26 April 2023 Afternoon Session Analysis

The Aussie lost its ground after March CPI was released.

The Australian dollar lost its ground against the US dollar after the March Consumer Price Index (CPI) was released. In the first quarter, the CPI fell from 7.8% to 7.0%, slightly higher than market expectations of 6.9%. At the same time, the RBA lowered the average CPI from 1.7% to 1.2%, the second consecutive decline. However, the data showed persistently high price pressures in Australia. Prior to this, the Reserve Bank of Australia (RBA) left the cash rate unchanged at its last meeting as additional time was needed to gauge the tightening effect of high rates to filter into the economy, but the board members leave the door open for further tightening. With recent inflation still high, the RBA is under increased pressure to reconsider tightening policy further by 25 basis points. Besides, the Australian labor market remains tight at faster than expected pickup in population growth and wage growth giving more space for RBA to further tighten before opting to pause the rate hikes. Meanwhile, Investors are awaiting for upcoming Producer Price Index (PPI) release on Friday to get more clues for the next RBA’s moves. As of writing, the pair of AUD/USD slipped by -0.17% to $0.6615 as the rise of safe-haven demand strengthened the US dollar.

In the commodities market, crude oil prices rebounded by 0.52% to $77.47 per barrel following a prior crude oil price dip of 2% of banking sector jitters and stronger on the US dollar. Besides, gold prices depreciated by -0.12% to $1994.64 per troy ounce as of writing amid the investors locked their profits after the gold price rose yesterday as economic jitters.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.2% | -0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.581M | -1.486M | – |

