26 November 2020 Afternoon Session Analysis

Pound surged while market await for Friday talks.

Pound sterling which acting as one of the major trading currency in FX market managed to extend its rally while hitting its highest level in three months early morning today and yet market participants are still focus on the upcoming negotiation between UK and EU. Yesterday, European Commission President Ursula von der Leyen revealed that ‘coming days will be decisive for Brexit negotiation as crucial differences between both parties remains. Moreover, Ursula von der Leyen also reiterated that she cannot promise if any deal could be sealed by this week, as the disagreement including the level of playing field, the enforcement of any agreement and fisheries issue are still threatening the consensus between two sides. On the other hand, EU Chief Negotiator Michel Barnier has warned the UK negotiators that EU will pull out from the Brexit negotiations in London this weekend if without a major shift by UK within these two days. Such a warning statement from EU has lifted up the market pessimism against a Brexit deal, while urging the market participants to speculate the possibility of Hard-Brexit. As of now, the pair of GBP/USD ticked up by 0.05% to 1.3388.

In the commodities market, the crude oil price appreciated by 0.33% to $46.10 per barrel despite oil rig counts rise in US. According to Baker Hughes, the number of oil rigs in US rose by 10 to 241 in total, however it still fails to stop the rally of oil price as this black commodity market is still riding on the positive news of vaccine’s development. Besides, gold price rose by 0.06% to $1809.10 a troy ounce amid exacerbating of pandemic in globally.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

19.30 EUR ECB Publishes Account of Monetary Policy Meeting

20.30 EUR ECB Monetary Policy Statement

Today’s Highlight Economic Data

N/A

Technical Analysis

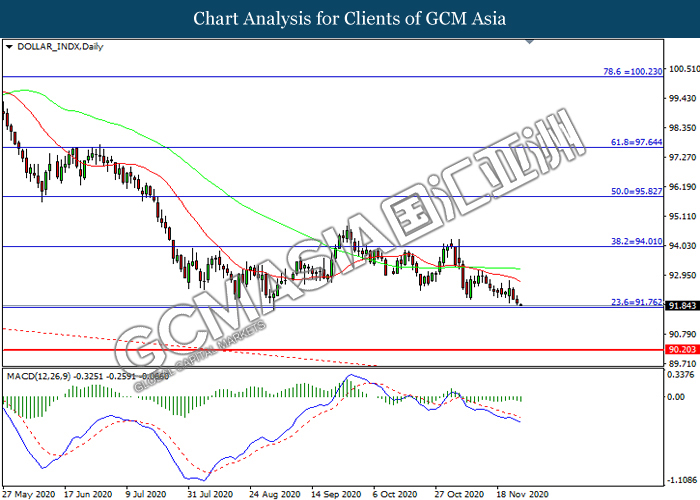

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 91.75. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 94.00, 95.85

Support level: 91.75, 90.20

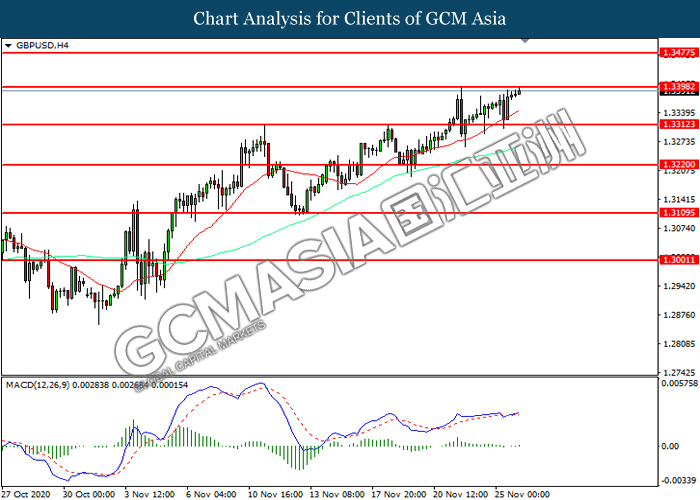

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3475

Support level: 1.3310, 1.3220

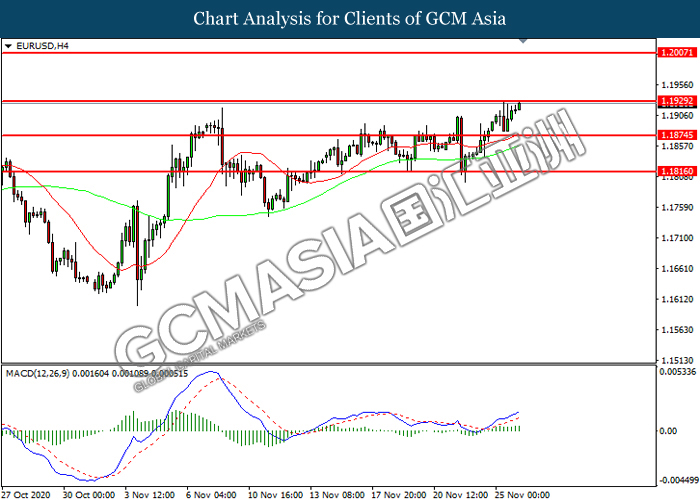

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1930. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1930, 1.2005

