25 May 2023 Morning Session Analysis

US Dollar surged as the possibility of further rate hikes increased.

The dollar index, which was traded against a basket of six major currencies, extended its rally during the previous trading session as the hawkish stance of the Fed member overweighed the market worrier with regards to the debt ceiling impasses. Yesterday, Federal Reserve Board Governor Christopher Waller said that he is concerned about the lack of progress on inflation. Hence, the official cash rate may not rise at next month’s Fed meeting, but an end to the rate-raising plan is unlikely at this moment. He also highlighted that the Fed need more evidence to show that the US inflation is moving toward their long term target, which is 2%. Waller’s hawkish view on the rate hike plan triggered continuous buying momentum in the dollar market, making it to hit the highest level in almost 10 weeks. On the other hand, the debt ceiling talk between the two major parties in the US continues as default deadline looms, but the deal is not imminent as divergence still exist between both parties. As of writing, the US dollar rose 0.39% to 103.90.

In the commodities market, crude oil prices were traded down by -0.12% to $74.15 per barrel as the strengthening of US dollar diminished the appeal of this black commodity at the moment. Besides, gold prices edged up by 0.15% to $1960.30 per troy ounce as the risk of default looms.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | -0.4% | -0.1% | – |

| 20:30 | USD – GDP (QoQ) (Q1) | 2.6% | 1.1% | – |

| 20:30 | USD – Initial Jobless Claims | 242K | 250K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Apr) | -5.2% | 0.5% | – |

