25 May 2022 Afternoon Session Analysis

US Dollar slumped amid economic recession concern.

The Dollar Index which traded against a basket of six major currencies extended its losses since yesterday over the backdrop of economic recession concern from the market. Despite the rate hike implementation that would likely combat inflation risk, the borrowing cost in the US region might increase significantly if Fed implies aggressive tightening monetary policy. The consumer spending would reduce as borrowing cost increased, which brought negative prospects toward economic progression in the US. Besides, the downbeat economic data had spurred further bearish momentum on the US Dollar. According to Census Bureau, US New Home Sales notched down from the previous reading of 709K to 591K, missing the market forecast of 750K. The lower than expected data indicated that the recession in the US housing market, dragged down the appeal of the US Dollar. As of writing, the Dollar Index edged up by 0.11% to 101.98.

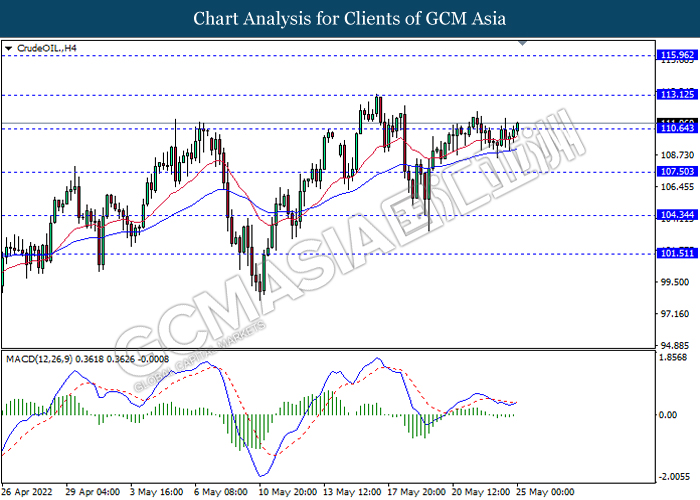

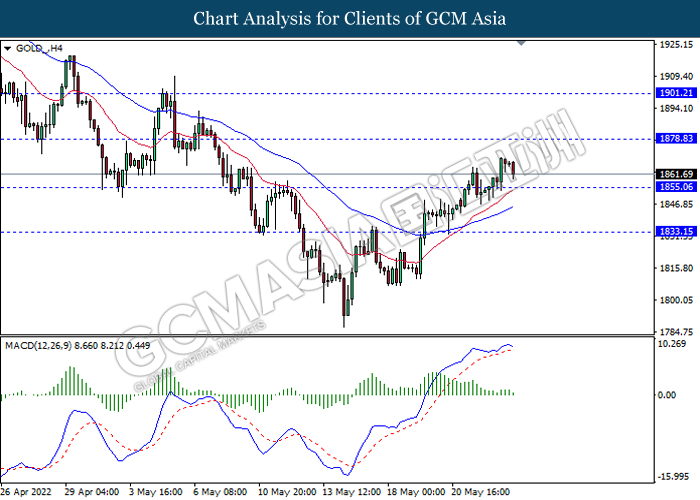

In the commodities market, crude oil price appreciated by 1.10% to $110.97 per barrel as of writing, boosted by tight supplies and the prospect of rising demand from the upcoming start of the US summer driving season. On the other hand, gold price depreciated by 0.36% to $1858.69 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | 0.2% | 0.2% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Apr) | 1.2% | 0.6% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | 1.383M | – |

