27 February 2023 Afternoon Session Analysis

Euro losses were limited by Lagarde’s hawkish speech.

The euro, as one of the most traded currencies by the global investor, closed lower last Friday as the US core PCE index surged, strengthening the dollar and sparked sell-off pressures on the pairing of EUR/USD. However, the losses of the euro currency were limited by the European Commission, President Christine Lagarde’s speech. In the interview, Lagarde reiterated that inflation in the eurozone was still high and the recent drop in inflation was mainly attributed to the decline in energy prices. According to Eurostat, the January inflation rate reduced slightly by 0.6% to 8.6% but the core inflation in the eurozone stood at 5.3%, higher than the prior reading of 5.2%. These data give more room for ECB to aggressively hike rates since it inflation target is 2%. The comments prompted investors that ECB will continue to hike rates for another 50-basis point and strengthen the position of the Euro. In addition, Eurozone will release Its CPI data in later this week, where the investors are waiting for more cues from the release of the data. As of writing, the EUR/USD slipped -0.08% to $1.0537.

In the commodities market, crude oil prices edged down by -0.71% to $75.81 per barrel amid a stronger dollar and market concern over the recession risks. Besides, gold prices depreciated by -0.09% to $1815.50 per troy ounce amid the increased expectation of an aggressive rate hike by the Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | -0.2% | 0.1% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | 2.5% | 1.0% | – |

