27 April 2023 Morning Session Analysis

Greenback tumbled as banking jitters remained.

The dollar index, which was traded against a basket of six major currencies, lost its ground yesterday amid the market concern over the banking jitters overshadowed the announcement of positive data in the US. In the US trading session, the First Republic Bank share price plummeted to new all-time low at $5.69 following a report showed that the Federal government and the banking giants are reluctant to lend a hand to First Republic at this point in time. According to the Bloomberg’s report, U.S. bank regulators are considering lowering their private assessment of First Republic, which could result in it facing potential limits on borrowing from the Federal Reserve. Additionally, without the government support, the other banks do not see a way forward if they choose to buy over some of the asset from First Republic Bank. Prior to that, the renewed worries of banking crisis was initiated after First Republic Bank reported deposit outflows of more than $100 billion in the first quarter, or a total of 40%. With the heightening risk of banking crisis in the US, the stronger-than-expected Core Durable Goods data failed to reignite the sentiment in US dollar market. As of writing, the dollar index dropped -0.39% to 101.45.

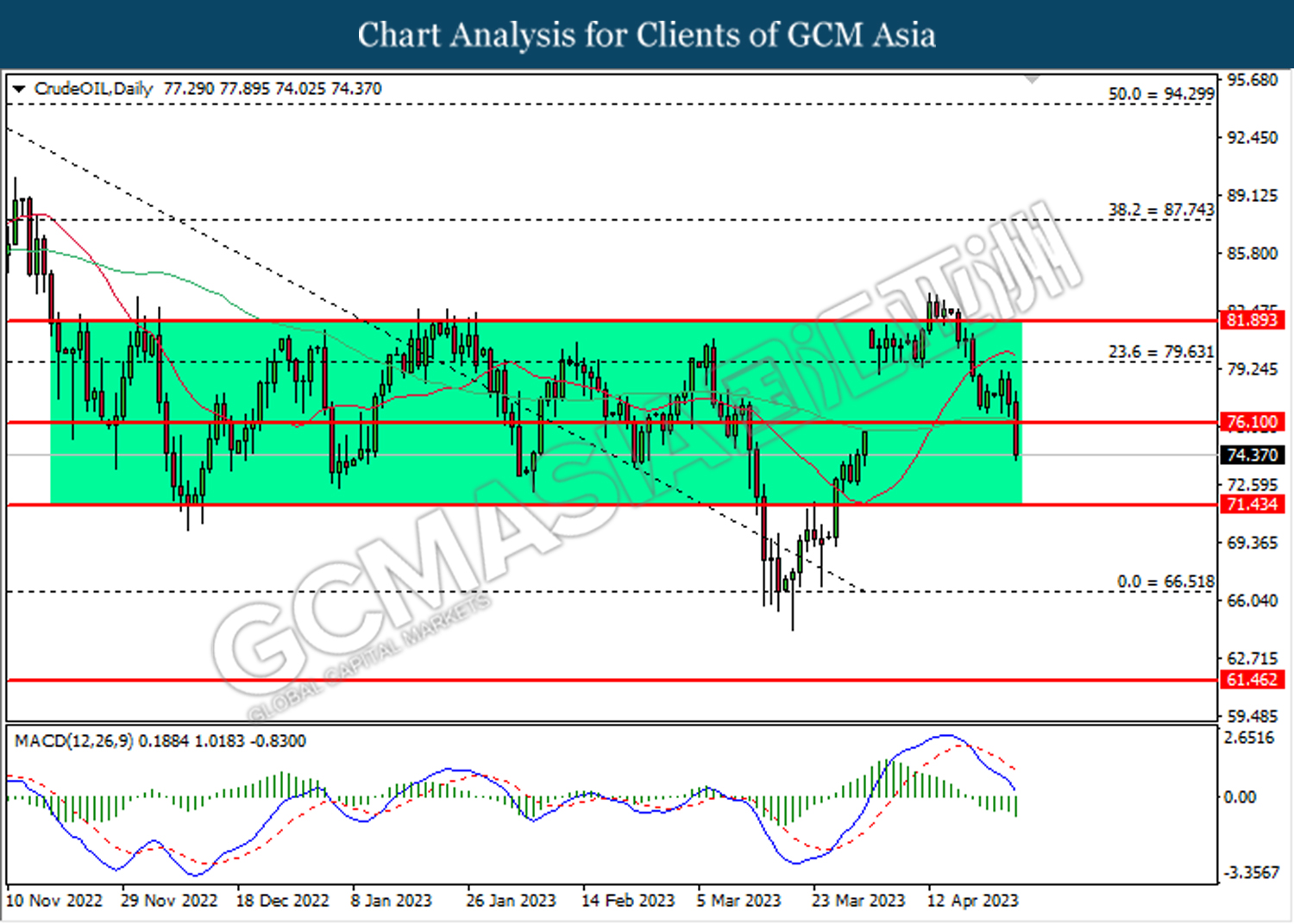

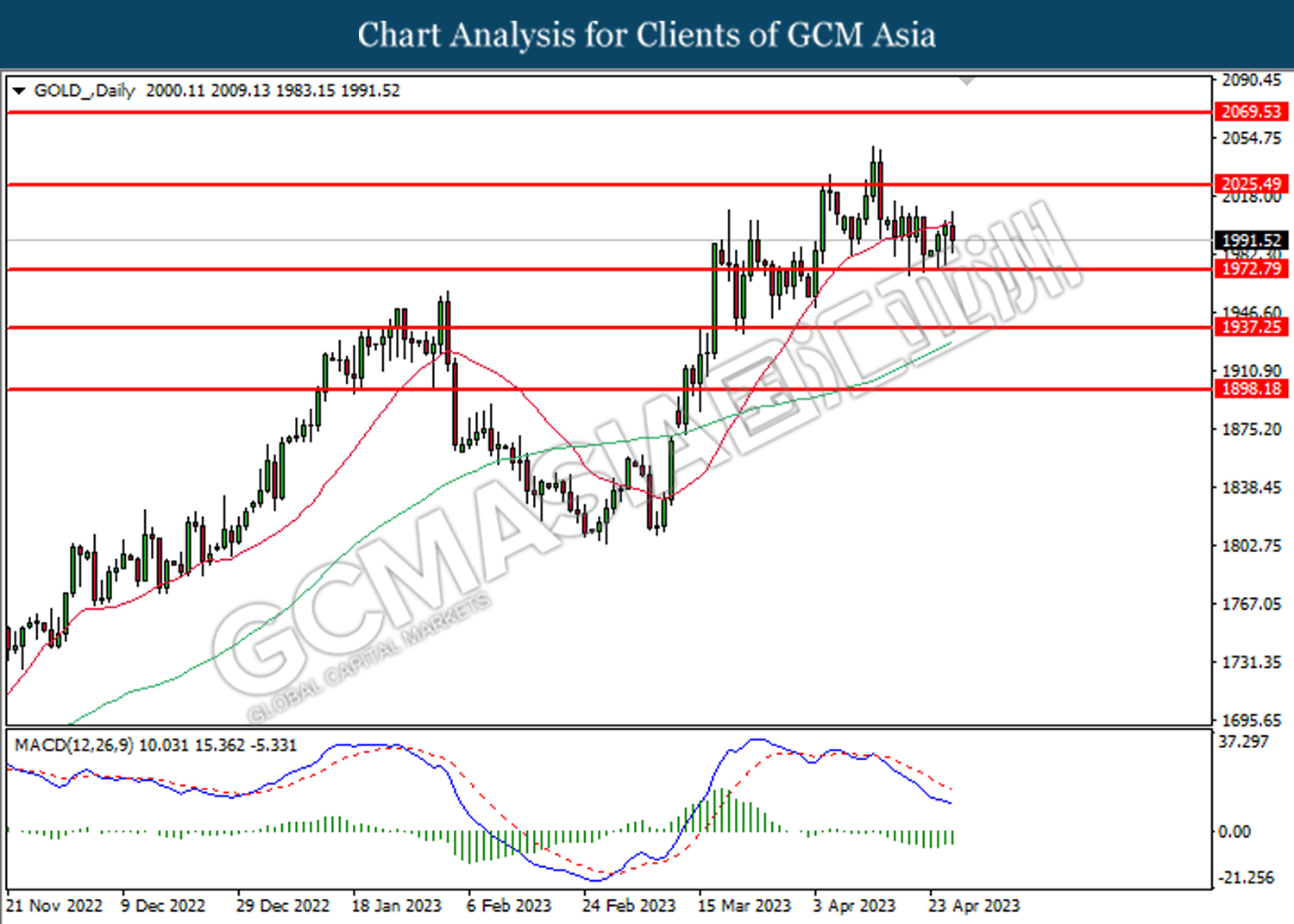

In the commodities market, crude oil prices were down by -0.04% to $74.40 per barrel as the renewed banking fears continued to weigh on the prospect of this black commodity. Besides, gold prices edged up by 0.05% to $1990.30 per troy ounce amid the rising of safe haven demand.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 2.6% | 2.0% | – |

| 20:30 | USD – Initial Jobless Claims | 245K | 248K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Mar) | 0.8% | 0.5% | – |

