26 January 2022 Afternoon Session Analysis

Rising geopolitical tensions, sparkling the appeal for safe-haven Yen.

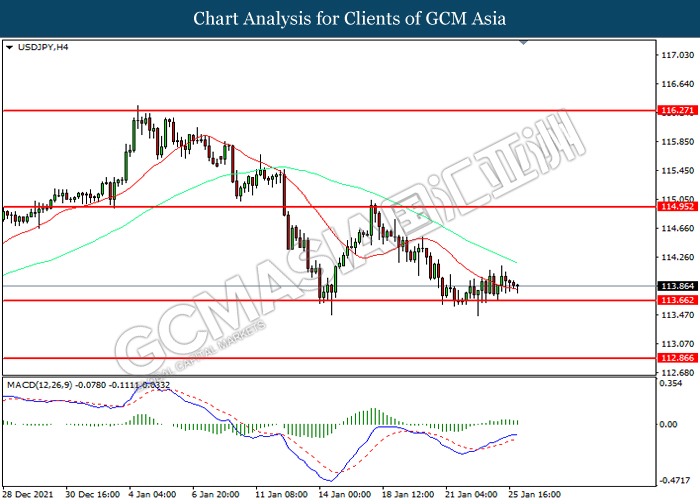

The safe-haven Japanese Yen surged amid escalating tensions between Russia and Ukraine, which diminishing risk appetite in the global financial market while spurring bullish momentum for the safe-haven asset. According to Reuters, Western leaders had stepped up preparations for any Russian military action in Ukraine. The tensions between the both counties remained high following NATO claimed on Monday that they were putting forces on standby and reinforcing Eastern Europe with more ships and fighter jets in response to a Russian troop build-up near the border with Ukraine. Besides, the United States and European Union have threatened to impose economic sanctions if Russia launched their invasion to Ukraine. The rising geopolitics tensions as well as spiking numbers of Covid-19 cases around the world would continue to jeopardize the economic momentum, prompting investors to shift their portfolio toward safe-haven asset. As of writing, USD/JPY depreciated by 0.03% to 113.85.

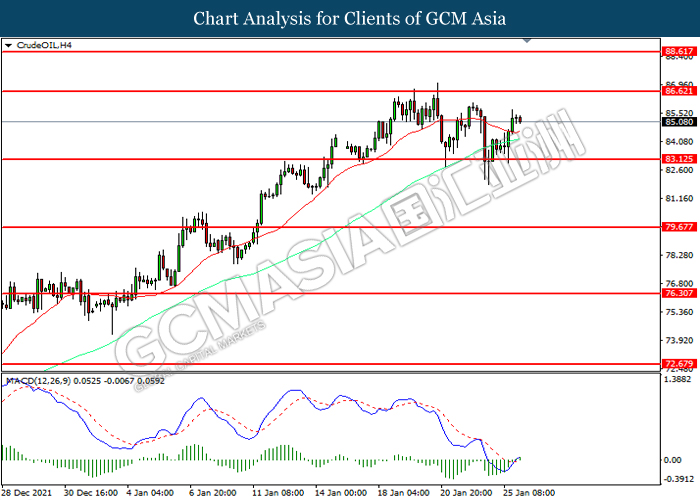

In the commodities market, the crude oil price surged 0.04% to $85.70 per barrel as of writing on the concerns over the possibility of supply disruption following the rising tensions between both Russia and Ukraine. On the other hand, the gold price appreciated by 0.03% to $1847.45 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Monetary Policy Report