Technical Analysis

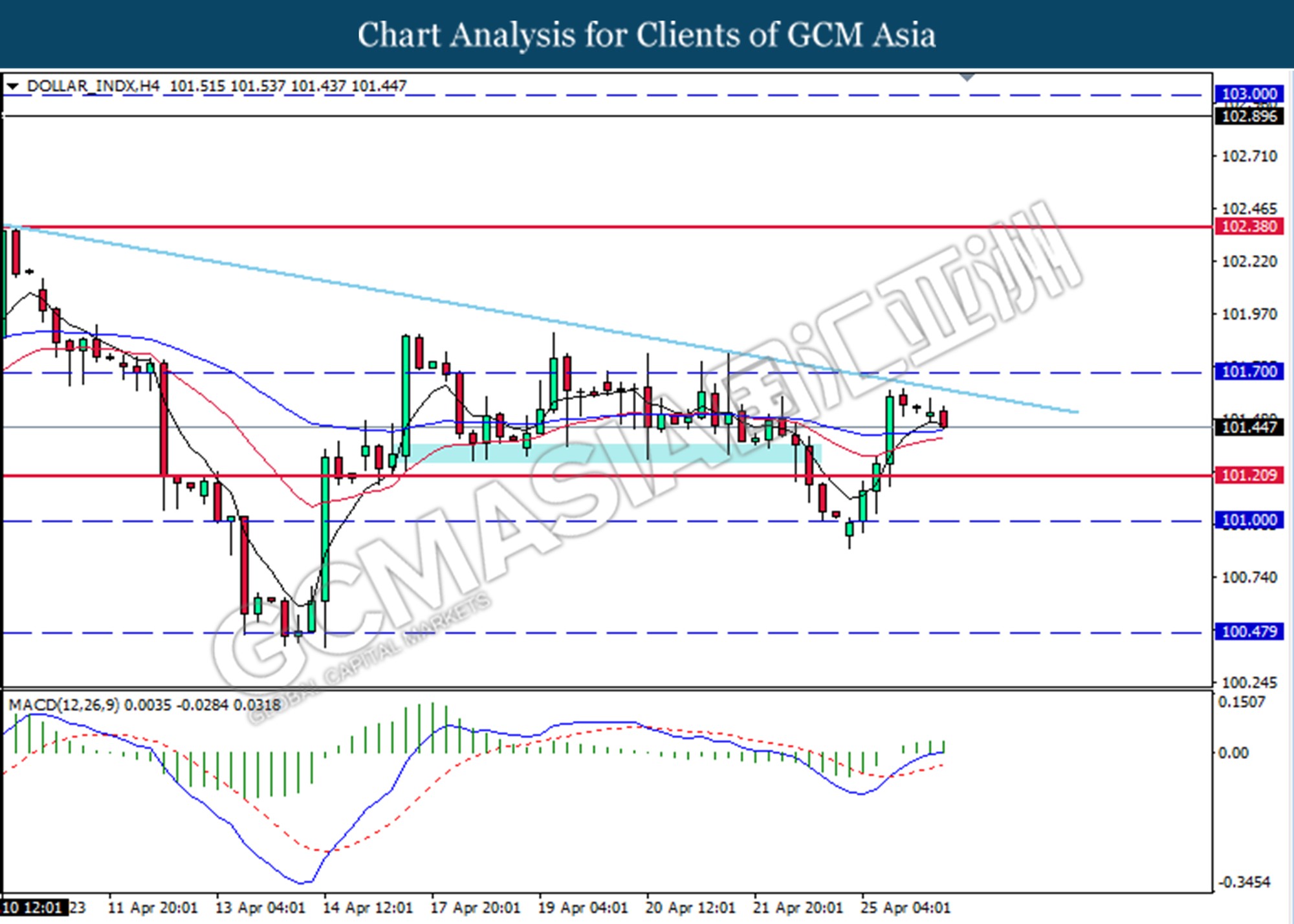

DOLLAR_INDX, H4: Dollar index was traded lower following from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.20

Resistance level: 101.70, 102.40

Support level: 101.20, 101.00

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2445.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

