27 February 2023 Morning Session Analysis

Greenback skyrocketed as inflation resurged.

The dollar index, which traded against a basket of six major currencies, managed to extend its rallies as the Fed’s preferred inflation gauge accelerated in January. According to the Bureau of Economic Analysis, the US Core PCE Price Index surged unexpectedly from the prior month’s reading of 0.4% to 0.6% last month, adding further pressure on the policymakers to curb inflation. Prior to that, the inflation figure has started to ease over the past few months, thanks to the aggressive rate hike plan by the Federal Reserve since early last year. However, with the backdrop of stubbornly high inflation, it may reinforce the Federal Reserve to continue with its rate hike plan, leaving the rate at a high level for longer or greater rate adjustment. All in all, a series of upbeat data has flipped the table over in the dollar market, saving the Greenback from the brink of collapse. On top of that, the dollar index shined as the instability of geopolitical issues in Iran boosted the market demand against the safe haven currency. Among them, the disputed nuclear program, human rights violations, and the supply of drones to Russia are the major factors that urged the investors to exit the country’s financial market amid the prospect of economic hardship. As of writing, the dollar index rose 0.63% to 105.25.

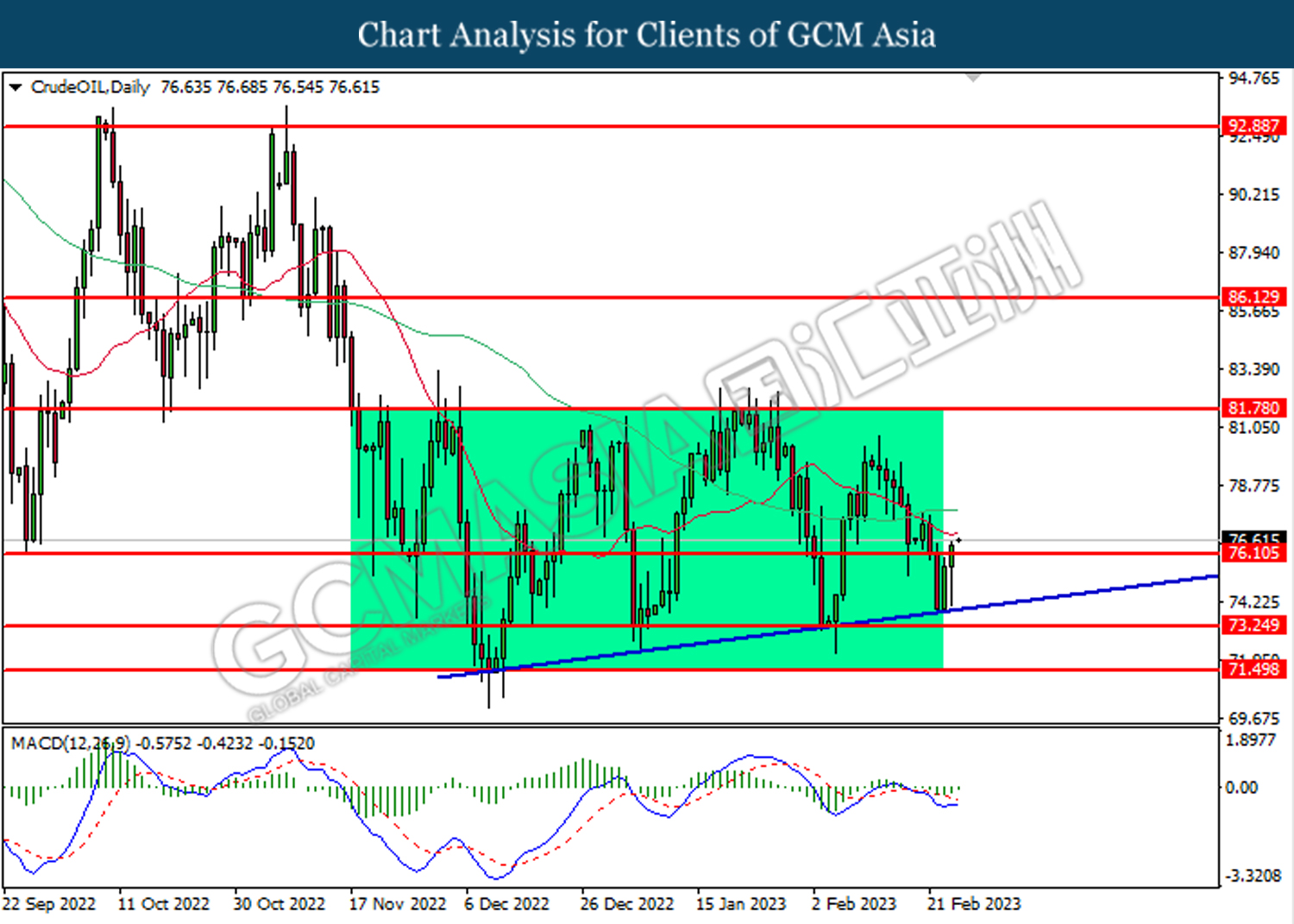

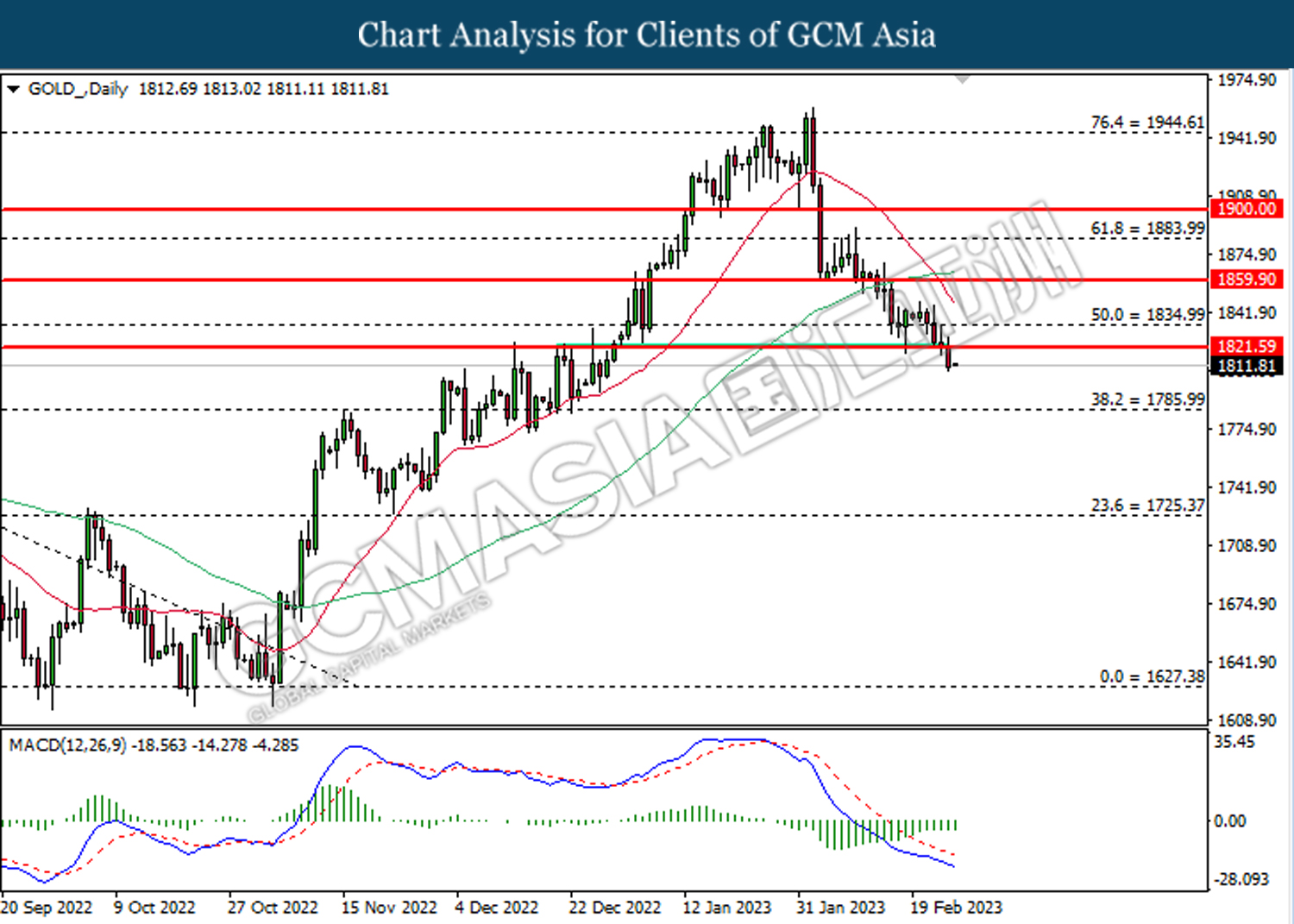

In the commodities market, crude oil prices rose by 1.09% to $76.30 per barrel as Russia halted oil supplies to Poland, said by Polish refiners. Besides, gold prices slumped by -0.59% to $1811.60 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | -0.2% | 0.1% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | 2.5% | 1.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 105.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