Technical Analysis

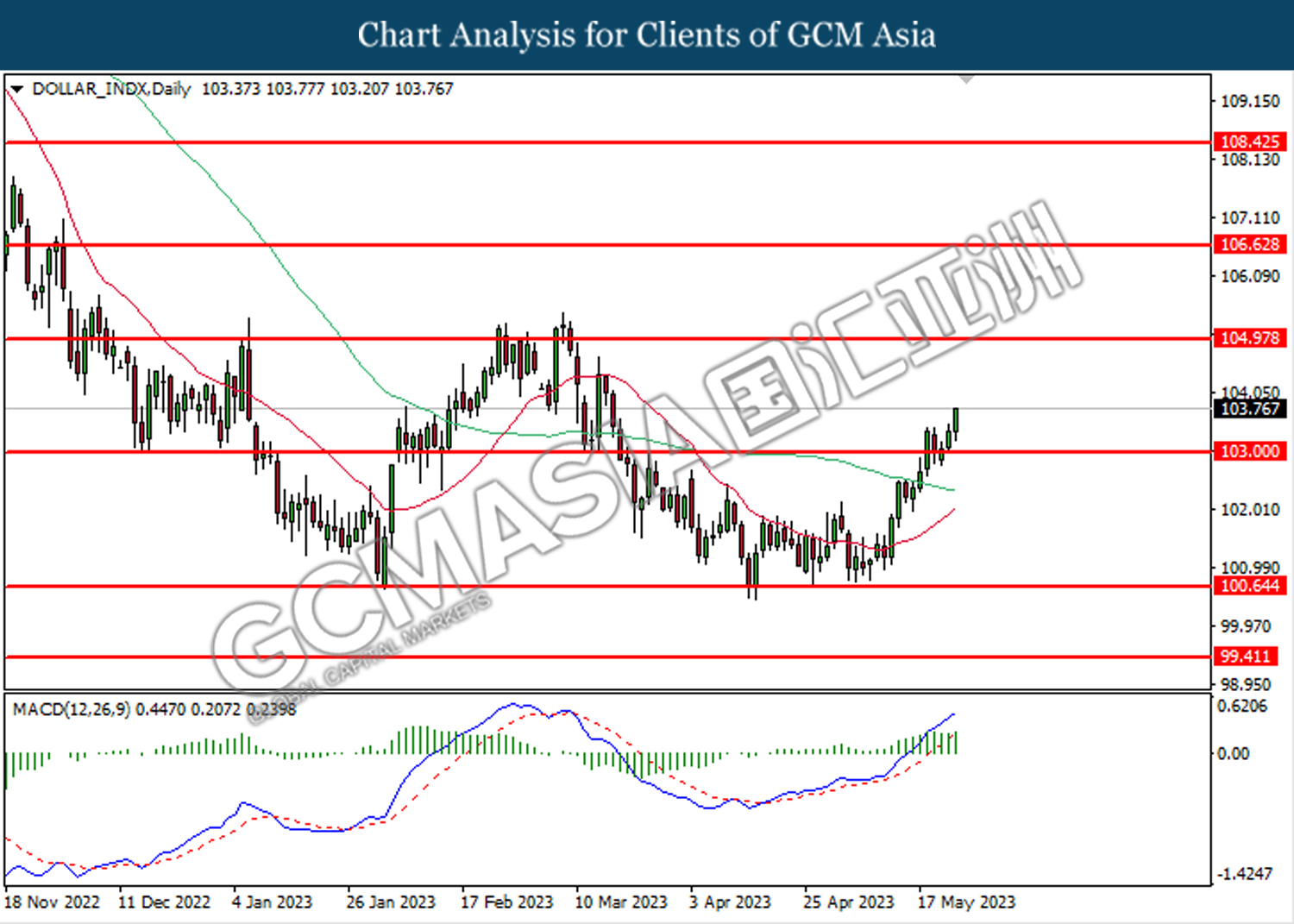

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

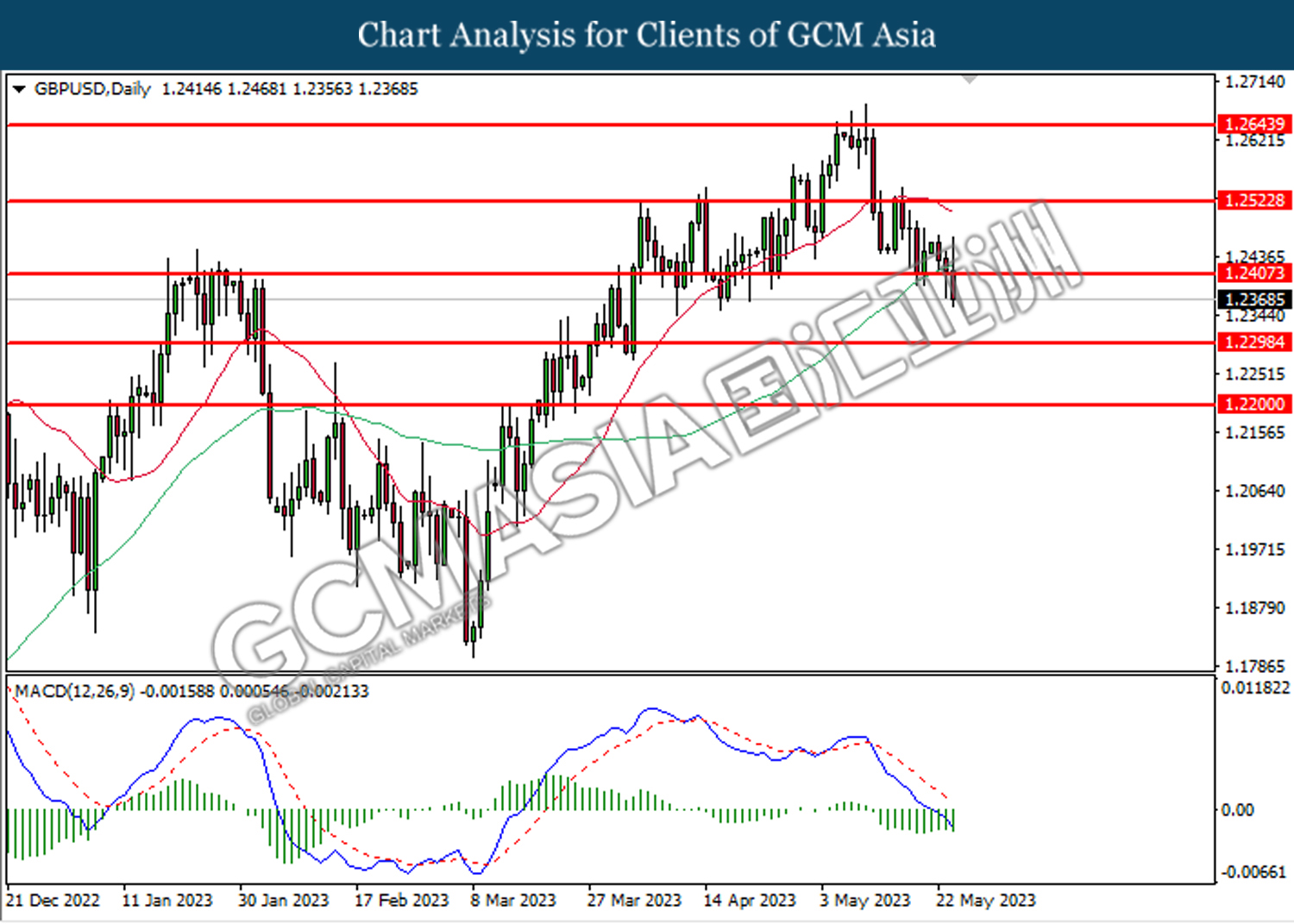

