26 July 2022 Morning Session Analysis

US Dollar slipped over the bearish economic progression.

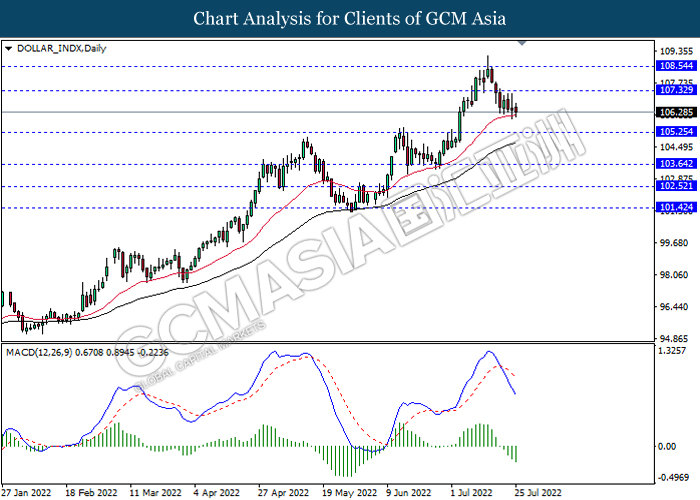

The Dollar Index which traded against a basket of six major currencies slipped on Monday over the expectation of economy slowdown from the US officials, which spurred bearish momentum on the US Dollar. According to Reuters, the US Treasury Secretary Janet Yellen claimed on Sunday that the economic growth was slowing, a recession was not inevitable. The pessimistic economic outlook of US had prompted investors to shift their capitals toward other currencies which having better prospects. Nonetheless, the movement of Dollar Index was relatively slower as investors are eyeing on the interest rate decision from Federal Reserve. As of now, Fed is widely expected to raise its interest rate by 75 basis point in the upcoming Thursday meeting. Two weeks ago, part of the market participant were predicting that the Fed would implement an aggressive 1% rate hike after the CPI data was released. As of writing, the Dollar Index depreciated by 0.27% to 106.33.

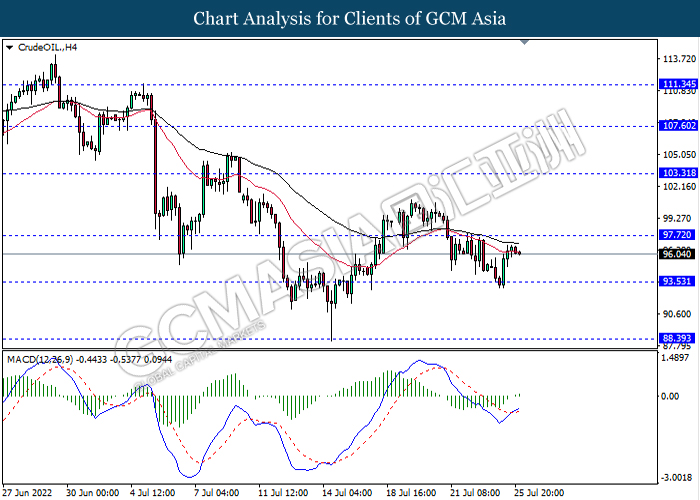

In the commodities market, the crude oil price eased by 0.37% to $96.34 per barrel as of writing. However, the oil price surged on yesterday trading session which was benefited from the weakening US Dollar. On the other hand, the gold price depreciated by 0.10% to $1717.30 per troy ounce as of writing following the rising expectation of rate hike from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 98.7 | 97.3 | – |

| 22:00 | USD – New Home Sales (Jun) | 696K | 664K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.55

