25 October 2022 Morning Session Analysis

Pound fall amid downbeat economic data.

The Sterling pound, which is majorly traded by the global investors, pressured by the huge bearish momentum which exerted following the release of a series of downbeat economic data in the nation. According to the Markit Economics, UK Composite Purchasing Managers’ Index (PMI) came in at 47.2, lower than the economist forecast at 48.1, bode well with the recession forecast by the Bank of England. Besides, both the Manufacturing PMI and Services PMI which has been released yesterday also printed a disappointing reading, where they came in at 45.8 and 47.5, missing the consensus forecast at 48.0 and 49.6 respectively. It is noteworthy to highlight that below the level of 50 is being considered as a contraction. On the other side, UK is now in the midst of electing a new prime minister following the resignation of Liz Truss after 6 weeks in office. Following a few days of contest, the former Chancellor of the Exchequer – Rishi Sunak was declared as the next leader of UK Conservative Party, who also set to be the new prime minister to replace Liz Truss. As of writing, the pair of GBP/USD rose 0.24% to 1.1300.

In the commodities market, the crude oil price rose by 0.10% to $84.95 per barrel as China’s economic growth provides fresh hope of oil demand. Besides, the gold prices rose 0.15% to $1651.85 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Oct) | 84.3 | 83.3 | – |

| 22:00 | USD – CB Consumer Confidence (Oct) | 108.0 | 106.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the trendline.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

