24 August 2022 Afternoon Session Analysis

Pound under pressure over soaring stagflation risk.

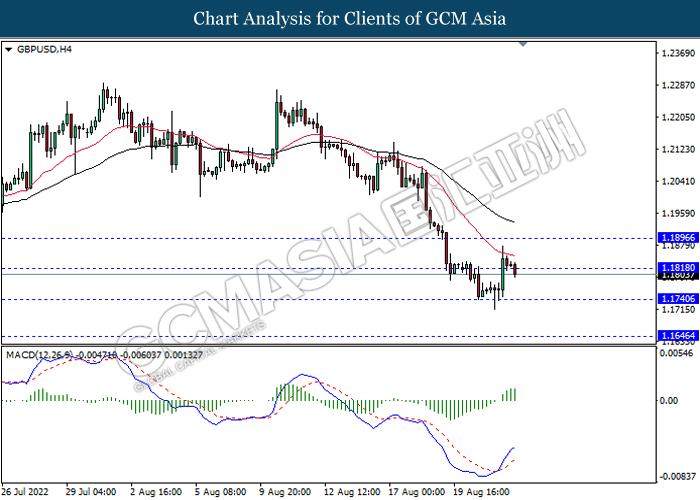

The GBP/USD, which well known by majority of investors received significant bullish momentum on yesterday amid the slip of US Dollar. Though, the overall trend of the pairing remained downward following the rising fears on UK’s economy. According to Reuters, the US bank Citi has forecasted that the British consumer price inflation would likely to reach a high level of 18.6% in January 2023. The spiking inflation would bring further side effect toward consumers and companies, which might lead to another serious stagflationary issue. The pessimistic economic outlook in UK has prompted investors to flee away from the UK market and seeking for other profitable assets. On the economic data front, a series of economic data such as UK Manufacturing Purchasing Managers Index (PMI) and UK Composite Purchasing Managers’ Index (PMI) has given a downbeat figures as well as Pound Sterling retreated from its prior gains. As of writing, GBP/USD depreciated by 0.21% to 1.1806.

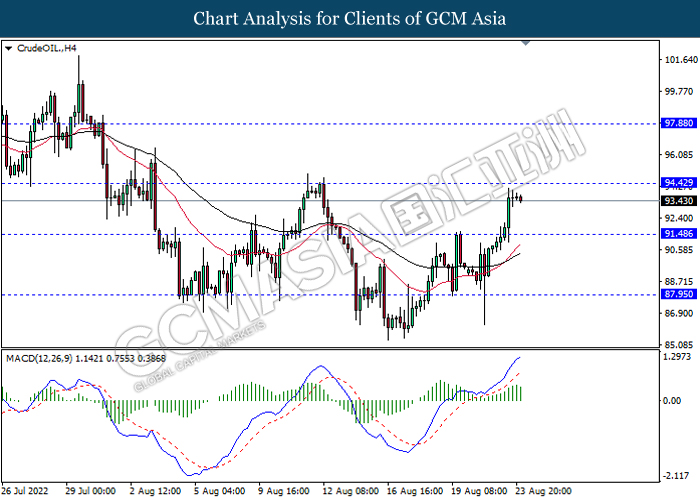

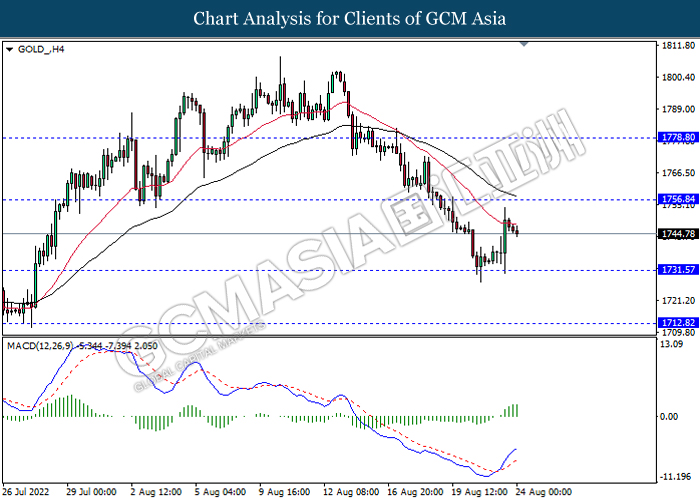

In the commodities market, the crude oil price edged up by 0.01% to $93.75 per barrel as of writing. According to American Petroleum Institute, the US API Weekly Crude Oil Stock notched down from the previous reading of -0.448M to -5.632M, far away from the consensus expectation of -0.450M. Besides, that, the gold price dropped by 0.19% to $1744.75 per troy ounce as of writing ahead of Fed Chairman Jerome Powell speech in Jackson Hole Symposium.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jul) | 0.4% | 0.2% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jul) | -8.6% | -4.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.056M | -0.933M | – |