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

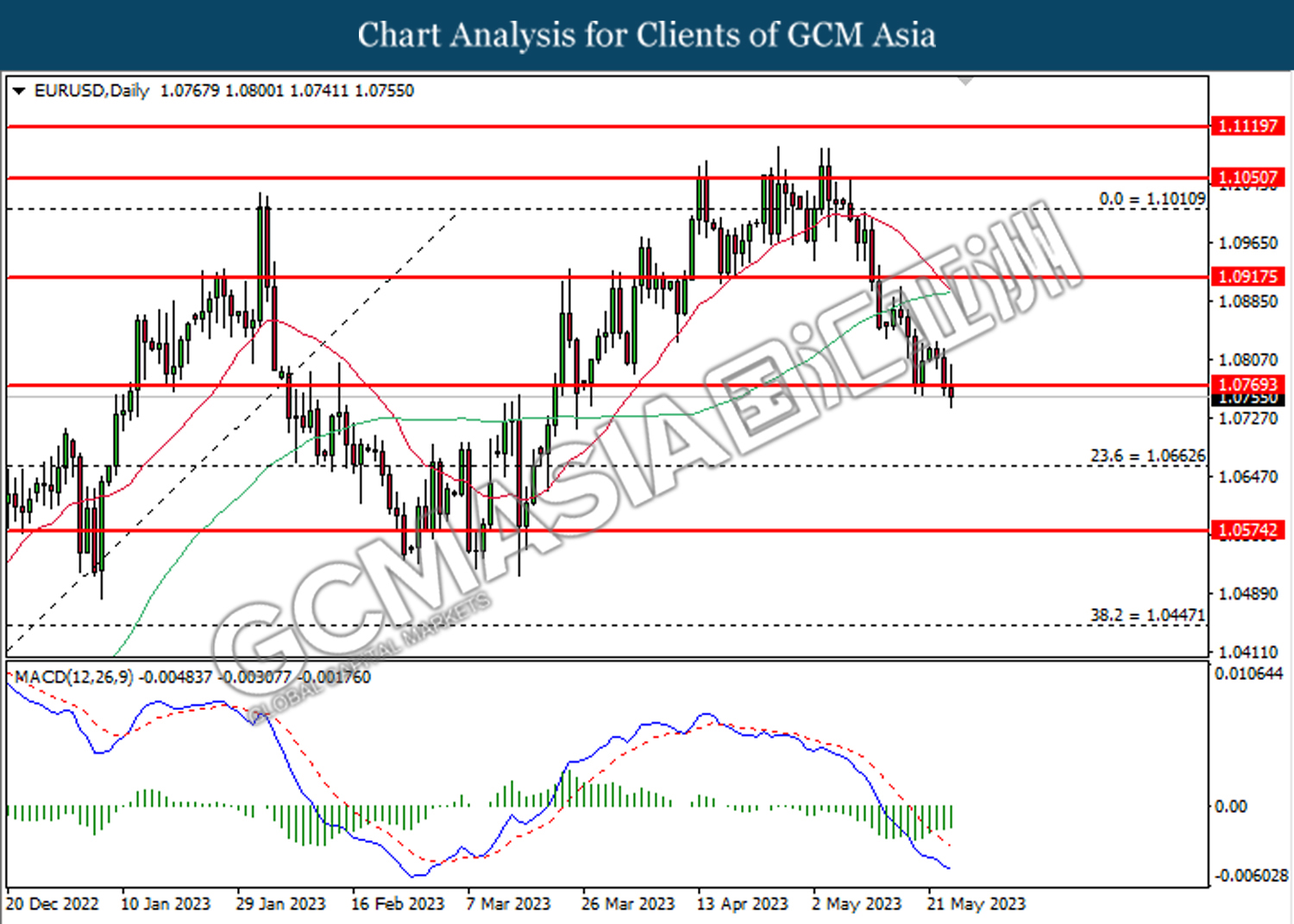

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

