25 April 2023 Morning Session Analysis

US Dollar teetered near the brink of collapse ahead of busy week.

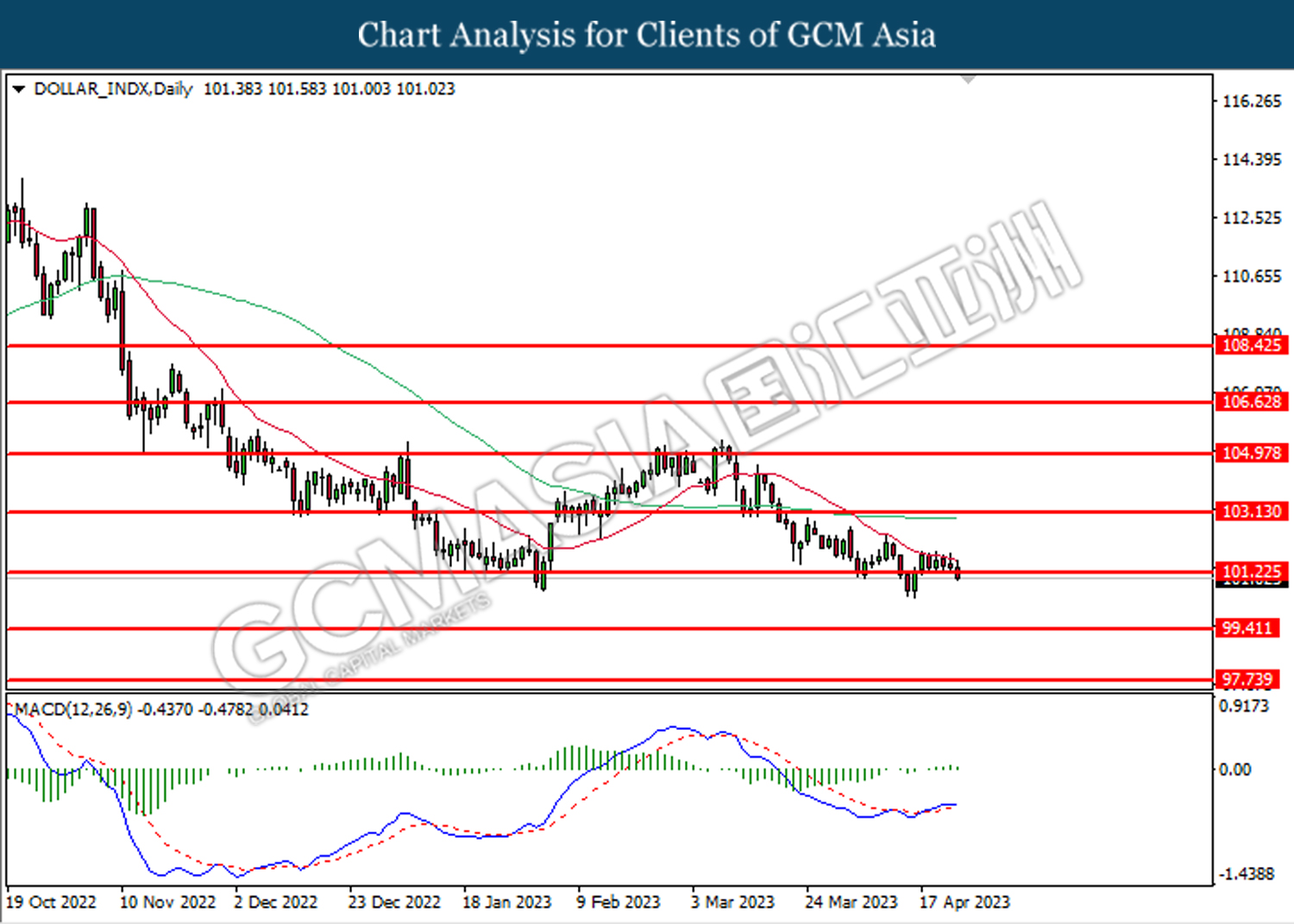

The dollar index, which was traded against a basket of six major currencies, hovered near the lowest level in one week as the market participants are waiting for the upcoming economic data to gauge whether the Federal Reserve would really hike its interest rate by another 25-basis point in the May’s meeting. Throughout the past week, the US dollar lost its shininess as a series of economic data proved that the nation’s economy was struggling near the edge of recession following the rate hikes a year ago. However, the losses of the greenback were limited by the unexpected upbeat data, which included S&P Global Composite PMI, Manufacturing PMI, and Services PMI. Going forward, the eyes of investors would be placed on the calendar later this week, for example, Gross Domestic Product (GDP), PCE Price Index, and so on. These economic data would likely shed more light on the future path of interest rates by the Fed. Weaker-than-expected data might disrupt the willingness of the Fed’s members to have another round of rate hikes in May’s meeting. As of writing, the dollar index dropped -0.47% to 101.35.

