25 October 2022 Afternoon Session Analysis

Yen slipped as BOJ seen keeping ultra-low rates.

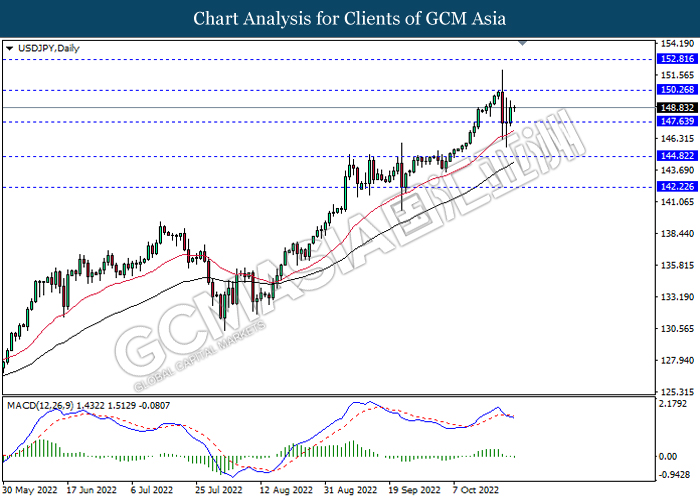

The USD/JPY which widely traded by global investors rebounded after the sharp decline on Friday amid the intervention from Bank of Japan (BoJ). According to Reuters, the Japanese currency temporarily surged by more than 7% against US Dollar, as the government and the BoJ made an unannounced intervention in the foreign exchange market. Over $33.6 billion has been sold by BoJ in order to support Yen, reported by The Financial Times. Though, the overall trend of USD/JPY remained bullish following the BoJ was anticipated to maintain its ultra-low interest rate. Although BoJ is expected to raise inflation forecast on Friday, but it would likely to keep negative rates to support the fragile economy. On the other hand, 75 basis point rate hike from Fed was expected by majority of investors, causing the interest rate differential of BoJ and Fed become wider, which prompting investors to flee away from Japanese currency market and purchase US Dollar. As of writing, the USD/JPY depreciated by 0.10% to 148.80.

In the commodities market, the crude oil price appreciated by 0.40% to $84.93 per barrel as of writing amid the expectation of output cut from OPEC+ which would start from November. In addition, the gold price edged up by 0.12% to $1651.78 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Oct) | 84.3 | 83.3 | – |

