25 January 2022 Morning Session Analysis

Greenback waits for Fed’s meeting.

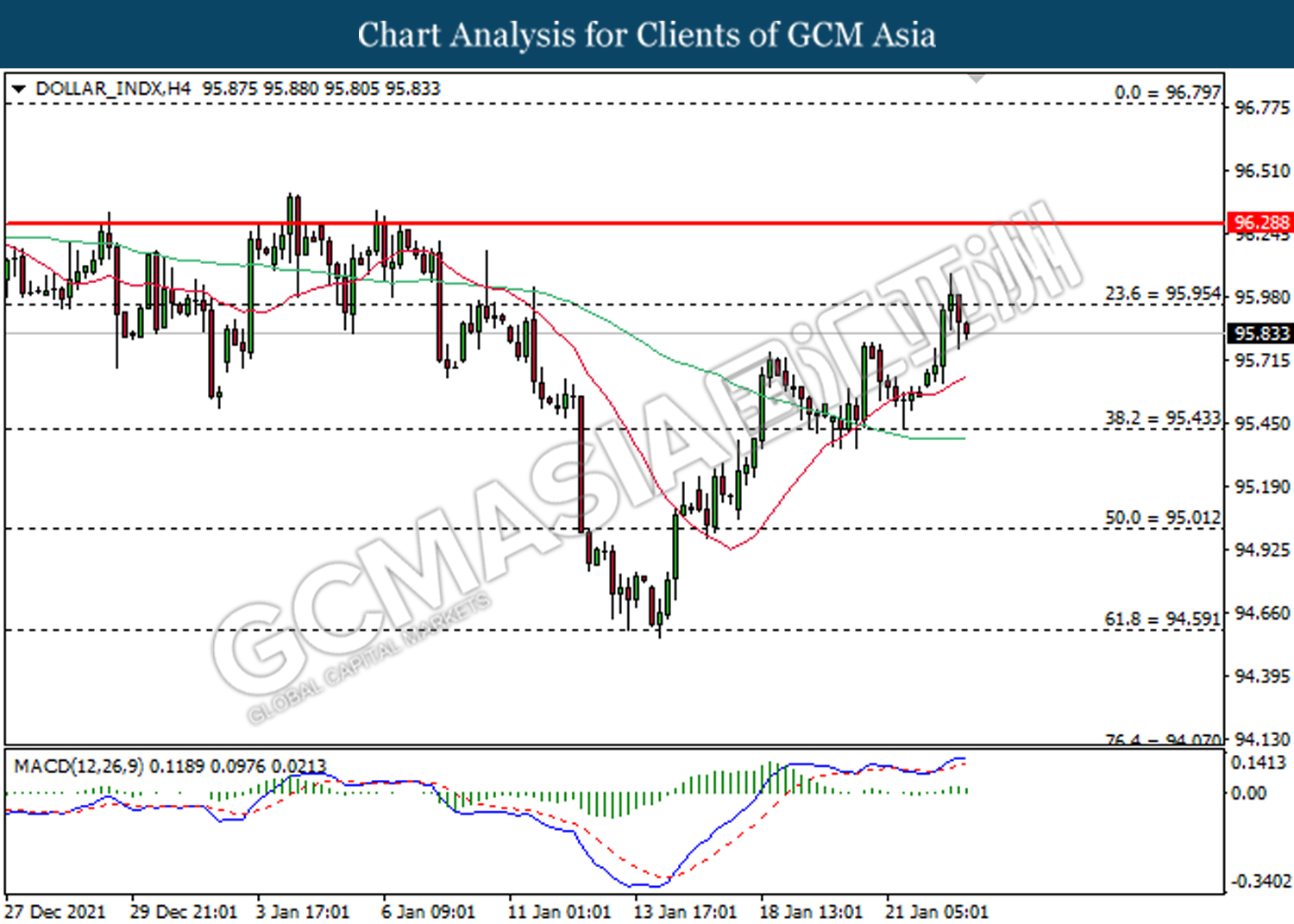

US dollar was traded flat as market participants waits for the upcoming Federal Reserve policy meeting. Prior, traders speculate that Fed may adopt a more aggressive approach in terms of monetary policy tightening as inflationary pressure is expected to rise further. According to US Inflation Expectation report, the data rose for the second consecutive day to 2.38% for a 10-year breakeven period, a significant rebound from previous four-month low. Escalating inflation expectation was mainly due to hawkish tilt by several Fed officials which deemed current inflation is far too high. Likewise, several of them also postulate that inflation may rise further up due to strong economic rebound in the US and ongoing supply chain issues due to pandemic. As of writing, dollar index was traded flat at around 95.83.