Support level: 105.25, 103.65

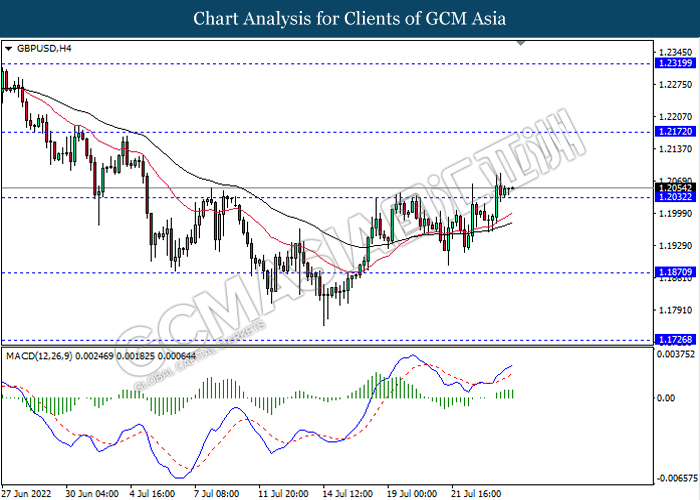

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

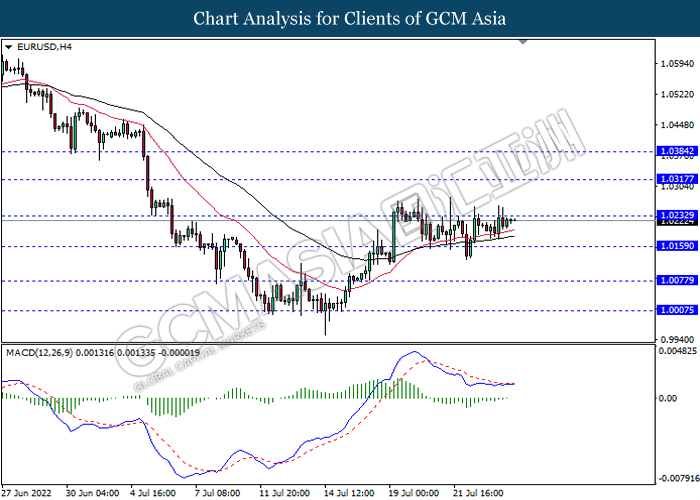

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

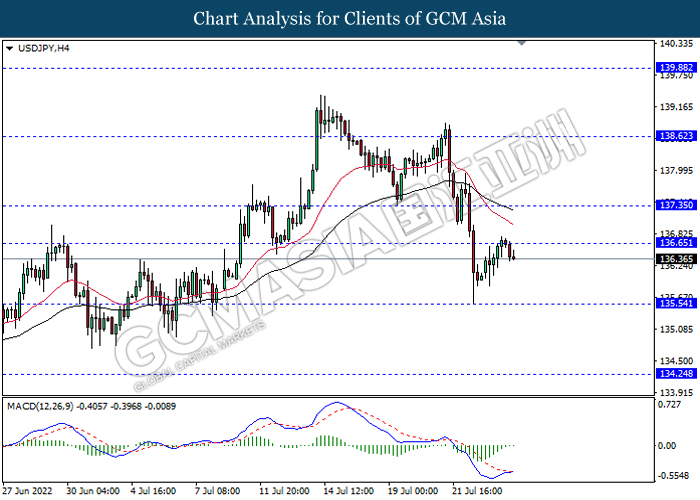

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

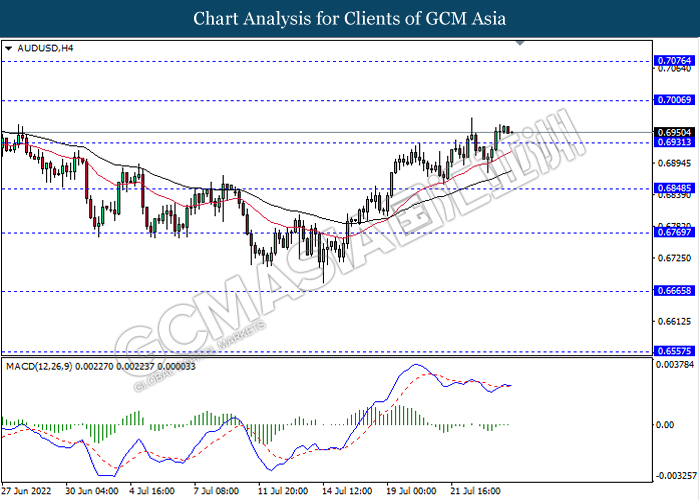

