25 April 2023 Afternoon Session Analysis

The pound appreciated after mixed economic data released.

The pound sterling, which is one of the most traded currencies by global investors, was traded higher after mixed economic data were released last Friday. The recent retail and core sales data for March sent the pound into the ground, with actual readings slipping to -0.9% and -1.0%, respectively, below consensus and previous readings. However, the pound sterling rebounded from its downtrend after S&P Global announced upbeat UK Composite PMI data. According to S&P Global, a downbeat manufacturing data showed a contraction in the UK. In March, with a 46.6 reading lower than the market consensus of 48.5 and prior readings of 47.9, Still, the service PMI data outperformed the market estimation with a level of 54.9 higher than the estimations and the prior reading of 49.0 and 49.2 respectively. The composite PMI grew from 52.2 to 53.9, above the upbeat market consensus of 52.6. The S&P Rating Agency upwardly revised the economic outlook on the UK’s AA credit rating from negative to stable as the near-term negative downside risk has been reduced. The stabilization of the data reflects the UK’s stronger-than-expected economic performance. As of writing, the GBP/USD had edged up by 0.03% to $1.2485.

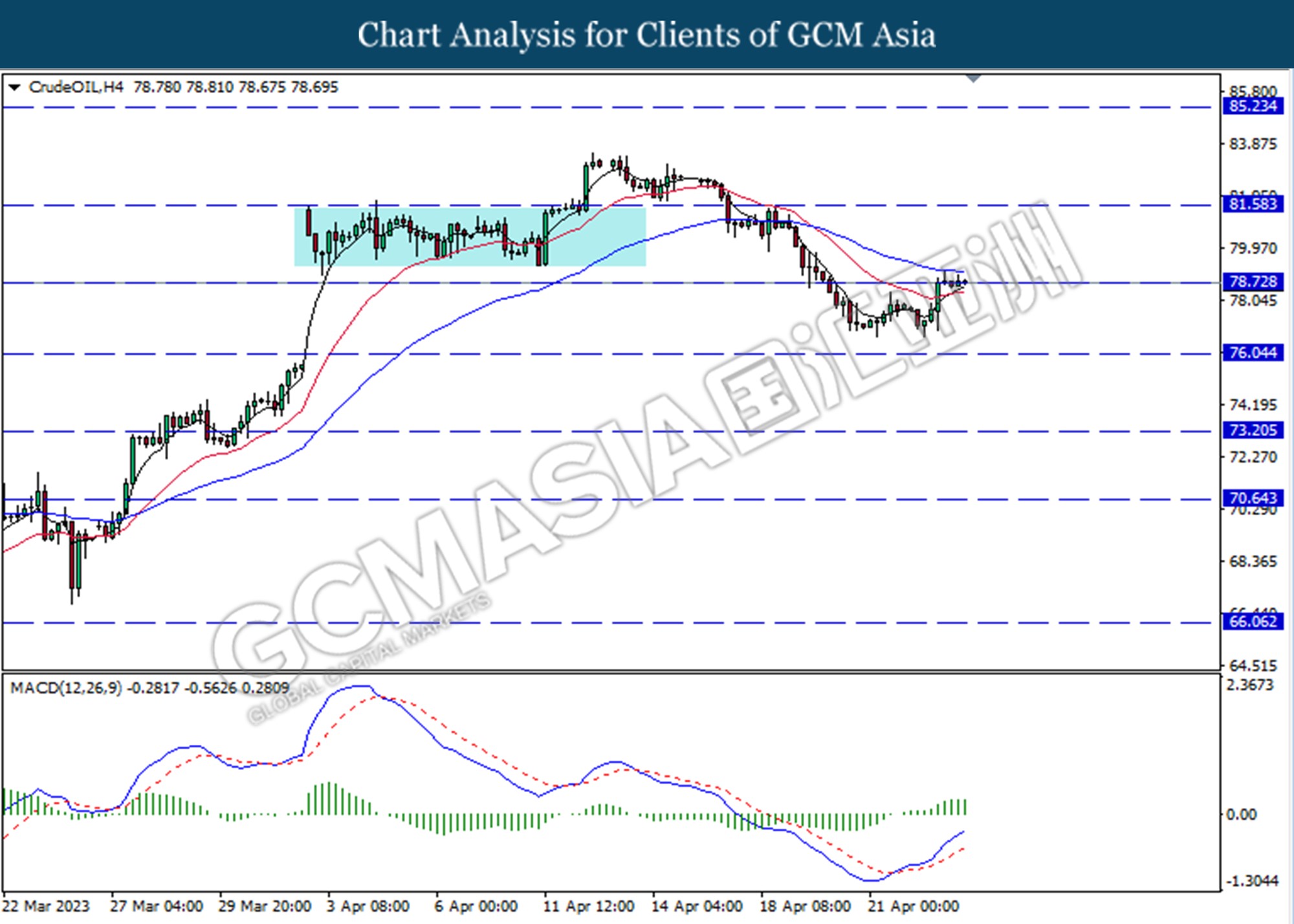

In the commodities market, crude oil prices were traded up by 0.03% to $78.78 per barrel amid OPEC production cuts in May and the weakening dollar. Besides, gold prices appreciated by 0.14% to $1992.91 per troy ounce as investors ponder on the US CB consumer confidence index.

Today’s Holiday Market Close

Time Market Event

All Day AUD ANZAC Day

All Day NZD ANZAC Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits | 1.550M | 1.413M | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 104.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Mar) | 640K | 630K | – |