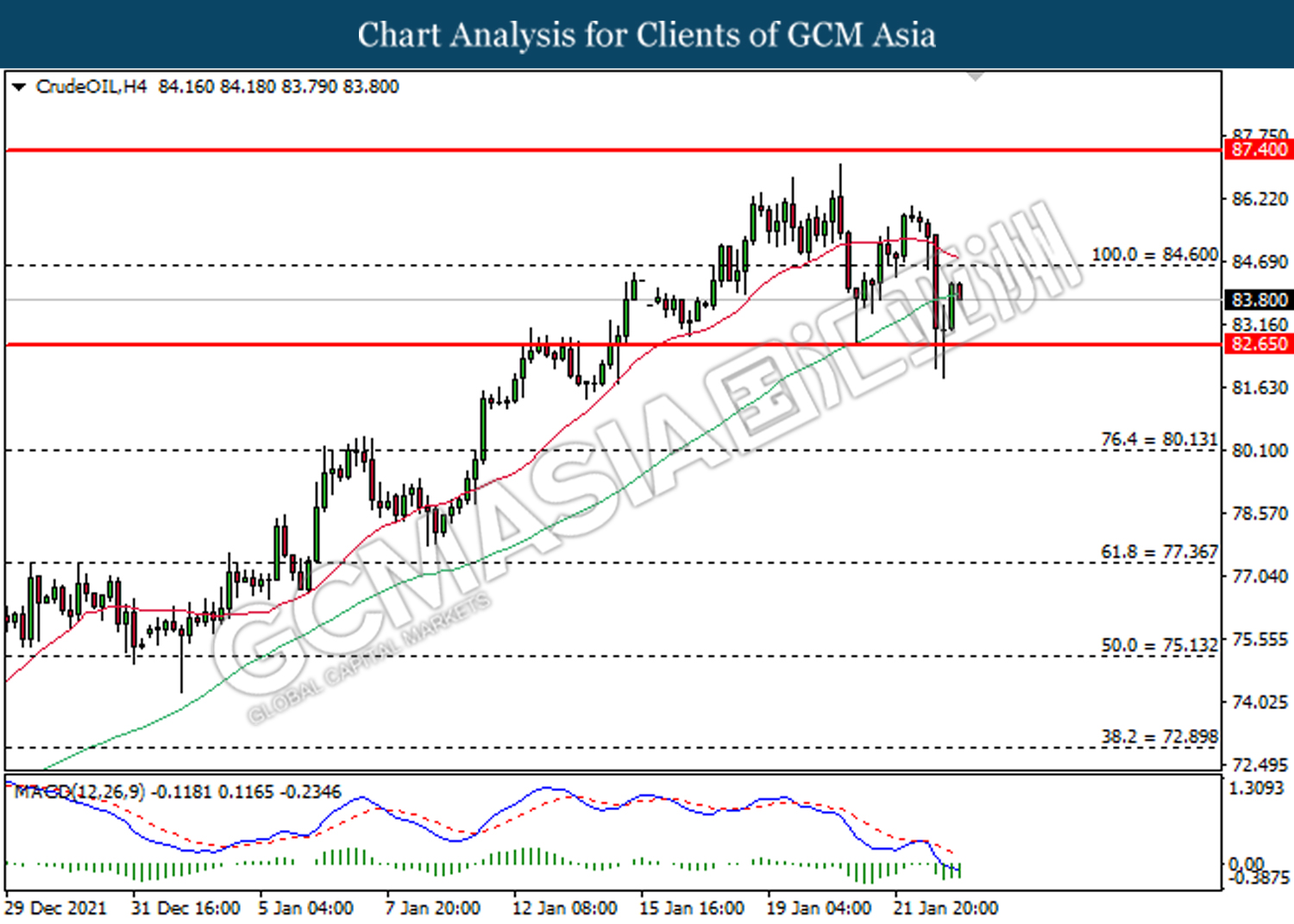

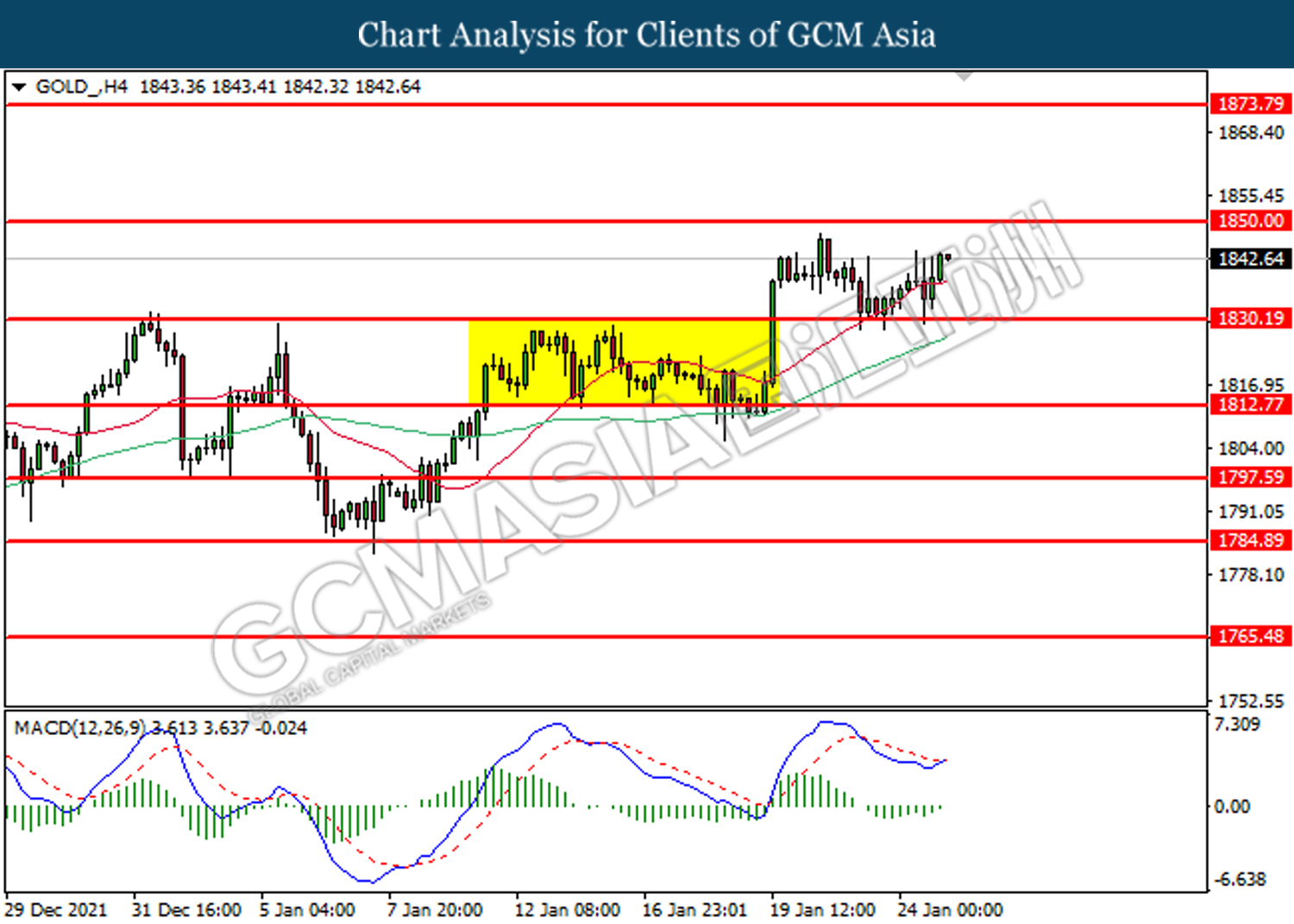

In the commodities market, crude oil price rose 0.21% to $84.00 per barrel due to ongoing struggles from OPEC to increase their oil production. On the other hand, gold price rose 0.04% to $1,842.15 a troy ounce following technical corrections from lower levels.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Jan) | 94.7 | 94.7 | – |

| 23:00 | USD – CB Consumer Confidence (Jan) | 115.8 | 111.8 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.95, 96.30

