24 February 2023 Afternoon Session Analysis

Eurodollar slipped as Eurozone Inflation cooled down.

The Euro, as one of the most traded currencies by the global investor, slipped after the Eurostat CPI report was released. The annual inflation was down to 8.6% in January compared to December at 9.2%, mainly due to falls in the prices of food, alcohol, and tobacco. Moreover, the increase in the US dollar has further declined the euro dollar. According to the Department of Labor, the Initial Jobless Claims were reduced by 3k to 192k, lower than the market expectation of 200k. This indicated that the US has a strong labor market, which created more room for Fed’s further rate hikes. Therefore, the US dollar strengthened and weakened the value of the Euro. However, the losses of the Euro were offset by the European Central Bank’s (ECB) tightening monetary stance. In order to tame the sky-high inflation in Eurozone, ECB has started to increase its interest rate aggressively since the mid of 2022. ECB Chairman Christine Lagarde reiterated that the central bank wishes to raise its interest rate by 50 basis points in March. The inflation has generally declined but the core CPI increased by 0.1% to 5.3%, higher than the previous reading of 5.2%. With that, it does not rule out the possibility ECB will hike rates aggressively in the future. As of writing, the EUR/USD was traded higher by 0.06% to $1.0601.

In the commodities market, crude oil prices edged up by 0.98% to $76.12 per barrel as Russia’s supply cuts tempered market concerns over rate hikes. Besides, gold prices appreciated by 0.29% to $1822.60 per troy ounce amid an unclear signal from the Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core PCE Price Index (MoM) (Jan) | 0.3% | 0.4% | – |

