26 January 2022 Morning Session Analysis

IMF kicks greenback down.

Greenback undergoes technical correction from its prior high levels after International Monetary Fund (IMF) releases bleak outlook with regards to global economy. From the report, IMF expects global economic growth to subside during the year of 2022 due to ongoing uncertainty stemming from inflation, pandemik and supply chain disruption. IMF expects economic growth to peak at 4.4% this year, 0.5% lower than previous forecast. They also emphasized that Omicron variant which is spreading rapidly may cap global economic growth as it triggers shortage of staff in certain industry. In addition, ongoing restriction and SOPs due to the pandemic may continue to jeopardize any recovery in supply chain. As of US, IMF expects its GDP growth to cap at 4% for the year and it may depreciate further to 2.6% for 2023. The forecast was made due to US President Joe Biden’s failure to introduce new round of stimulus, faster paced monetary policy tightening as well as supply disruption in the market. As of writing, the dollar index was flat at 95.91.

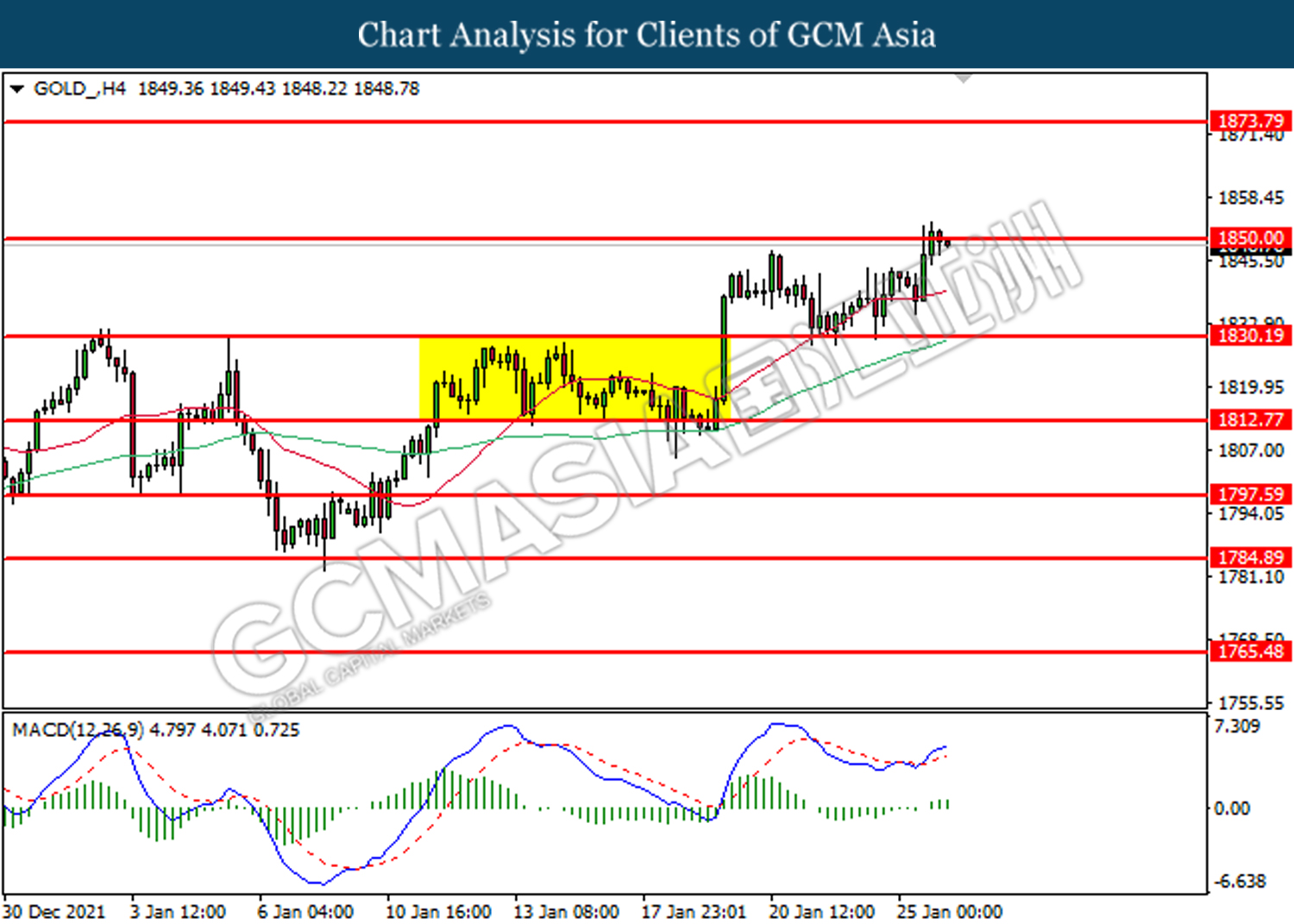

As for commodities, crude oil price rose 0.02% to $85.36 per barrel as geopolitical tension in between Russia and Ukraine rises further. Otherwise, gold price ticked down 0.03% to $1,849.65 a troy ounce due to technical correction from its higher levels.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Monetary Policy Report

23:30 CAD BoC Press Conference

03:00 (27th) USD FOMC Statement

03:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | New Home Sales (Dec) | 744K | 760K | – |

| 23:00 | BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 23:30 | Crude Oil Inventories | 0.515M | – | – |