Support level: 95.45, 95.00

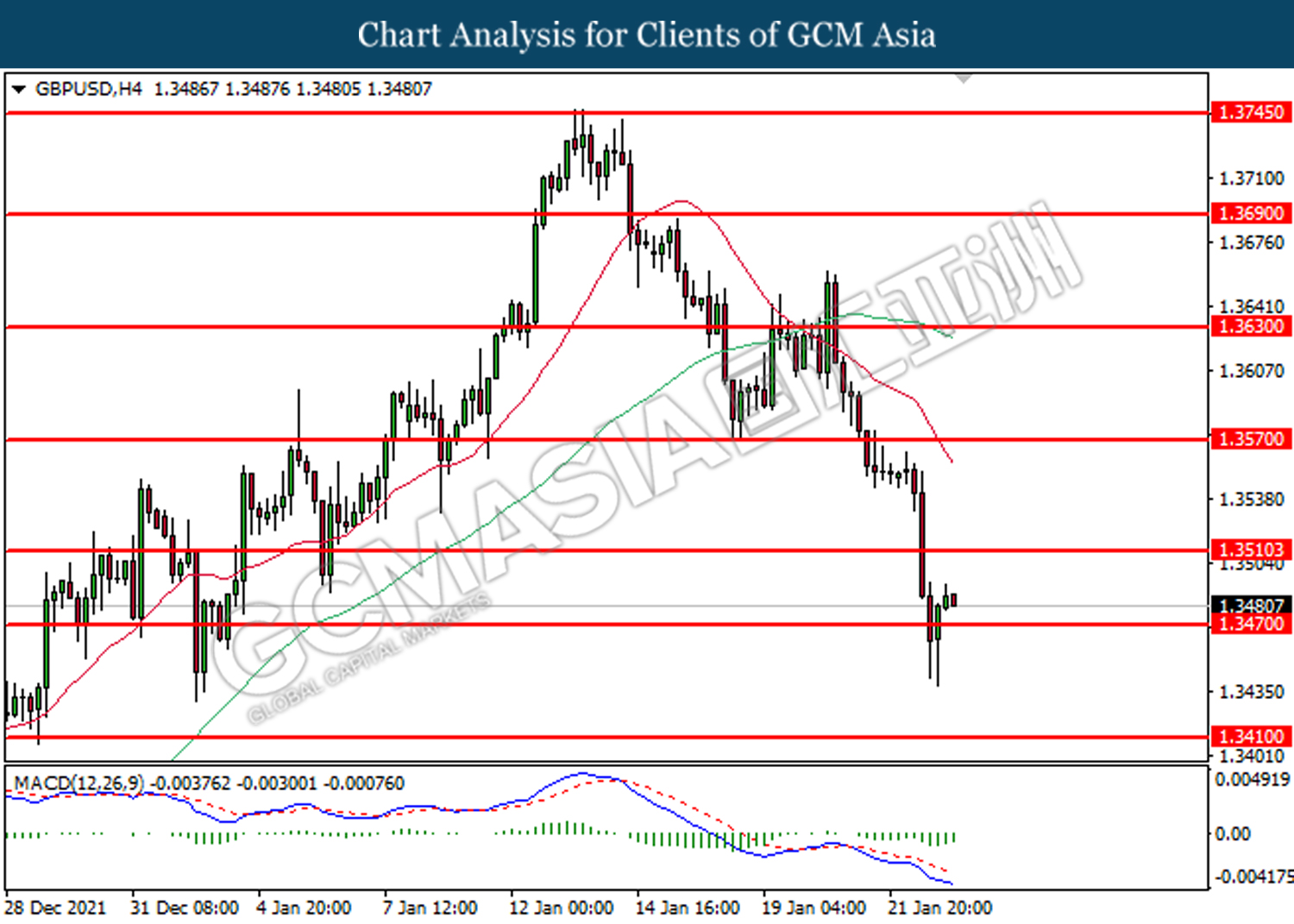

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3510, 1.3570

Support level: 1.3470, 1.3410

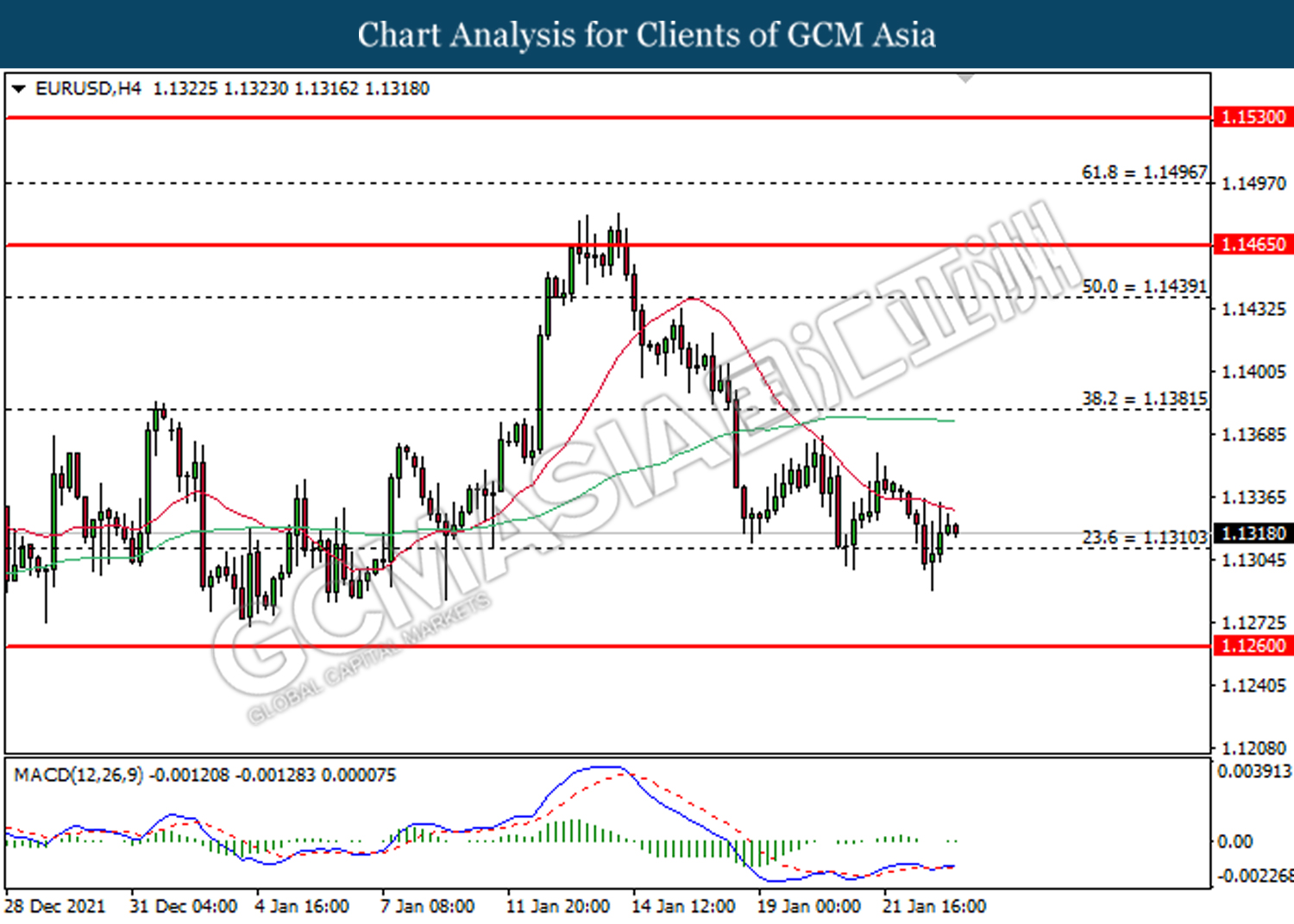

