25 March 2022 Morning Session Analysis

US Dollar appreciated on upbeat data and hawk expectation.

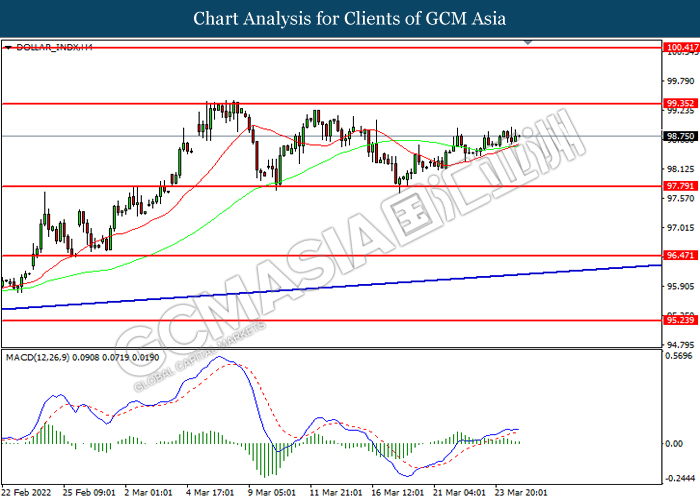

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of upbeat economic data from the United States yesterday. According to Department of Labor, US Initial Jobless Claims notched down significantly from the preliminary reading of 215K to 187K, better than the market forecast at 212K, the lowest level since September 1969. Though, the US Durable Goods Orders unexpectedly declined in February as delayed shipment as well as supply shortage issues. The positive economic data and the hawkish statement from Federal Reserve have strengthened hopes upon the central bank to implement a more aggressive contractionary monetary policy. Expectations for a hike of 50 basis point during the May meeting are currently priced at 70.5%, according to CME’s FedWatch tool. As of writing, the Dollar Index appreciated by 0.15% to 98.75.

In the commodities market, the crude oil price depreciated by 0.05% to $113.50 per barrel as of writing following the European Unions dropped the proposal of banning Russian supply. On the other hand, the gold price appreciated by 0.07% to $1959.20 amid risk-off sentiment in the global financial market following the rising tensions between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Feb) | 1.90% | 0.80% | – |

| 17:00 | EUR – German Ifo Business Climate Index (Mar) | 98.9 | 94 | – |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | -5.70% | 1.50% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

