27 April 2022 Morning Session Analysis

US Dollar appreciated as stagflation risk lingered in global market.

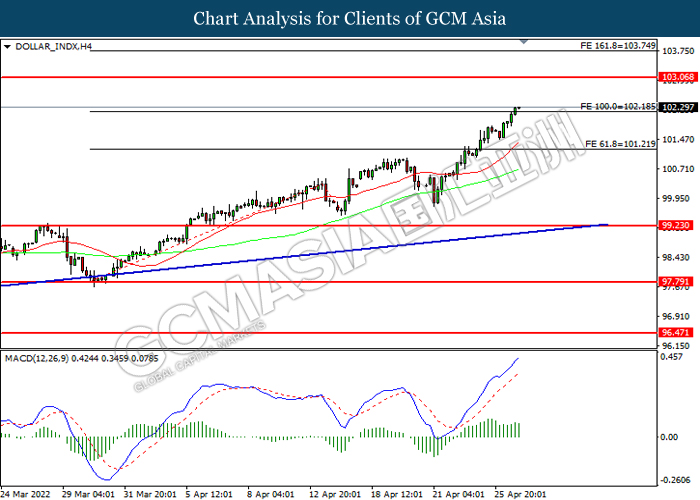

The Dollar Index which traded against a basket of six major currencies surged amid concerns about the recession in the global economic as well as the hawkish expectation upon the Federal Reserve will continue to boost market demand on the safe-haven Dollar. Currently, Beijing had ramped up plans for massive-testing of 20 million people and spurred further worries about a looming lockdown in future in order to combat the spiking number of Covid-19 cases. Besides, the US Stock Index were closing at its lowest level since December 2020 amid the rising US Treasury yield continue to drag down the appeal for the equity market. On the economic data front, the US Dollar extend its gains over the backdrop of upbeat economic data. According to Census Bureau, US Core Durable Goods Orders for last month notched up significantly from the previous reading of -0.5% to 1.1%, exceeding the market forecast at 0.6%. Such upbeat economic data had sparked further inflation risk in future, increasing the probability for the aggressive contractionary monetary policy in future. As of writing, the Dollar Index appreciated by 0.54% to 102.30.

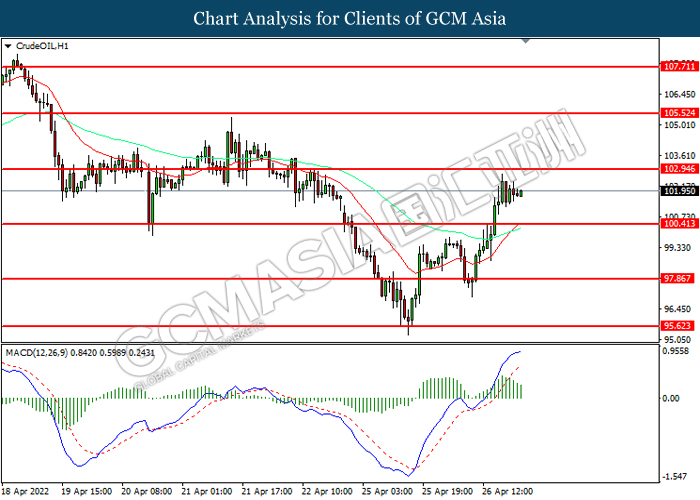

In the commodities market, the crude oil price depreciated by 0.03% to $102.50 during the early Asian trading hours following the released of bearish inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at 4.780M, exceeding the market forecast at 2.167M. On the other hand, the gold market appreciated by 0.03% to $1905.85 per troy ounces amid stagflation risk in the financial market had boosted up market demand on safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | Pending Home Sales (MoM) (Mar) | – | -1.50% | -4.10% |

| 22:30 | Crude Oil Inventories | – | 2.471M | -8.020M |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.05, 103.75