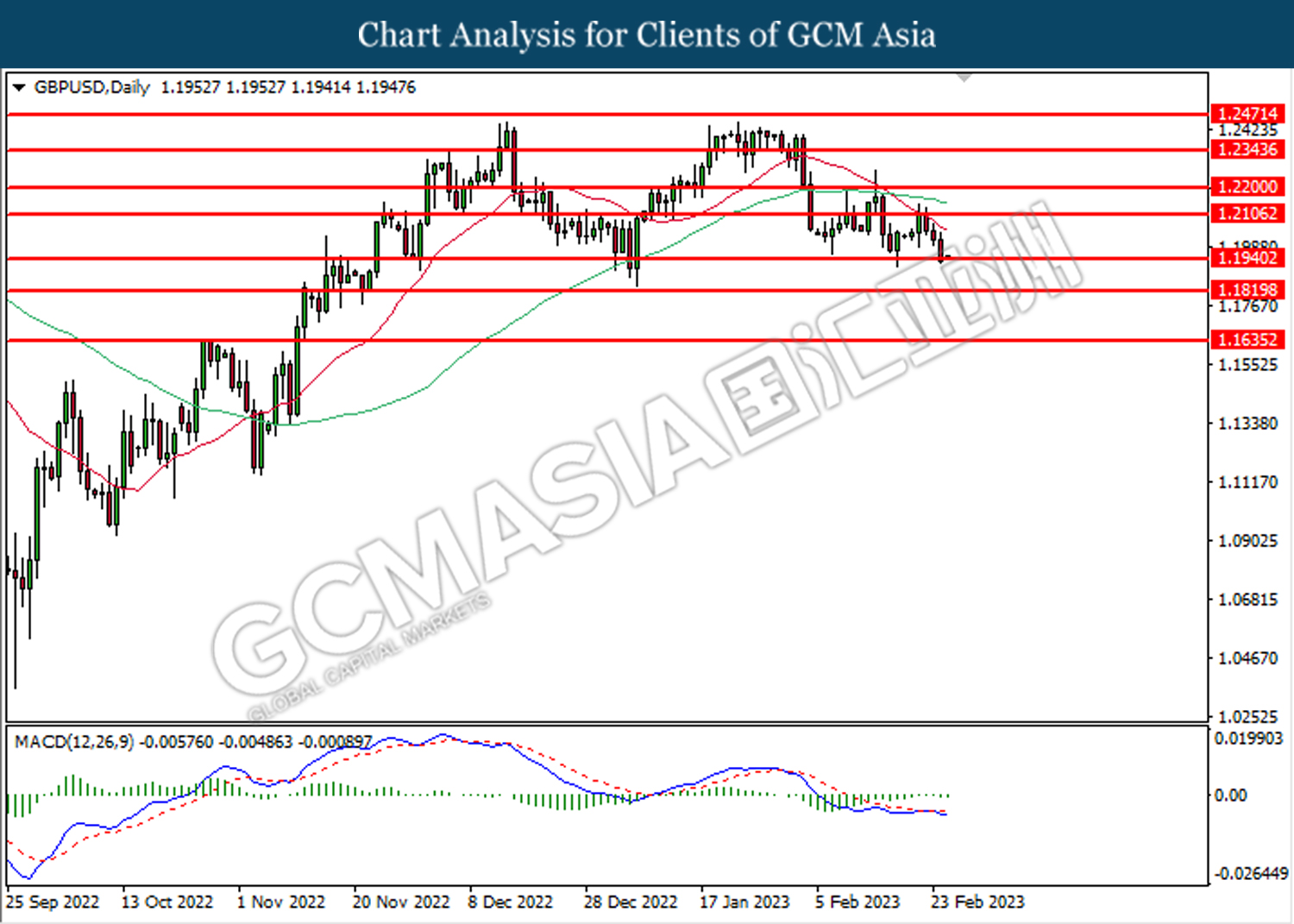

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1940. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

