27 April 2022 Afternoon Session Analysis

Euro under pressure amid rising stagflation risk.

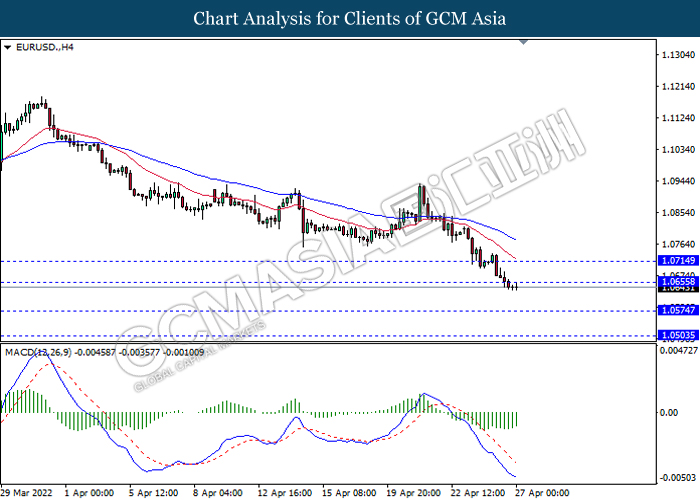

EURUSD extend its losses on Wednesday over the backdrop of the spike of crude oil price. According to Reuters, China’s central bank claimed on Tuesday, which it will step up prudent monetary policy support to its economy as Beijing races to stamp out a nascent COVID-19 outbreak in the capital and avert the same debilitating city-wide lockdown that has shrouded Shanghai for a month. The move from China central bank would boost up economic activities in China, leading to the increasing demand of crude oil. Nonetheless, the surge of crude oil price had brought negative prospects toward Euro. As Europe was one of the dependent on commodities such as crude oil, rising oil price would increase the import costs of companies in Europe region, and it would reduce the profit margin of the companies indirectly. It dialed down the market optimism toward economic progression in Europe region, prompting investors to shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, EURUSD edged up by 0.04% to 1.0640.

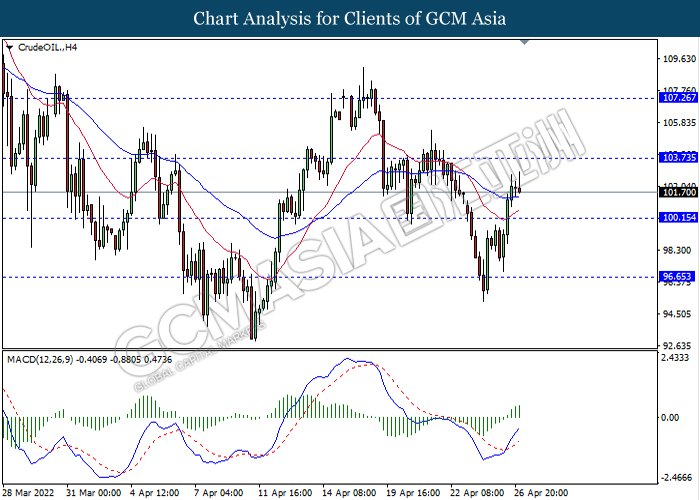

In commodities market, crude oil price rallied by 0.70% to 102.41 per barrel as of writing following the China economic stimulus would likely to increase oil demand. Besides, gold price depreciated by 0.27% to 1898.90 per troy ounces as of writing amid the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | Pending Home Sales (MoM) (Mar) | – | -1.50% | -4.10% |