| 03:00 (27th) | Fed Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

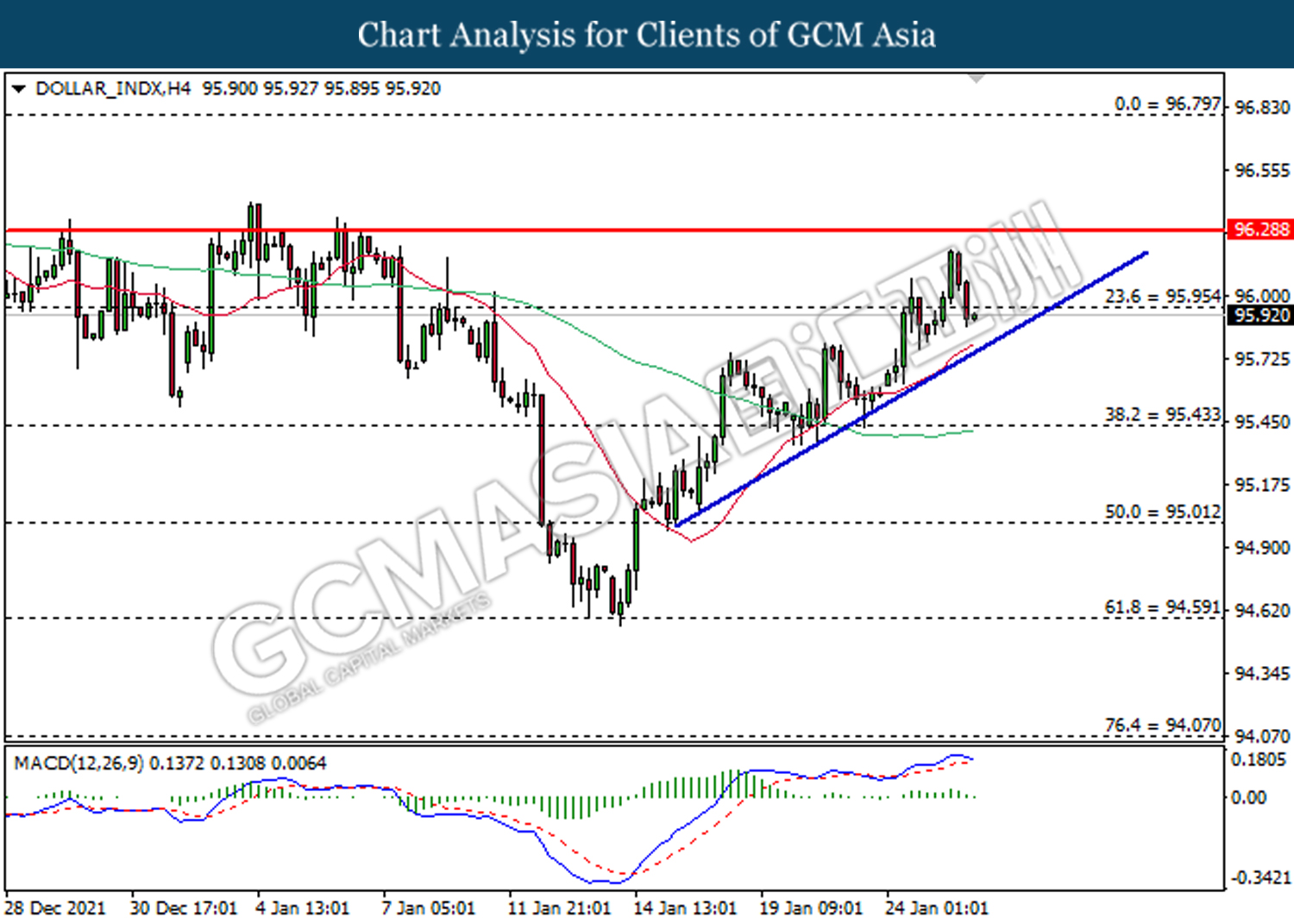

DOLLAR_INDX, H4: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.95, 96.30

Support level: 95.45, 95.00

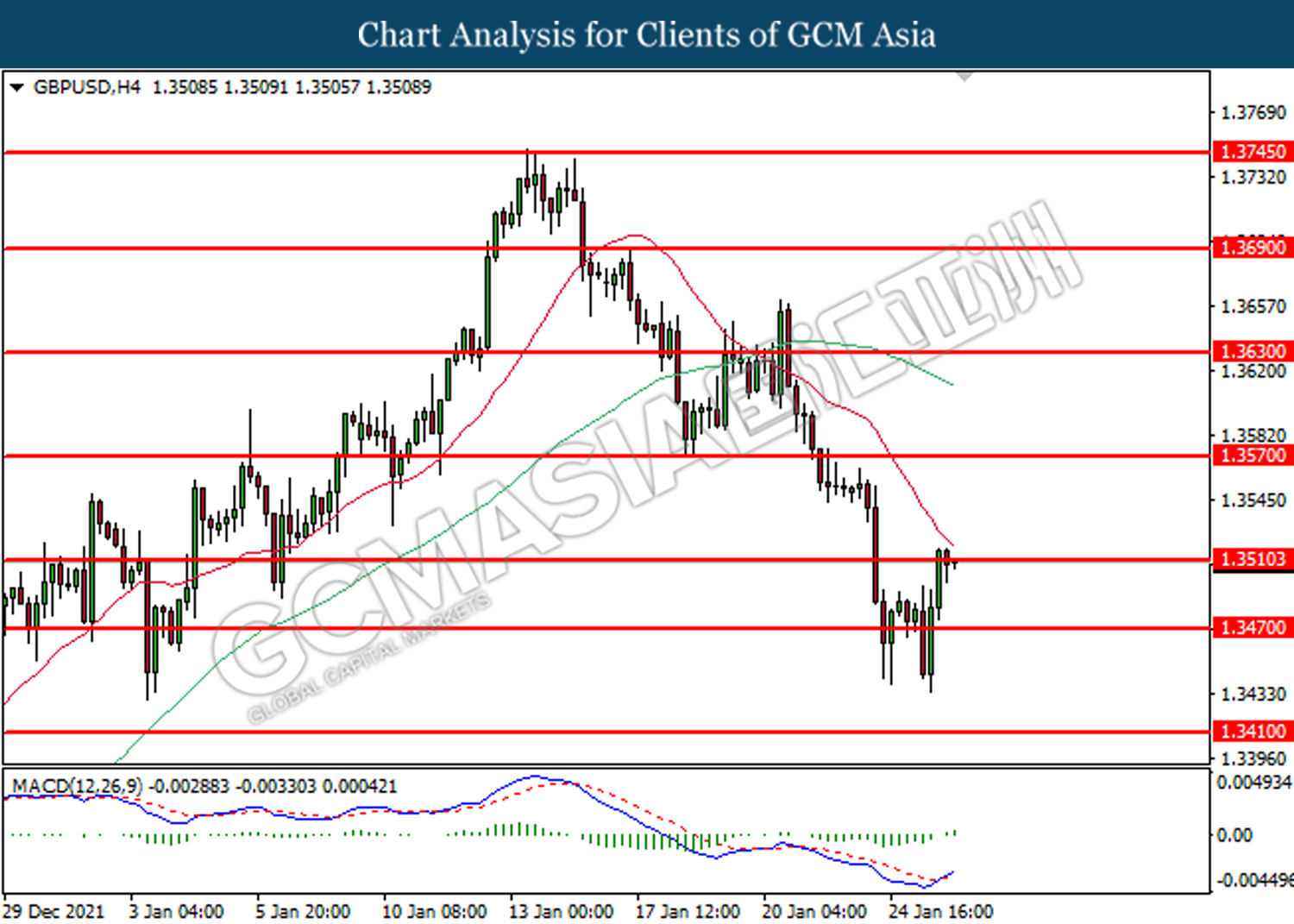

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3510, 