Technical Analysis

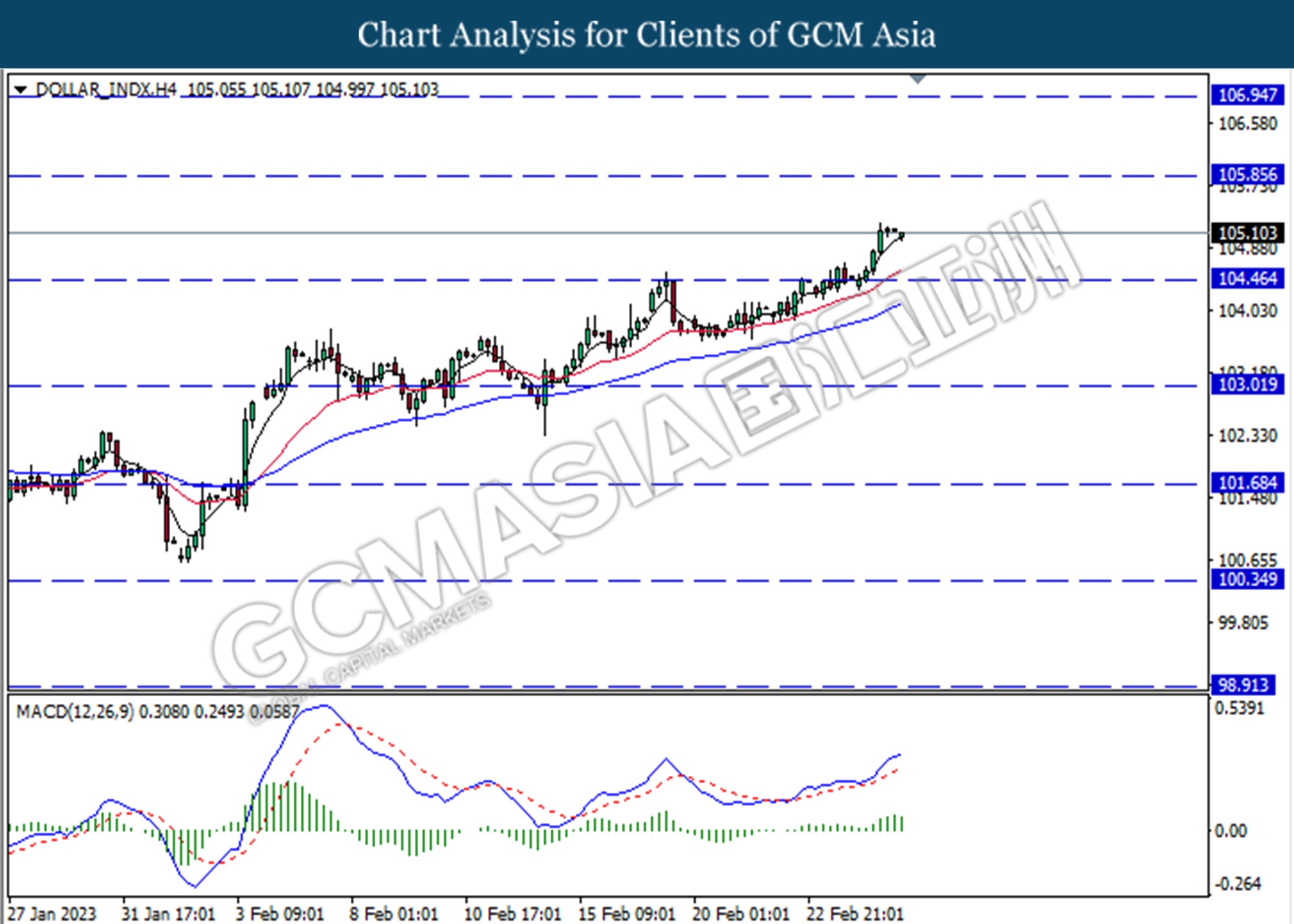

DOLLAR_INDX, H4: Dollar index was traded higher following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 104.45.

