26 June 2023 Afternoon Session Analysis

Euro zone business stalled EUR slipped.

The EUR which traded against the dollar index slipped after the eurozone business showed stalling conditions in June according to the HCOB flash PMI survey data produced by S&P Global. The Composite PMI index fell from 52.8 to 50.3 in June, lower than the market expectation of 52.5. Although the reading recorded an expansion which stay above the 50-level threshold, the business activity growth drop of 2.5 points was the largest recorded for a year. S&P Global reported that the new order fell for the first time, employment growth slowed, and future output expectations deteriorated. The economic slowdown in the euro has been accompanied by an apparent tightening of monetary policy by the European Central Bank (ECB) to curb high inflation. As inflation was recorded at 6% in May and the labour market is still in resilient conditions, suggesting more price pressure ahead as workers improve their bargaining power. Meanwhile, Germany, the bloc’s biggest economy, outperformed service, and France was a significant drag with a services PMI of 48. Firms surveyed said economic activity was down again, citing inflation and tough financial conditions as reasons for the drop in business activity. As of writing, the EUR/USD edged up by 0.03% to $1.0905.

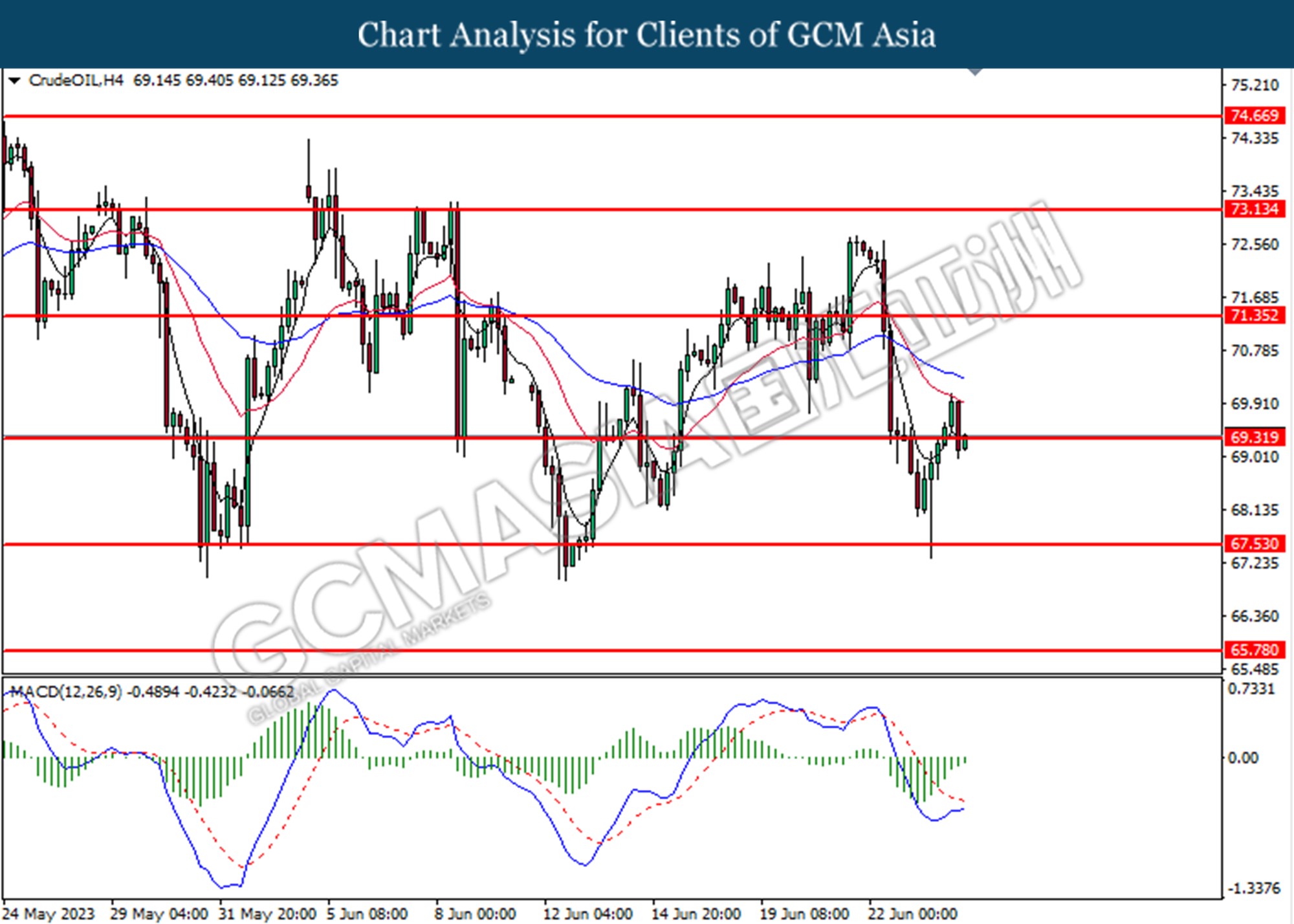

In the commodities market, crude oil prices slipped by -0.01% to $69.15 per barrel as investors waited for more clarity on news of a mutiny in Russia. Besides, the gold prices rose by 0.19% to $1925.20 per troy ounce as the uncertainty of geopolitical in Russia spurred the gold demand,

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

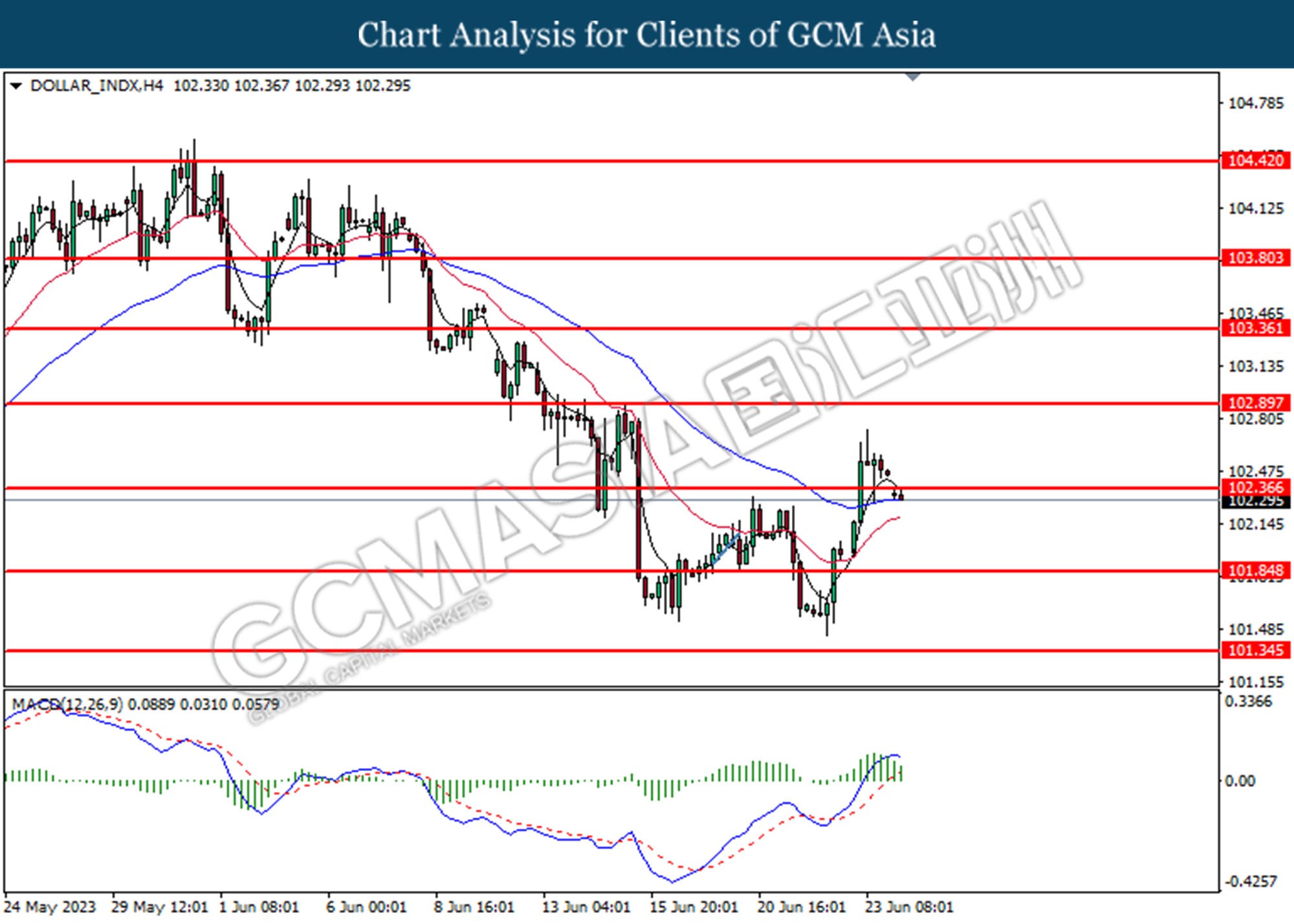

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below from the prior support level at 102.35. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