| 22:00 | USD – CB Consumer Confidence (Oct) | 108.0 | 106.5 | – |

Technical Analysis

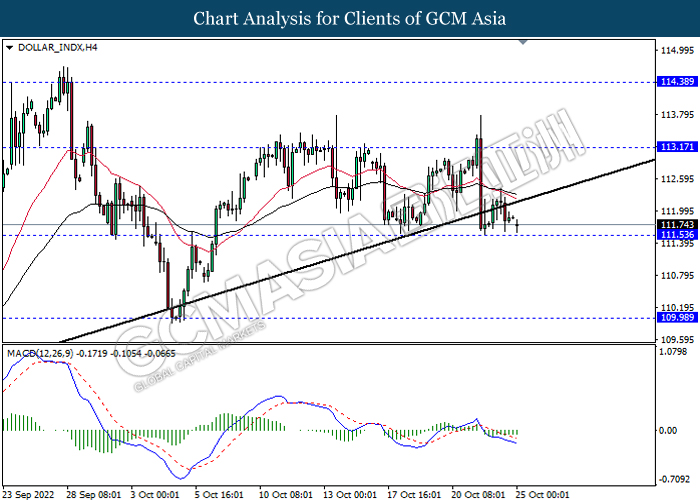

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 113.15, 114.40

Support level: 111.55, 109.95

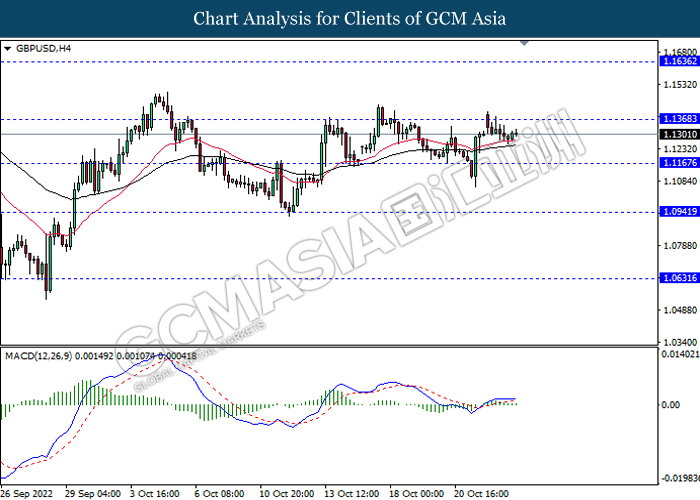

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

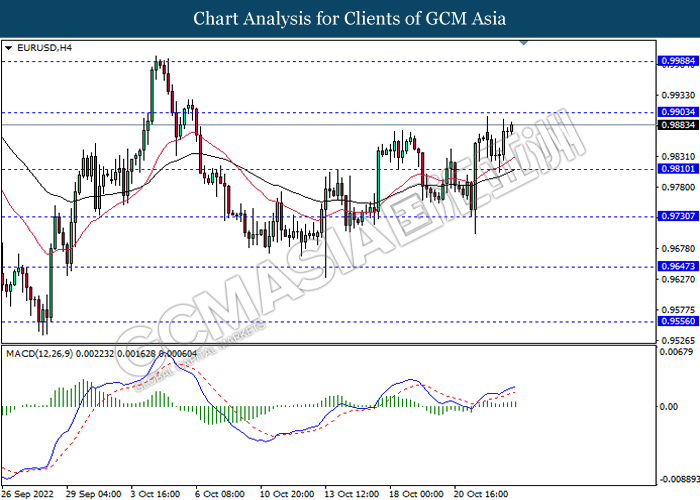

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

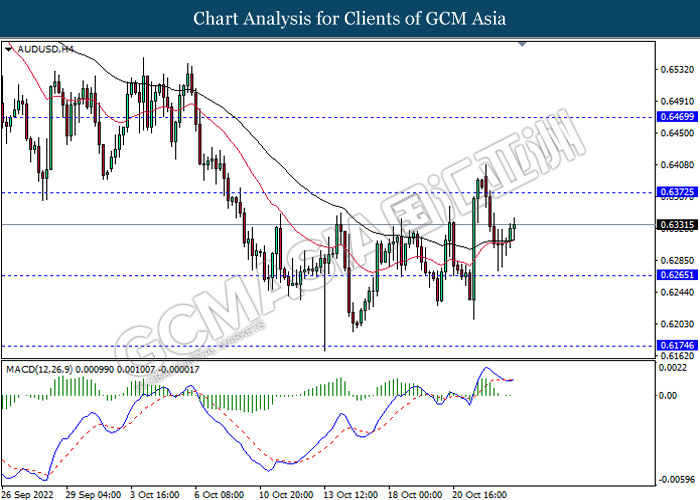

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6175

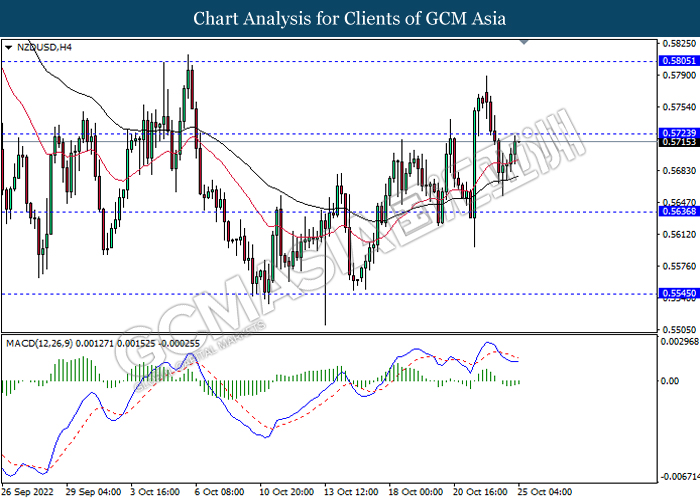