Technical Analysis

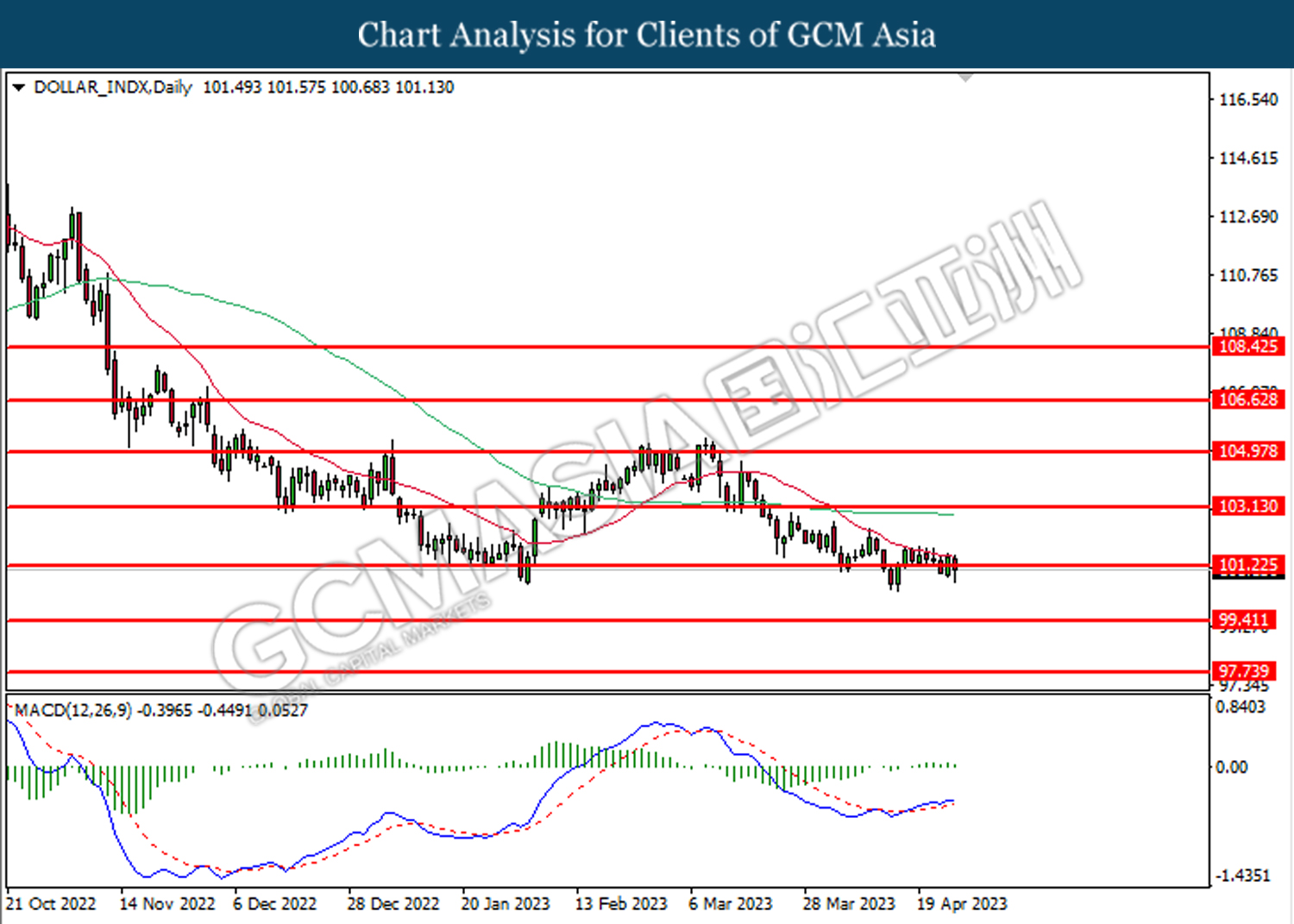

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