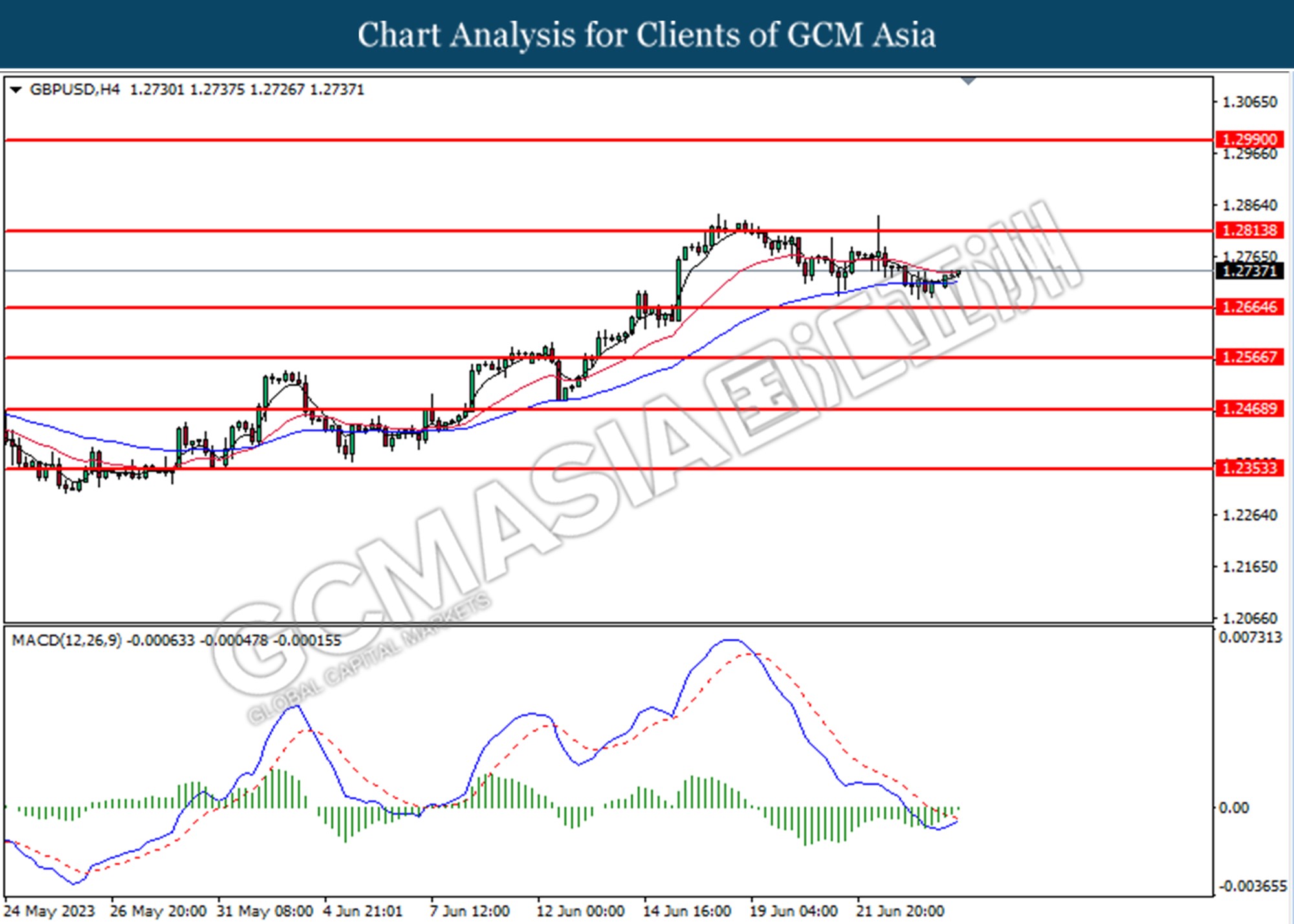

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2815.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

