24 September 2020 Afternoon Session Analysis

Dollar soars amid resurgence of Covid-19 in global.

Dollar index which gauges its value against a basket of six major currencies managed to extend its gains to the highest level in 2 months amid market worries over the exacerbating pandemic have heightened after countries showed a significant surge in coronavirus cases. According to the Worldometer Statistics, countries such as UK and France which seemingly have recovered from the pandemic recorded unexpected high number of confirmed cases yesterday, near to 13K and 6k respectively. Besides, lack of new catalyst in vaccine development have also tampered the market appetite toward the riskier asset, while expecting a 100% secured-to-use vaccine will not be officially released in the near term. Moreover, hawkish bias statement from Fed Chairman Jerome Powell regarding the unfolding monetary policy still continue boosting the attraction of dollar index. In the recent speech, Jerome Powell revealed that the economy is recovering in a strong pace despite the uncertainty risk of pandemic remained. During Asian trading session, dollar index retraced 0.03% to 94.35.

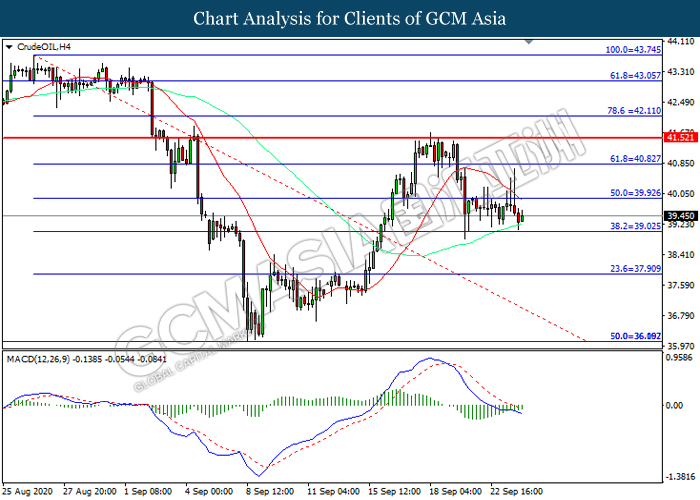

In the commodities market, the crude oil price depreciated by 1.03% to $39.50 per barrel amid disappointed economic data from different countries such as Europe and UK turned the oil market sentiment soured. Besides, oil price received further downward pressure after crude oil inventories in US showed a higher-than-expected reading. Moreover, gold price slumped 0.18% to $1860.00 per troy ounce as market sees inflation pace would turn slower compare to previous forecast.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15.30 CHF SNB Monetary Policy Assessment

19.50 GBP BoE Gov Bailey Speaks

22.00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.30 | CHF – SNB Interest Rate Decision | -0.75% | -0.75% | – |

| 16.00 | EUR – German Ifo Business Climate Index (Sep) | 92.6 | 93.8 | – |

| 20.30 | USD – Initial Jobless Claims | 860K | 840K | – |

| 22.00 | USD – New Home Sales | 901K | 895K | – |

Technical Analysis

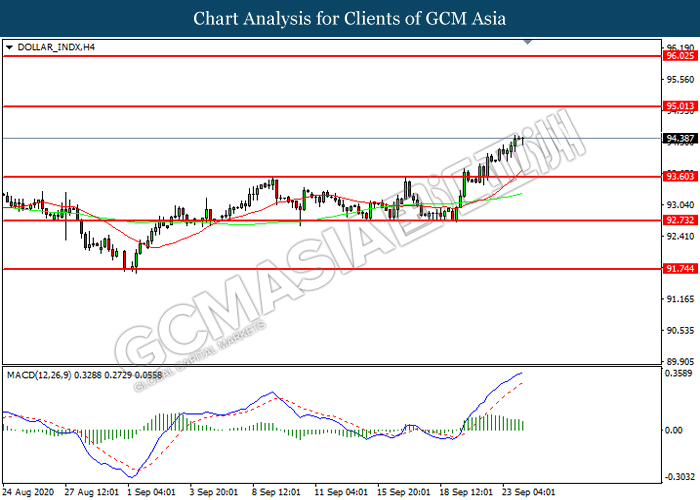

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 93.60. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 93.60, 95.00

