26 August 2022 Morning Session Analysis

Greenback revived as the US economy contracted mildly.

The dollar index, which gauges its value against a basket of six major currencies, regained its foot after experiencing some losses since the beginning of the week, as the US economy contracts milder than consensus expectation in the second quarter. According to the Bureau of Economic Analysis, the US GDP came in at -0.6%, missing the consensus forecast of -0.8%, mirroring that the economy shrank at a moderate pace in the second quarter. Consumer spending has eased some of the drag from a sharp slowdown in inventory accumulation, dispelling fears that the nation’s economy is heading toward recession. Besides, the upbeat employment data also urged investors to buy in the dollar index yesterday. According to the labour department, the US Initial Jobless Claims data came in at 243K, far lower than the consensus forecast at 253K, showing some sign of recovery in the labour market. However, the gains of the greenback were limited by the market concern over the speech of Jerome Powell on Friday, as the Federal Reserve Chairman is expected to provide some clues about the pace of the rate hike plan. At this point in time, the investors are wavering between the possibility of a 50 or 75 basis point hike in the September Fed meeting. With the backdrop of hawkish statements had been given by the Fed members, markets are expecting a hawkish message from Powell. As of writing, the dollar index dropped 0.24% to 108.40.

In the commodities market, the crude oil price was down by 0.09% to $92.95 a barrel amid a possible nuclear deal between the US and Iran, which would eventually be making Iranian oil to be allowed for exportation resumption to the world. Besides, the gold prices depreciated -0.10% to $1757.00 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Jul) | 0.6% | 0.3% | – |

