24 May 2018 Daily Analysis

Greenback retraces over dovish FOMC statement and Trump’s new tariff plan.

Dollar index was down by 0.12% to 93.79 as of writing following dovish FOMC statement while Trump’s new US auto tariff proposal continued to weigh on the Greenback. Overnight, the FOMC Committee released their statement that there was a lack of urgency to tighten monetary policy in a more aggressive pace given that “modestly above 2 percent would be consistent with the committee’s symmetric inflation target and could be helpful in anchoring inflation expectations in the long run”. In addition, according to the administration officials and industry executives, US President Trump and his administration is looking into using national-security laws to impose new tariffs on vehicle imports, thus provoking market participants’ concerns over the risks of global trade war. On the other hand, GBP/USD fell 0.67% to $1.3355 following the release of worse-than-expected Consumer Price Index (CPI) data in April, last stood at 2.4% versus the expected reading of 2.5%, thus lowering investors’ expectations towards the Bank of England (BoE) to increase its interest rates within a shorter timeframe.

In the commodities market, crude oil price fell by 0.15% to $71.63 per barrel following expectations over the potential increase in OPEC output in response to make up for reduced supply from Iran and Venezuela. Otherwise, gold price rose 0.20% to $1294.00 a troy ounce in the wake of recent geopolitical uncertainty as triggered by Trump’s new tariff plan.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Carney Speaks

16:15 USD FOMC Member Dudley Speaks

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

22:35 USD FOMC Member Bostic Speaks

Tentative (Fri) EUR BoE Gov Carney Speaks

02:00 (Fri) USD FOMC Member Harker Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | 0.3% | 0.3% | – |

| 14:00 | EUR – GfK German Consumer Climate (Jun) | 10.8 | 10.8 | – |

| 16:30 | GBP – Retail Sales (MoM) (Apr) | -1.2% | 0.7% | – |

| 20:30 | USD – Initial Jobless Claims | 222K | 220K | – |

| 22:00 | USD – Existing Home Sales (Apr) | 1.1% | – | – |

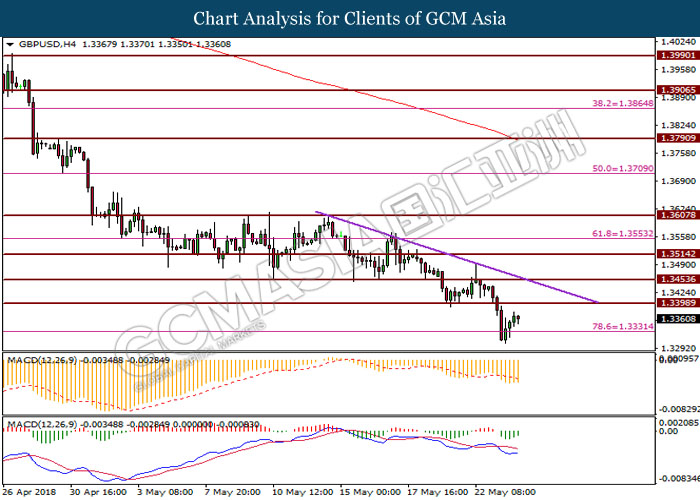

GBPUSD

GBPUSD, H4: GBPUSD was traded higher prior breaking resistance level at 1.3330. MACD signal line that shows continuous weakness would suggest the pair to continue its losses towards the support level at 1.3330.

Resistance level: 1.3400, 1.3450

Support level: 1.3330, 1.3270

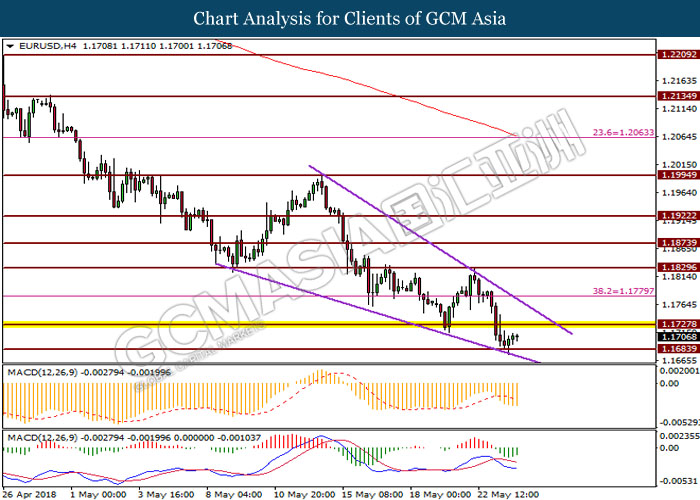

EURUSD

EURUSD, H4: EURUSD was traded higher prior rebound from support level at 1.1680. MACD signal line that shows continuous bearish momentum would suggest the pair to extend its losses to retest the said support level.

