26 April 2023 Morning Session Analysis

Elevated risk aversion boosted the US dollar.

The dollar index, which was traded against a basket of six major currencies, managed to regain its luster yesterday as the market sentiment turned risk-averse, prompting investors to flock to safe-haven assets. The lower risk appetite around the market was mainly attributed to the investors’ concern over the prospect for the global economy, especially since the inflationary pressures in nation such as the UK and EU were still high. Besides, the US dollar experienced a further rise in value after the mixed economic data were released. Among them, the New Home Sales and Building Permit data out beat the consensus forecast, while the CB Consumer Confidence posted a disappointing result yesterday. According to the Conference Board, the US Consumer Confidence Index fell to 101.3, down from 104.0 in March, but the reading is still above the crucial level of 100. Nevertheless, it is noteworthy to highlight that the lower-than-expected consumer confidence data showed that the consumers became more pessimistic about the outlook for both business conditions and labor markets compared to last month. As of writing, the US dollar rose by 0.49% to 101.85.

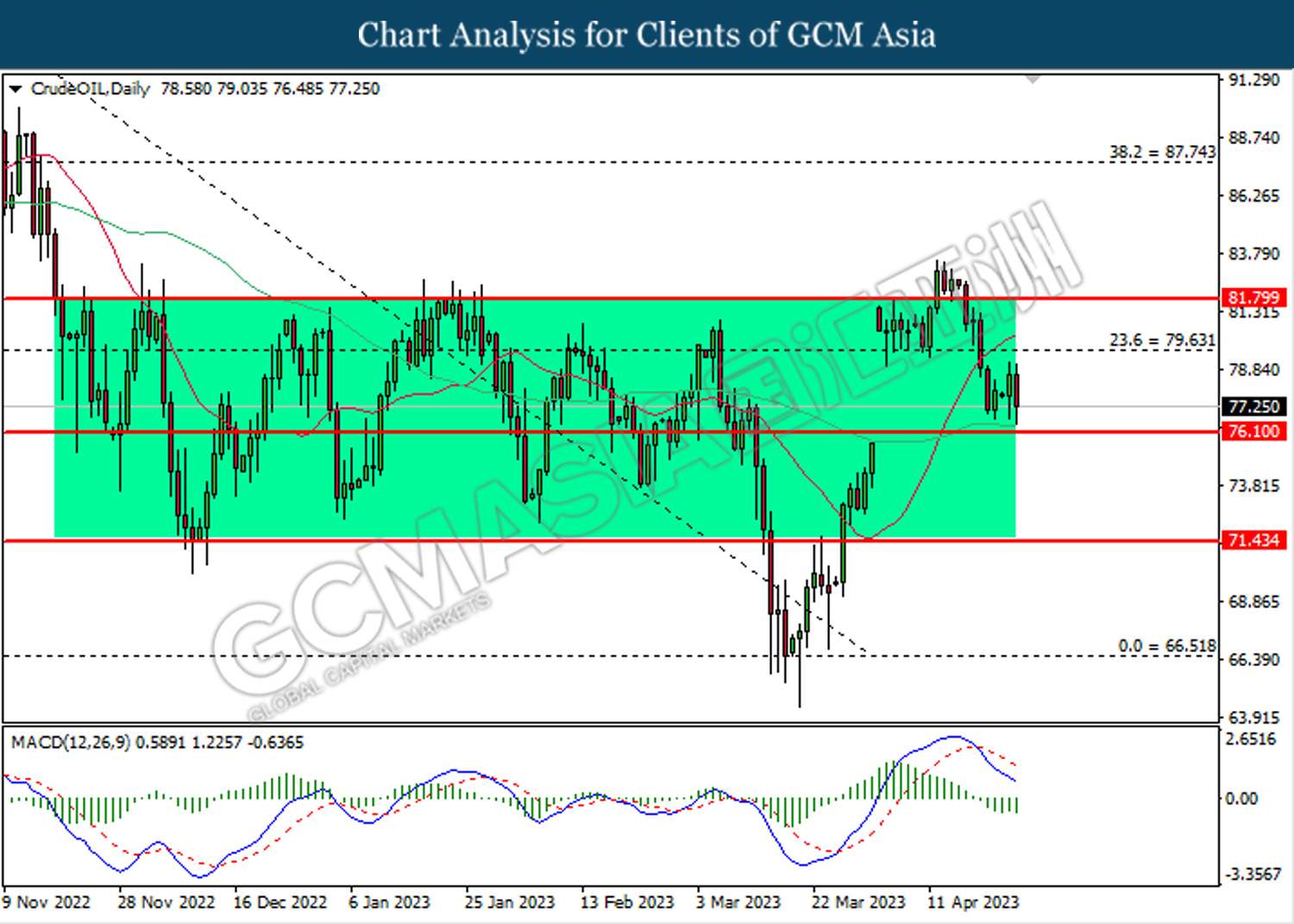

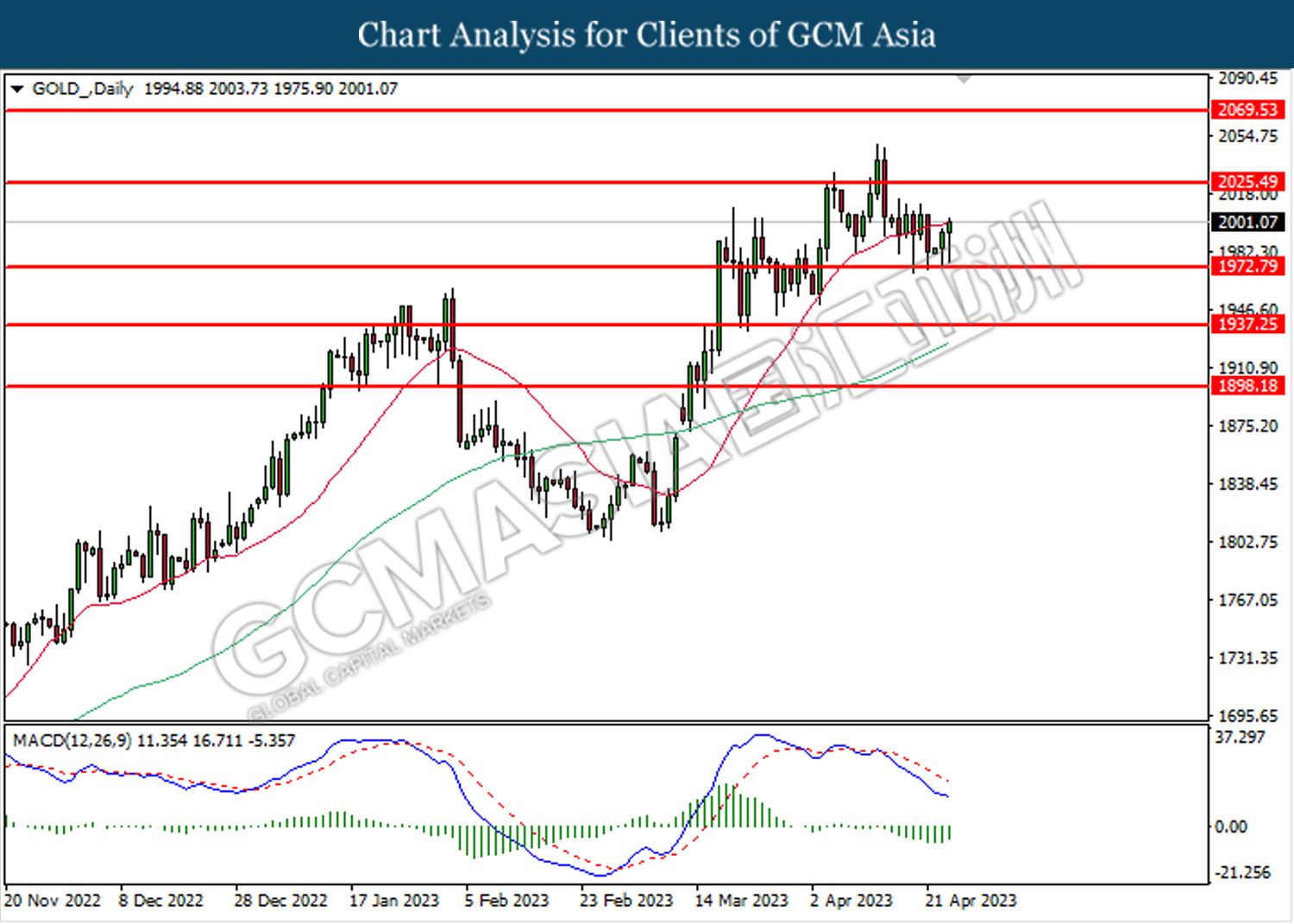

In the commodities market, crude oil prices were up by 0.25% to $77.35 per barrel following the slight retracement in the US dollar market despite API weekly Crude Oil Stock data showing a large crude draw. Besides, gold prices edged up by 0.11% to $1999.45 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.2% | -0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.581M | -1.486M | – |