Support level: 93.60, 92.75

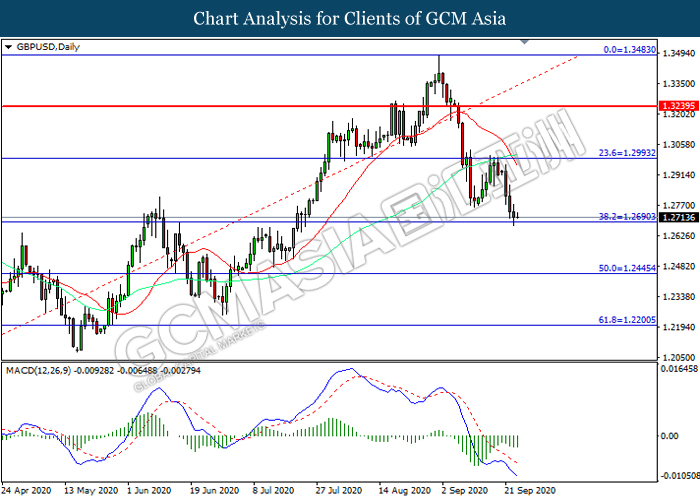

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2690. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2995, 1.3340

Support level: 1.2690, 1.2445

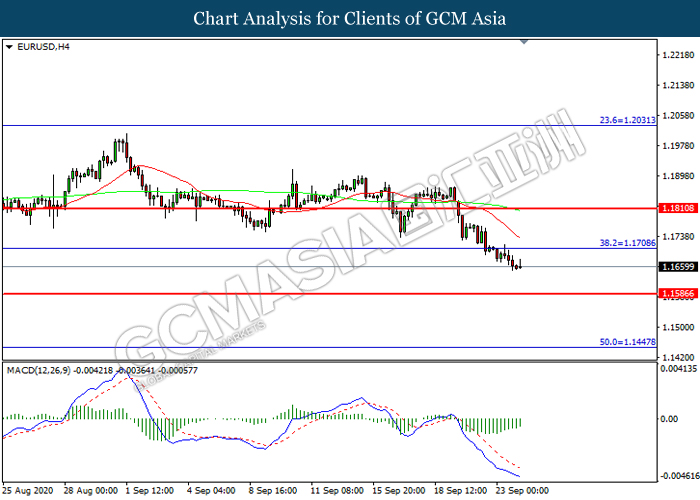

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1710. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1710, 1.1810

Support level: 1.1585, 1.1445

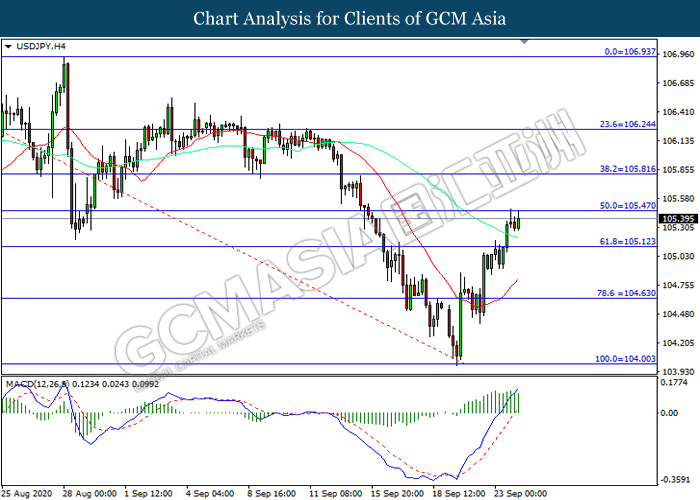

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 105.45. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 105.45, 105.80

Support level: 105.10, 104.65

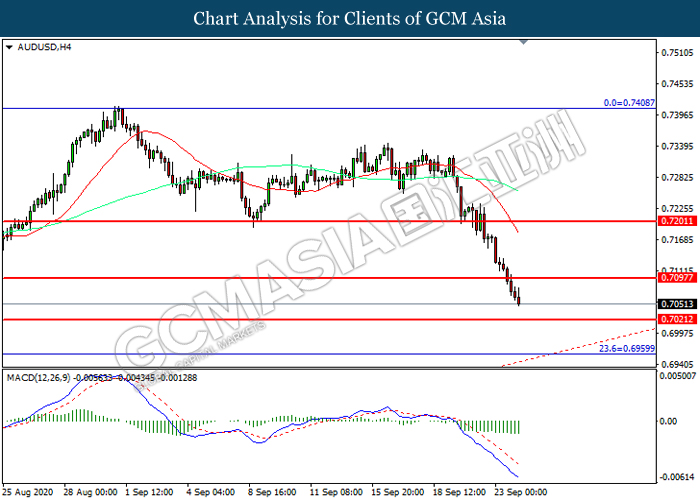

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7020.

