27 January 2022 Morning Session Analysis

Powell reinvigorates US dollar.

Greenback extended its gains earlier today as Federal Reserve unleashes hawkish tilts during its monetary policy meeting. As expected, Federal Reserve has maintained its current monetary policy setting in terms of interest rate and bond purchasing program. Overall, market focus towards Fed’s meeting is more focused on their views towards the economy and how hawkish their stance could be. Several Fed officials reveals that they may increase interest rates if current economic condition allows for such action to be taken. However, Fed Chair Jerome Powell stated that US economy is still subjected to risks ahead due to the spread of Omicron variant. Likewise, he expects inflationary pressure to subside substantially if current issues such as supply chain disruption and scarcity of raw materials is resolved in the near future. Nonetheless, Powell emphasized that they have an ample of room to increase interest rates without jeopardizing the labor market while such action will be highly dependent on future economic data. As of writing, the dollar index was up 0.02% to 96.40.

In the commodities market, crude oil price rose 0.71% to $87.34 per barrel as Saudi Arabia is expected to raise their oil selling price next month over the backdrop of rising global demand. On the other hand, gold price was down by 0.05% to $1,821.62 a troy ounce as US dollar extended its gains.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | Core Durable Goods Orders (MoM) (Dec) | 0.80% | 0.40% | – |