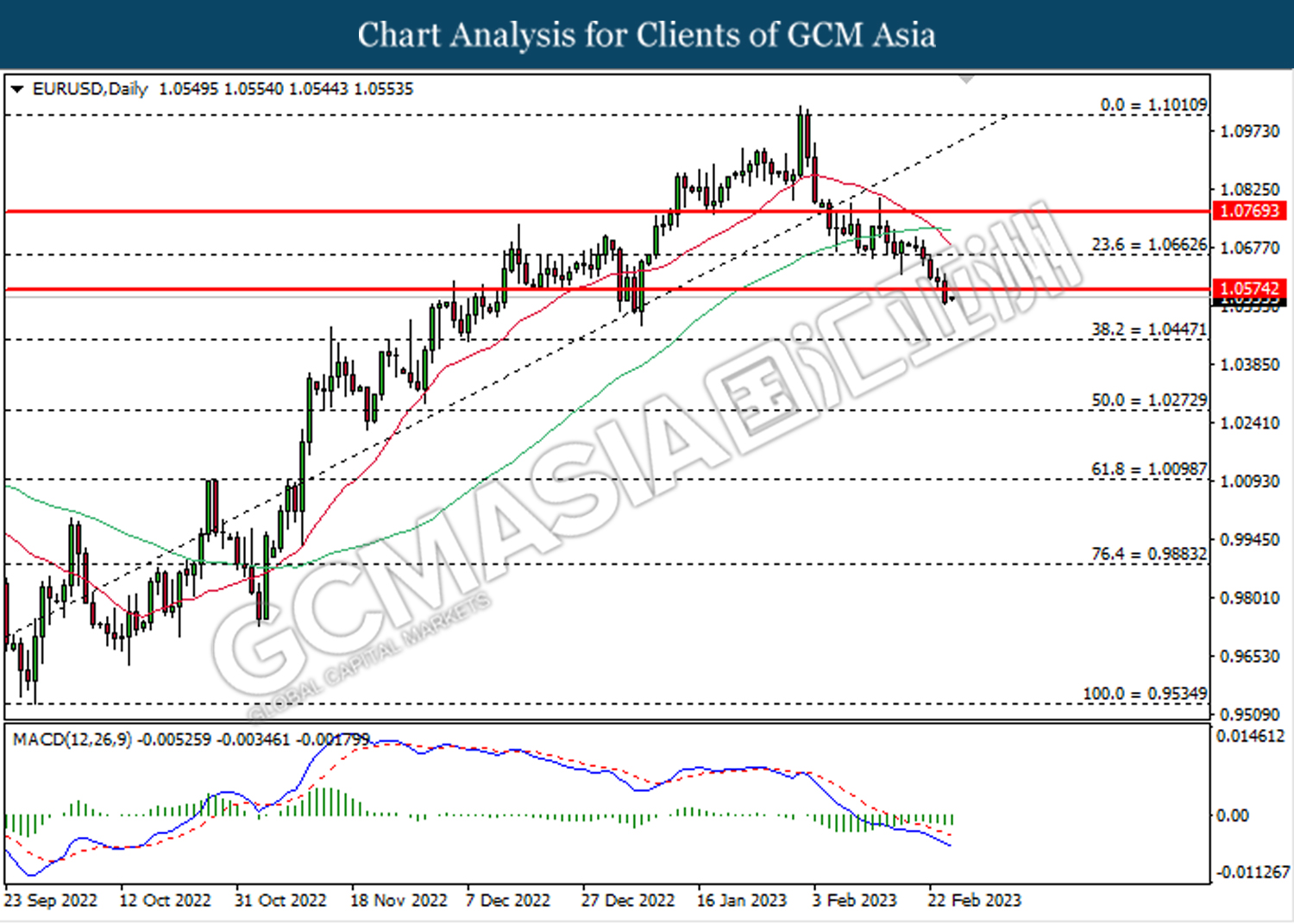

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0445.

