24 July 2017 Weekly Analysis

GCMAsia Weekly Report: July 24 – 28

Market Review (Forex): July 17 – 21

U.S. Dollar

Greenback fell to its lowest level in more than a year against other currencies last Friday, pressured by a stronger euro and increasing political uncertainty in Washington. The dollar index was down 0.32% to 93.78, its lowest close since June 22nd, 2016. Overall, the index has ended with a loss of 1.32%, marking its second consecutive weekly decline.

Earlier last week, Republican lawmakers pulled their support on the latest version of Trumpcare to replace Obamacare (healthcare bill) has delivered major blow to the Trump’s administration. Concurrently, Bloomberg reported that an investigation into alleged links between President Donald Trump’s campaign and Russia in last year’s election will be extended into his business dealings, fueling further concern over rising political turmoil in Washington.

Recent progresses that hints political uncertainty has triggered massive selling pressure on the dollar as Trump may face difficulties or delays in delivering his economic policies. Likewise, diminishing doubts over Federal Reserve’s plans for a third rate hike this year was also tied onto greenback’s recent weakness.

USD/JPY

Japanese yen appreciates further as USD/JPY closed near one-month low of 111.12.

EUR/USD

Euro skyrocketed to its highest level in two years against the dollar at $1.1683 following propelled expectations that European Central Bank may soon taper its bond-buying program.

GBP/USD

Pound sterling inches higher against the dollar after rising 0.15% to $1.2993 during late Friday trading.

Market Review (Commodities): July 17 – 21

GOLD

Gold price rose for sixth consecutive session on Friday while notching its largest weekly gain in two months as the greenback continued its downfall to the lowest level in more than a year. Price of the precious metal closed up 0.72% at $1,254.48 while recording a gain of 1.97%. A weaker dollar tends to boost prices for gold, which is denominated in US dollar. Likewise, a lower prospect for an interest rate hike will increase the appeal of gold as an alternative asset when borrowing cost is expected to be kept constant.

Crude Oil

Crude oil price settled lower last Friday while ending at its lowest level in a week due to soured sentiment following the reports that OPEC supply was set to rise, despite its agreement to freeze daily production levels. Oil prices settled down $1.15 or 2.5% to $45.77 a barrel. Friday’s sharp drop pared its earlier weekly gains with its prices posting a loss up to 1.7% thus far.

Oil prices slumped on Friday after tanker-tracking firm, PetroLogistics reported that crude oil output from OPEC members is set to rise by 145,000 barrels a day in July. The increase in oil supply will push its production level above 33 million barrels per day due to increasing output from Saudi Arabia, United Arab Emirates and Nigeria.

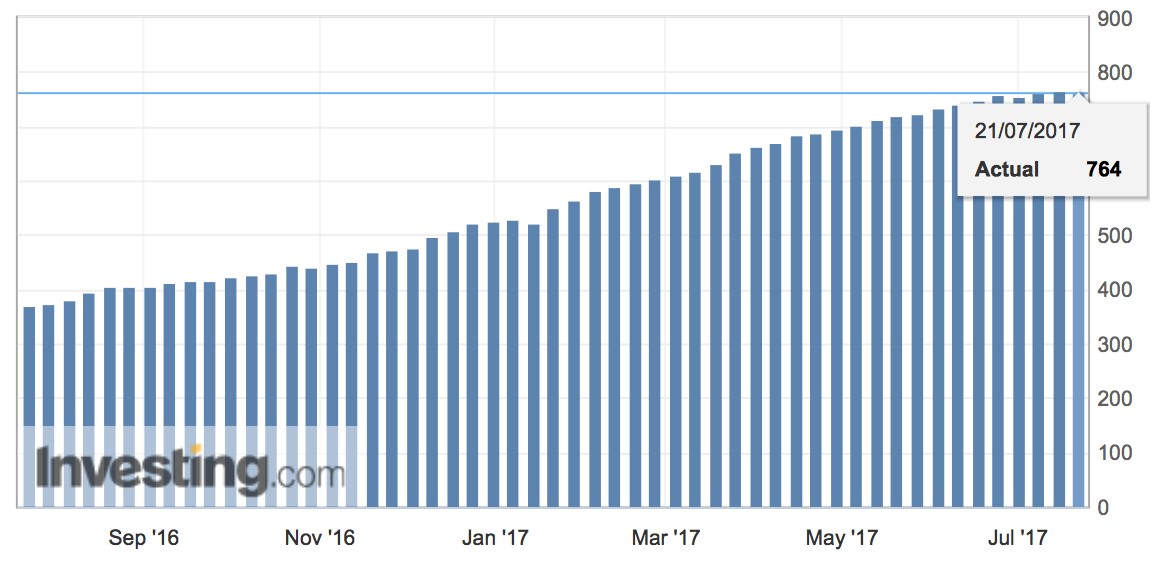

The news came ahead of a highly anticipated meeting between some members of OPEC and non-OPEC this Monday who will be gathering to discuss overall compliance and adherence in restricting their daily production levels. Meanwhile, US energy services company Baker Hughes reported that the number of active oil drilling rigs declined by 1 to 764 thus far, suggesting early signs of diminishing domestic production growth.

