25 May 2018 Daily Analysis

Dollar slumps over negative economic data and renewed geopolitical tensions.

Dollar index was traded lower against its major peers by 0.23% to 93.80 as of writing following the release of bearish economic data in the region and President Trump’s cancellation of planned summit with North Korea. Overnight, Greenback took a hit after the Commerce Department reported reduction in existing home sales by 2.5% in April, much higher than the expected reading for a fall of 0.2%. In addition, initial jobless claims recorded gains of 11,000 to a seasonally adjusted 234,000 last week versus the expected reading for a drop to only 220,000. Moreover, Greenback suffered massive selling after the White House stated it would be “inappropriate” to discuss possible denuclearization with North Korea leader Kim Jong Un which was previously scheduled to be held on June 12 in Singapore following open hostility displayed in the recent statement of the latter party. On the contrary, GBP/USD rose 0.25% to $1.3369 after retail sales reflected an actual gains of 1.6% versus the forecast reading of 0.8% in April.

In the commodities market, crude oil price fell 1.57% to $70.71 per barrel as the oil market was continuously being haunted by fears over OPEC and its allies to scale back production cut as a measure to counter possible oil shortage in global market. Otherwise, gold price rose 1.18% to $1302.51 a troy ounce following the summit between U.S. and North Korea was being called off by the White House, thus triggering renewed geopolitical tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD Fed Chair Powell Speaks

23:45 USD FOMC Member Bostic Speaks

23:45 USD FOMC Member Kaplan Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 07:30 | JPY – Tokyo Core CPI (YoY) (Mar) | 0.6% | 0.6% | 0.5% |

| 16:00 | EUR – German Ifo Business Climate Index (May) | 102.1 | 101.9 | – |

| 16:30 | GBP – GDP (QoQ) (Q1) | 0.1% | 0.1% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Apr) | -0.1% | 0.5% | – |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 98.8 | 98.8 | – |

| 01:00 | CrudeOIL – US Baker Hughes Oil Rig Count | 844 | – | – |

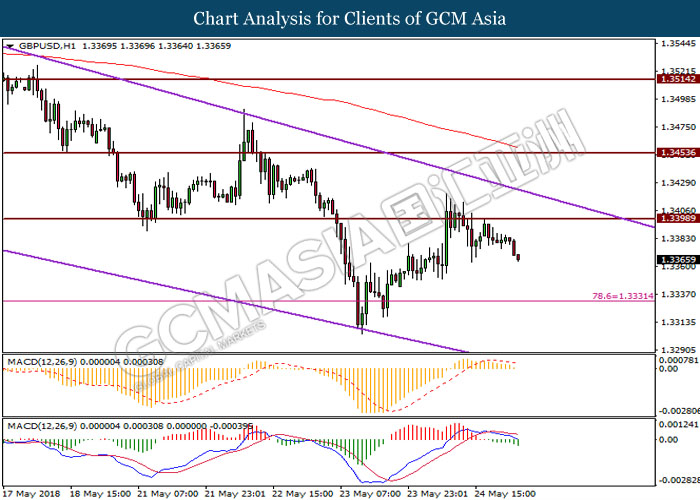

GBPUSD

GBPUSD, H1: GBPUSD was traded lower prior retracement from resistance level at 1.3400. Death-cross as displayed by MACD signal line would suggest the pair to extend its losses towards the support level at 1.3330.

Resistance level: 1.3400, 1.3450

Support level: 1.3330, 1.3270

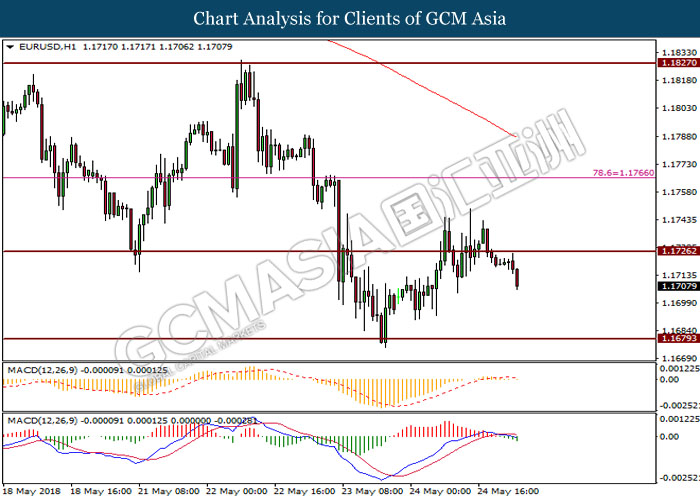

EURUSD

EURUSD, H1: EURUSD was traded lower prior breaking support level at 1.1720. Death-cross as displayed by MACD signal line would suggest the pair to extend its losses towards the next support level at 1.1680.

