24 February 2023 Morning Session Analysis

US dollar muted amid mixed economic data.

The dollar index, which is traded against a basket of six major currencies, failed to extend its rally yet hovered near the highest level since the beginning of January following the release of mixed data. According to the Bureau of Economic Analysis, the US 4th quarter GDP dropped sharply from the prior reading at 3.2% to 2.7% missing the consensus forecast at 2.9%, reflecting that the Federal Reserve’s rate hike plan dragged down the consumer spending in the United States. The sharp decline in the GDP data has surprised the market participants negatively, as most of the US economic data in recent weeks were so strong and decent. As the GDP is one of the most significant measure of economic growth, the disappointing result has raised the market concern over the desire of Fed further rate hike. Despite, the losses of the greenback were limited, as the US labor market continued to show that it is still remain resilient recently. According to the Department of Labor, the number of Americans filing for unemployment claims declined further from 195K to 192K over the past one week, beating the consensus forecast at 200K. As of writing, the dollar index rose 0.02% to 104.60.

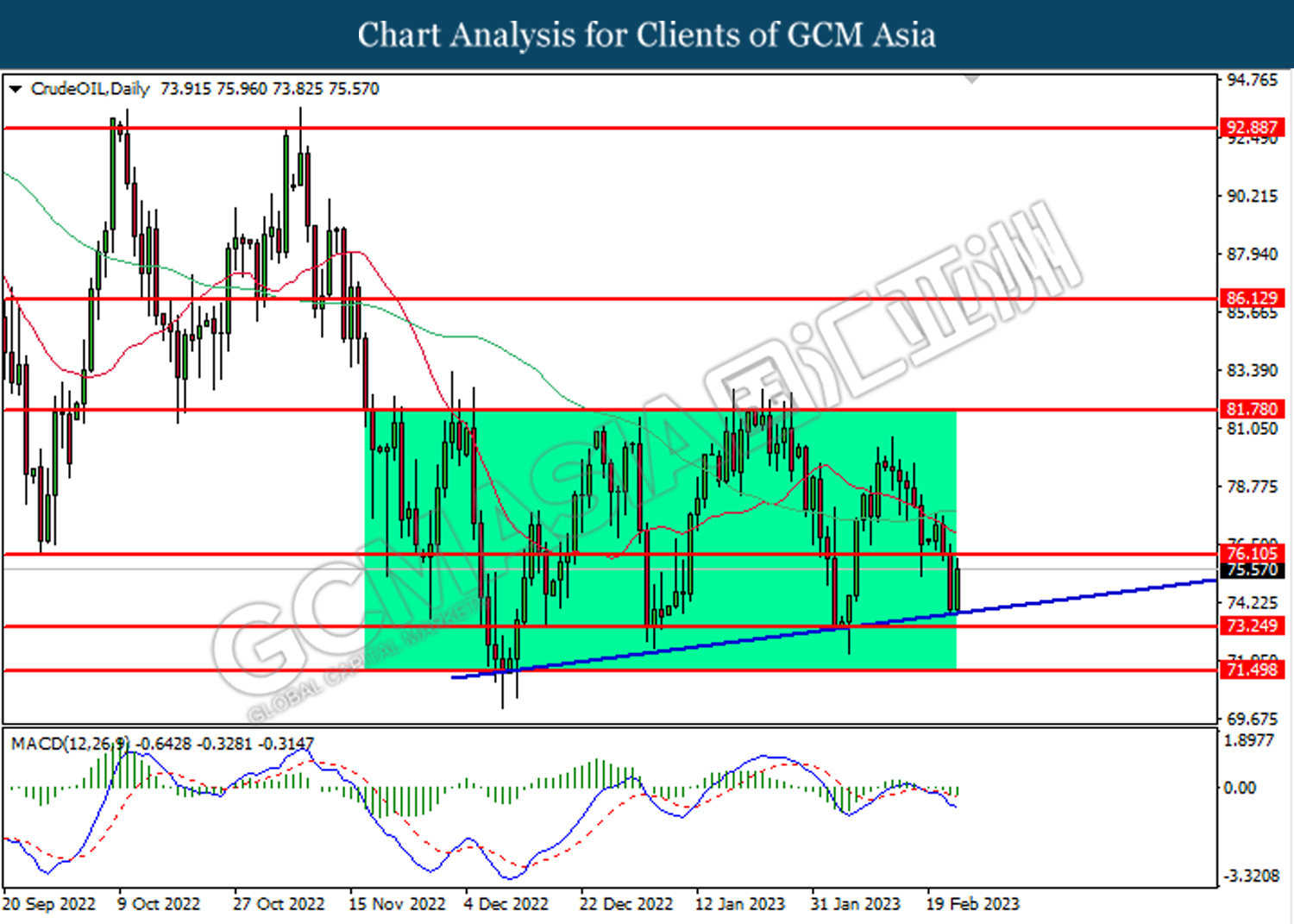

In the commodities market, crude oil prices were up by 2.17% to $75.30 per barrel as the Russia’s oil cut plan and the reopening of China economy outweighed the sharp increase in the US oil inventory. Besides, gold prices edged down by -0.02% to $1822.60 per troy ounce as the US dollar’s strength appears unabated.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q4) | -0.2% | -0.2% | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Jan) | 0.3% | 0.4% | – |