| 23:00 | USD – New Home Sales (Jan) | 616K | 620K | – |

Technical Analysis

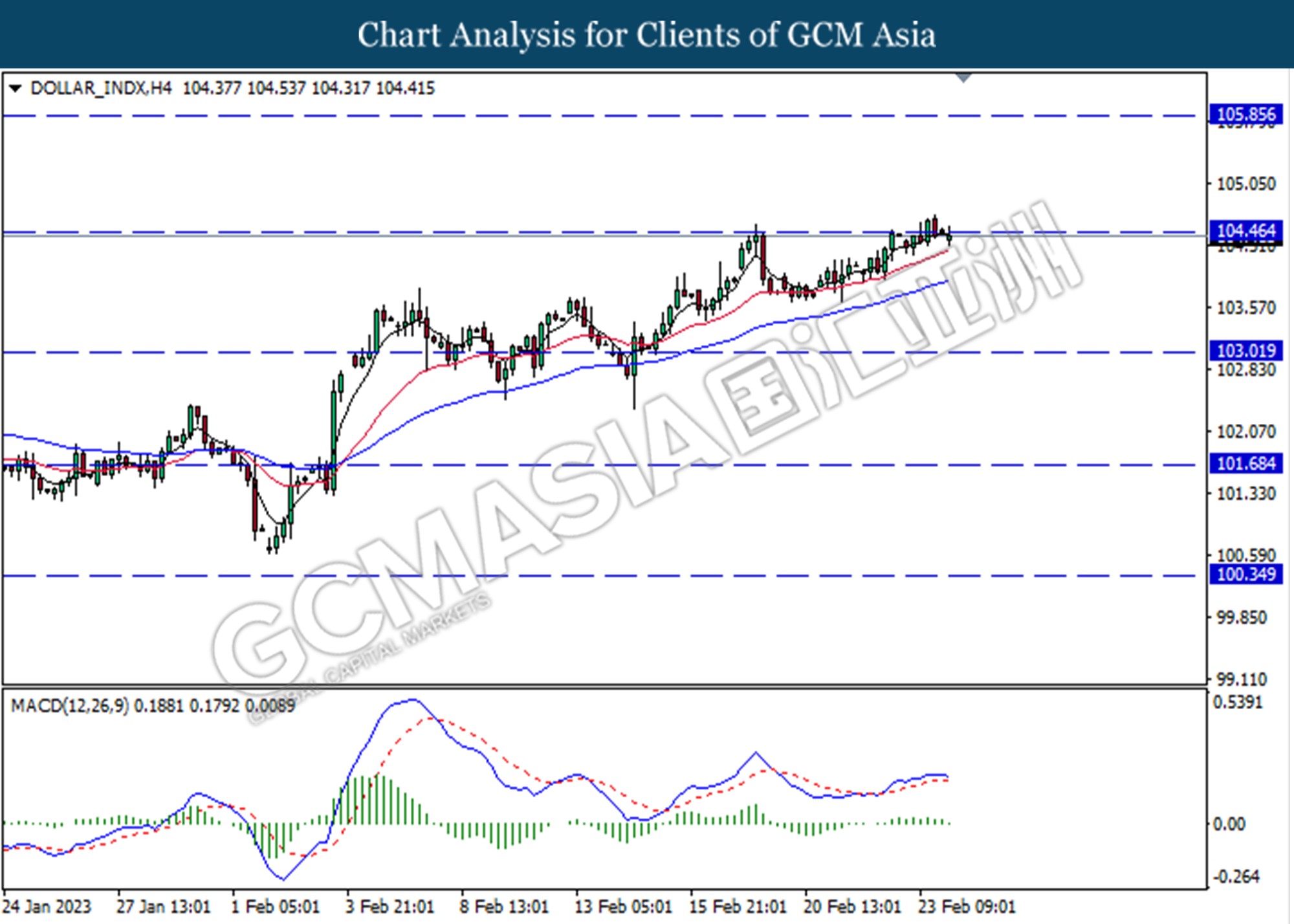

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 104.45. However, MACD which illustrated bearish momentum suggests the index to undergo technical correction in a short term