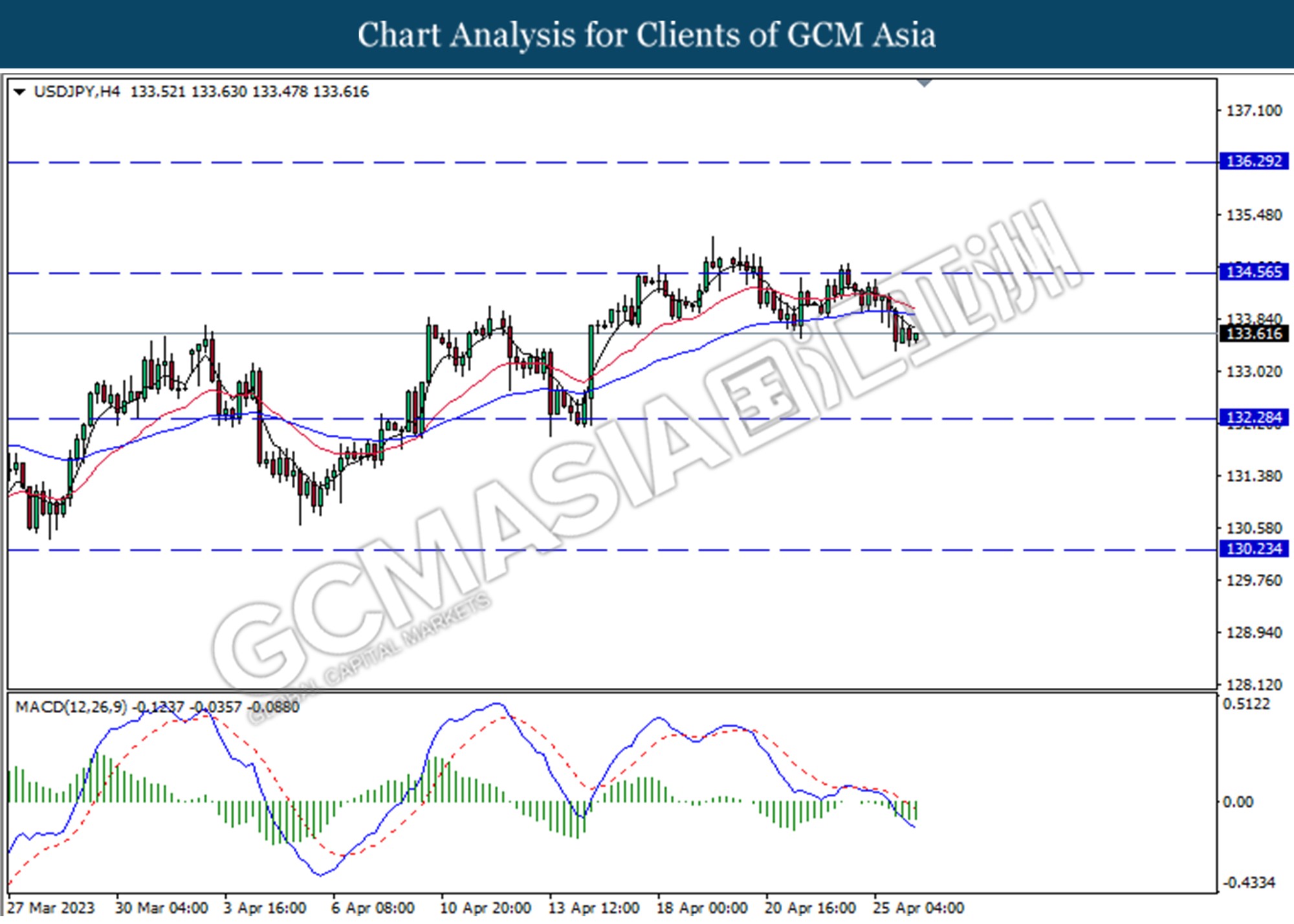

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 134.55. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6600. MACD which illustrated bearish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525.

NZDUSD, H4: NZDUSD was traded lower a prior retracement from the resistance level at 0.6195. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6120