Support level: 1.1875, 1.1815

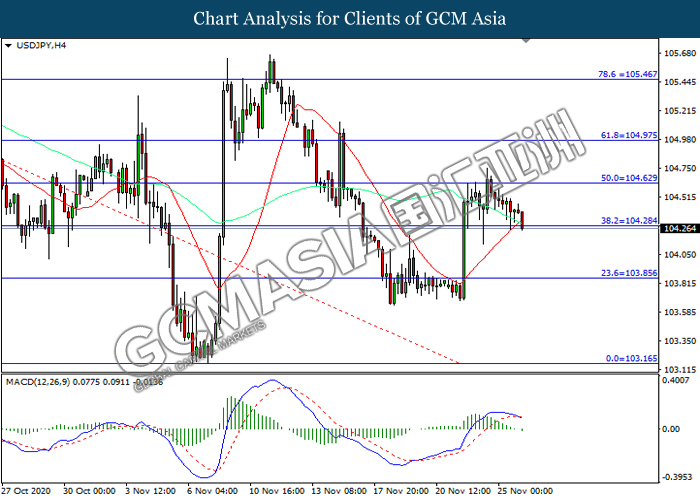

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 104.25. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.30, 104.65

Support level: 103.85, 103.15

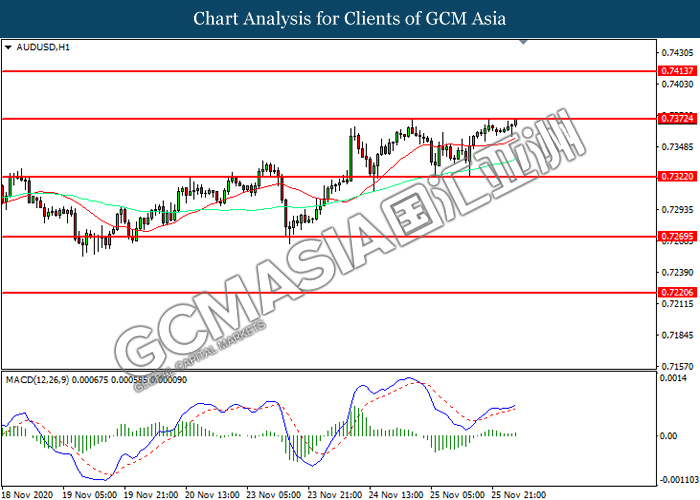

AUDUSD, H1: AUDUSD was traded higher while currently testing the resistance level at 0.7370. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7370, 0.7415

Support level: 0.7320, 0.7270

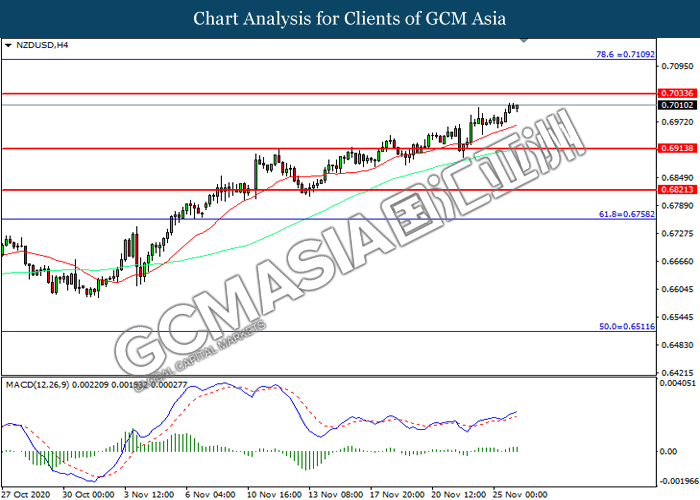

NZDUSD, H4: NZDUSD was traded higher while currently near the resistance level at 0.7035. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7035, 0.7110