Resistance level: 106.95, 105.85

Support level: 104.45, 103.00

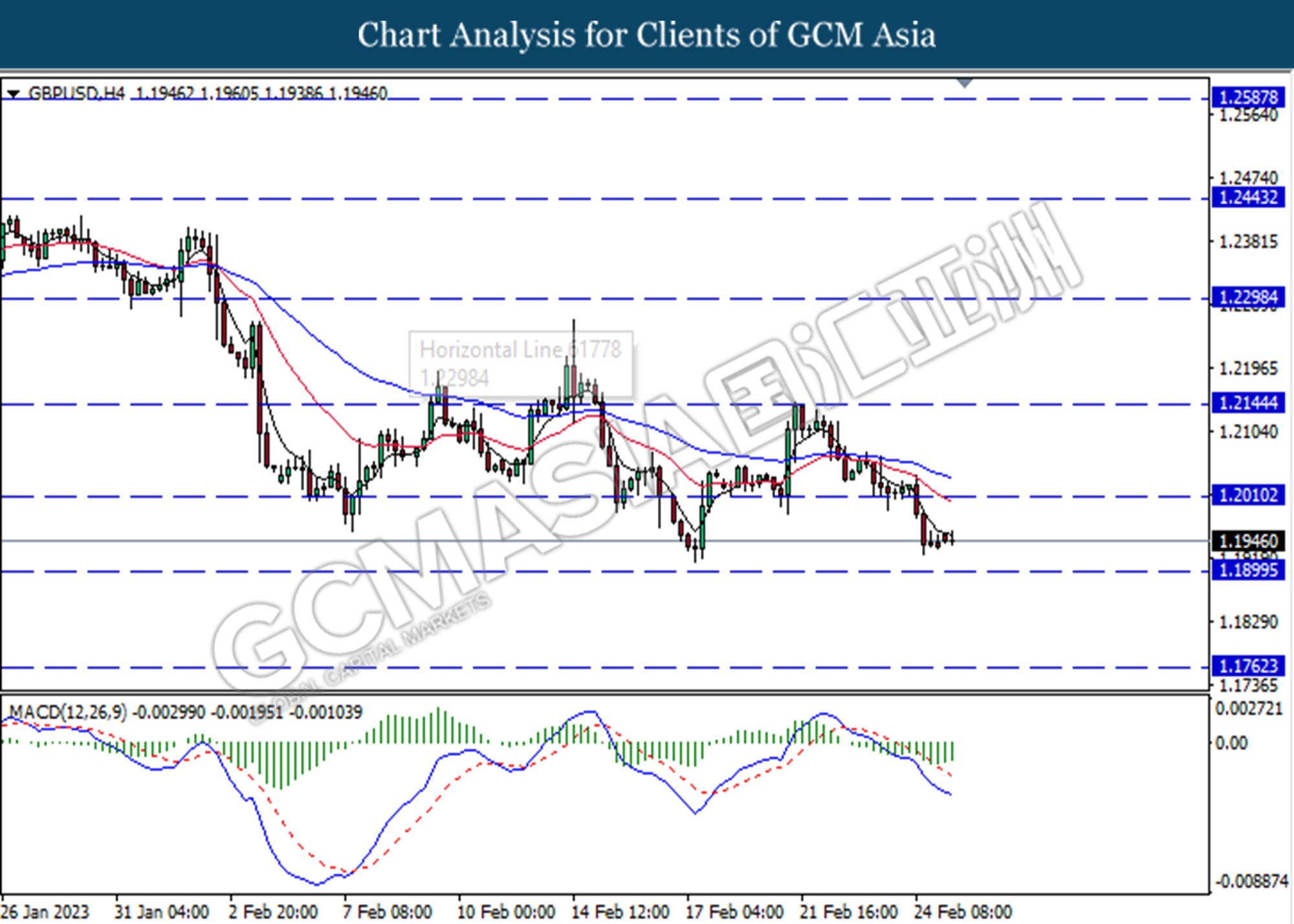

GBPUSD, H4: GBPUSD was traded lower following a prior break below the previous support at 1.2010. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 1.1900