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

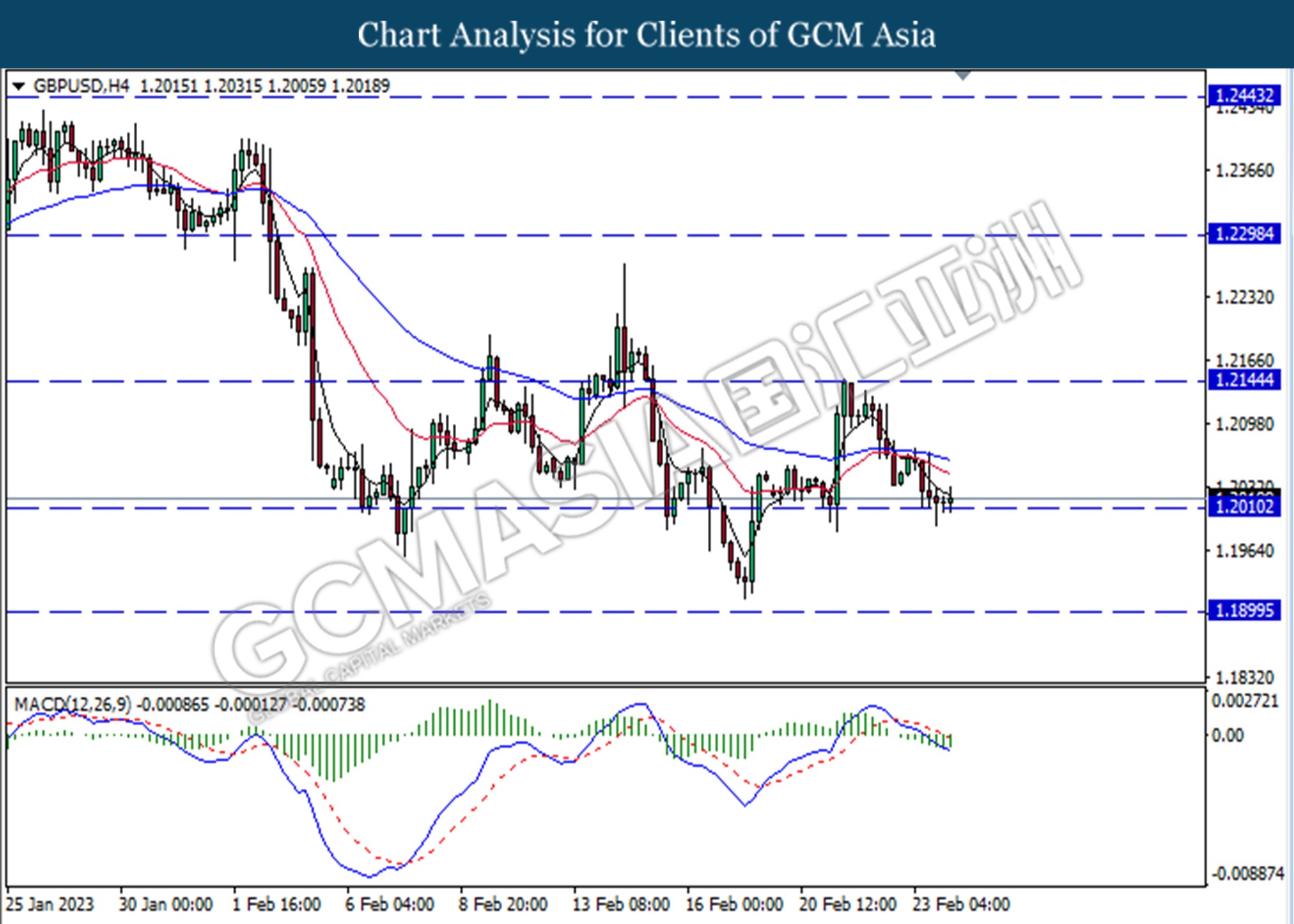

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2010. MACD which illustrated bearish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded lower following a prior retracement from the previous support level at 1.0635. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.0635.

