26 May 2022 Afternoon Session Analysis

Euro rallied amid the ECB hawkish speech.

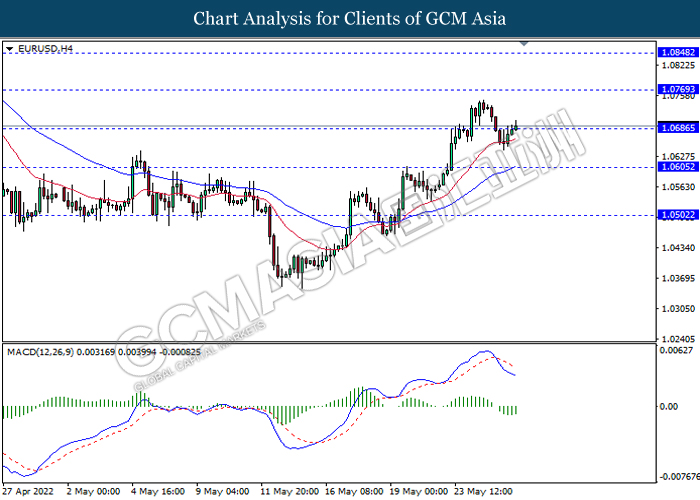

The Euro rebounded from its recent low on Thursday amid the backdrop of the European Central Bank (ECB) hawkish tone. According to CNBC, ECB President Christine Lagarde had claimed that the ECB could increase rates in July and “be in a position to exit negative interest rates by the end of the third quarter.” The rate hike implementation from ECB would likely to increase the risk-off return of investors, sparkling the appeal of Euro. Besides, the slump of US Dollar had spurred further bullish momentum on the EURUSD. According to CNBC, Federal Reserve officials appeared a statement on FOMC meetings early today, which claimed that the need to raise interest rates quickly and possibly more than markets anticipate to tackle a burgeoning inflation problem. Not only did policymakers see the need to increase benchmark borrowing rates by 50 points, but they also said similar hikes likely would be necessary at the next several meetings. Despite Fed unleashed its speech which it would increase interest rate in future, the market participants had digested the information as the rate hike implementation was within market expectation, which prompting investors to invest in other currencies which having better prospects such as Euro. As of writing, EURUSD appreciated by 0.21% to 1.0701.

In the commodities market, crude oil price edged up by 0.55% to $110.94 per barrel as of writing following the tight supply concern of the European Union (EU) wrangles with Hungary over plans to ban imports from Russia. On the other hand, gold price appreciated by 0.19% to $1849.20 per troy ounces as of writing over the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | -1.4% | -1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 218K | 213K | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | 2.1% | 2.0% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Apr) | -1.2% | -1.9% | – |