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1380, 1.1440

Support level: 1.1310, 1.1260

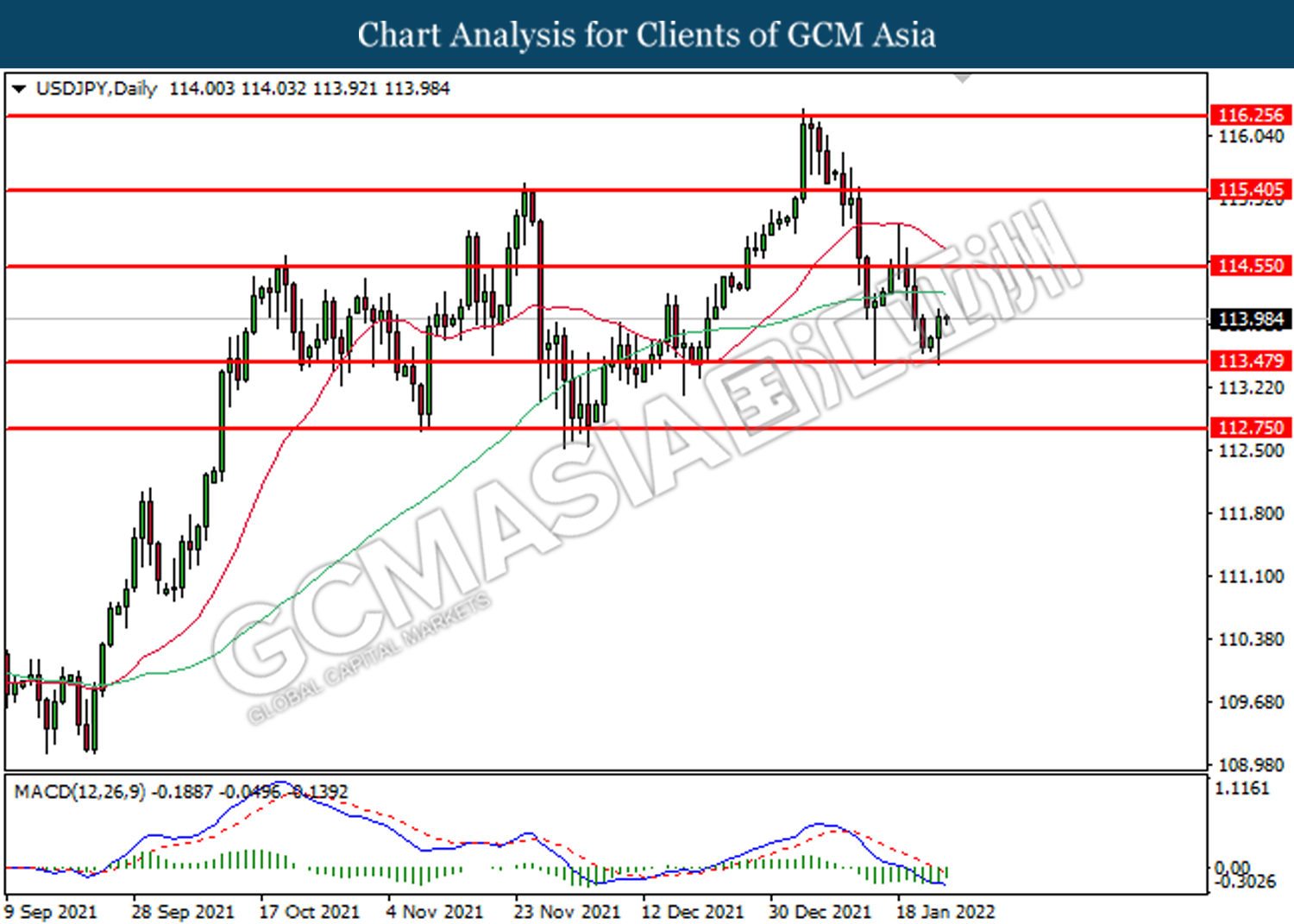

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

