25 January 2019 Morning Session Analysis

Draghi steals the show, Euro relinquished.

Euro experienced a large selloff in the FX market following dovish signals given by the European Central Bank (ECB) President Mario Draghi. As of writing, pair of EUR/USD ticked down 0.02% to 1.1309. As widely expected, ECB has maintained their stance with regards to monetary policy by leaving its benchmark rates unchanged. However, Draghi warned during its press conference that the risks which envelopes the Euro Zone growth outlook has moved towards the downside due to persistent uncertainties. The downtick in growth was linked to various factors such as geopolitical and threat of protectionism, vulnerabilities in emerging markets and financial market volatility. In addition, Draghi noted that they may leave their interest rates at a low level for extended period of time should the economy frailties in the region perseveres. On the other hand, the dollar index rose 0.46% to 96.13 following major depreciation in euro. Likewise, the greenback received additional support following the release of several economic data from the US which detailed better-than-expected readings.

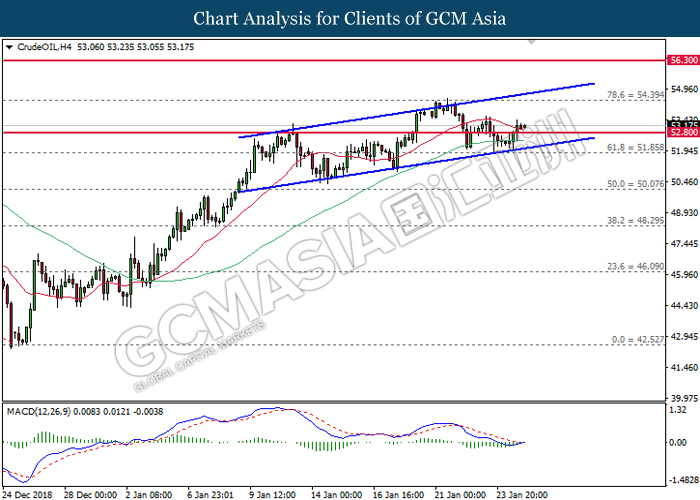

As for commodities market, crude oil price rose more than 1% on yesterday to $53.13 per barrel following Venezuelan crisis. According to news outlets, Trump administration is reportedly considering sanctions against Venezuelan oil in order to punish President Nicolas Maduro’s government for rescinding diplomatic ties with Washington. The sanction may further reduce global oil supply and prop up its prices in the long-run. On the other hand, gold price ticked down 0.02% to $1,280.88 a troy ounce over the backdrop of stronger US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index | 101.0 | 100.7 | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Dec) | 0.4% | 0.3% | – |

| 23:00 | USD – New Home Sales (Nov) | 544K | 560K | – |

| 02:00

(26th) |

CrudeOIL – US Baker Hughes Oil Rig Count | 825 | – | – |

Technical Analysis

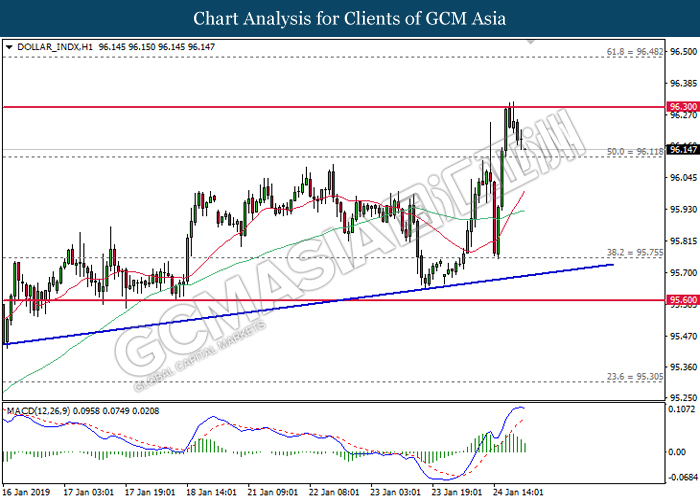

DOLLAR_INDX, H1: Dollar index was traded lower following prior retracement from 96.30. MACD which illustrate diminished upward momentum suggests the pair to extend its losses after closing below 96.10.