Technical Analysis

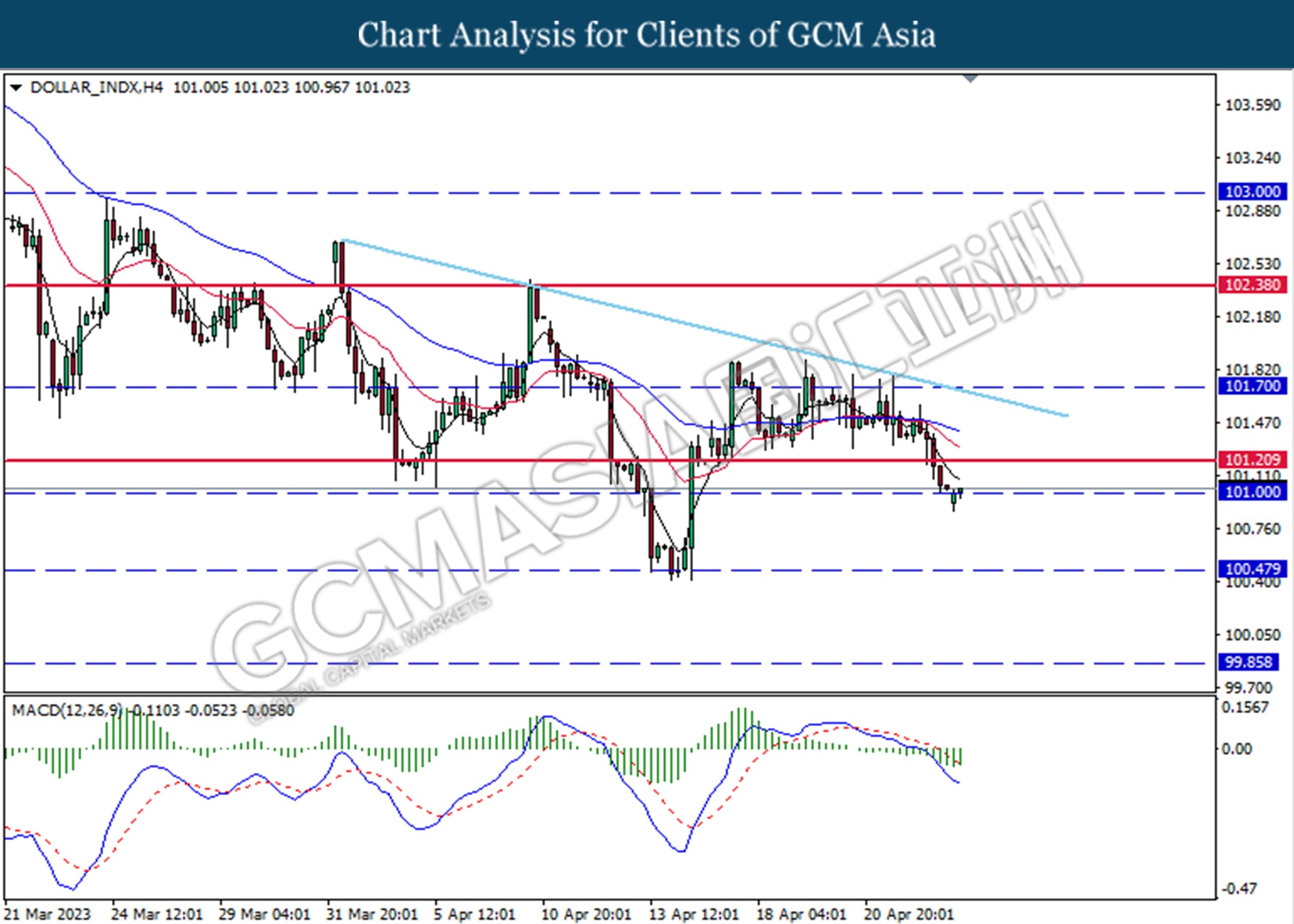

DOLLAR_INDX, H4: Dollar index was traded higher following a prior break above the previous resistance level at 101.00. However, MACD which illustrated bearish momentum suggests the index to traded lower as a technical correction.