Resistance level: 1.1730, 1.1780

Support level: 1.1680, 1.1630

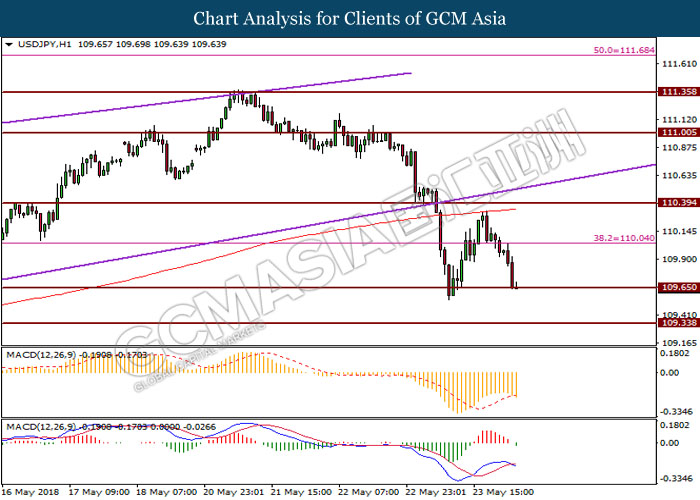

USDJPY

USDJPY, H1: USDJPY was traded lower after breaking support level at 110.00. Death-cross as displayed by MACD signal line would suggest the pair to extend its losses if candlestick successfully closes below the support level at 109.60.

Resistance level: 110.00, 110.40

Support level: 109.60, 109.30

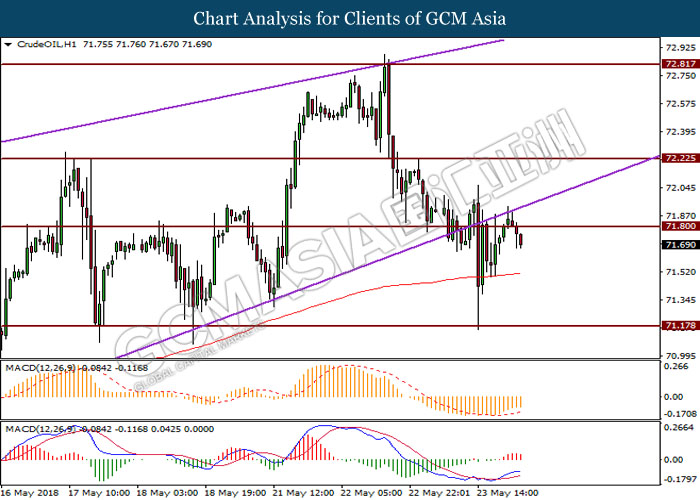

CrudeOIL

CrudeOIL, H1: Crude oil price was traded lower prior its failure to break resistance level at 71.75. MACD signal line that portrays weakness in bullish momentum would suggest the commodity price to extend its losses if candlestick closes below the previous low.

Resistance level: 71.80, 72.20

Support level: 71.20, 70.60

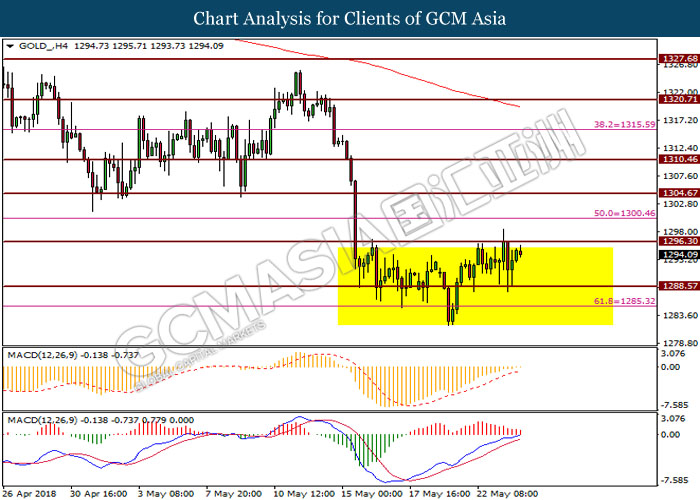

GOLD

GOLD_, H4: Gold price was traded in consolidation with absence of significant indication from both candlestick pattern formation and MACD. Thus, a breakout is required to grasp the direction of price movement for the yellow metal in short-term.

Resistance level: 1296.30, 1300.50

Support level: 1288.60, 1285.30