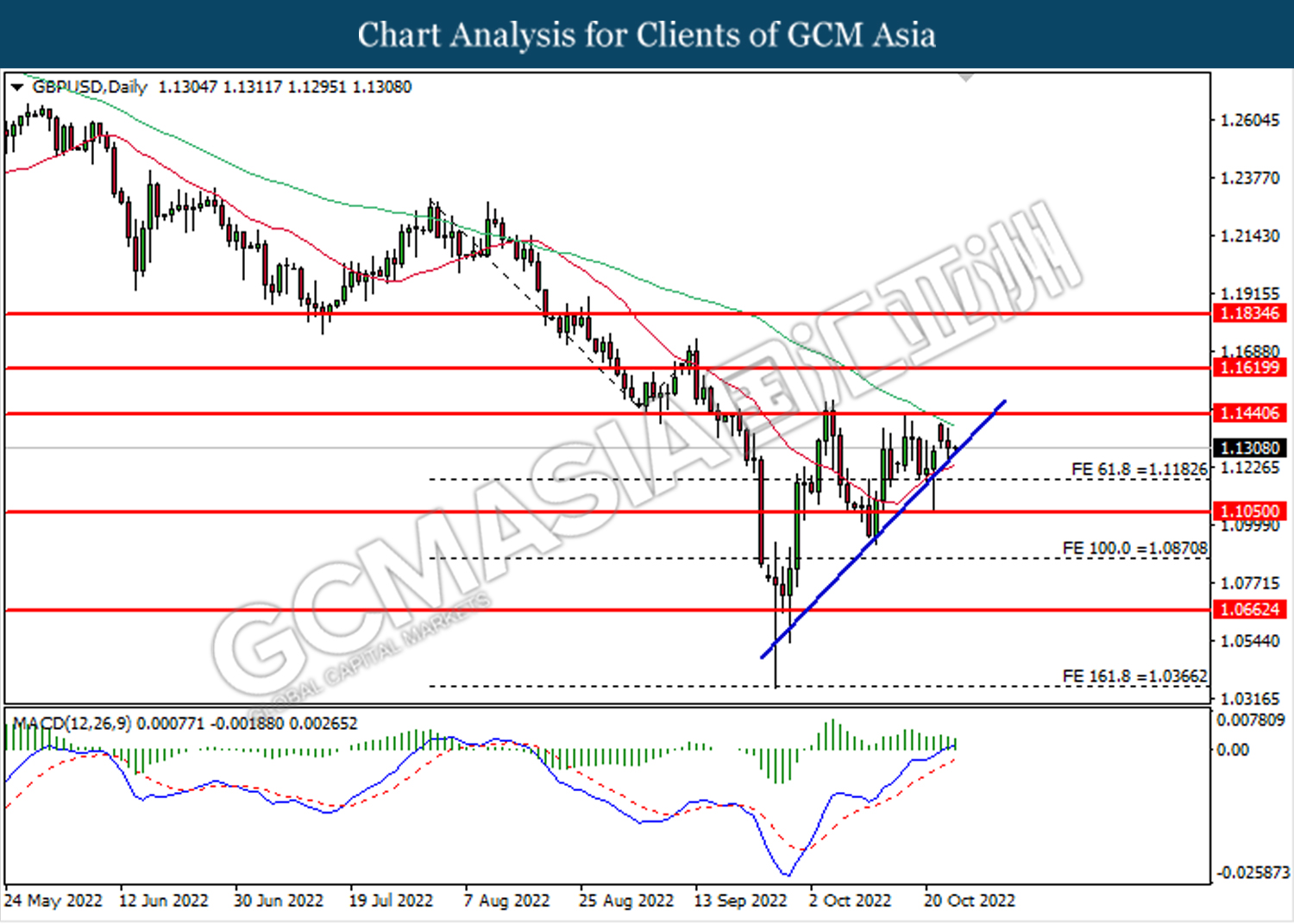

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1440. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1440, 1.1620