1.3570

Support level: 1.3470, 1.3410

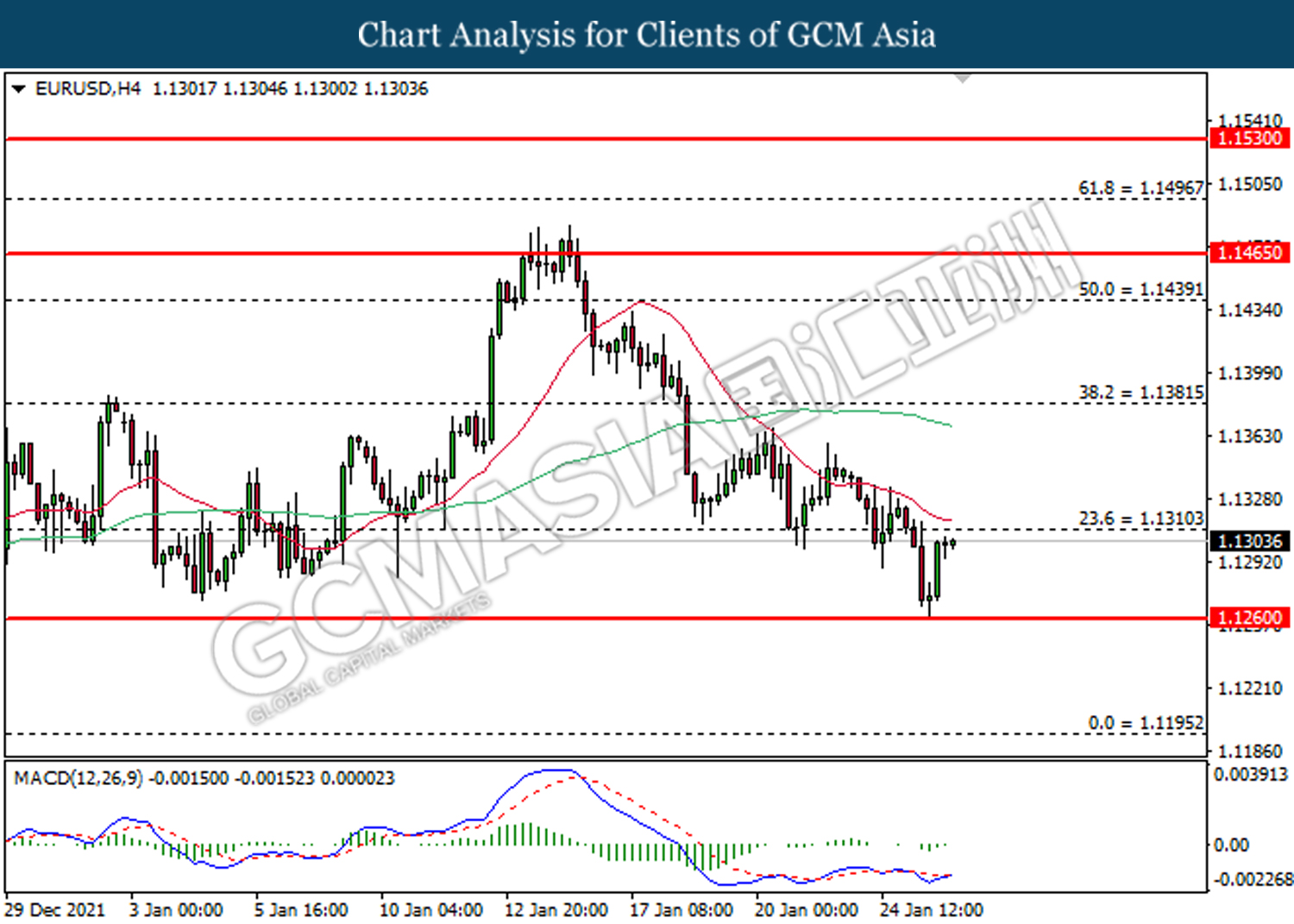

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1310, 1.1380