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

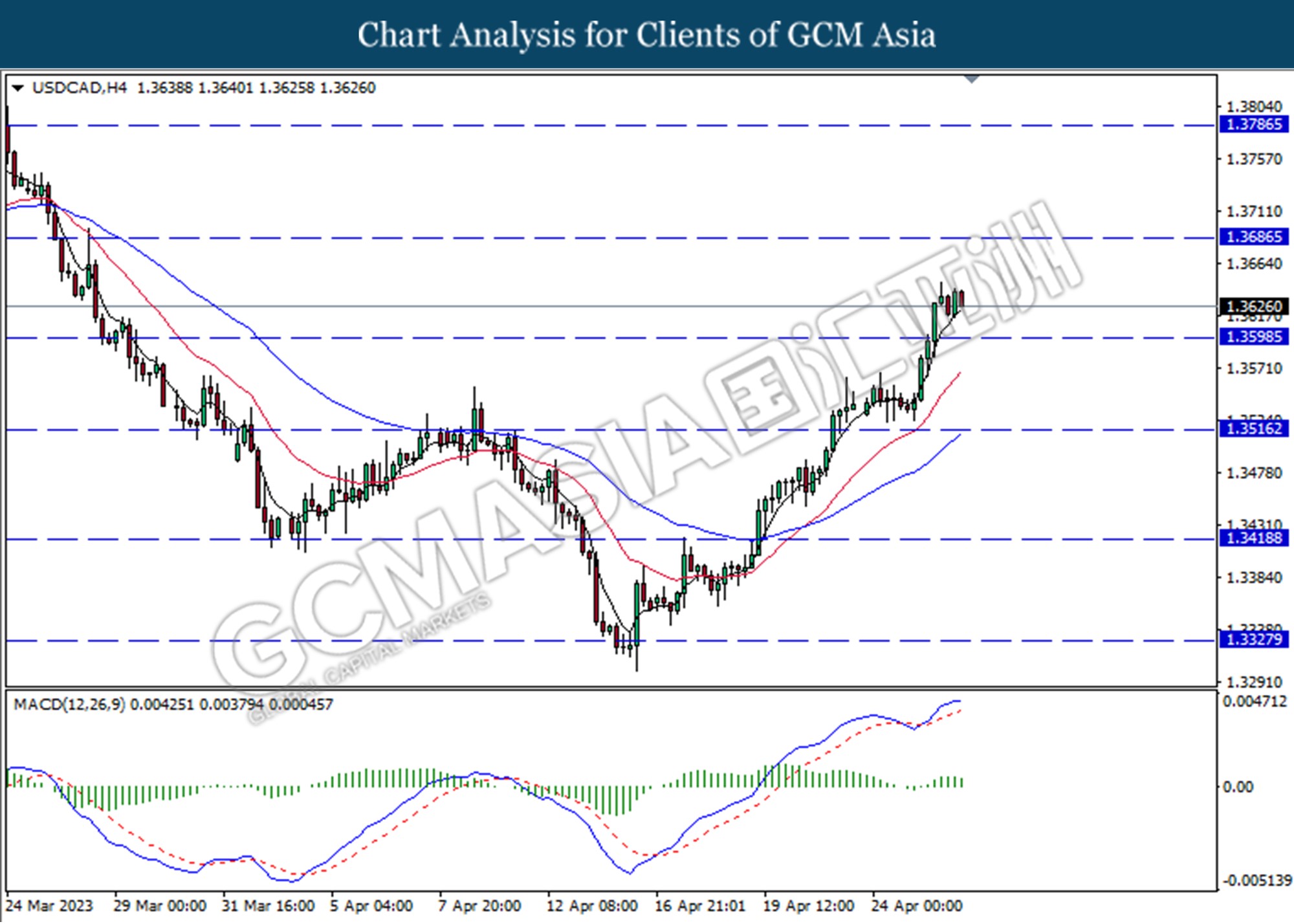

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3600. However, MACD which illustrated diminishing bullish momentum suggests the pair traded lower as a technical correction.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