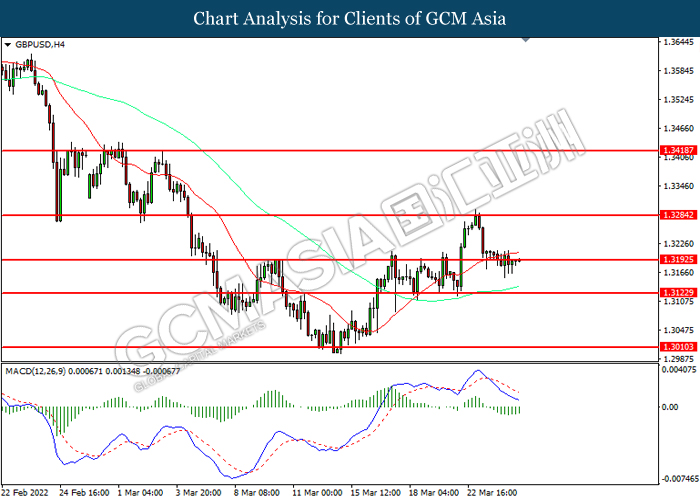

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3285, 1.3420

Support level: 1.3195, 1.3125

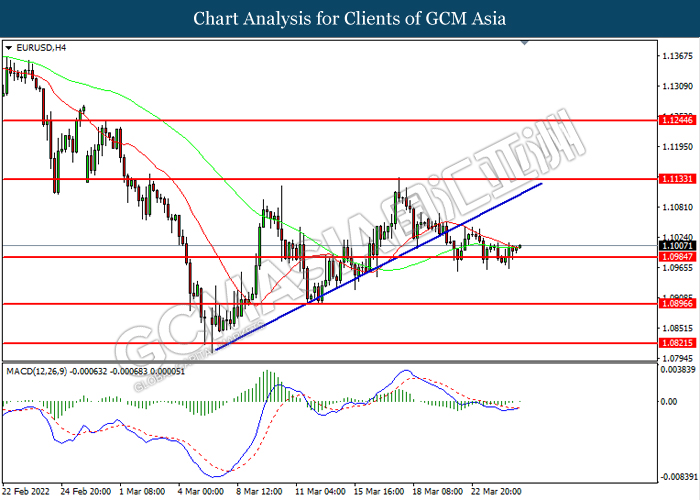

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

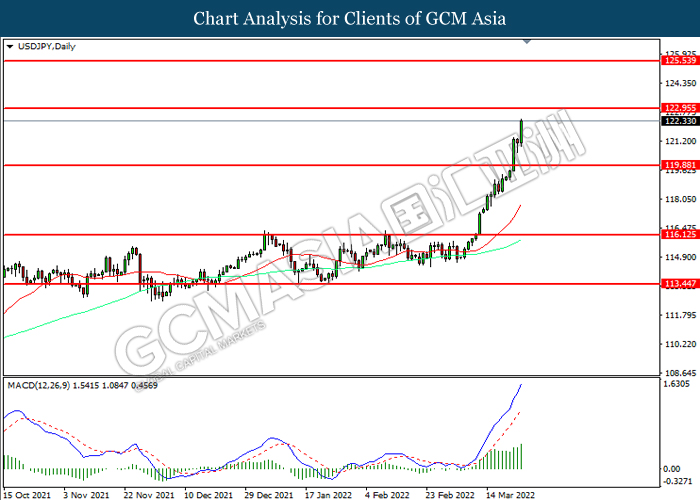

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

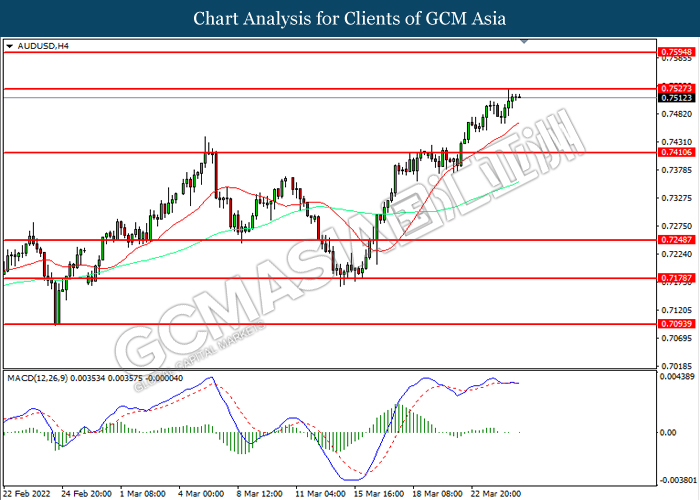

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

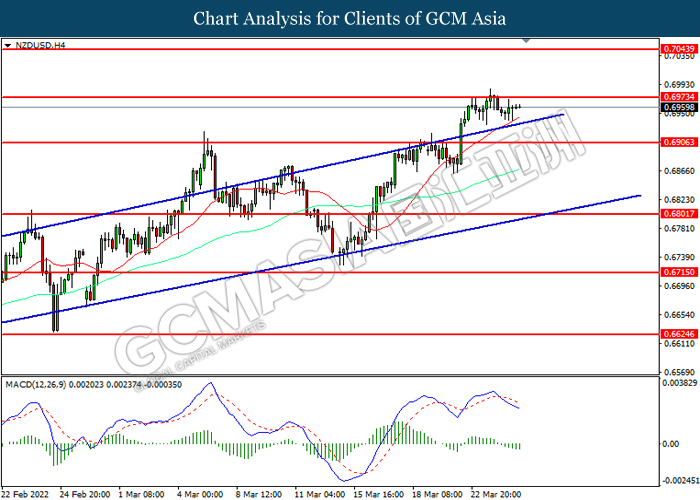

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