Resistance level: 1.1720, 1.1770

Support level: 1.1680, 1.1610

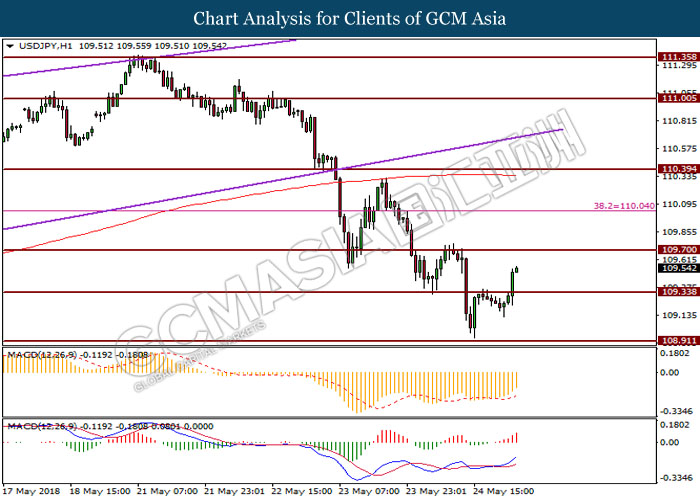

USDJPY

USDJPY, H1: USDJPY was traded higher prior breaking resistance level at 109.30. Positive divergence as displayed by MACD signal line would suggest the pair to extend its gains towards the next resistance level at 109.70.

Resistance level: 109.70, 110.00

Support level: 109.30, 108.90

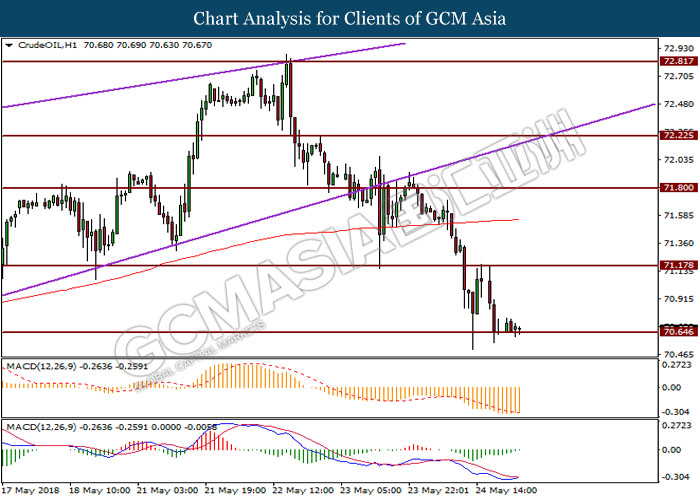

CrudeOIL

CrudeOIL, H1: Crude oil price was traded lower after breaking support level at 71.20. However, golden-cross as shown by MACD signal line would suggest the commodity price to undergo short-term technical correction to trade higher before continuing its bearish bias.

Resistance level: 71.20, 71.80

Support level: 70.60, 69.80

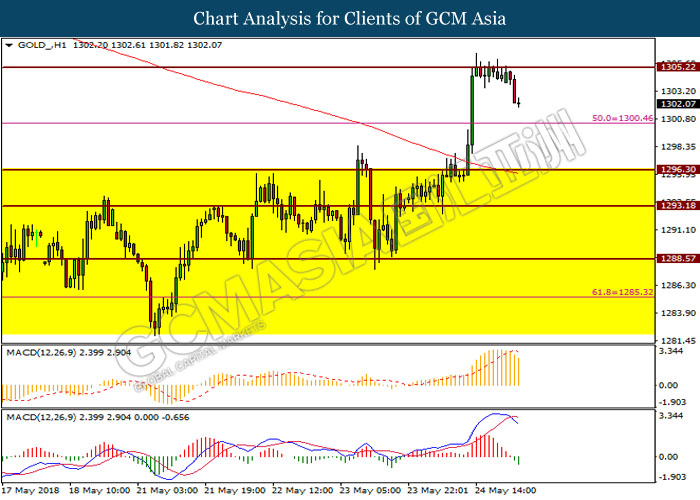

GOLD

GOLD_, H1: Gold price was traded lower prior retracement from resistance level at 1305.20. Formation of death cross by MACD signal line would suggest the safe-haven asset price to extend its losses towards the support level at 1300.50.

Resistance level: 1305.20, 1310.40

Support level: 1300.50, 1296.30