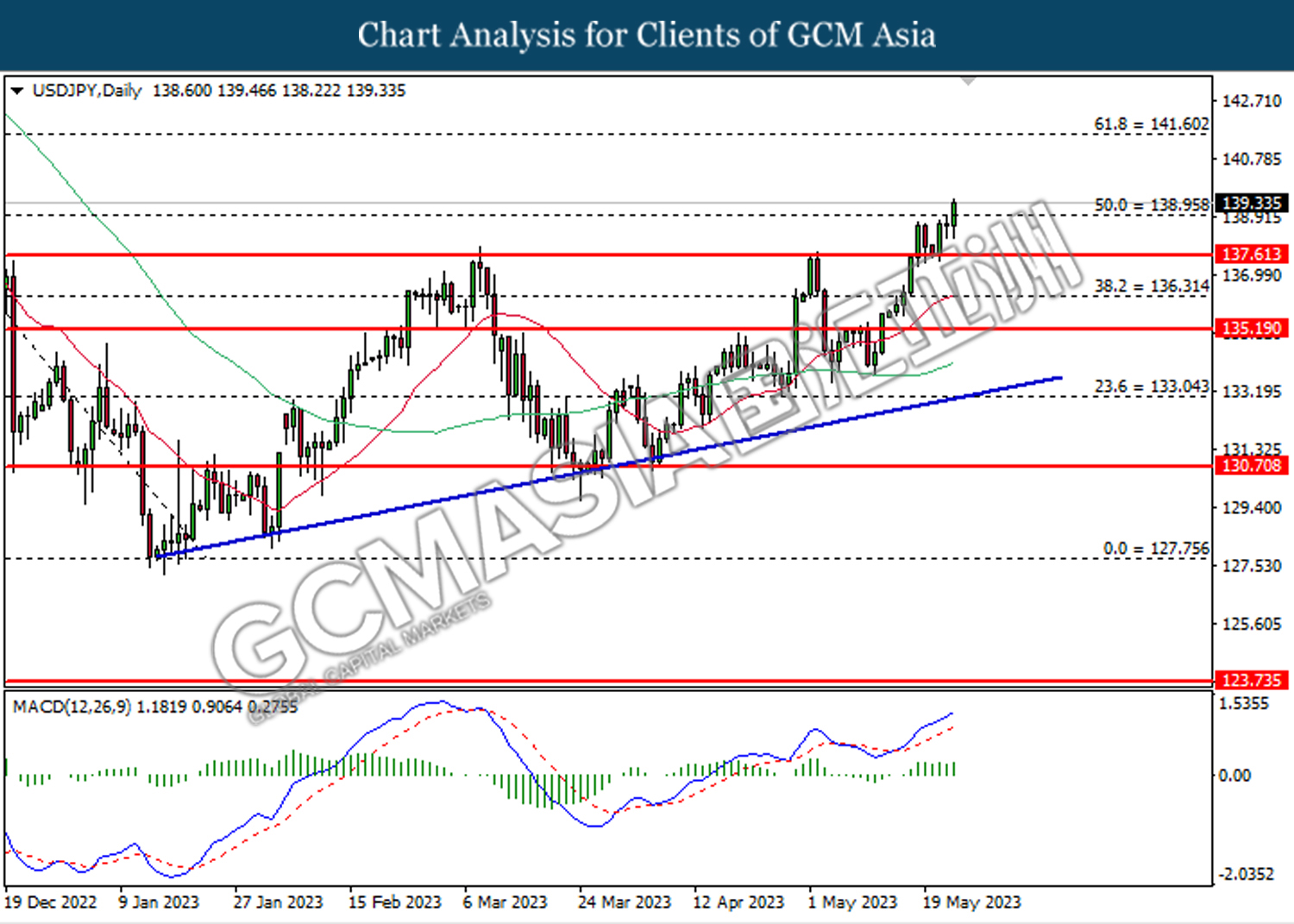

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 138.95. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 137.60, 136.30

