24 February 2022 Morning Session Analysis

US begins to sanction Russia.

Greenback remains well supported from its lower levels as tension in between Russia and Ukraine rises to a new height. According to Al Jazeera, Washington stated that Russian troops along the Ukrainian border may strike at any time. Satellite imagery shows that more than 80% out of 150,000 troops are currently on stand-by mode. On the other hand, US President Joe Biden has announced the enactment on sanction upon a natural gas pipeline Nord Stream 2 which links Russia and Germany. Sanction upon the $11 billion infrastructure project is one of the moves taken by US in order to reduce the risk of war in between Russia and Ukraine. However, economists believe that the sanction may do more harm towards Germany than Russia as the former consumes more than 27% of natural gas that were being delivered to them. As of writing, the dollar index was up 0.02% to 96.14.

As for commodities market, crude oil price rose 0.43% to $92.69 per barrel due to rising tension in between Russia and Ukraine. Likewise, gold price rose 0.07% to $1910.43 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – GDP (QoQ) (Q4) | 6.90% | 7.00% | – |

| 21:30 | USD – Initial Jobless Claims | 248K | 235K | – |

| 23:00 | USD – New Home Sales (Jan) | 811K | 807K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

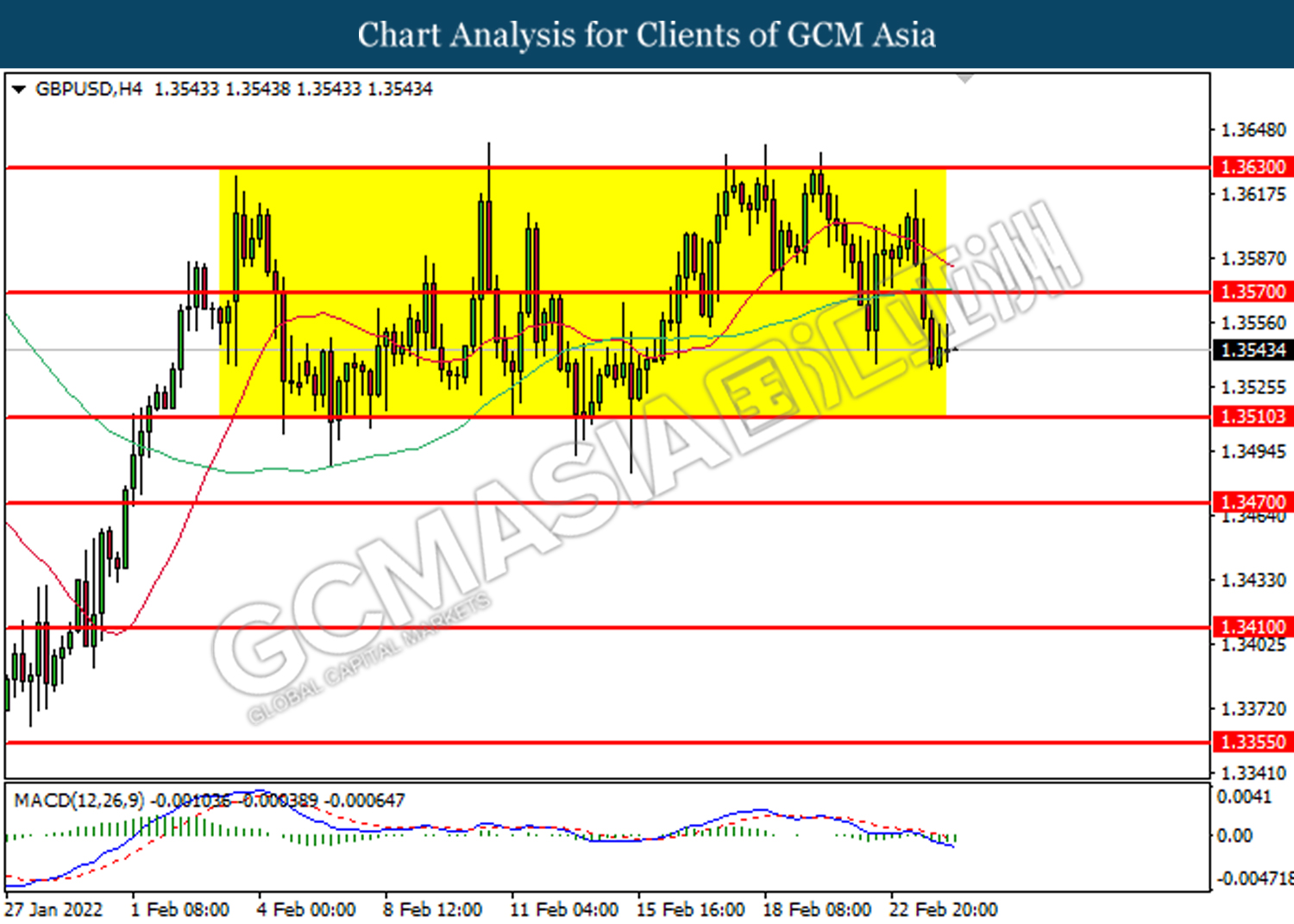

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

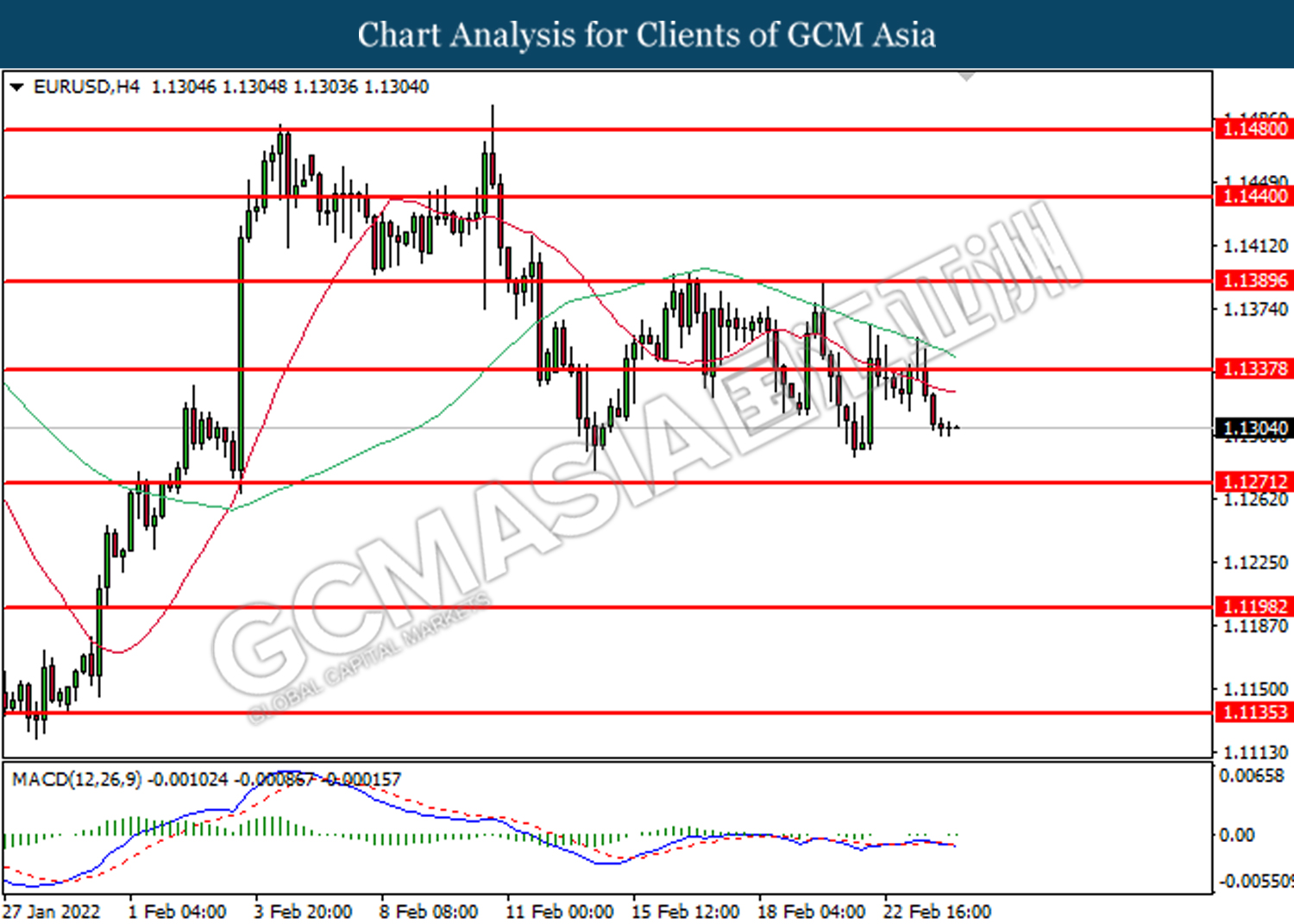

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

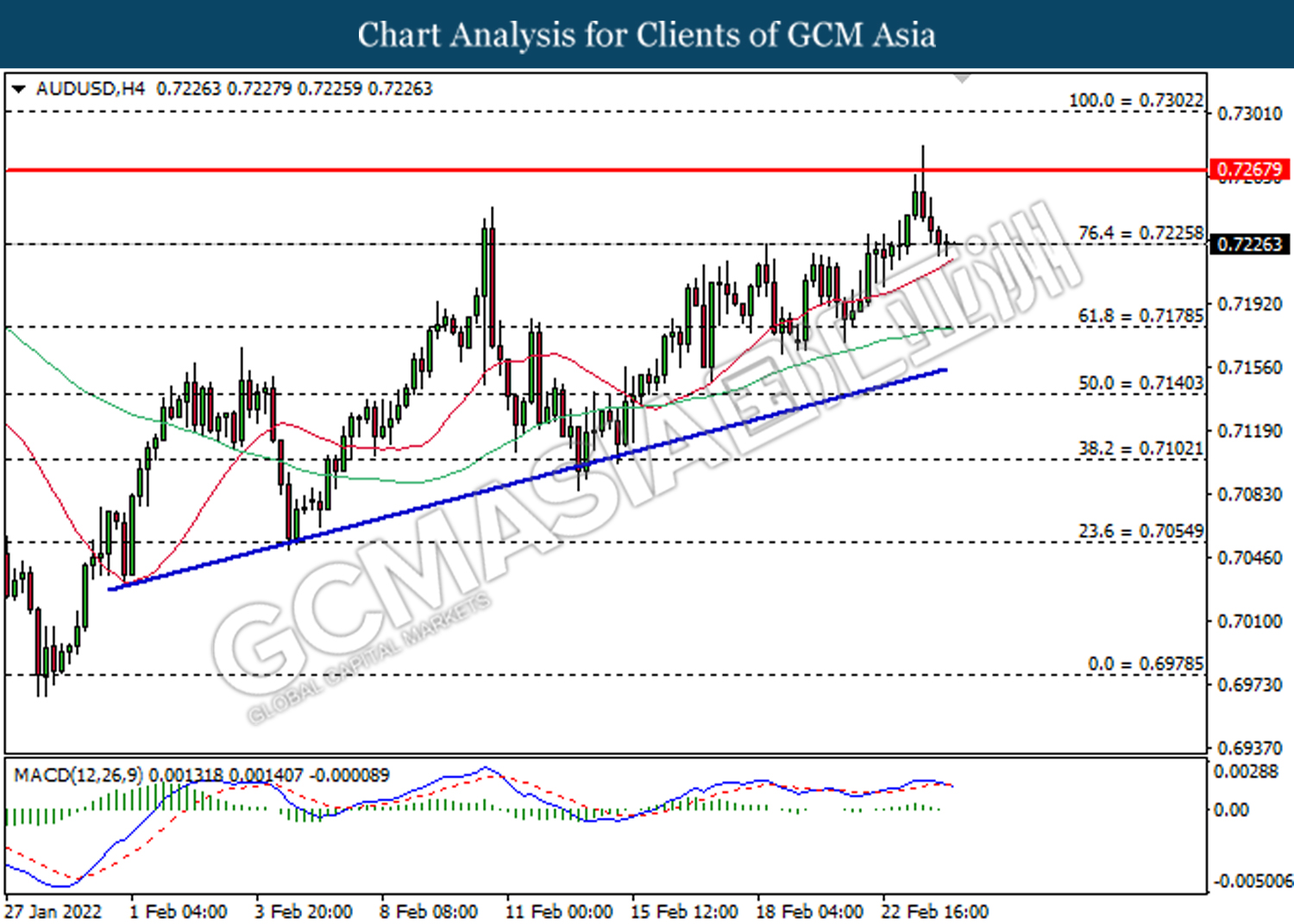

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7270, 0.7300

Support level: 0.7225, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6745, 0.6710