| 23:00 | USD – New Home Sales (Jan) | 616K | 620K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

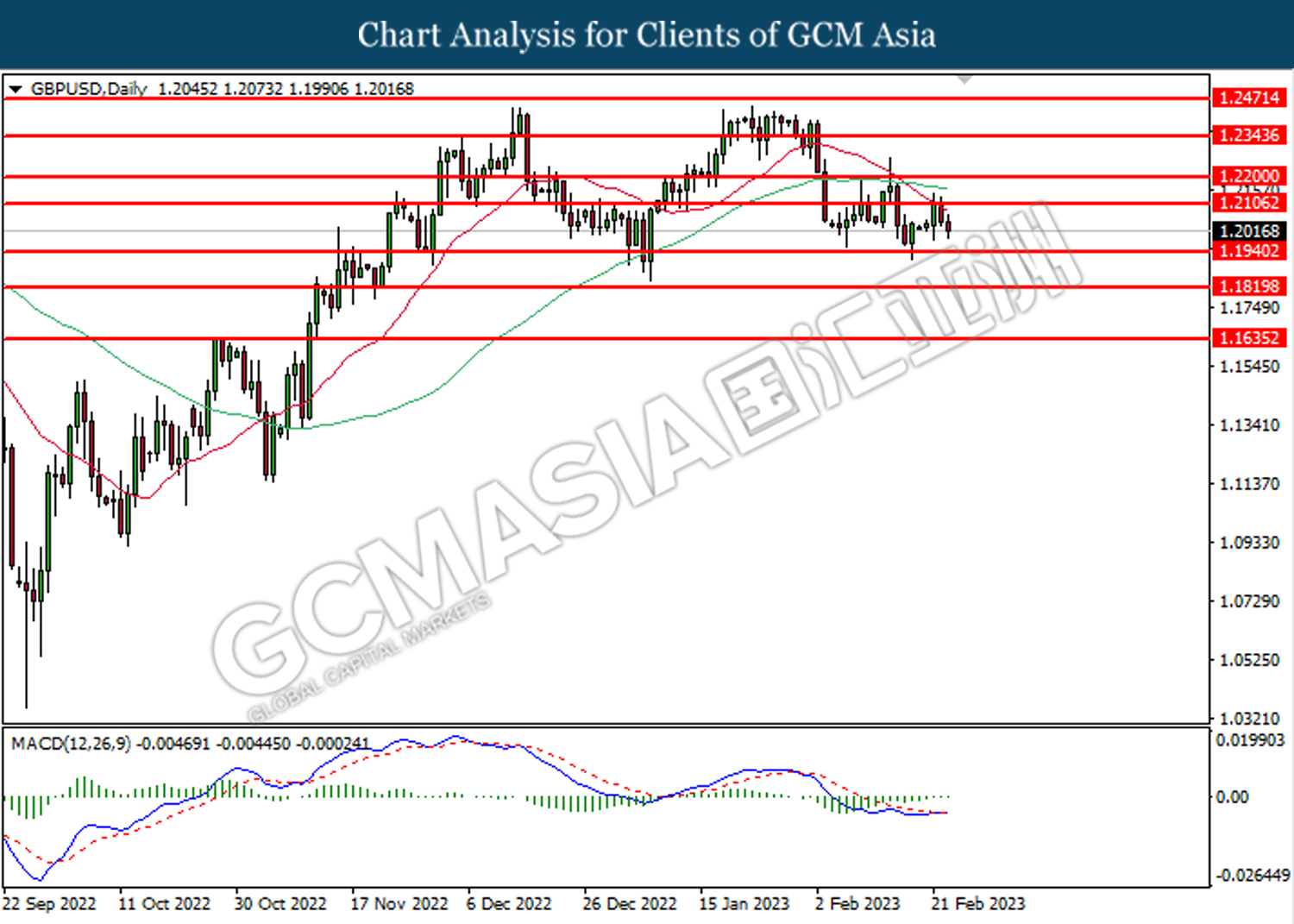

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

