24 December 2018 Afternoon Session Analysis

Greenback bruised by data and politics.

US dollar extended its losses during mid-Asian trading session following political instability while coupled with bearish economic data from last Friday. Trading volumes were thinning out as most global markets set to shut for Christmas holidays. However, market bids for Japanese yen and Swiss franc remains on the high side due to political stress as US Federal Government was partially shut while Democrats took over the House of Representatives. Furthermore, greenback received additional downward pressure following recessive economic data from last Friday. For the month of November, US Core Durable Goods Orders plunged by -0.3%, missing economist forecast for 0.3%. In addition, Gross Domestic Product for third quarter slows down to 3.4%, a tad lower than previous quarter and forecast to remain at 3.5%. Both releases accompany a series of recessive data as of recent which has dialed down market’s sentiment towards US economic growth. Elsewhere, pound sterling extended its gains this morning while traders continues to monitor Brexit progress in United Kingdom. UK Prime Minister Theresa May is set to seek her parliamentary approval in January, putting a final answer to the long-going progress of exiting the European Union. As of writing, the dollar index was down 0.19% to 96.23 while pair of GBP/USD rose 0.21% to 1.2665.

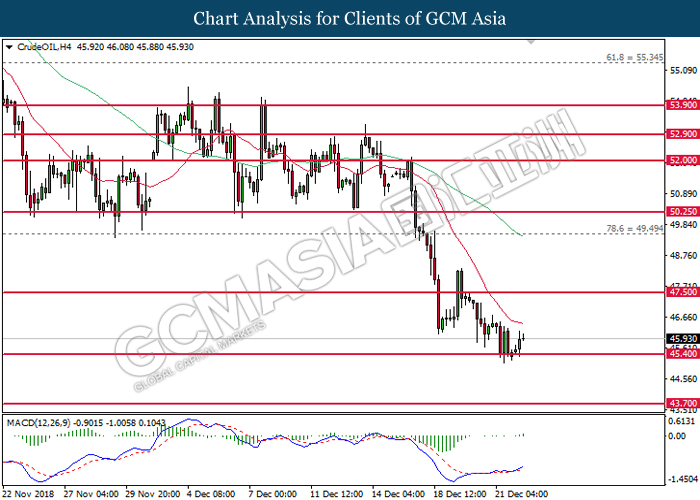

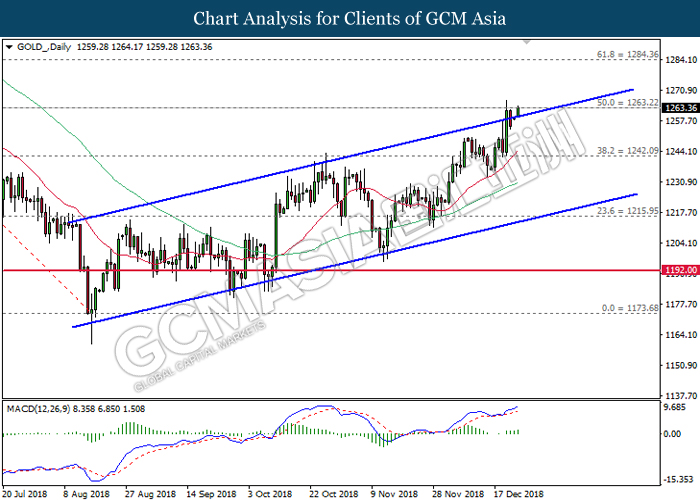

In the commodities market, crude oil price rose 1.51% to $45.77 per barrel during Asian trading session. The commodity recovered its losses after OPEC and non-OPEC monitoring committee will reportedly meet in late February or early March to discuss further actions to be taken to maintain price stability. Otherwise, gold price jumped 0.64% to $1,263.87 a troy ounce following risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Today’s Holiday Market Close

Time Market Event

N/A

Technical Analysis

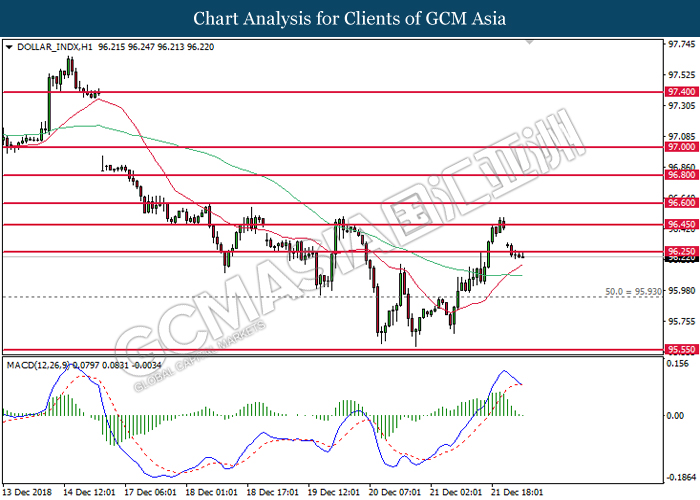

DOLLAR_INDX, H1: Dollar index was traded lower following prior retrace from the resistance of 96.45. MACD which begins to form a death cross signal suggests the index to extend its losses after a close below 20-MA line (red).