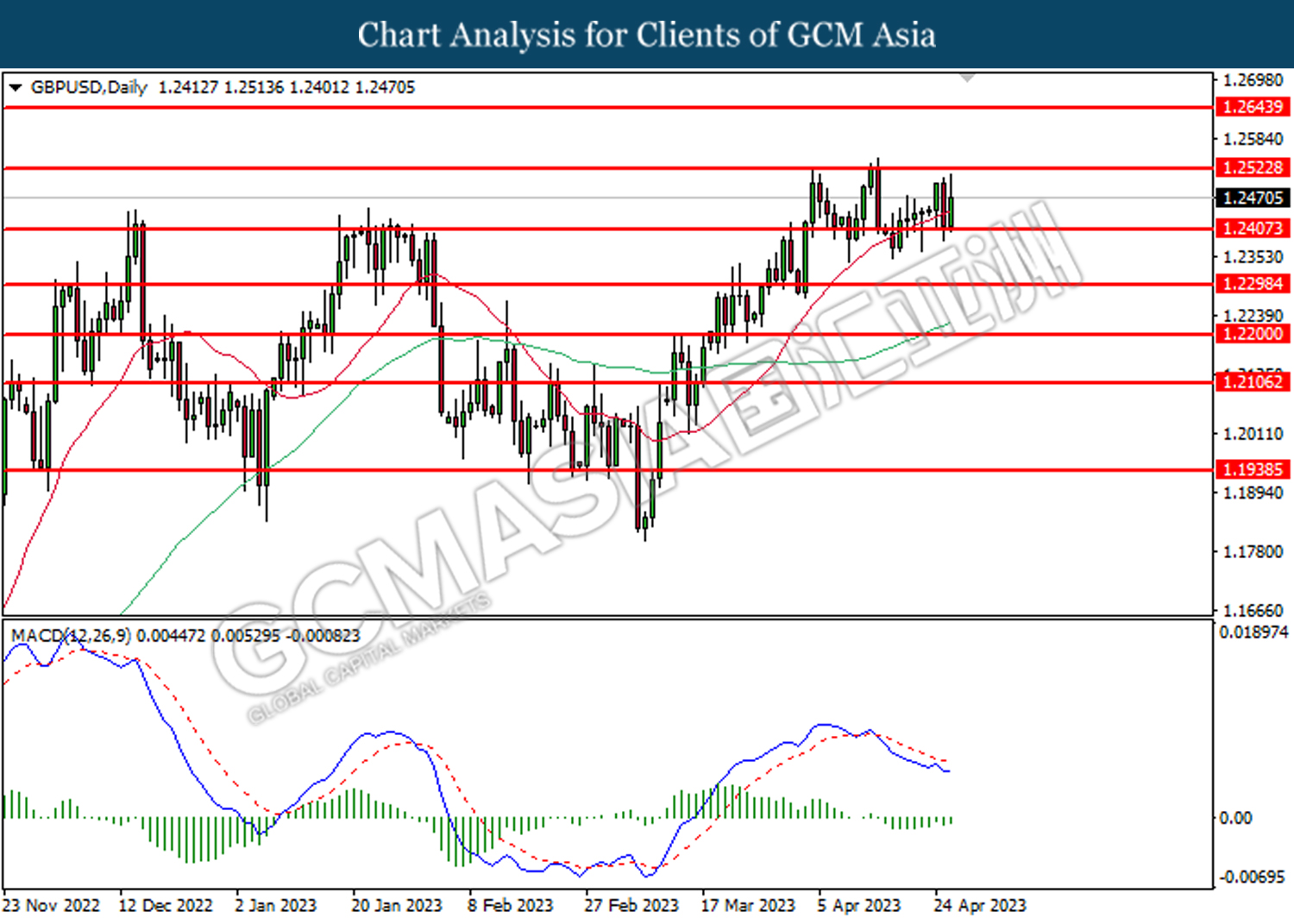

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

