.95.

Resistance level: 1808.85, 1835.00

Support level: 1765.95, 1726.25