Resistance level: 101.20, 101.70

Support level: 101.00, 100.50

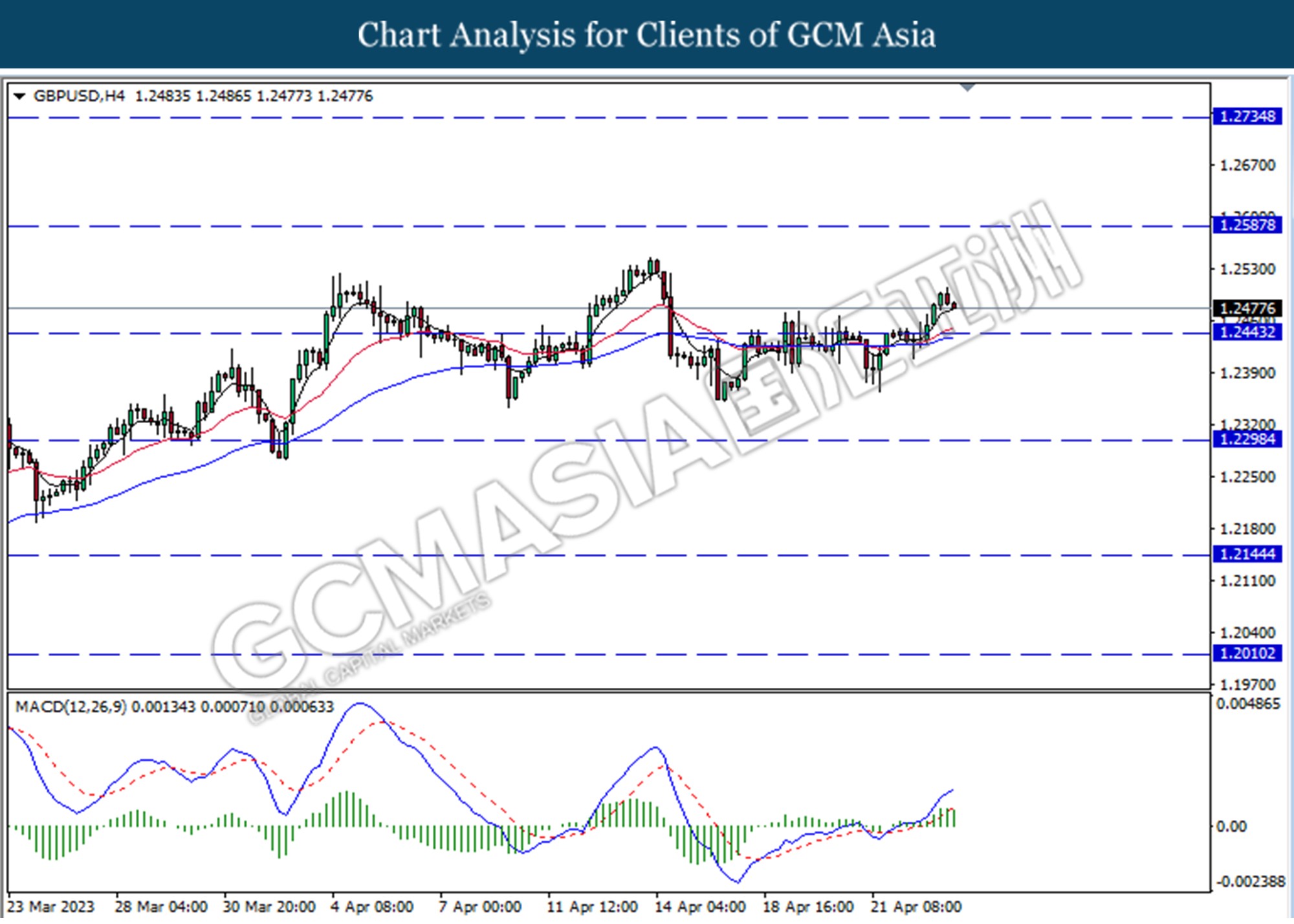

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.2445.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2145