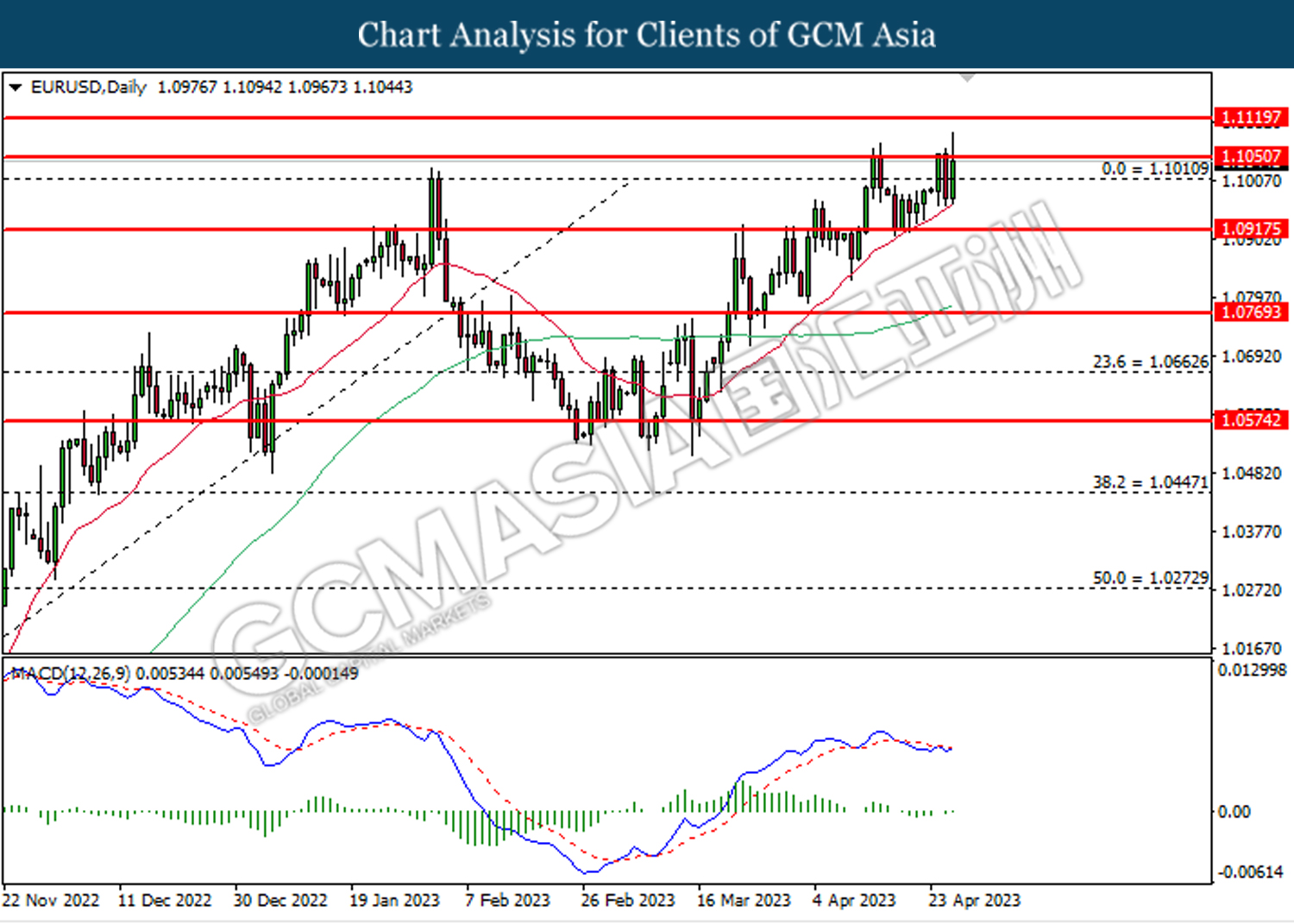

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

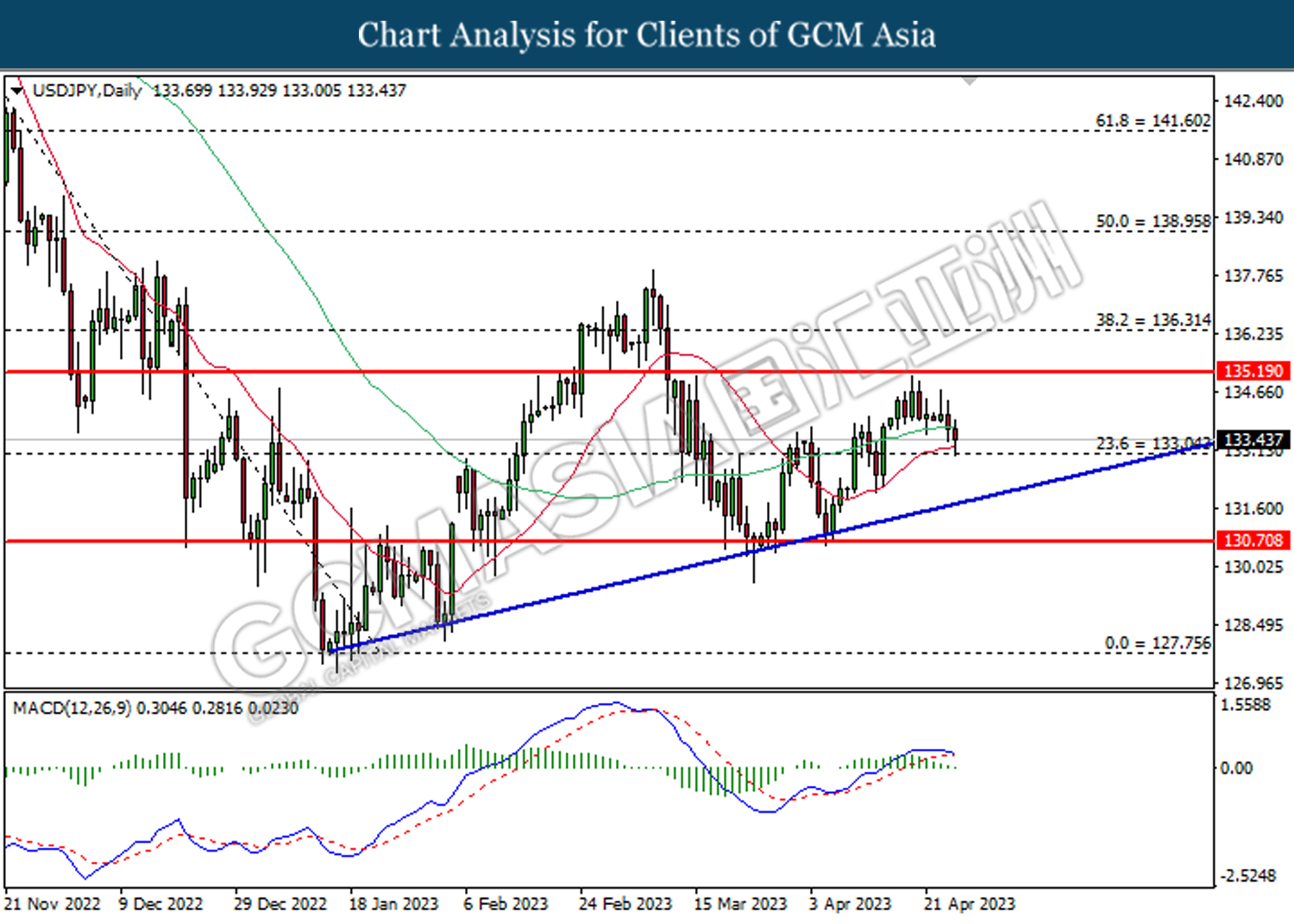

