24 May 2022 Afternoon Session Analysis

Atlanta Fed unleashed dovish talk, US Dollar beaten down.

The Dollar Index which traded against a basket of six major currencies slumped to its recent low from yesterday over the dovish speech was unleashed from Atlanta Federal Reserve. According to Reuters, Atlanta Fed President Raphael Bostic appeared a speech on Monday, which claimed that it “might make sense” for the Federal Reserve to pause further interest rate hikes following expected half-point rate increases over the next two months as the central bank assesses the impact on inflation and the economy. As Fed might pause rate hike implementation, it would likely to reduce the risk-off return of investors, dragged down the appeal for the US Dollar. Besides, US President Joe Biden considering to reduce tariffs on China, which claimed on Monday. The reducing tariffs on China would likely to boost up the international transaction between US and China, dialed up the market optimism toward economic progression in US, and prompting investors to shift their capitals toward risk-appetite assets such as stocks. As of writing, the Dollar Index edged up by 0.22% to 102.32.

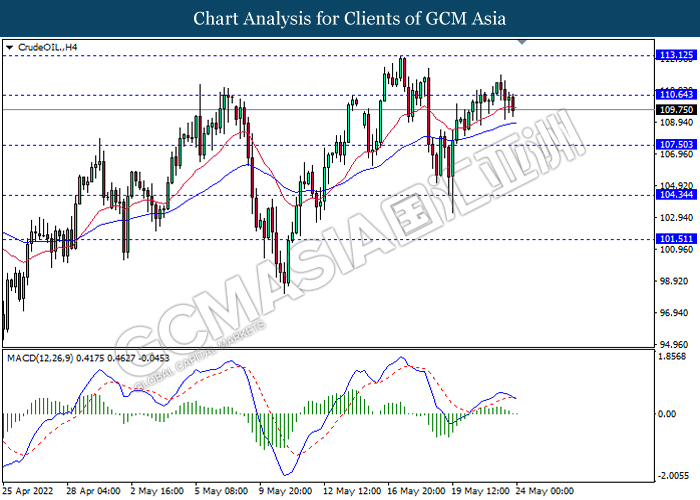

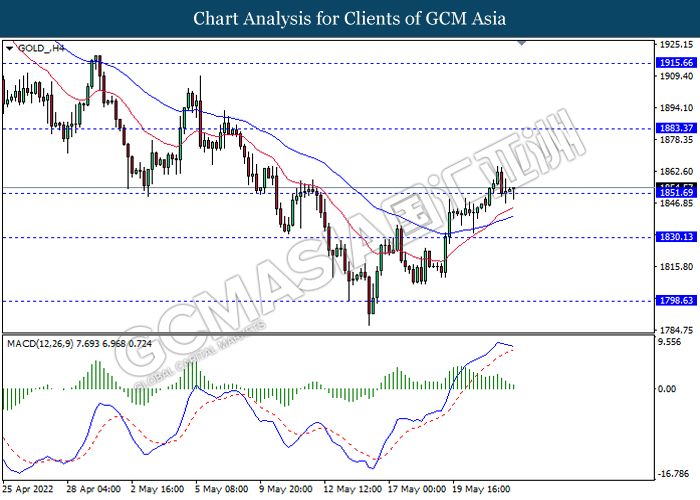

In commodities market, crude oil price depreciated by 0.73% to $109.48 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish over the soaring demand on oil due to the easing lockdown in China. On the other hand, gold price appreciated by 0.04% to $1848.74 per troy ounces as of writing following the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (May) | 54.6 | 54.0 | – |

| 16:30 | GBP – Composite PMI | 58.2 | – | – |

| 16:30 | GBP – Manufacturing PMI | 55.8 | – | – |

| 16:30 | GBP – Services PMI | 58.9 | – | – |

| 22:00 | USD – New Home Sales (Apr) | 763K | 750K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