| 21:30 | GDP (QoQ) (Q4) | 2.30% | 5.40% | – |

| 21:30 | Initial Jobless Claims | 286K | 255K | – |

| 23:00 | Pending Home Sales (MoM) (Dec) | -2.20% | 0.30% | – |

Technical Analysis

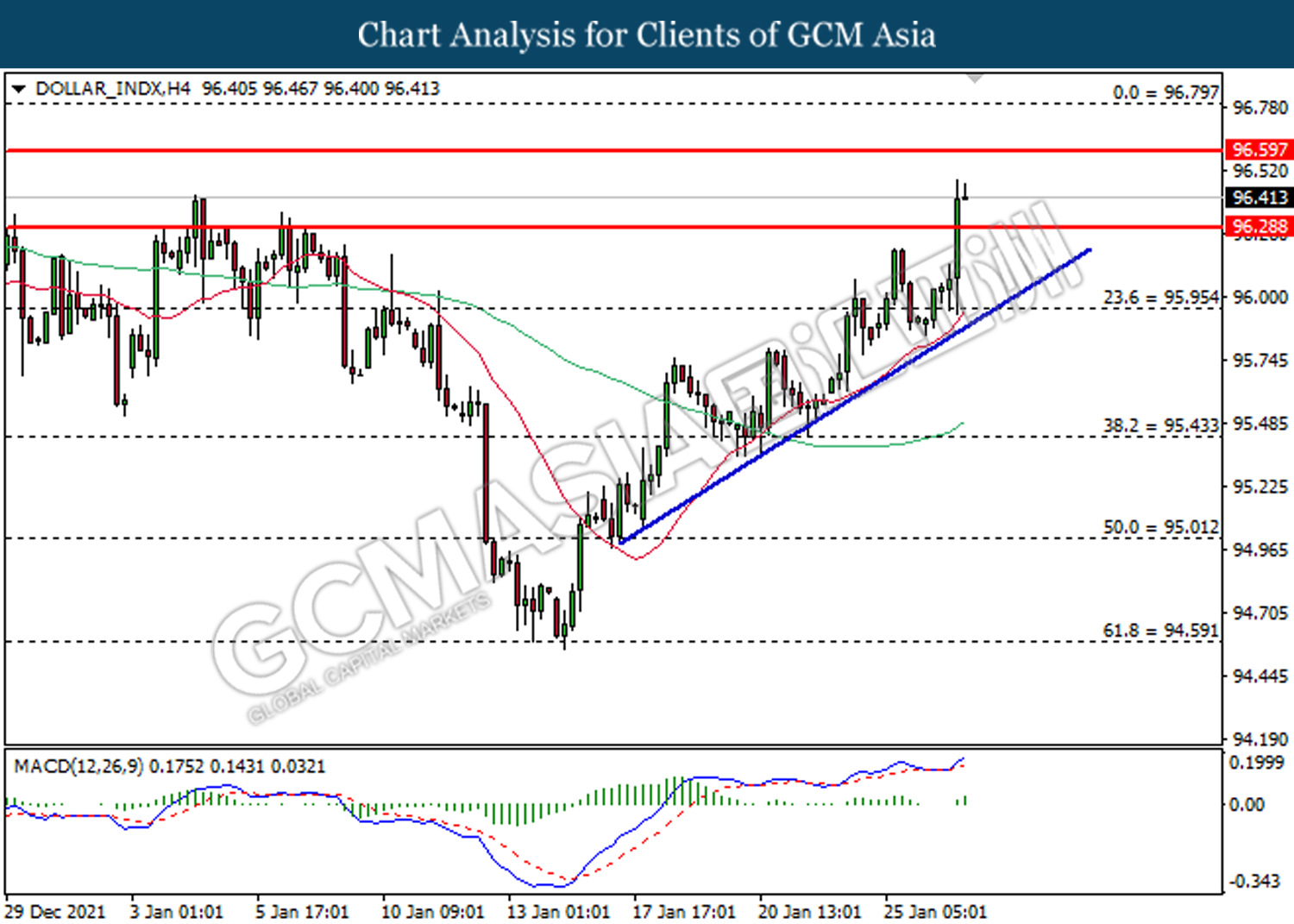

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 96.60, 96.80

Support level: 96.30, 95.95

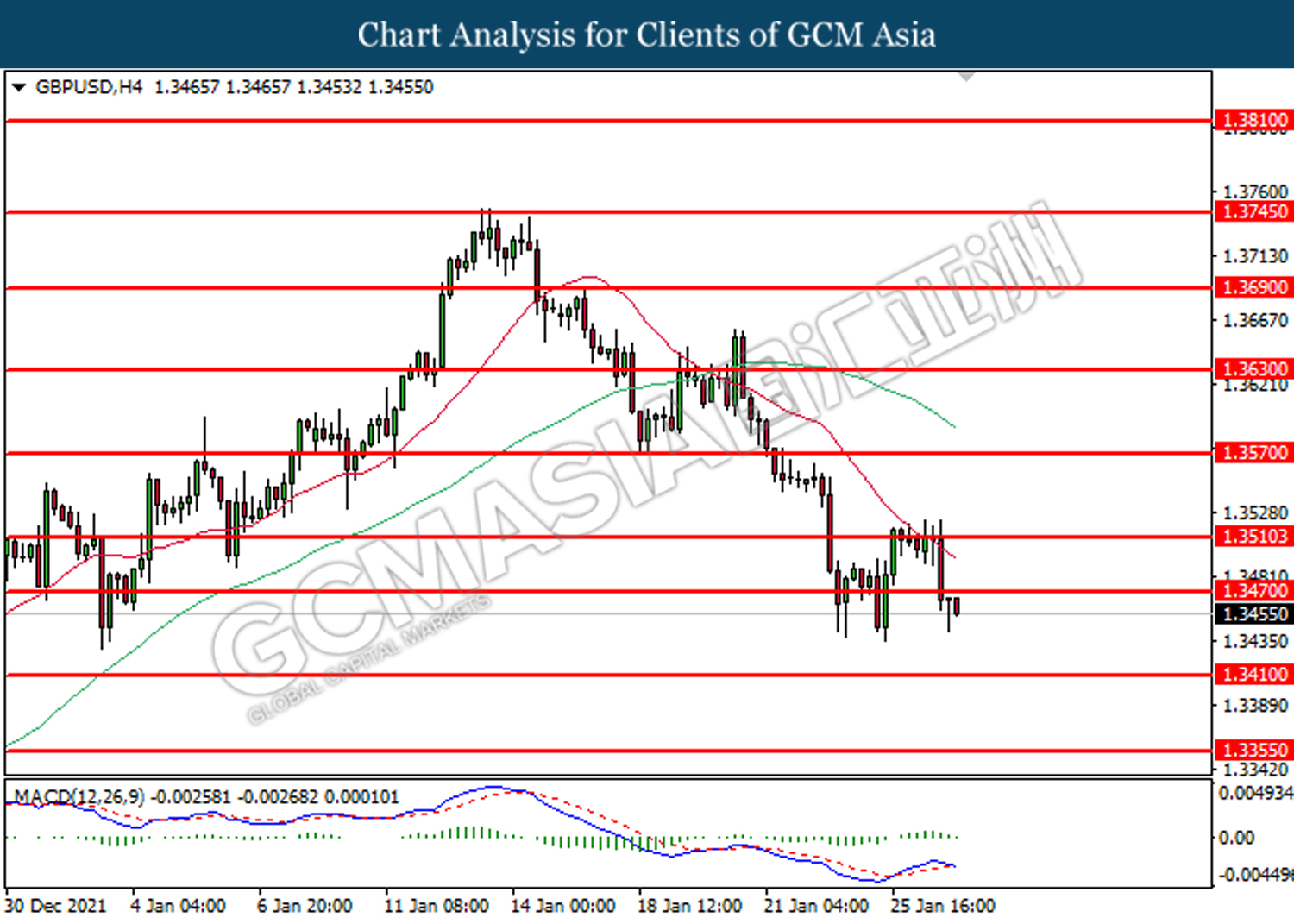