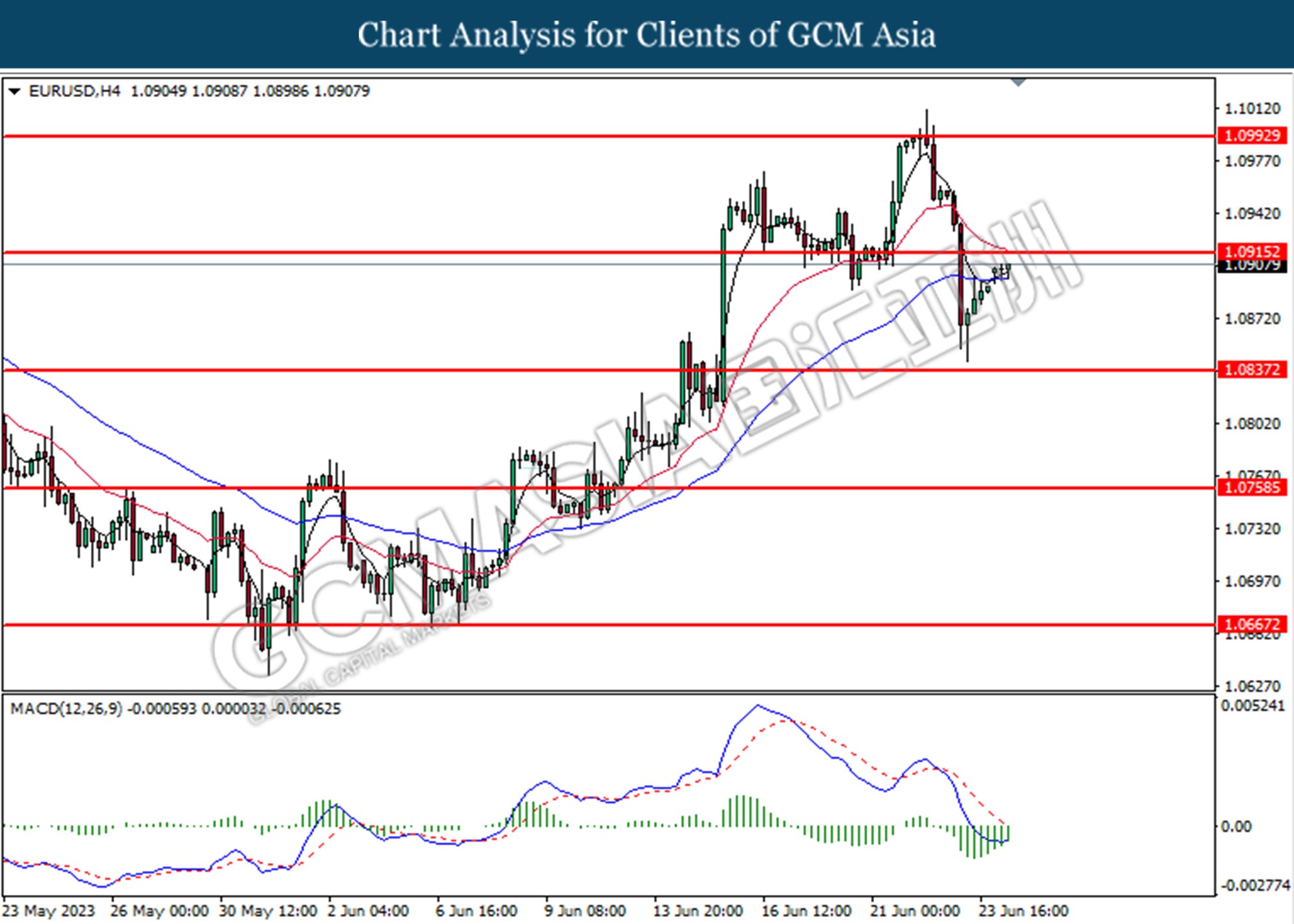

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0990.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