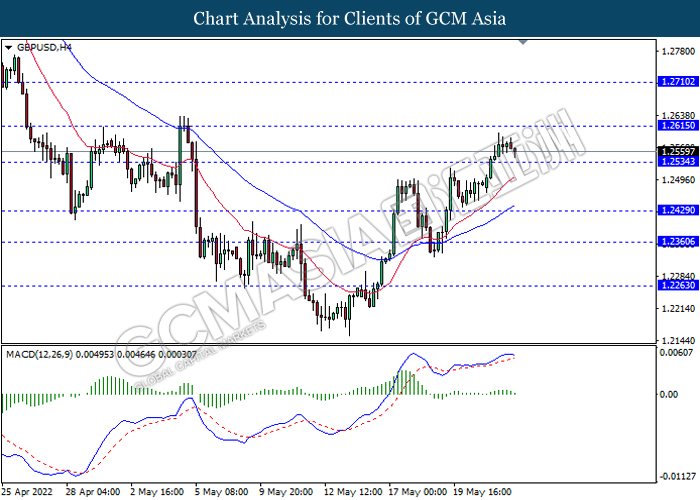

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

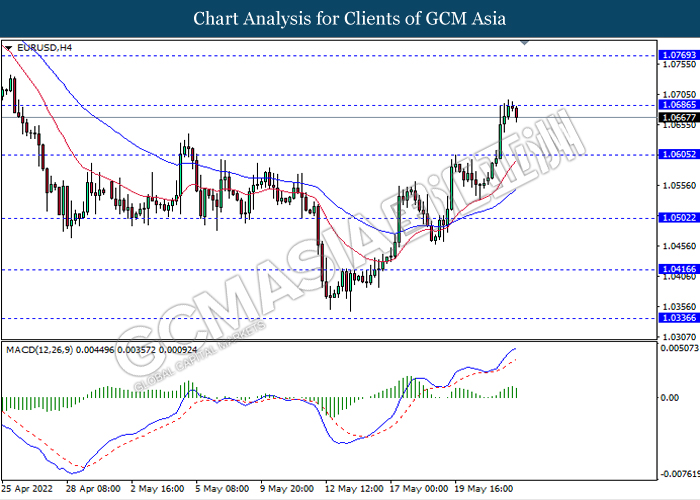

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0500

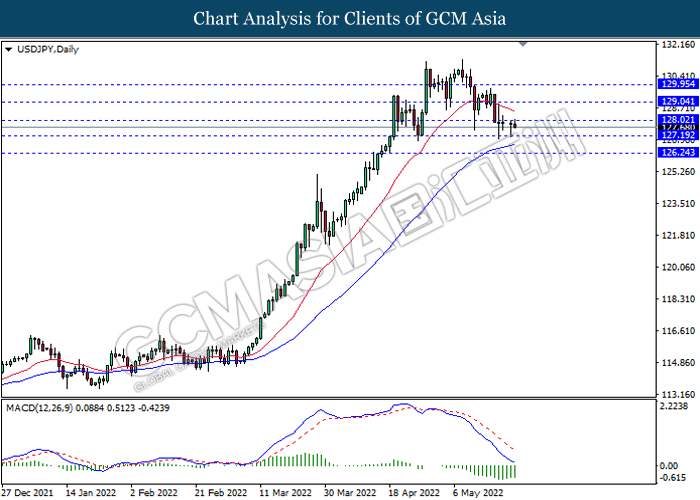

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

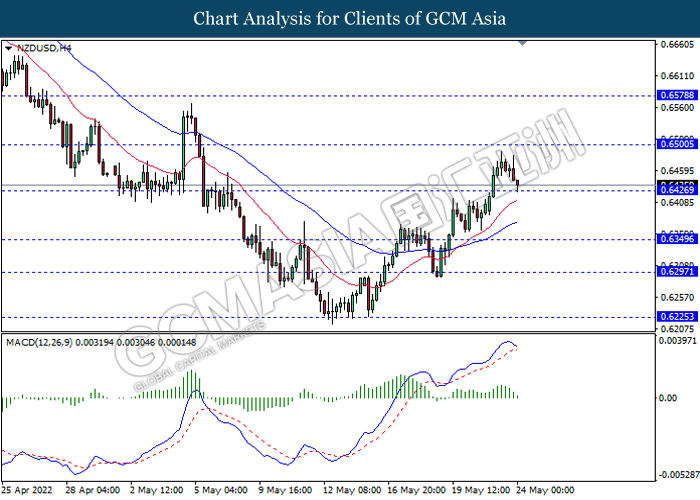

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

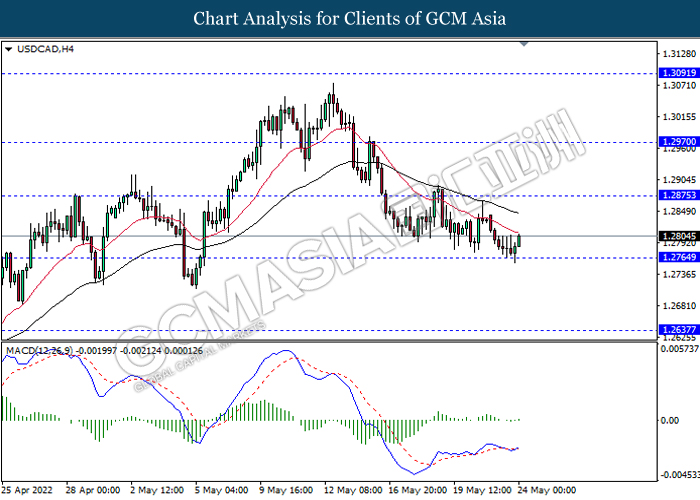

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

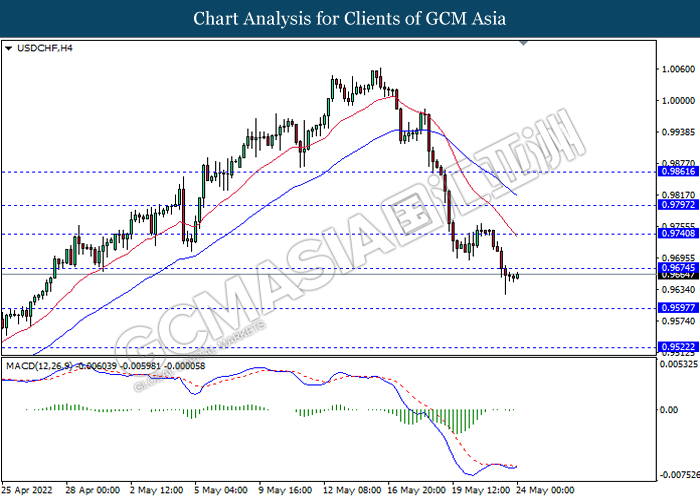

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1883.35, 1915.65

Support level: 1851.70, 1830.15