Support level: 1.1185, 1.1050

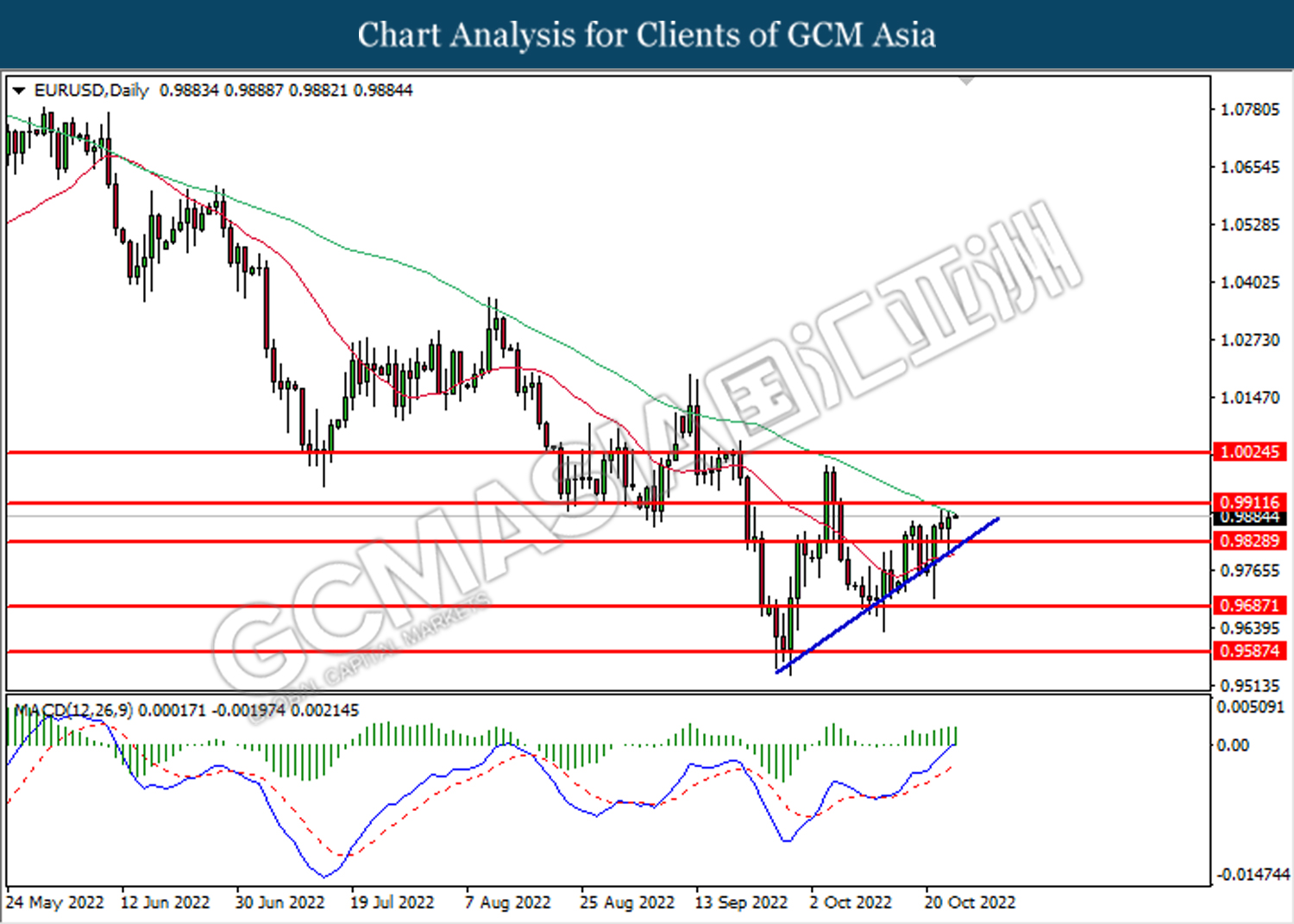

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9830. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9910.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