Previously, OPEC and some non-OPEC members had extended a deal to cut 1.8 million barrels per day until March 2018. However, the production-cut agreement has yet to yield any impact on global inventory levels due to rising supply from non-participating countries such as Libya, Nigeria and United States.

U.S. Baker Hughes Oil Rig Count

Active drilling rigs was down by 1 and total count thus far remains at two-years high of 764.

Weekly Outlook: July 24 – 28

For the week ahead, investors will be anticipating the outcome of Wednesday’s US Federal reserve policy meeting while US economic growth data will be released on Friday. Likewise, survey data from the EU zone on Monday will provide some signals regarding the its economic recovery in the euro area. In addition, UK is set to release its second quarter growth reading on Wednesday.

Oil traders will be focusing on Monday’s meeting of major crude producers for further prospect regarding their effort to rebalance the global supply and demand levels. Likewise, traders will also keep an eye on fresh weekly information regarding US crude stockpiles on Tuesday and Wednesday for further market signals.

Highlighted economy data and events for the week: July 24 – 28

| Monday, July 24 |

Data EUR – German Manufacturing PMI (Jul) CAD – Wholesale Sales (MoM) (May) USD – Existing Home Sales (Jun)

Events Crude Oil – OPEC Meeting

|

| Tuesday, July 25 |

Data EUR – German Ifo Business Climate Index (Jul) USD – CB Consumer Confidence (Jul)

Events N/A

|

| Wednesday, July 26 |

Data Crude Oil – API Weekly Crude Oil Stock AUD – CPI (QoQ) (Q2) GBP – GDP (YoY) (Q2) USD – New Home Sales (Jun) Crude Oil – Crude Oil Inventories USD – Fed Interest Rate Decision

Events USD – FOMC Statement

|

| Thursday, July 27 |

Data USD – Initial Jobless Claims USD – Core Durable Goods Orders (MoM) (Jun)

Events N/A

|

|

Friday, July 28

|

Data EUR – German CPI (MoM) (Jul) USD – GDP (QoQ) (Q2) CAD – GDP (MoM) (May) USD – Michigan Consumer Sentiment (Jul) Crude Oil – U.S. Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: July 24 – 28

Dollar Index

DOLLAR_INDX, Daily: Dollar index broke out from the bottom level of downward channel, signaling the further extension of downtrend. Both MA lines which continue to expand downwards suggests the index to extend its losses towards 93.20.

Resistance level: 94.00, 94.95

Support level: 93.20, 92.45

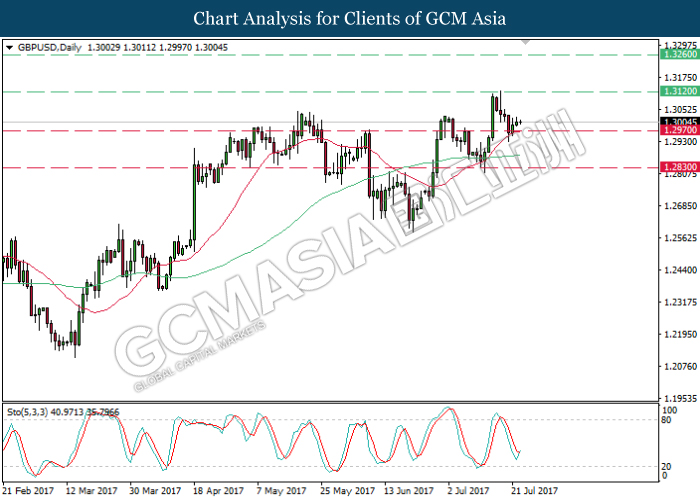

GBPUSD

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level of 1.2970. Rebound signal from oversold level as seen from the Stochastic Oscillator suggests GBPUSD to extend its gains towards the resistance level of 1.3120.

Resistance level: 1.3120, 1.3260

Support level: 1.2970, 1.2830

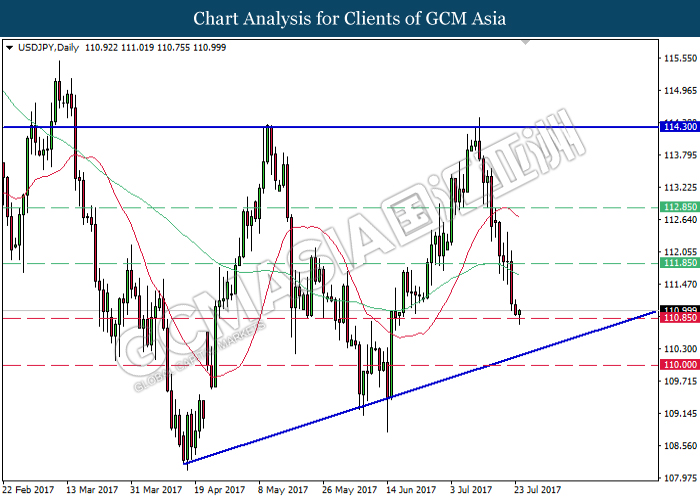

USDJPY

USDJPY, Daily: USDJPY extended its losses following prior retracement from the top level of ascending triangle. A closure below the support level of 110.85 would suggest USDJPY to advance towards the bottom level of the triangle.