Resistance level: 0.7095, 0.7200

Support level: 0.7020, 0.6960

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6510. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6755, 0.6895

Support level: 0.6510, 0.6265

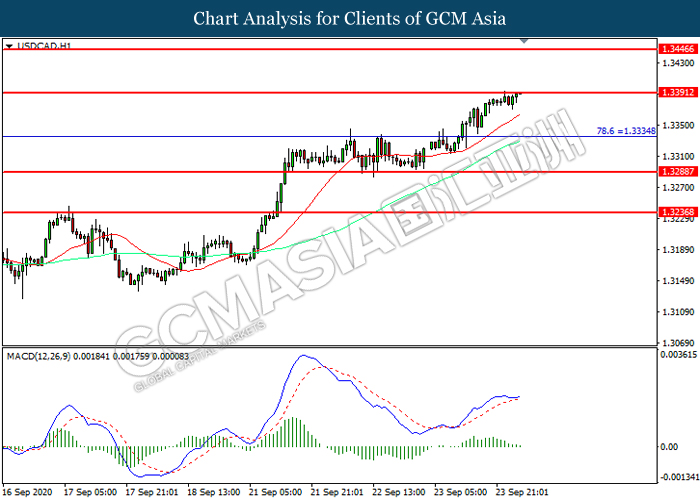

USDCAD, H1: USDCAD was traded higher while currently testing the resistance level at 1.3390. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3390, 1.3445

Support level: 1.3335, 1.3285

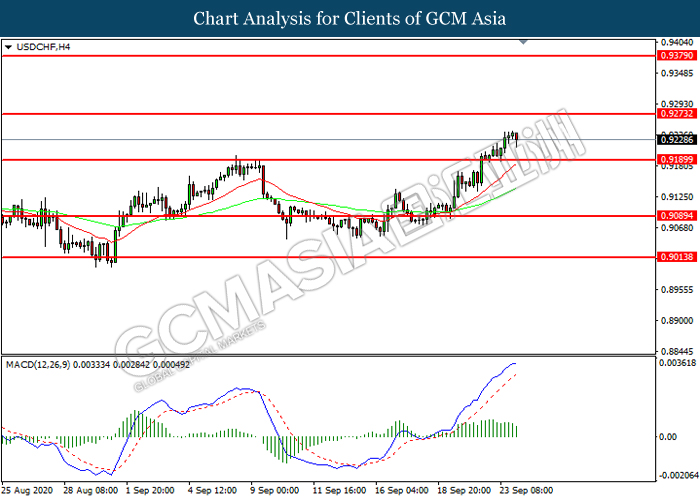

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9190. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9275, 0.9380

Support level: 0.9190, 0.9090

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 39.05. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 39.95, 40.85

Support level: 39.05, 37.90

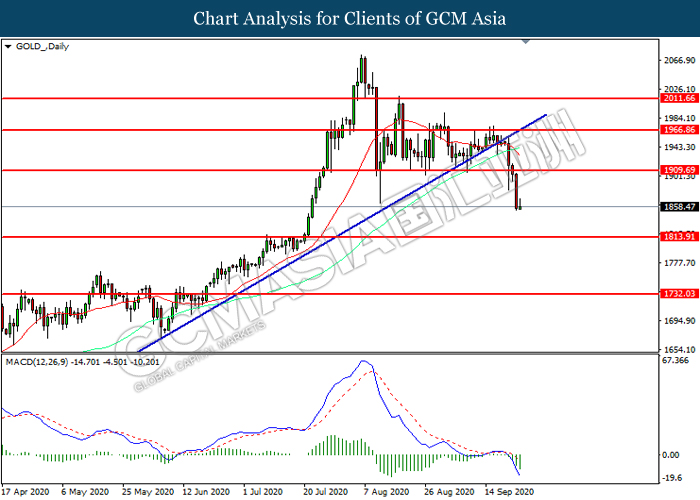

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1909.70. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1813.90.

Resistance level: 1909.70, 1966.85

Support level: 1813.90, 1732.05