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3470, 1.3510

Support level: 1.3410, 1.3355

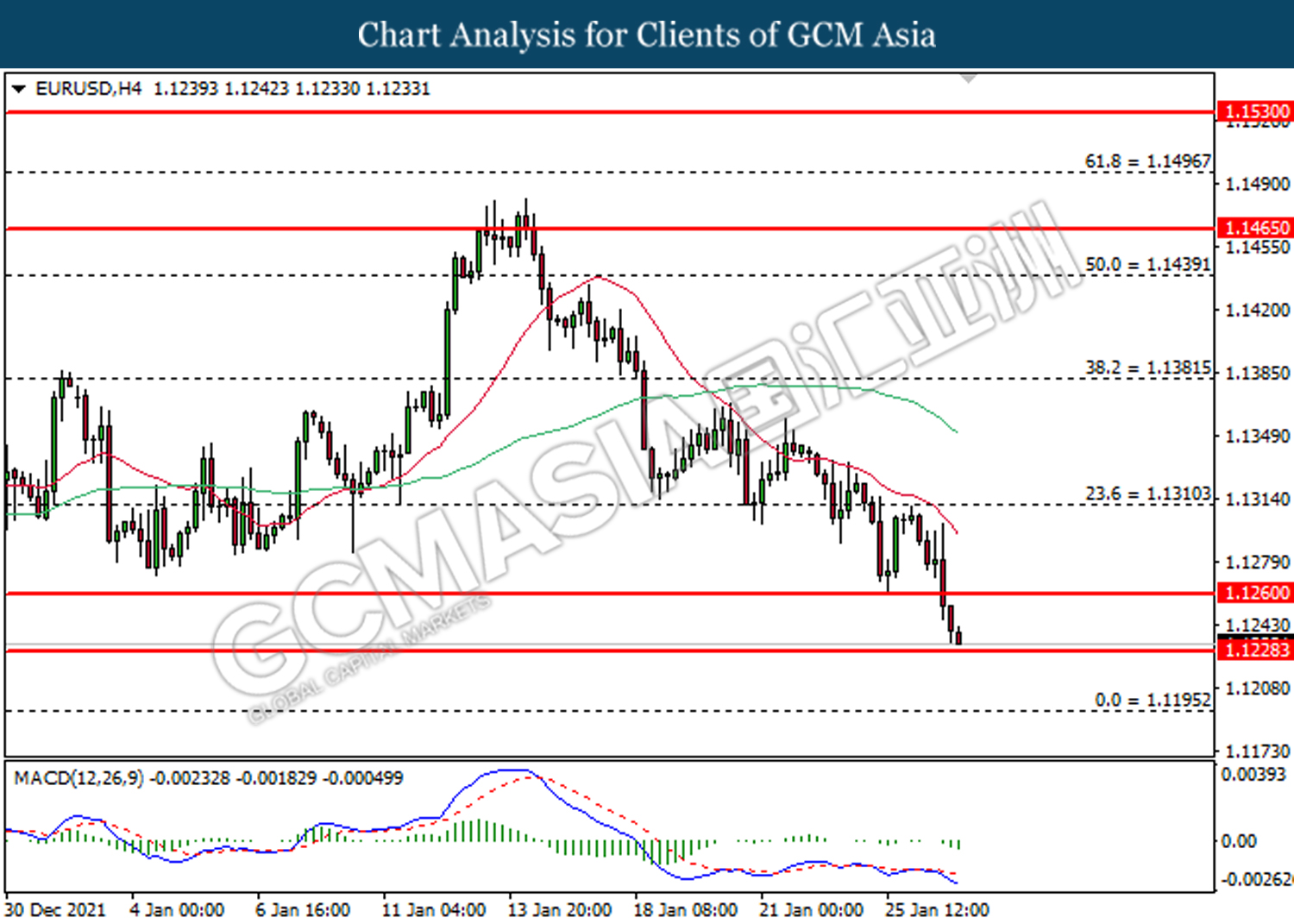

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1260, 1.1310

