26 August 2019 Afternoon Session Analysis

Next global recession incoming?

Dollar index which measures against a basket of six major currency pairs remain pressured and getting pummeled as the risk of global recession are increasing. U.S and China have escalated the trade tension with each side levy a series of tariffs on each other, causing trade deal hope to stray away further. Federal Reserve Chairman Jerome Powell also didn’t provide any positive news to cheer on, stating that who did not announce any major stimulus measures to ease a worsening global economic outlook, and stated that Fed will take necessary countermeasures to support the U.S economy. President Trump also escalated his attacks against Fed, labelled Jerome Powell as an “enemy” following the lack of support from Fed to Trump’s plan, sending shockwaves to the market. Investors are now cautious as recent developments are signaling the risk of a global recession are imminent. On the other hand, euro also remain pressured despite dollar weakness. Last week, the European Central Bank (ECB) have stated that it is prepared to implement more preventive measure to support Euro economy, also stating that downside risks for growth had become “more pervasive”. Investors are now eyeing on further confirmation from German data to gauge further direction. At the time of writing, dollar index fell 0.02% to 97.50 while EUR/USD slips 0.04% to 1.1138.

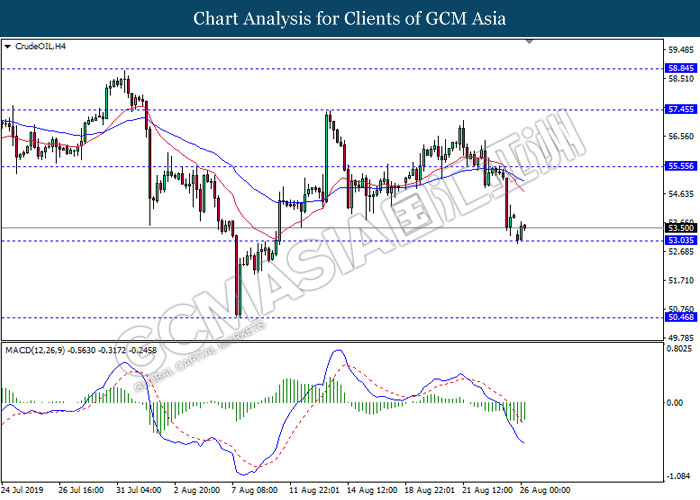

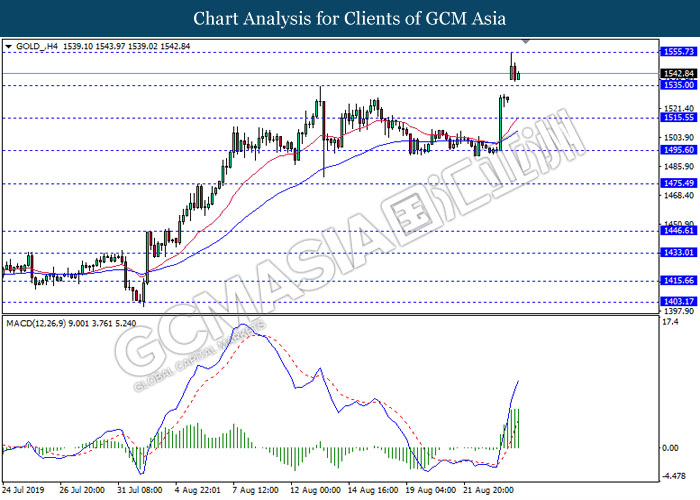

In the commodities market, crude oil price slip 0.74% to $53.54 per barrel following intensified trade war. As trade tension between U.S and China escalate, market are now fear of incoming global recession which could affect the demand for the commodity, thus knocking out confidence in the global economy. Meanwhile, gold price skyrocketed 0.99% to $1541.85 a troy ounce at the time of writing following weak dollar amid trade war.

Today’s Holiday Market Close

Time Market Event

All Day GBP Summer Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Aug) | 95.7 | 95.1 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jul) | 1.0% | 0.1% | – |

Technical Analysis

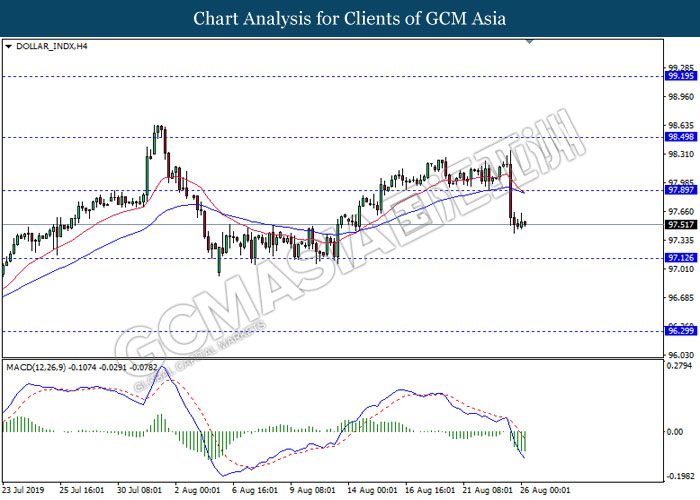

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 97.90. MACD which illustrate persistent bearish momentum signal suggest the dollar to extend its losses towards the support level 97.10.