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

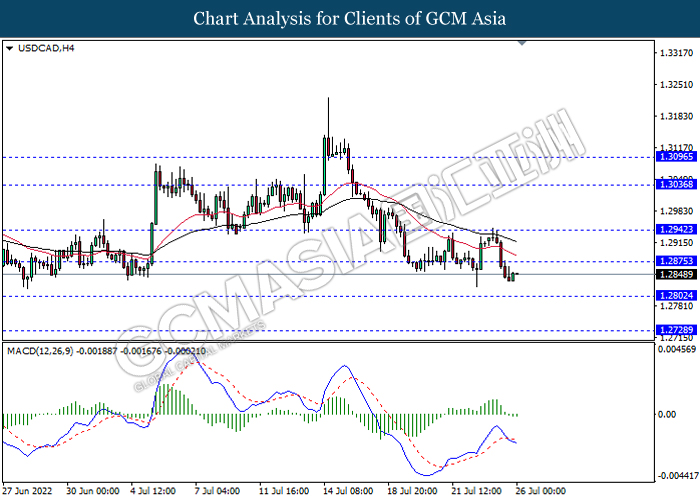

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

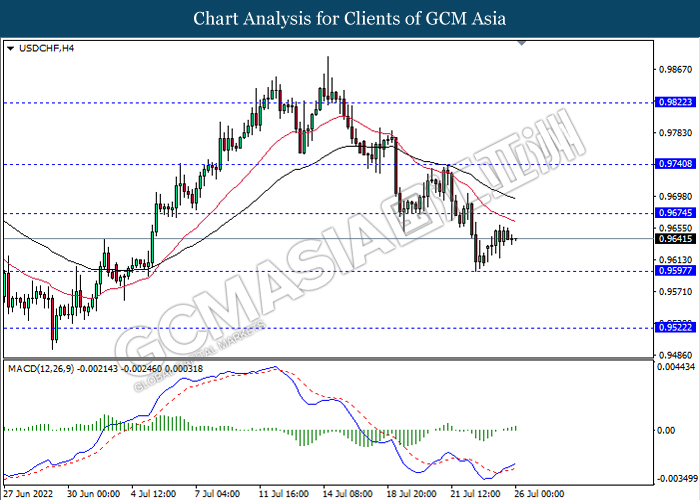

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

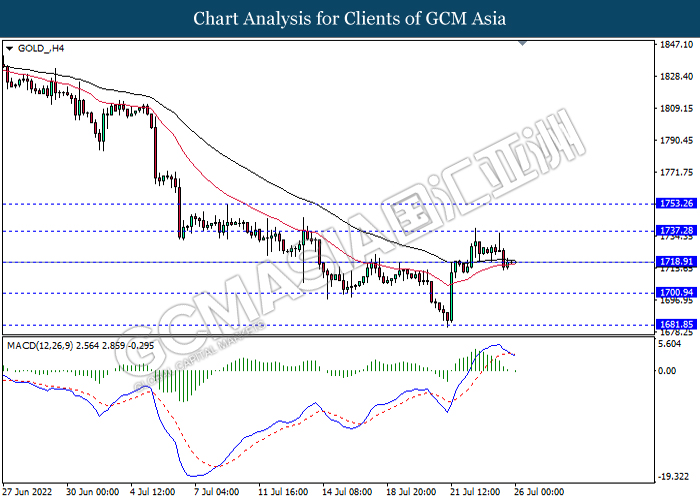

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85