Support level: 0.6915, 0.6820

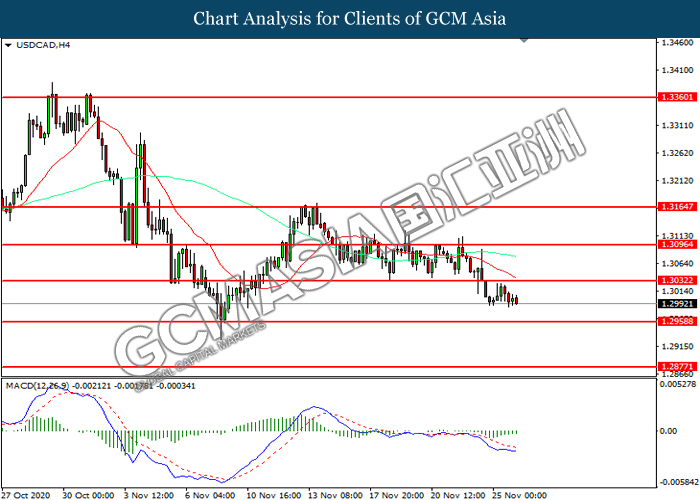

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3030. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3030, 1.3095

Support level: 1.2960, 1.2875

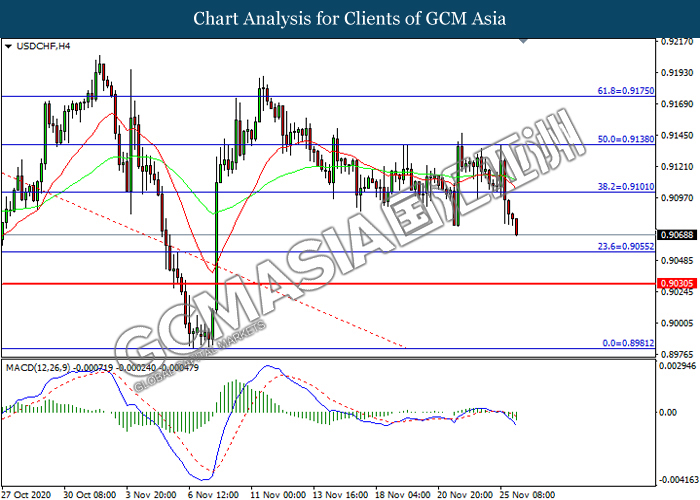

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9100. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9055.

Resistance level: 0.9100, 0.9140

Support level: 0.9055, 0.9030

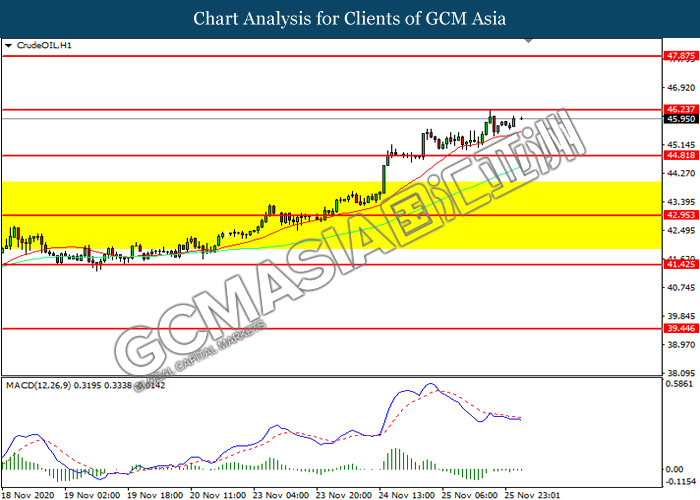

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 46.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 46.25, 47.85

Support level: 44.80, 42.95

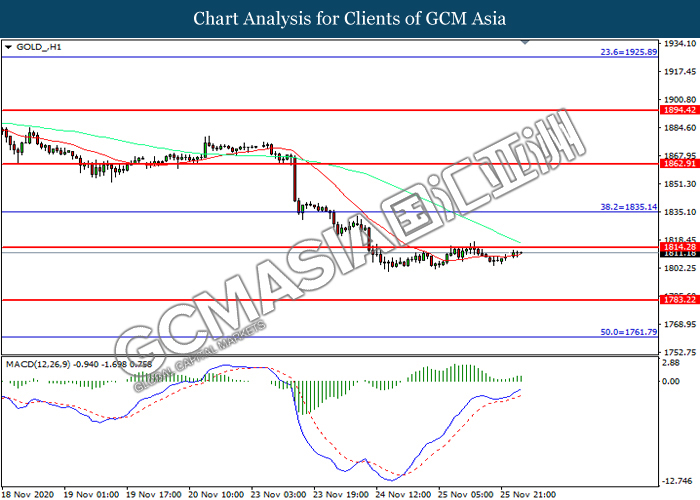

GOLD_, H1: Gold price was traded within a range while currently testing the resistance level at 1814.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1814.30, 1835.15

Support level: 1783.20, 1761.80