| 22:30 | Crude Oil Inventories | – | 2.471M | -8.020M |

Technical Analysis

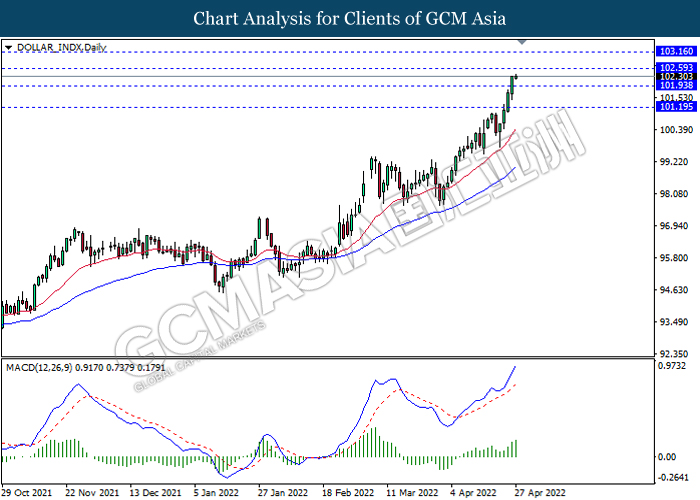

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.60, 103.15

Support level: 101.95, 101.20

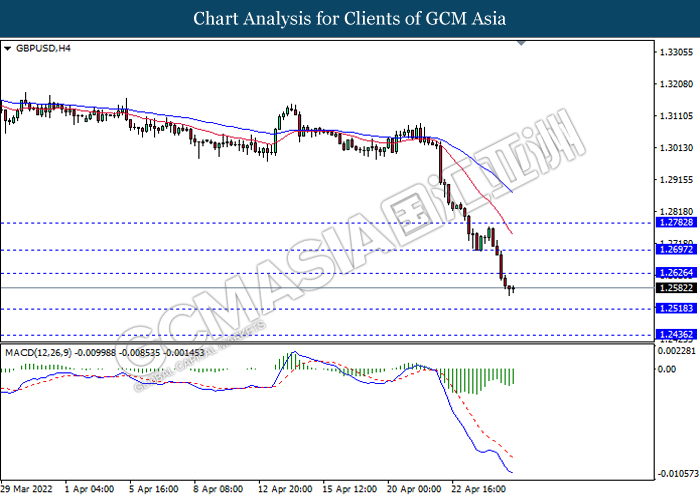

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2625, 1.2695

Support level: 1.2520, 1.2435

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0655, 1.0715

Support level: 1.0575, 1.0505

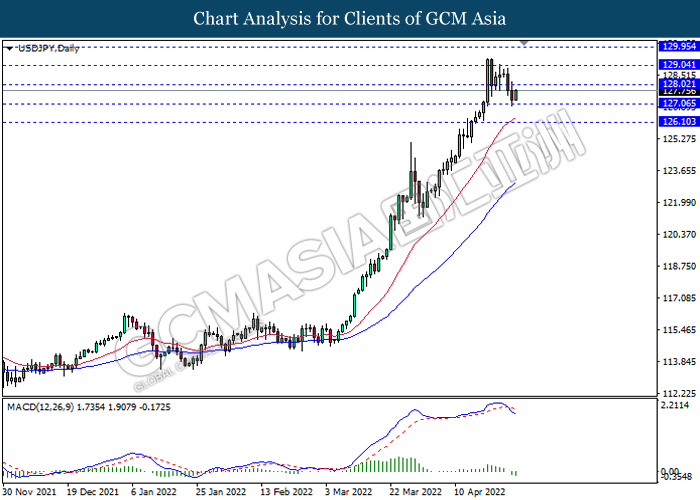

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 128.00, 129.05

Support level: 127.05, 126.10

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7235, 0.7300

Support level: 0.7160, 0.7105