23:30 CAD BoC Press Conference

03:00 (27th) USD FOMC Statement

03:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – New Home Sales (Dec) | 744K | 760K | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 23:30 | USD – Crude Oil Inventories | 0.515M | – | – |

| 03:00 (27th) | USD – Fed Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

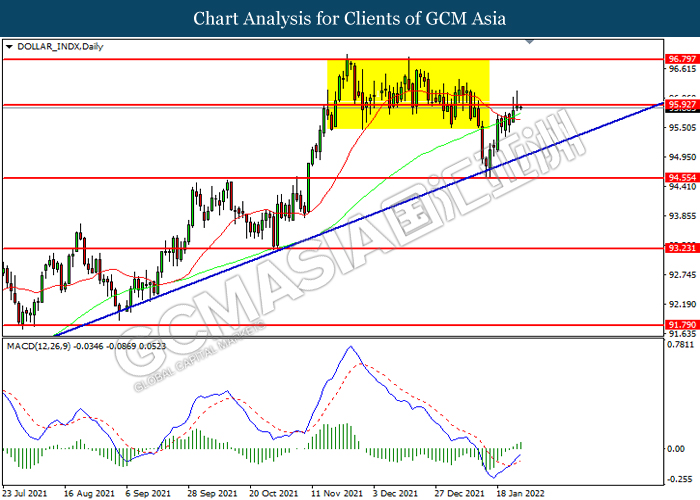

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.95. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

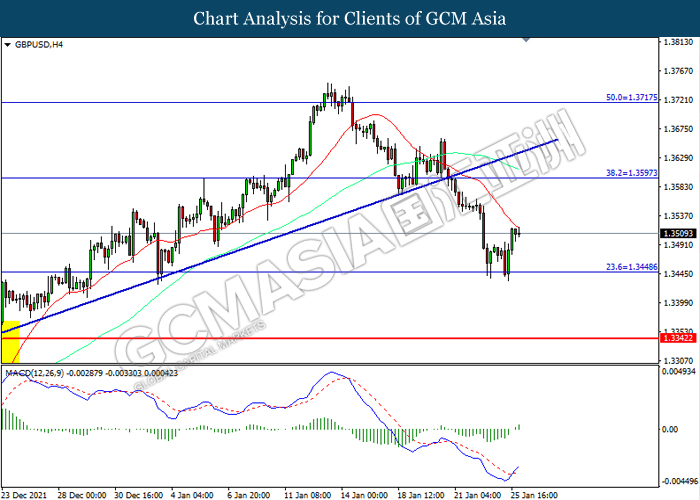

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3450. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3595.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

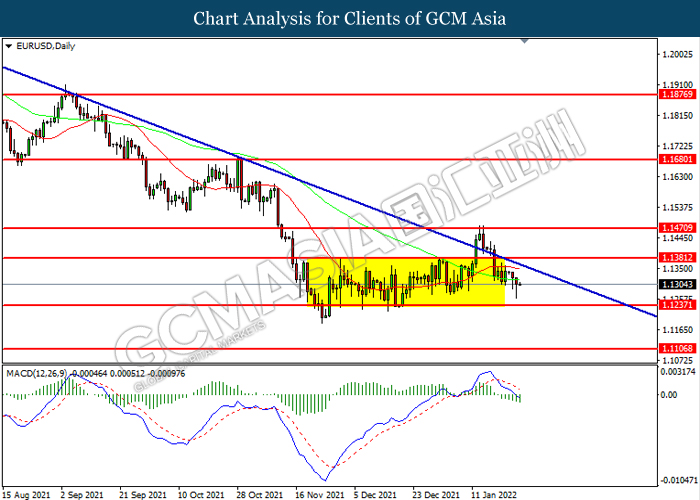

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

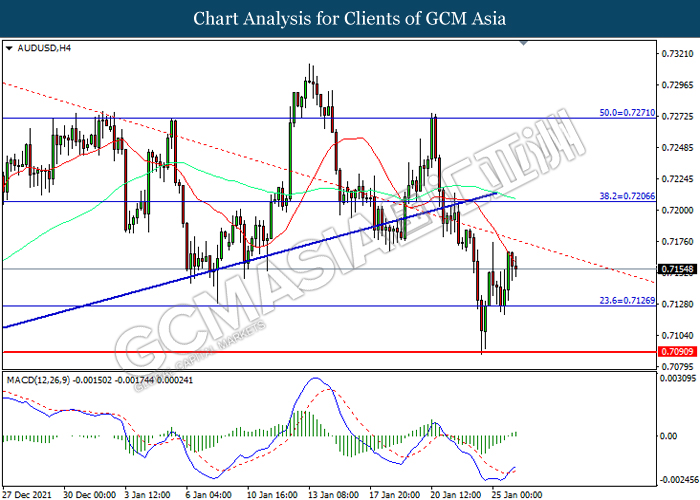

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7205.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6570.