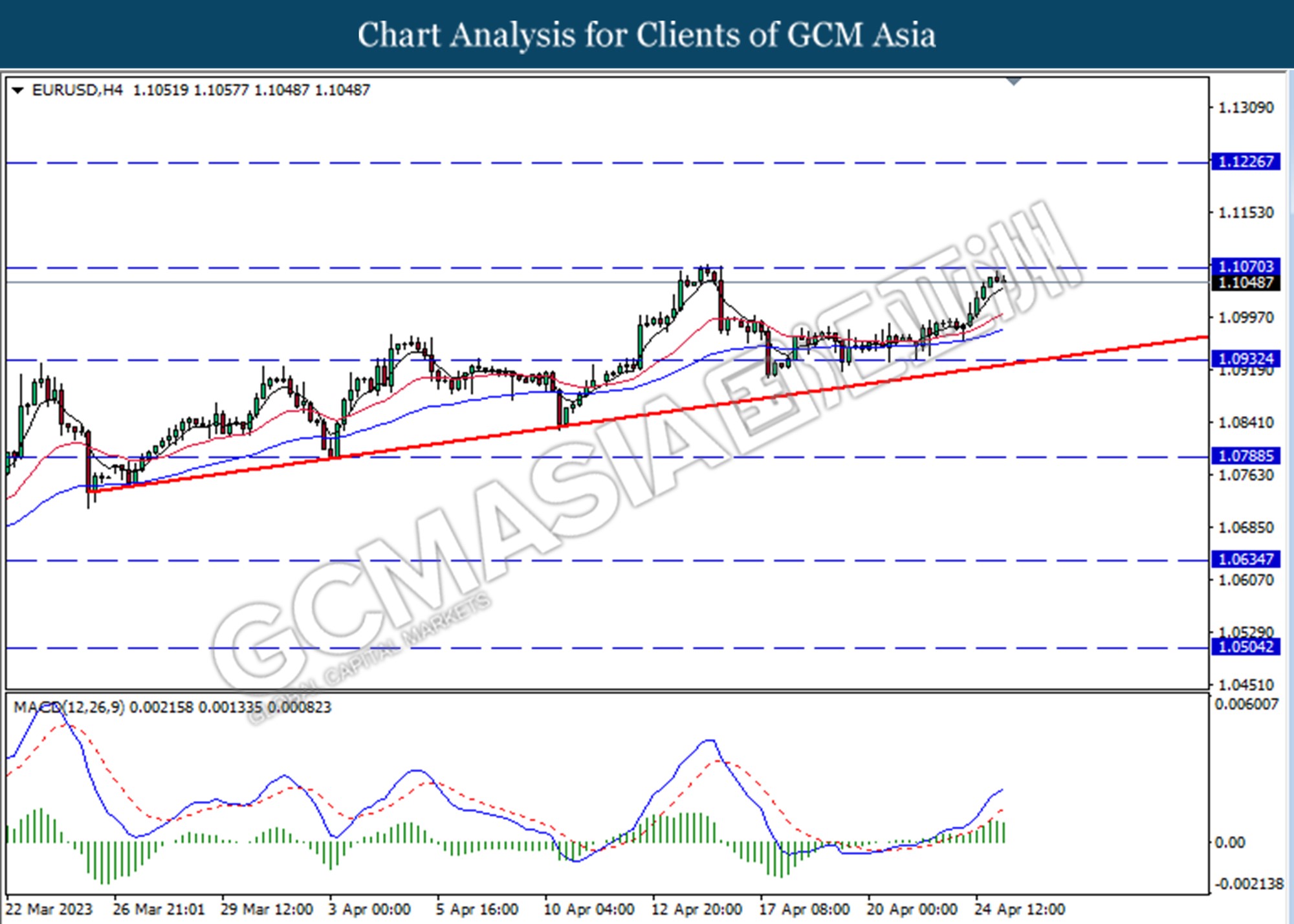

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.1070. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