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

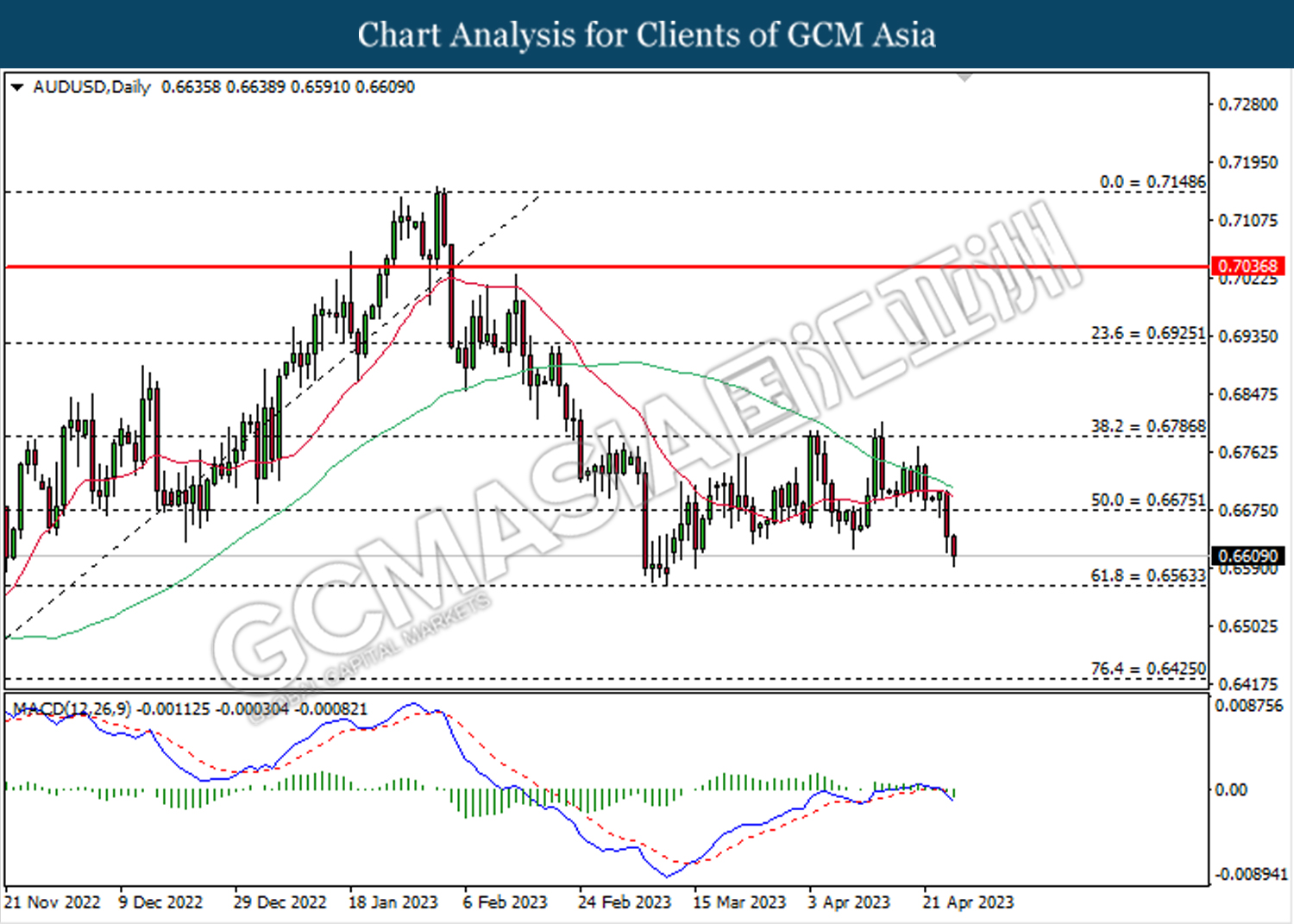