Resistance level: 96.30, 96.50

Support level: 96.10, 95.75

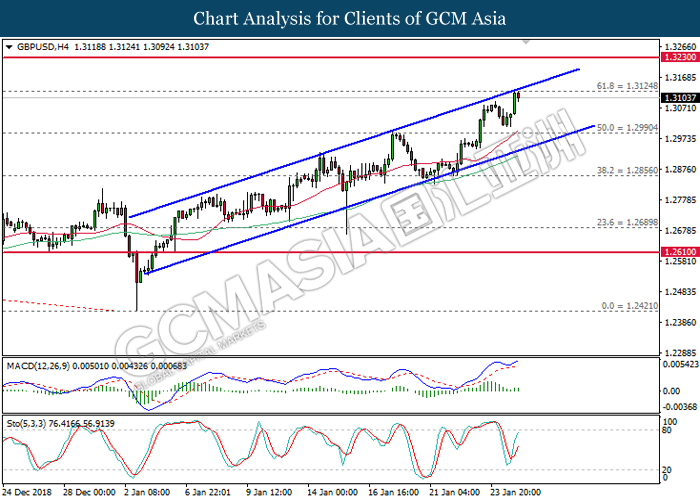

GBPUSD, H4: GBPUSD remains traded within an ascending channel while currently testing at the top level. Both MACD and Stochastic has formed a bullish signal which may suggests the pair to extend its gains following a breakout from the top level.

Resistance level: 1.3125, 1.3230

Support level: 1.2990, 1.2855

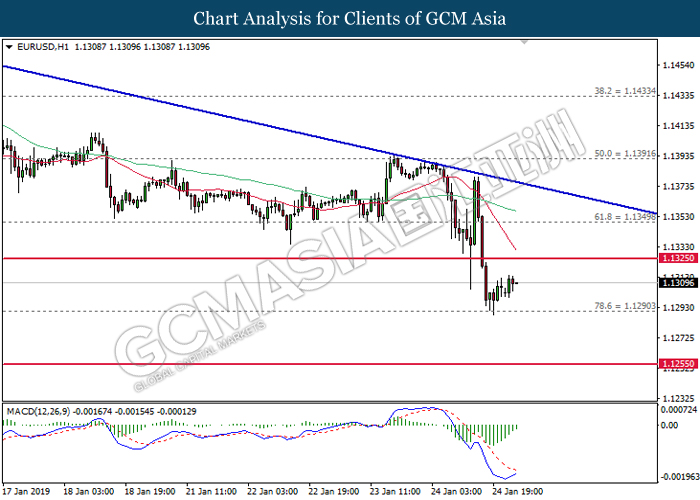

EURUSD, H1: EURUSD was traded higher following prior rebound from the support of 1.1290. MACD which illustrate diminished downward momentum suggests the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1325, 1.1350

Support level: 1.1290, 1.1255

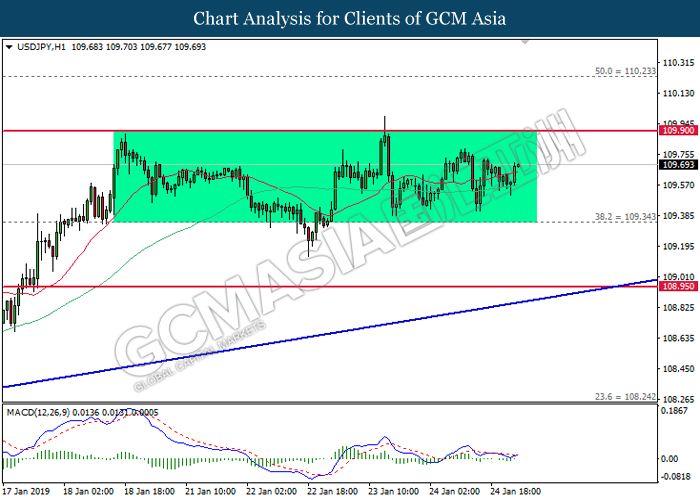

USDJPY, H1: USDJPY remains traded within a sideways channel following prior rebound from the lower level. Due to the lack of signal from both MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 109.90, 110.25

Support level: 109.35, 108.95

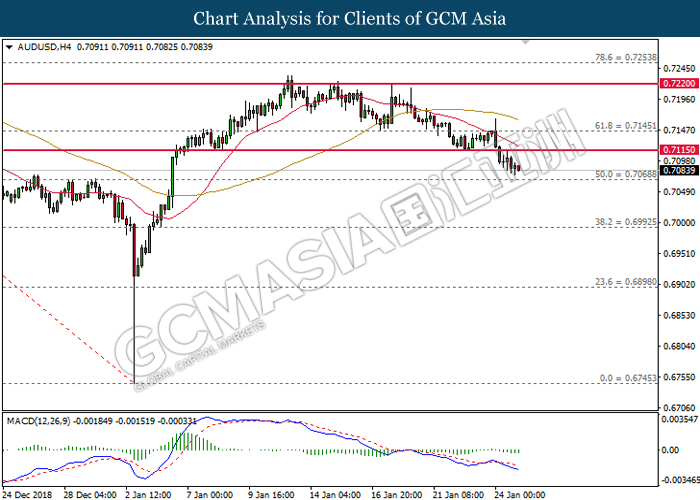

AUDUSD, H4: AUDUSD was traded lower following prior closure below 0.7115. MACD which continues to illustrate persistent bearish signal suggests the pair to extend its losses after breaking the support at 0.7070.

