25 May 2022 Morning Session Analysis

Pound slumped amid growing recession fears.

The Pound Sterling slumped following the economic data indicated that the UK private sector growth unexpectedly slumped in May, insinuating further fears upon recession while dragging down the appeal for Pound Sterling. On the economic data front, the Markit Economics reported that the UK Composite Purchasing Managers’ Index (PMI) and UK Manufacturing Purchasing Managers Index (PMI) came in at 51.8 and 54.6, both fared worse than market expectation at 56.5 and 54.9 respectively. Besides, the UK Services Purchasing Managers Index (PMI) notched down significantly from the previous reading at 58.9 to 51.8, missing the market forecast at 56.9, according to the Chartered Institute of Purchasing & Supply and the NTC economics. As most of the crucial manufacturing data slowed much more than expectation, which spurring further recession worries while diminishing the probability for the Bank of England to increase interest rate. As of writing, GBP/USD depreciated by 0.02% to 1.2540.

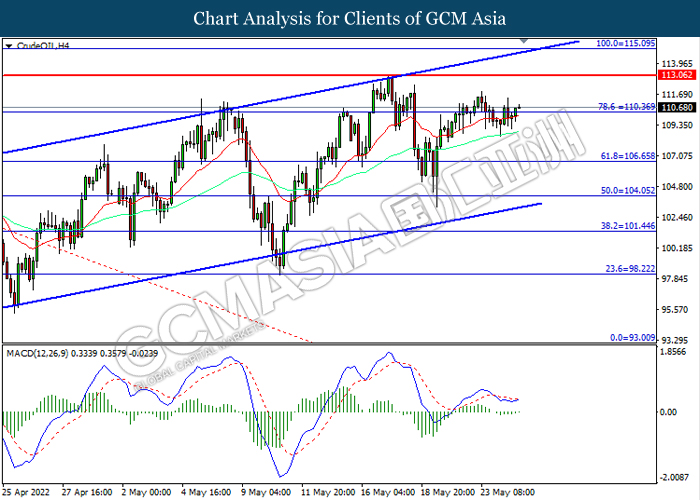

In the commodities market, the crude oil price retreated 0.02% to $110.60 per barrel as of writing over the backdrop of bearish inventory data. According to American Petroleum Institute (API), the US Crude inventories increased by 567,000 barrels for last week, missing the market forecast at dropping 690,000 barrels. On the other hand, the gold price surged by 0.01% to $1866.85 per troy ounces as of writing amid the rising recession fears continue to drive up the market demand on the safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | 0.2% | 0.2% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Apr) | 1.2% | 0.6% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | 1.383M | – |