Technical Analysis

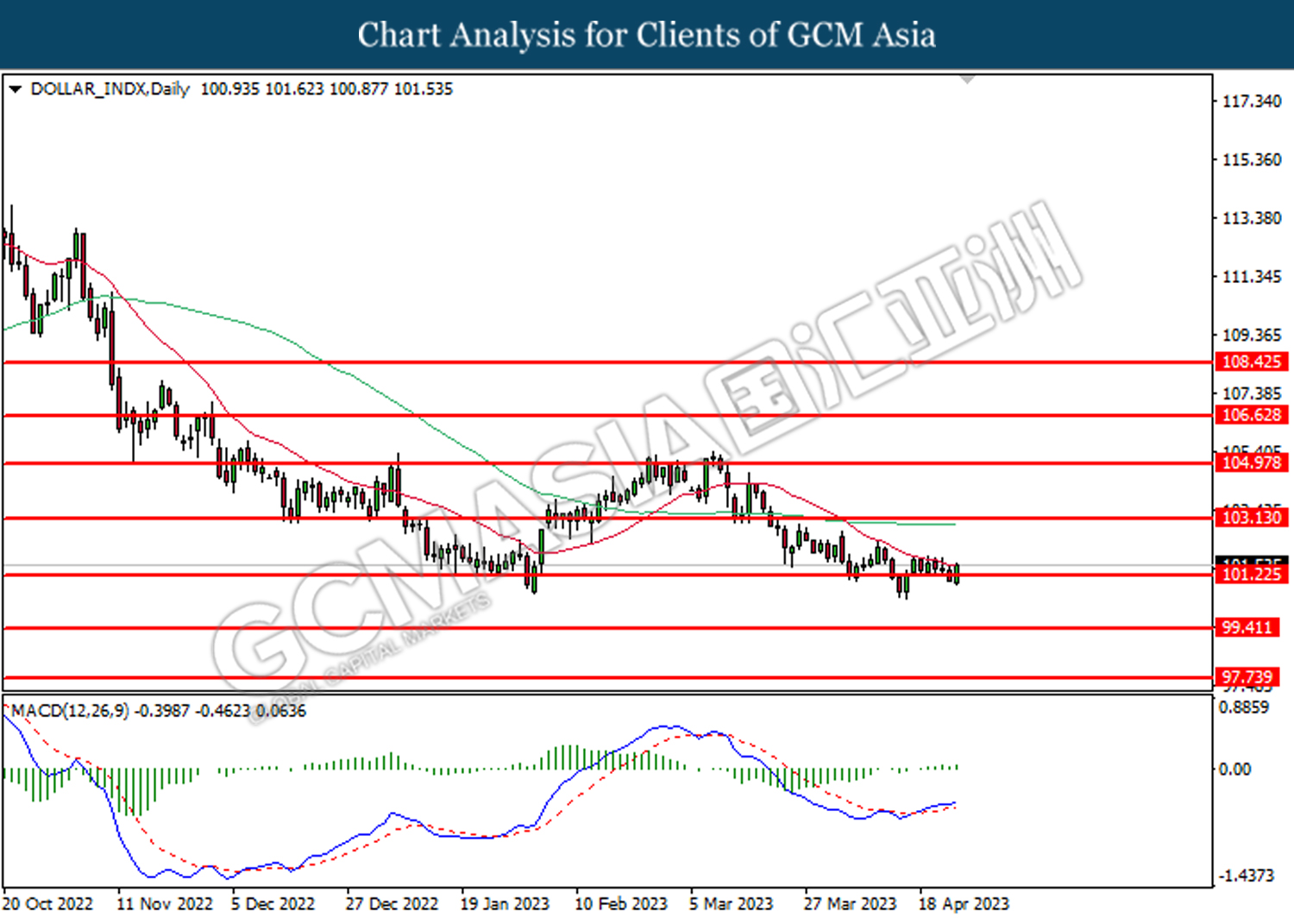

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

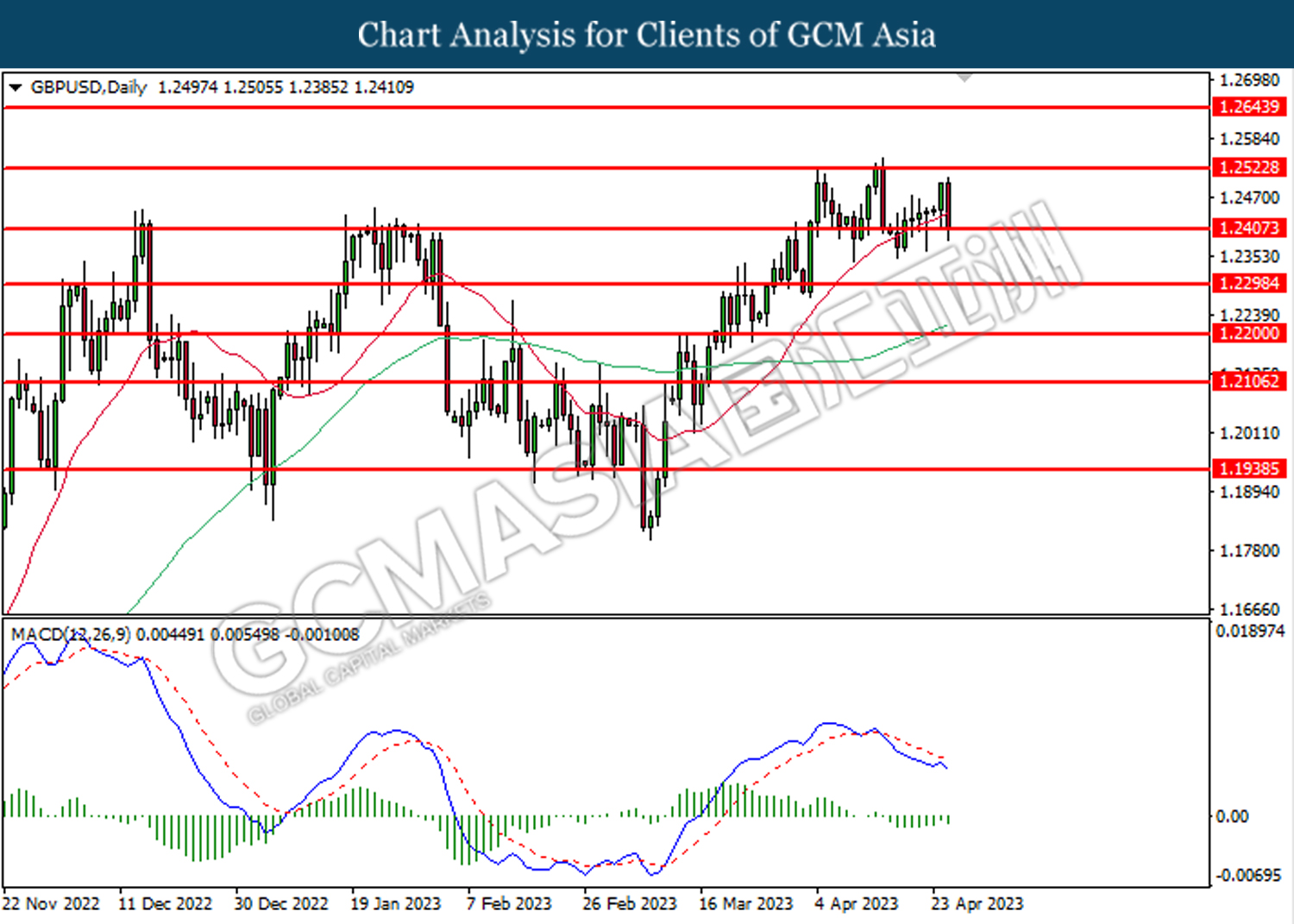