In the commodities market, crude oil prices were up by 0.42% to $78.30 per barrel amid the depreciation of the US dollar spurred the demand for oil products. Besides, gold prices edged up by 0.19% to $1992.95 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day AUD ANZAC Day

All Day NZD ANZAC Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits | 1.550M | 1.413M | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 104.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Mar) | 640K | 630K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

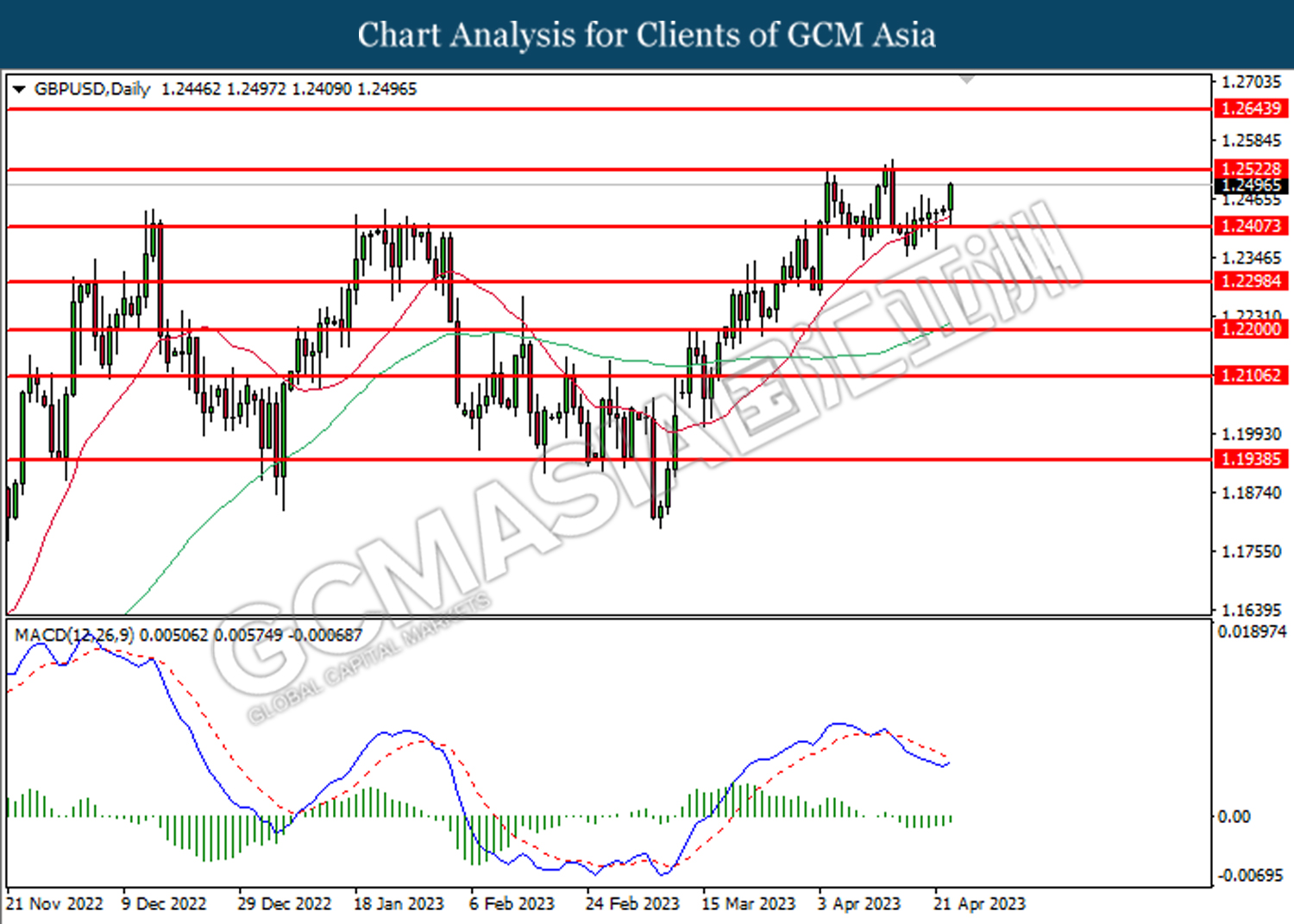

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

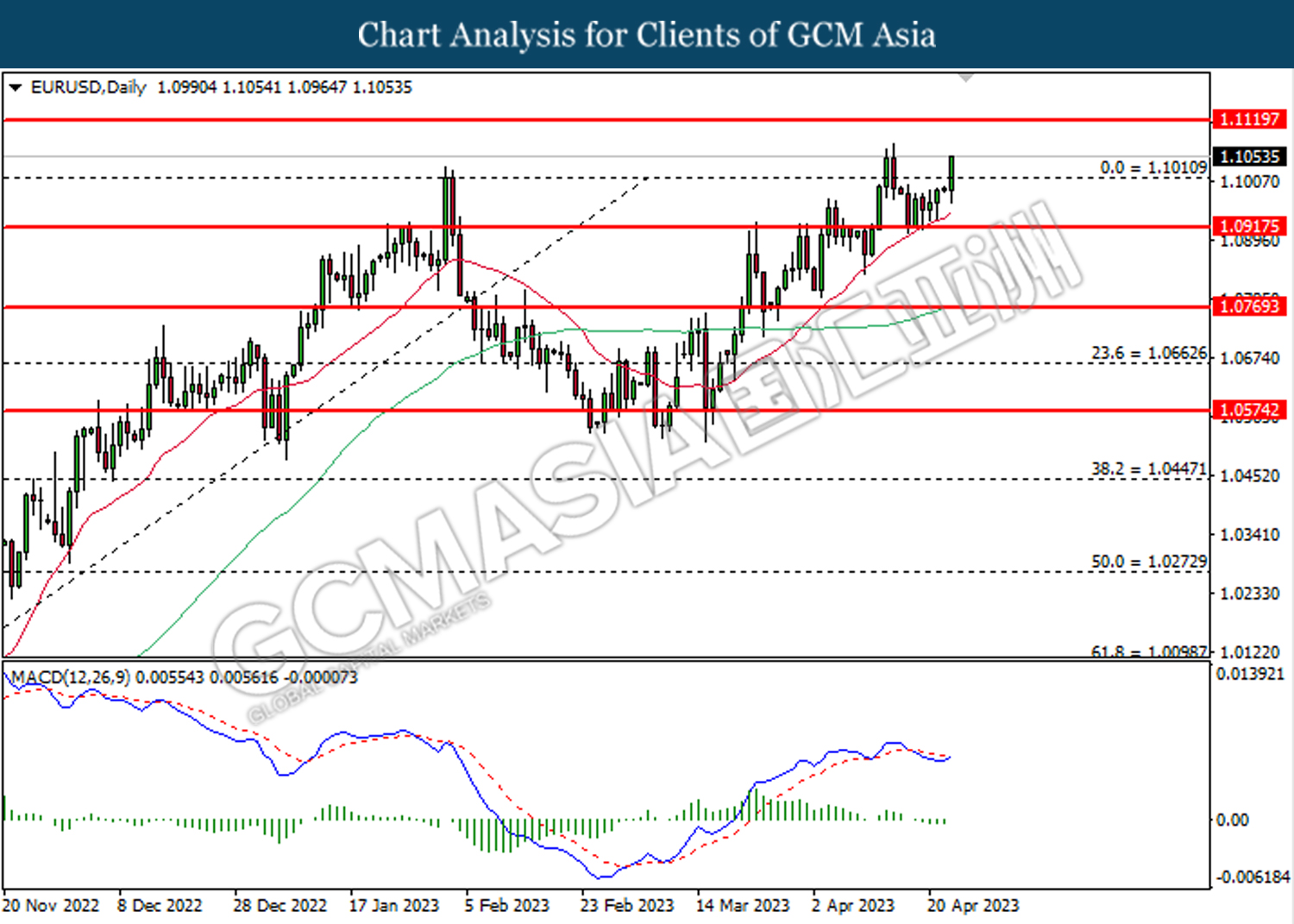

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1010. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