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

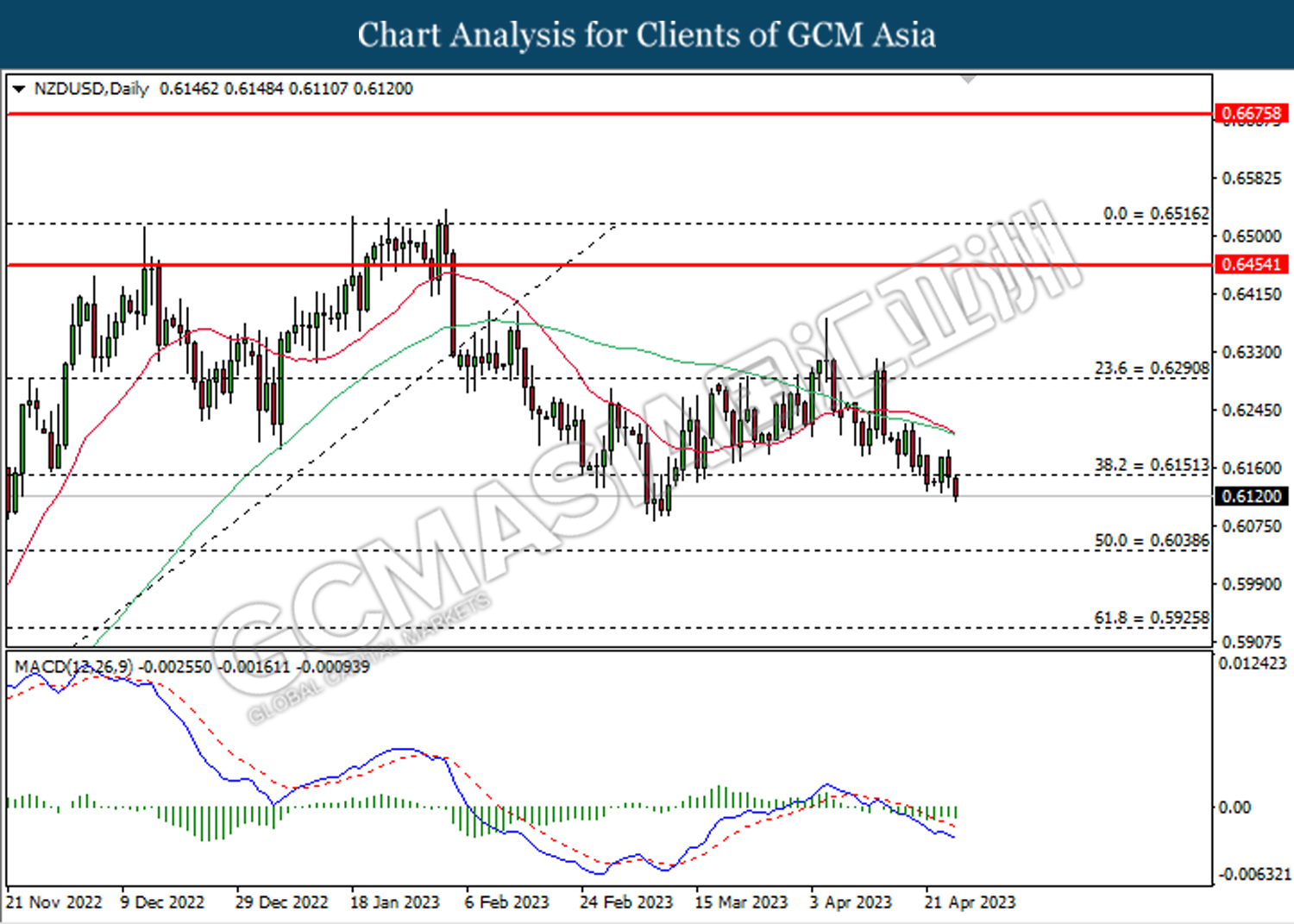

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