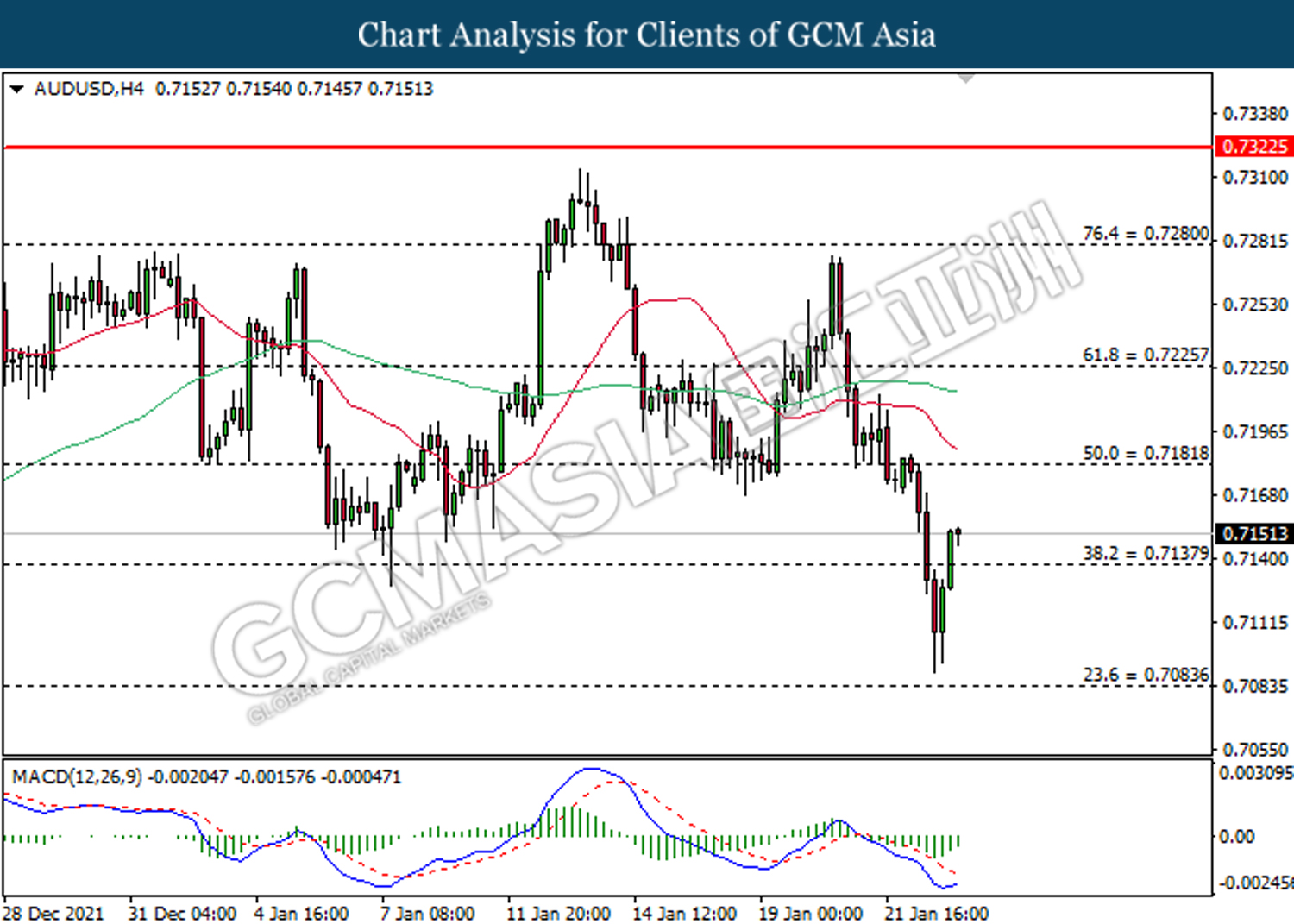

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7085

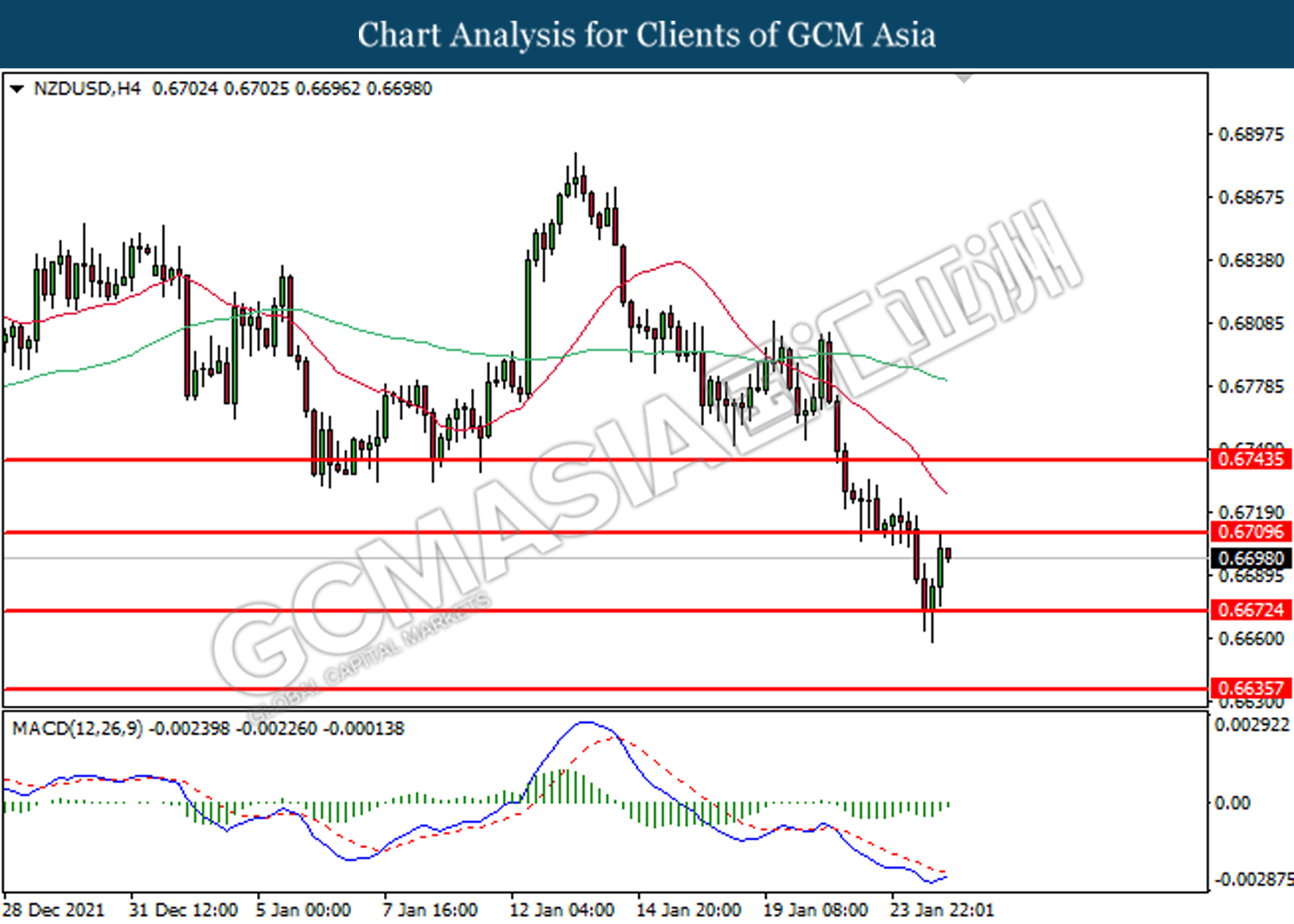