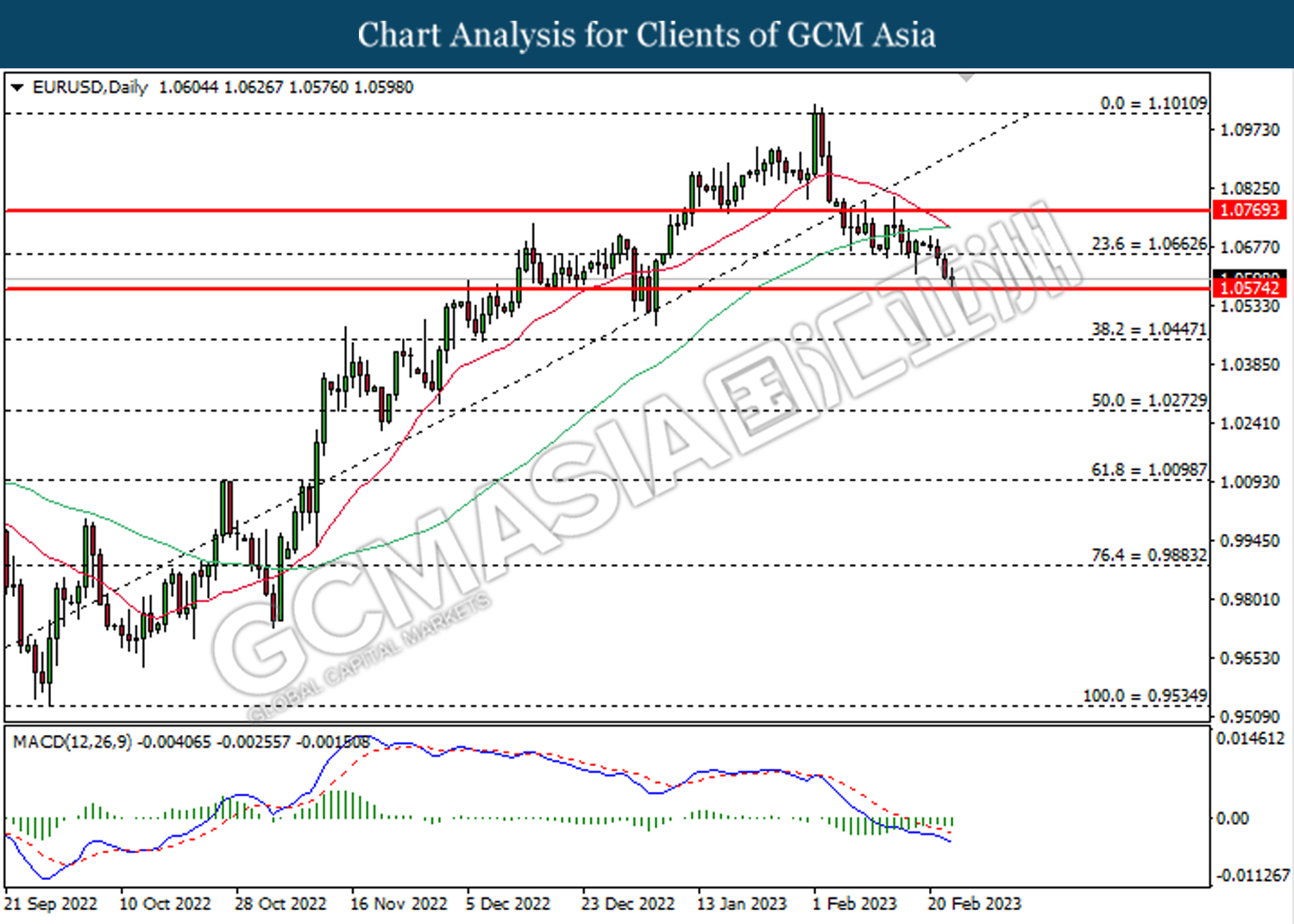

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

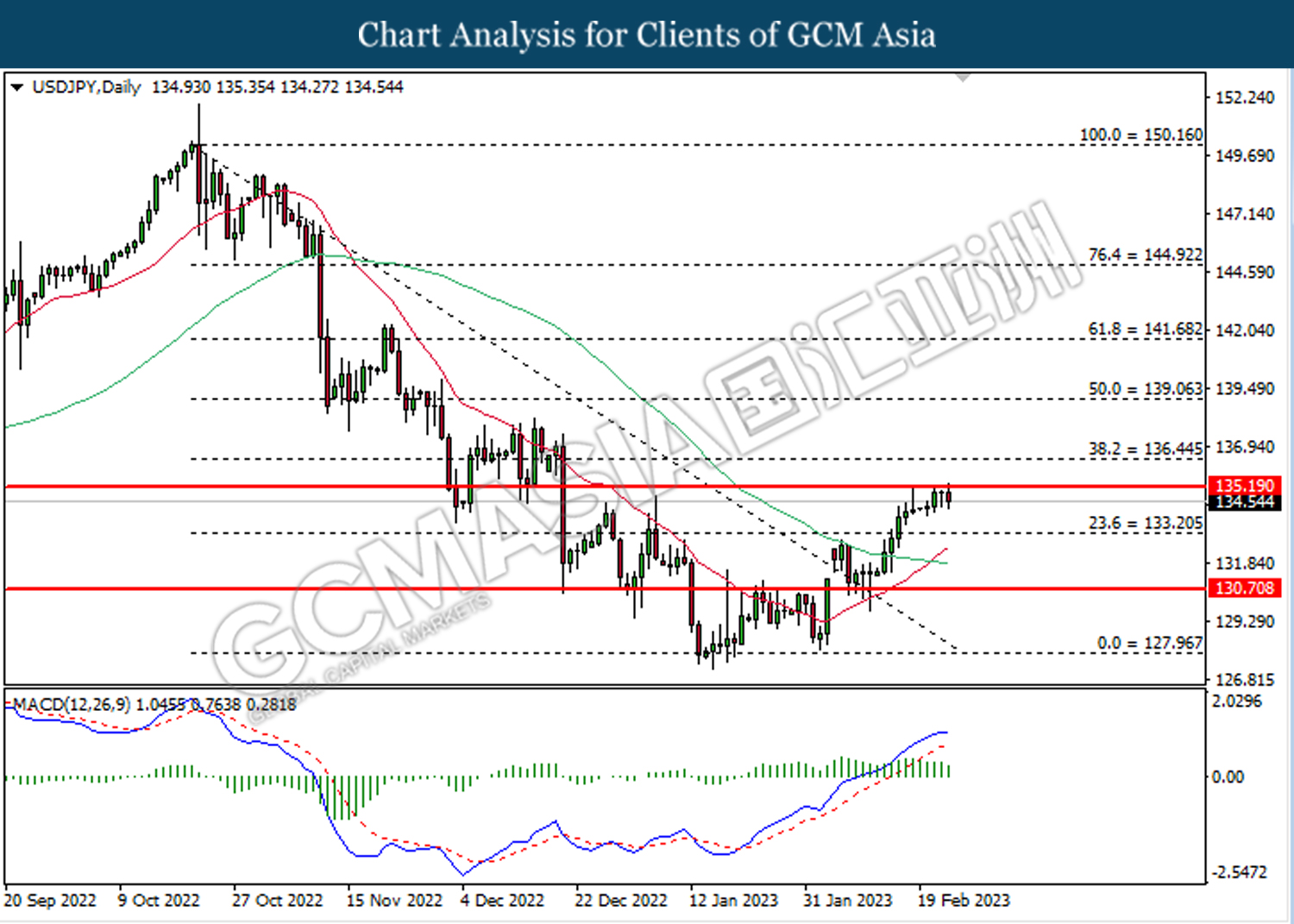

