25 February 2022 Afternoon Session Analysis

Euro rebounded amid technical correction, eyed on tensions between Russia-Ukraine.

The Euro rebounded following significant sell-off on yesterday amid technical correction. Nonetheless, the overall trend for the pair of Euro still remained uncertainty while investors would still need to maintain their focus toward the prospect of the relationship between Russia-Ukraine to receive further trading signal. In earlier, Russia unleashed their biggest attack on a European state since World War Two, causing tens of thousand of people flee their homes. According to the Guardian, European countries had decided to imposed sanctions on 27 individuals and entities on Russia. Besides, restrictions on access to Europe’s capital market have been imposed, in particular by prohibiting the financing of Russia, its government and its central Bank. Several policymakers at European Central Bank (ECB) had said the situation in Ukraine could cause the ECB to slowdown its contractionary monetary policy in future. As of writing, EUR/USD appreciated by 0.21% to 1.1215.

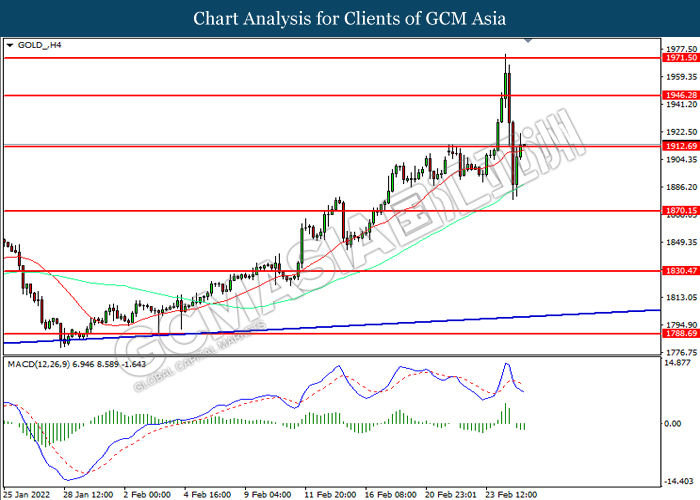

In the commodities market, the crude oil price appreciated by 2.62% to 97.05 per barrel as of writing. The oil market edged higher amid rising tensions between Russia-Ukraine had spurred concerns toward the oil supply disruption in future. On the other hand, the gold price appreciated by 0.52% to $1913.85 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q4) | -0.70% | -0.70% | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | 0.60% | 0.40% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | -3.80% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 97.35. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 97.35, 98.20

Support level: 96.00, 94.55

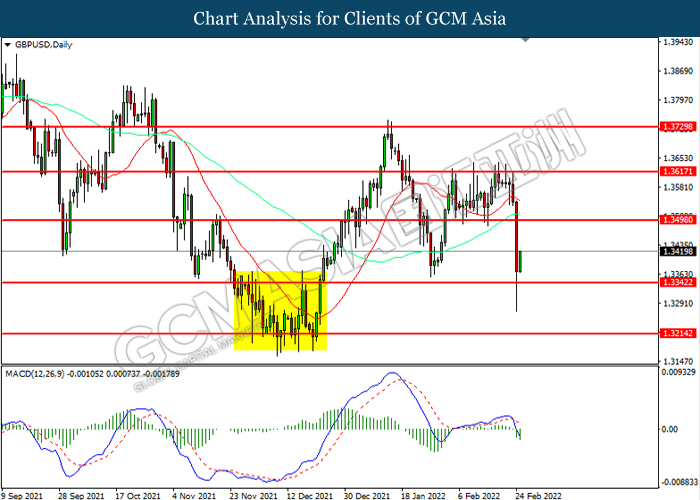

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3340. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3500, 1.3615

Support level: 1.3340, 1.3215

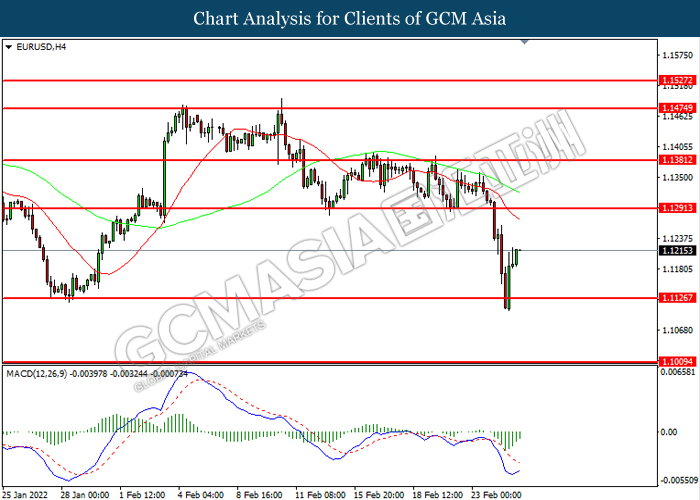

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1125. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1290.