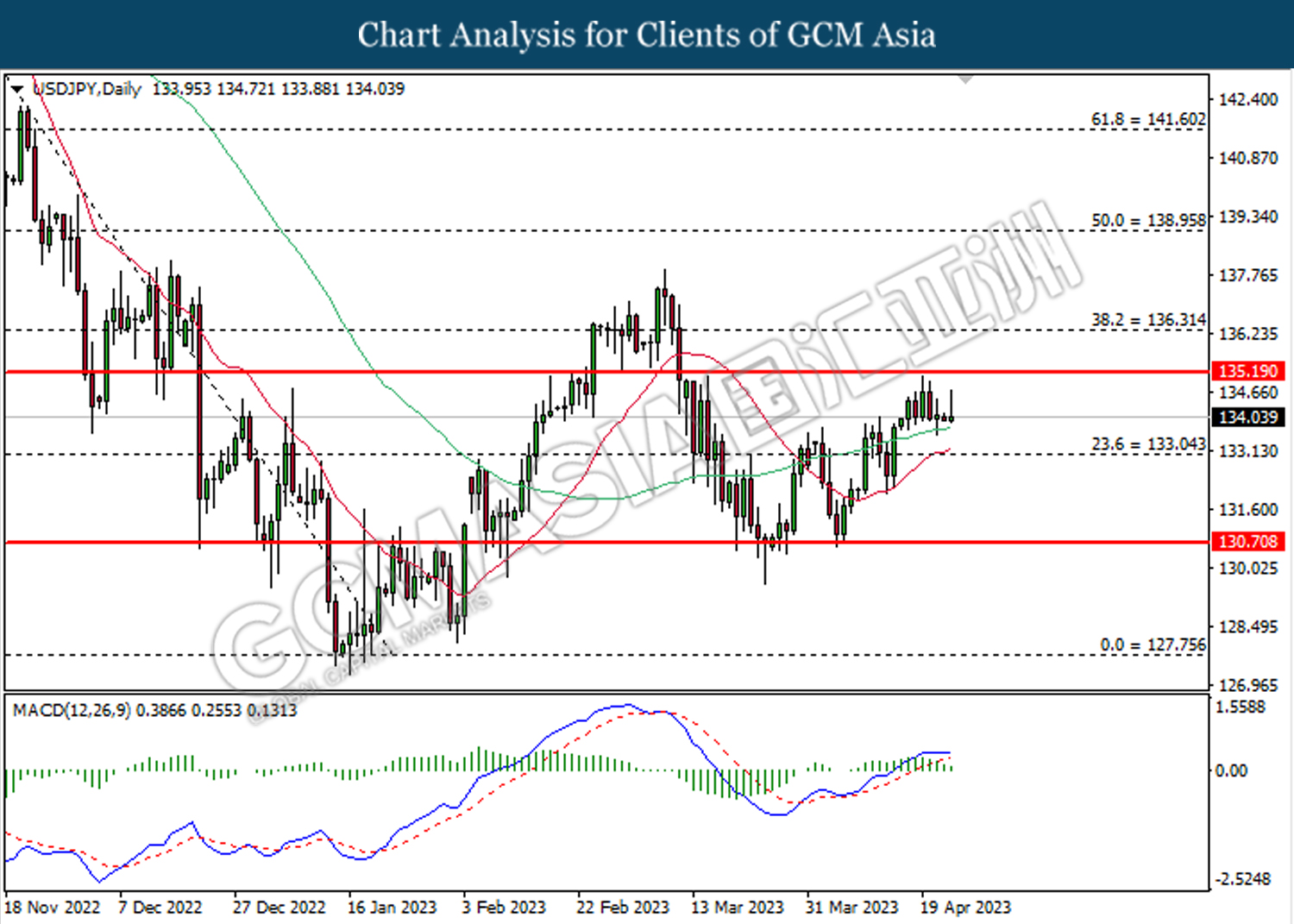

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

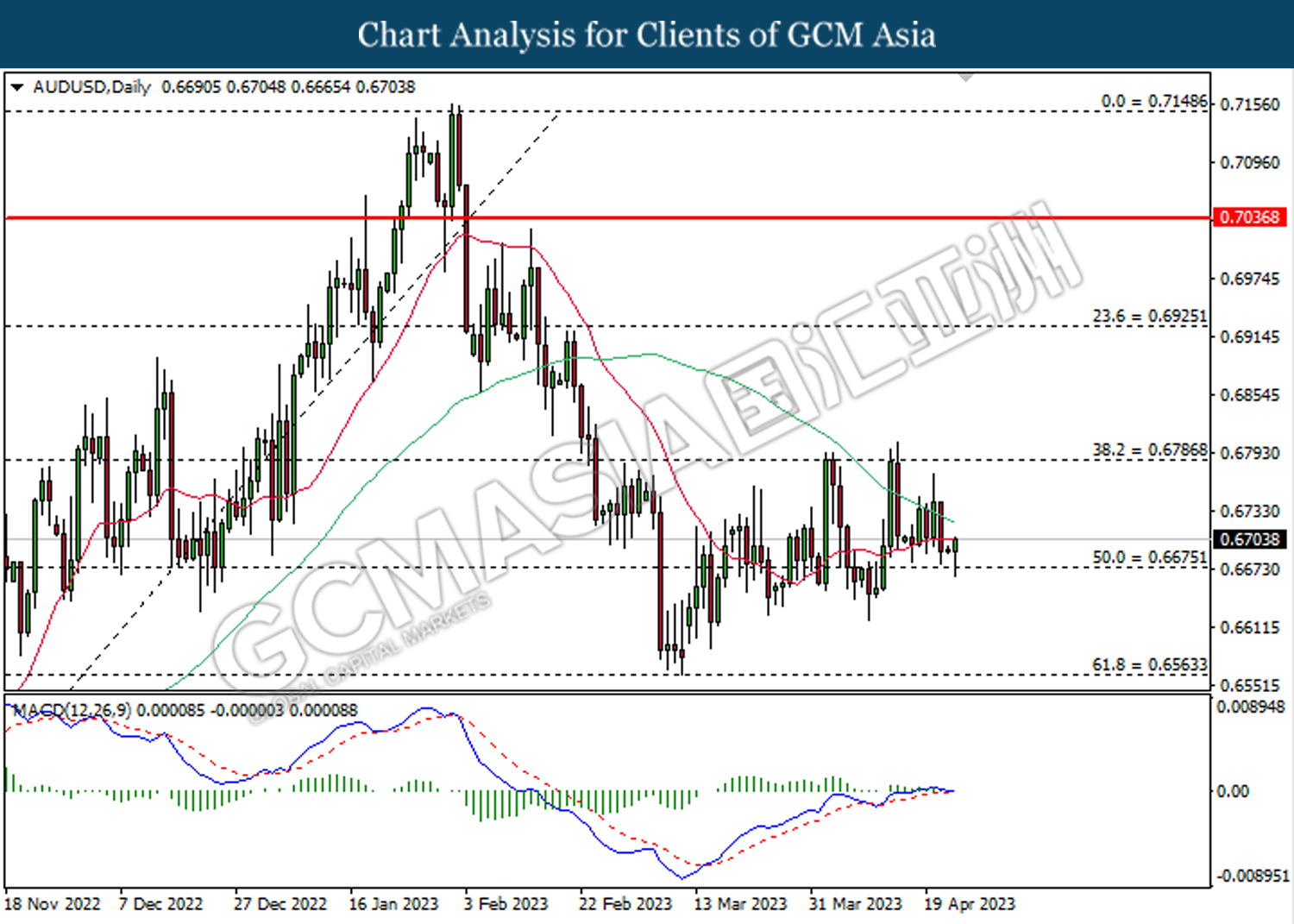