Technical Analysis

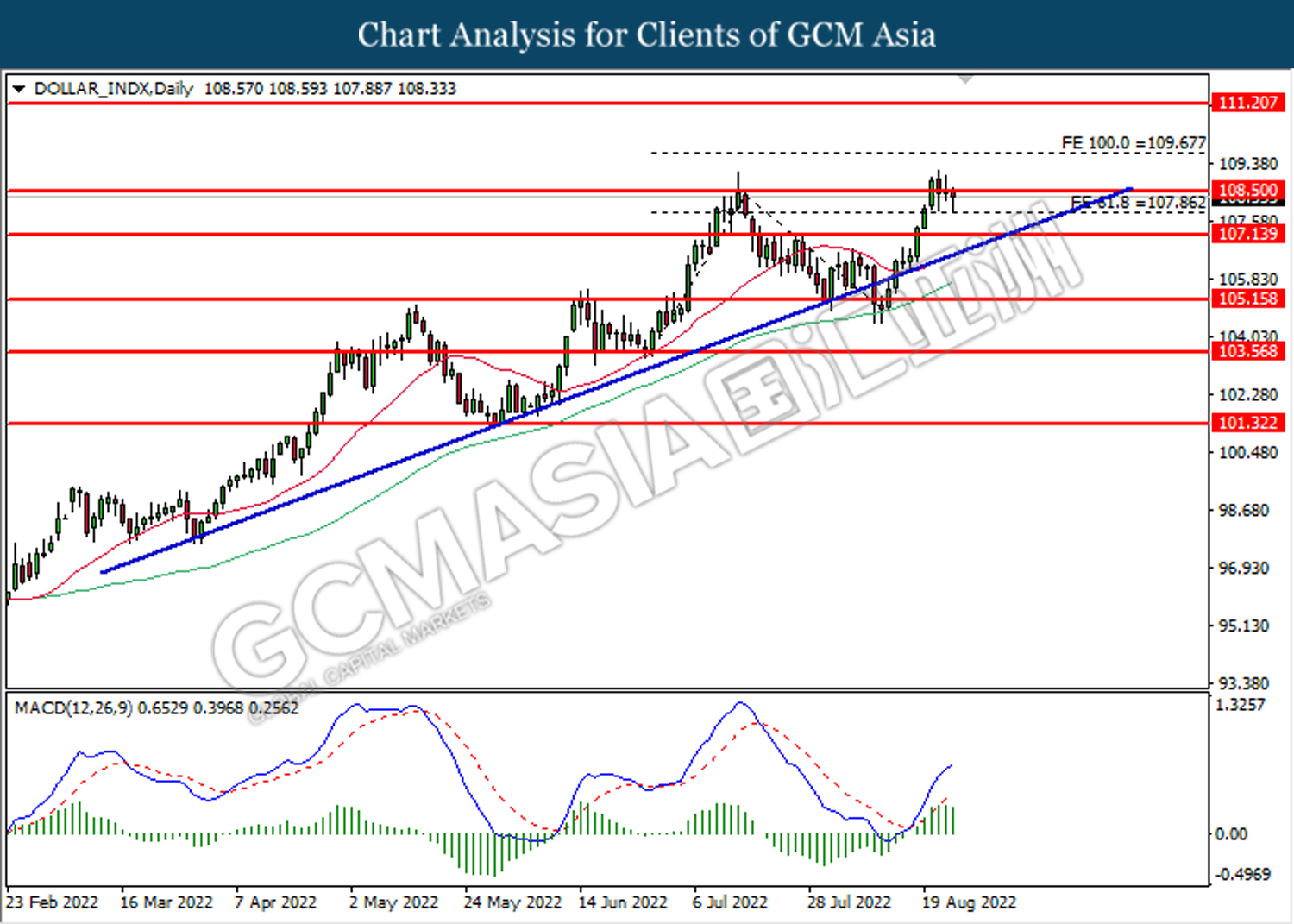

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 108.50. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after its candle successfully closes below the support level.