Resistance level: 1.1290, 1.1380

Support level: 1.1230, 1.1010

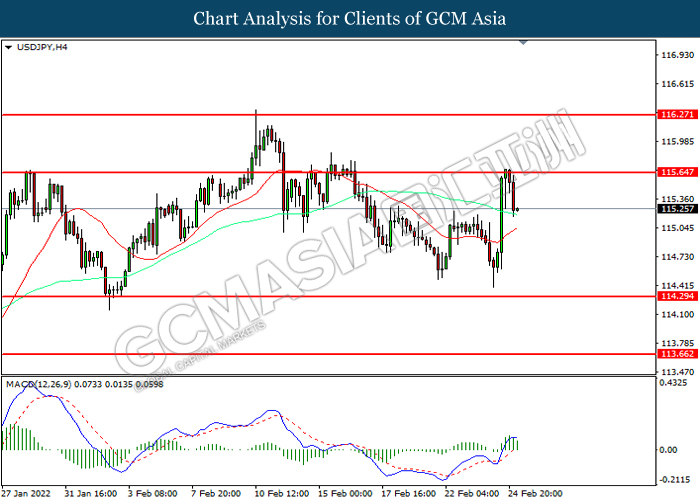

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 115.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 114.30.

Resistance level: 115.65, 116.25

Support level: 114.30, 113.65

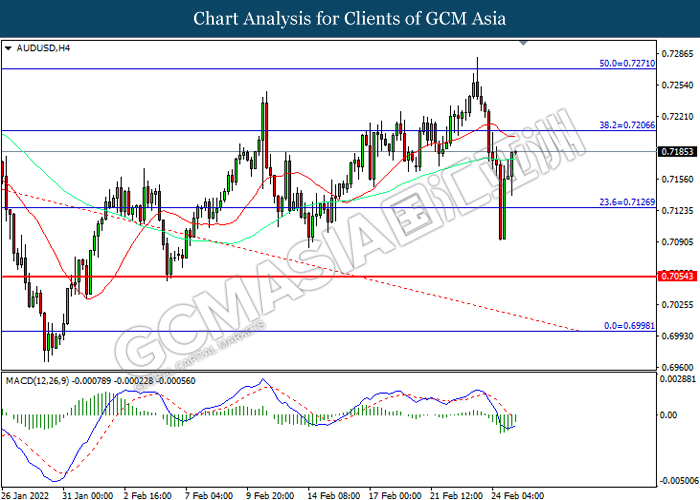

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level at 0.7205. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

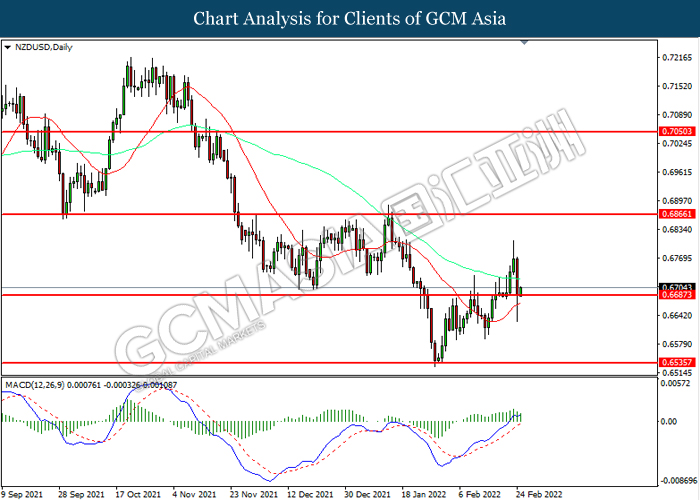

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6685. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.7050

Support level: 0.6685, 0.6535

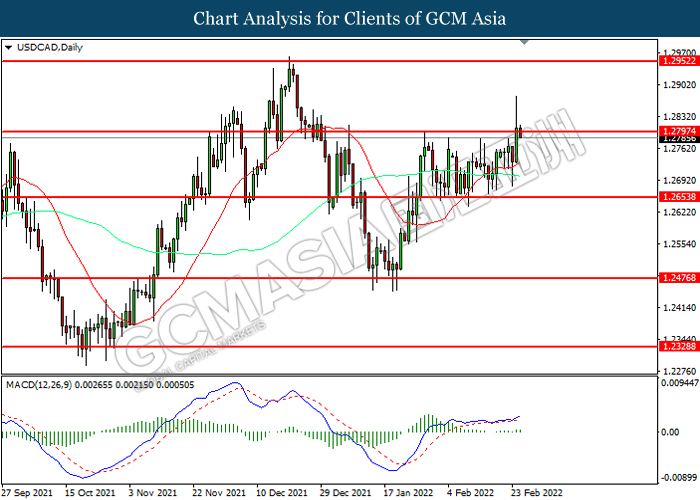

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2795. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2795, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 95.90. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 95.90, 98.05

Support level: 93.05, 88.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1946.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1946.03, 1971.50

Support level: 1912.35, 1870.15