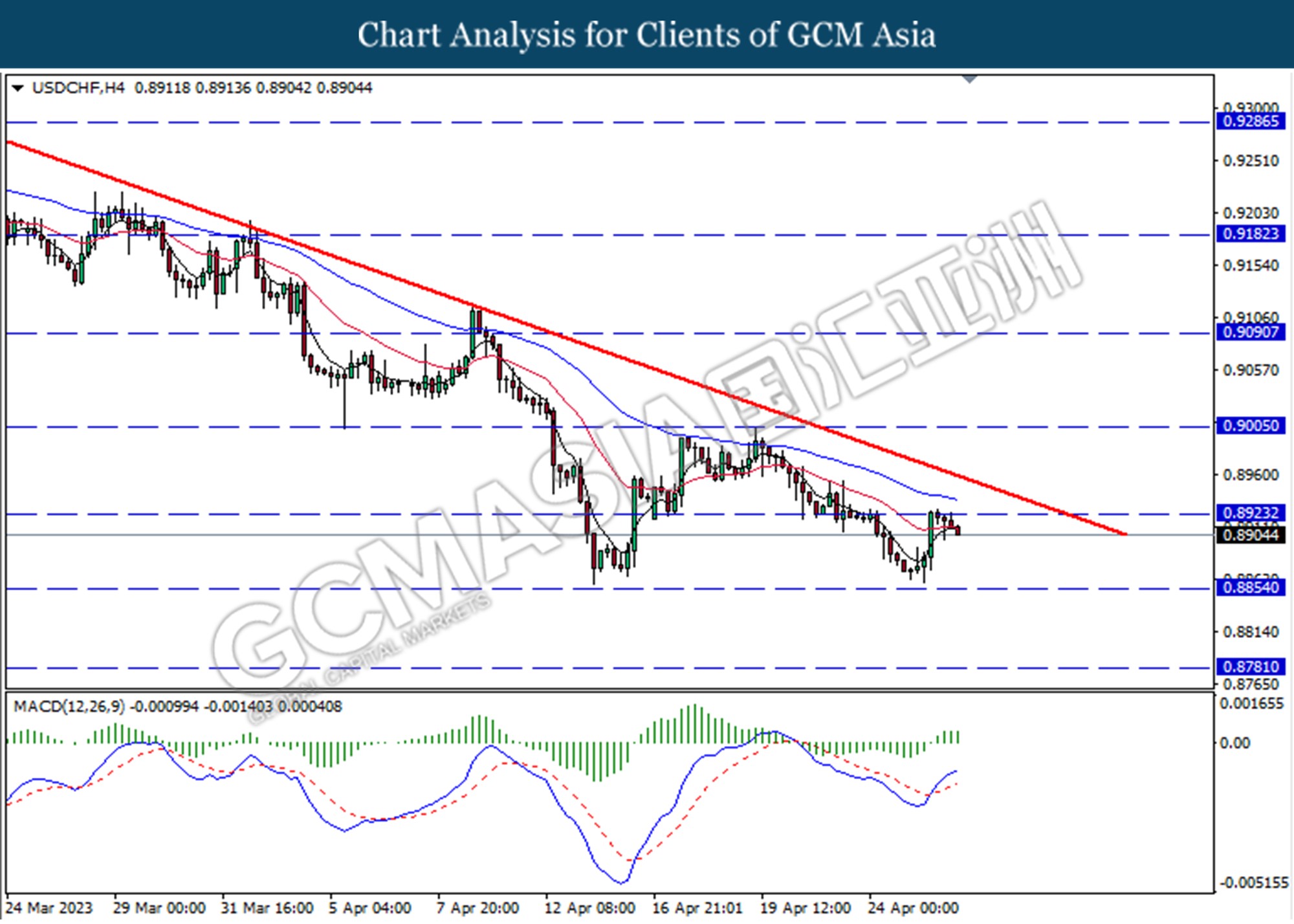

USDCHF, H4: USDCHF was USDCHF was traded lower following a prior retracement from the resistance level at 0.8925. However, MACD which illustrated bullish momentum suggests the pair traded higher as technical correction.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

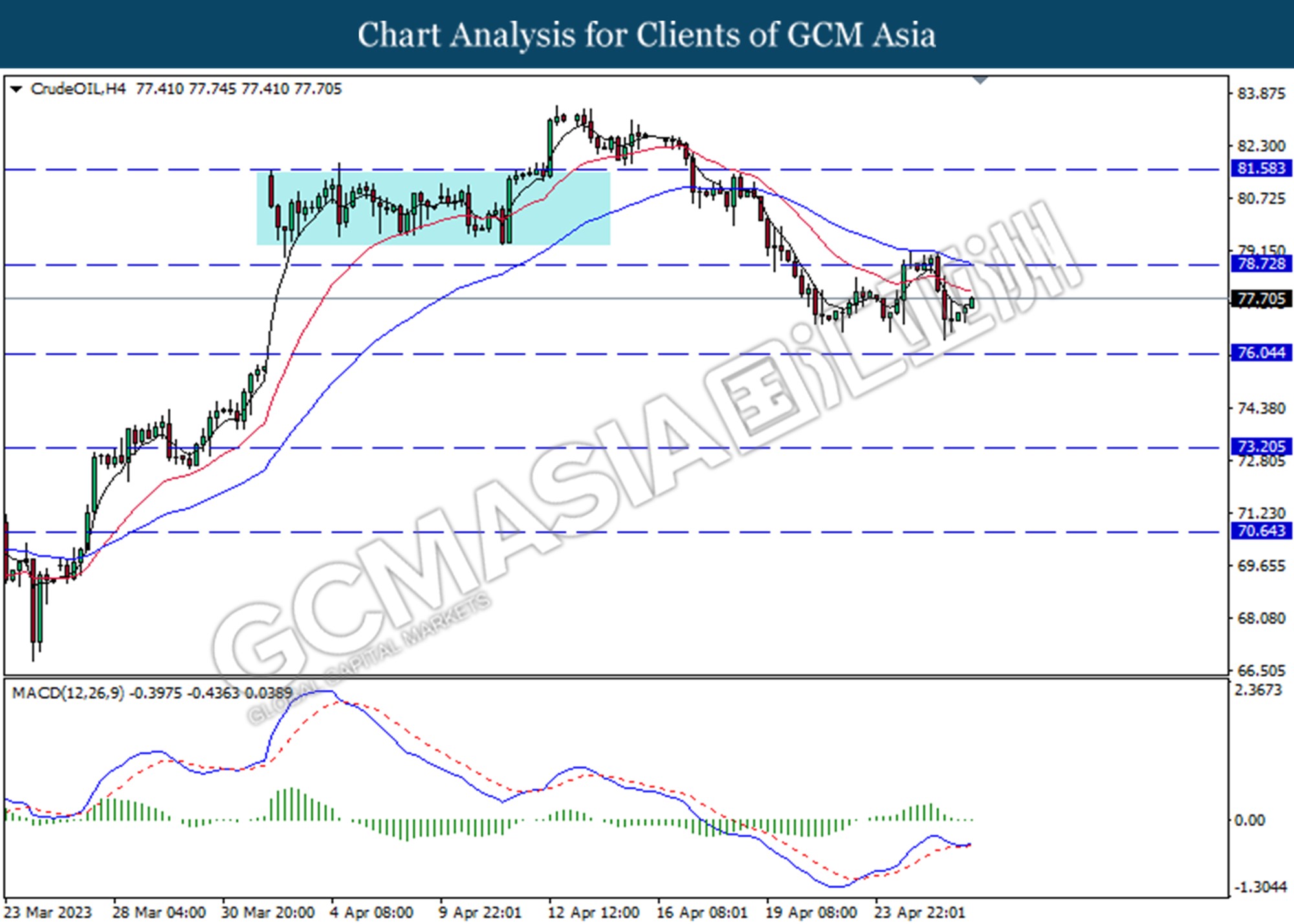

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair traded lower as technical correction.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