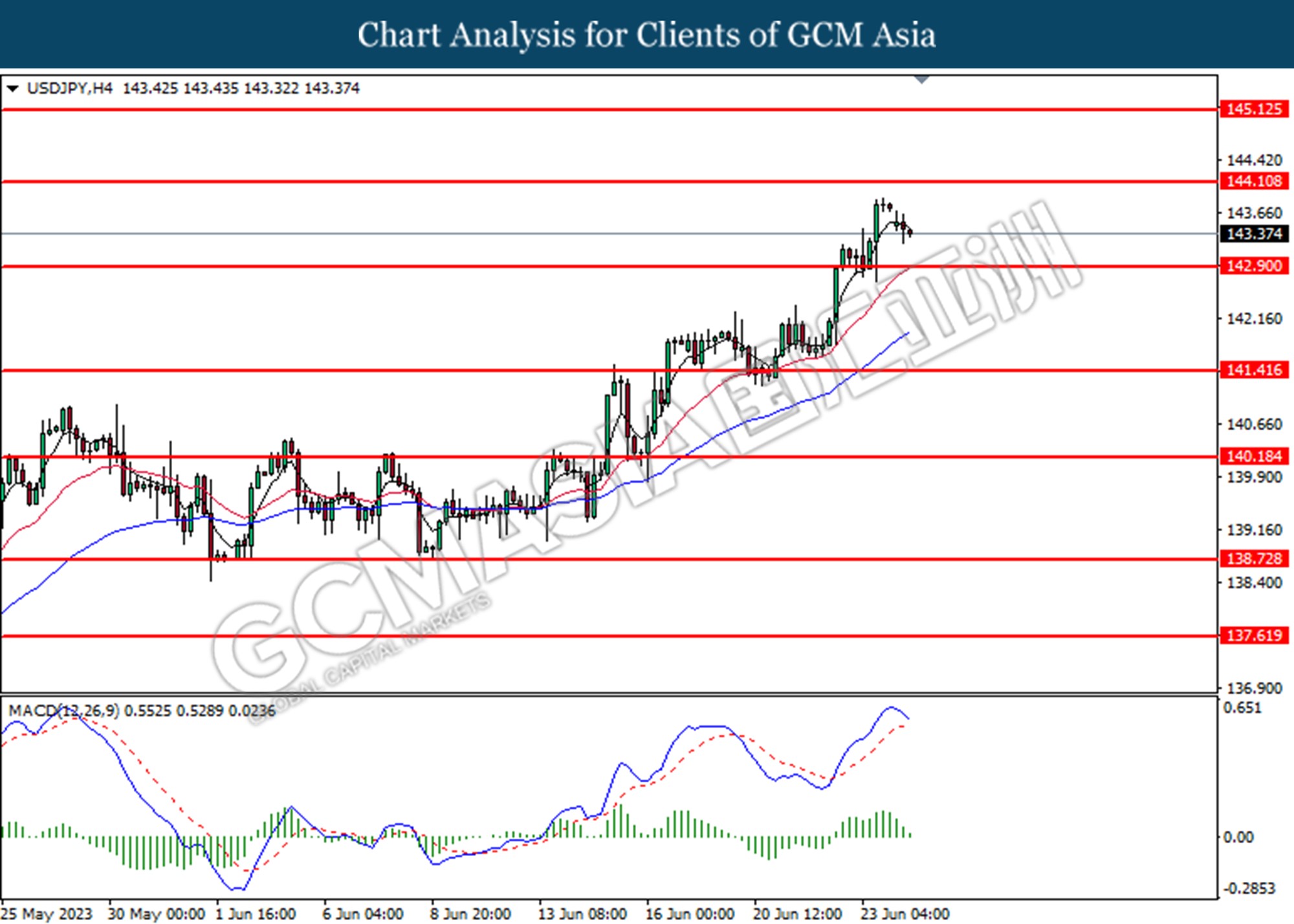

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 142.90.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