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

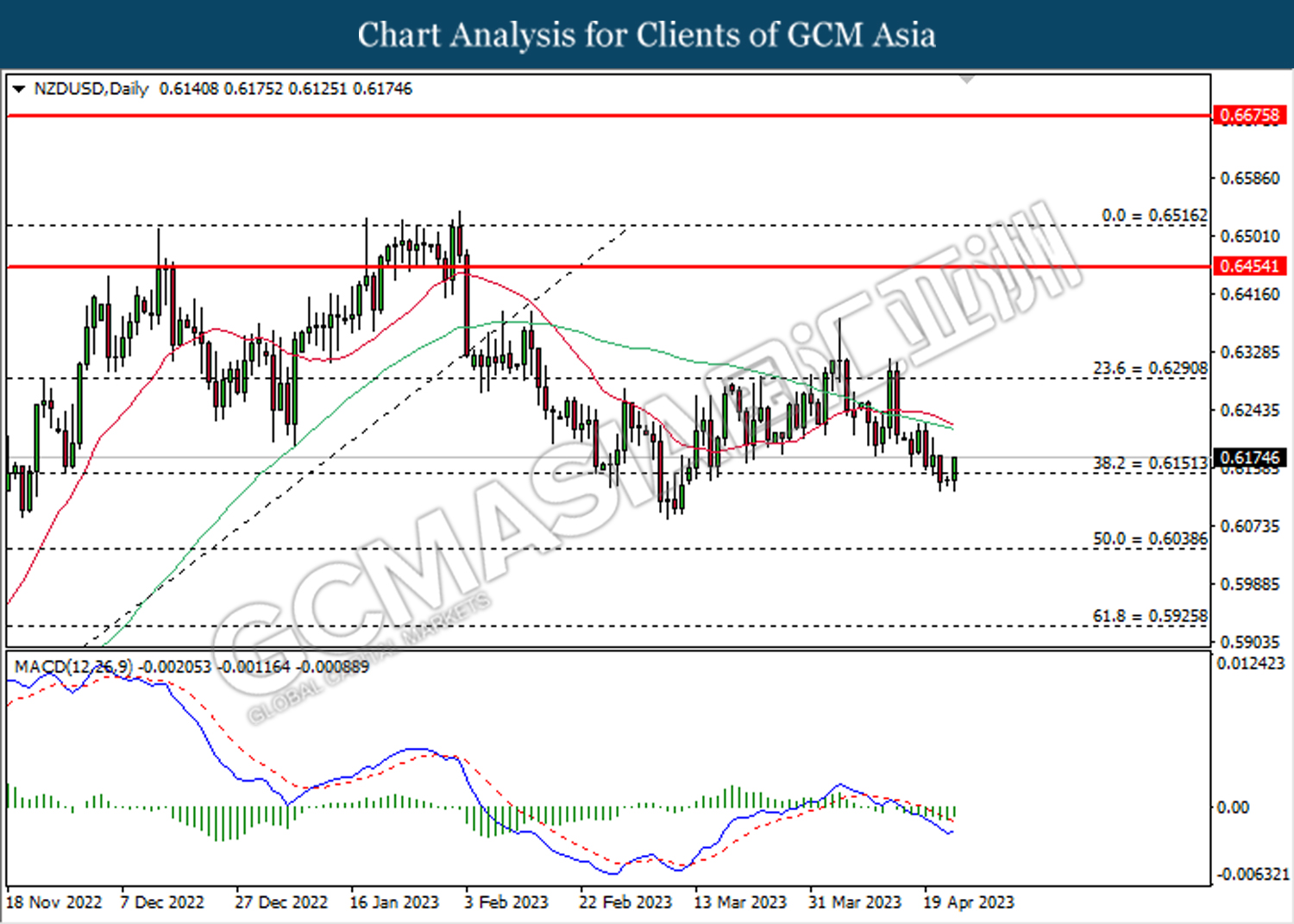

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