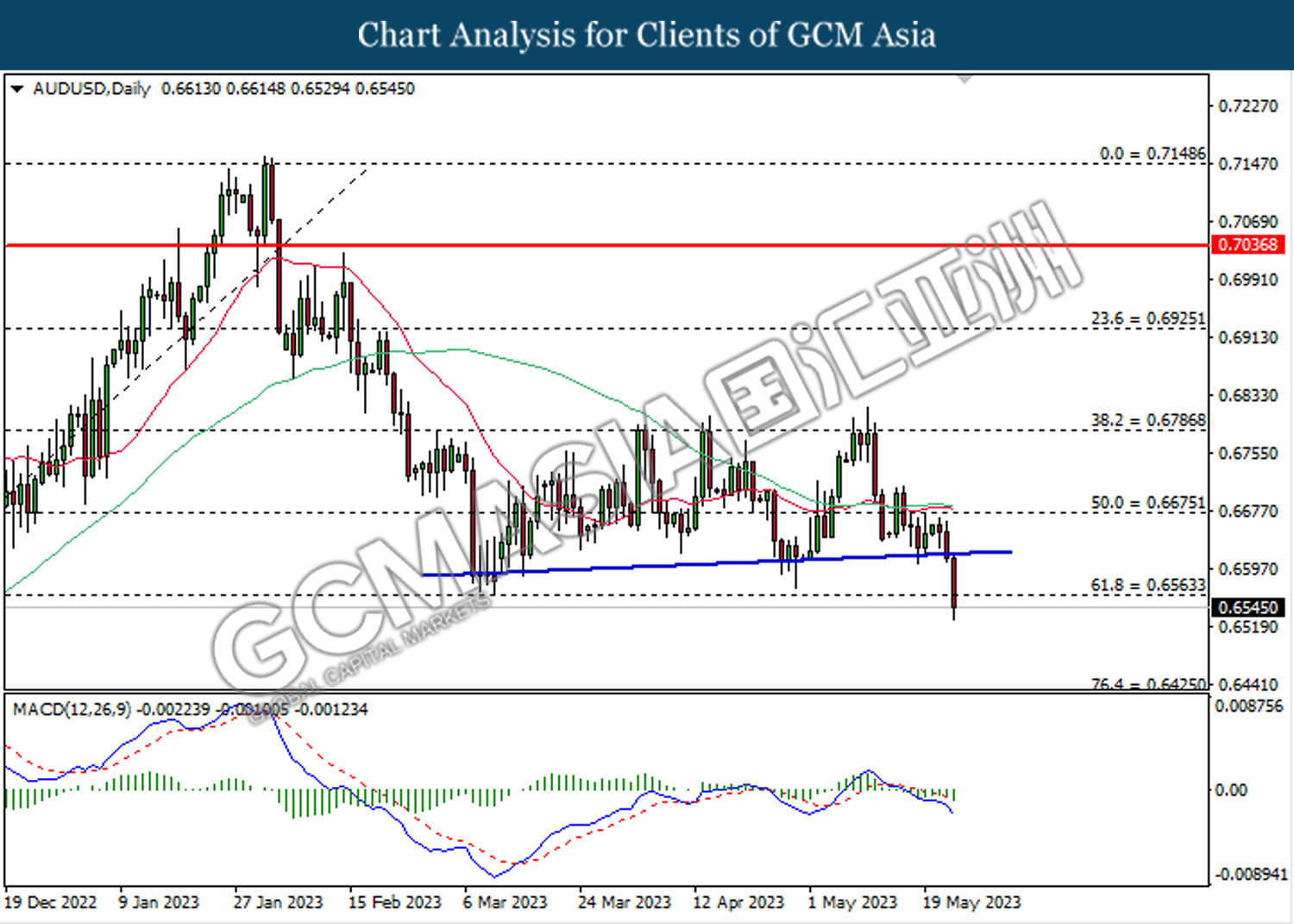

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

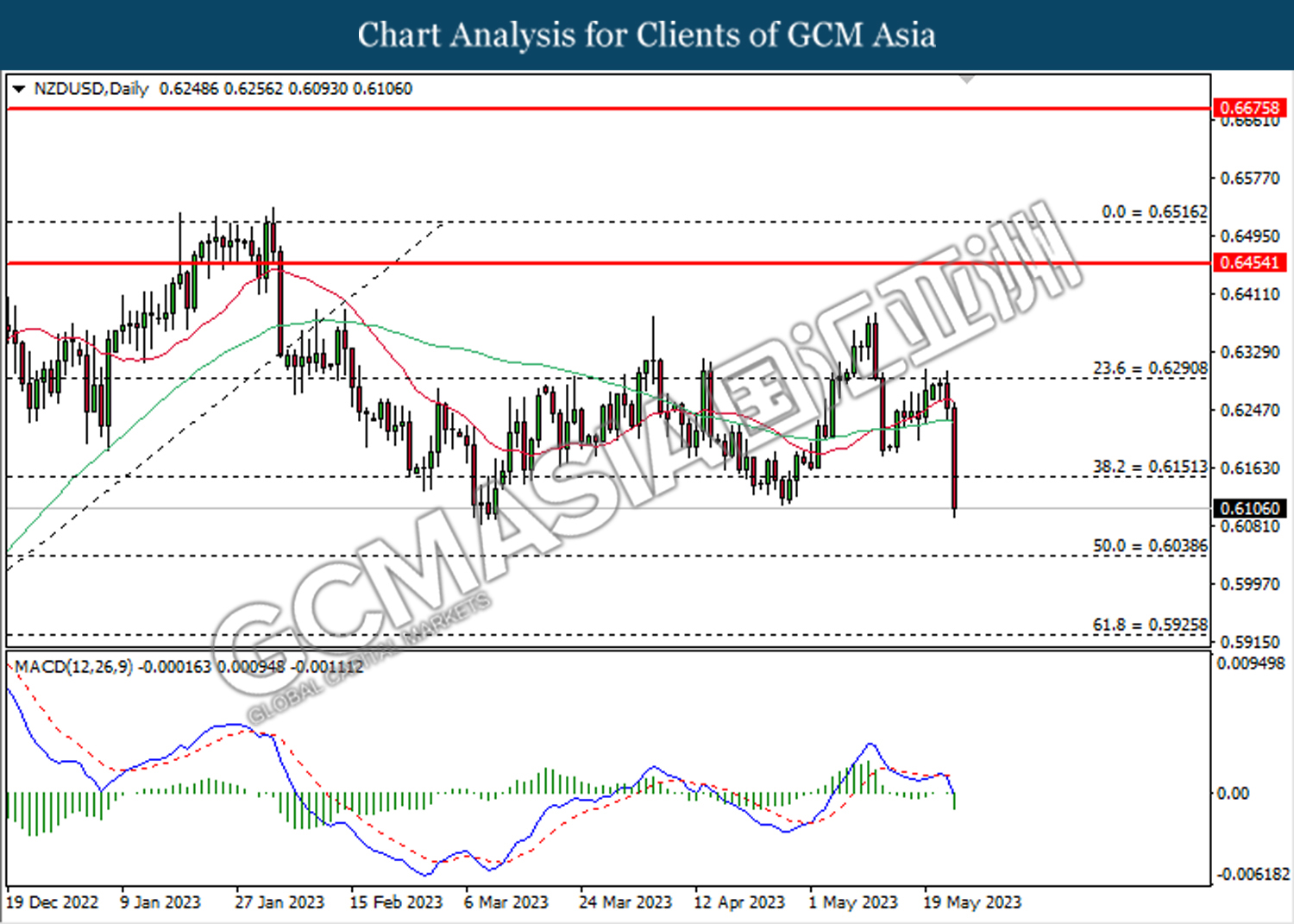

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