Resistance level: 1.2010, 1.2145

Support level: 1.1900, 1.1760

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.0635, 1.0790

Support level: 1.0505,1.0360

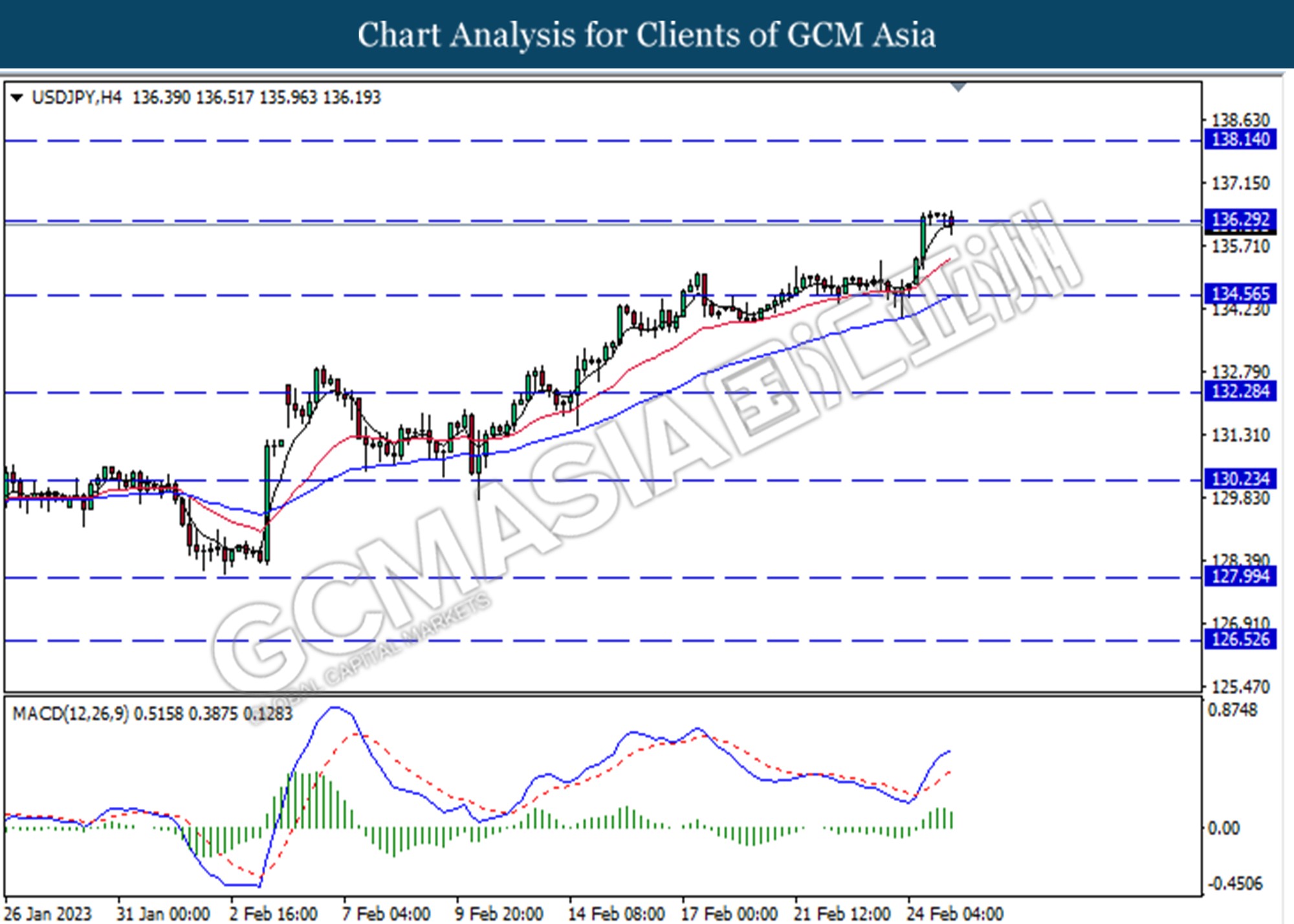

USDJPY, H4: USDJPY was traded lower following a break below the previous support level at 136.30. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 134.55.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower following a prior break below the previous support level at 0.6775. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