Support level: 101.20, 99.25

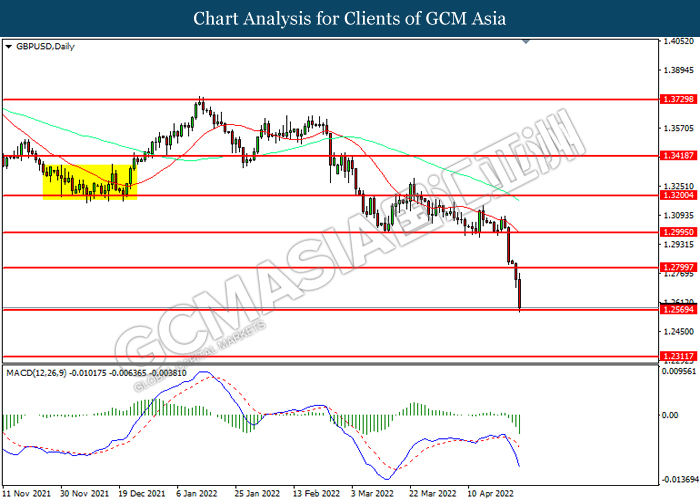

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2800, 1.2995

Support level: 1.2570, 1.2310

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend tis losses toward support level.

Resistance level: 1.0845, 1.1155

Support level: 1.0550, 1.0300

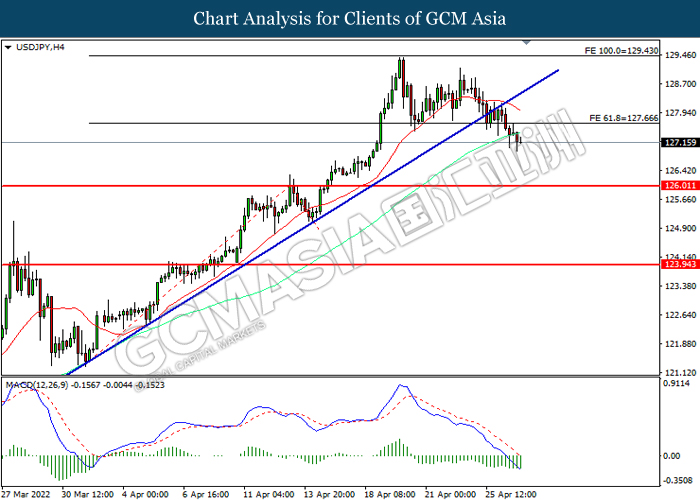

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 127.65, 129.45

Support level: 126.00, 123.95

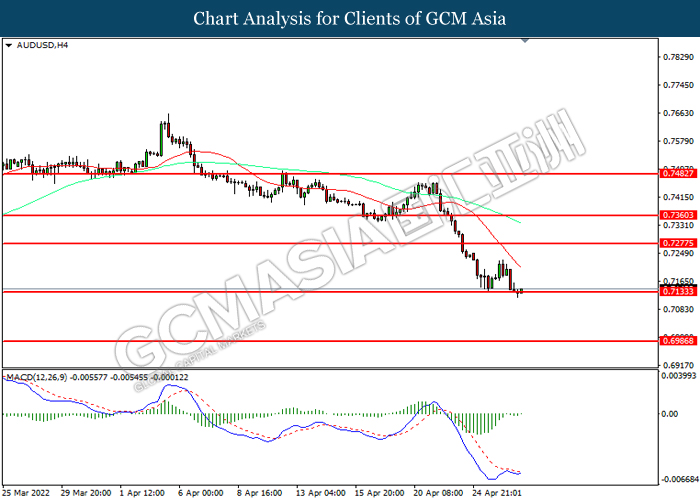

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7280, 0.7360

Support level: 0.7135, 0.6985

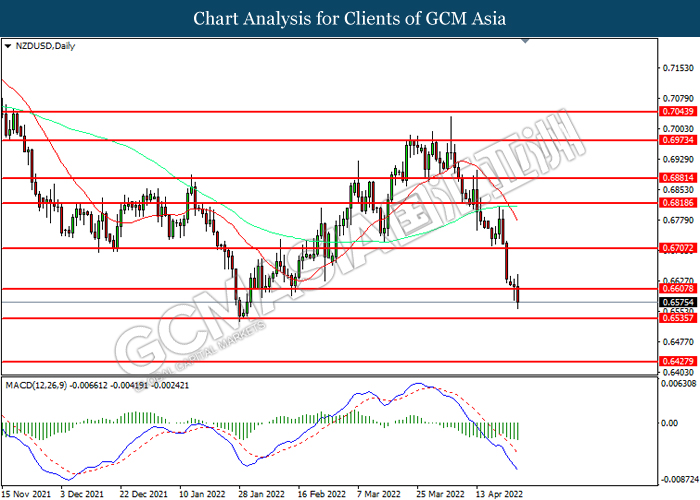