Resistance level: 1.0635, 1.0790

Support level: 1.0575, 1.0445

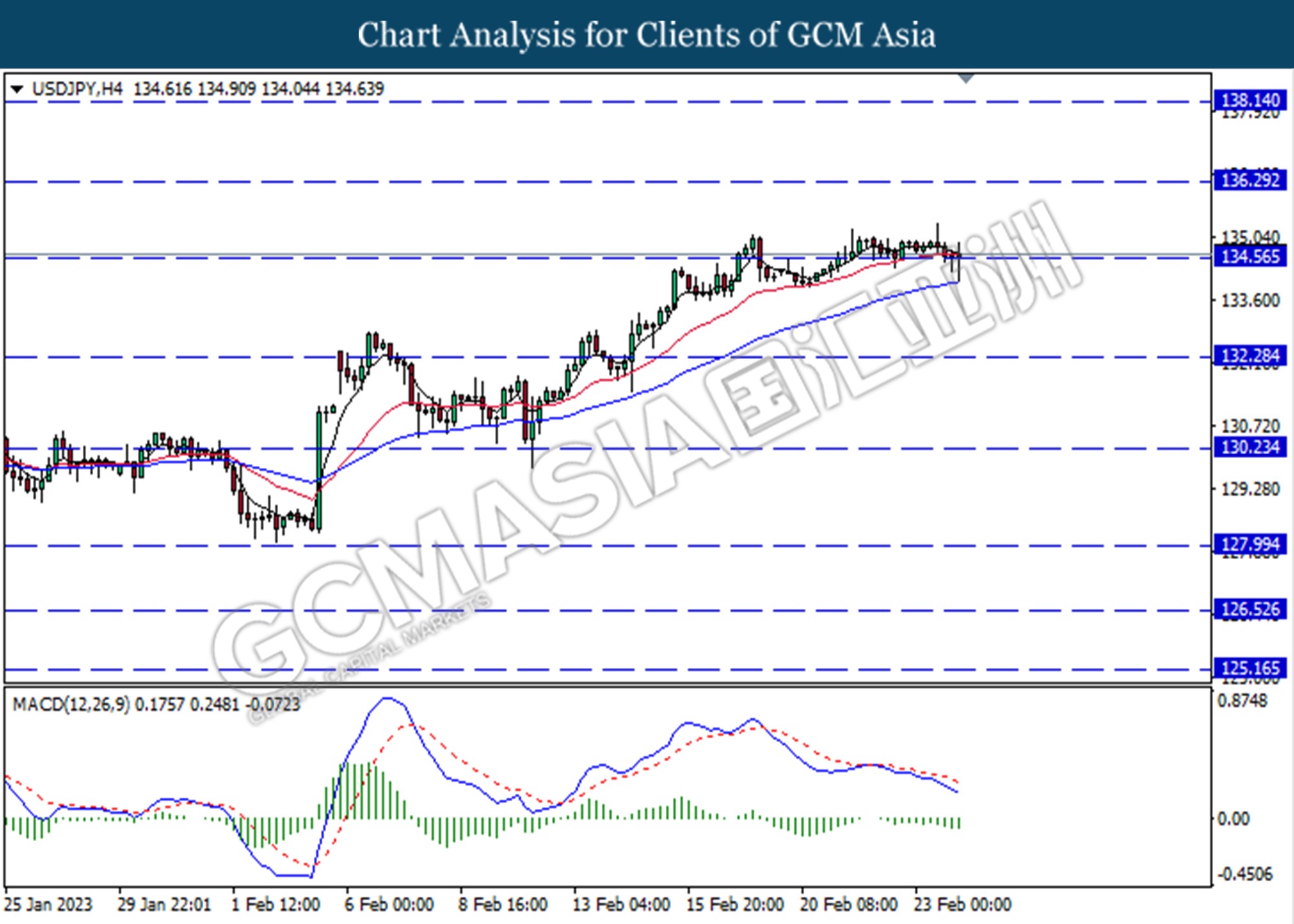

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 134.55. MACD which illustrated bearish momentum suggests the pair to extend its losses after it successfully breakout above the support level.

Resistance level: 136.30. 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded higher following a rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6870.