Support level: 1.1230, 1.1195

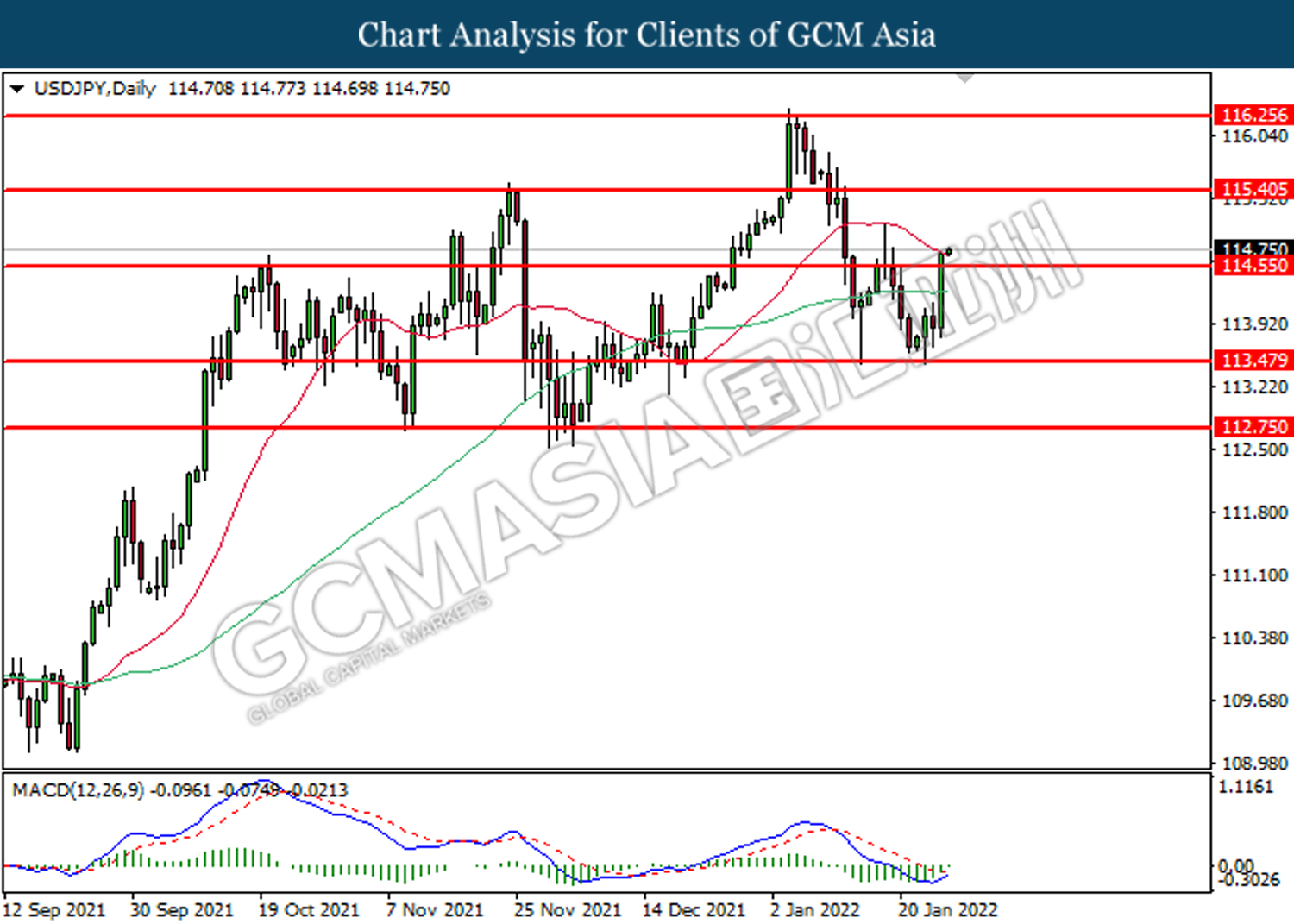

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in mid-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