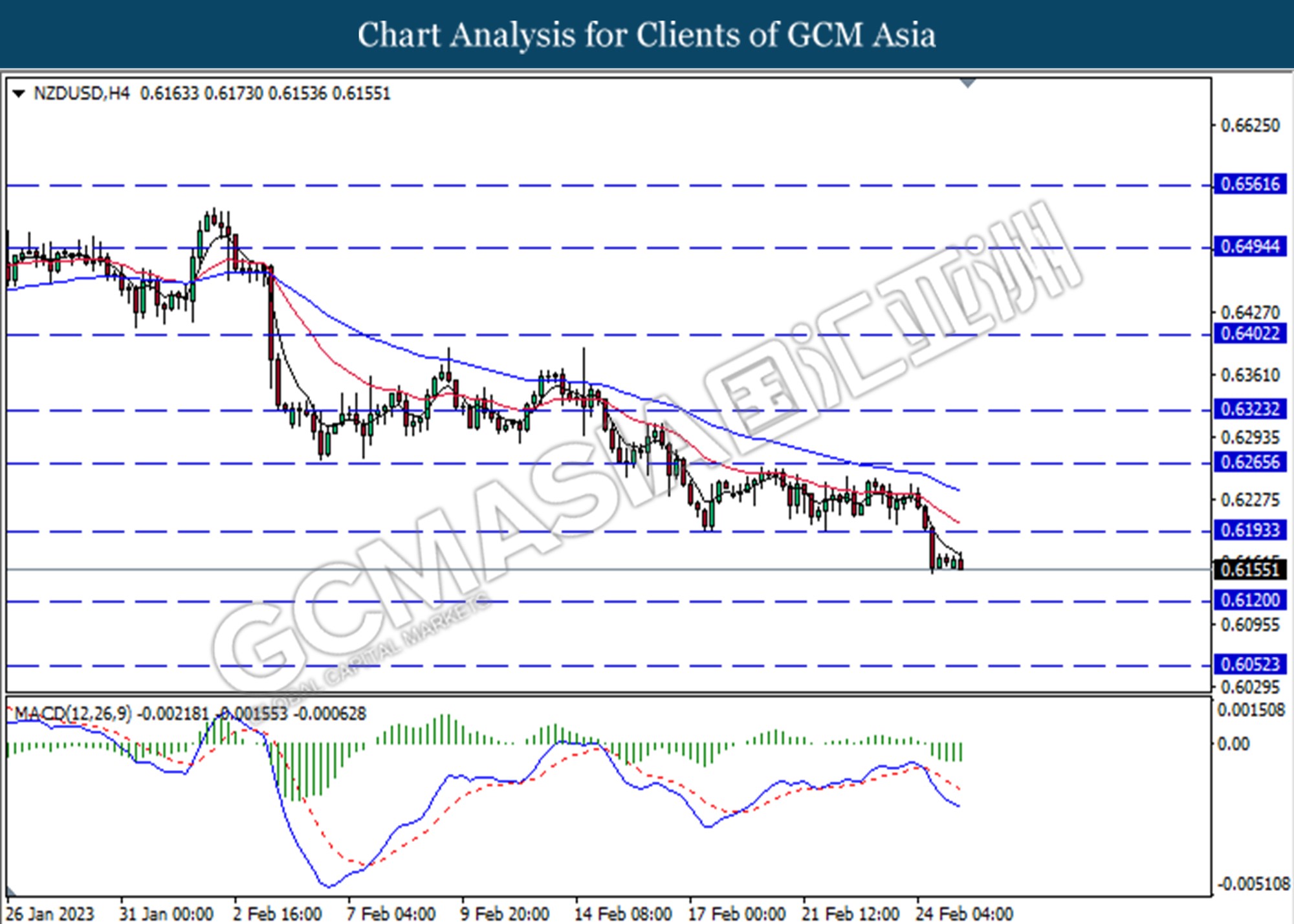

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

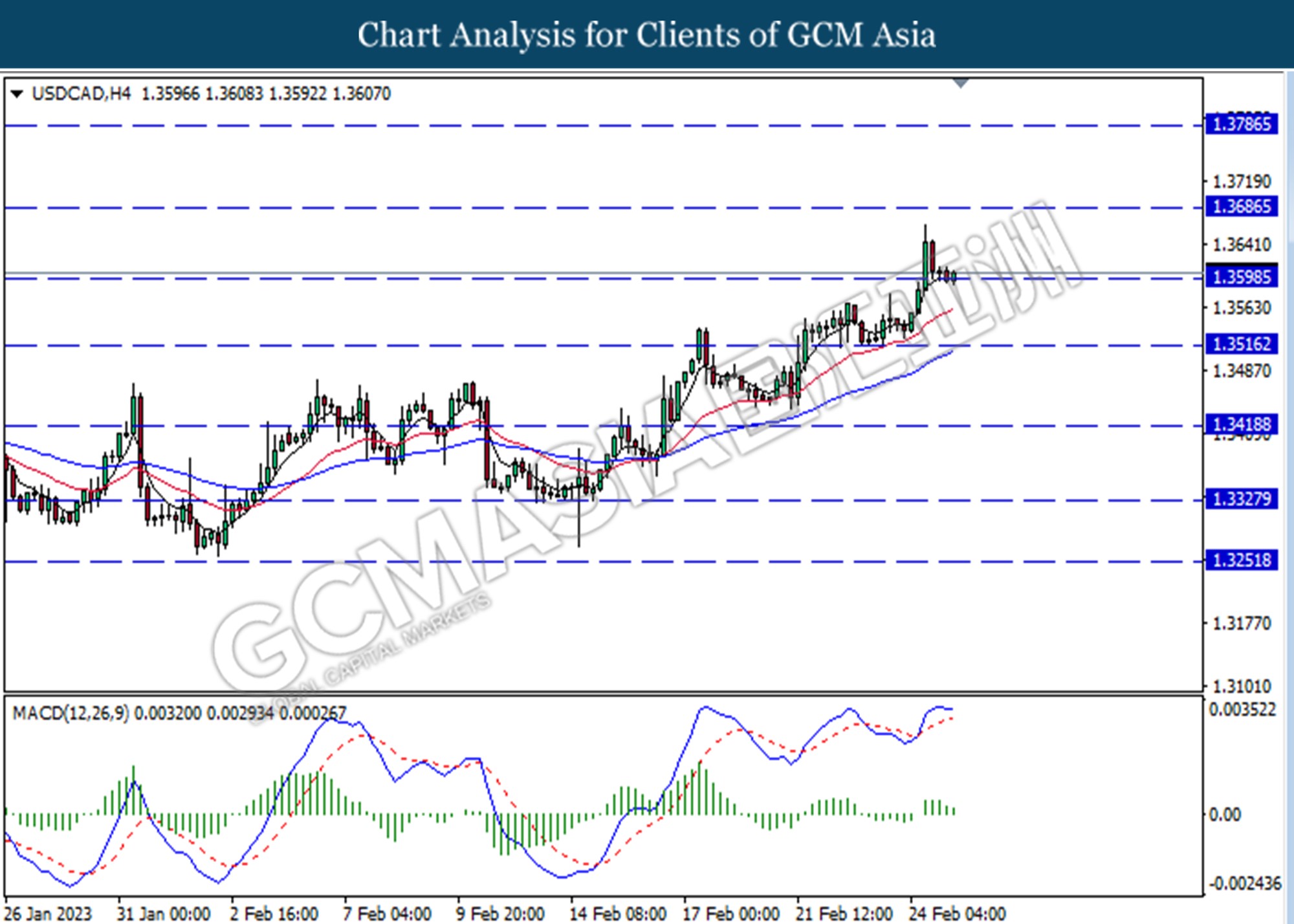

USDCAD, H4: USDCAD was traded lower currently testing for the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