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

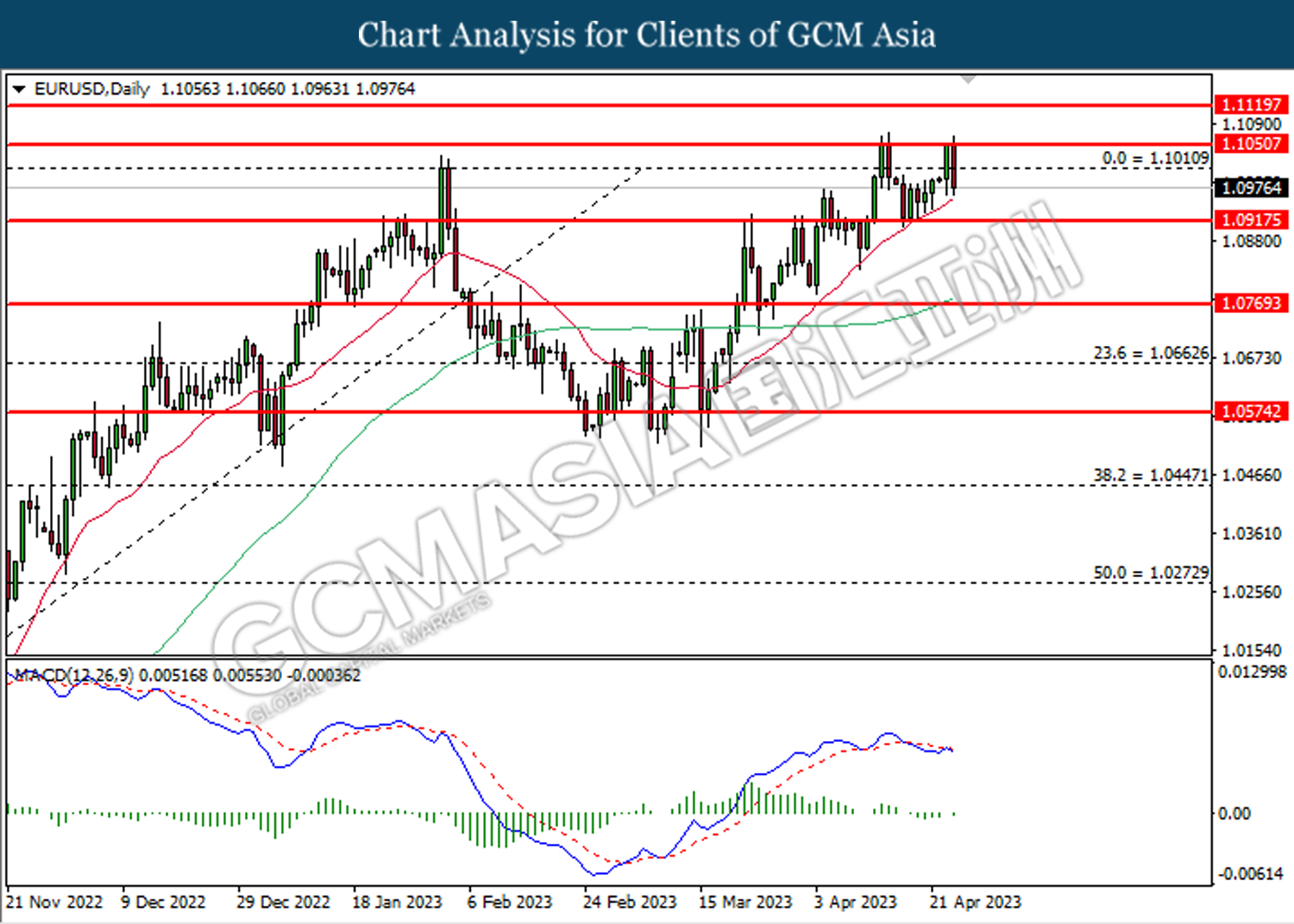

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