Resistance level: 111.85, 112.85, 114.30

Support level: 110.85, 110.00

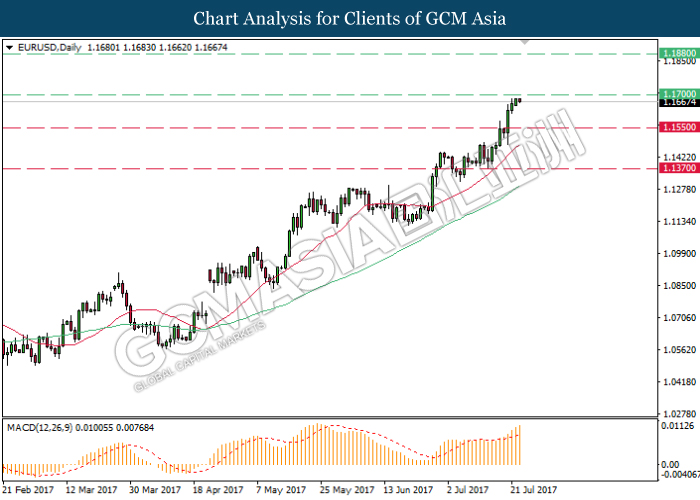

EURUSD

EURUSD, Daily: EURUSD extended its uptrend following prior formation of golden cross by both MA lines. The increasing upward momentum from MACD suggests EURUSD to extend its gains after successfully closing above the psychological level of 1.1700.

Resistance level: 1.1700, 1.1880

Support level: 1.1550, 1.1370

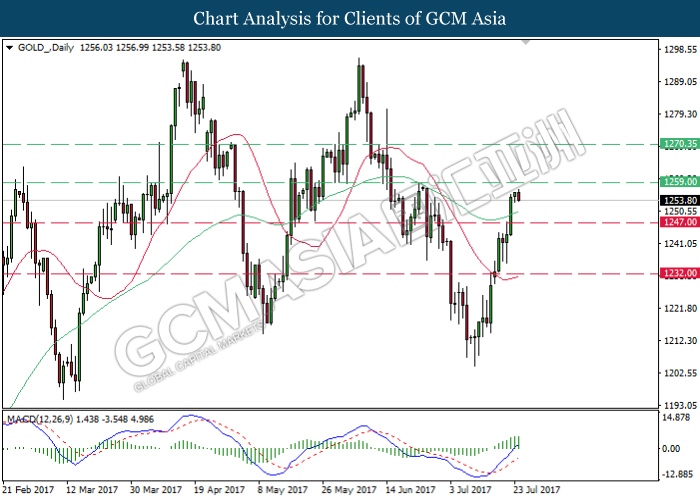

GOLD

GOLD_, Daily: Gold price extended its gains following prior rebound while currently testing near the resistance level of 1259.00. MACD histogram which illustrates substantial upward signal suggests its price to continue its upward momentum after closing above the level of 1259.00.

Resistance level: 1259.00, 1270.35

Support level: 1247.00, 1232.00

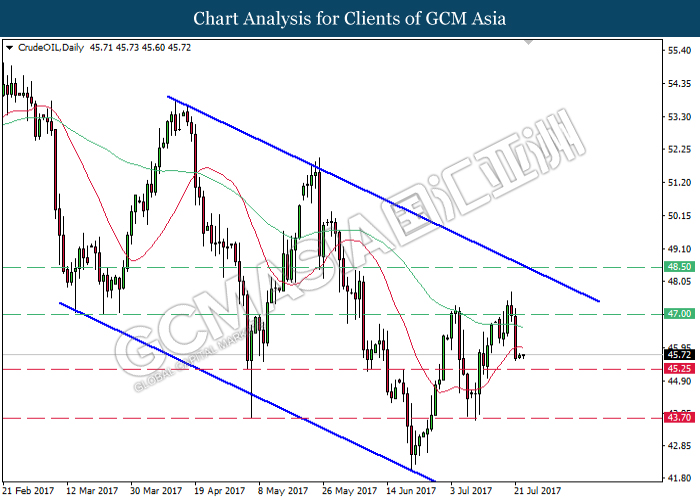

Crude Oil

CrudeOIL, Daily: Crude oil price were traded lower following prior retracement near the threshold of 47.00. Recent closure below the 20-MA line (red) suggests further downside bias for crude oil price to extend its losses towards the support level of 45.25.

Resistance level: 47.00, 48.50

Support level: 45.25, 43.70