26 October 2022 Morning Session Analysis

Greenback plunged amid the release of downbeat economic data.

The dollar index, which traded against a basket of six major currencies, sagged after a downbeat economic data was released, whereby the result of the data against the market optimism. According to the Conference Board, the US CB Consumer Confidence data came in at 102.5, far lower than the consensus forecast at 106.5, mirroring that the consumer confidence in economic activity deteriorated. With that, it may urge the Federal Reserve to adjust the cash rate conservatively, says 50 basis point in the upcoming meeting. On the other side, the greenback received further sell-off pressures after Rishi Sunak becomes the new prime minister. The Sterling rallied to a six-week high on Tuesday on improved risk sentiment as Rishi Sunak became Britain’s prime minister. Rishi Sunak became Britain’s third prime minister in two months on Tuesday, tasked with tackling a mounting economic crisis and a warring political party. As Rishi Sunak is tilted toward increasing tax and reducing government spending, the market participants take him as someone who can save the UK economy from recession and stabilize the financial market going forward. As of writing, the dollar index dropped -0.88% to 111.00.

In the commodities market, crude oil prices edged down by -0.09% to $84.85 per barrel as the API data shows some stockpile over the week. According to the API, the US crude oil inventories data came in at 4.520M, higher than the consensus forecast at 0.200M. Besides, gold prices appreciated 0.07% to $1652.15 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – New Home Sales (Sep) | 685K | 585K | – |

| 22:00 | CAD – BoC Interest Rate Decision | 3.25% | 4.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.725M | 1.029M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.70. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 110.00.

Resistance level: 111.70, 113.10

Support level: 110.00, 107.90

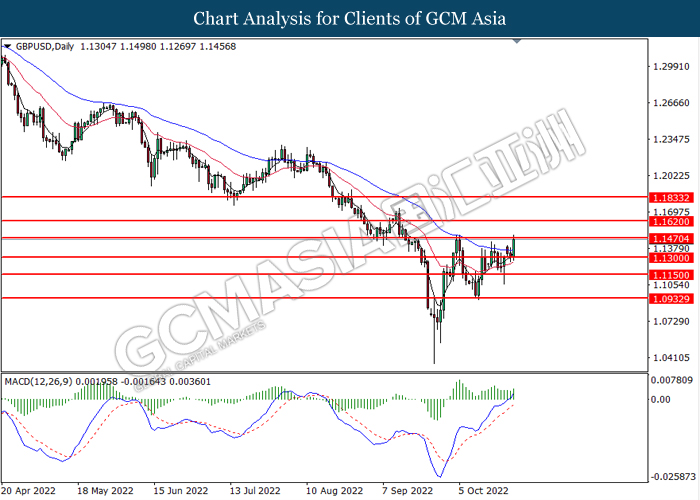

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1470. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1470, 1.1620

Support level: 1.1300, 1.1150

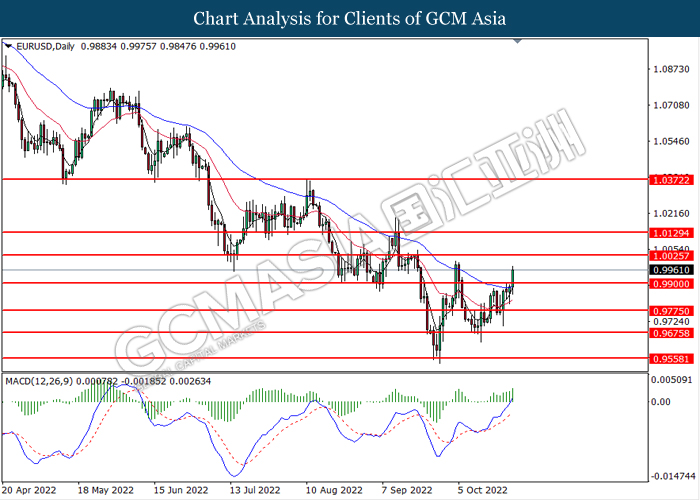

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9900. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