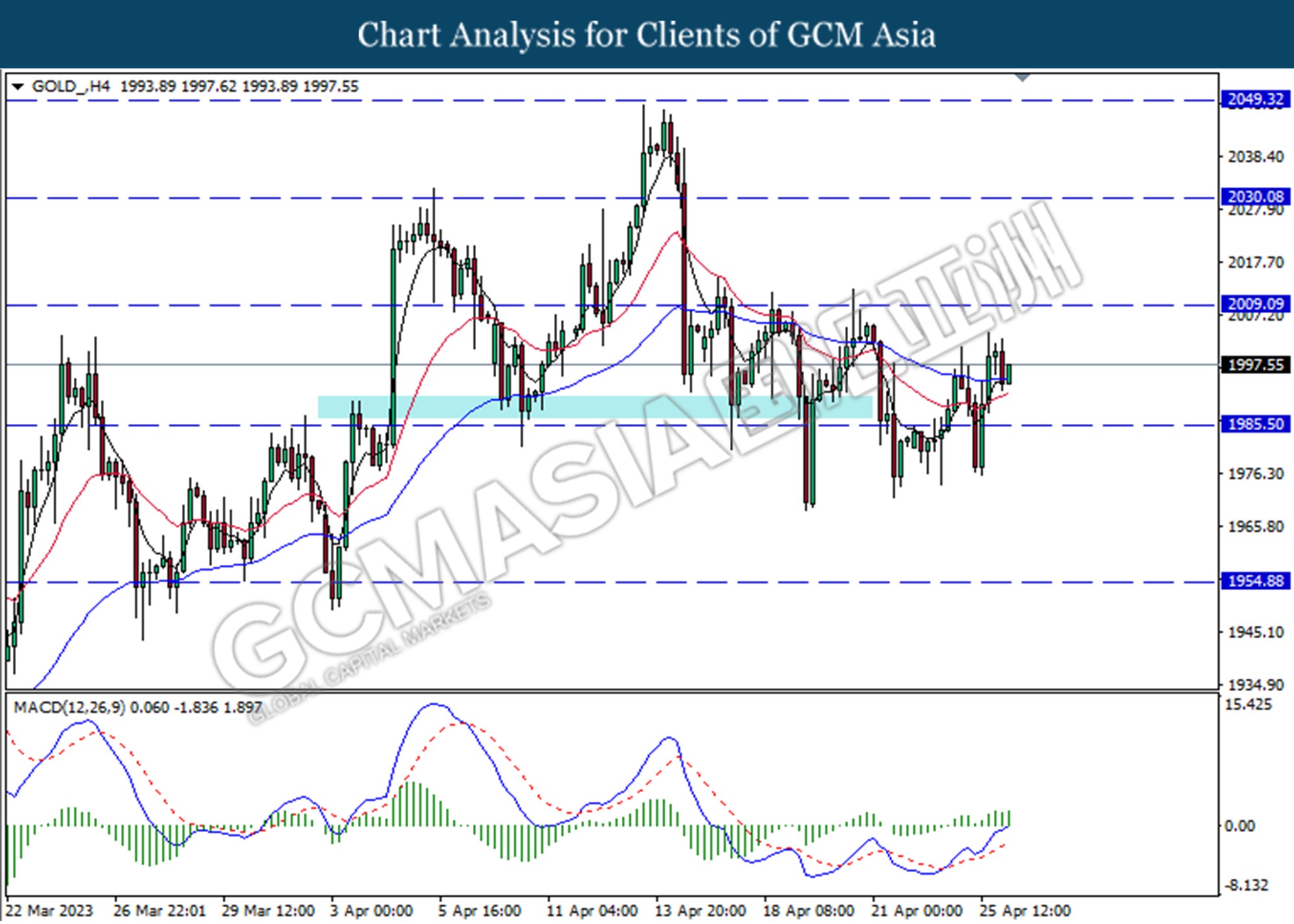

GOLD_, H4: Gold price was traded higher following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity traded higher as technical correction.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90