Resistance level: 1.0575, 1.0665

Support level: 1.0445, 1.0275

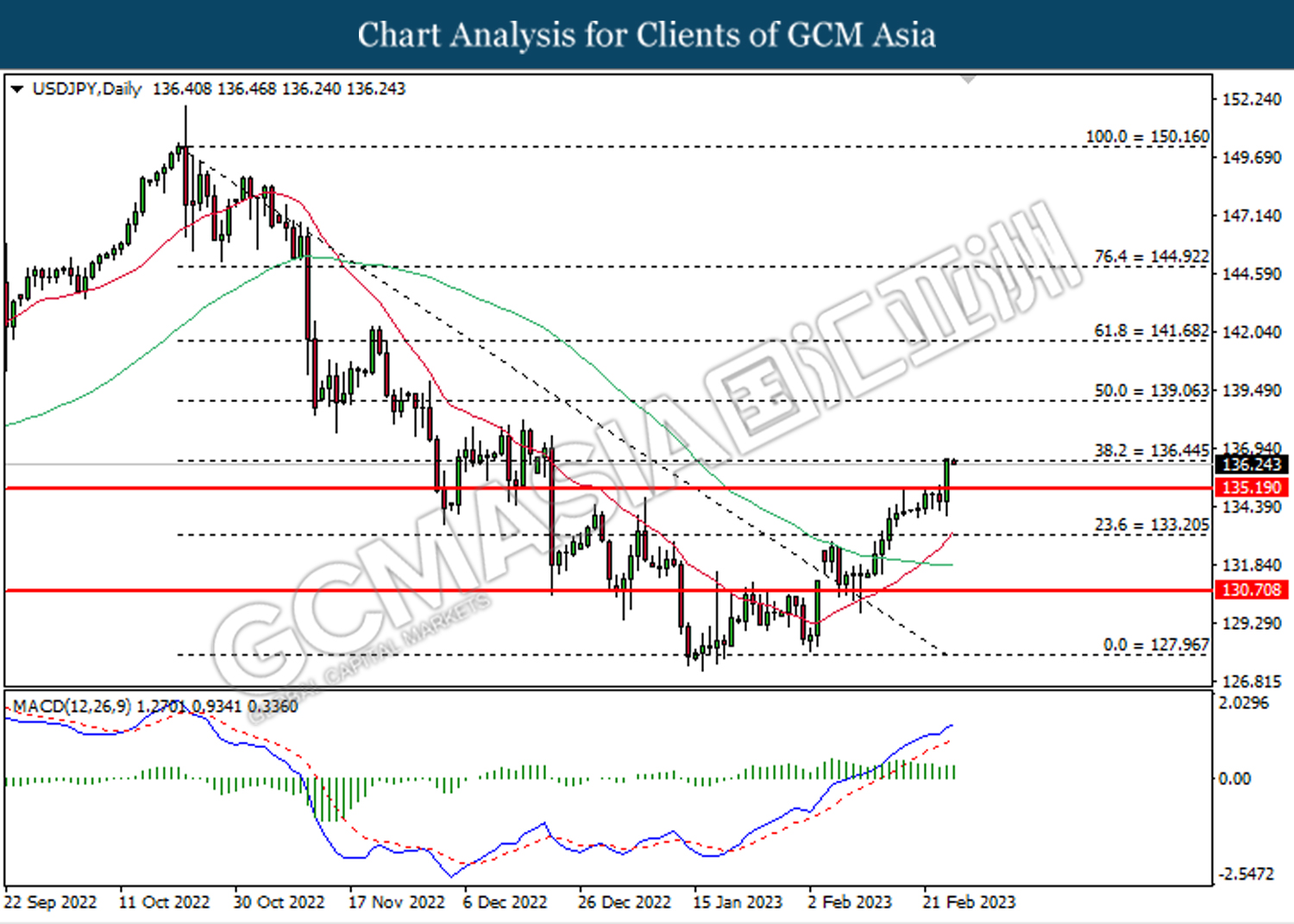

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

