24 November 2021 Afternoon Session Analysis

Dollar remain steady amid increasing expectation of hawkish Fed.

The dollar index which traded against a basket of six major currency pairs held steady and rose as market continue to react towards the nomination of U.S. Federal Reserve Chair Jerome Powell to a second term which increase the expectation of rate hike from Fed. Recently, U.S President Joe Biden has formally nominated Jerome Powell for second term as the Fed chairman. His renomination has help reinforced market expectations that the Fed is likely to raise interest rate hikes in 2022 compared to his opponent, Lael Brainard which is more dovish. Fed Bank of Atlanta President Raphael Bostic stated that the U.S. central bank may need to speed up the removal of monetary stimulus in response to strong employment gains and surging inflation, which could lead to a quicker-than-expected interest rate hike. His comment further increasing the market confidence, thus bring more demand towards the greenback. At the time of writing, dollar index rose 0.07% to 96.50.

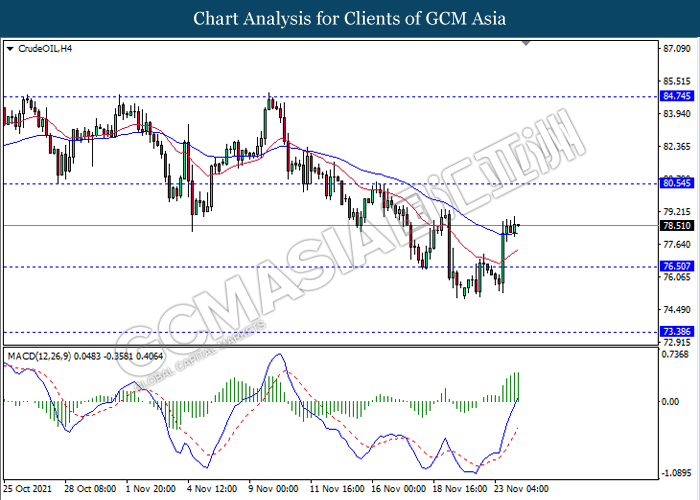

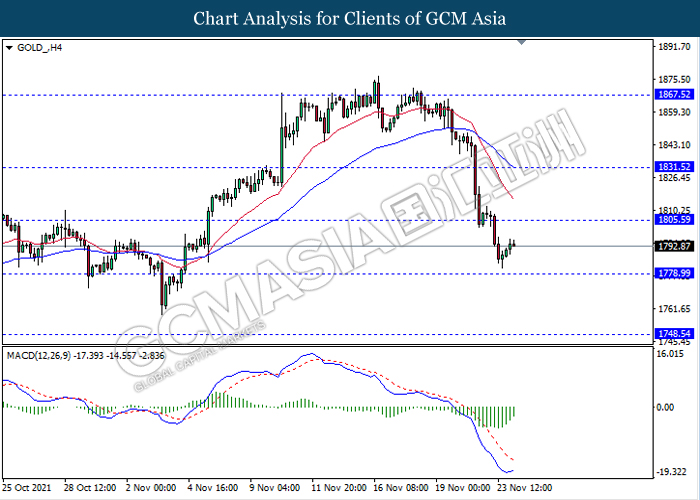

In the commodities market, crude oil price rose 0.08% to $78.48 per barrel at the time of writing as investors continue to digest the news of U.S release oil stocks from its strategic reserves. The U.S. announced that it will release 50 million barrels from the Strategic Petroleum Reserve (SPR) on Tuesday. While the move could potentially create the threat of more supply in short term, empty storage will put even more strain on the already low oil stockpiles, thus providing some relief. On the other hand, gold price remains weak and fell 0.08% to $1792.72 a troy ounce as of writing amid ongoing dollar strength.