Technical Analysis

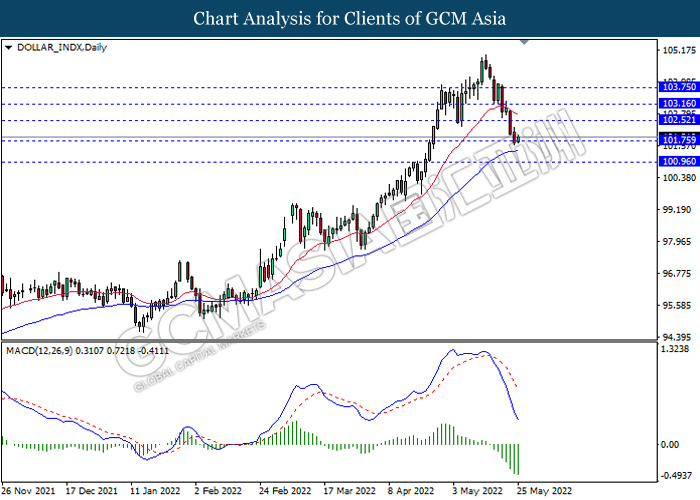

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

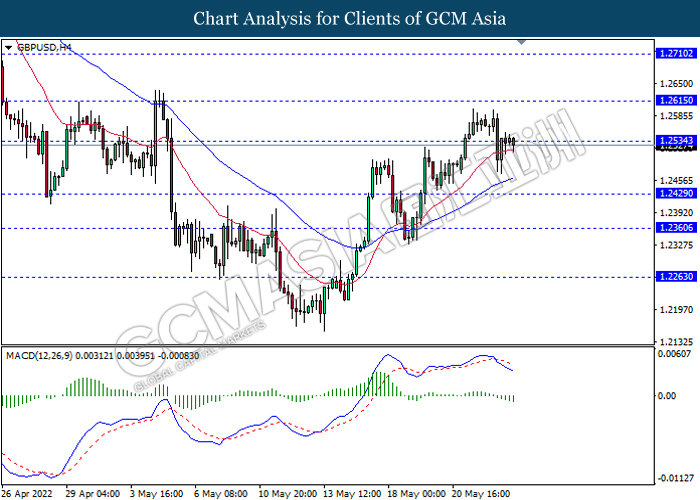

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

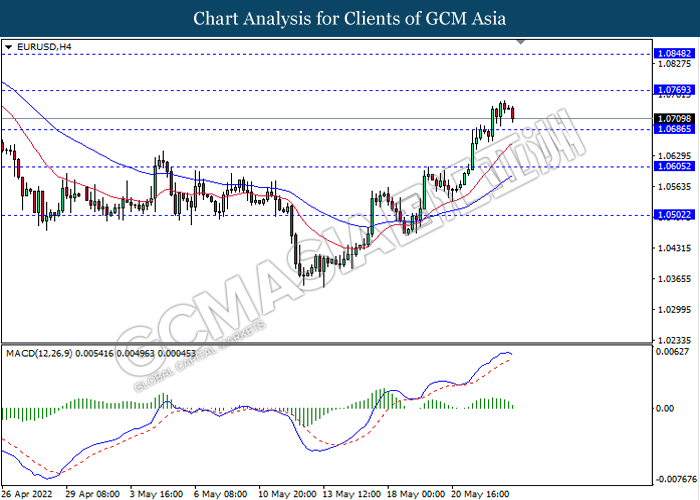

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

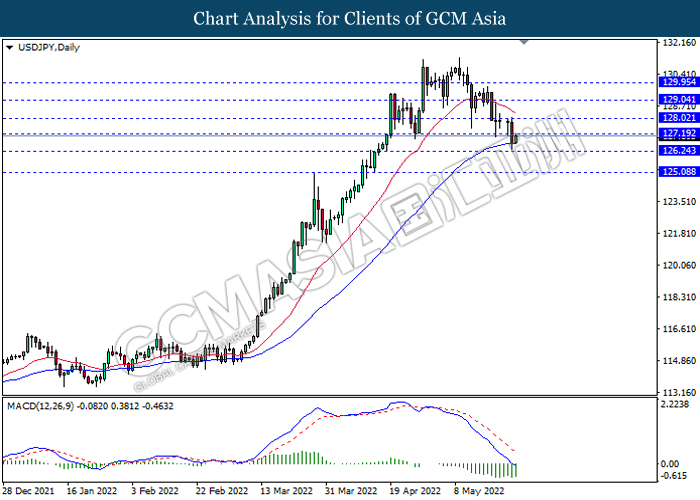

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 127.20, 128.00

Support level: 126.25, 125.10