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.45

Support level: 133.20, 130.70

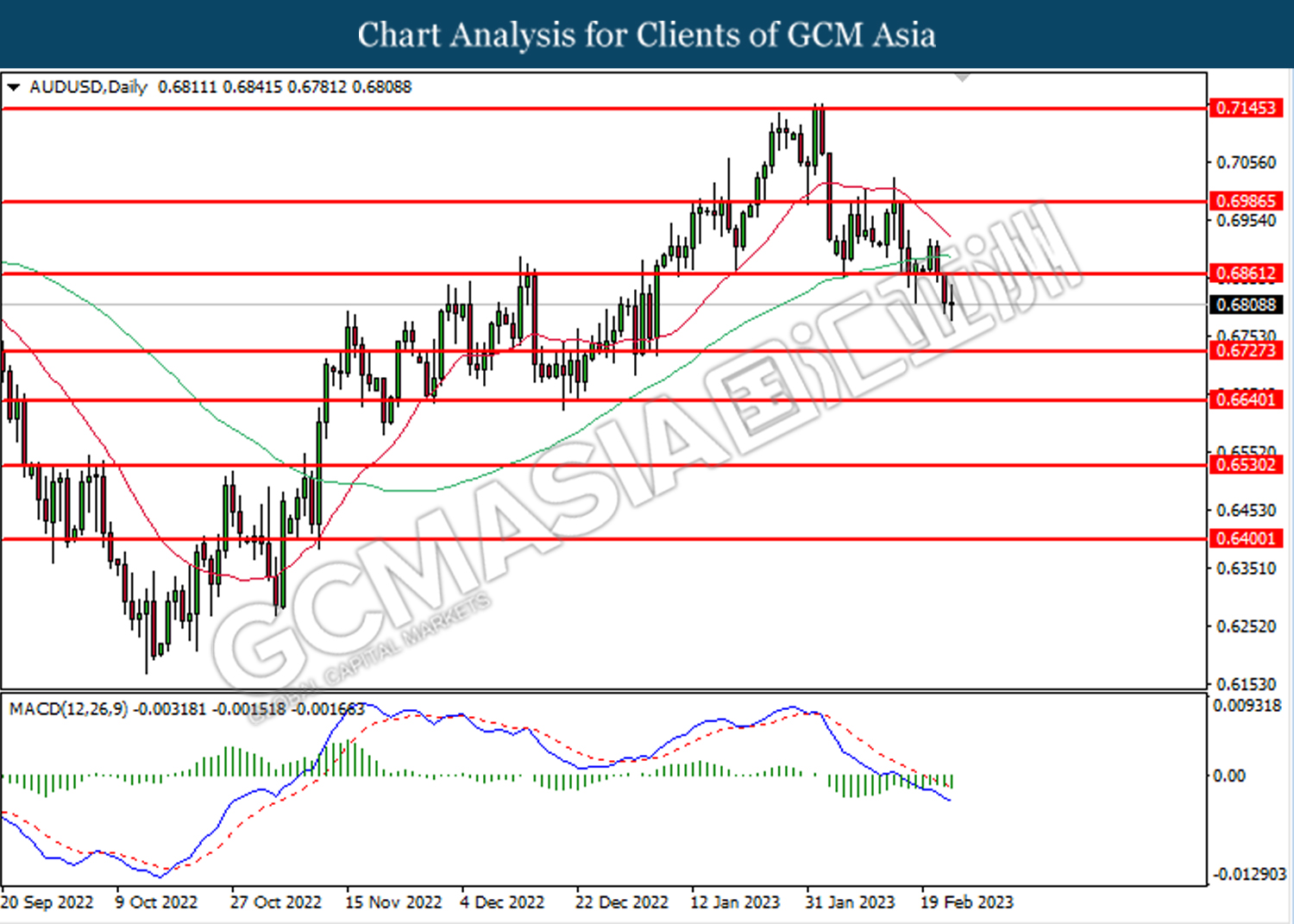

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