Resistance level: 97.90, 98.50

Support level: 97.10, 96.30

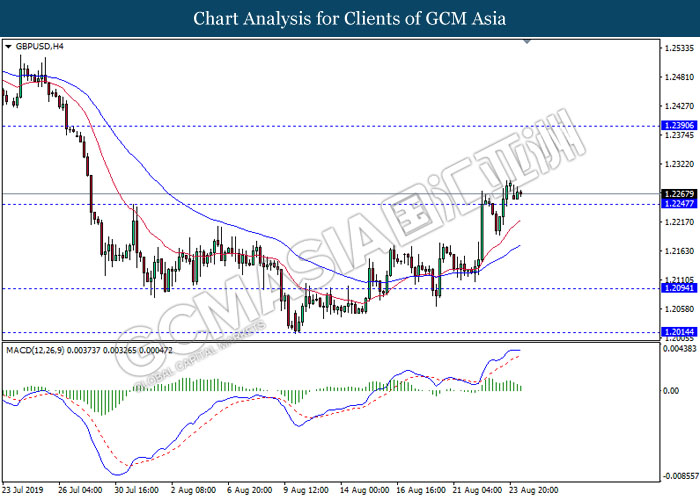

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.2245. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2390, 1.2585

Support level: 1.2245, 1.2095

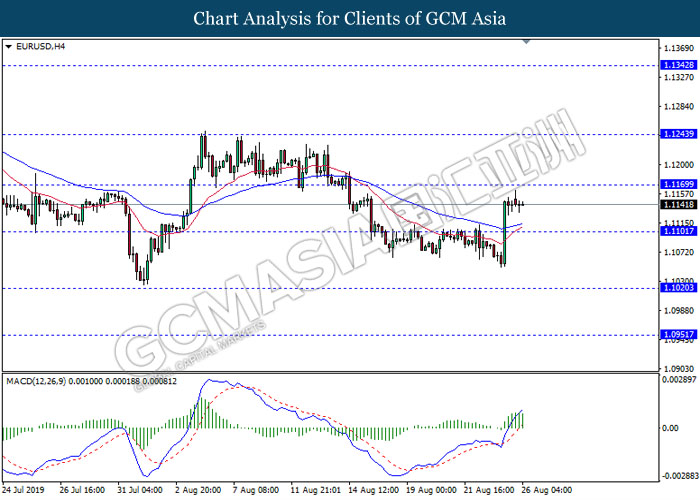

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level 1.1100. MACD which illustrate bullish momentum signal suggest the pair to extend its gains towards the resistance level 1.1170.

Resistance level: 1.1170, 1.1245

Support level: 1.1100, 1.1020

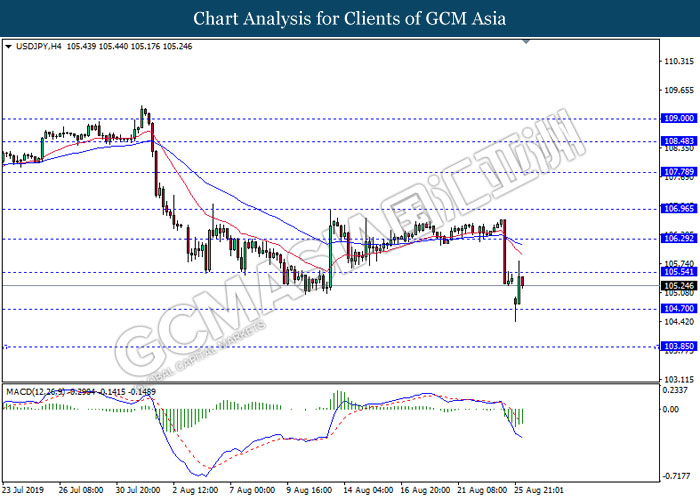

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 105.55. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 105.55, 106.30