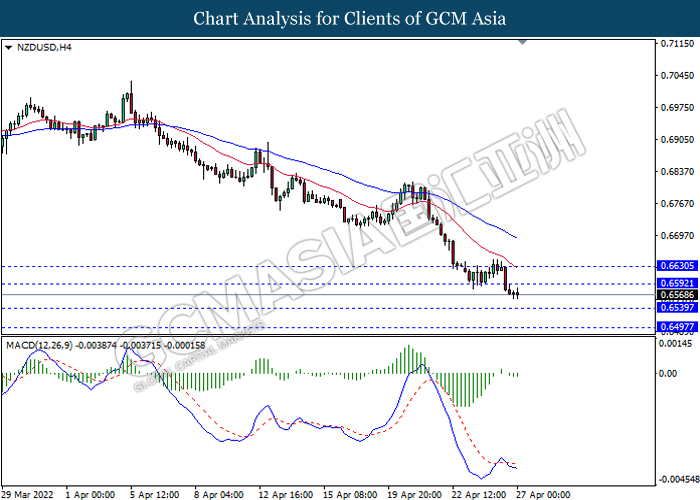

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6590, 0.6630

Support level: 0.6540, 0.6495

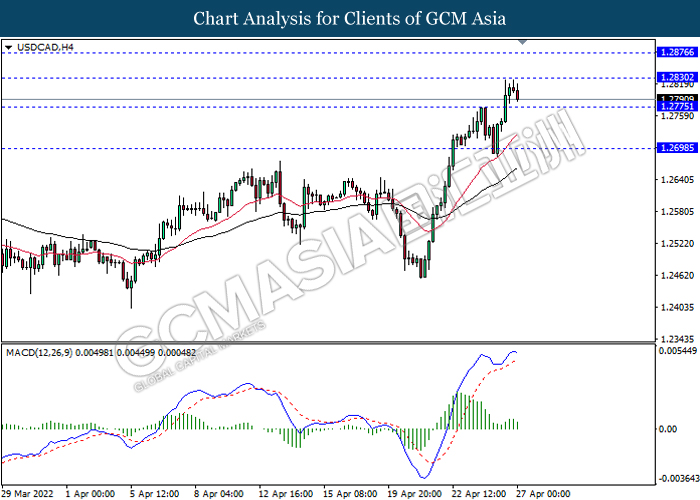

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2830, 1.2875

Support level: 1.2775, 1.2700

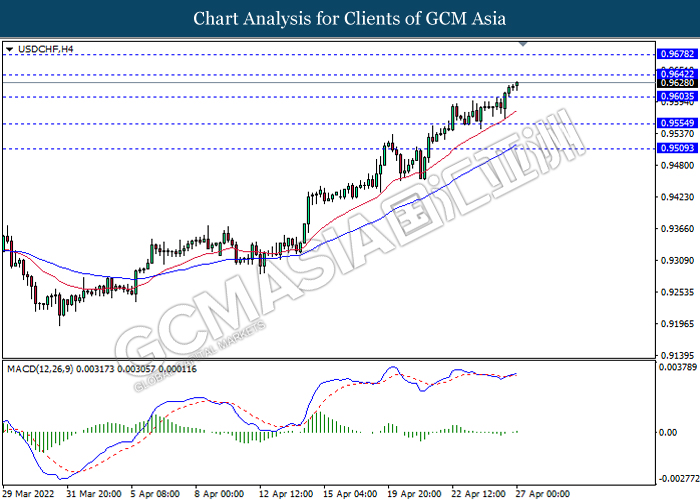

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9640, 0.9680

Support level: 0.9605, 0.9555

CrudeOIL, H4: Crude oil price was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 103.75, 107.25

Support level: 100.15, 96.65

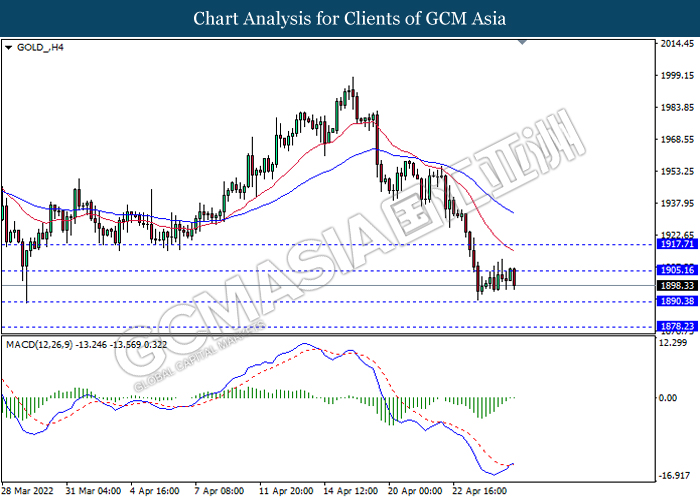

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1905.15, 1917.70

Support level: 1890.40, 1878.25