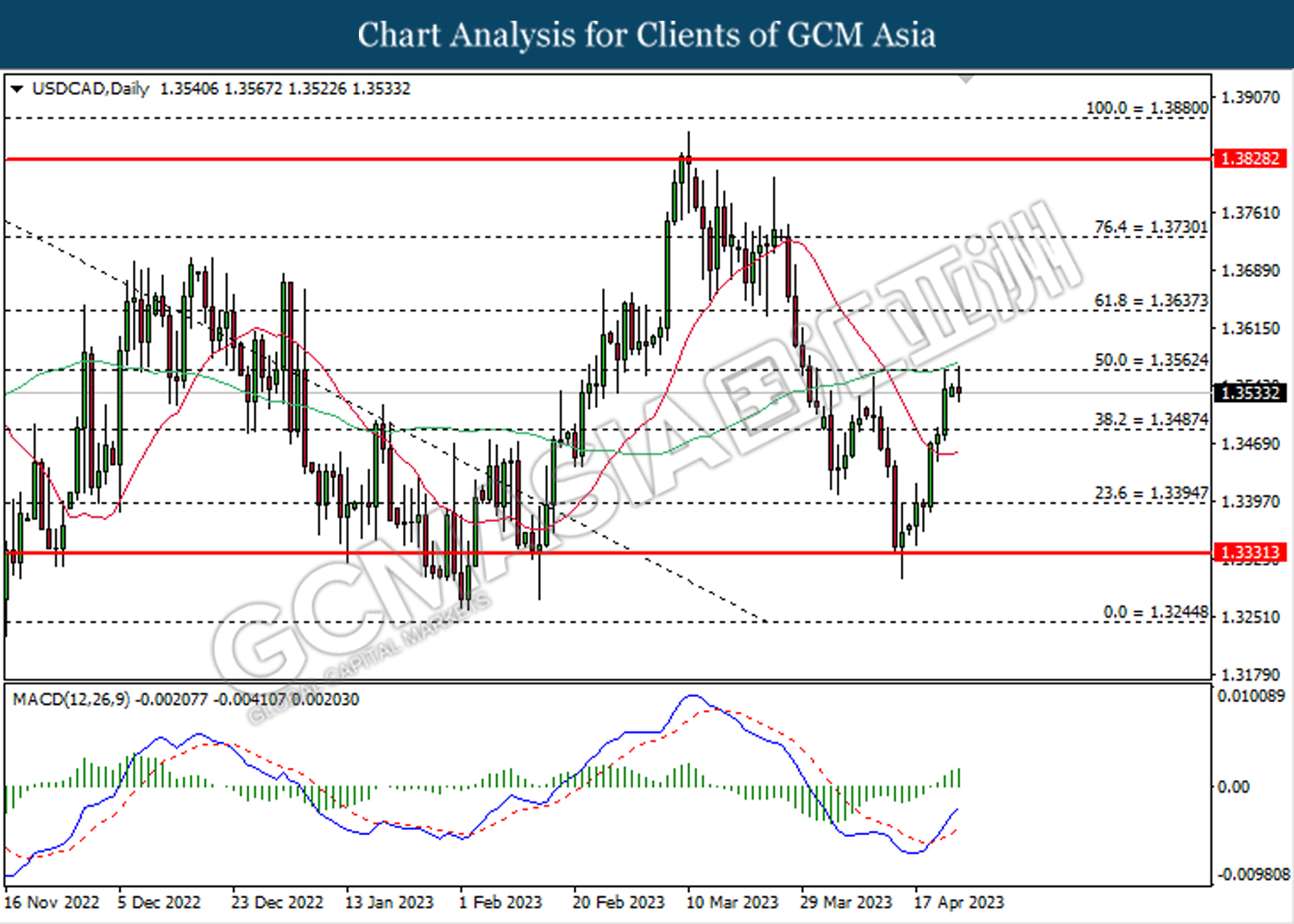

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3565. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