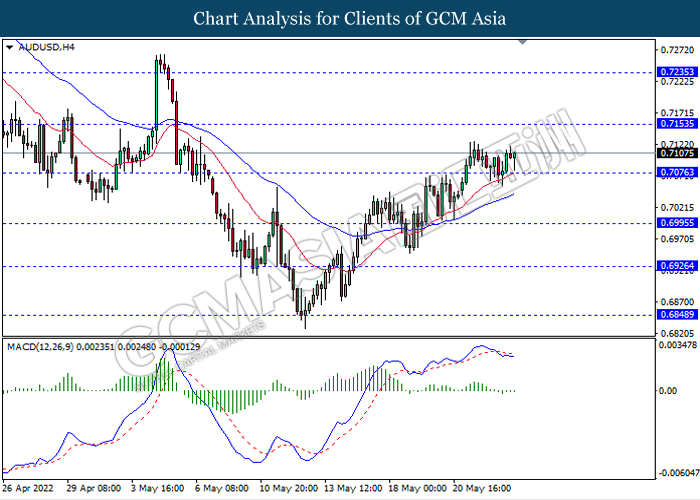

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

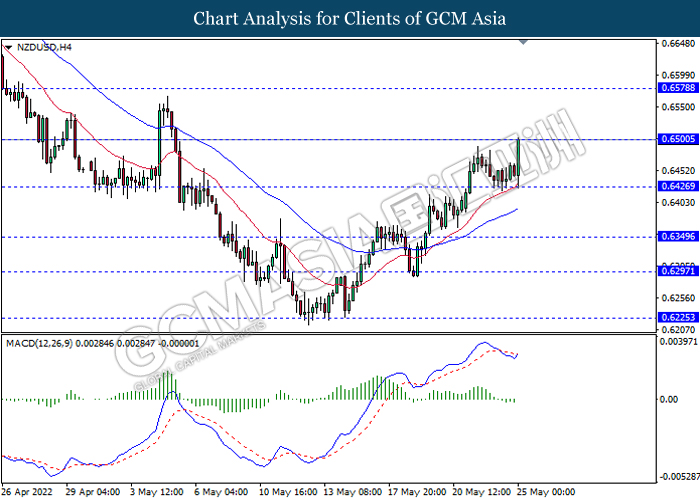

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

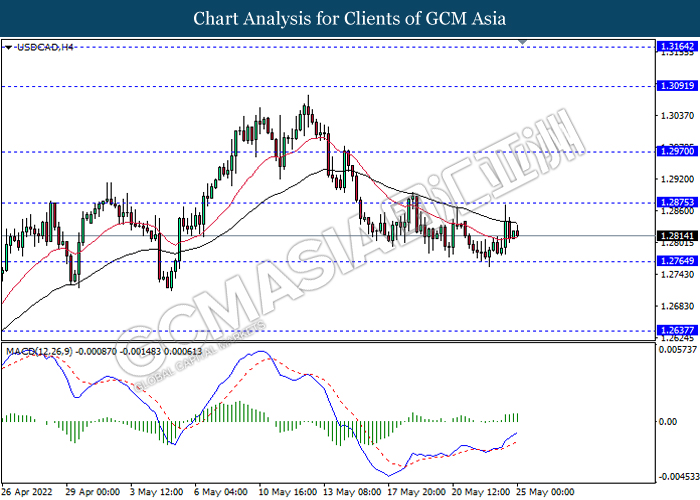

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

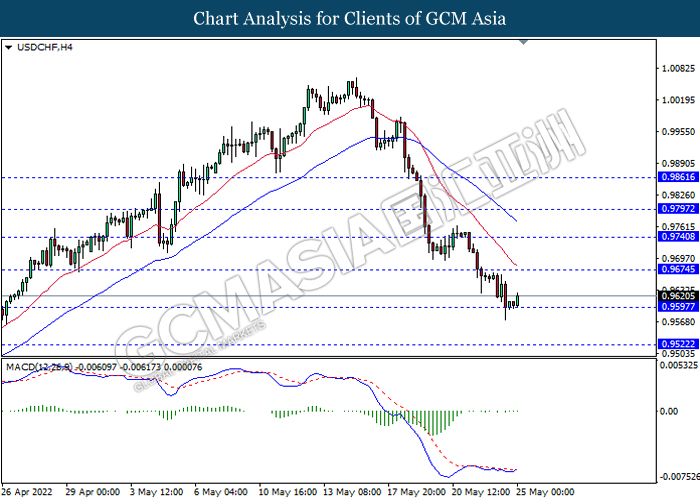

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1878.85, 1901.20

Support level: 1855.05, 1833.15