Technical Analysis

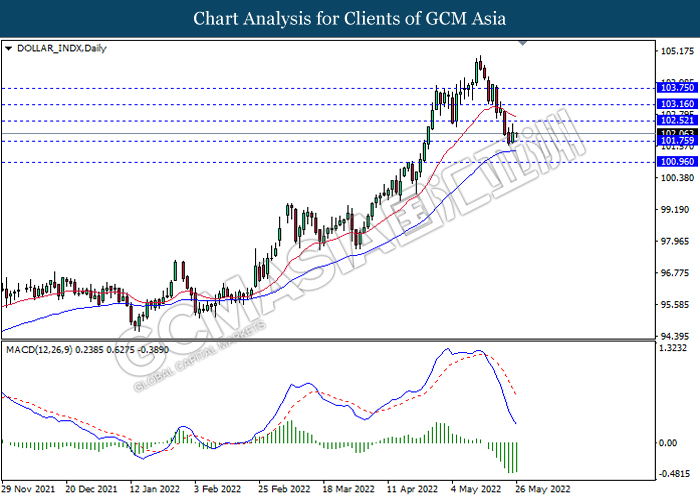

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

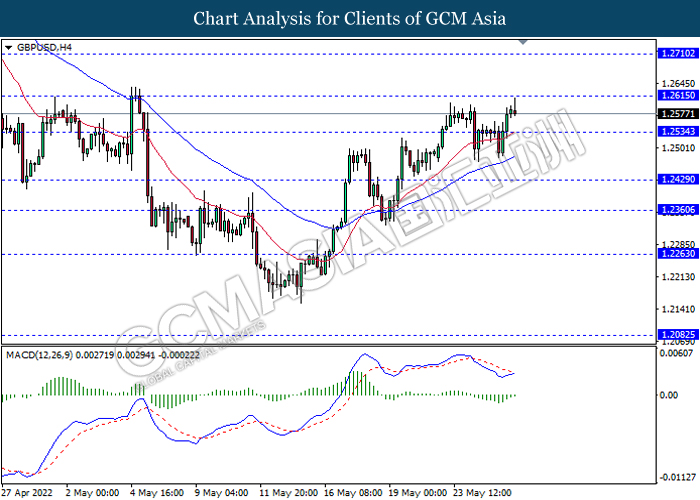

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

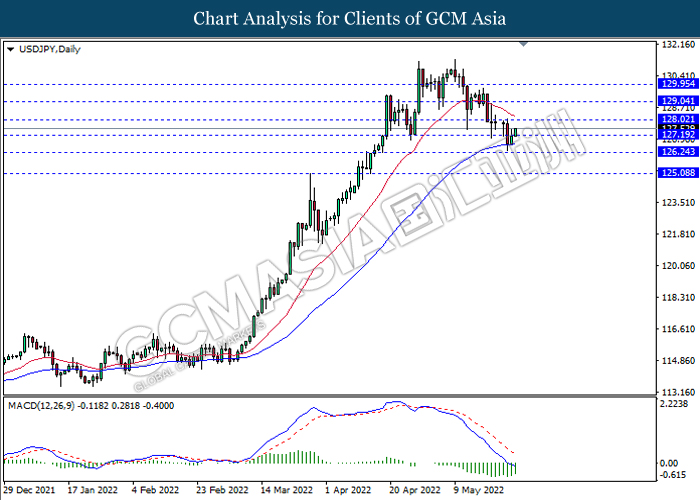

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

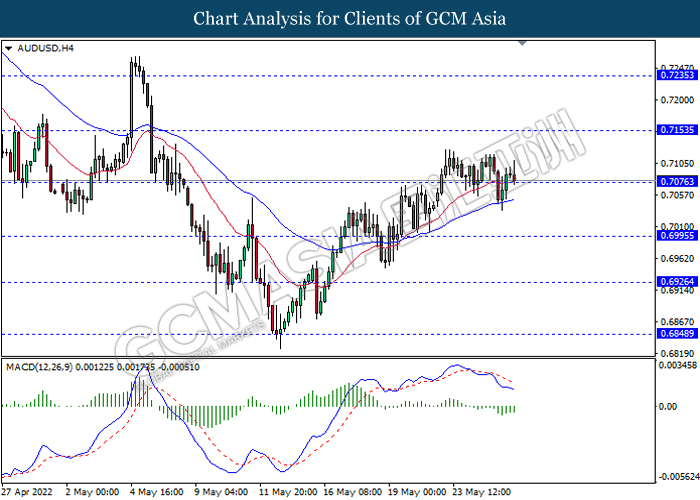

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

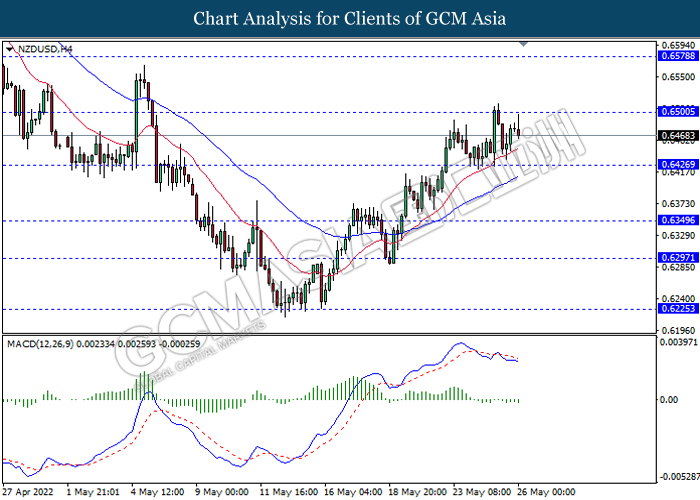