Resistance level: 109.70, 111.20

Support level: 108.50, 107.85

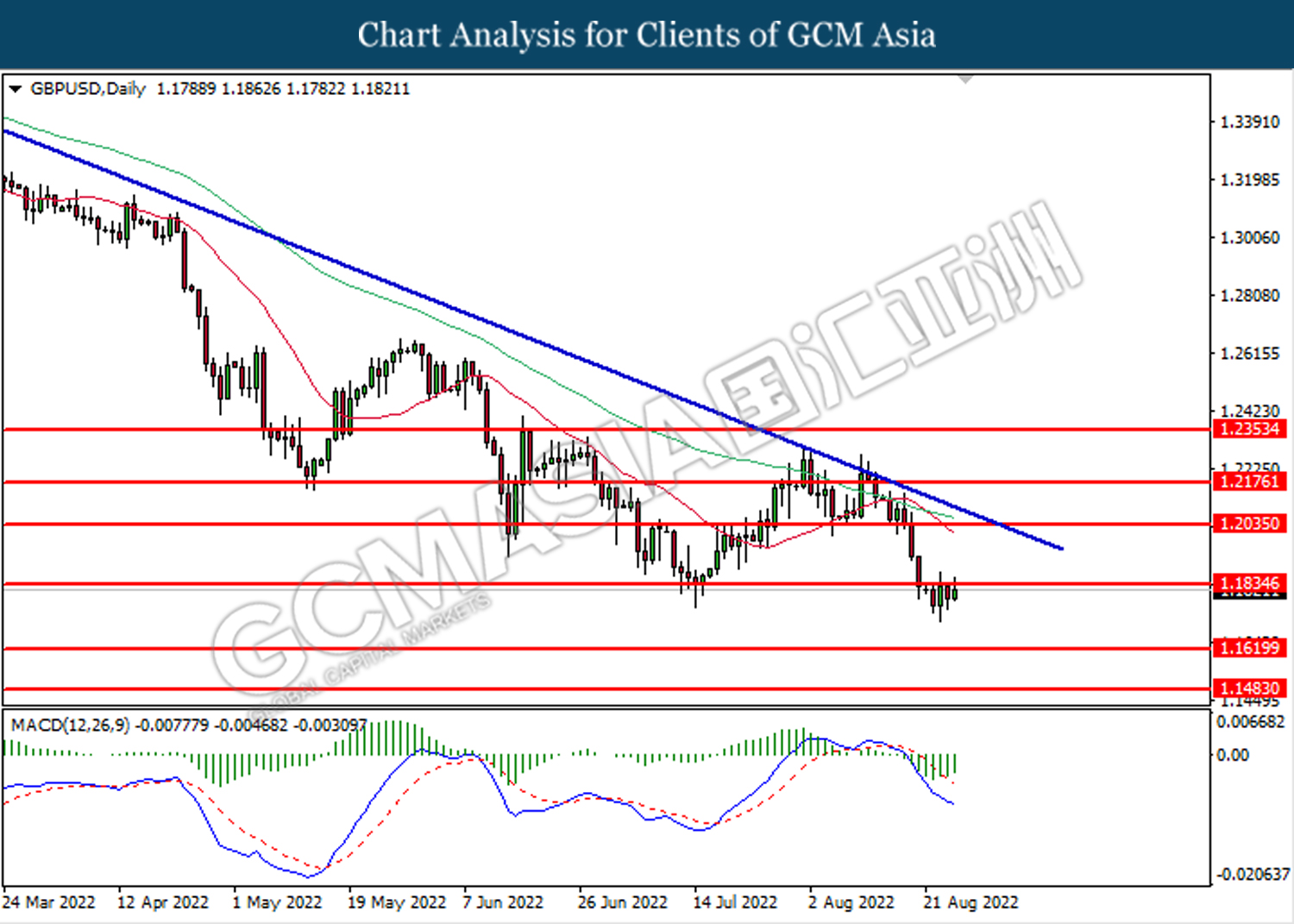

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1835. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