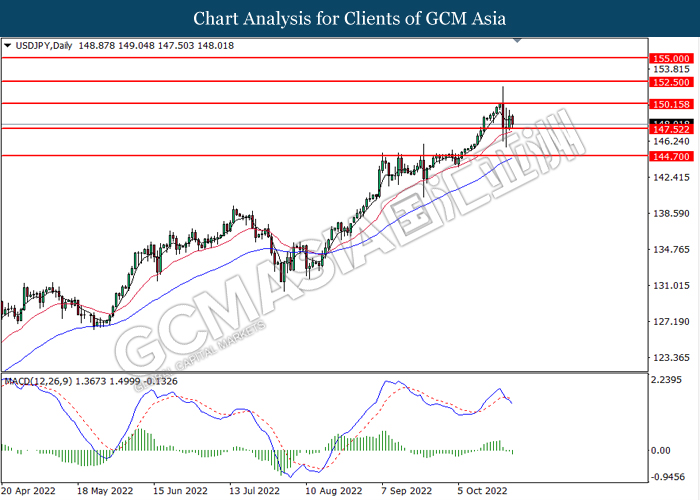

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 147.50. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 150.15, 152.50

Support level: 147.50, 144.70

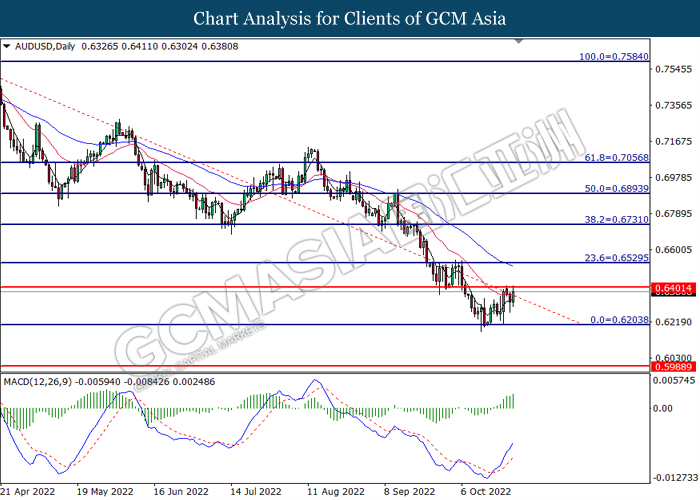

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6400, 0.6530

Support level: 0.6205, 0.5990

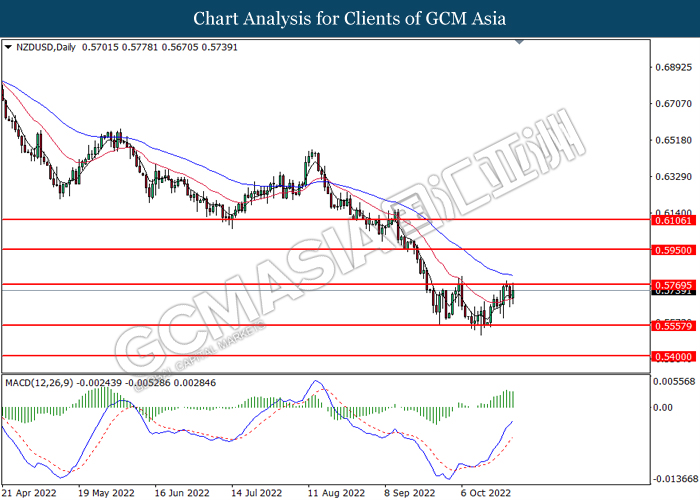

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.5770, 0.5950

Support level: 0.5560, 0.5400

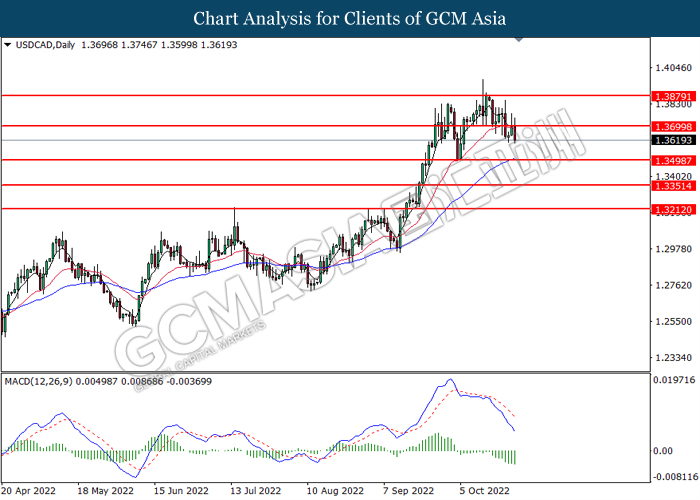

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0050, 1.0150

Support level: 0.9935, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 81.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 86.70.

Resistance level: 86.70, 93.10

Support level: 81.45, 76.85

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1660.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1638.40.

Resistance level: 1660.90, 1677.80

Support level: 1638.40, 1615.40