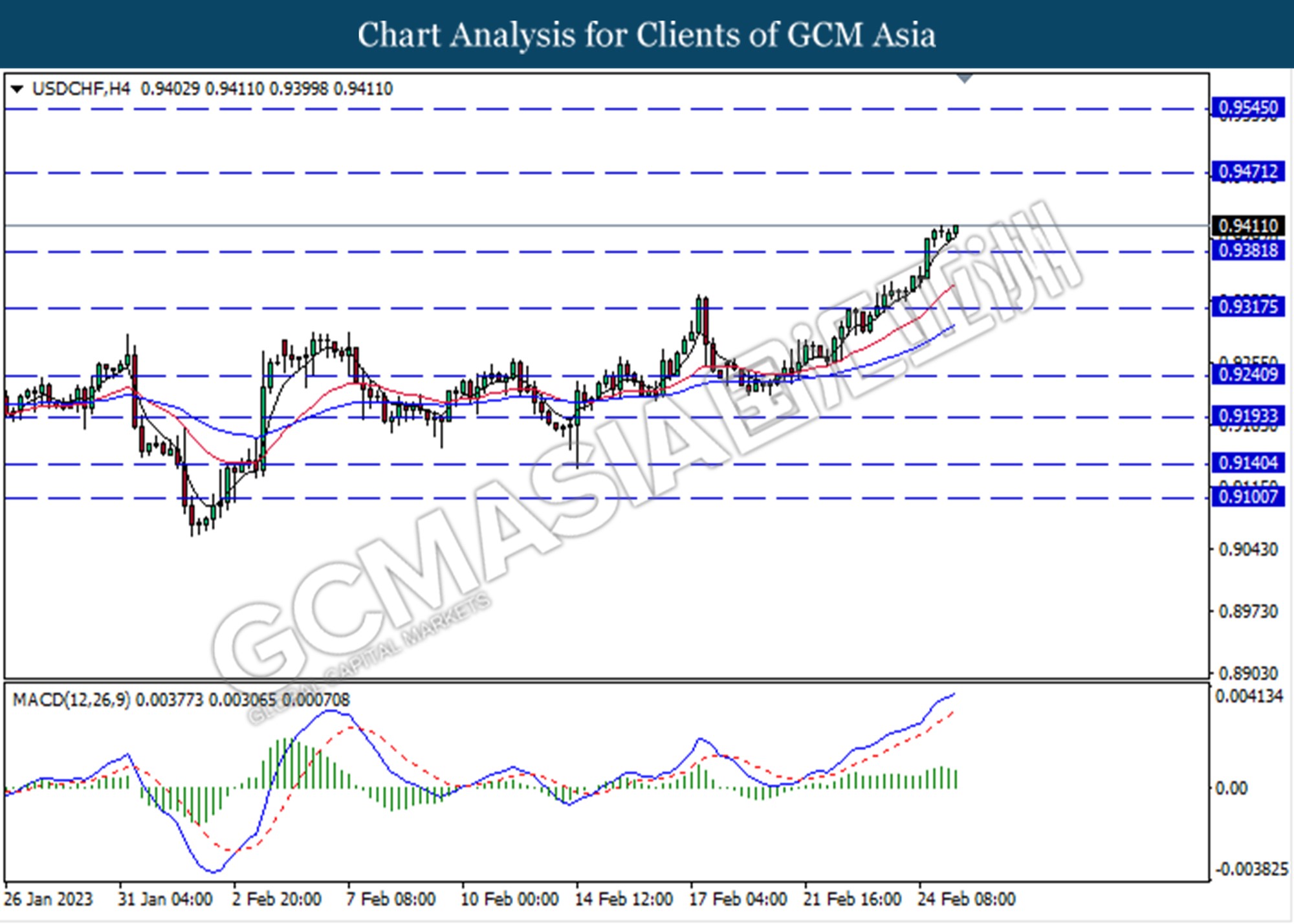

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9380. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9470