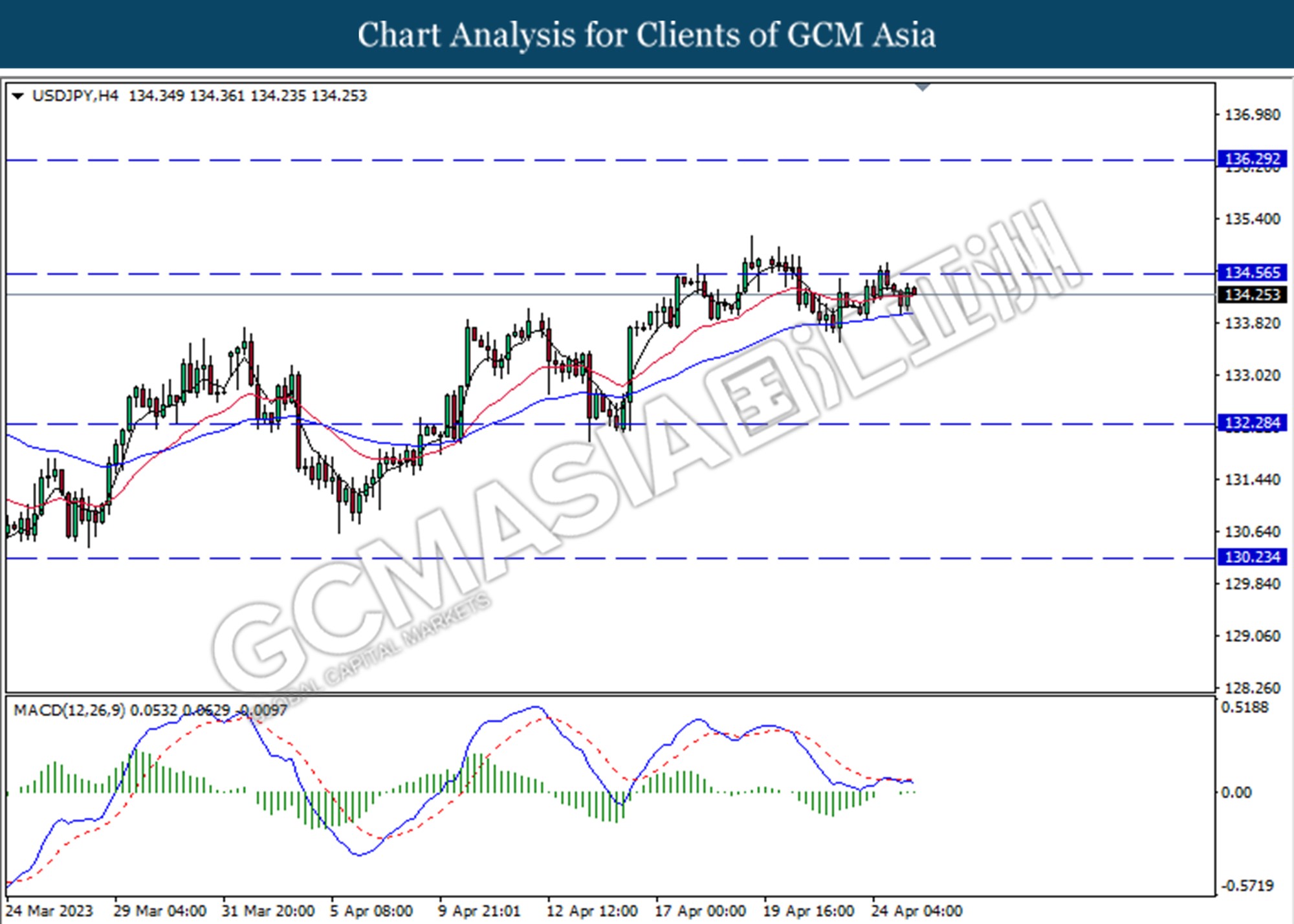

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

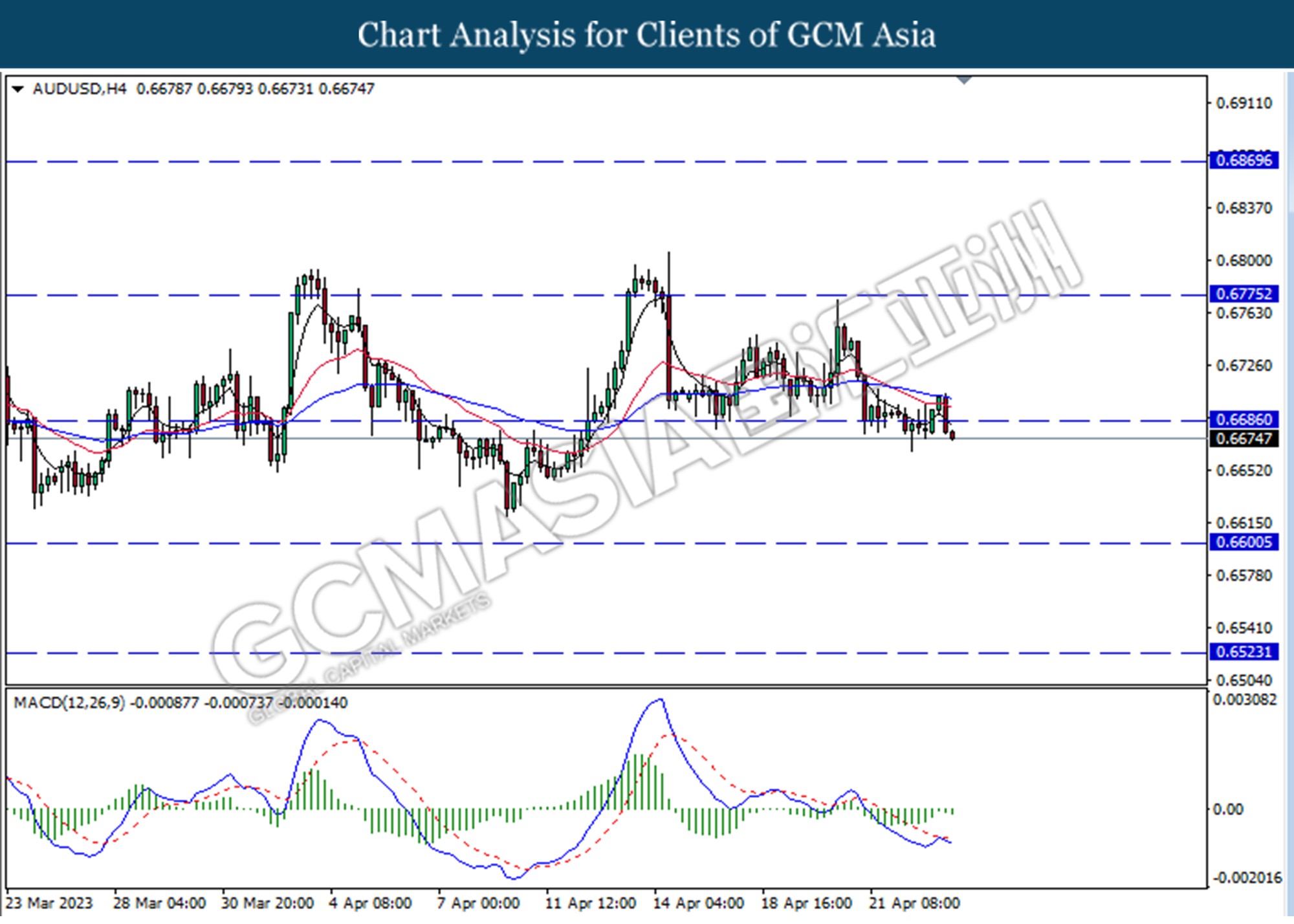

AUDUSD, H4: AUDUSD was traded lower following the prior break below from the previous support level at 0.6685. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6600.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525.