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

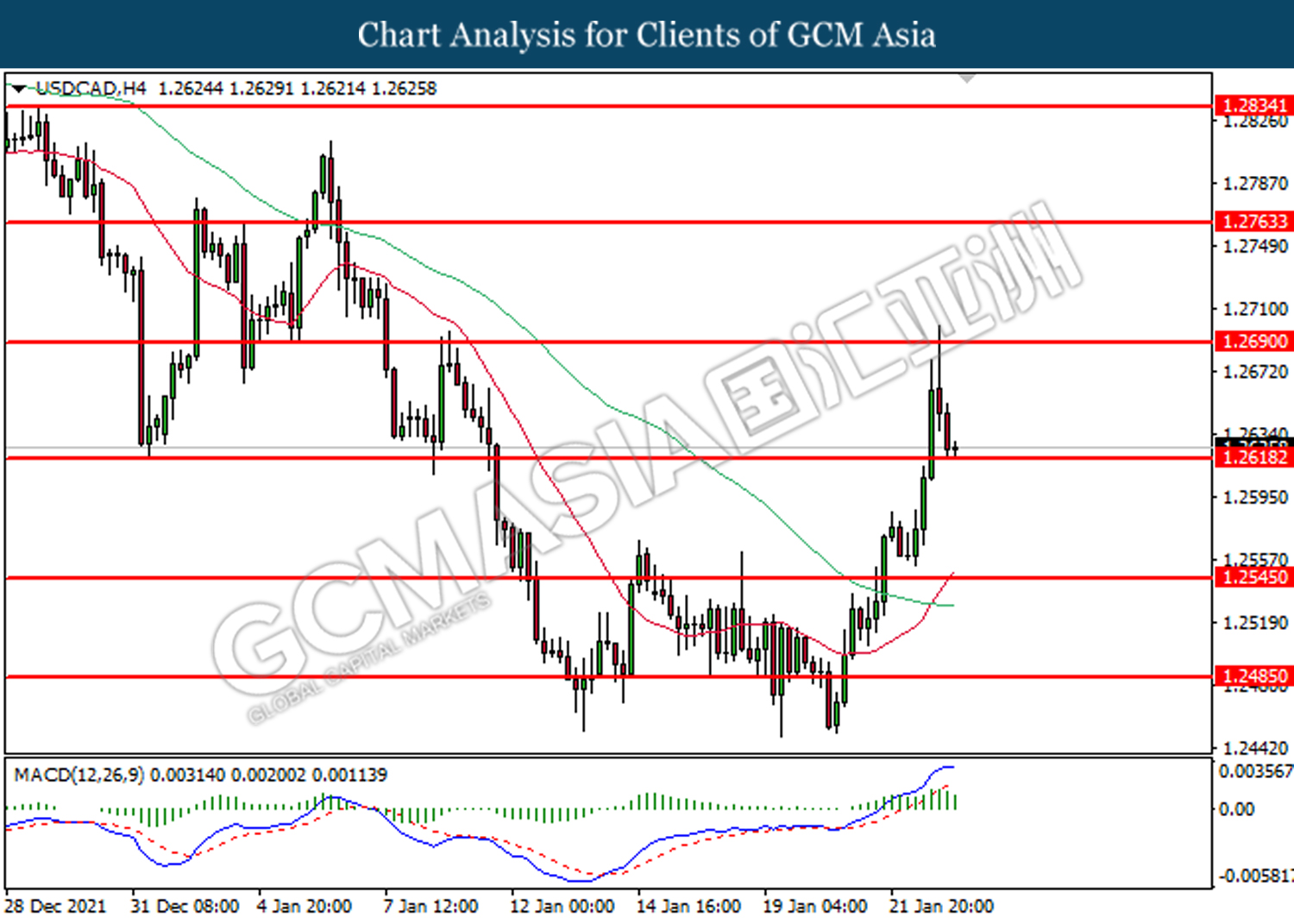

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2620.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