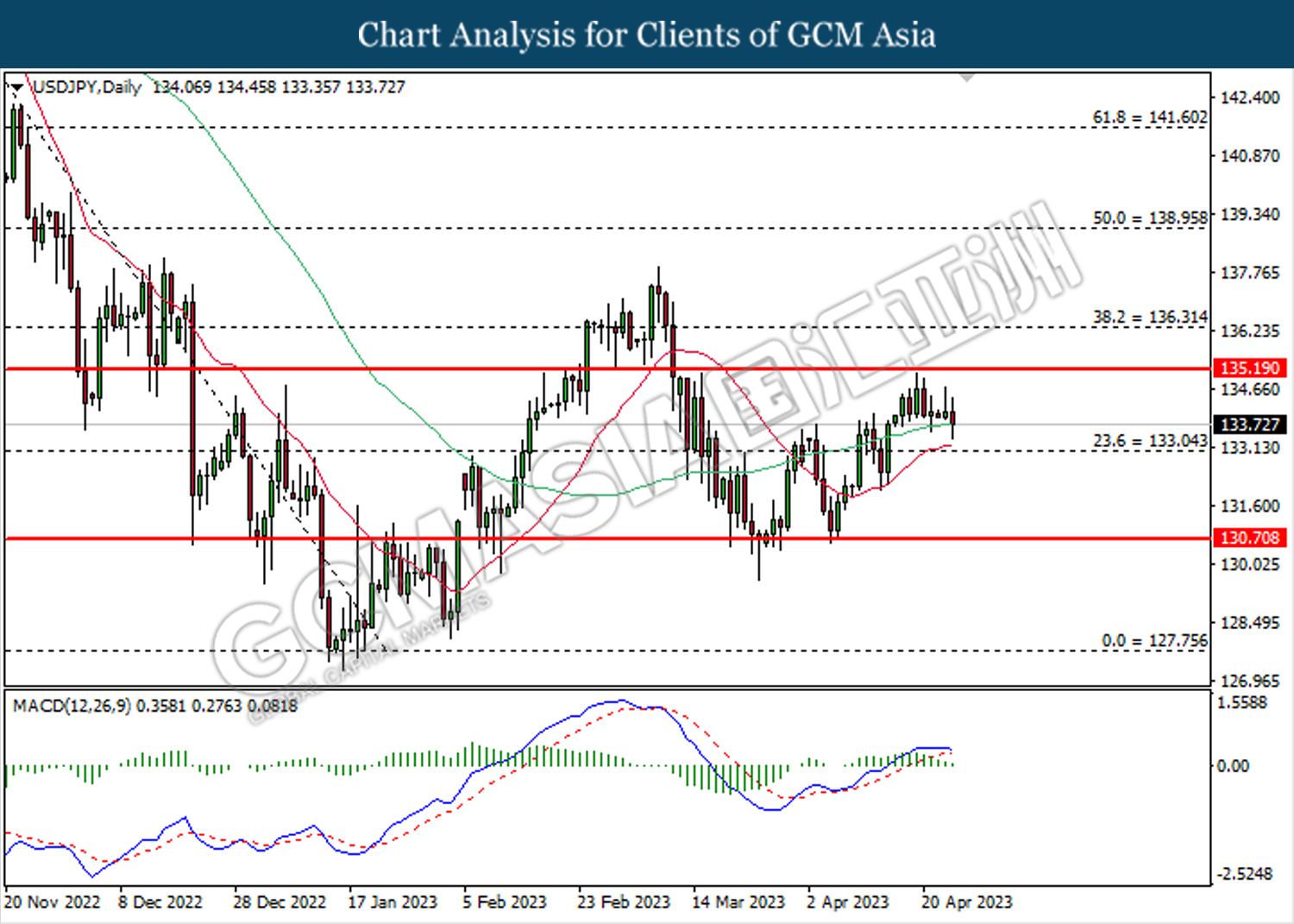

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

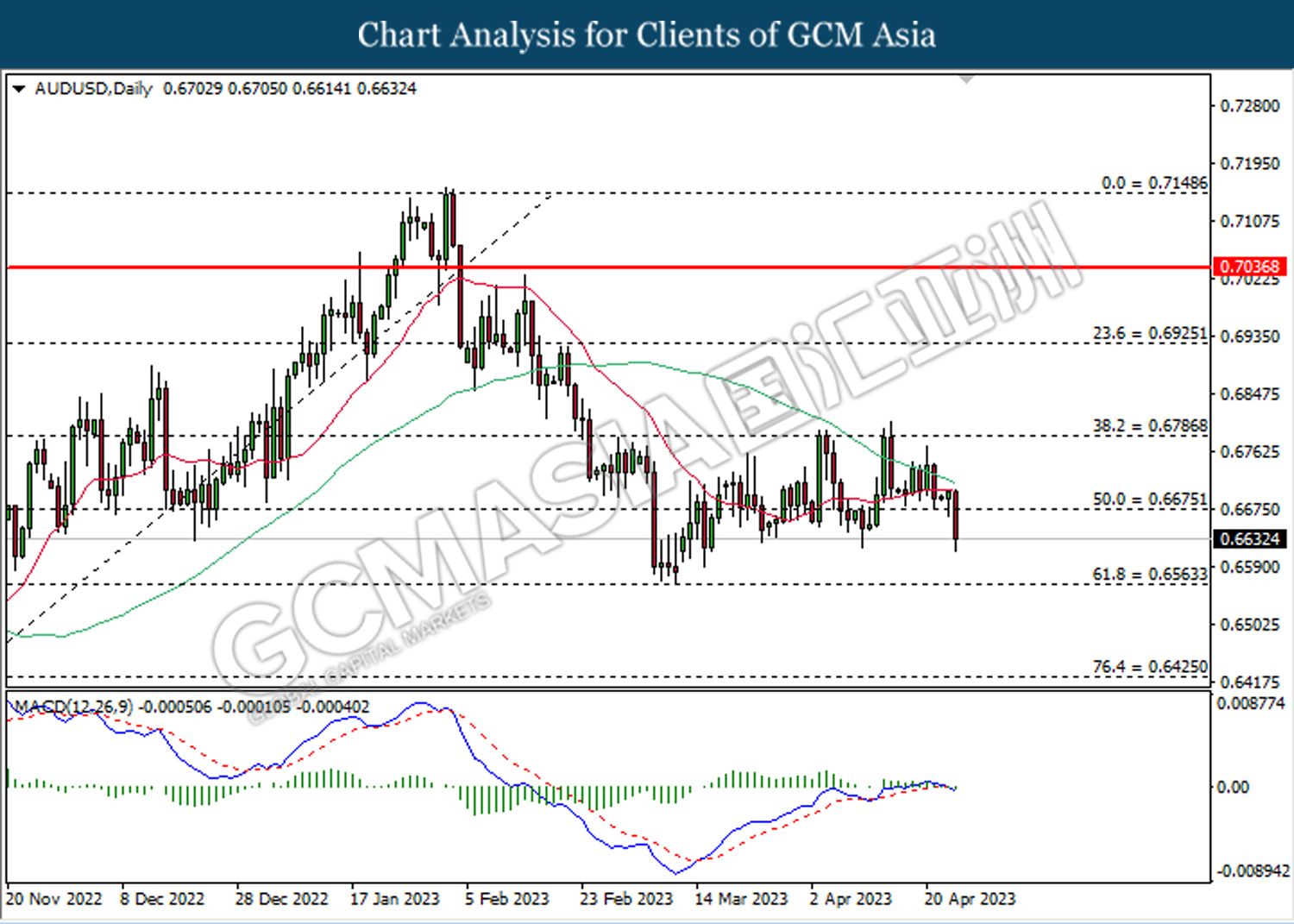