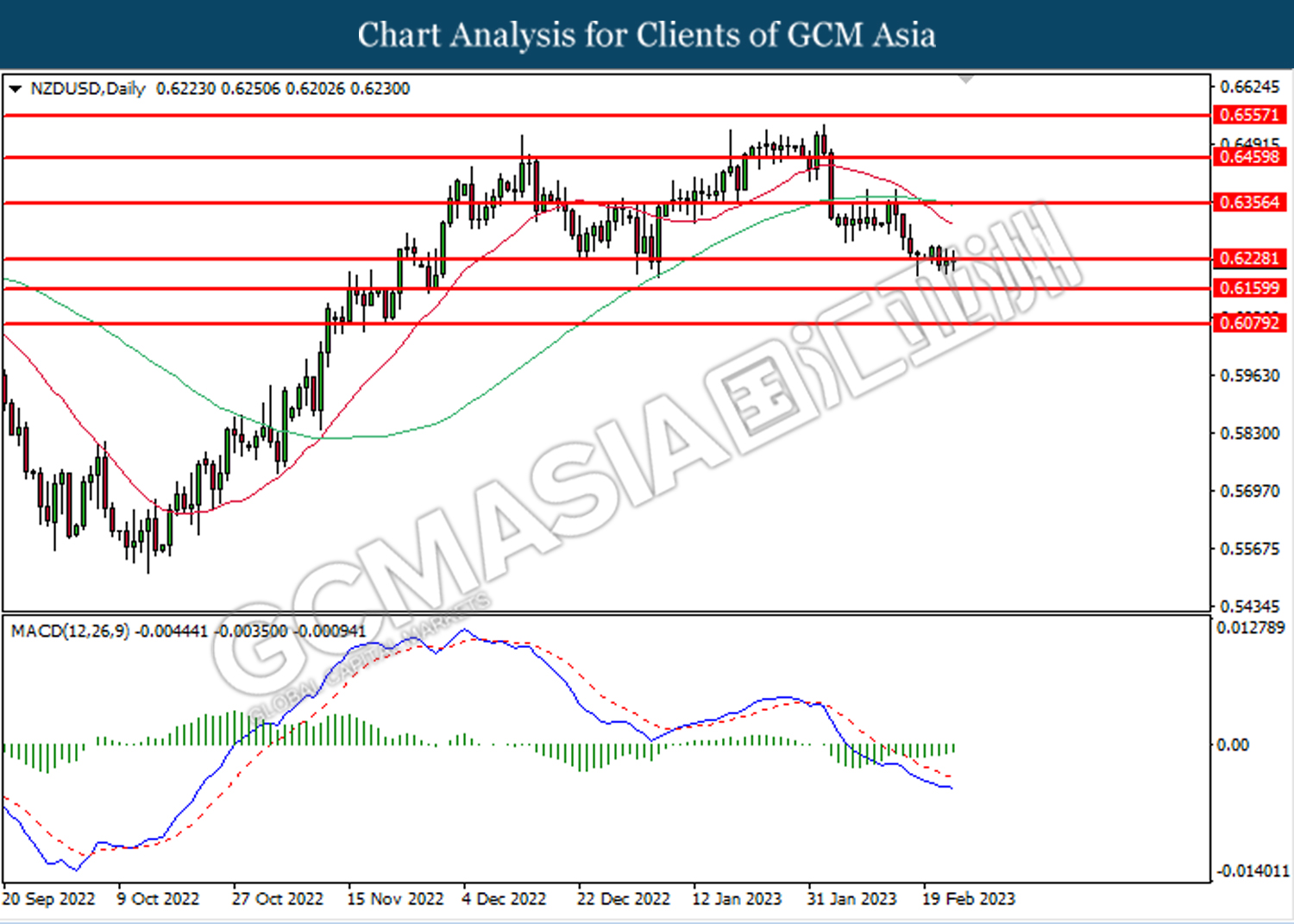

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6230. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6230, 0.6160