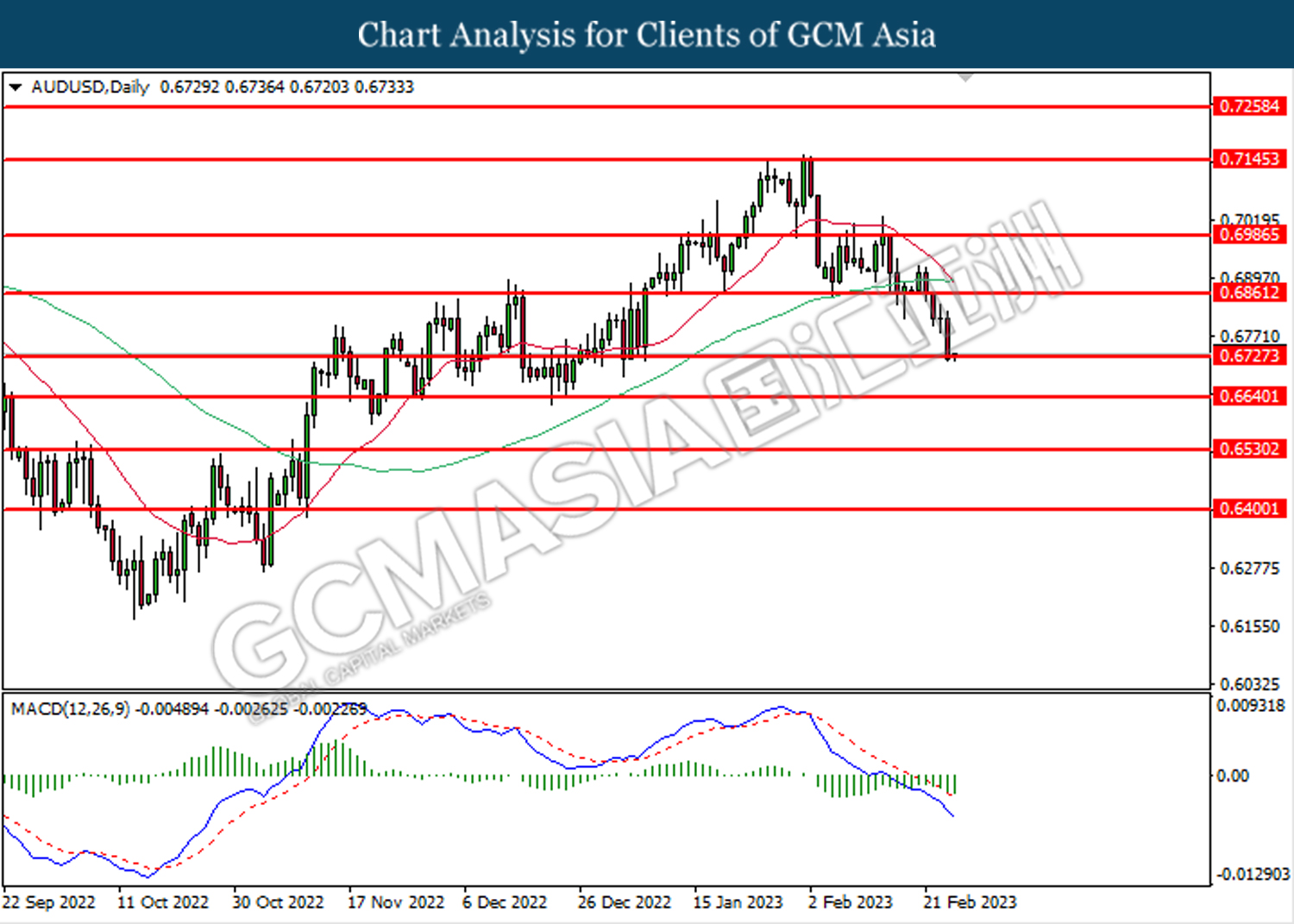

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