Support level: 104.70, 103.85

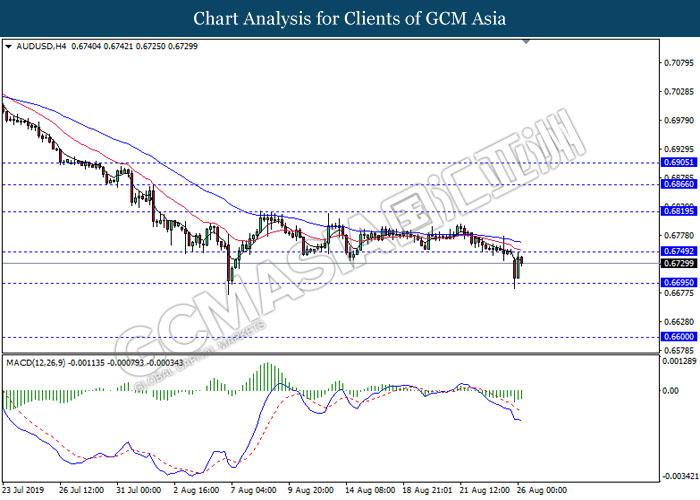

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.6750. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.6750, 0.6820

Support level: 0.6695, 0.6600

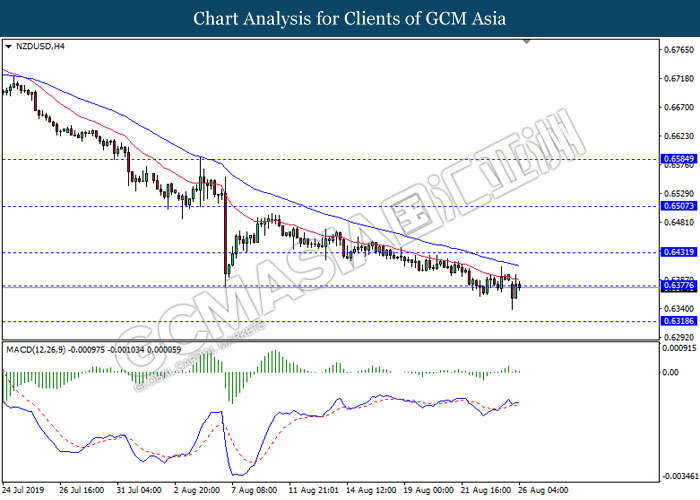

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6375. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6430, 0.6505

Support level: 0.6375, 0.6320

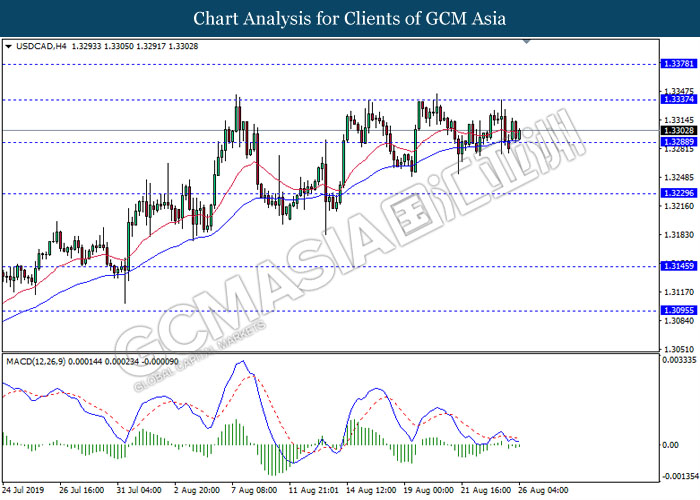

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.3290. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.3335.

Resistance level: 1.3335, 1.3380

Support level: 1.3290, 1.3230

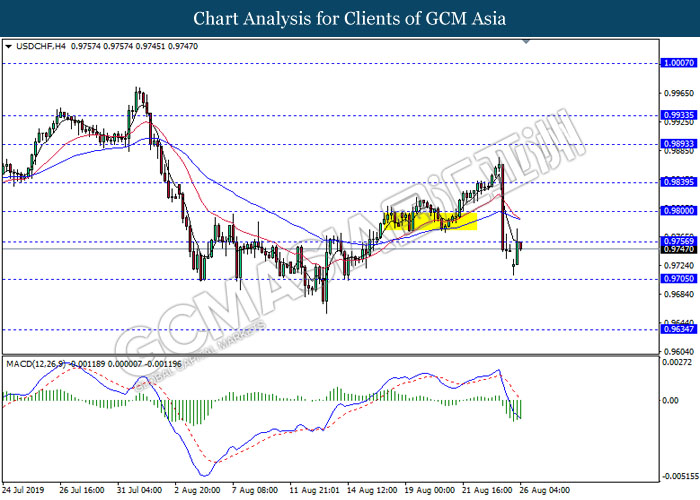

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9755. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9755, 0.9800

Support level: 0.9705, 0.9635

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 53.05. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its rebound towards the resistance level 55.55.

Resistance level: 55.55, 57.45

Support level: 53.05, 50.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1535.00. MACD which illustrate bullish bias signal suggest the commodity to extend its gains towards the resistance level 1555.75

Resistance level: 1555.75, 1575.00

Support level: 1535.00, 1515.55