Resistance level: 0.9470, 0.9545

Support level: 0.9380, 0.9320

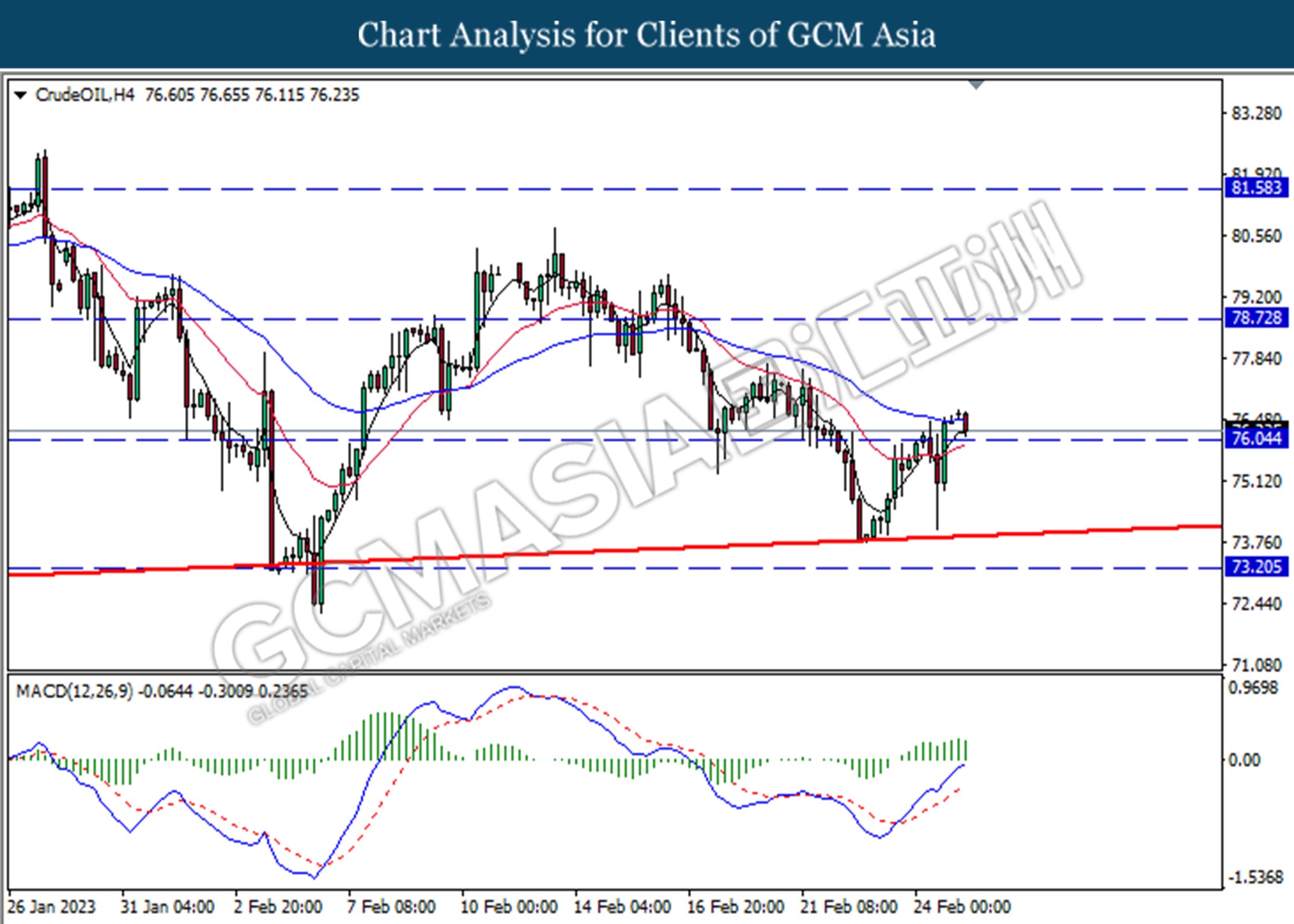

CrudeOIL, H4: Crude oil price was traded lower currently testing for the support level at 76.05. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after successfully breaking below the support level.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