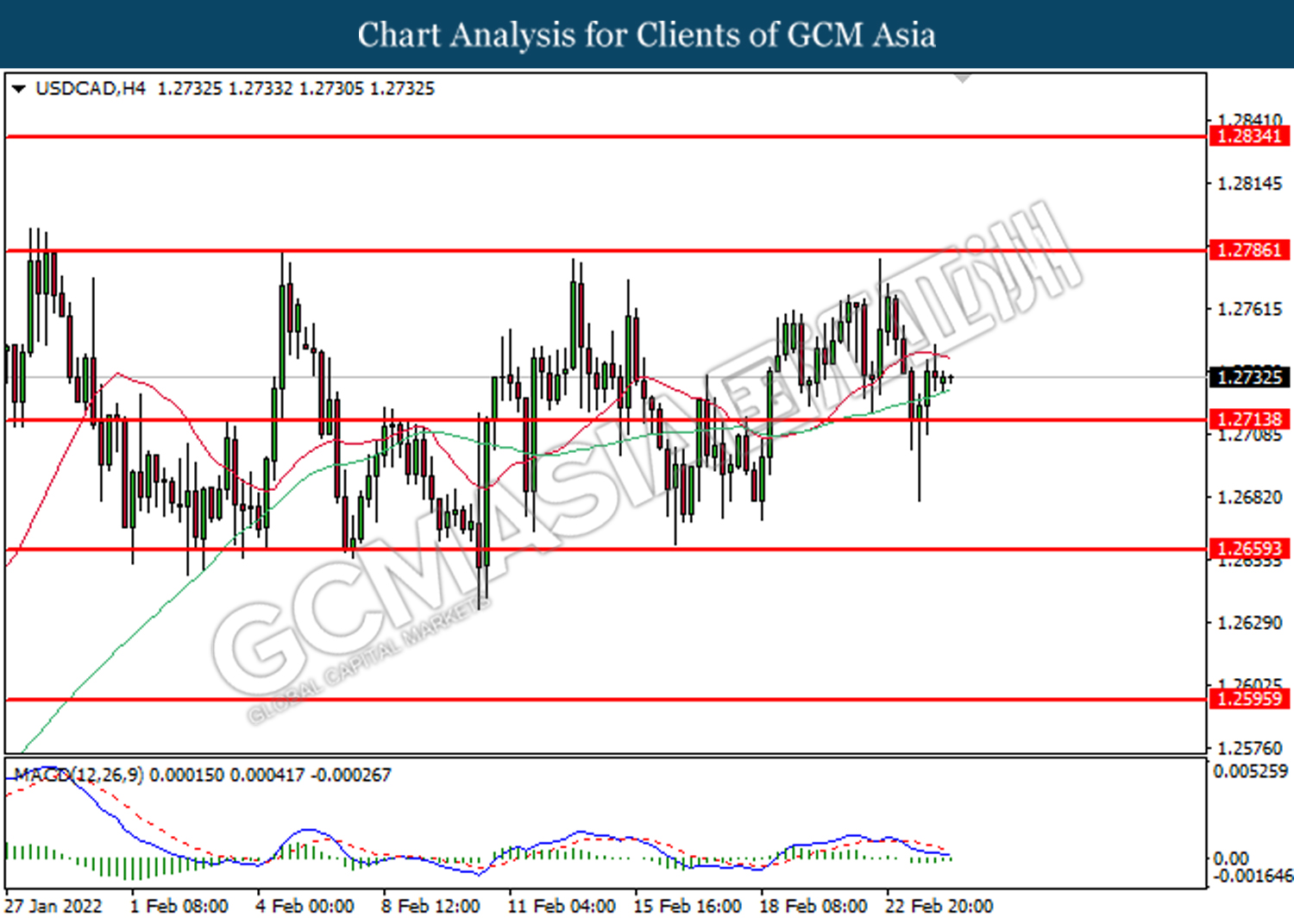

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