Resistance level: 96.25, 96.45

Support level: 95.95, 95.55

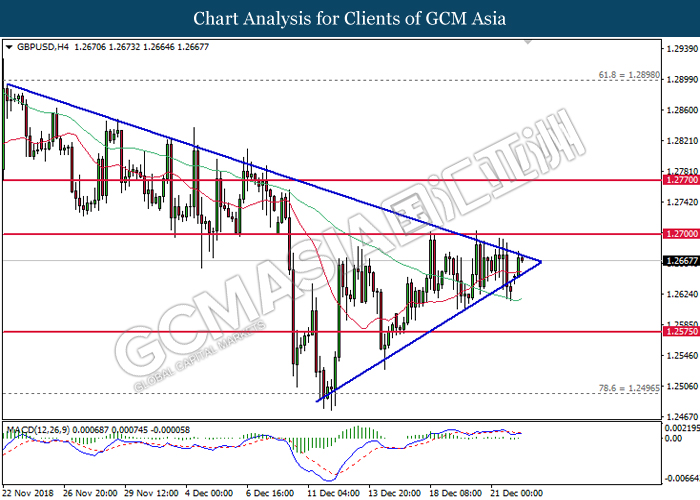

GBPUSD, H4: GBPUSD remains traded within a narrowing triangle following prior rebound from the bottom level. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 1.2700, 1.2770

Support level: 1.2575, 1.2500

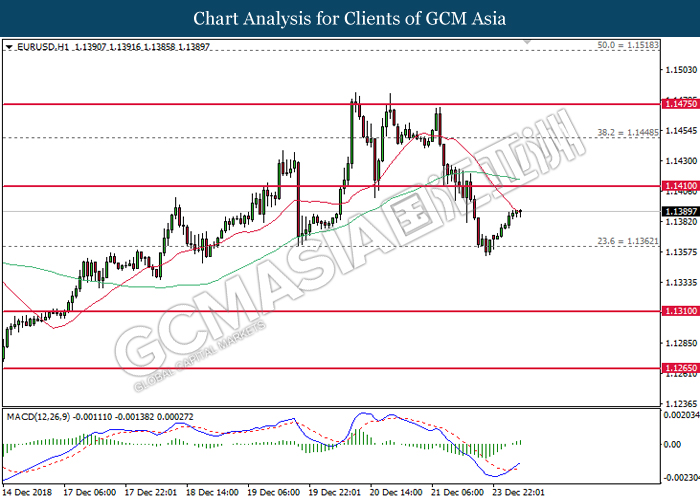

EURUSD, H1: EURUSD was traded higher following prior rebound from the support of 1.1360. MACD which illustrate the formation of bullish signal suggests the pair to extend its gains after closing above the 20-MA line (red).

Resistance level: 1.1410, 1.1450

Support level: 1.1360, 1.1310

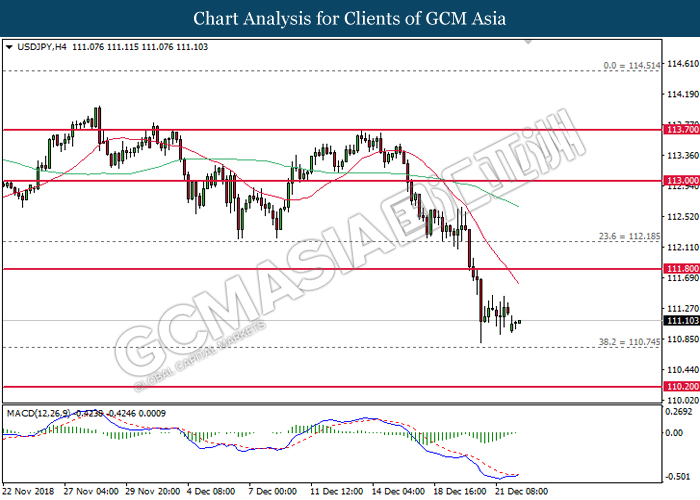

USDJPY, H4: USDJPY was traded higher following prior rebound from its prior low levels. MACD which illustrate the formation of golden cross suggests the pair to extend its gains in short-term as technical correction.

Resistance level: 111.80, 112.20

Support level: 110.75, 110.20

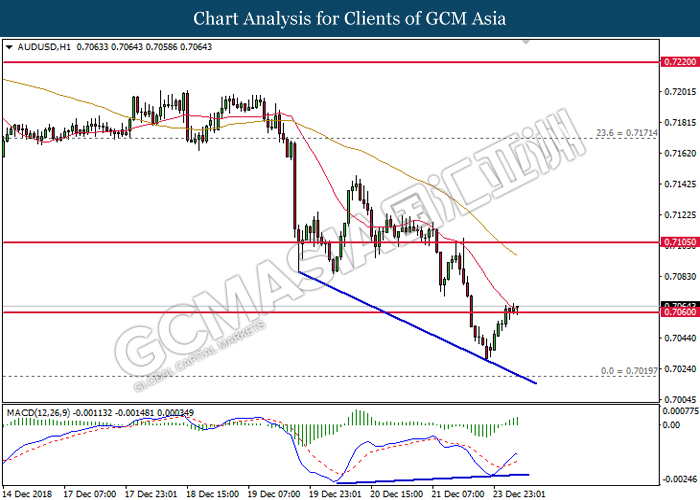

AUDUSD, H1: AUDUSD was traded higher following prior closure above 0.7060. MACD which has formed a positive divergence signal suggests the pair to be traded higher in short-term, towards the direction of 0.7105.