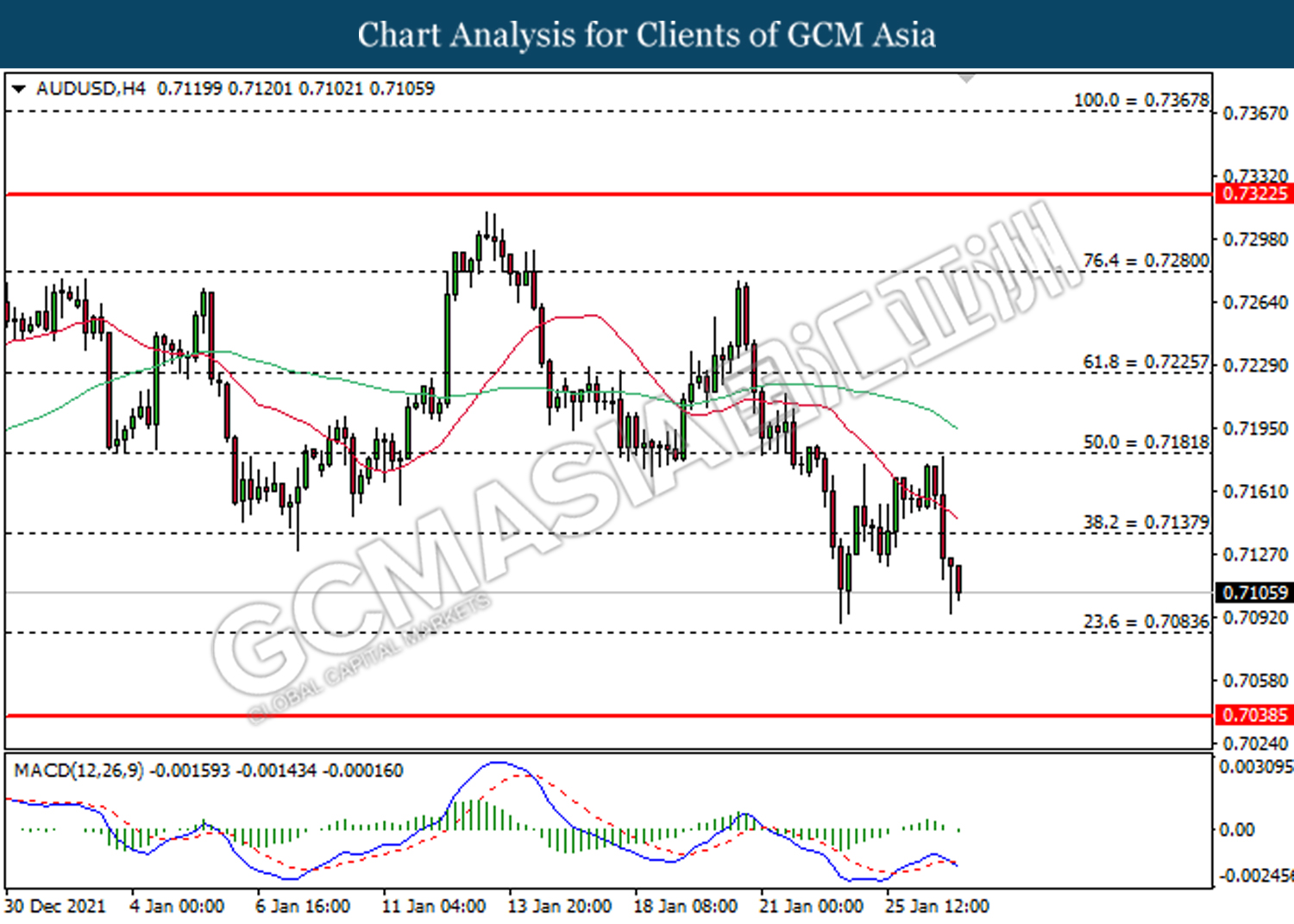

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7140, 0.7180

Support level: 0.7085, 0.7040

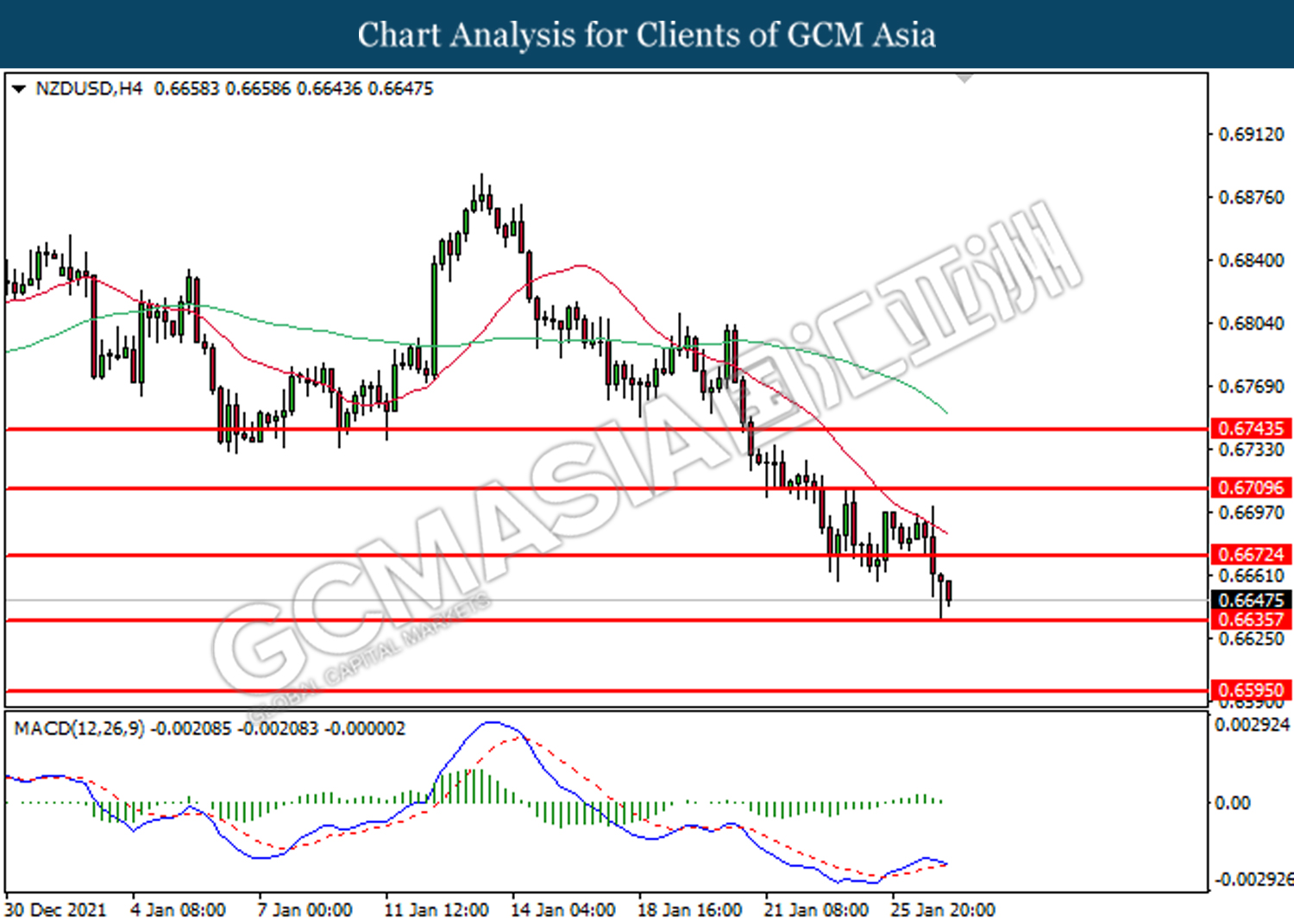

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