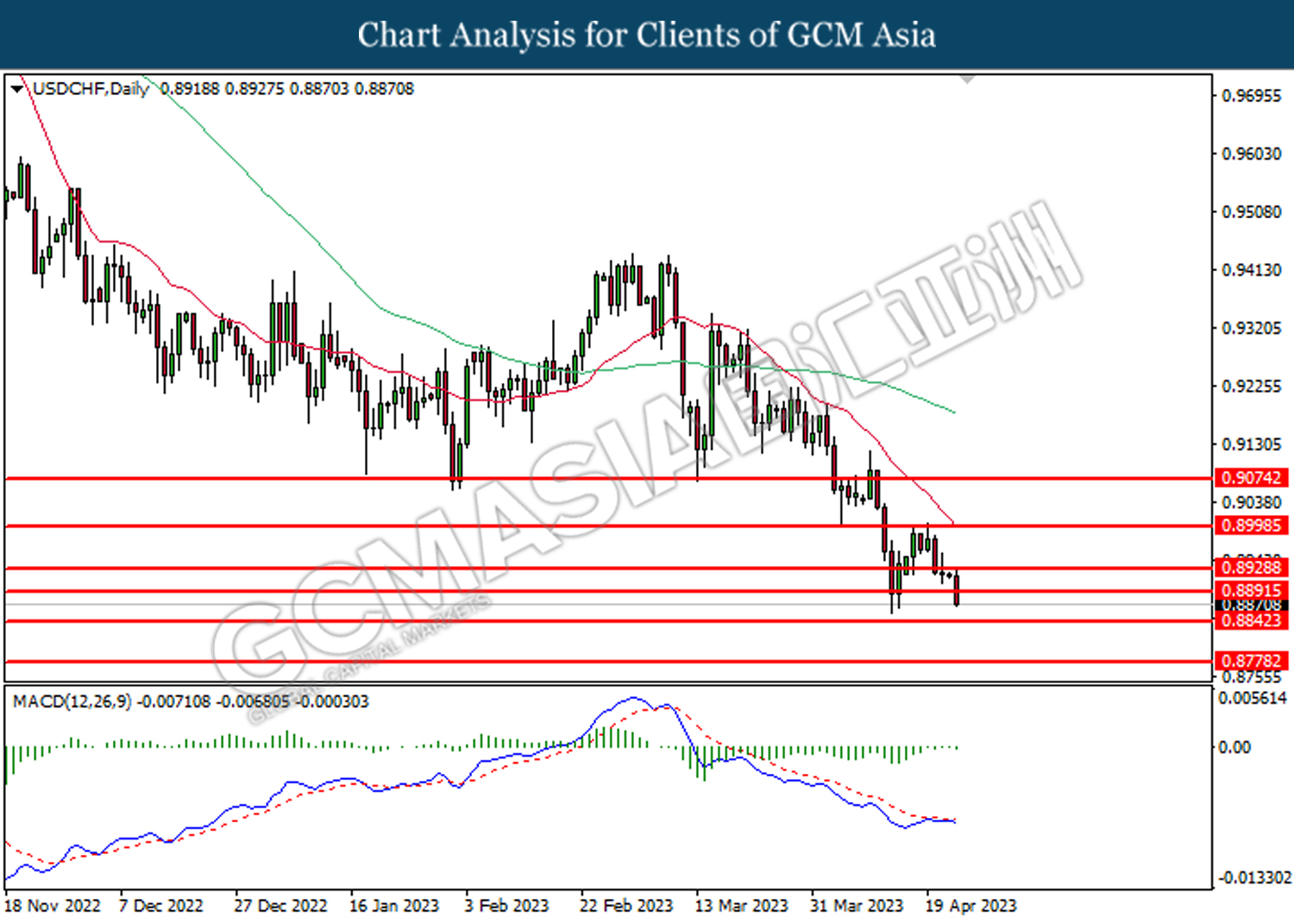

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8890. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.8890.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