Resistance level: 0.7105, 0.7170

Support level: 0.7060, 0.7020

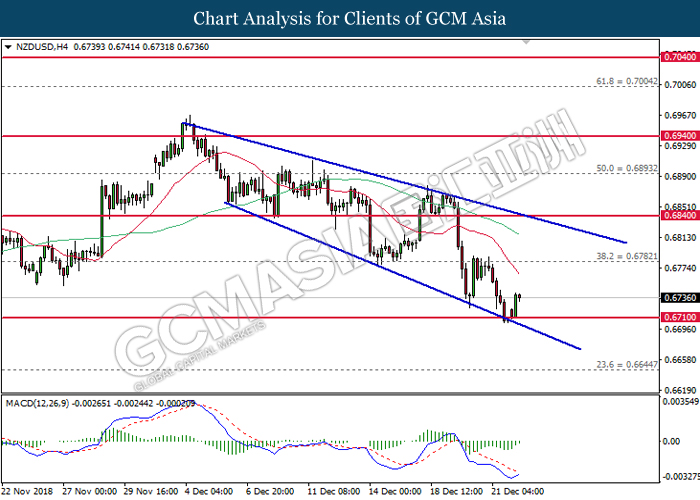

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6710. MACD which illustrate diminishing downward momentum suggests the pair to extend its gains, towards the direction of 0.6780.

Resistance level: 0.6780, 0.6840

Support level: 0.6710, 0.6645

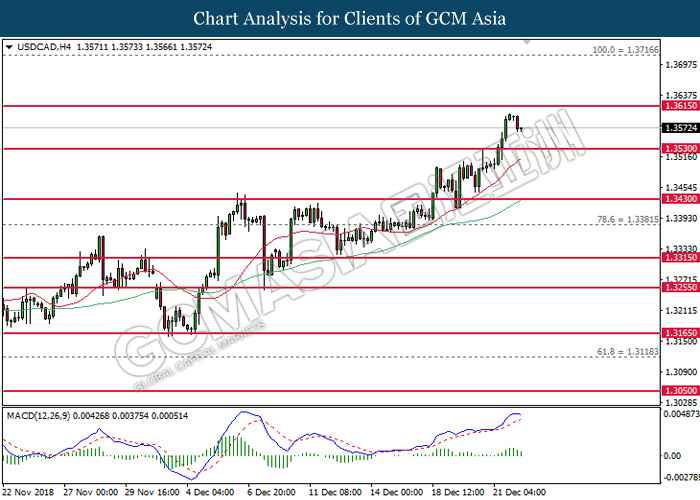

USDCAD, H4: USDCAD was traded lower following retracement from its previous high. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3615, 1.3715

Support level: 1.3530, 1.3430

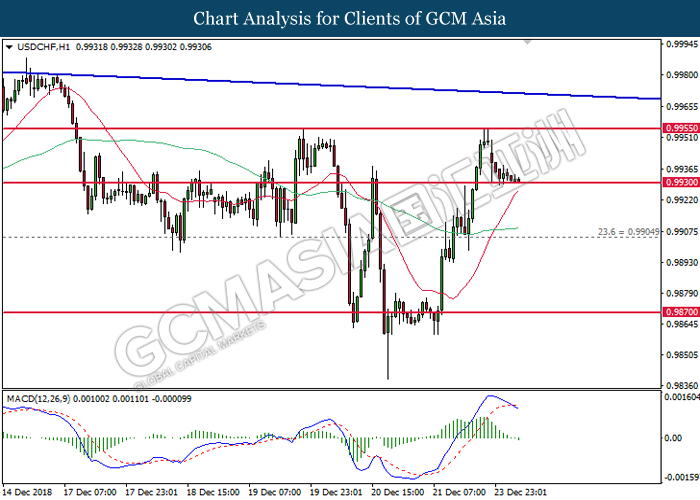

USDCHF, H1: USDCHF was traded lower following prior retrace from the resistance at 0.9955. MACD which has formed a death cross signal suggests the pair to advance further down after closing below 0.9930.

Resistance level: 0.9955, 1.0000

Support level: 0.9930, 0.9905

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 45.40. MACD which illustrate bullish signal suggests the commodity price to be traded higher in short-term as technical correction.

Resistance level: 47.50, 49.50

Support level: 45.40, 43.70

GOLD_, Daily: Gold price was traded higher following prior breakout while currently testing at the resistance of 1263.20. MACD which illustrate bullish signal suggests its prices to move further upwards after successfully closing above the target of 1263.20.

Resistance level: 1263.20, 1284.35

Support level: 1242.10, 1215.95