Resistance level: 0.6870, 0. 6945

Support level: 0.6775, 0.6685

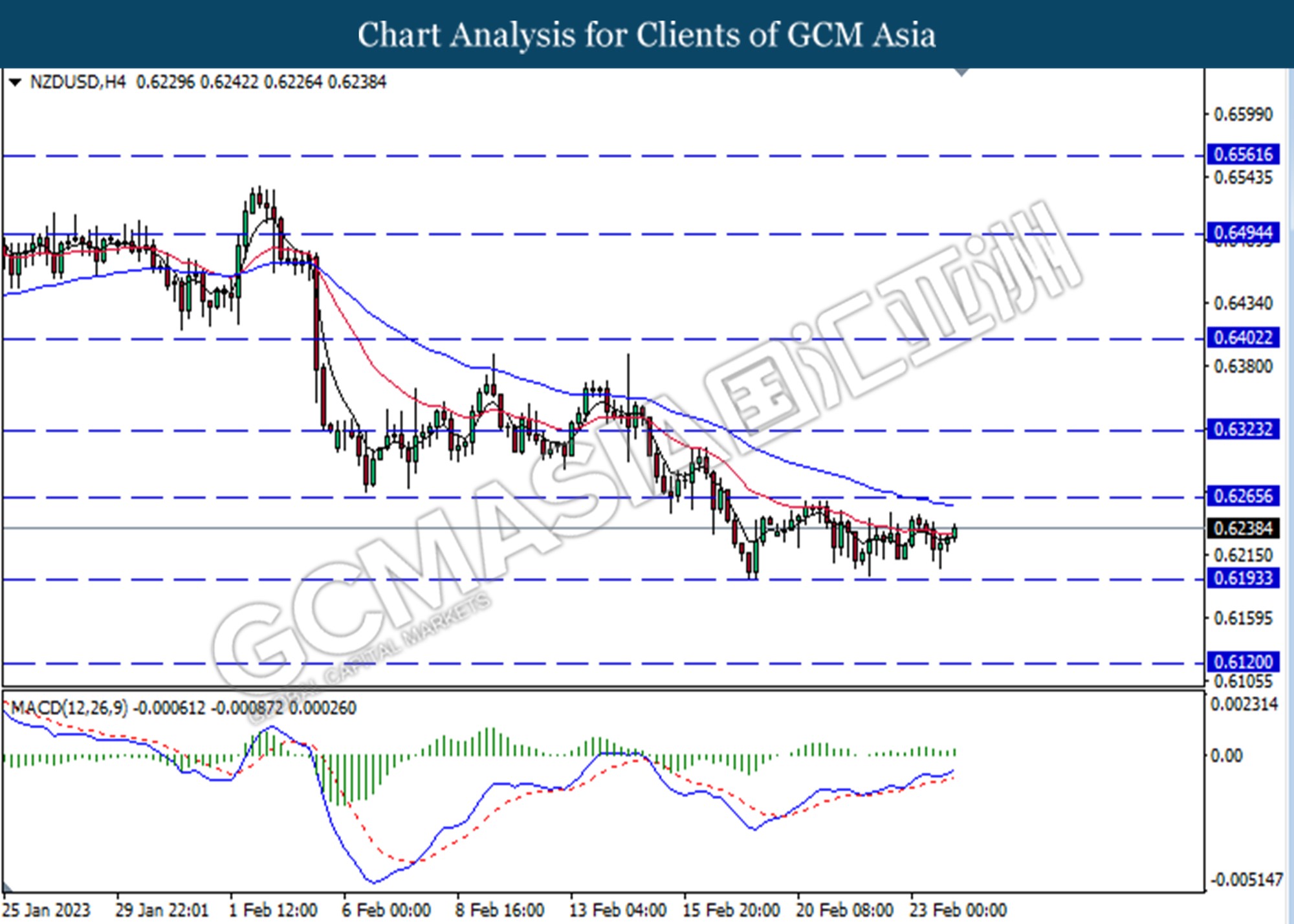

NZDUSD, H4: NZDUSD was traded higher following a rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