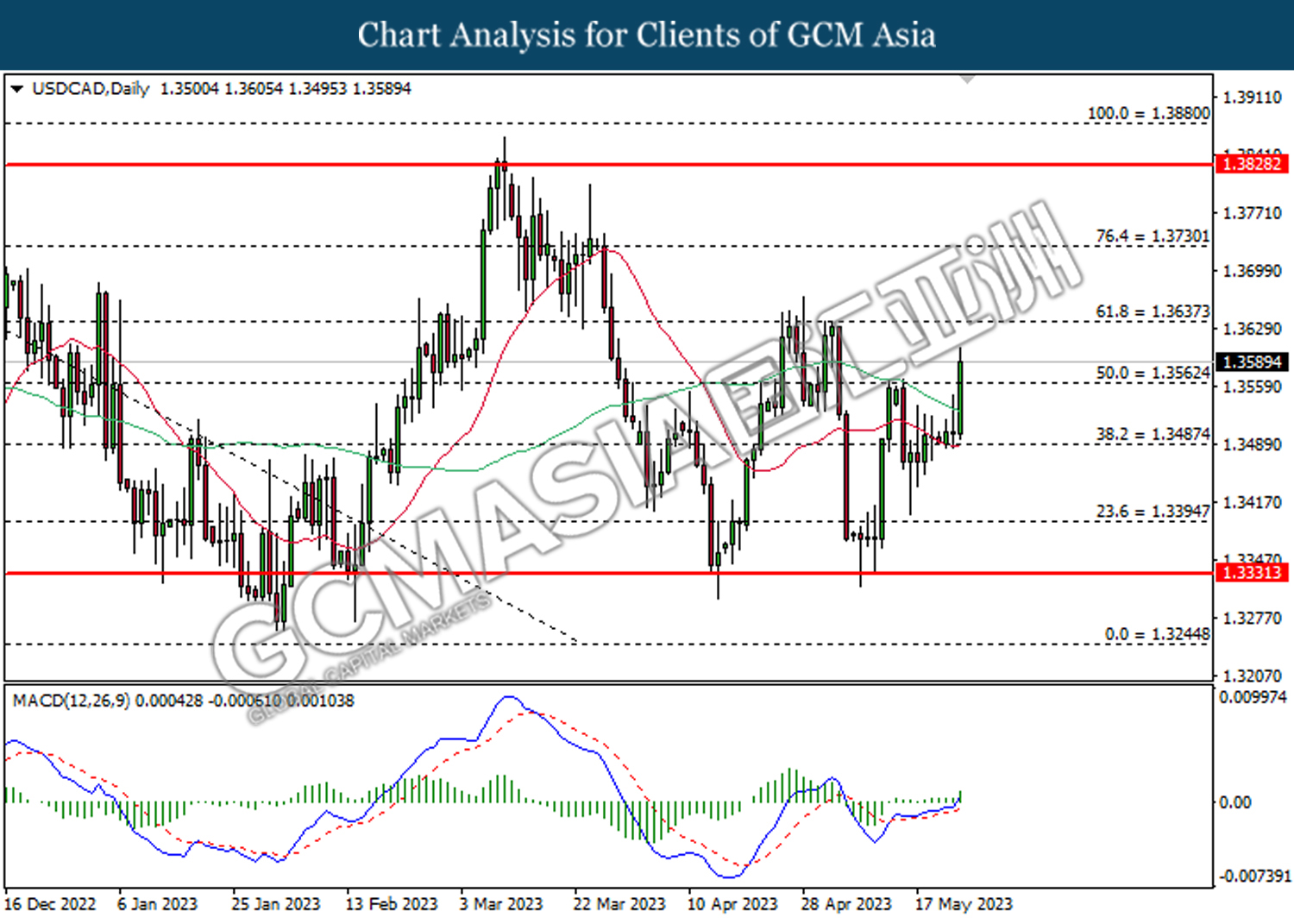

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3565. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3560, 1.3635