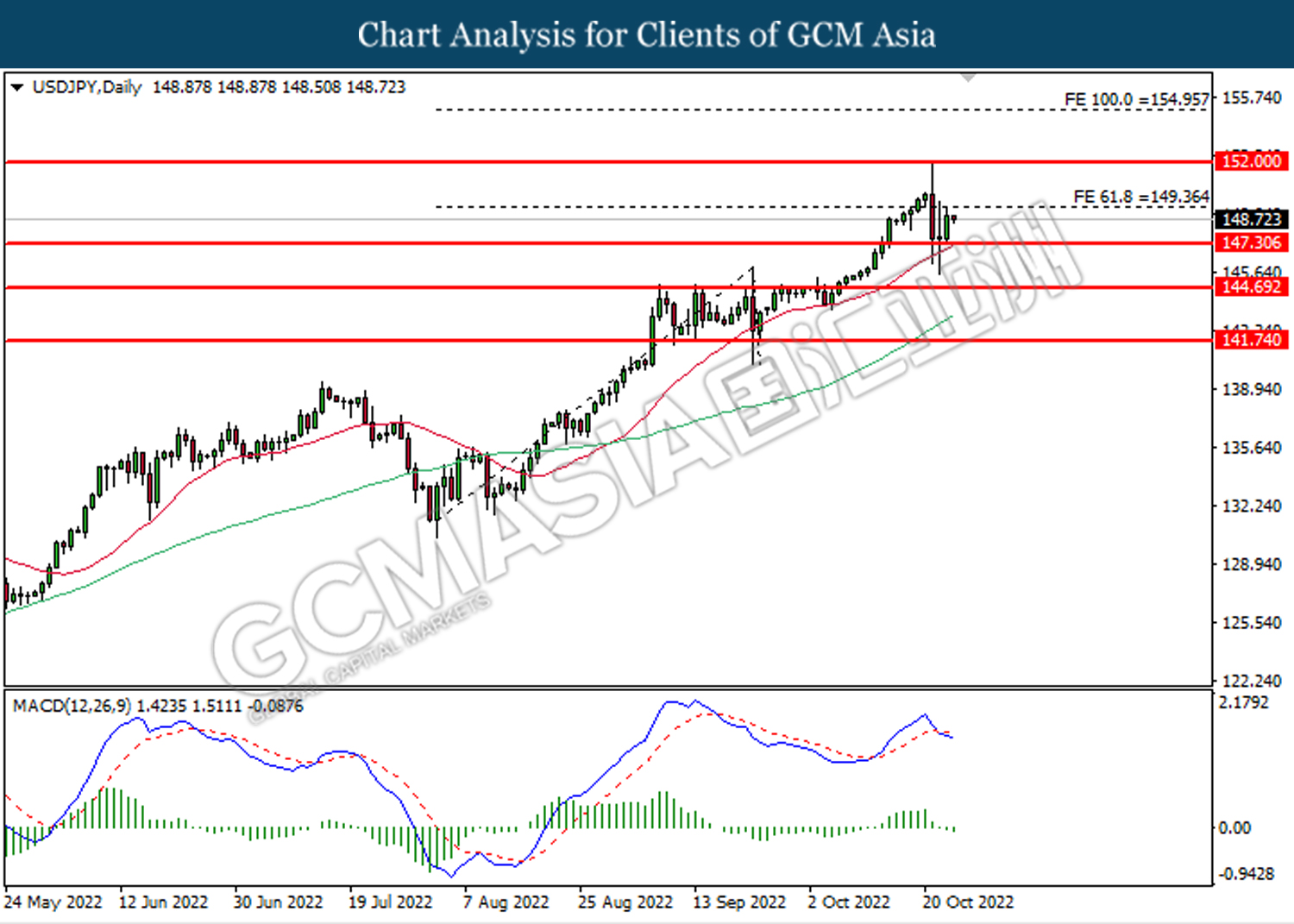

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

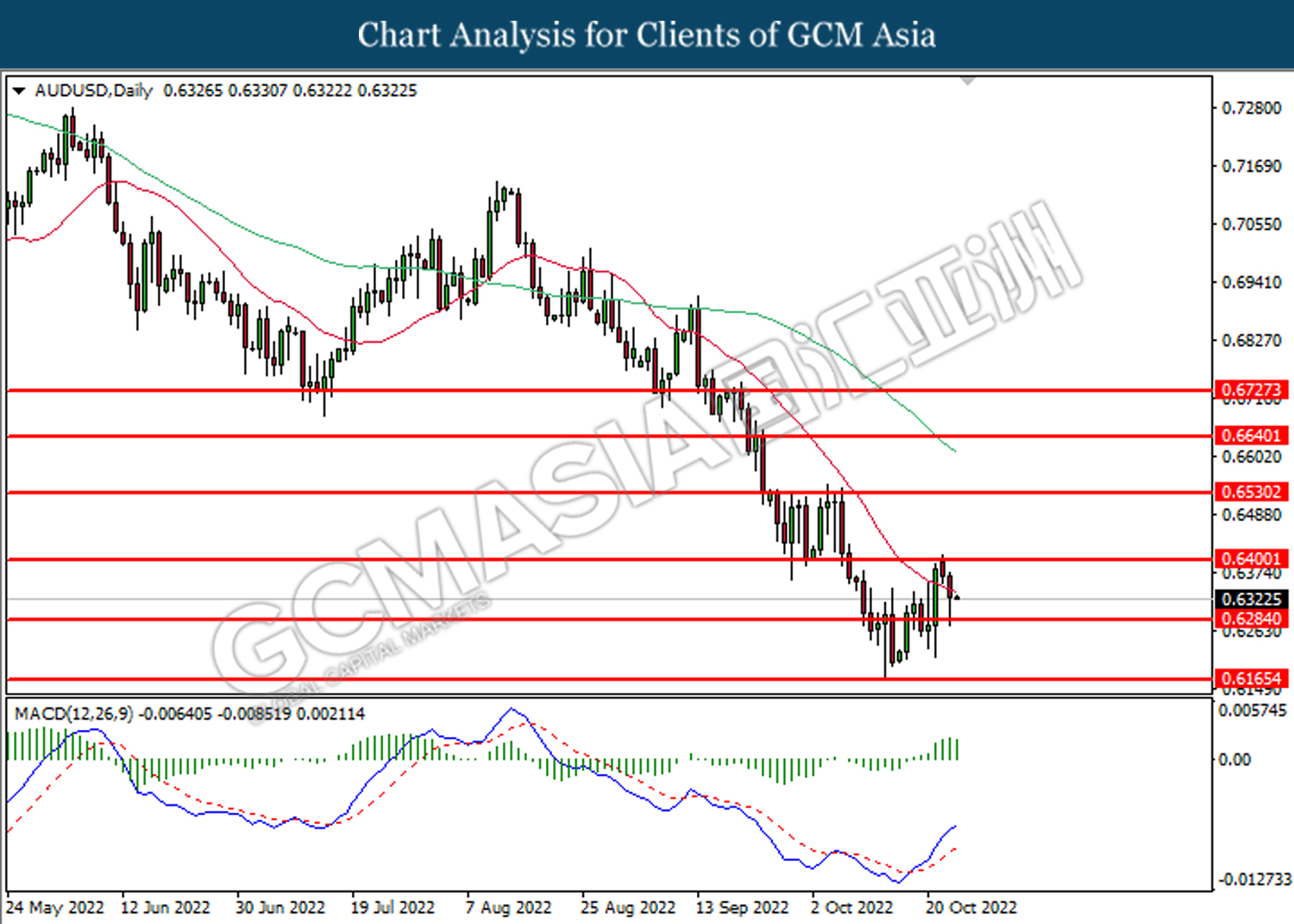

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6400, 0.6530

Support level: 0.6285, 0.6165

