26 May 2022 Morning Session Analysis

US Dollar slumped as Fed meeting minutes aligned with market expectation.

The Dollar Index which traded against a basket of six major currencies retreated following the released of the FOMC meeting minutes from Federal Reserve. The Federal Reserve policymakers agreed that the Fed should act “expeditiously” on their contractionary monetary policy to combat the spiking inflation rate in short-term basis. Nonetheless, they also reiterated that the Fed could be well positioned for a pause on rate hike decision later this year as they expected the global inflation risk would start to stabilize following the supply disruption issues solved. Recently, the bearish economic data had appeared to reduce the support for hawkish tone from Fed. Inflation rate expectations have been predicted lower, and tightening financial conditions are beginning to jeopardize the market demand in key sectors of the economy including housing and manufacturing industry. Investors currently would continue to scrutinize the lates updates with regards of further economic data to gauge the likelihood movement for US Dollar. As of writing, the Dollar Index depreciated by 0.21% to 102.05.

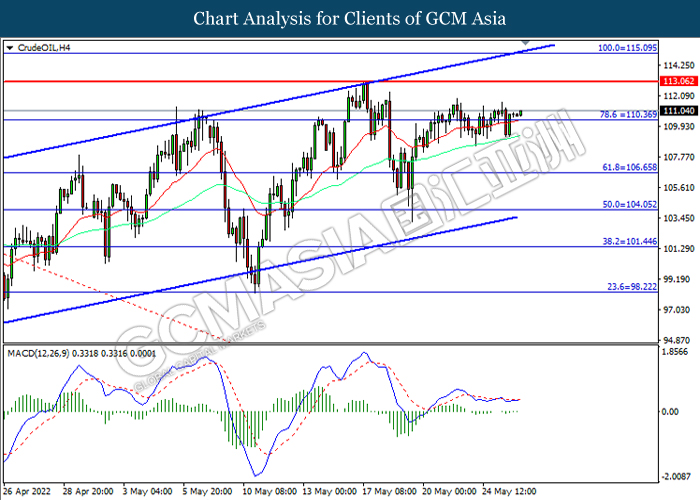

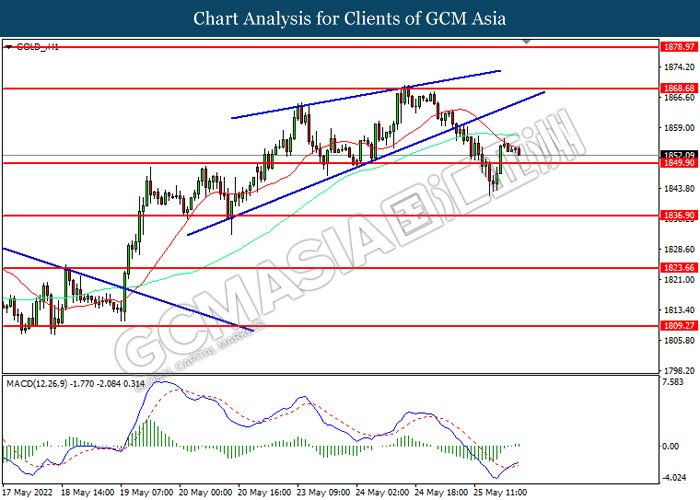

In the commodities market, the crude oil price surged 0.03% to $112.25 per barrel as of writing. The oil market received bullish momentum over the backdrop of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil inventories came in at -1.1019M, better than the market forecast at -0.737M. On the other hand, the gold price depreciated by 0.01% to $1853.75 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | -1.4% | -1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 218K | 213K | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | 2.1% | 2.0% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Apr) | -1.2% | -1.9% | – |