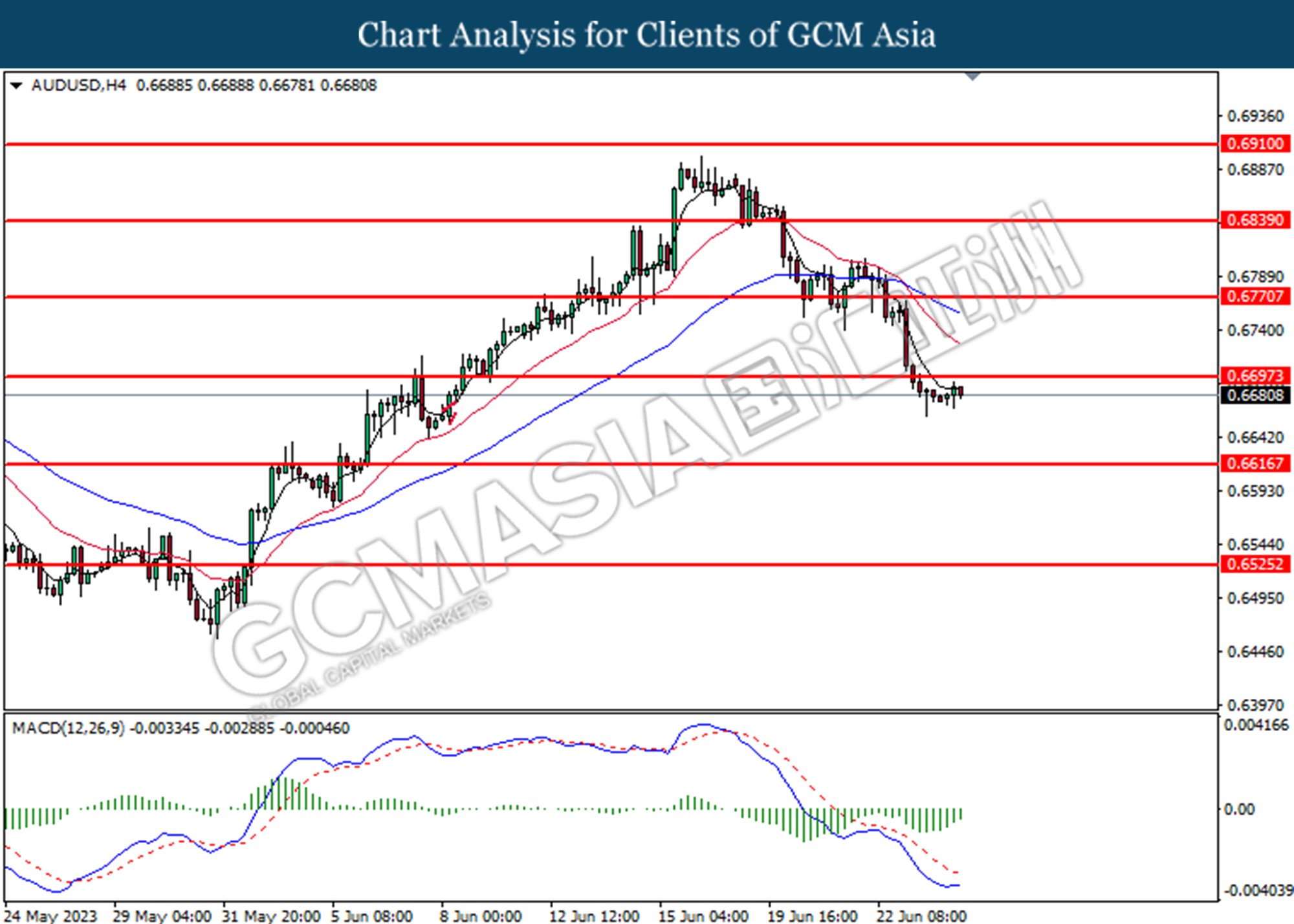

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 0.6700.