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

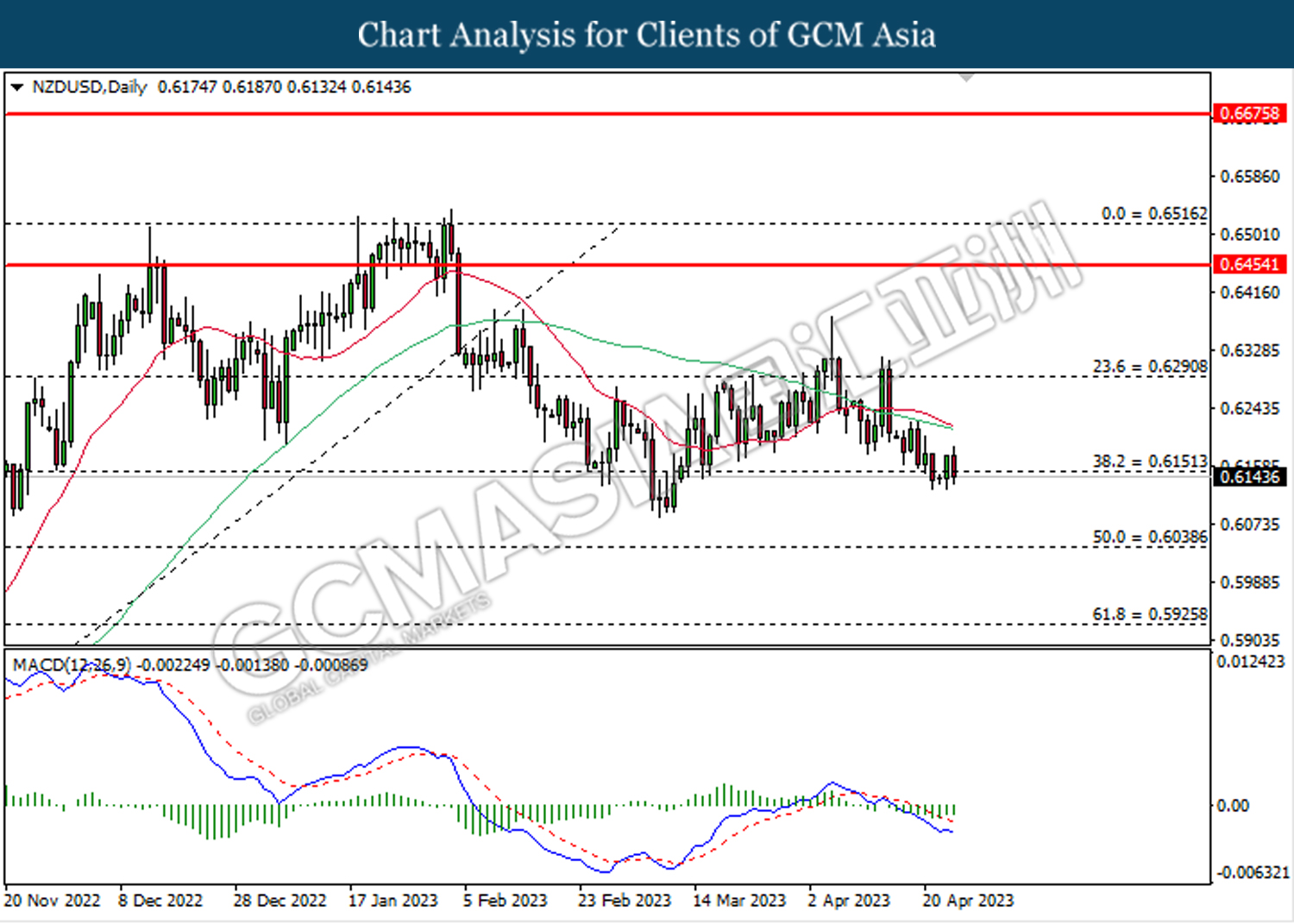

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