Support level: 1.3485, 1.3395

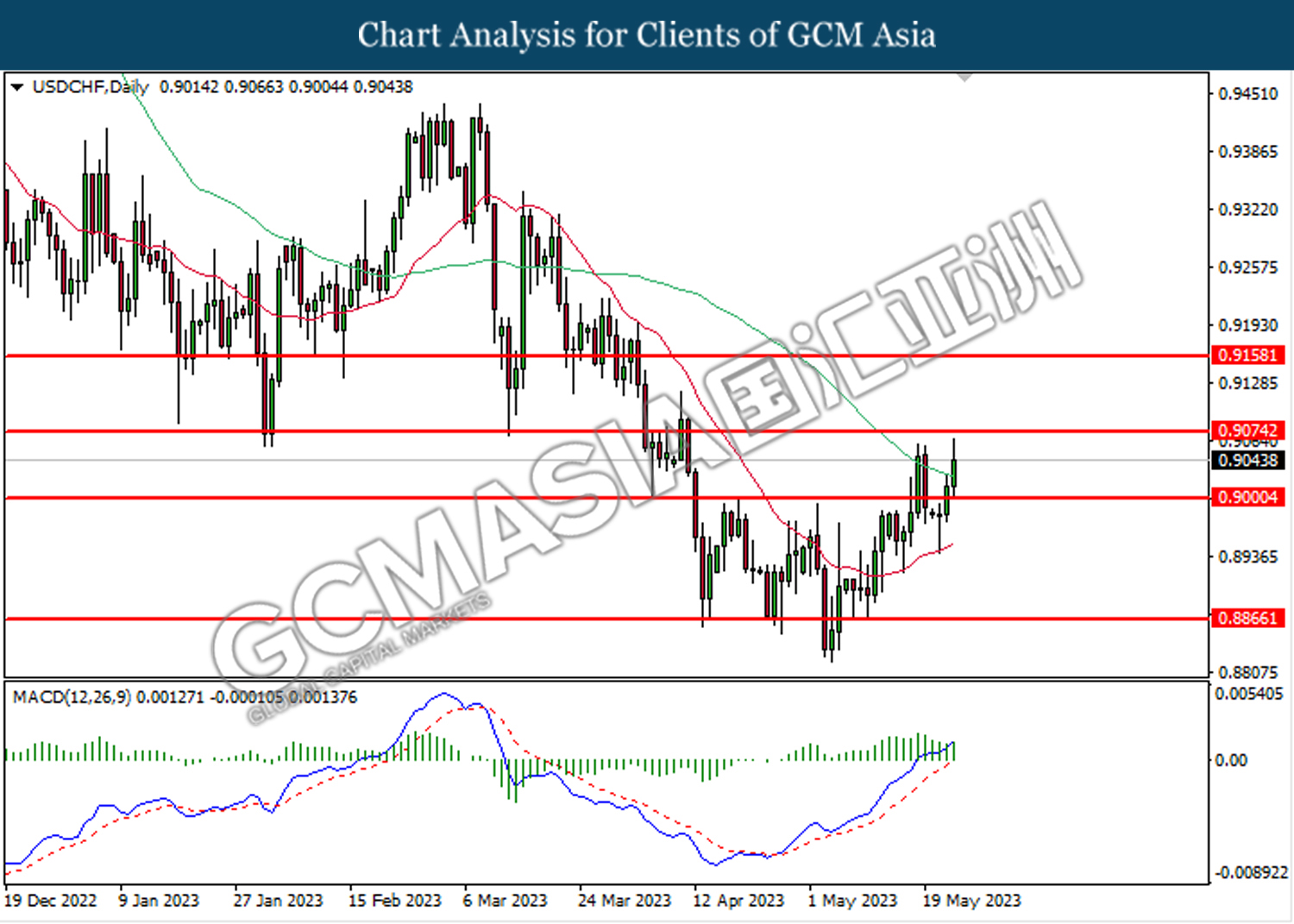

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.9000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9075.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