Resistance level: 0.6700,0.6770

Support level: 0.6615, 0.6525

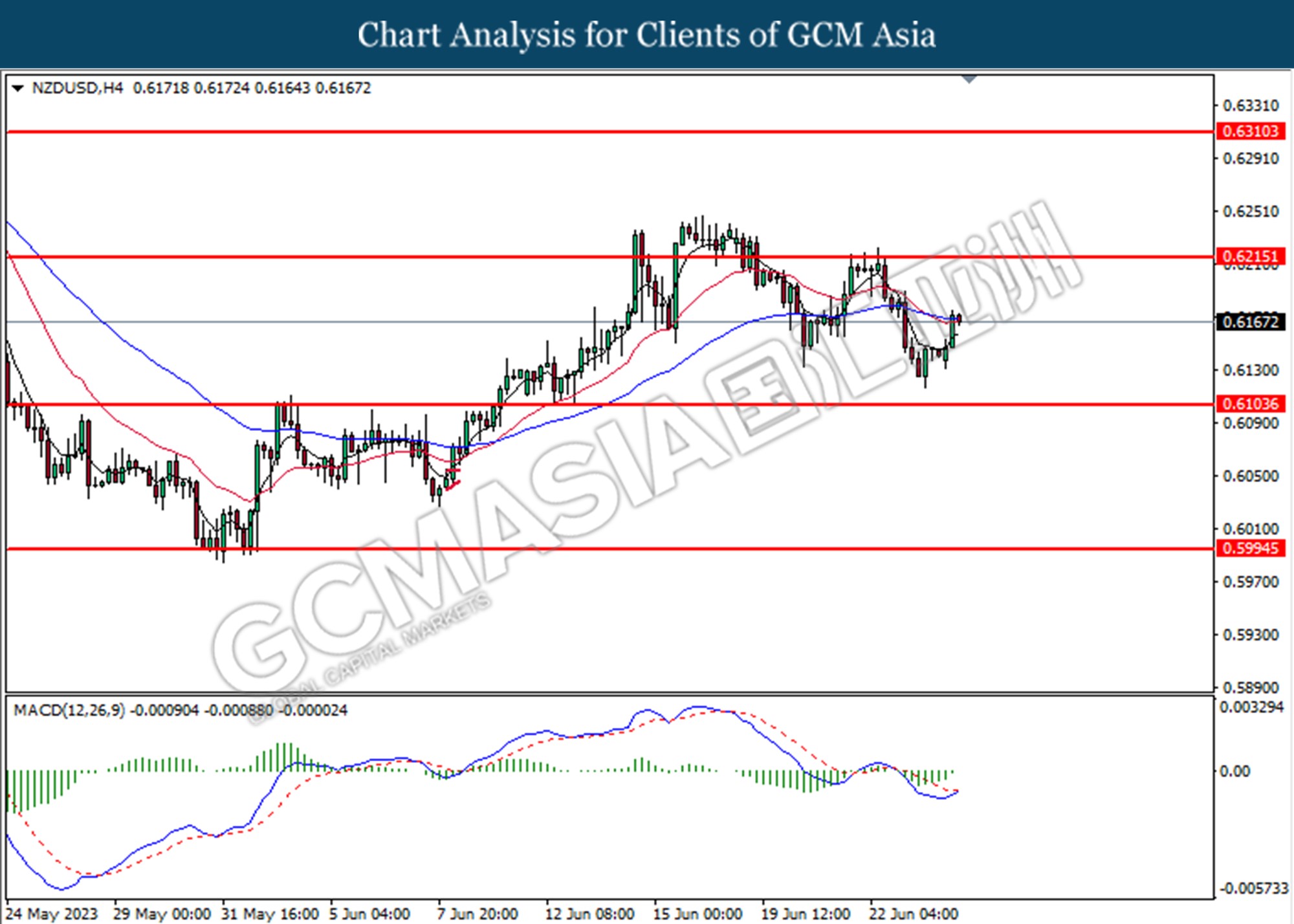

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3140.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

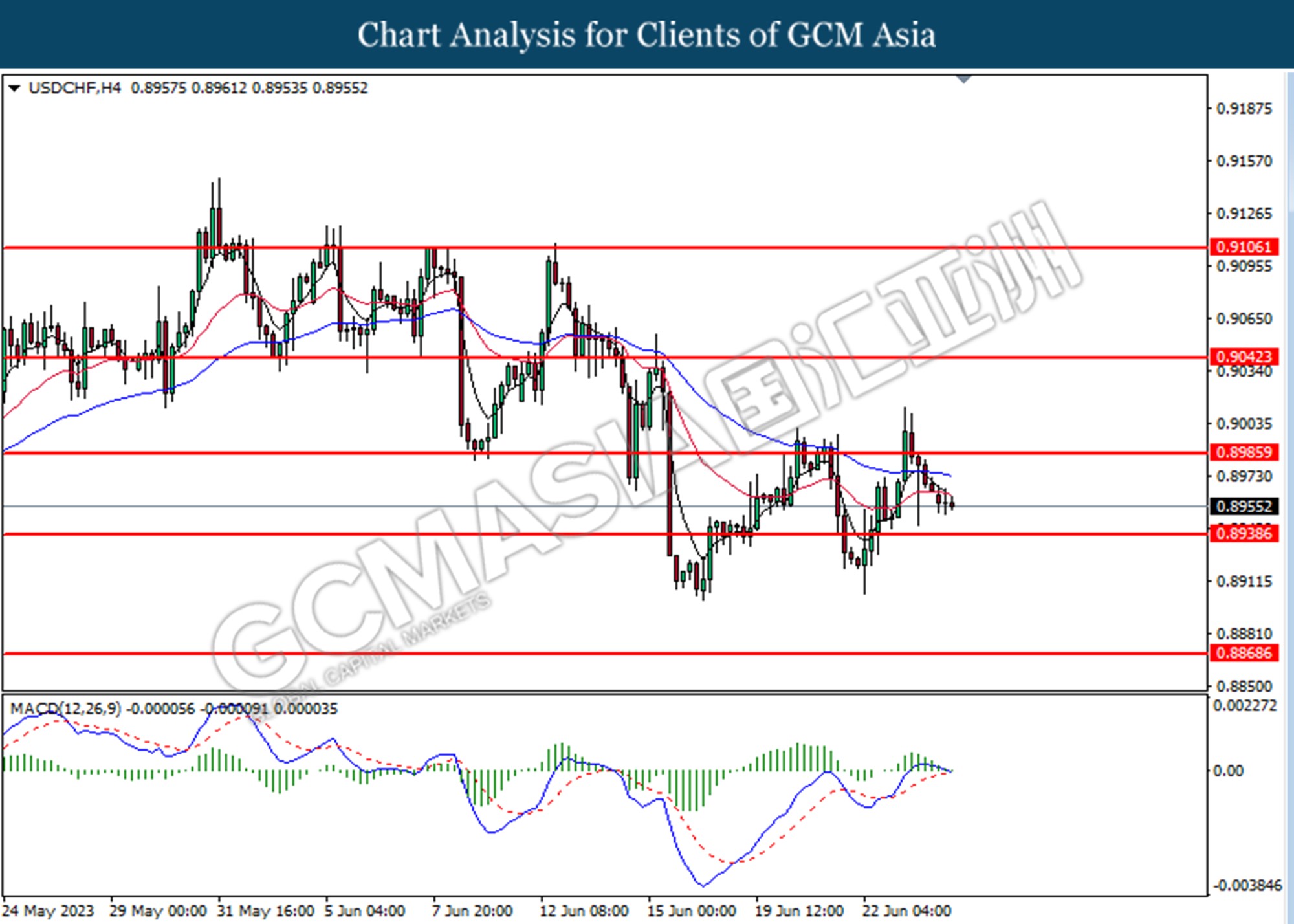

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8985. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.8940.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breaks above from the prior resistance level at 69.30. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the next resistance level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