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

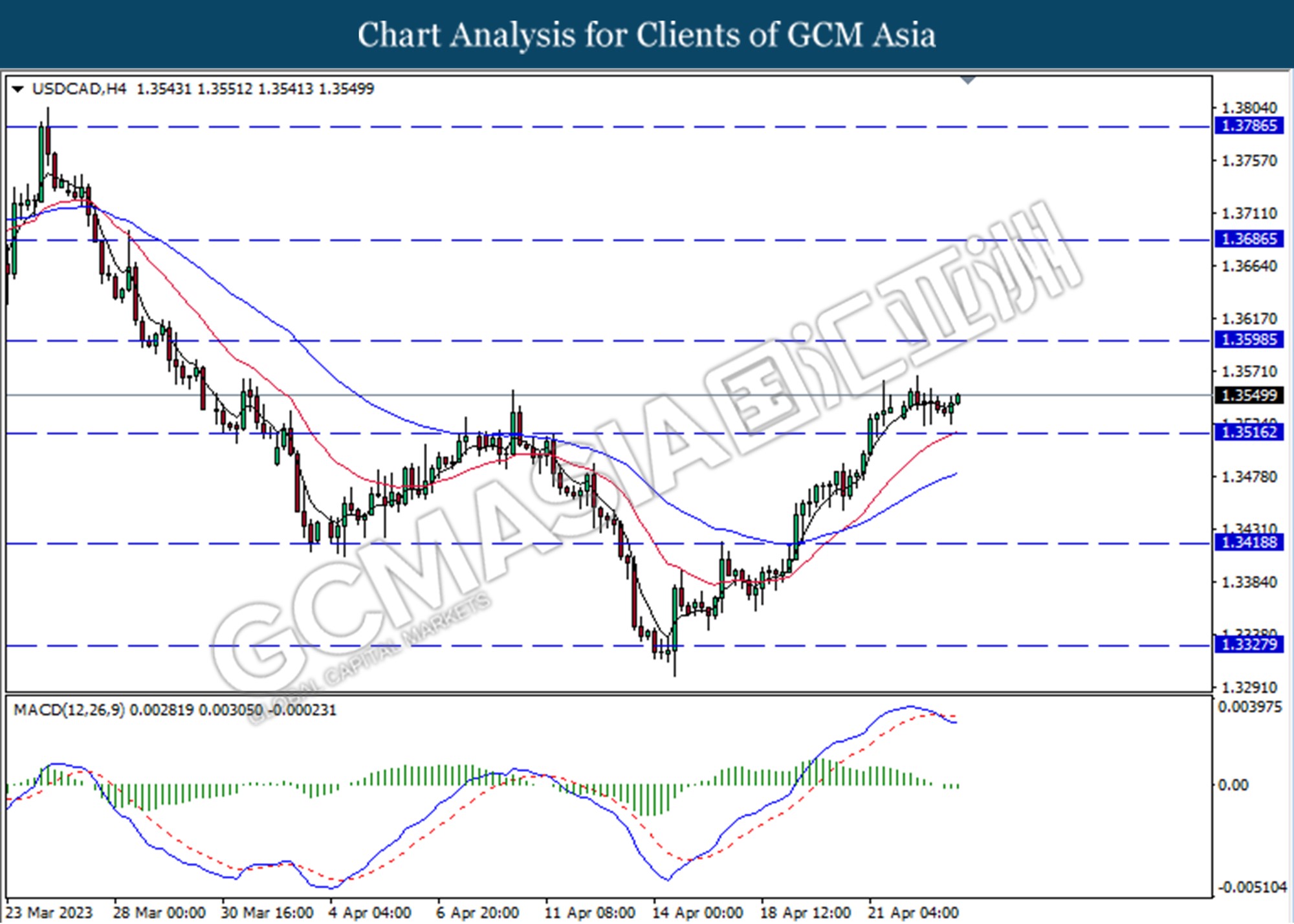

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3515. However, MACD which illustrated diminishing bearish momentum suggests the pair traded lower as technical correction.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