Technical Analysis

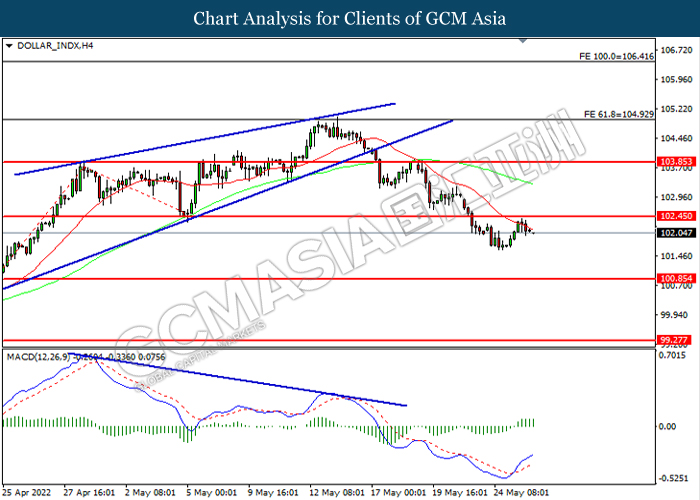

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

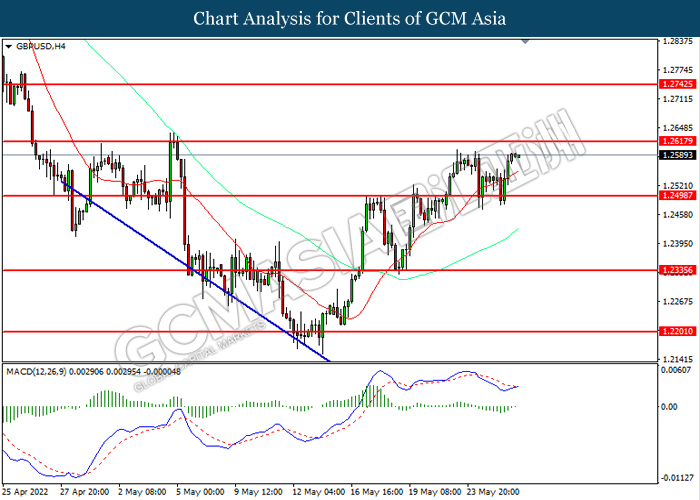

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2615, 1.2745

Support level: 1.2500, 1.2335

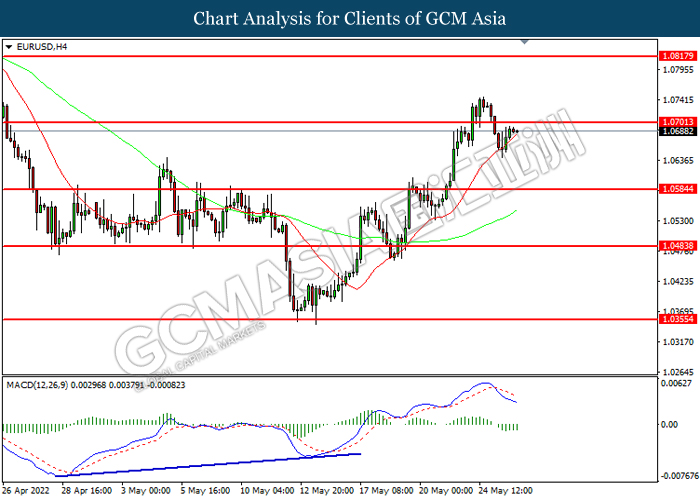

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0700, 1.0815

Support level: 1.0585, 1.0485

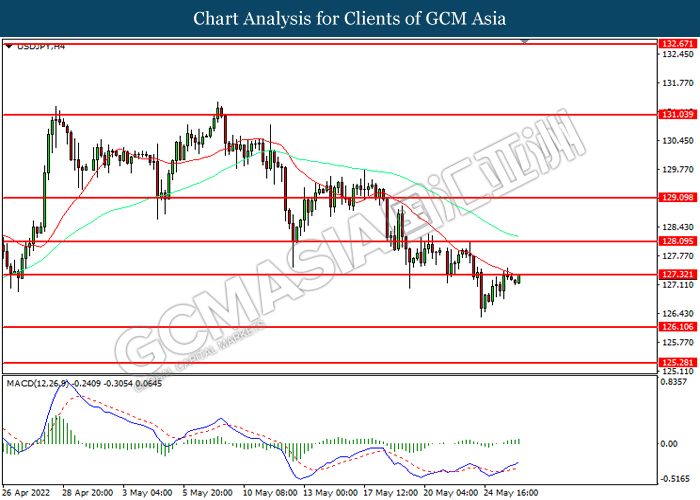

USDJPY, H4: USDJPY was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 127.30, 128.10