Technical Analysis

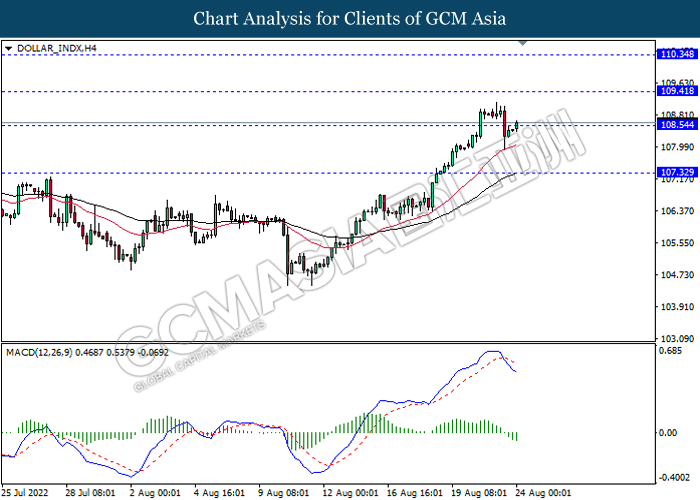

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1820, 1.1895

Support level: 1.1740, 1.1645

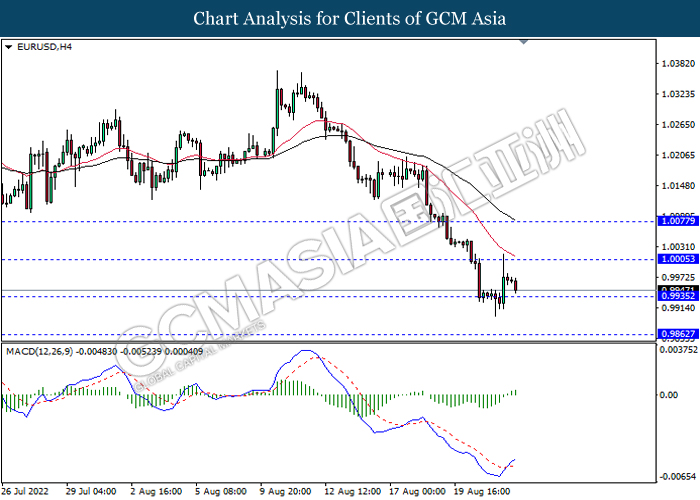

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

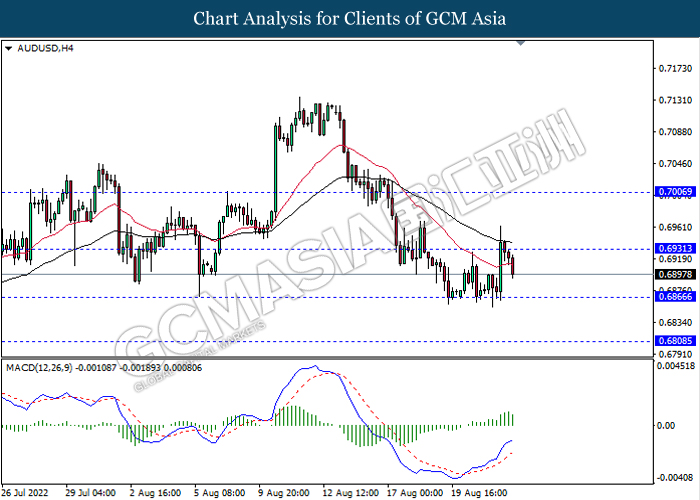

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6810

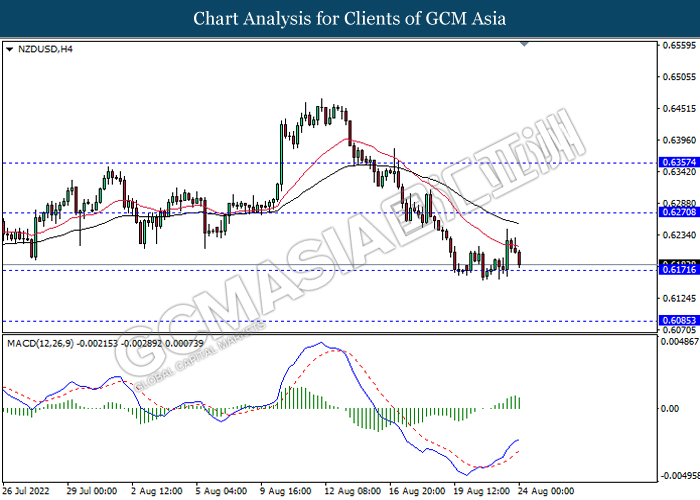

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

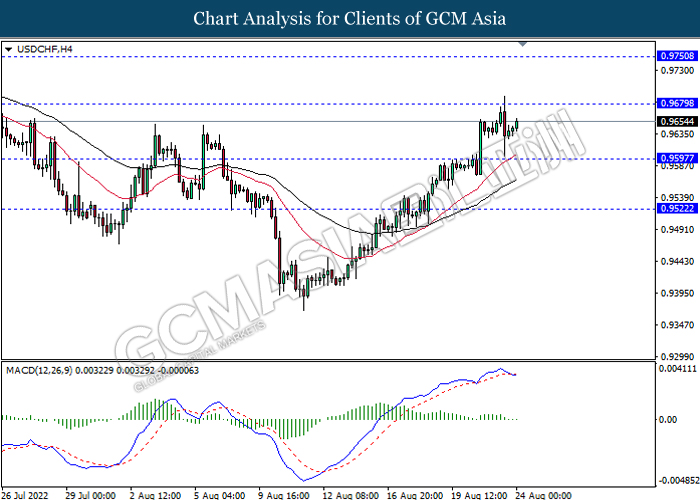

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 94.40, 97.90

Support level: 91.50, 87.95

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80