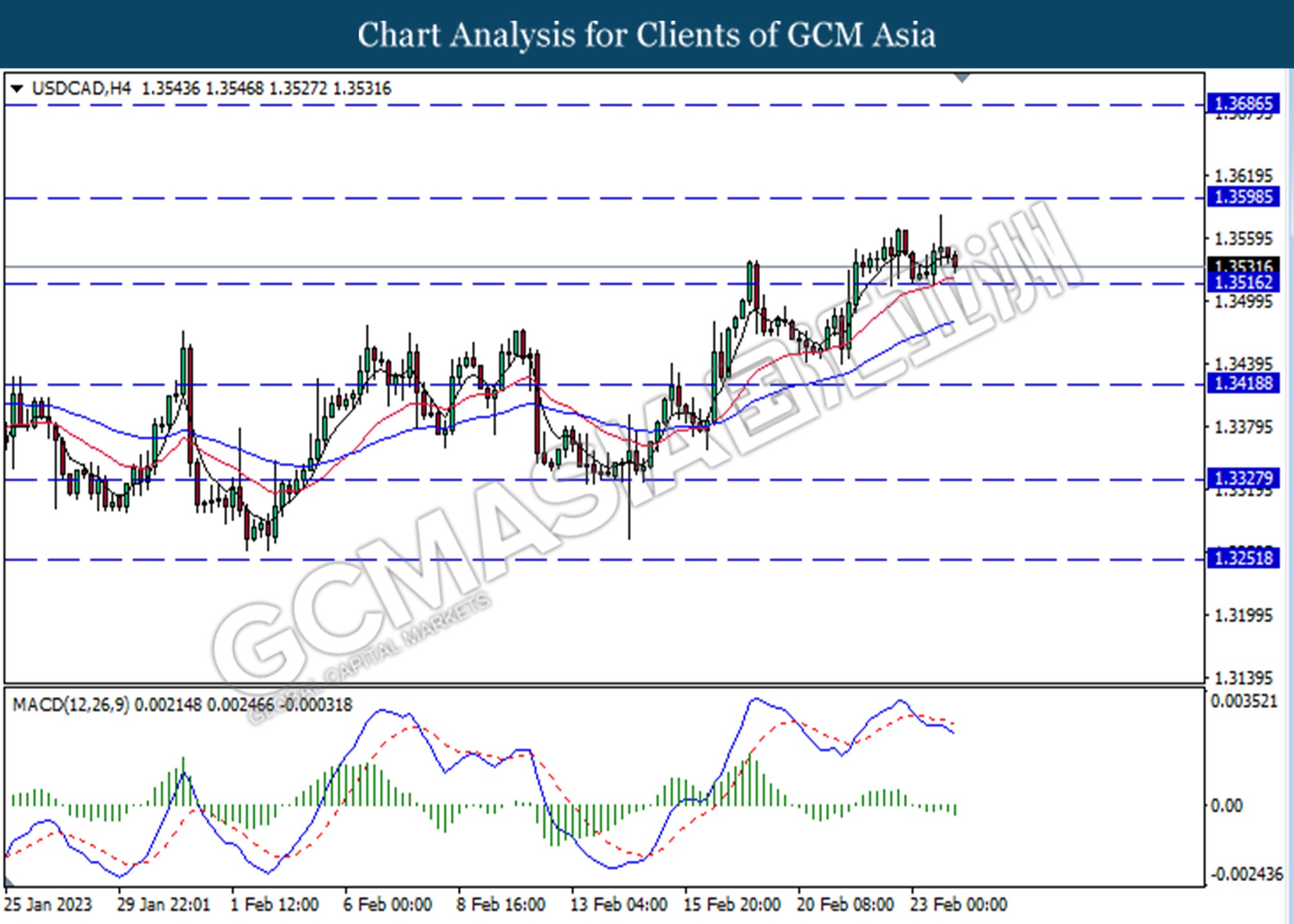

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3690

Support level: 1.3515, 1.3420

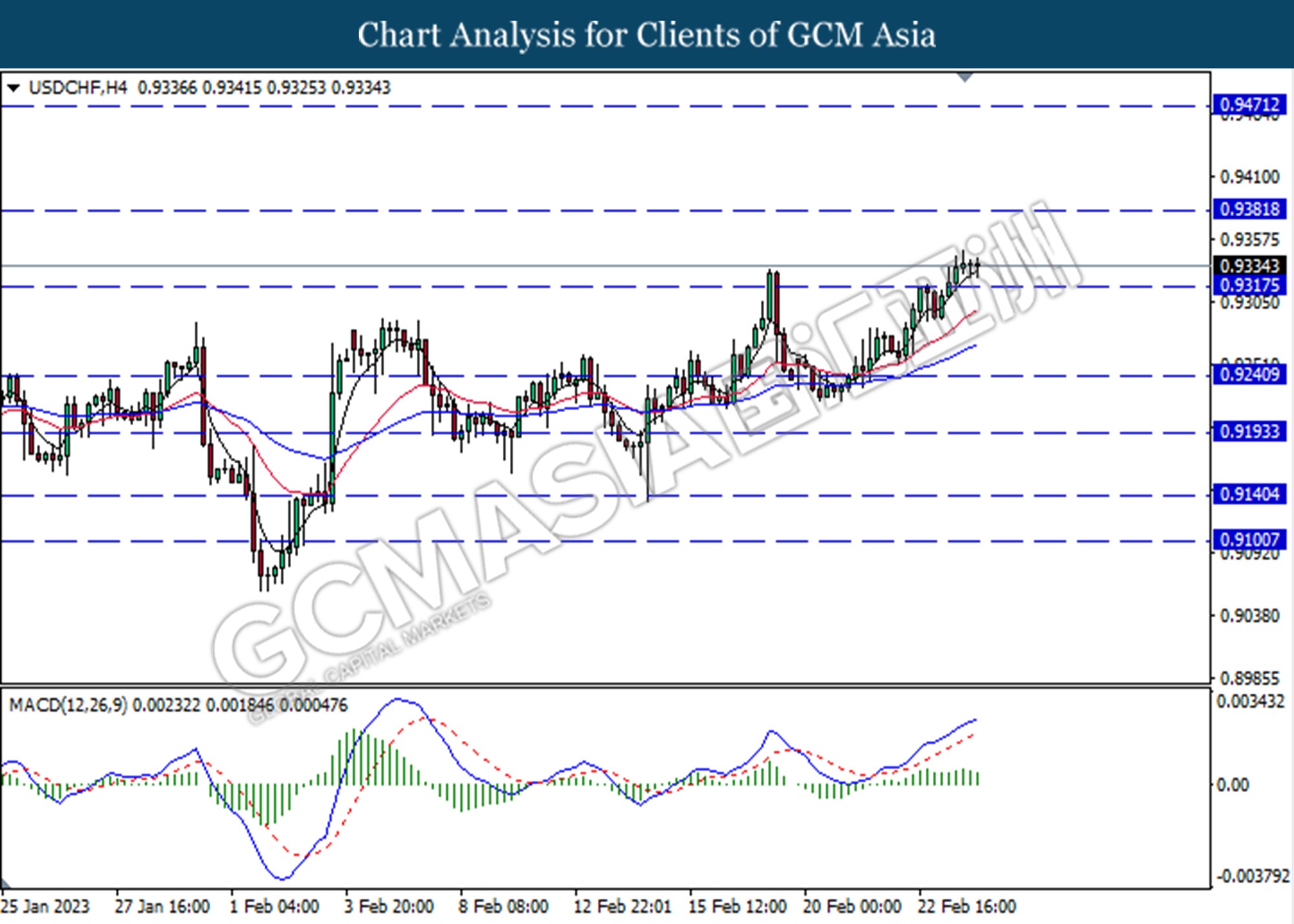

USDCHF, H4: USDCHF was traded higher following a prior break out above the previous resistance level at 0.9320. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9380.