Technical Analysis

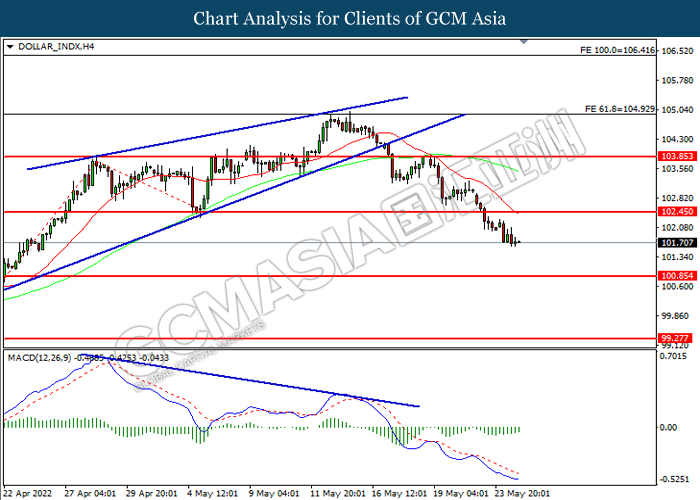

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2615, 1.2745

Support level: 1.2500, 1.2335

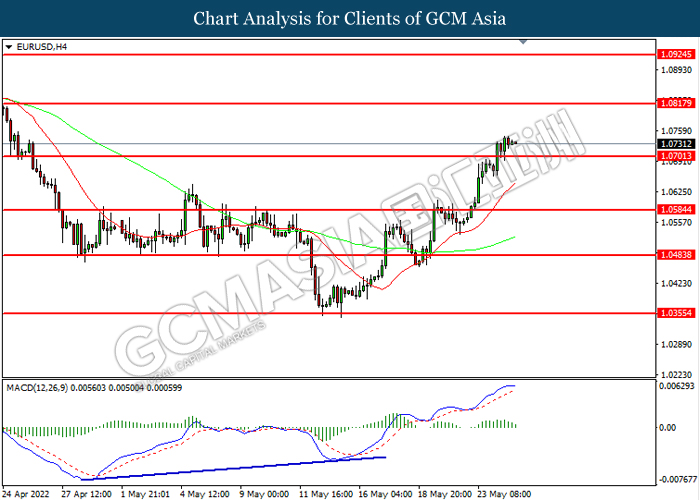

EURUSD, H4: EURUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0815, 1.0925

Support level: 1.0700, 1.0585

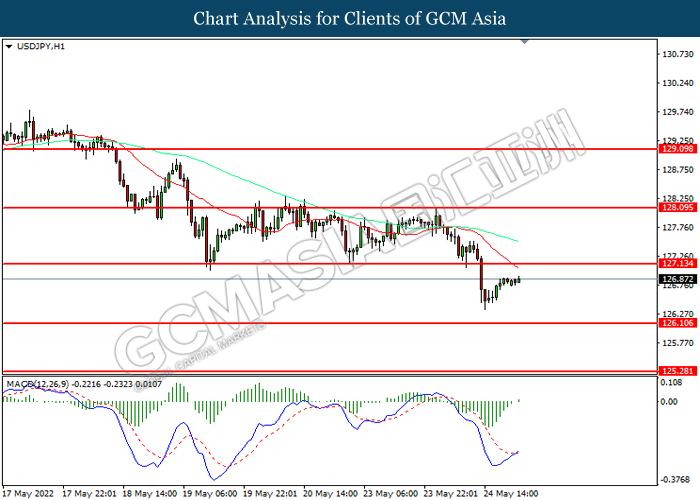

USDJPY, H1: USDJPY was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 127.15, 128.10