Support level: 1.1260, 1.1195

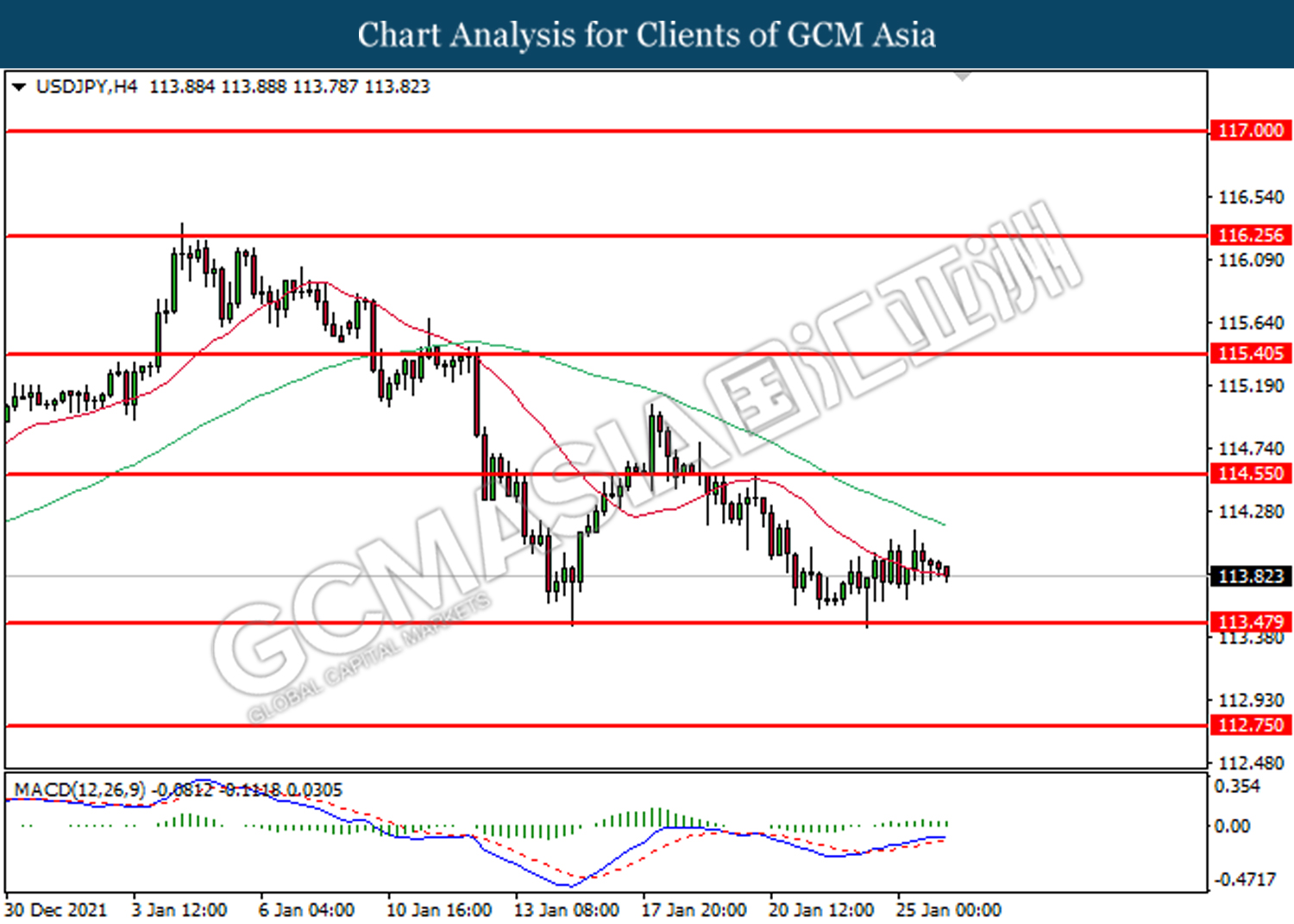

USDJPY, H4: USDJPY was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