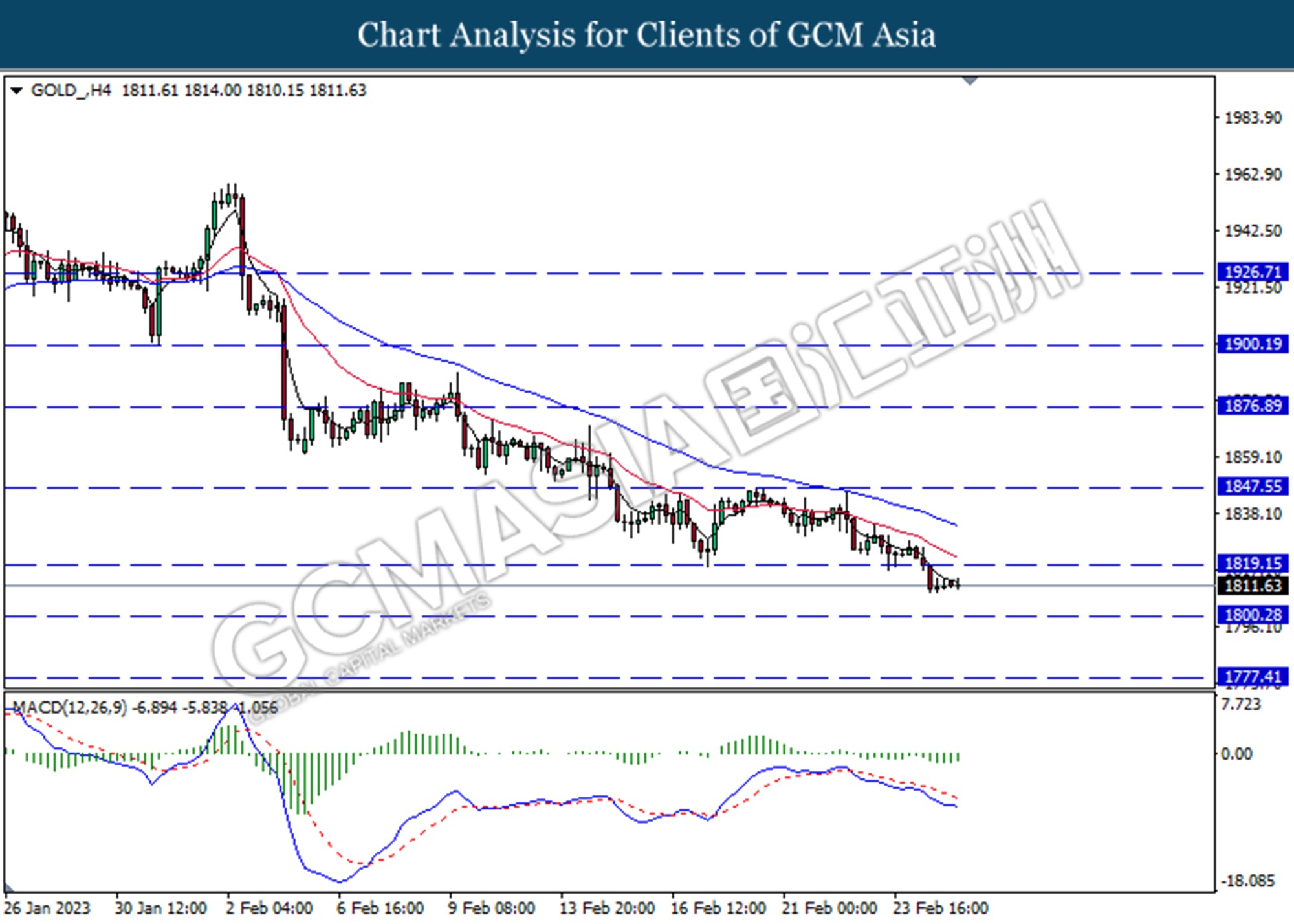

GOLD_, H4: Gold price was traded lower following the prior breakout below the previous support level at 1819.15. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1800.30

Resistance level: 1819.15, 1876.90

Support level: 1800.30, 1777.40