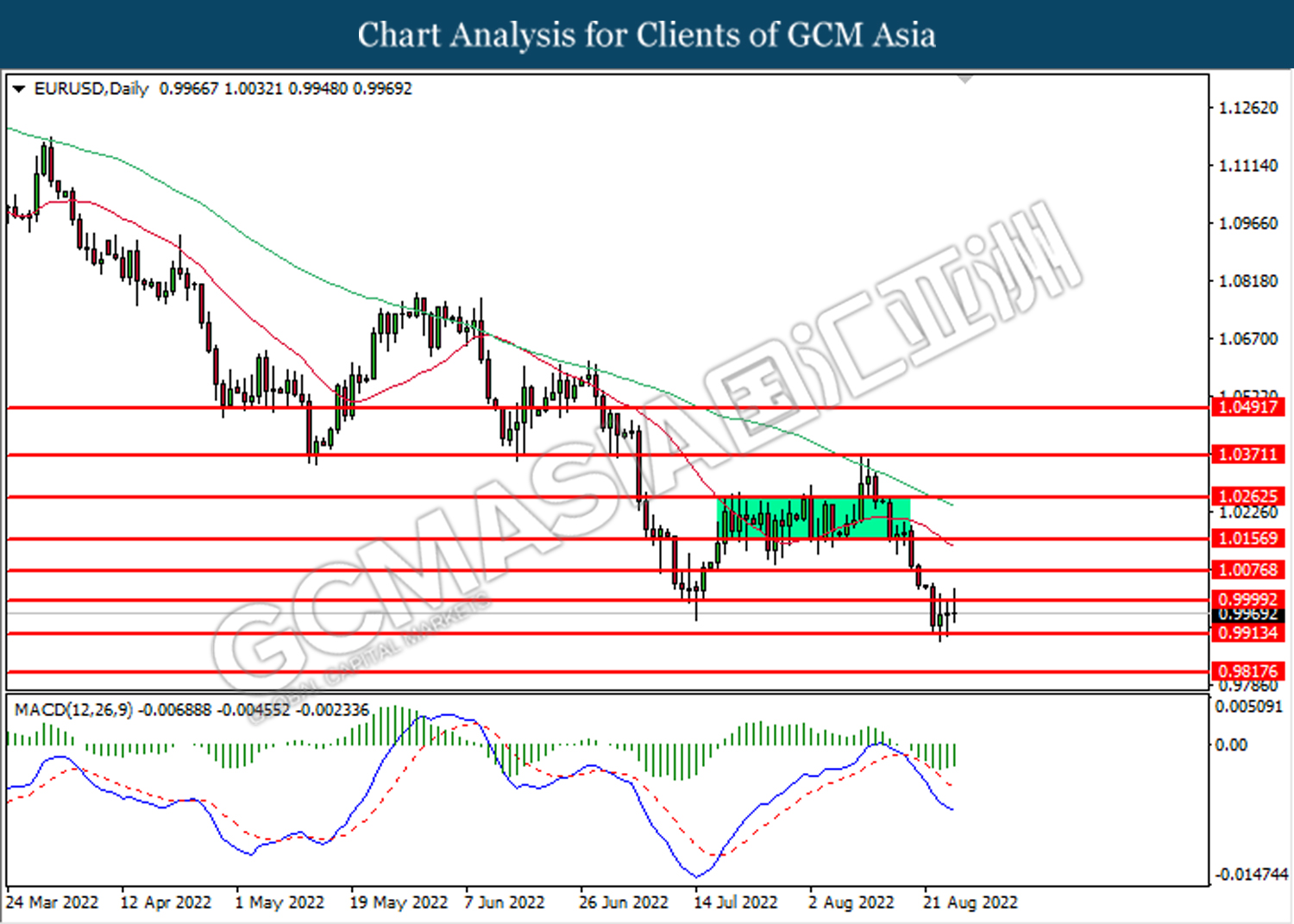

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

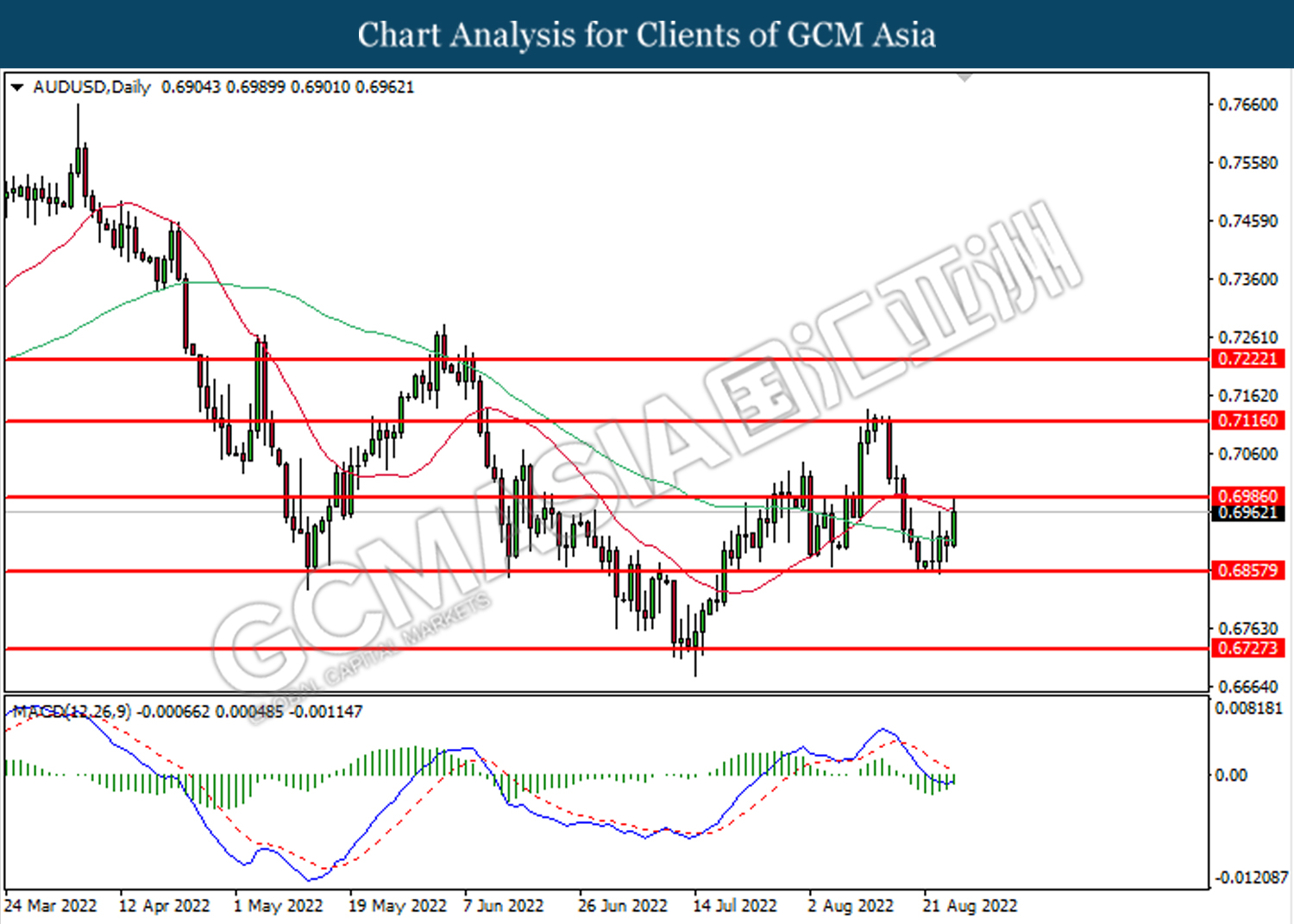

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