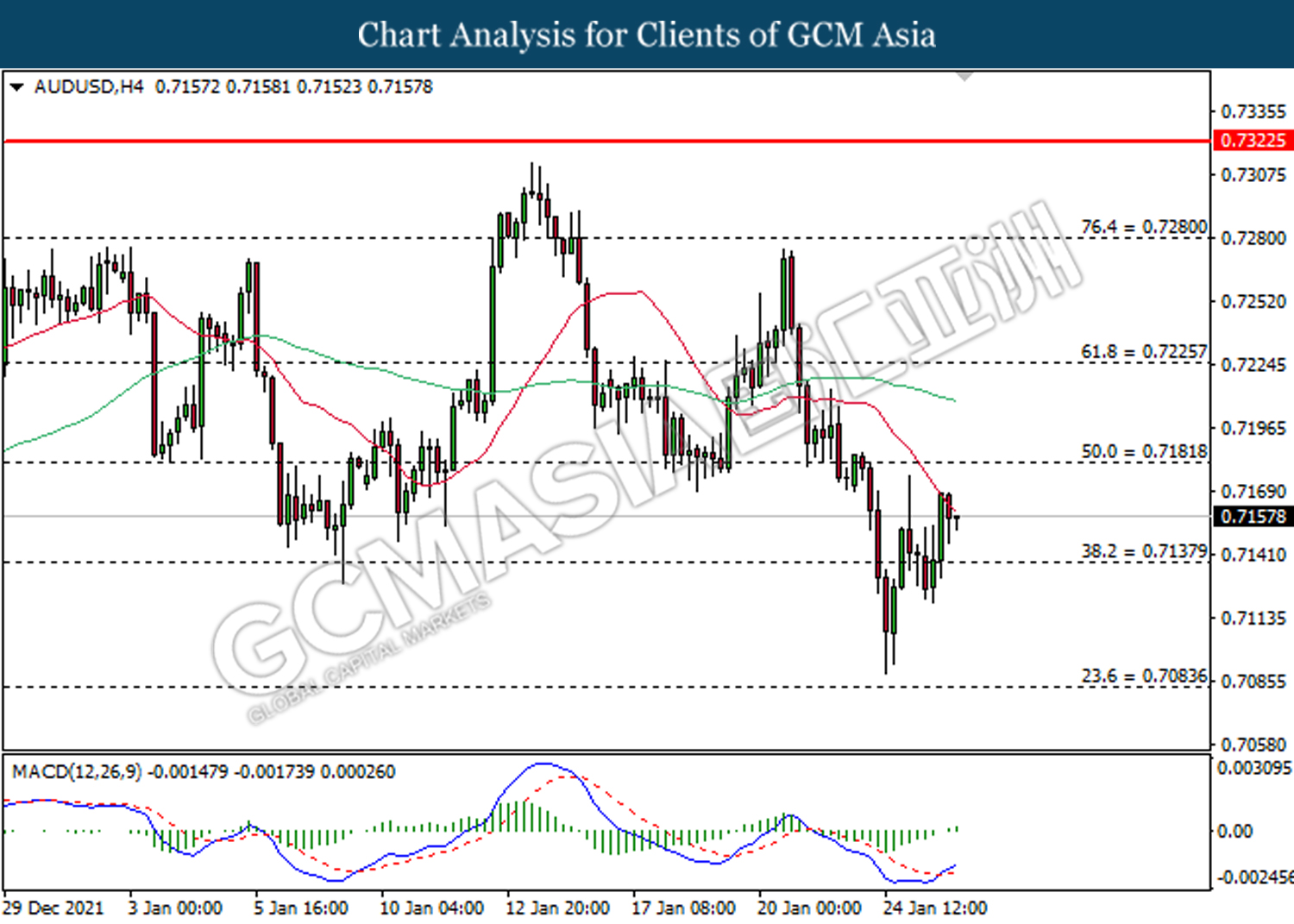

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7085

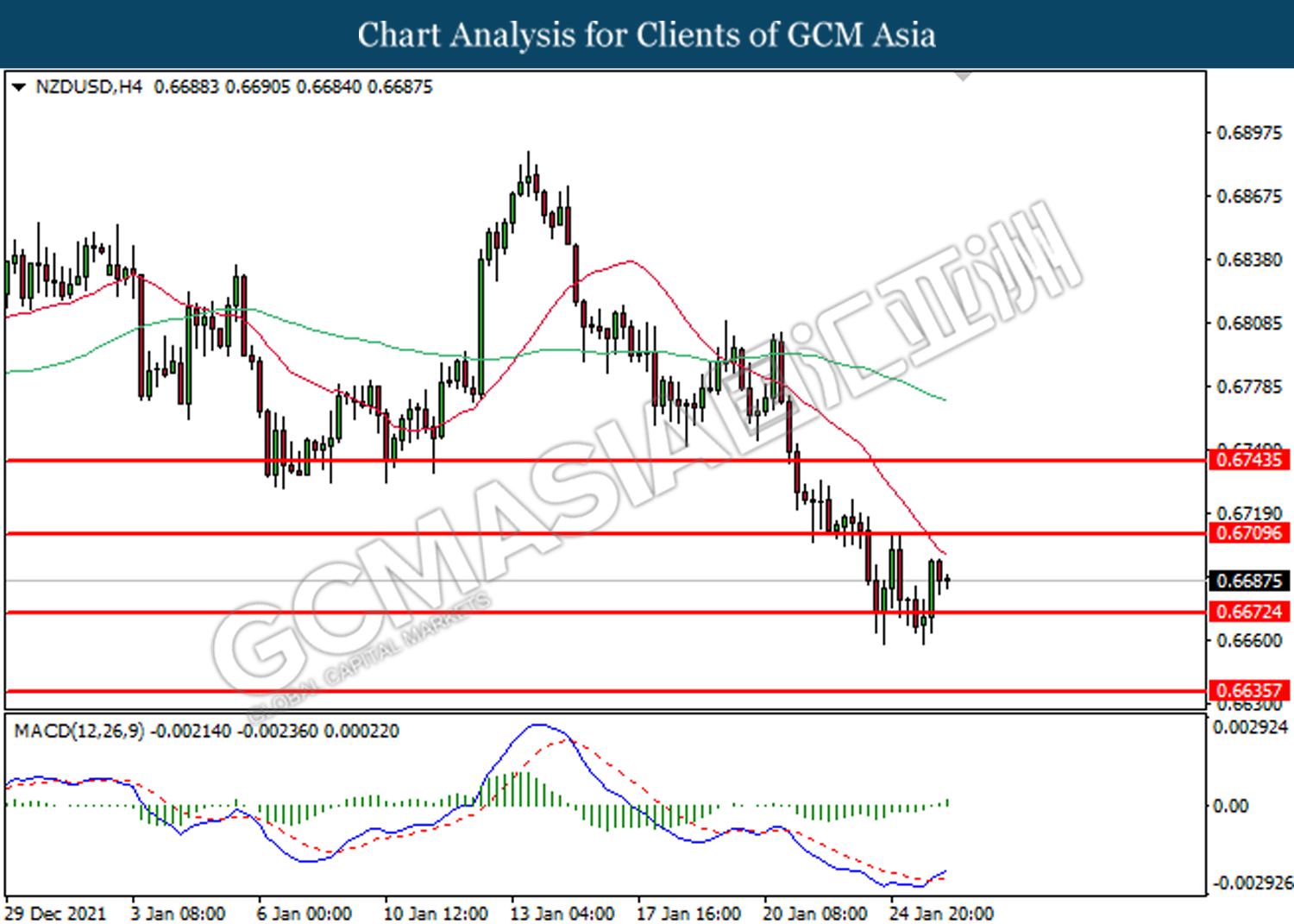