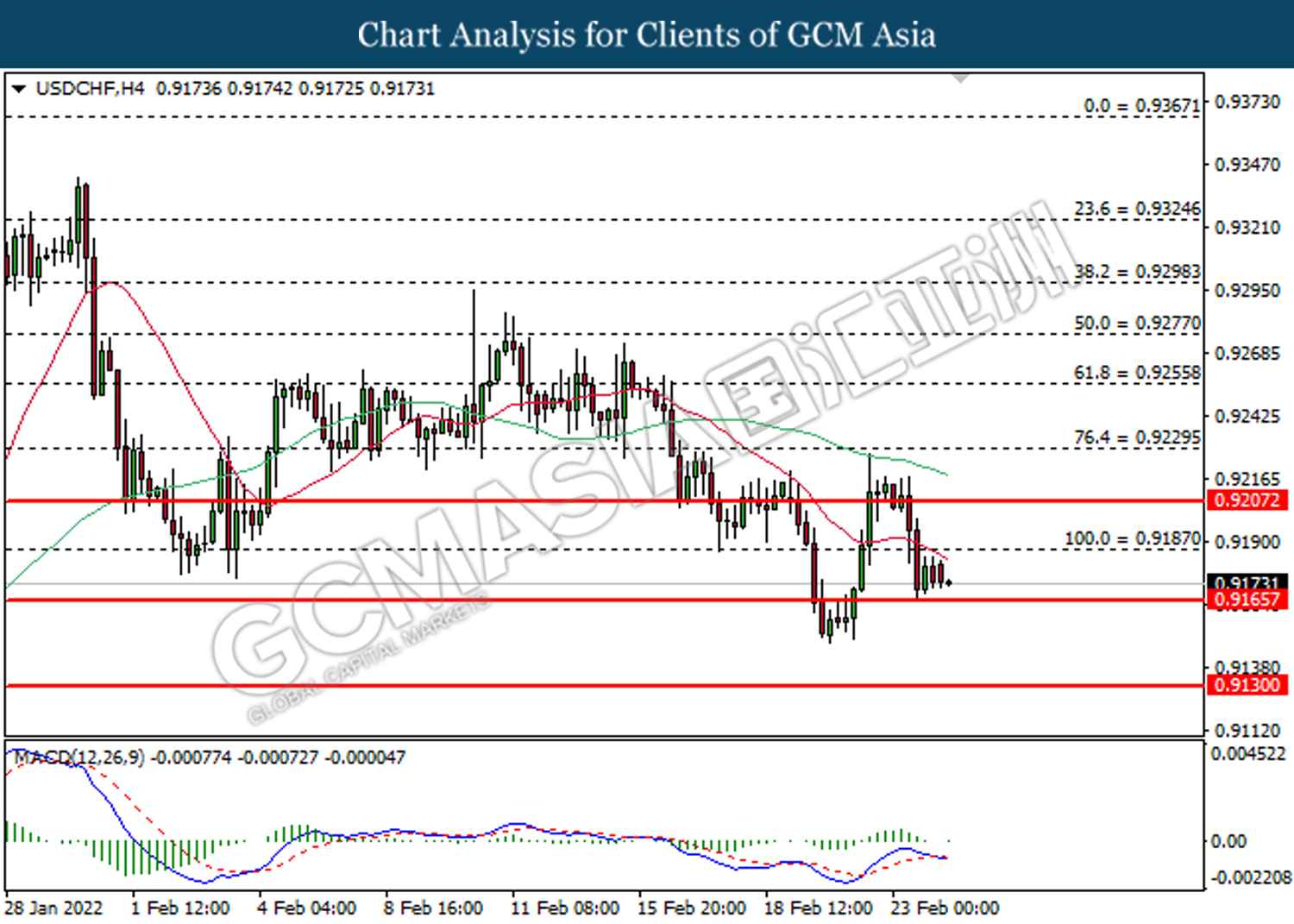

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

