26 October 2022 Afternoon Session Analysis

Euro jumped as economic data showed an expansion in Germany.

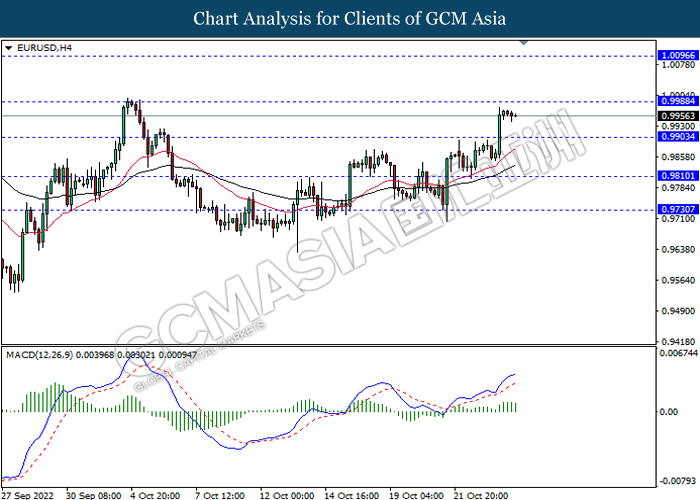

The EUR/USD, which traded by majority of investors rallied significantly on yesterday amid the economic data which better-than-expectation. According to Ifo Institute for Economic Research, the Germany Ifo Business Climate Index in October came in at the reading of 84.3, exceeding the consensus forecast of 83.3. Such data had given a sign of economic expansion in German, which brought positive prospects toward economic progression in Eurozone as Germany was the largest economy in Europe. On the other hand, the USD/CAD dropped significantly on yesterday as Bank of Canada (BoC) was expected to announce another hefty rate hike on Wednesday. As of now, the market participants are anticipating that third-quarter of a percentage point rate increase would be implemented by BoC. Though, the rate hike pace might be slow down after the rate hike announcement as the sky-high inflation risk in Canada has started to diminish. Starting from July, the Canada CPI has lowered from 8.1% to the current 6.9%. As of writing, the EUR/USD depreciated by 0.04% to 0.9960 while USD/CAD eased by 0.03% to 1.3601.

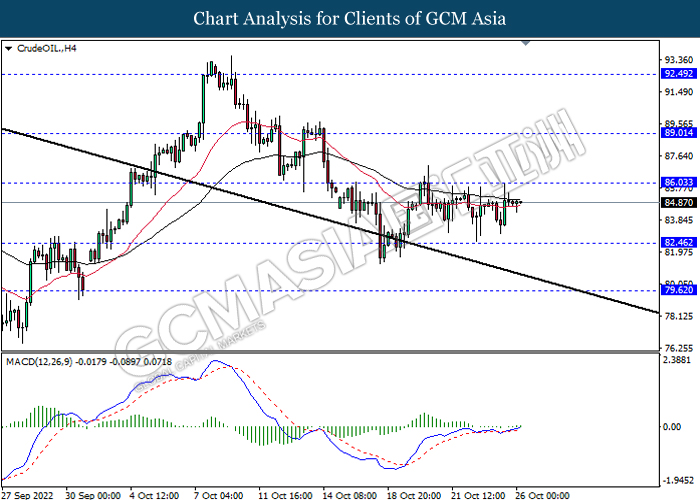

In the commodities market, the crude oil price depreciated by 0.60% to $84.81 per barrel as of writing. Nonetheless, the oil price was rose for more than $1 per barrel on yesterday over the weakening dollar has dialed up the demand of this black commodity. In addition, the gold price appreciated by 0.15% to $1656.27 per troy ounce as of writing following the value of US Dollar depreciated.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – New Home Sales (Sep) | 685K | 585K | – |

| 22:00 | CAD – BoC Interest Rate Decision | 3.25% | 4.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.725M | 1.029M | – |