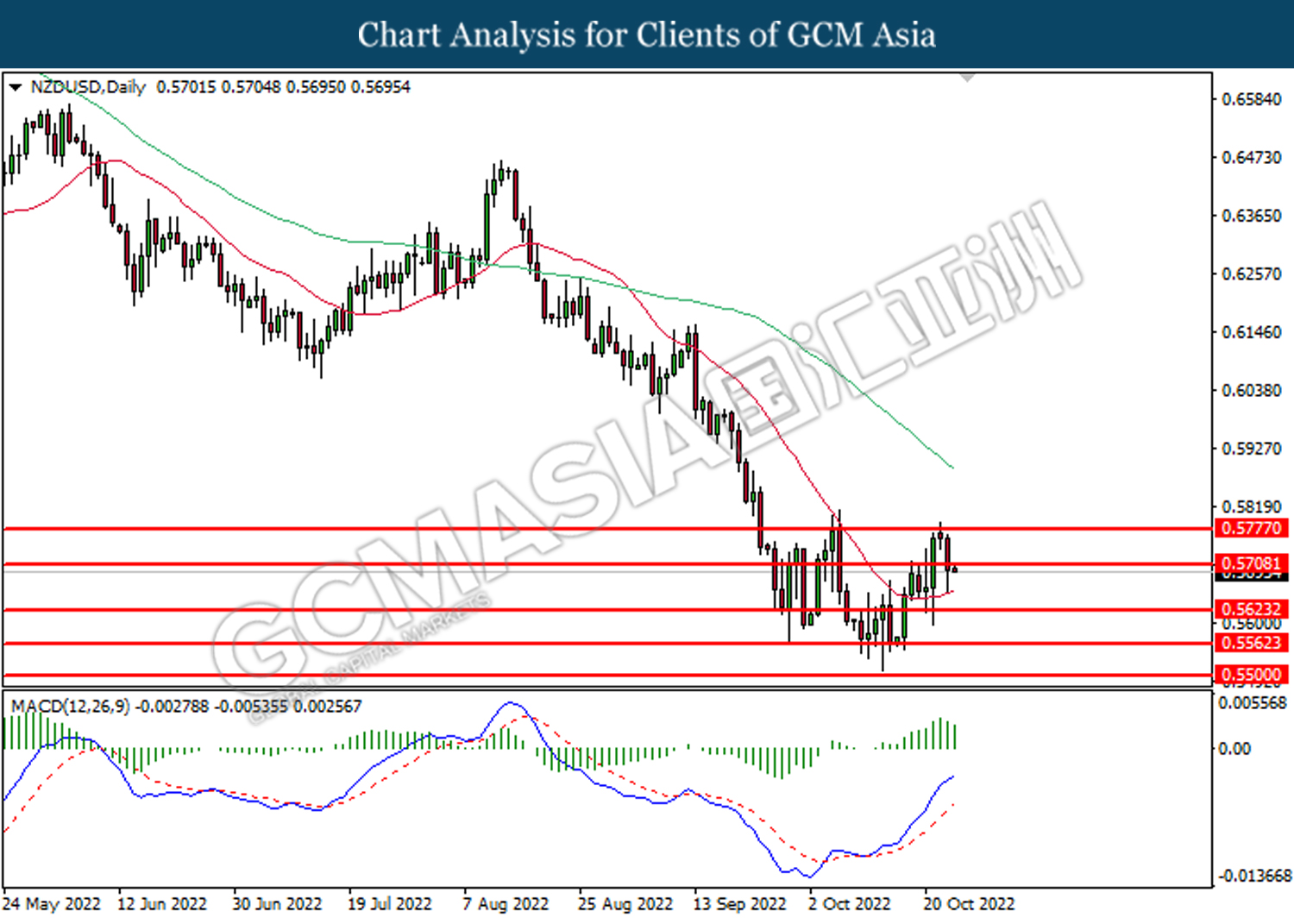

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.5710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.5625.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