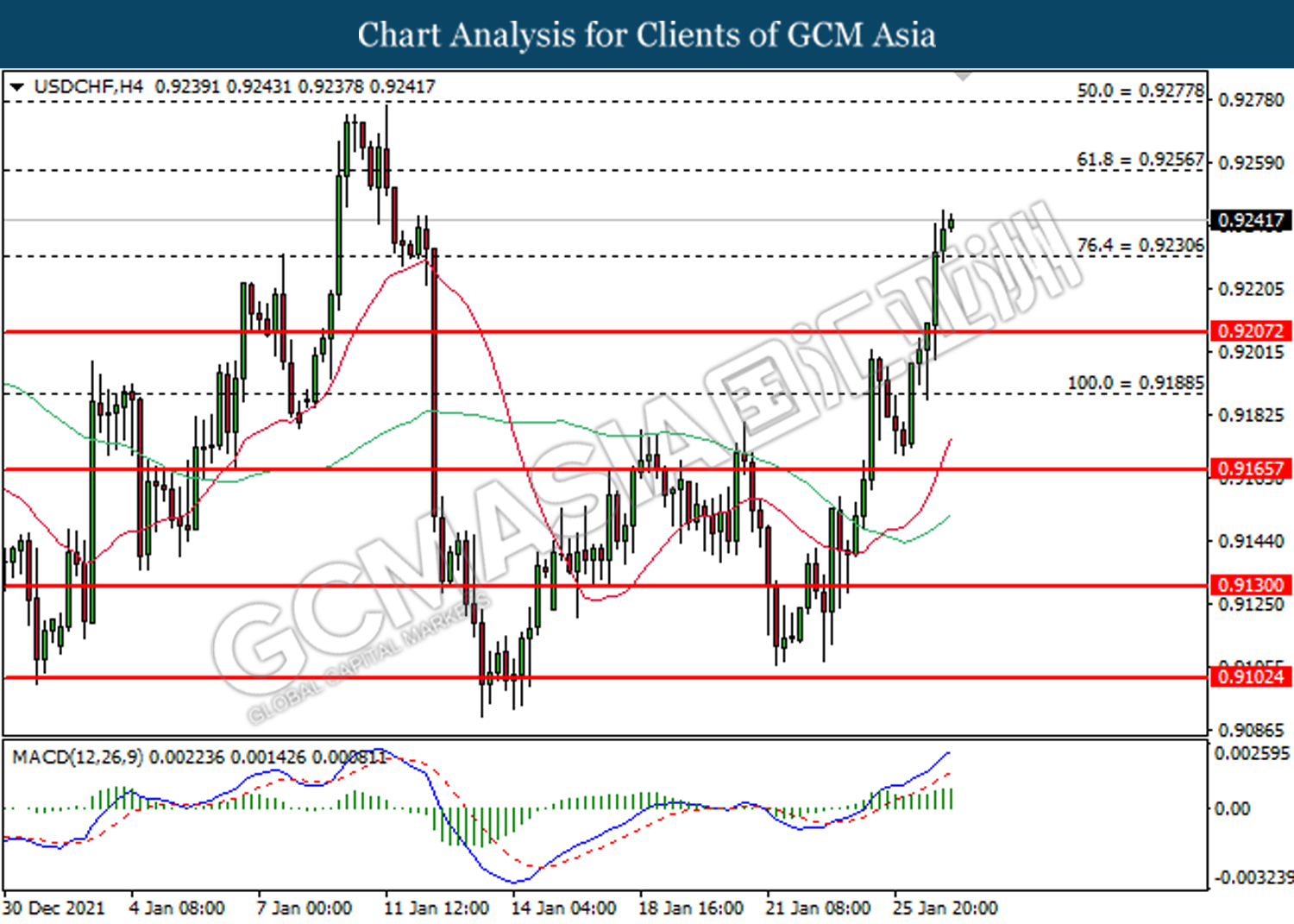

USDCHF, H4: USDCHF was traded higher following prior breakout at 0.9210. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior closure above 84.60. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 87.40, 89.50