Technical Analysis

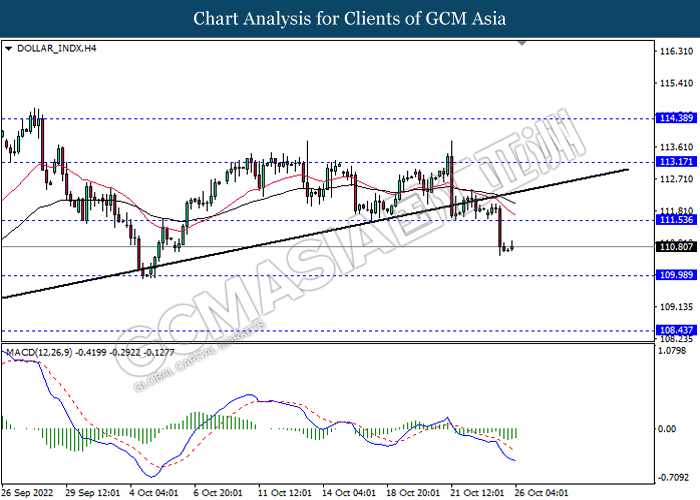

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

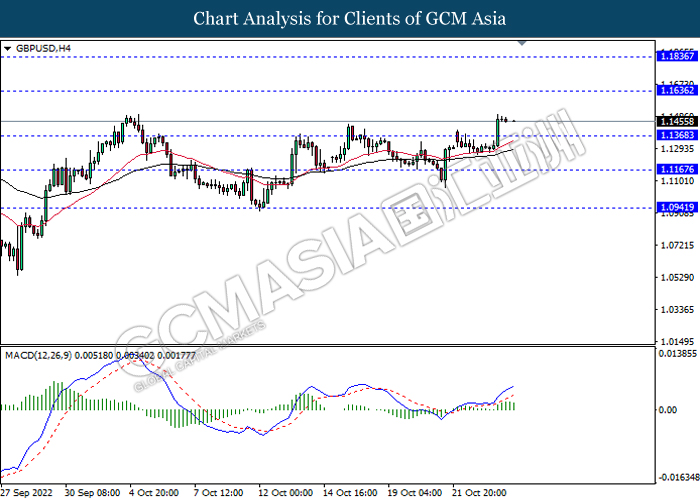

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9990, 1.0095

Support level: 0.9905, 0.9810

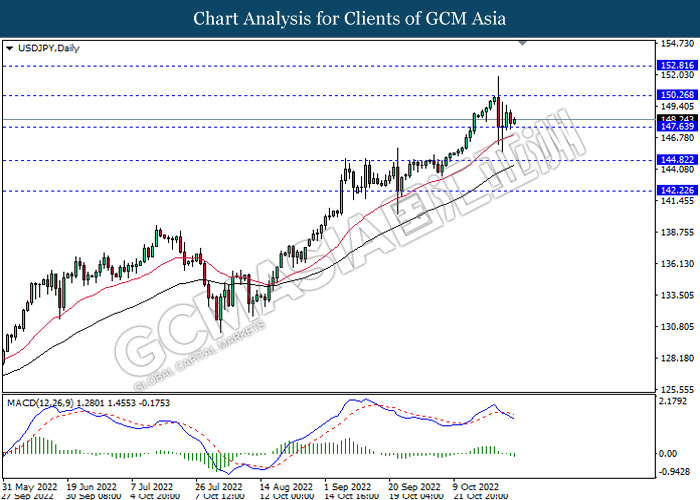

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

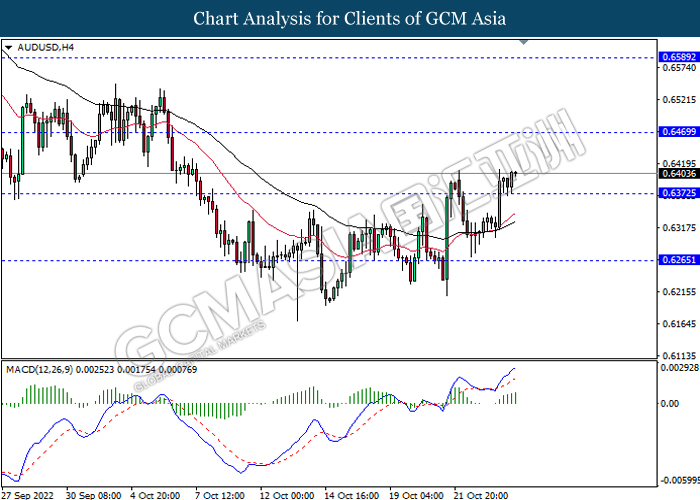

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

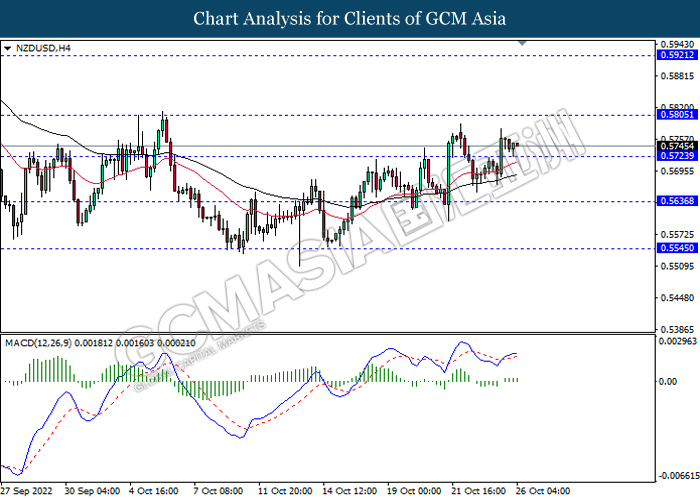

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5805, 0.5920

Support level: 0.5725, 0.5635

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

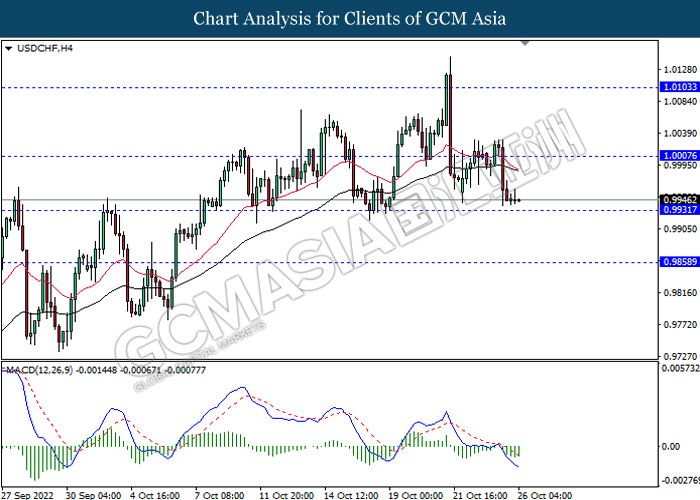

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1663.15, 1678.70

Support level: 1648.45, 1635.45