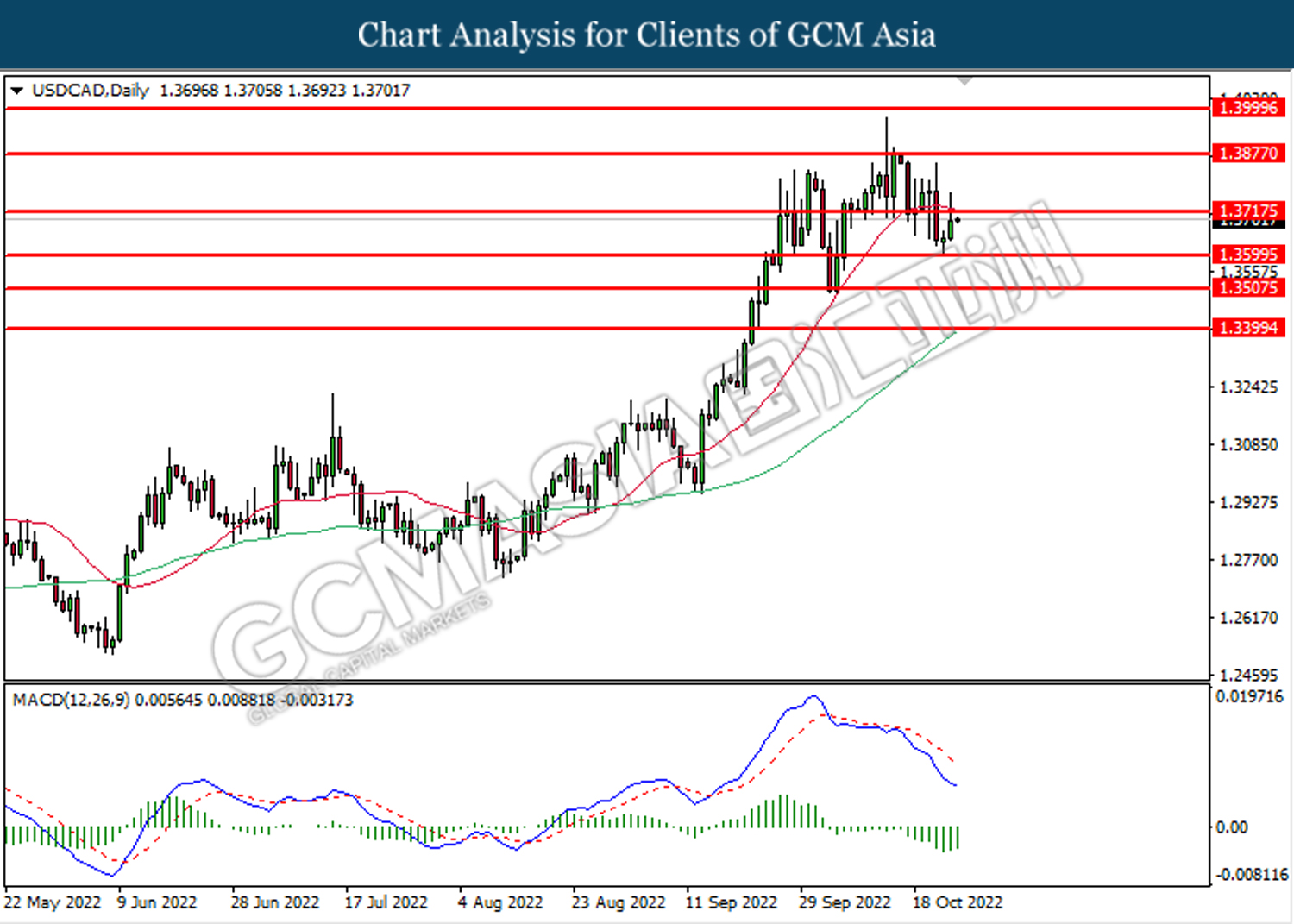

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

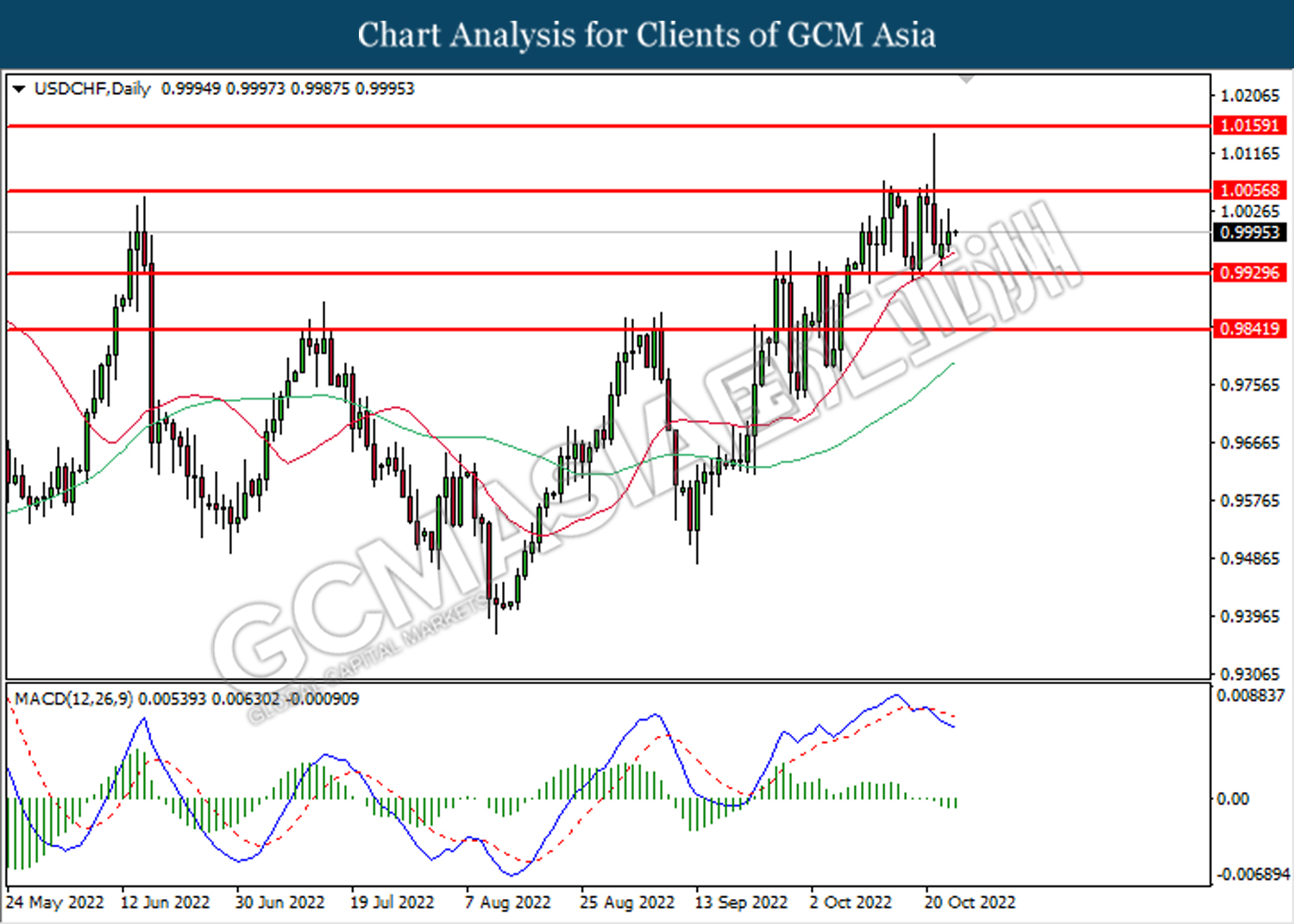

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9930. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