Resistance level: 0.7115, 0.7145

Support level: 0.7070, 0.6990

NZDUSD, H4: NZDUSD remains traded within a narrowing triangle following prior retrace from the top. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term, towards the direction of 0.6710.

Resistance level: 0.6780, 0.6840

Support level: 0.6710, 0.6645

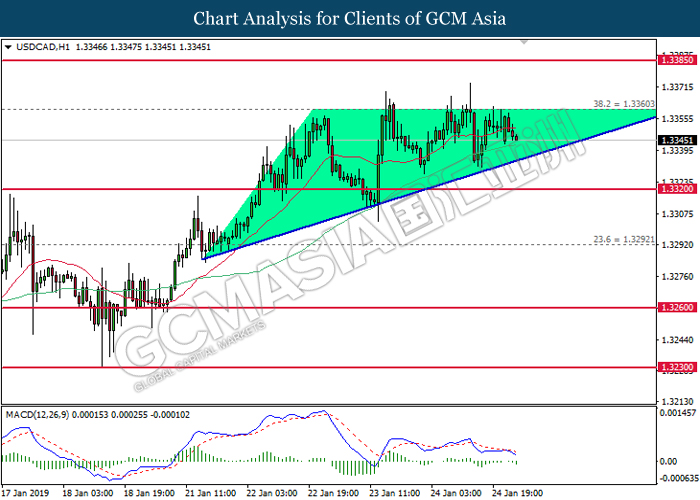

USDCAD, H1: USDCAD remains traded within a ascending triangle following prior retrace from the top. MACD which has formed a bearish signal suggests the pair to advance further down in short-term as technical correction.

Resistance level: 1.3360, 1.3385

Support level: 1.3320, 1.3290

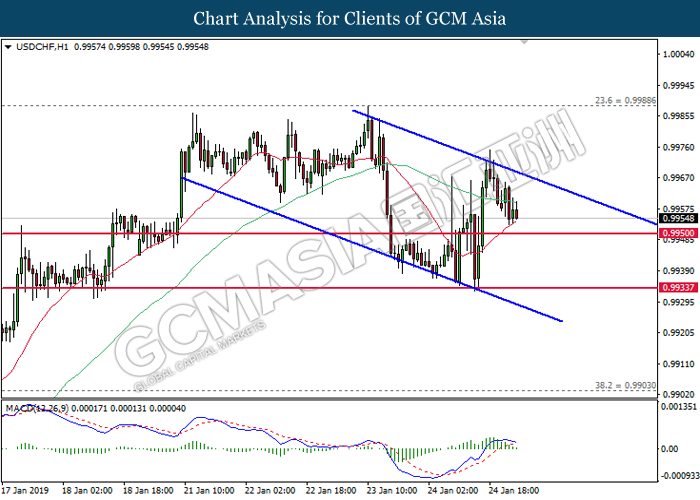

USDCHF, H1: USDCHF remains traded within a descending channel while currently testing at the support of 0.9950. MACD which illustrate diminished upward momentum suggests the pair to extend its losses after a successful closure below 0.9950.

Resistance level: 0.9990, 1.0020

Support level: 0.9950, 0.9935

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level of ascending channel. MACD which illustrate the formation of golden cross suggests its prices to advance further up, towards the direction of 54.40.

Resistance level: 54.40, 56.30

Support level: 52.80, 51.85

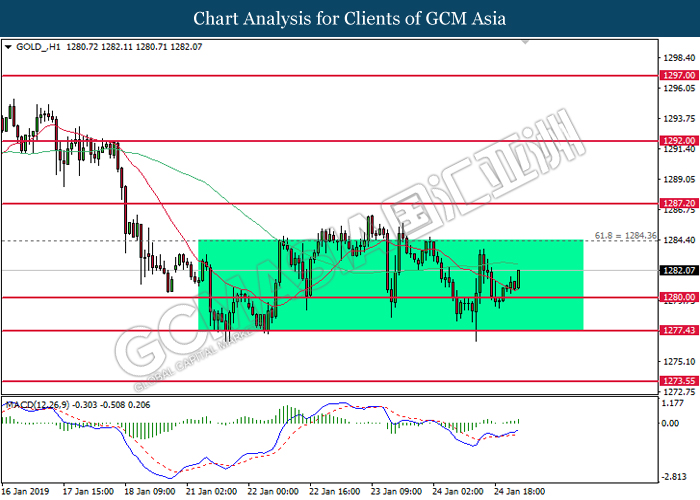

GOLD_, H1: Gold price remains traded within a sideways channel following prior rebound from the lower level. MACD which has formed a golden cross signal suggests its prices to be traded higher in short-term.

Resistance level: 1284.35, 1287.20

Support level: 1280.00, 1277.45