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.5725, 0.5805

Support level: 0.5635, 0.5545

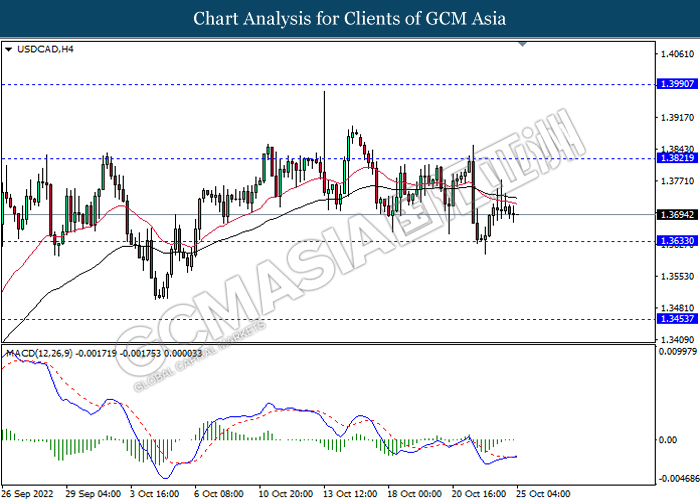

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

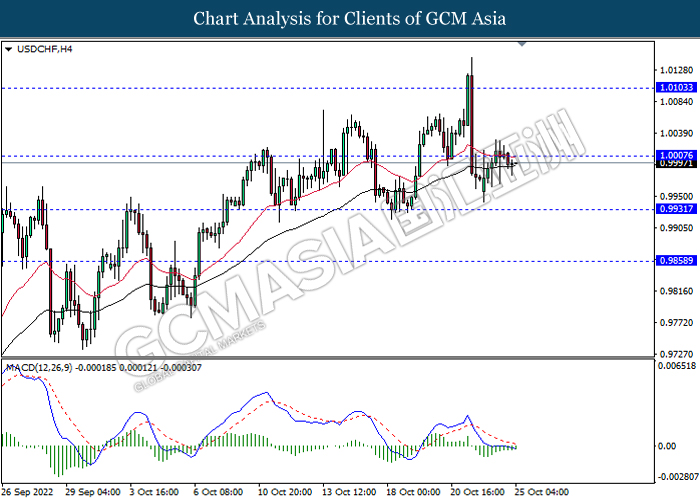

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

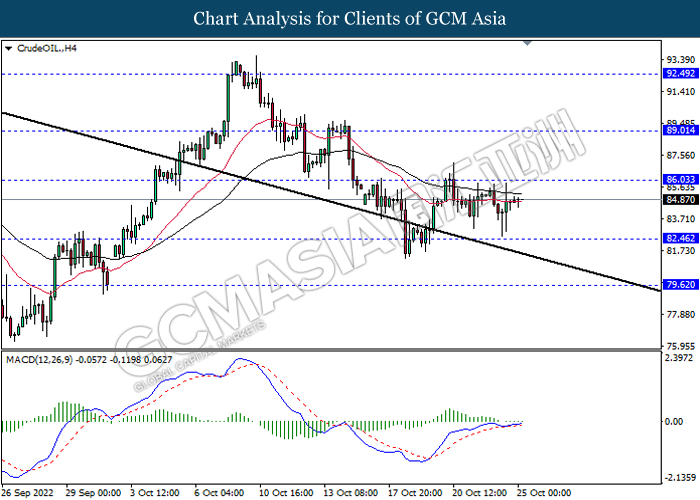

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

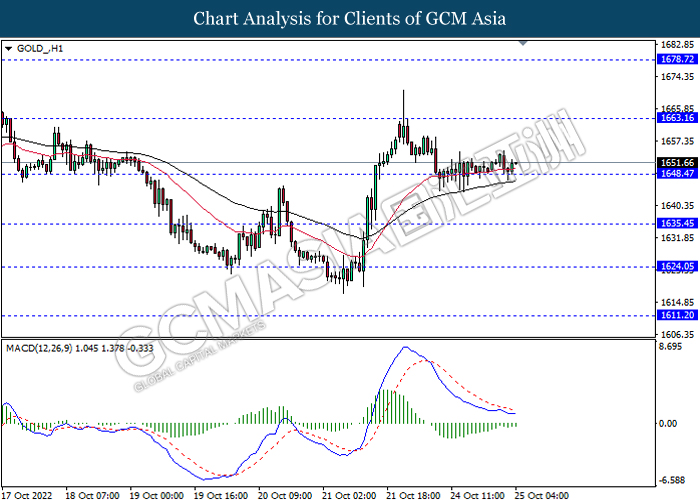

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1633.15, 1678.70

Support level: 1648.45, 1635.45