24 February 2022 Afternoon Session Analysis

Safe-haven currencies surged amid rising tensions Russia-Ukraine.

The safe-haven asset such as Japanese Yen and Swiss France surged significantly over the backdrop of risk-off sentiment in the global financial market following Russian President Vladimir Putin authorised a military operation in eastern Ukraine on Thursday. Explosion rocked the breakaway eastern Ukrainian city of Donetsk and civilian aircraft were warned away as the United States claimed a major attack by Russia on Ukraine was imminent. Currently, a total of 80% of Russian soldiers assembled are in a position to launch a full-scale invasion on Ukraine, according to senior US defence official. The rising tensions between Ukraine-Russia would be spurring geopolitics risk to the global, which stoked a shift in sentiment toward safe-haven asset. As of writing, USD/JPY depreciated by 0.20% to 114.75 while USD/CHF dived 0.05% to 0.9175.

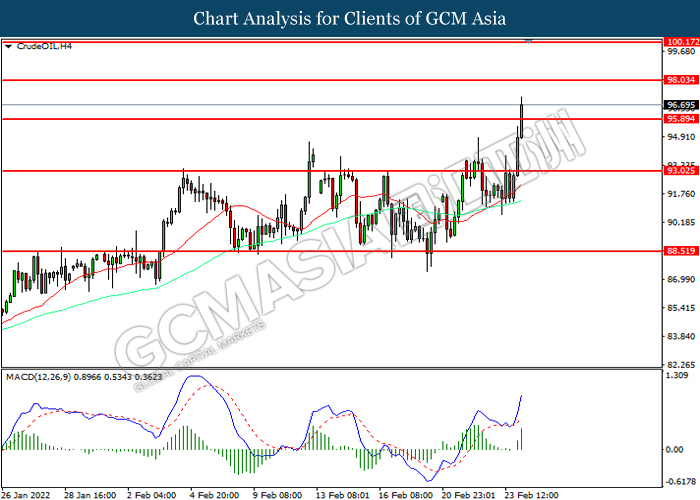

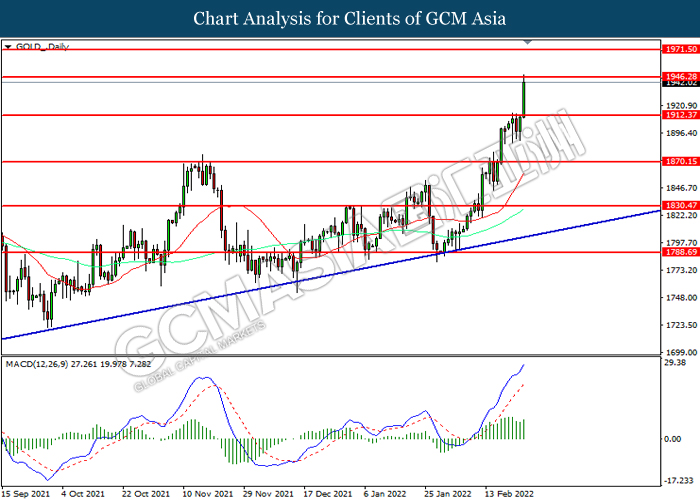

In the commodities market, the crude oil price surged 2.60% to 96.35 per barrel as of writing. The oil market edged higher amid market participants concerned that the rising tensions between Russia-Ukraine would increase further uncertainty for the oil supply in future, insinuating bullish momentum on the crude oil price. On the other hand, the gold price appreciated by 1.05% to $1927.80 per troy ounces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – GDP (QoQ) (Q4) | 6.90% | 7.00% | – |

| 21:30 | USD – Initial Jobless Claims | 248K | 235K | – |

| 23:00 | USD – New Home Sales (Jan) | 811K | 807K | – |

Technical Analysis

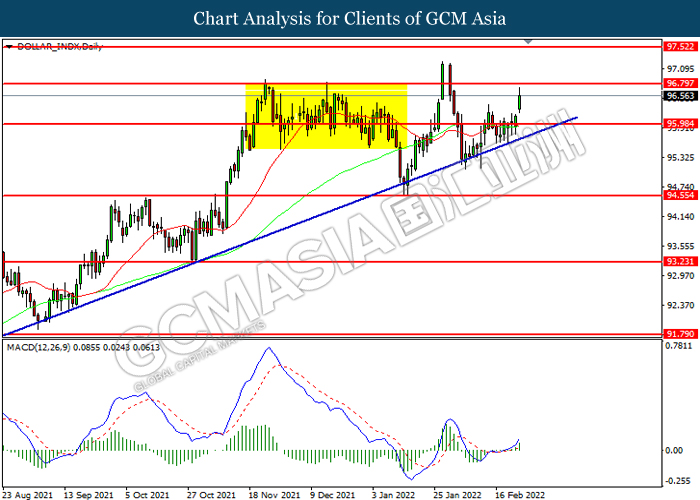

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 96.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.80, 97.50

Support level: 96.00, 94.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3500. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3615, 1.3730