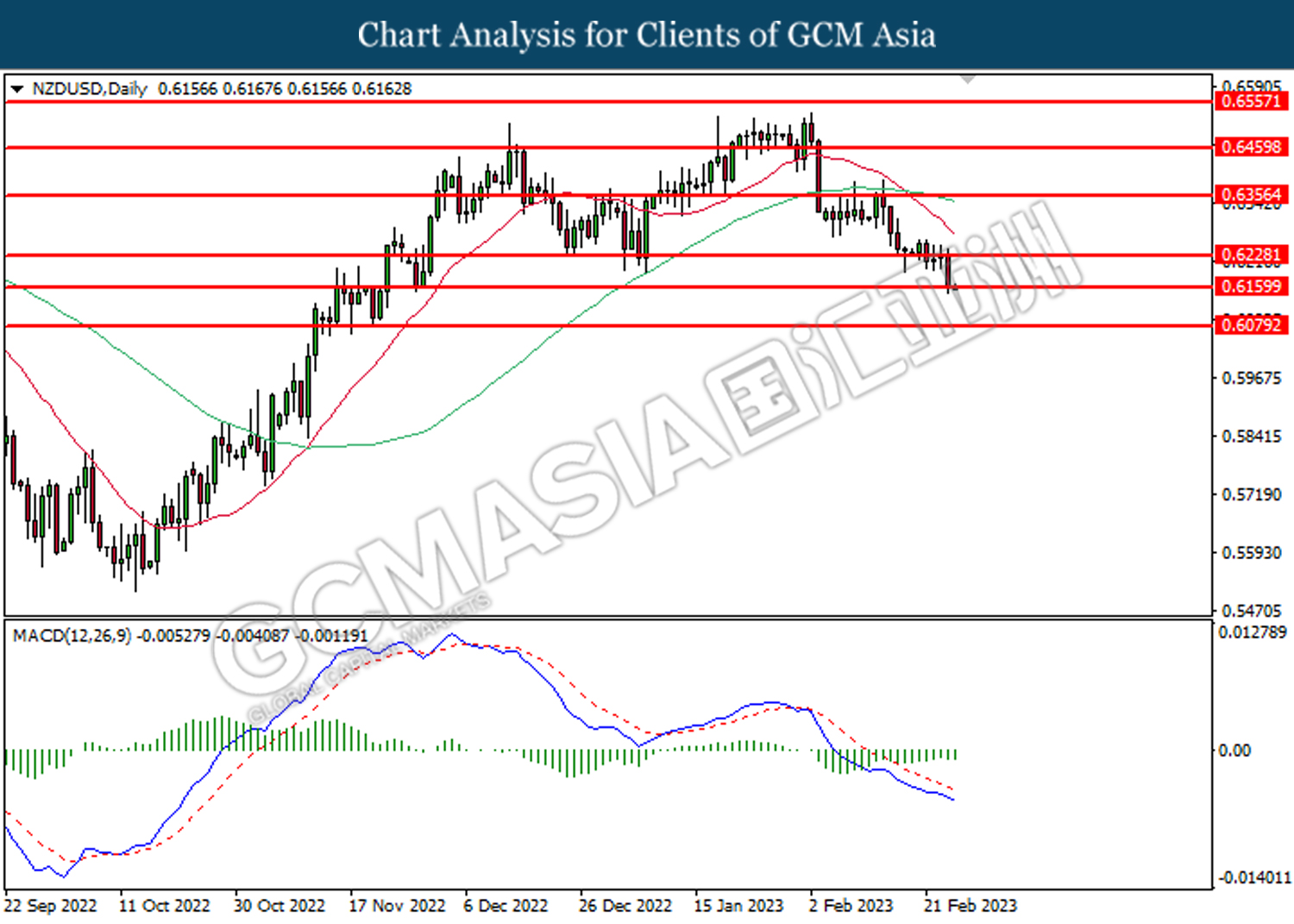

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6160. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