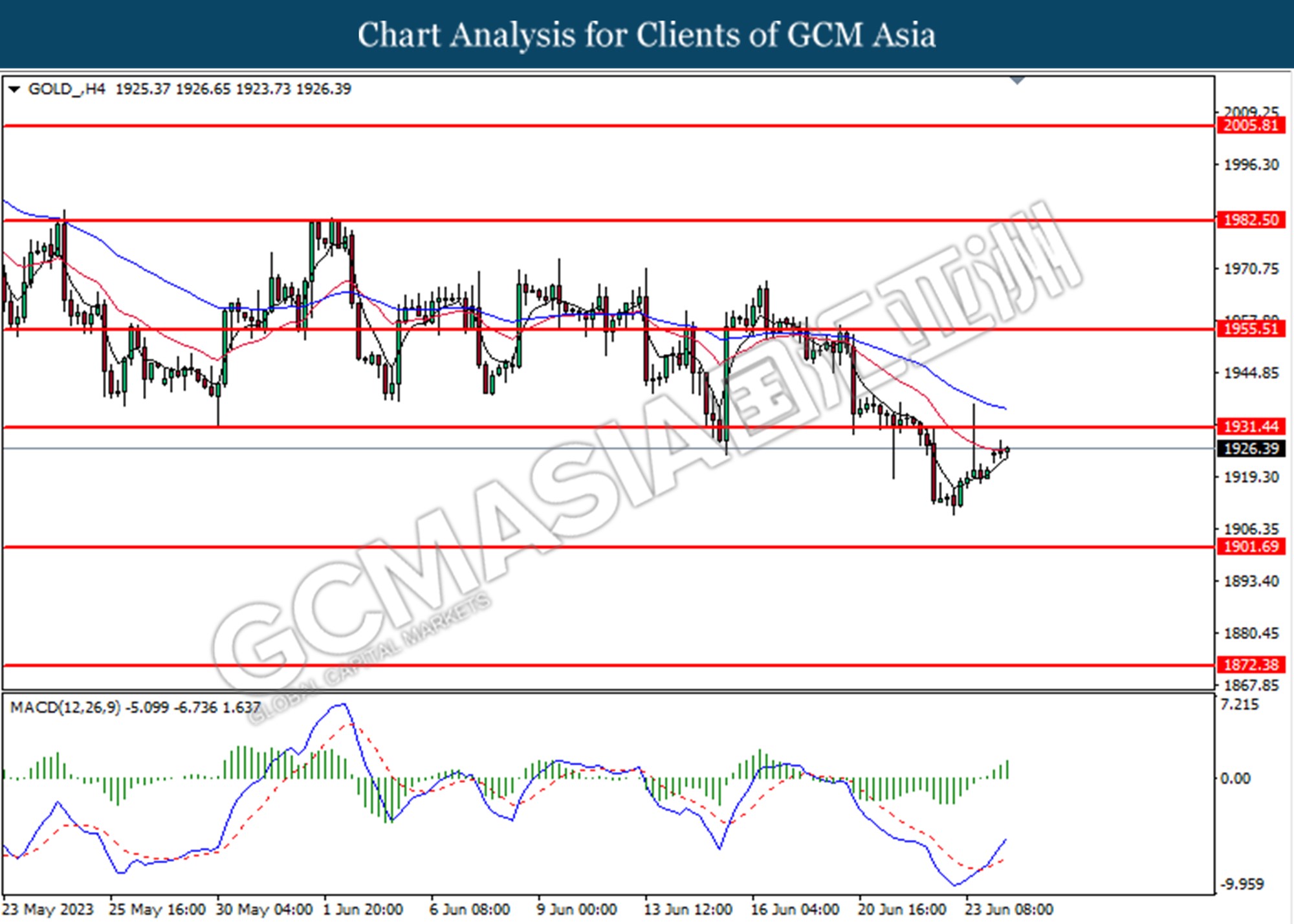

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1931.45.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40