Support level: 1.3500, 1.3440

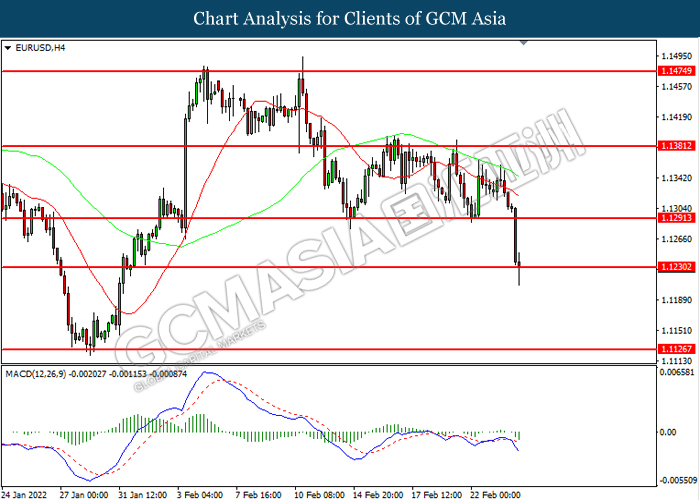

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1230. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1290, 1.1380

Support level: 1.1230, 1.1125

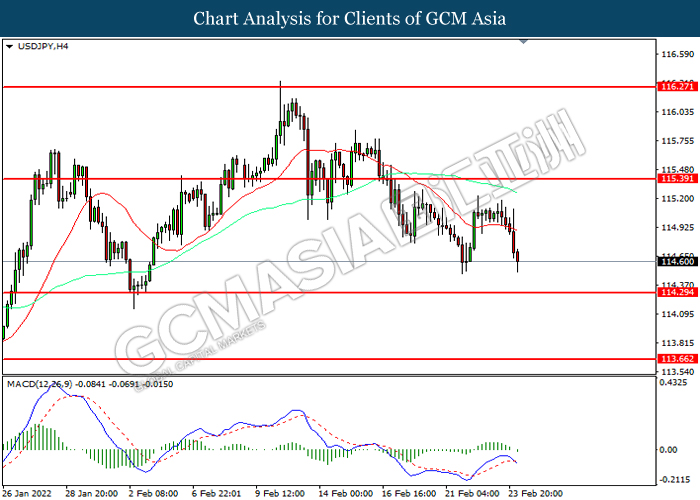

USDJPY, H4: USDJPY was traded lower while currently near the support level at 114.30. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

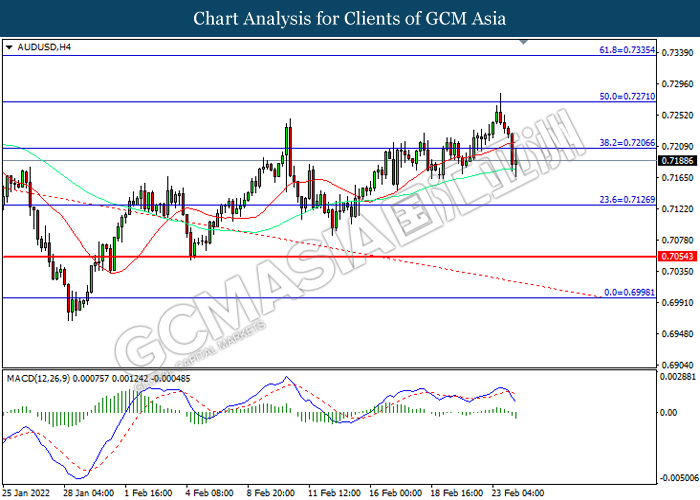

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

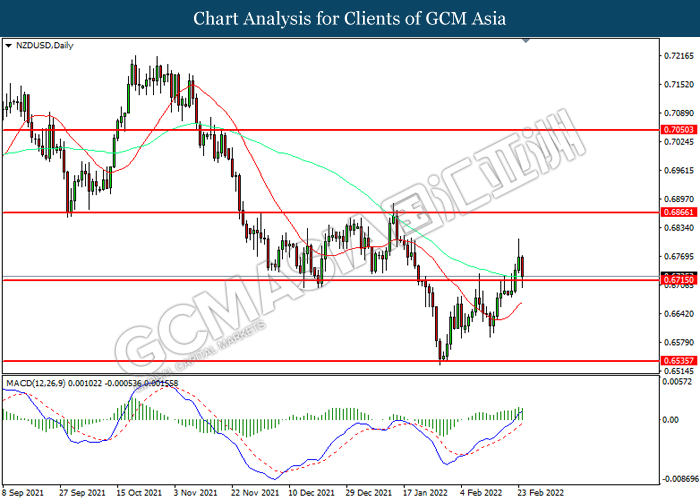

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6715. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 95.90. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 98.05.

Resistance level: 98.05, 100.15

Support level: 93.05, 88.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1946.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1946.03, 1971.50

Support level: 1912.35, 1870.15