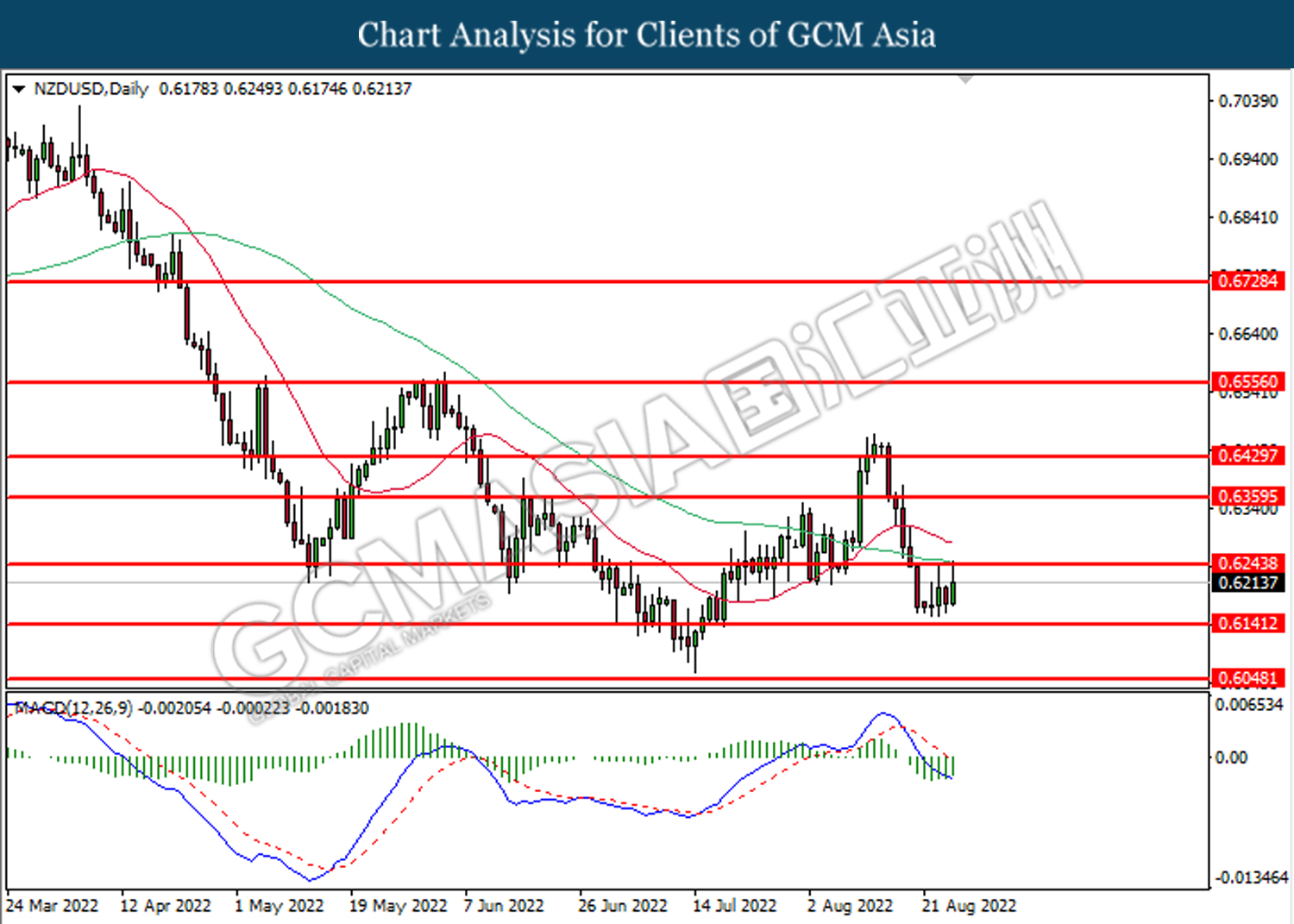

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6245.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