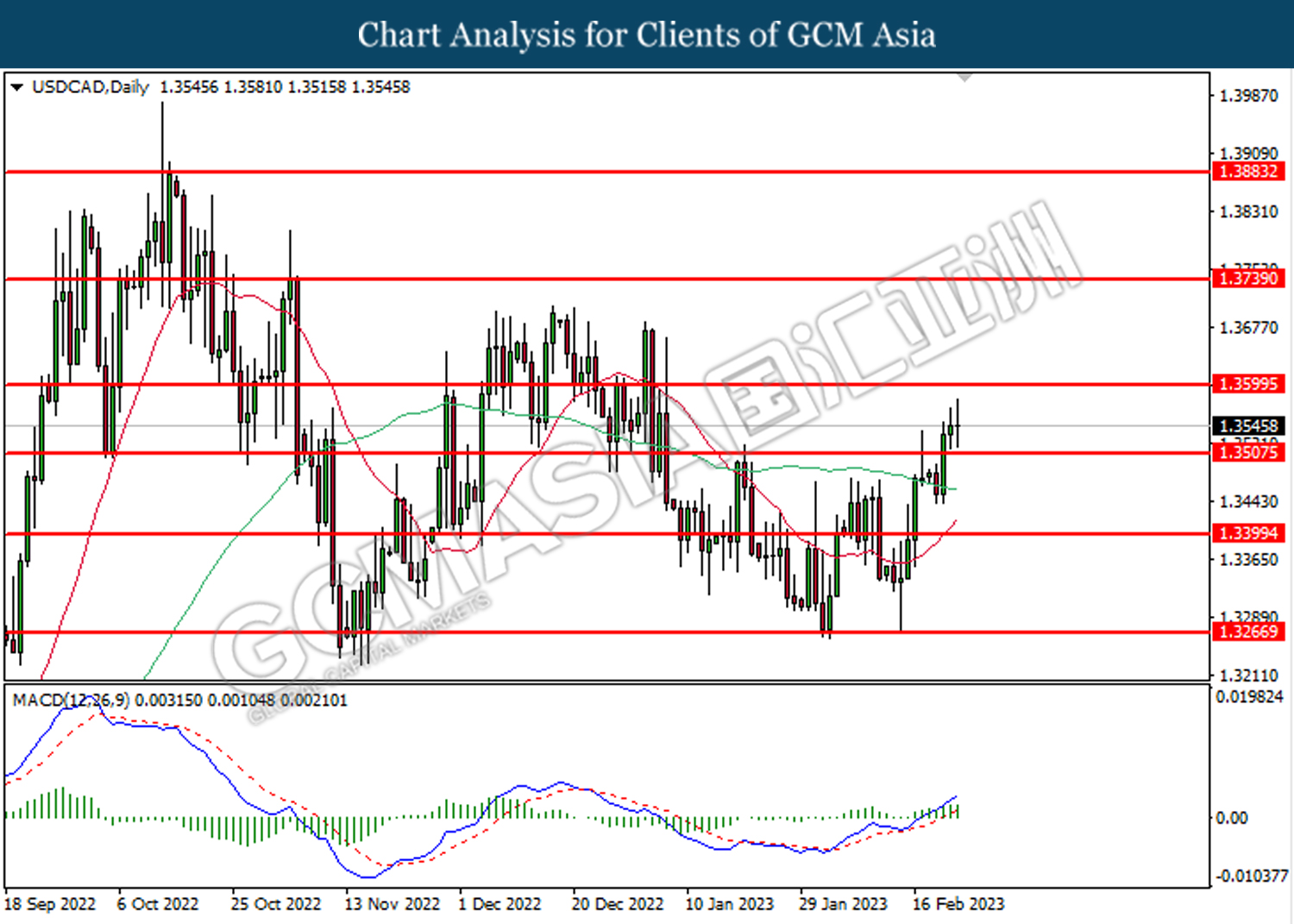

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3505. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the next resistance level at 1.3600.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