Support level: 126.10, 125.30

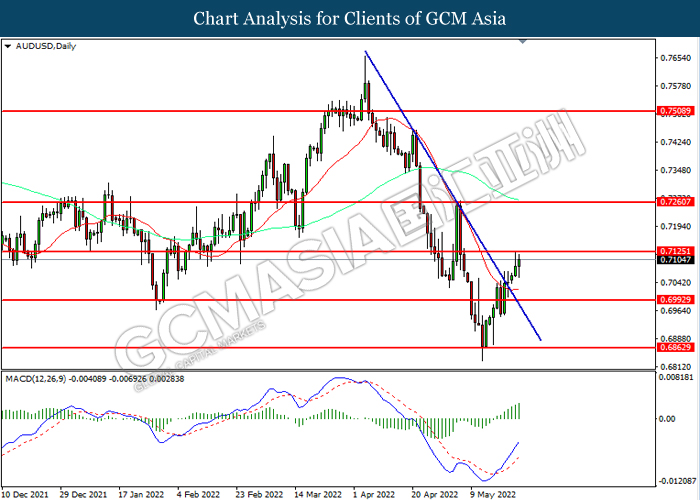

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7125, 0.7260

Support level: 0.6995, 0.6865

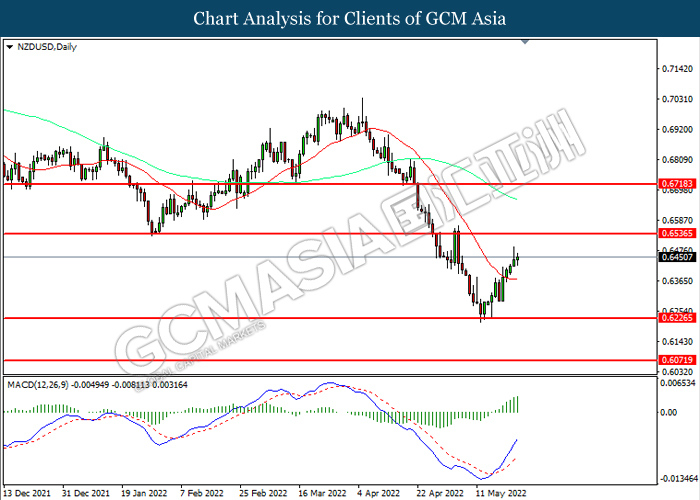

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

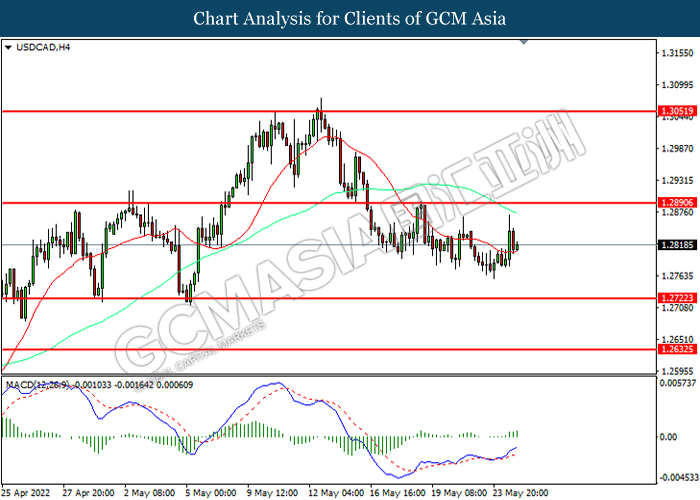

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

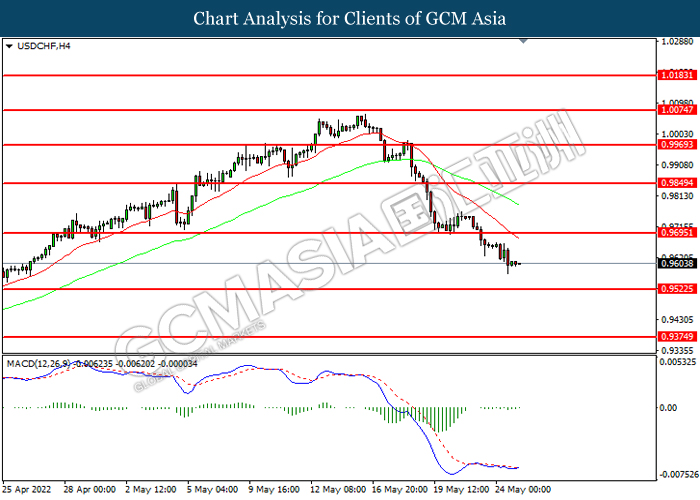

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 113.05, 115.10

Support level: 110.35, 106.65

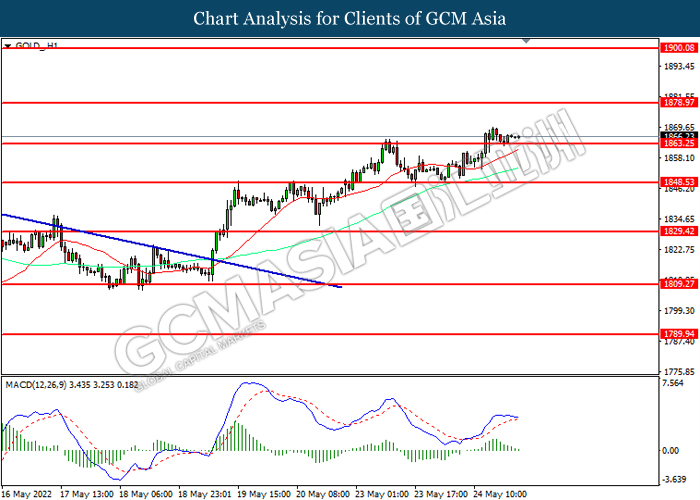

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1878.95, 1900.10

Support level: 1863.25, 1848.55