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6820

Support level: 0.6535, 0.6430

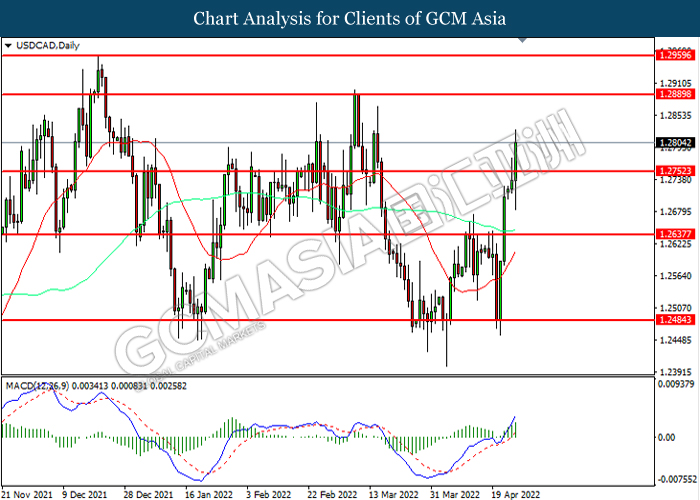

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

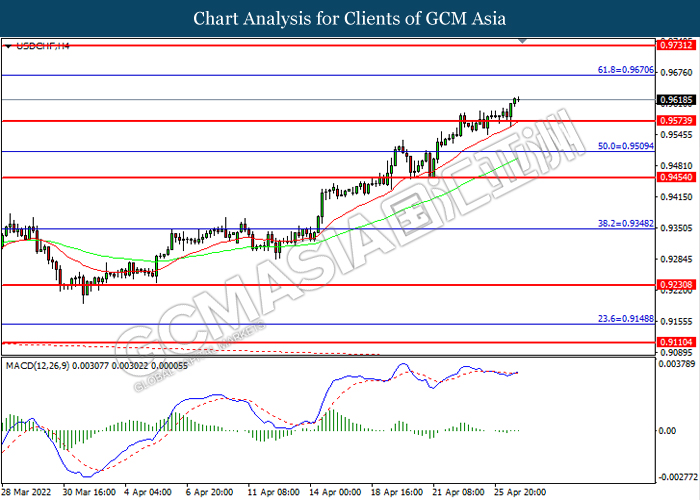

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. Nonetheless, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9670, 0.9730

Support level: 0.9575, 0.9510

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 102.95, 105.50

Support level: 100.40, 97.85

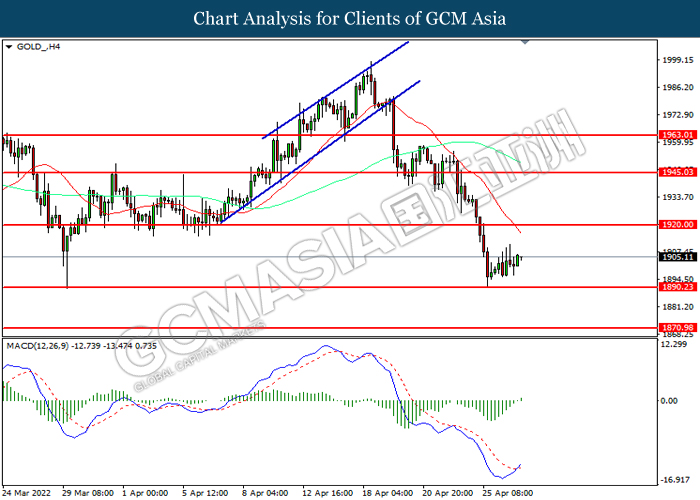

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1920.00, 1945.05

Support level: 1890.25, 1871.00