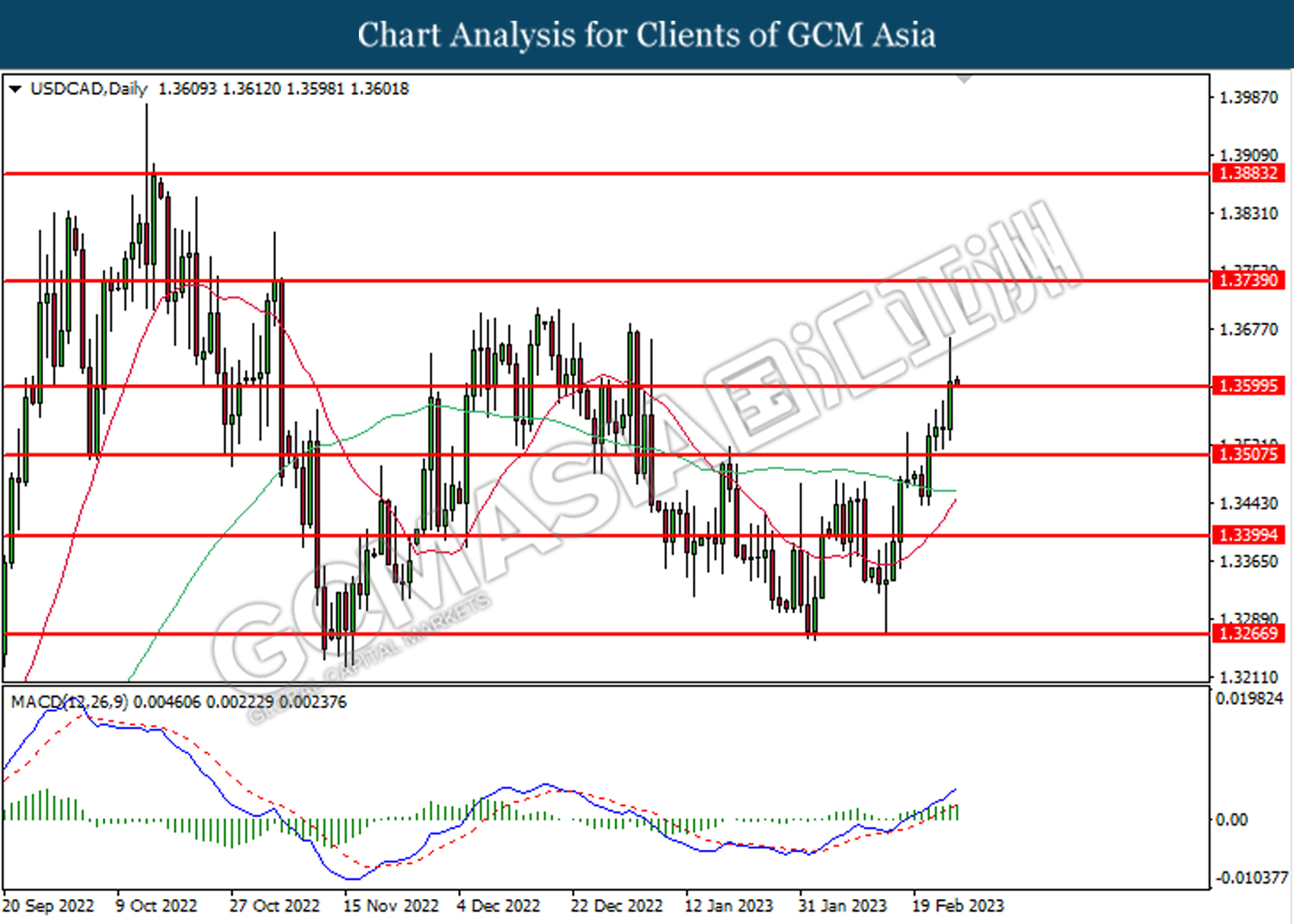

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the next resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1821.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1786.00

Resistance level: 1821.60, 1835.00

Support level: 1786.00, 1725.35