Support level: 126.10, 125.30

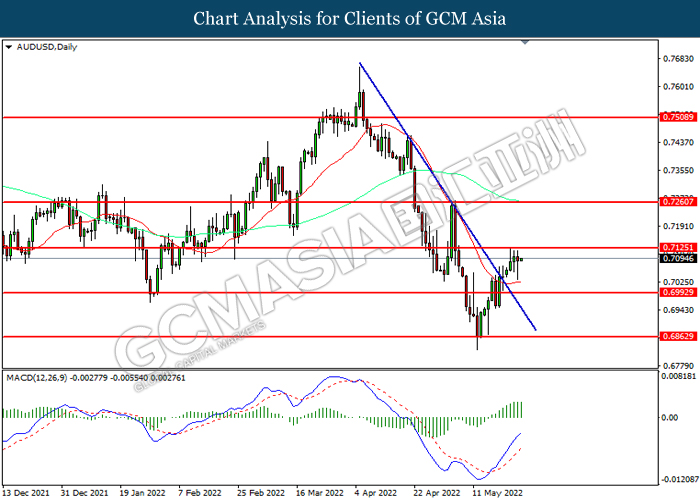

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7125, 0.7260

Support level: 0.6995, 0.6865

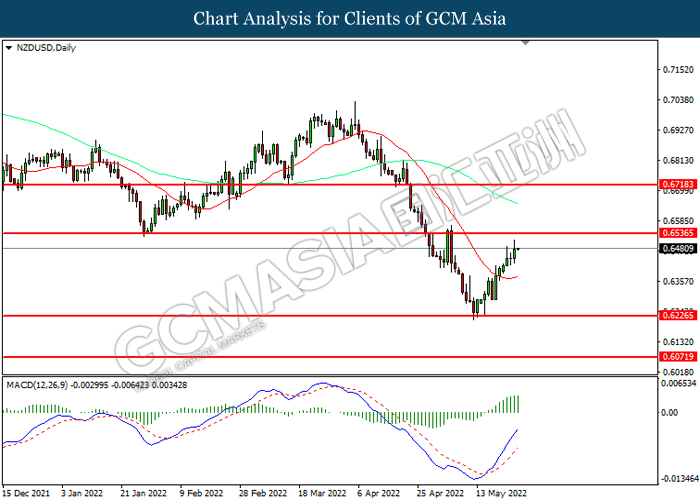

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

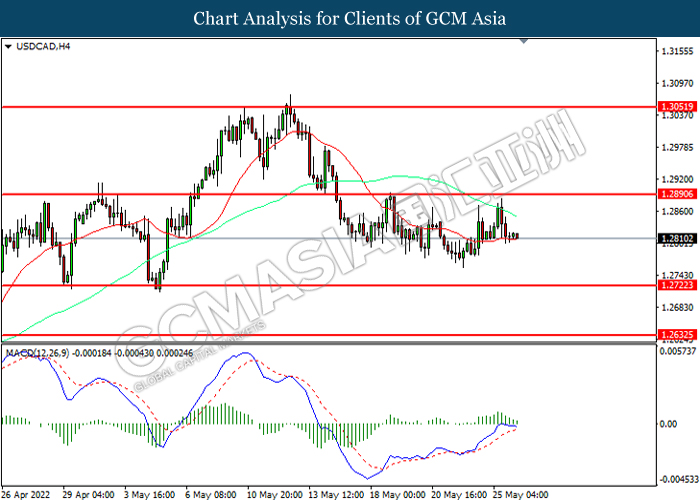

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

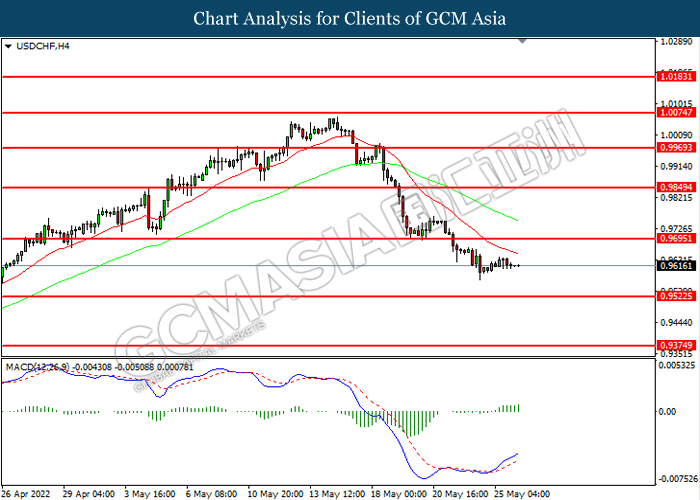

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 113.05, 115.10

Support level: 110.35, 106.65

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1868.70, 1878.95

Support level: 1849.90, 1836.90