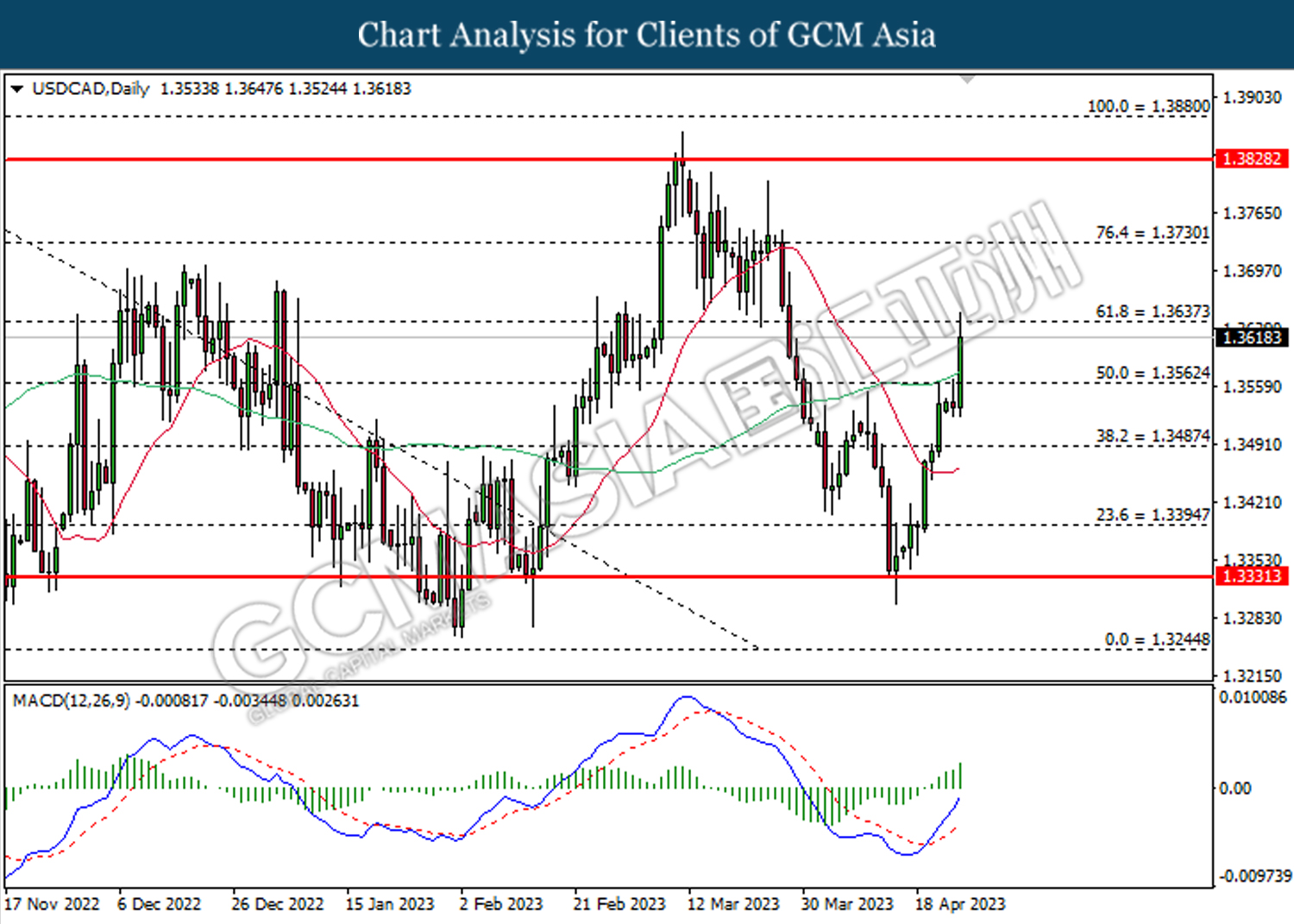

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

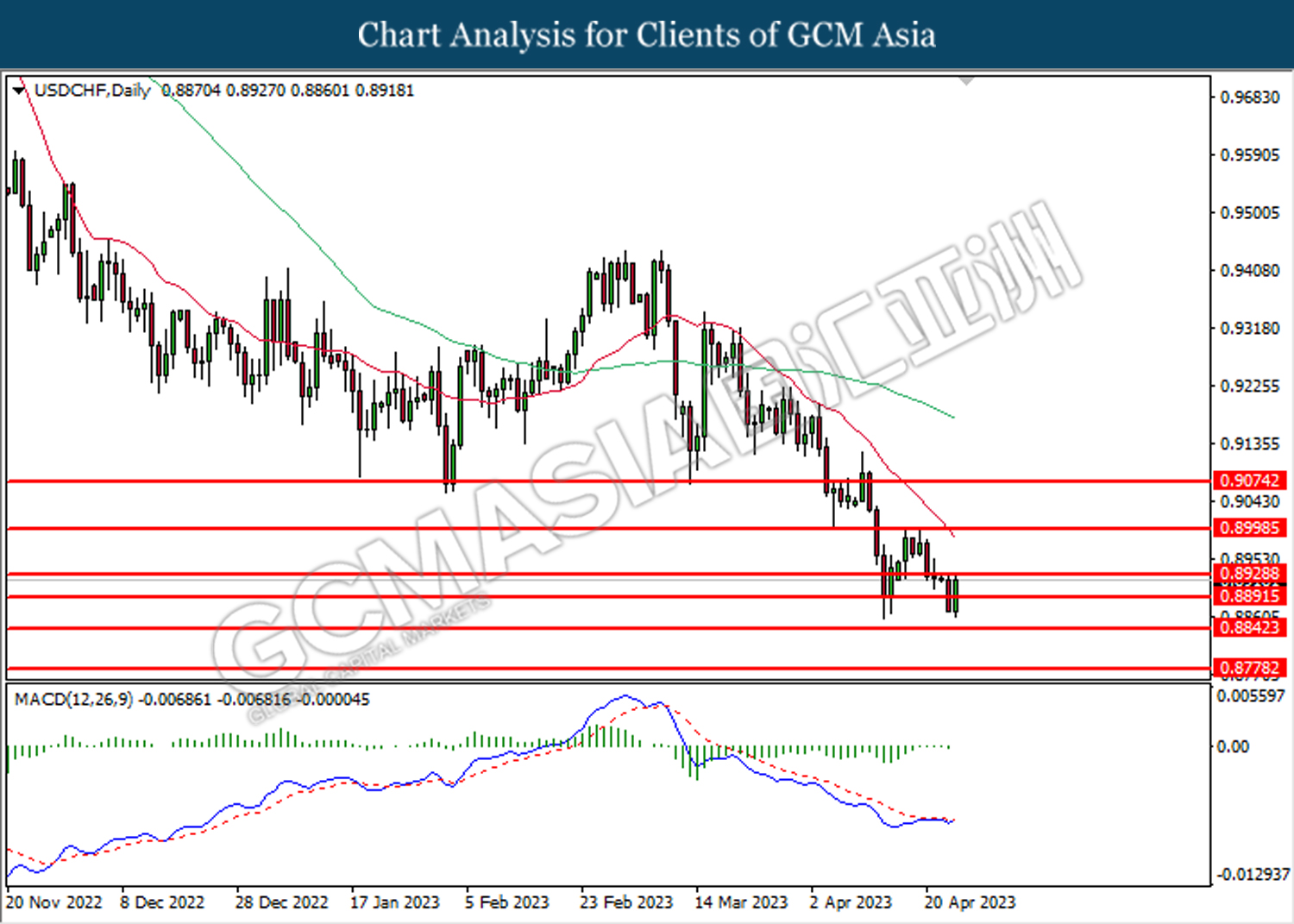

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 79.65.

Resistance level: 79.65, 81.80

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25