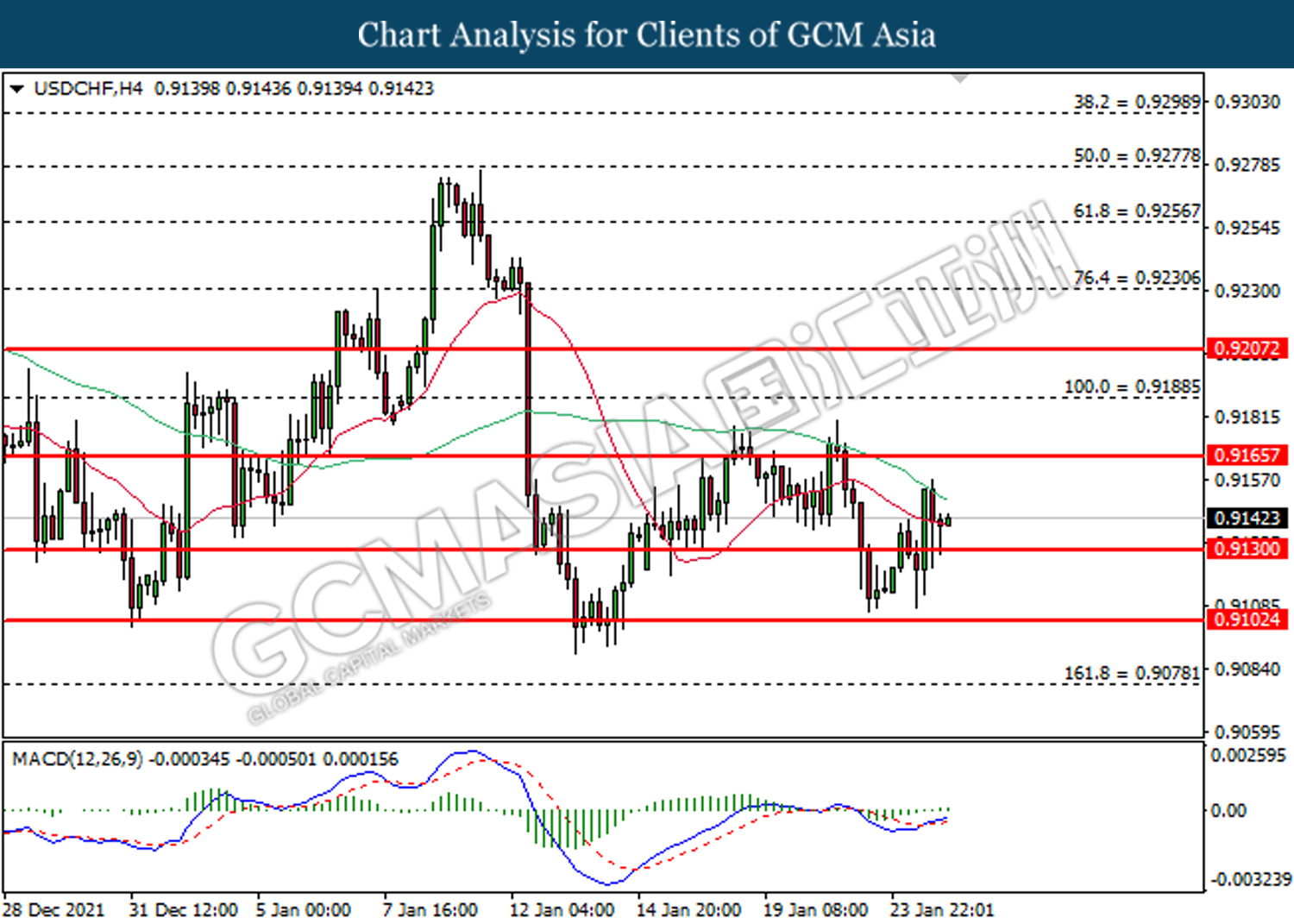

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 86.40, 87.40

Support level: 82.65, 80.15

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80