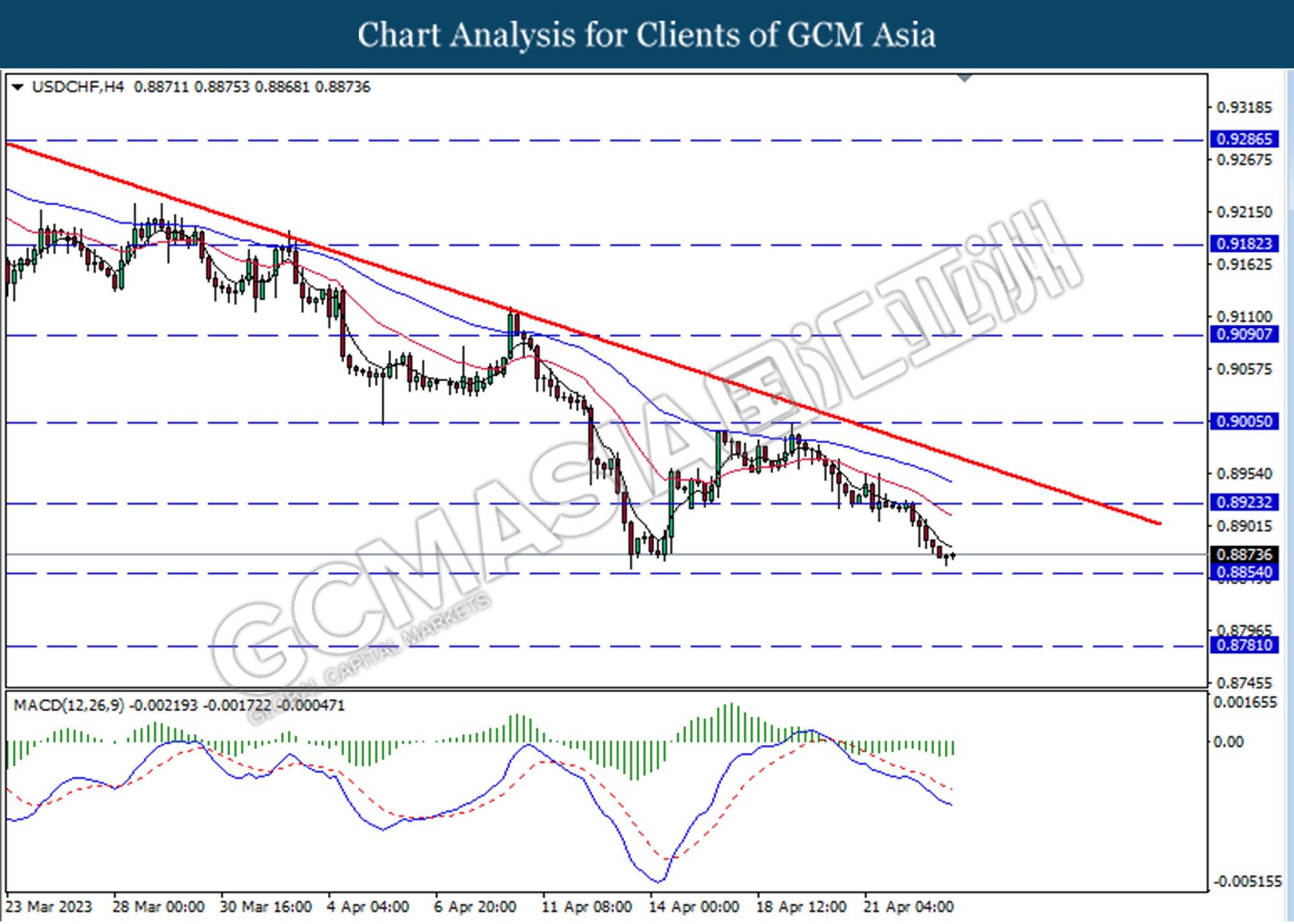

USDCHF, H4: USDCHF was traded lower following a prior break below from the previous support level at 0.8925. However, MACD which illustrated diminishing bearish momentum suggests the pair traded higher as technical correction.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 78.70. MACD which illustrated bullish momentum suggests the commodity extended its gains if successfully break above the resistance level.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity traded higher as technical correction.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90