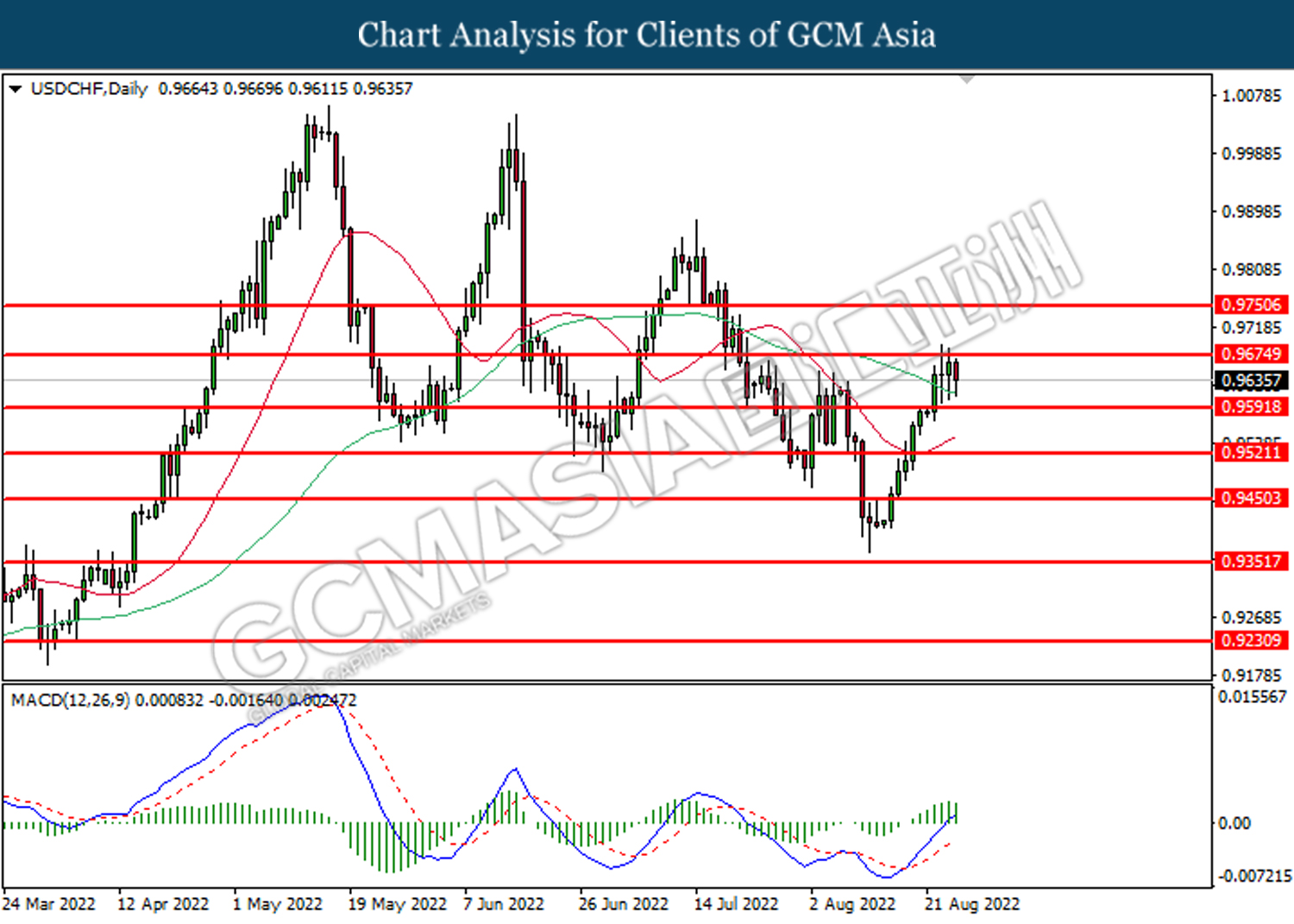

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

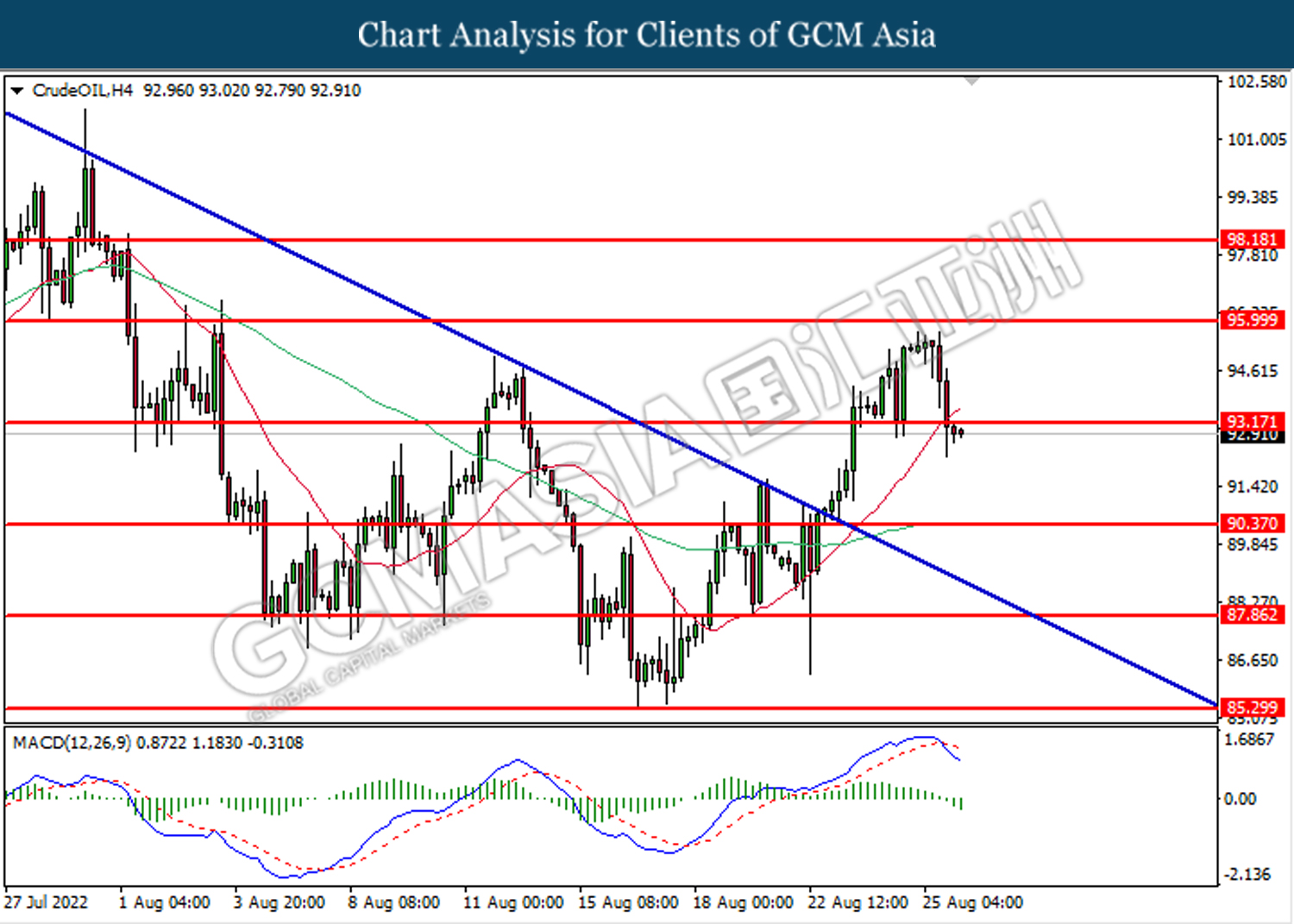

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the support level at 93.15. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 90.35.