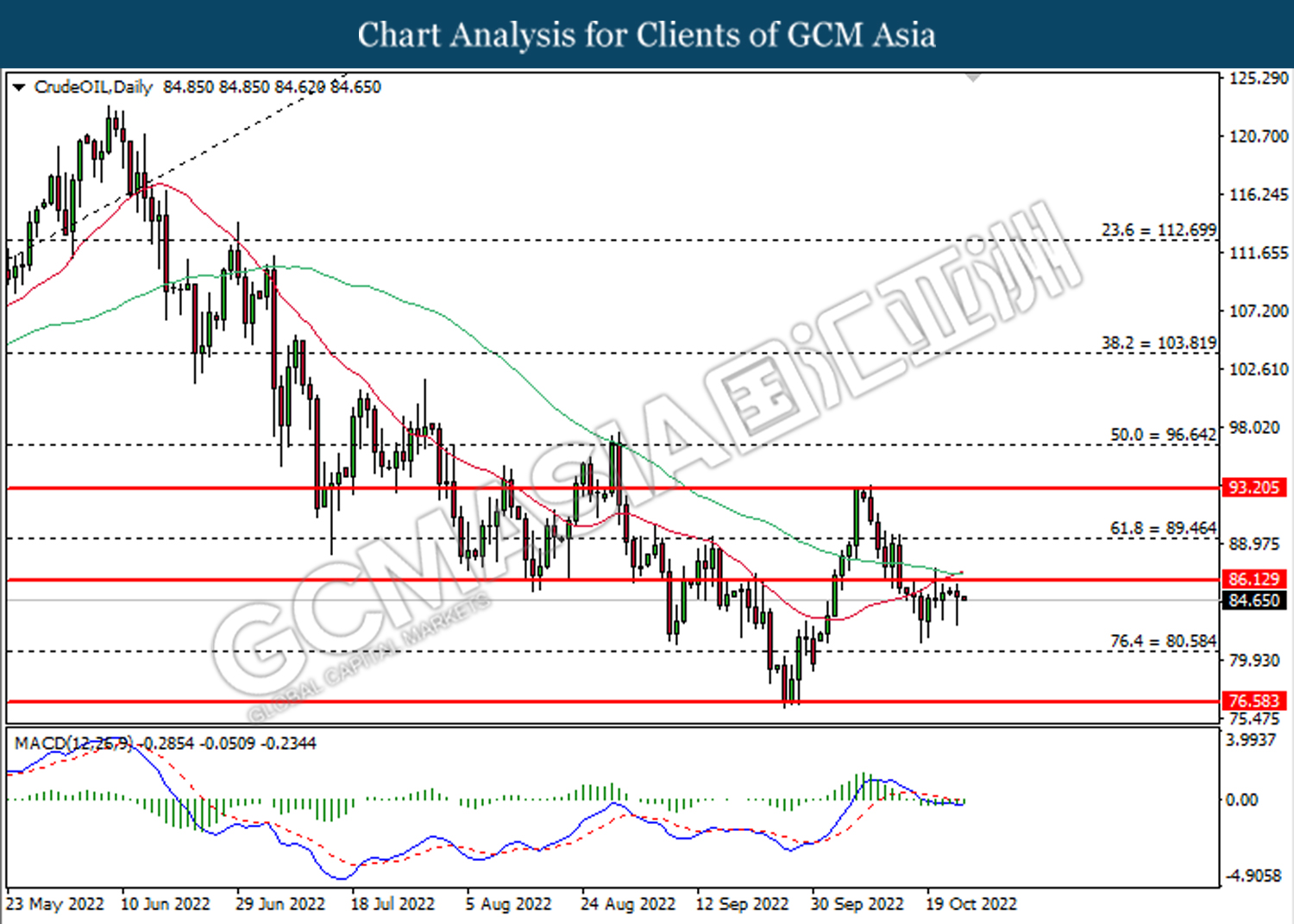

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1661.40. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term toward the resistance level.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00