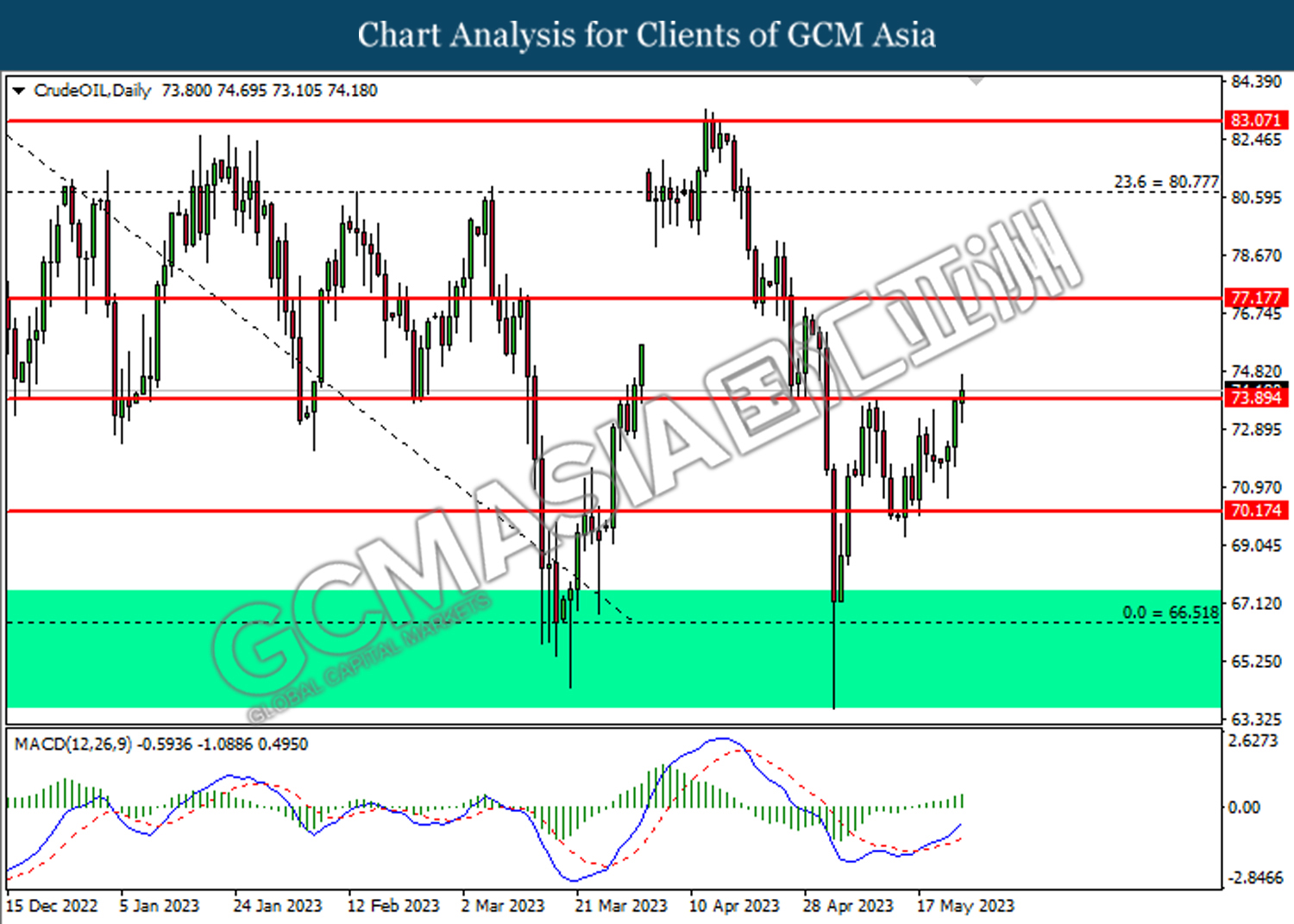

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

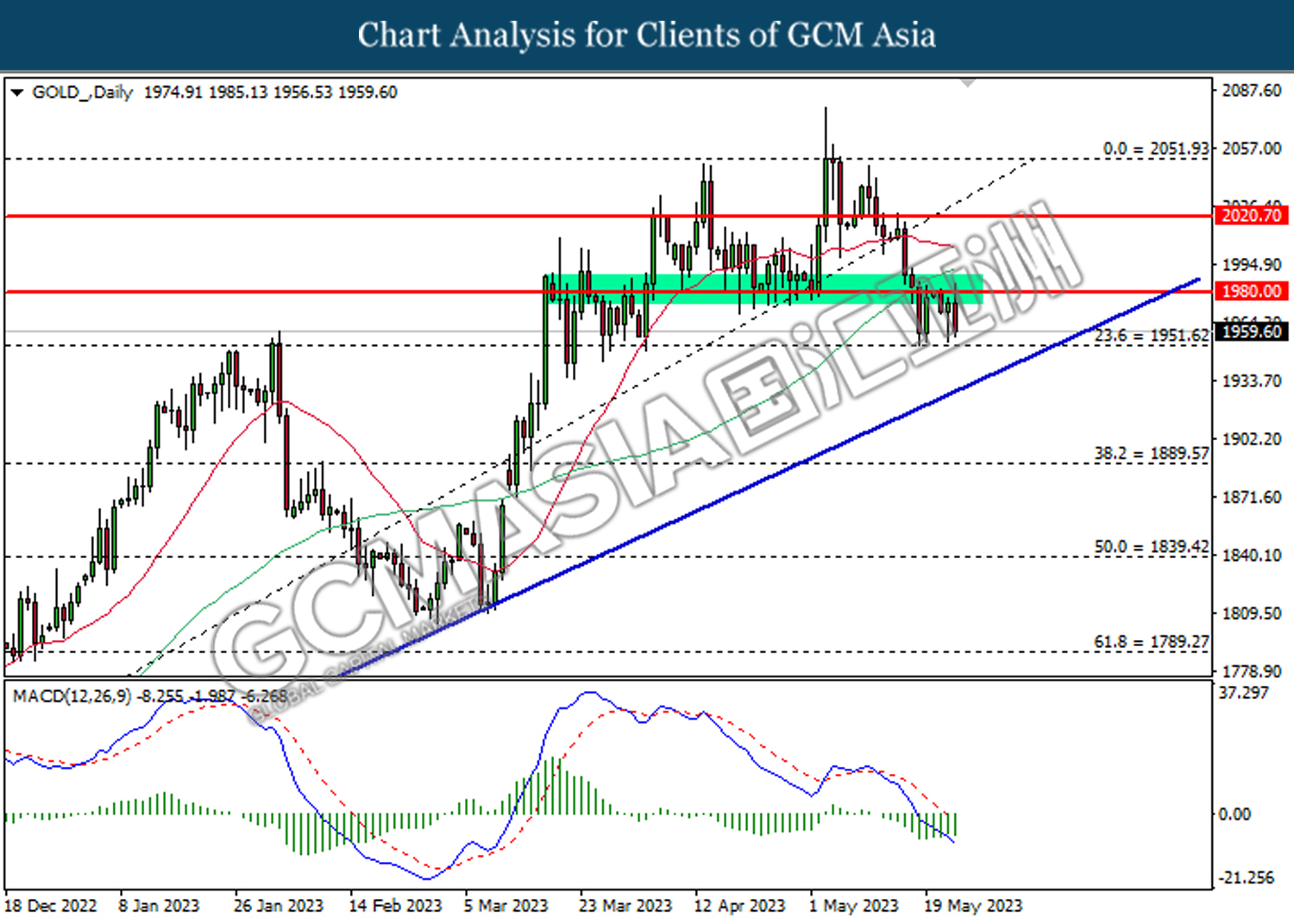

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1980.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1951.60.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55