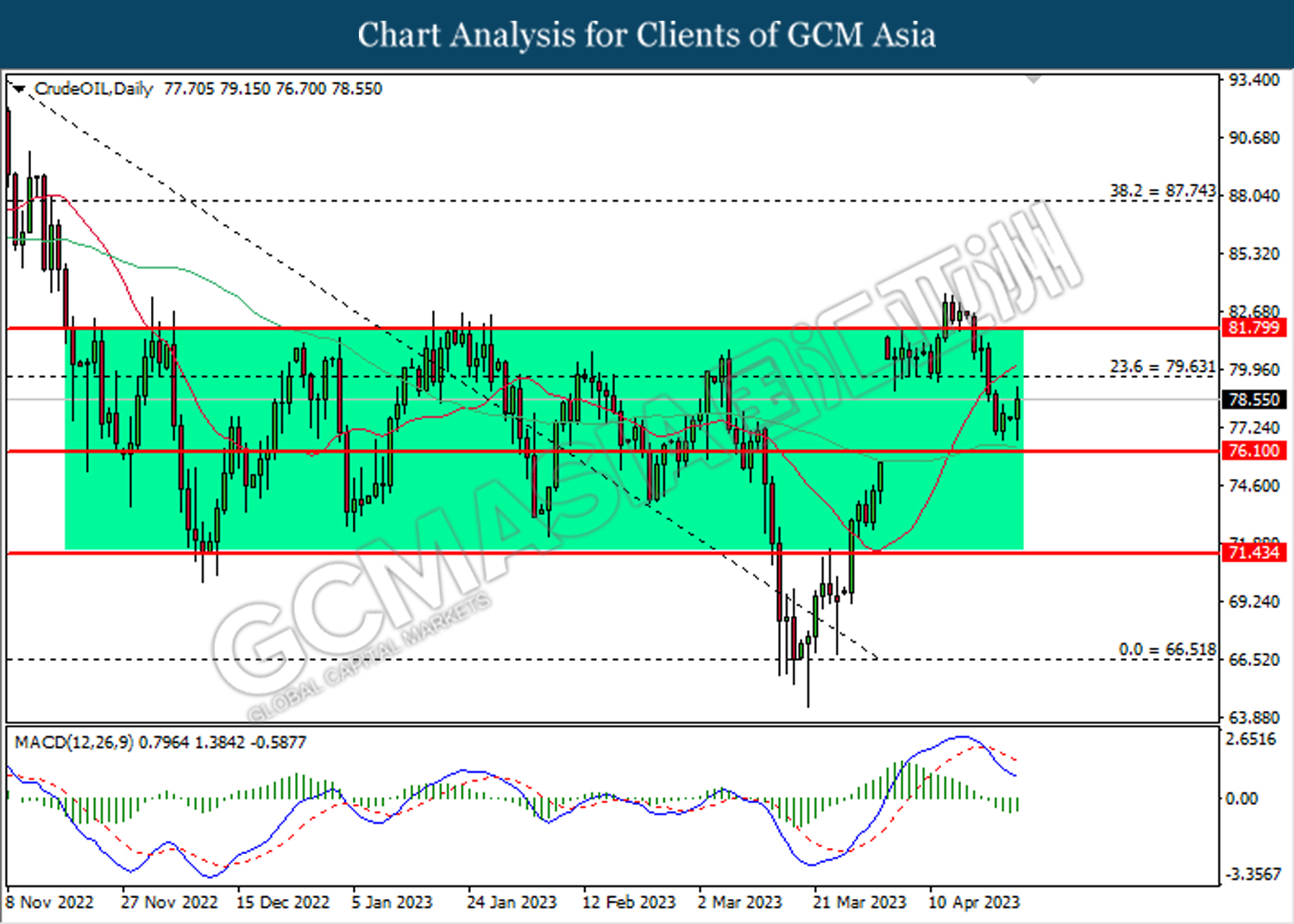

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 79.65.

Resistance level: 79.65, 81.80

Support level: 76.10, 71.45

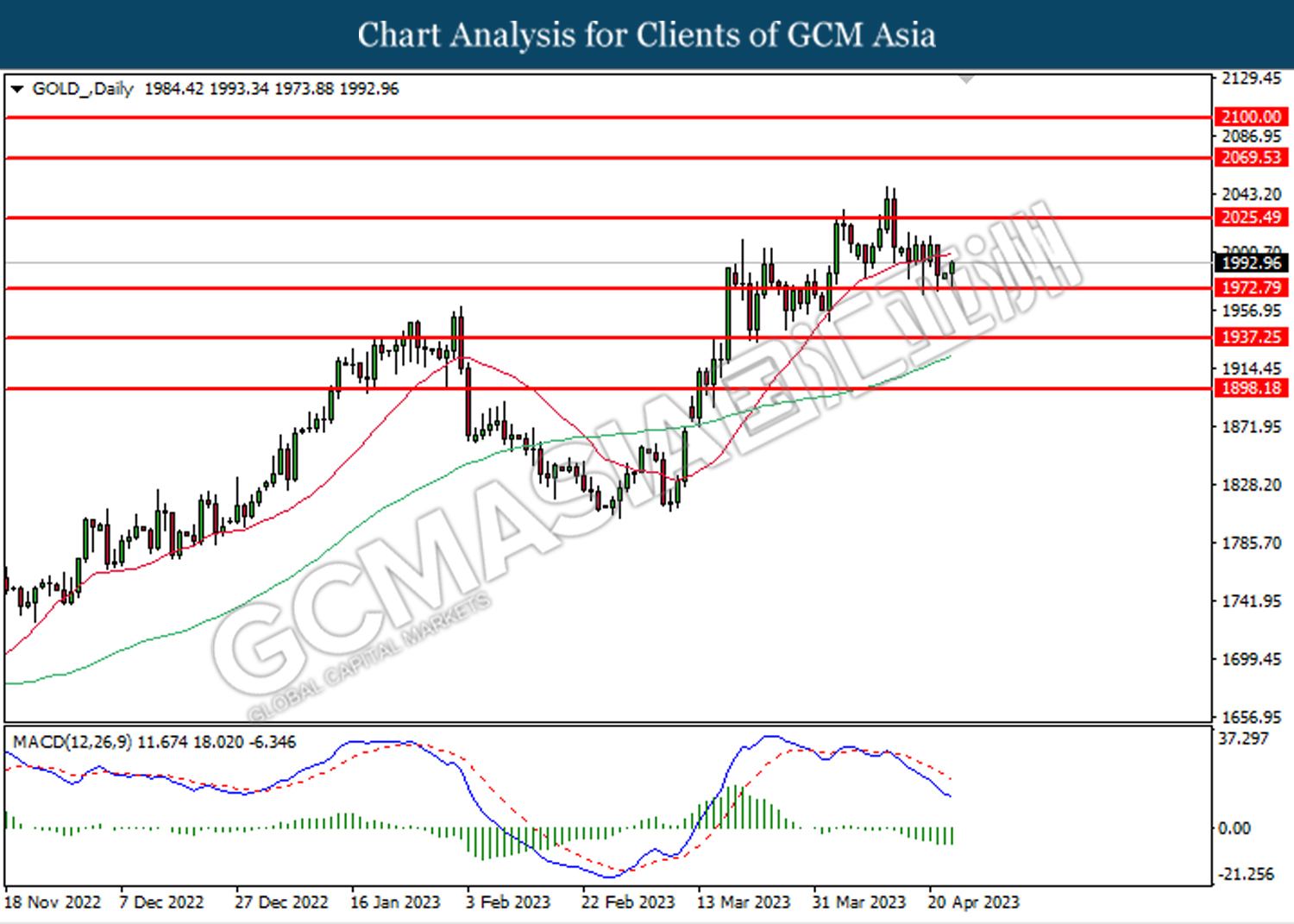

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25