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

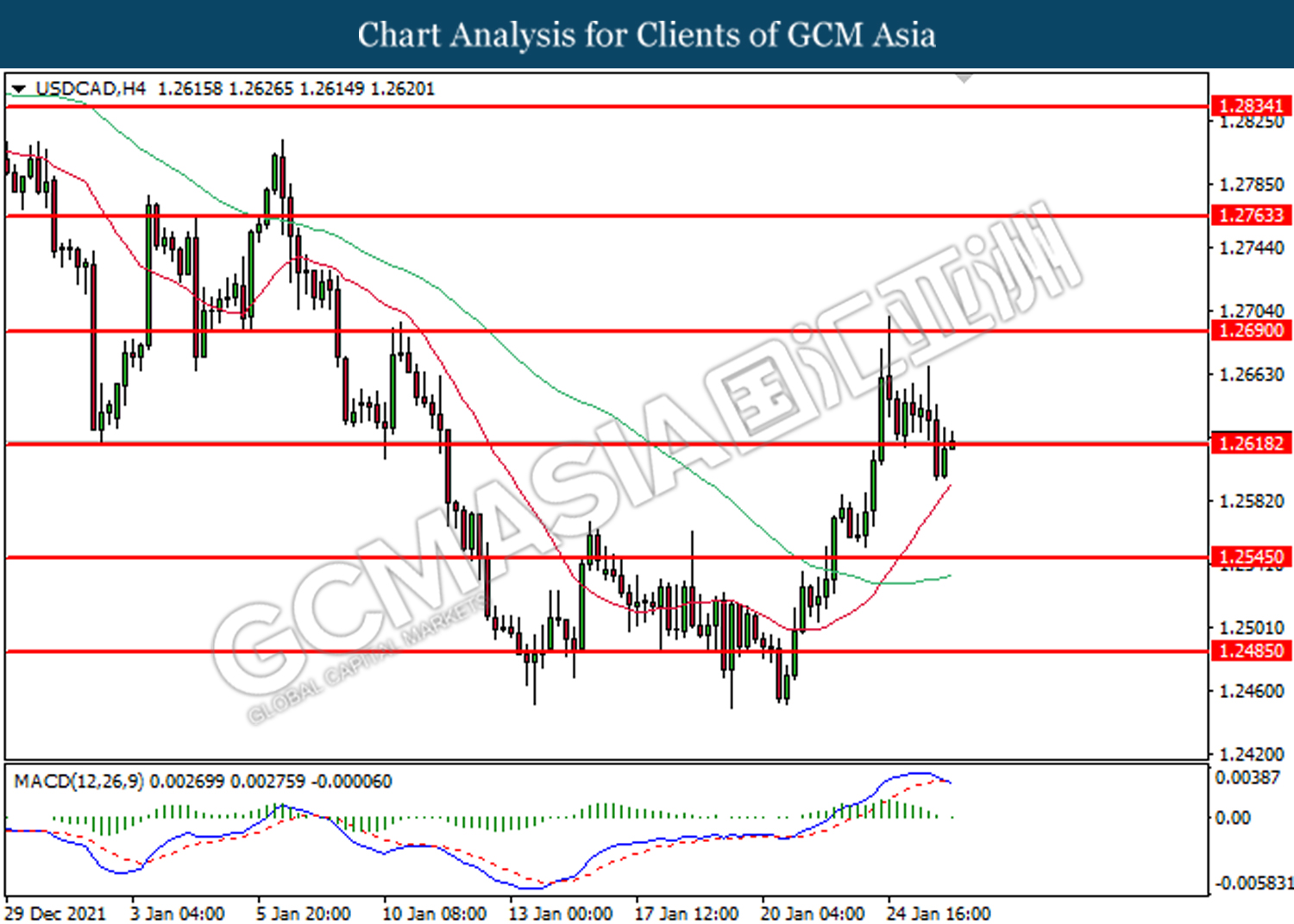

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2620.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 86.30, 87.40

Support level: 84.60, 82.65

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80