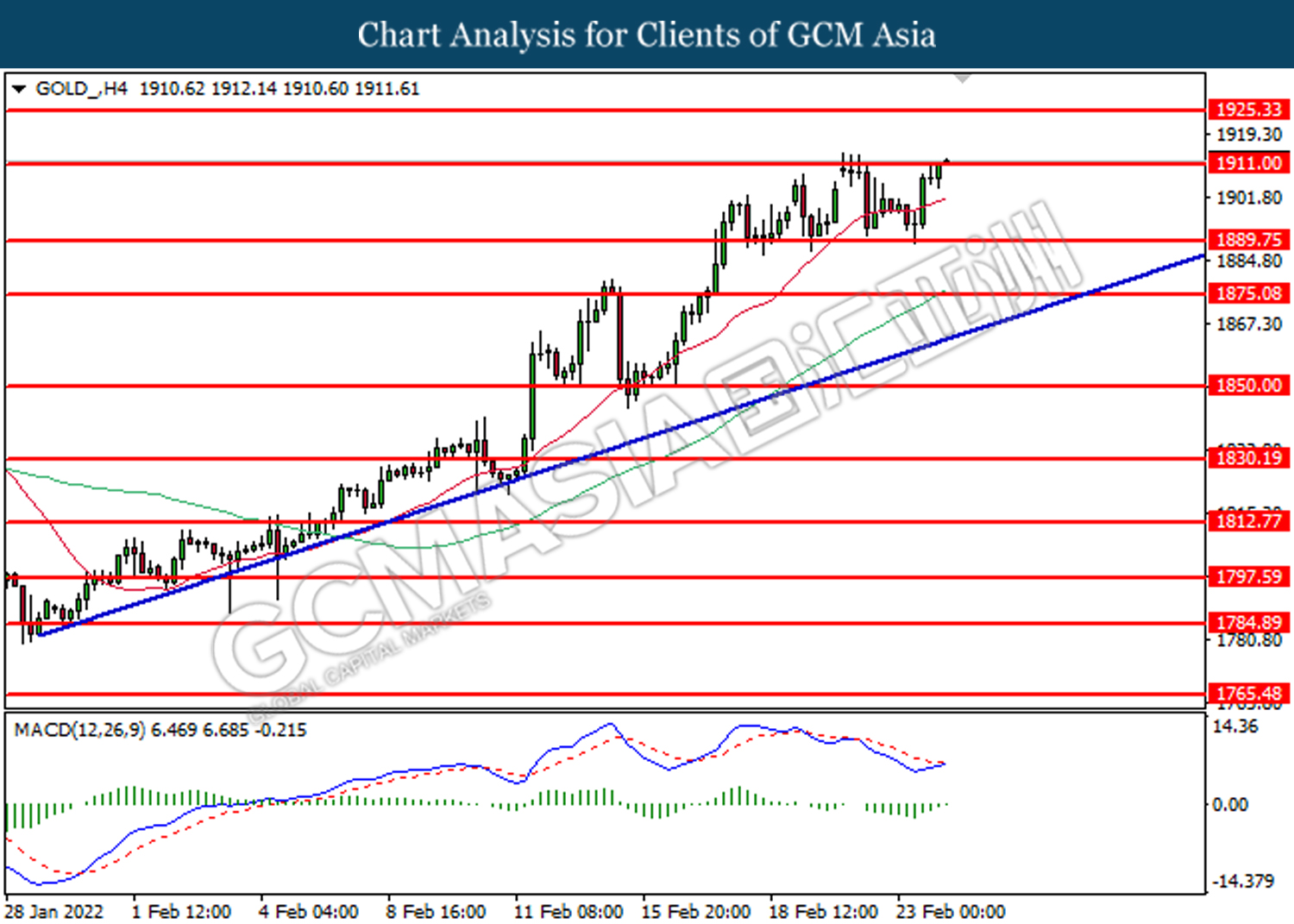

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10