Resistance level: 93.15, 96.00

Support level: 90.35, 87.85

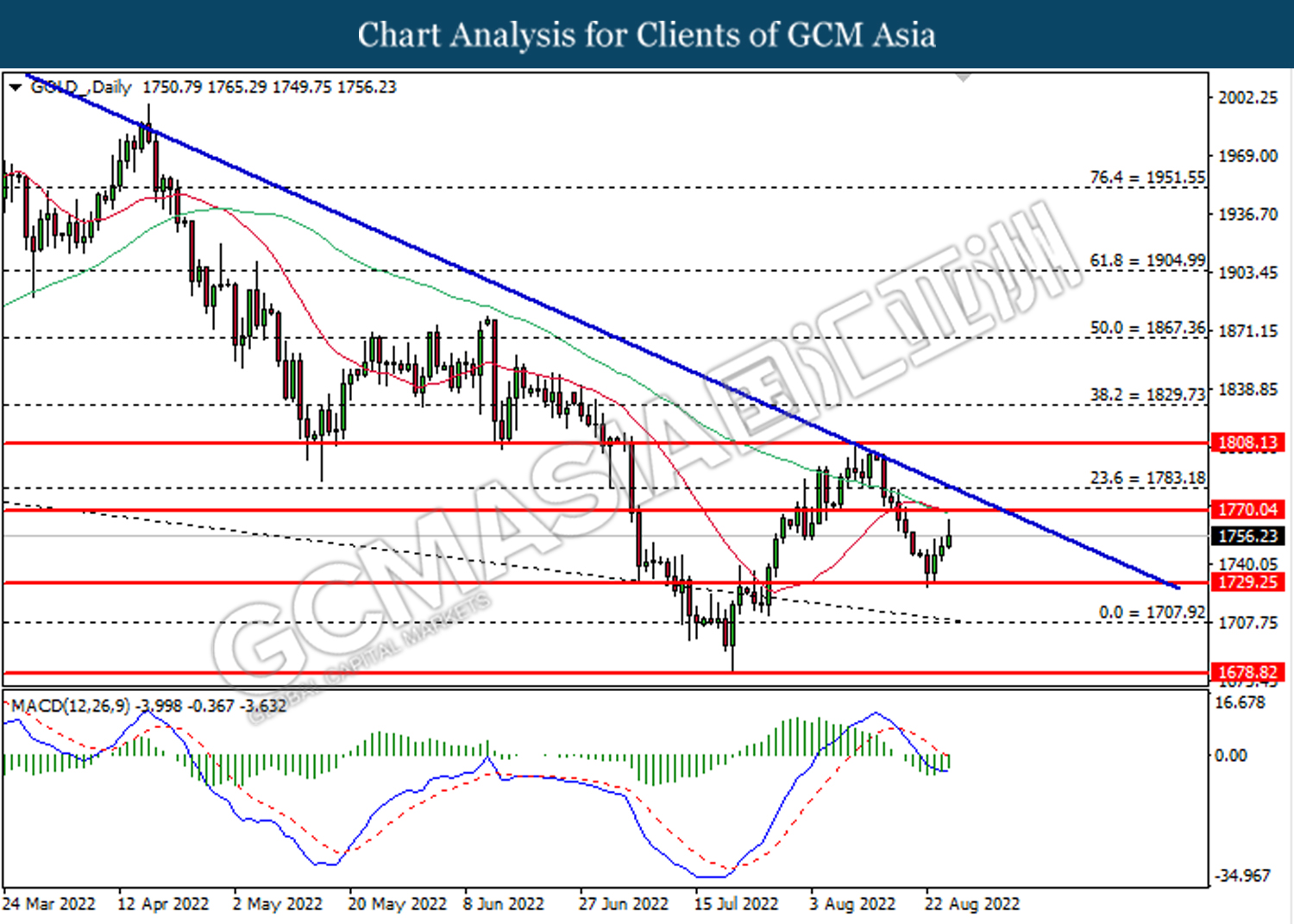

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90