Support level: 84.60, 82.65

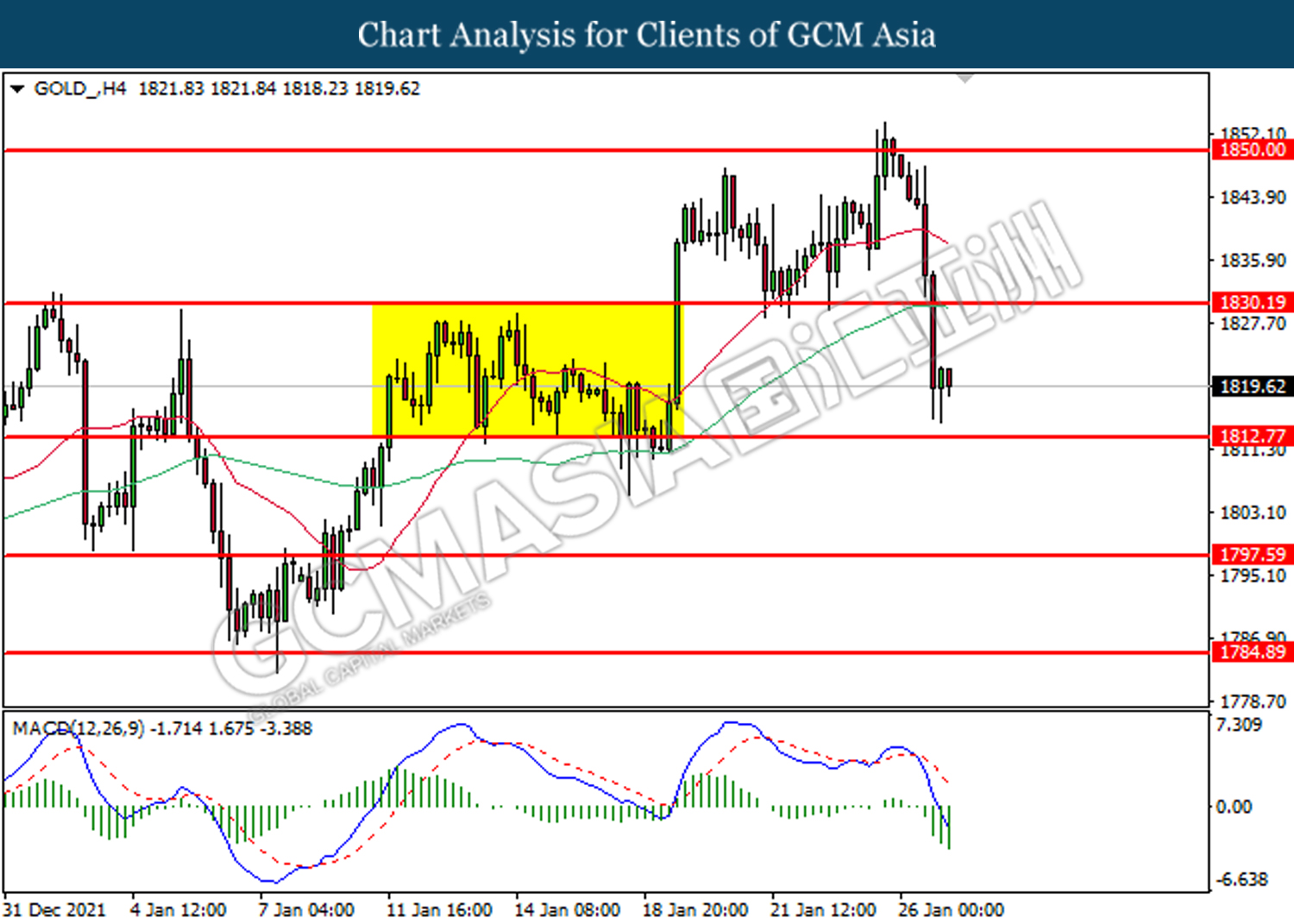

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after closing below 1812.80.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60