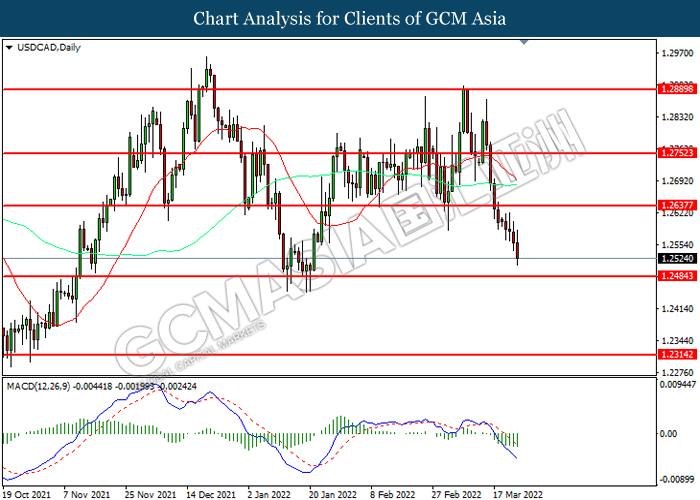

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

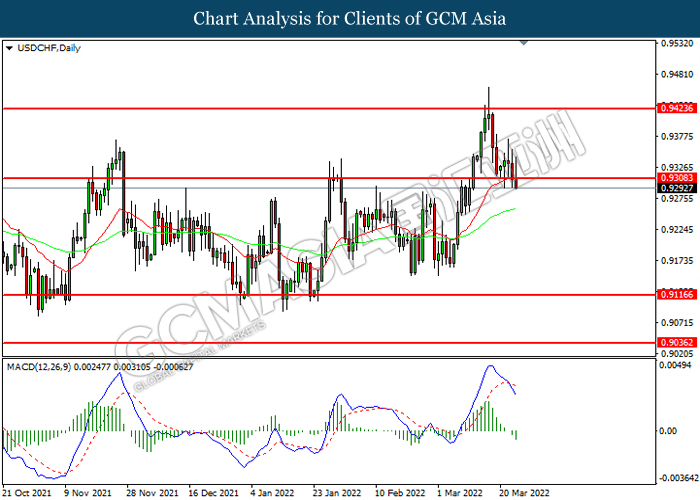

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9310, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level at 112.95. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 112.95, 116.55

Support level: 107.95, 104.40

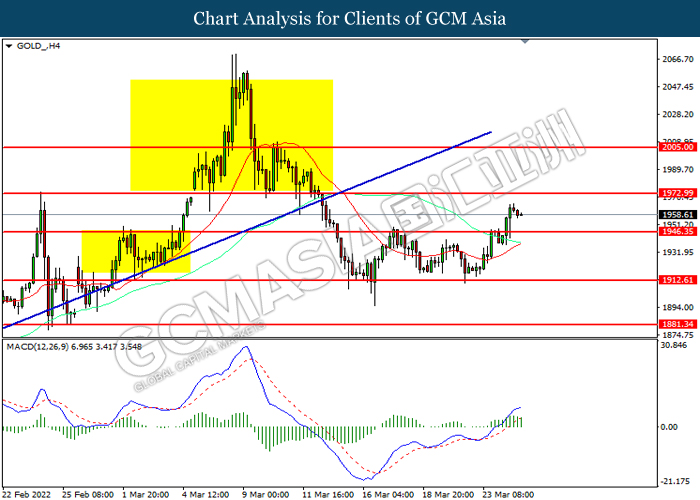

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1946.35, 1912.60