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

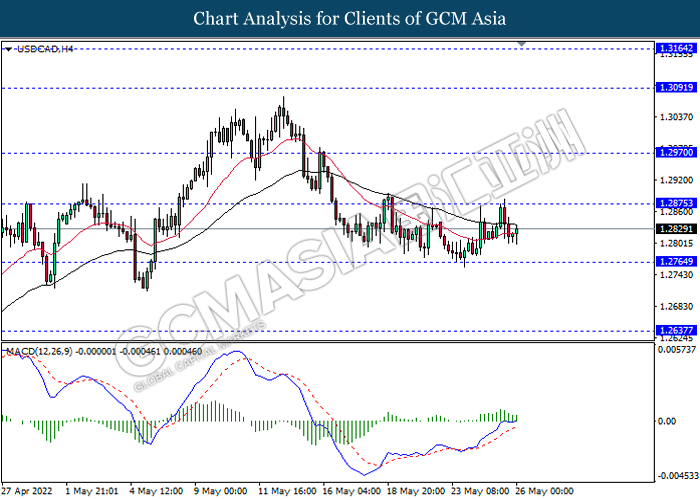

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

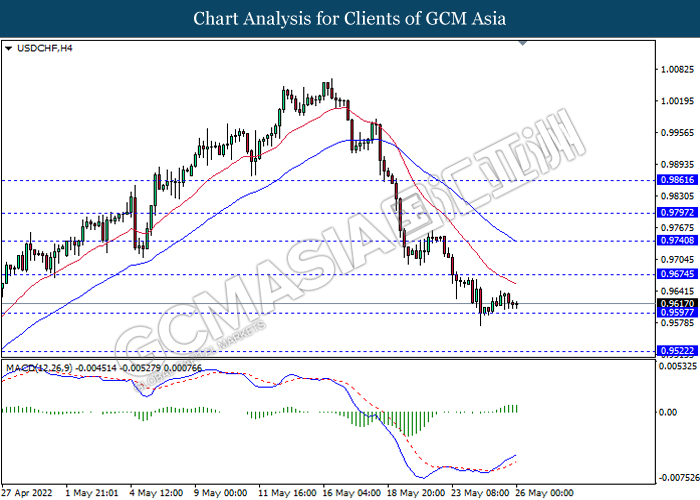

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

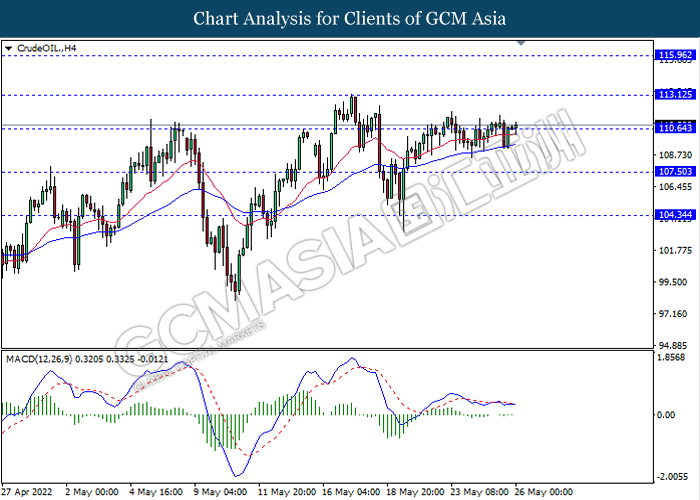

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

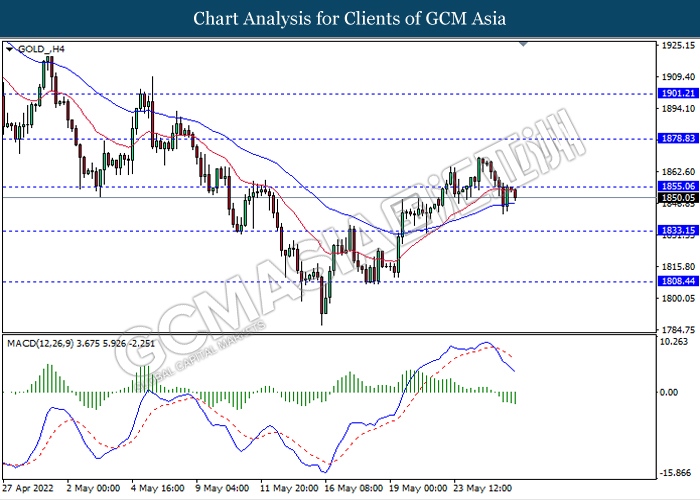

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45