Resistance level: 0.9380, 0.9470

Support level: 0.9320, 0.9240

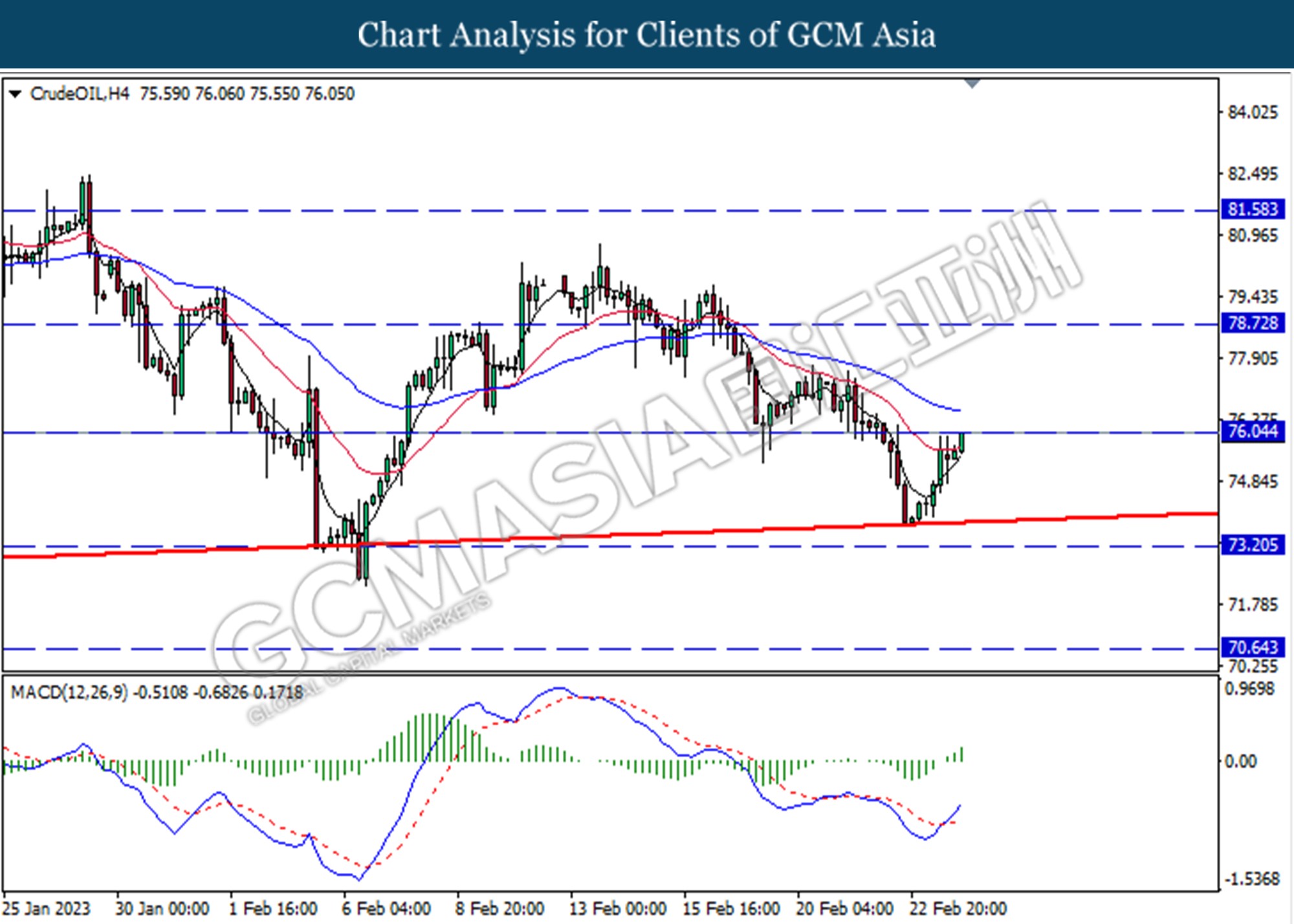

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the upward trend line while currently testing for the resistance level at 76.05. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains if successfully breaks above the resistance level.

Resistance level: 76.05, 78.70

Support level: 73.20,70,65

GOLD_, H4: Gold price was traded lower following the prior rebound from the support level at 1819.15. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1797.85