Today’s Holiday Market Close

Time Market Event

All Day JPY Public Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 1.90% | 2.2% | – |

| 16:30 | EUR – German Manufacturing PMI (Nov) | 57.8 | 56.9 | – |

| 17:30 | GBP – Composite PMI (Oct) | 54.1 | 54.1 | – |

| 17:30 | GBP – Manufacturing PMI (Oct) | 56.3 | 56.3 | – |

| 17:30 | GBP – Services PMI (Oct) | 54.6 | 54.6 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded flat near the support level 96.25. However, MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the dollar to be traded lower as a technical correction after it breaks below the support level.

Resistance level: 96.90, 97.55

Support level: 96.25, 95.50

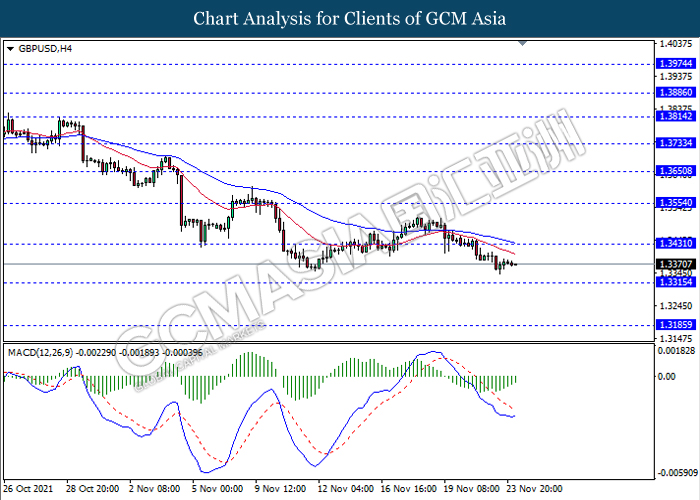

GBPUSD, H4: GBPUSD was traded lower following recent breakout below the previous support level 1.3430. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a technical correction back towards the level 1.3430.

Resistance level: 1.3430, 1.3555

Support level: 1.3315, 1.3185

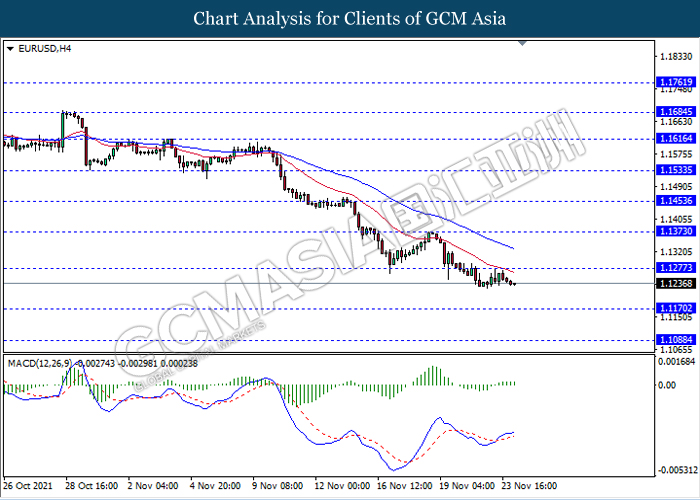

EURUSD, H4: EURUSD was traded flat near the resistance level 1.1275. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher as a technical correction after it breaks above the level.

Resistance level: 1.1275, 1.1375

Support level: 1.1170, 1.1090

USDJPY, H4: USDJPY was traded flat near the support level 114.60. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower as a technical correction after it breaks below the support level.