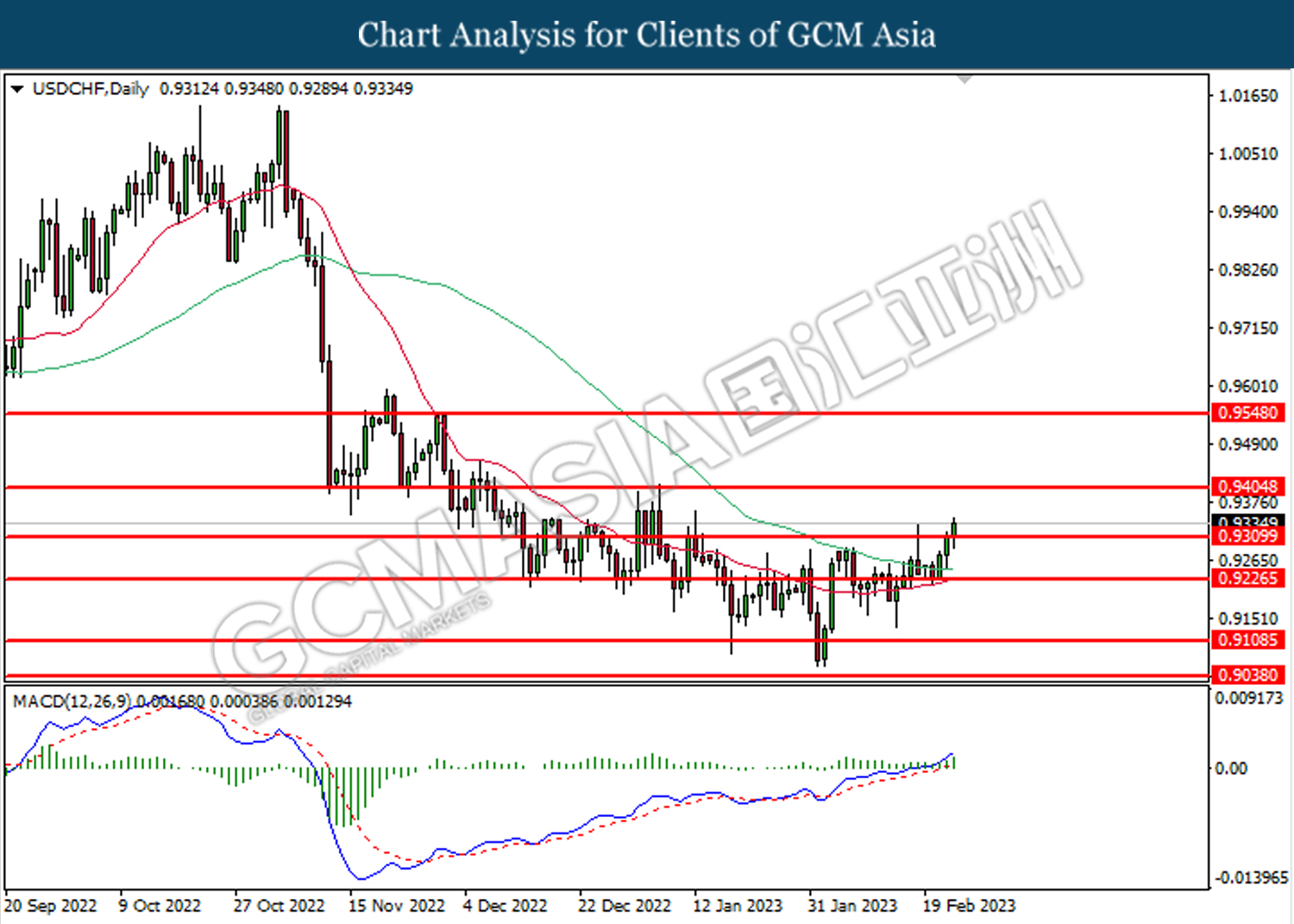

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 81.80

Support level: 73.25, 71.50

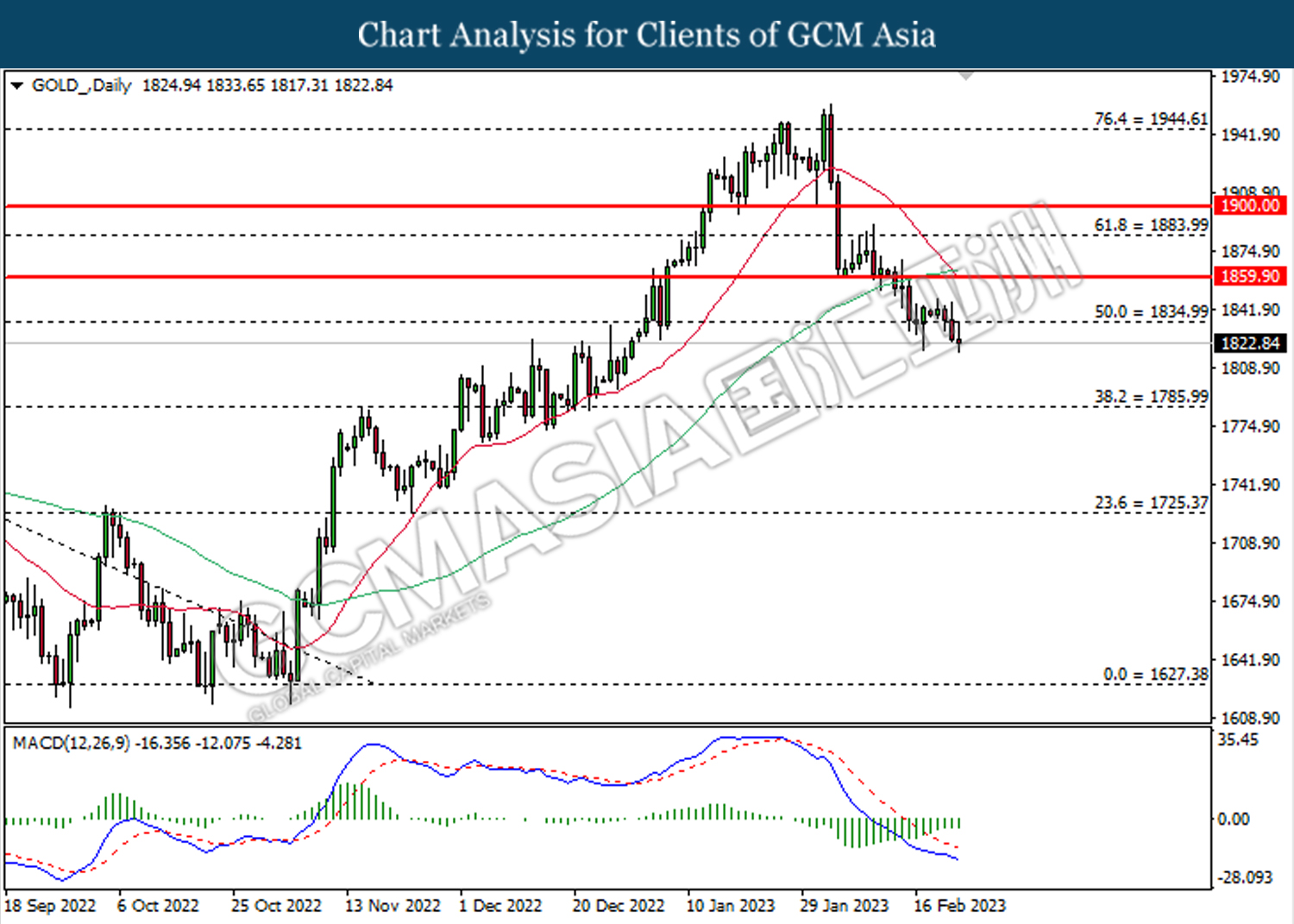

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1835.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1786.00.

Resistance level: 1835.00, 1859.90

Support level: 1786.00, 1725.35