Resistance level: 0.6710, 0.6865

Support level: 0.6570, 0.6405

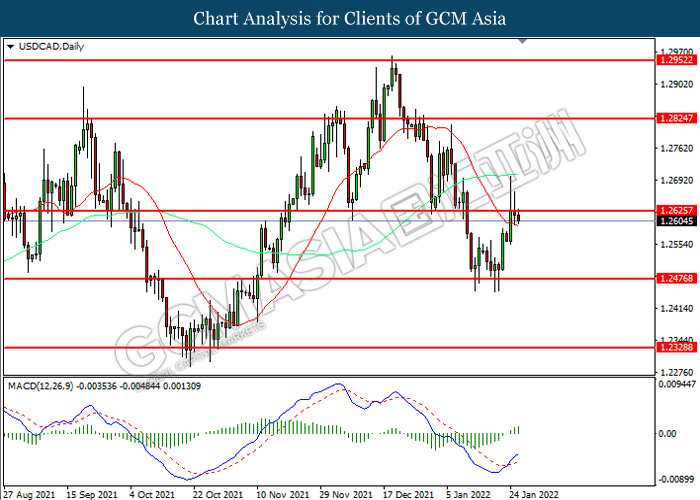

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2625, 1.2825

Support level: 1.2470, 1.2330

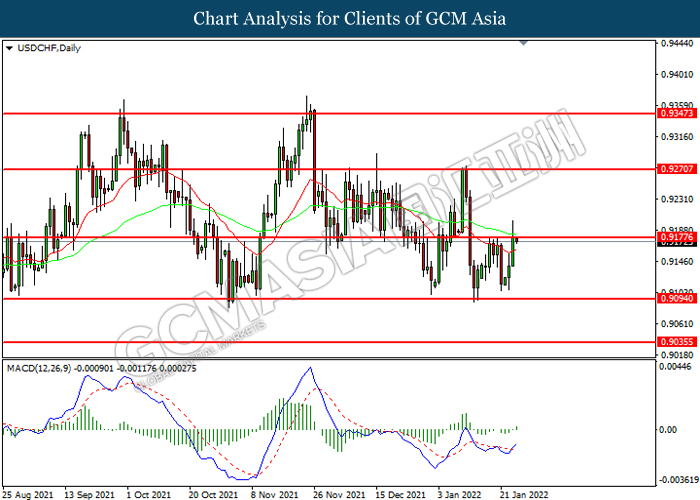

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9175. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 83.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 86.60.

Resistance level: 86.60, 88.60

Support level: 83.15, 79.65

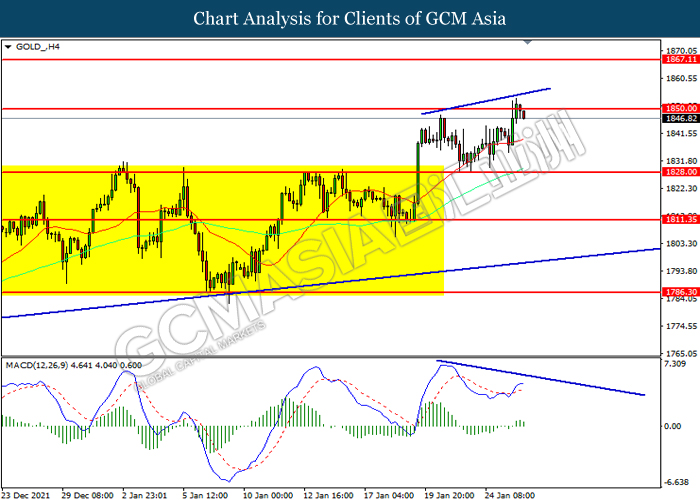

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1850.00. However, MACD which illustrated diminishing bullish momentum suggest the gold price to be traded lower in short-term as technical correction.

Resistance level: 1850.00, 1867.10

Support level: 1828.00, 1811.35