Resistance level: 115.85, 116.95

Support level: 114.60, 113.20

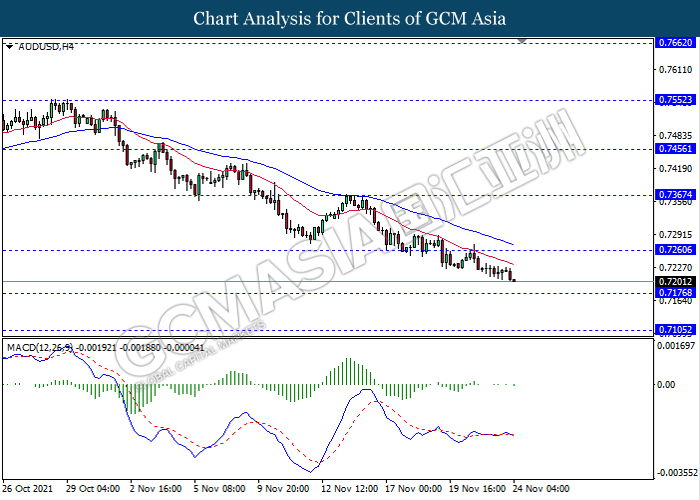

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.7175. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7260, 0.7365

Support level: 0.7175, 0.7105

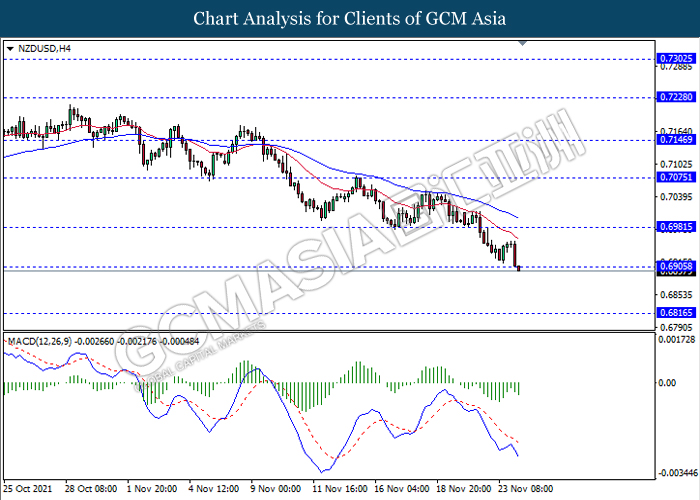

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6905. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6980, 0.7075

Support level: 0.6905, 0.6815

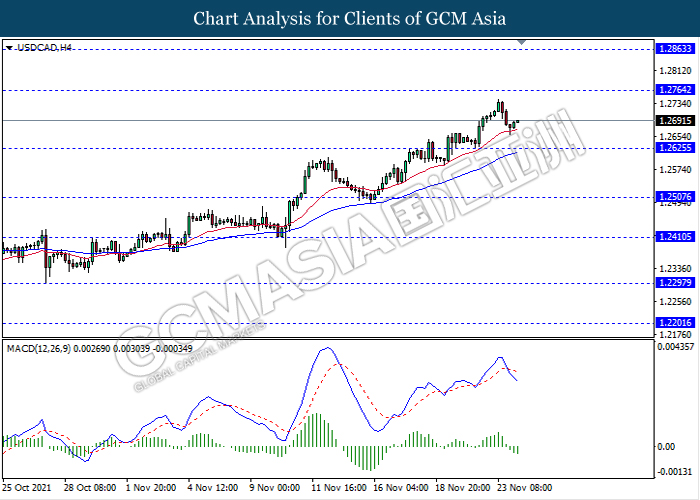

USDCAD, H4: USDCAD was traded lower following recent retracement from its high level. MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 1.2625.

Resistance level: 1.2765, 1.2865

Support level: 1.2625, 1.2505

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9300. MACD which illustrate bullish momentum signal suggest the pair to extend its gains towards the resistance level 0.9370.

Resistance level: 0.9370, 0.9455

Support level: 0.9300, 0.9225

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level 76.50. MACD which illustrate bullish momentum signal suggest the commodity to extend its gains towards the resistance level 80.55.

Resistance level: 80.55, 84.75

Support level: 76.50, 73.40

GOLD_, H4: Gold price was traded higher following prior rebound from the support level 1779.00. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its rebound towards the resistance level 1805.60.

Resistance level: 1805.60, 1831.50

Support level: 1779.00, 1748.55