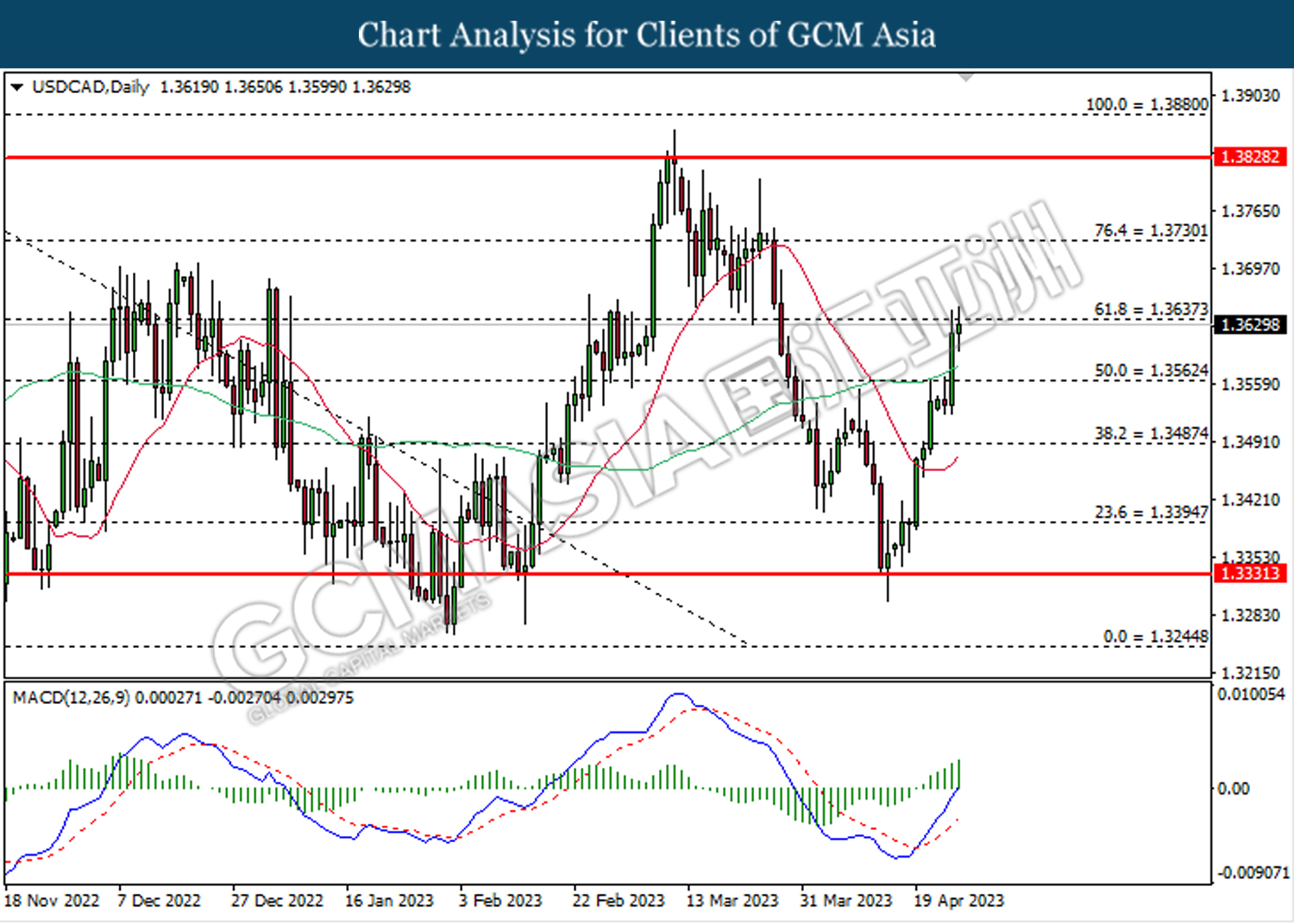

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

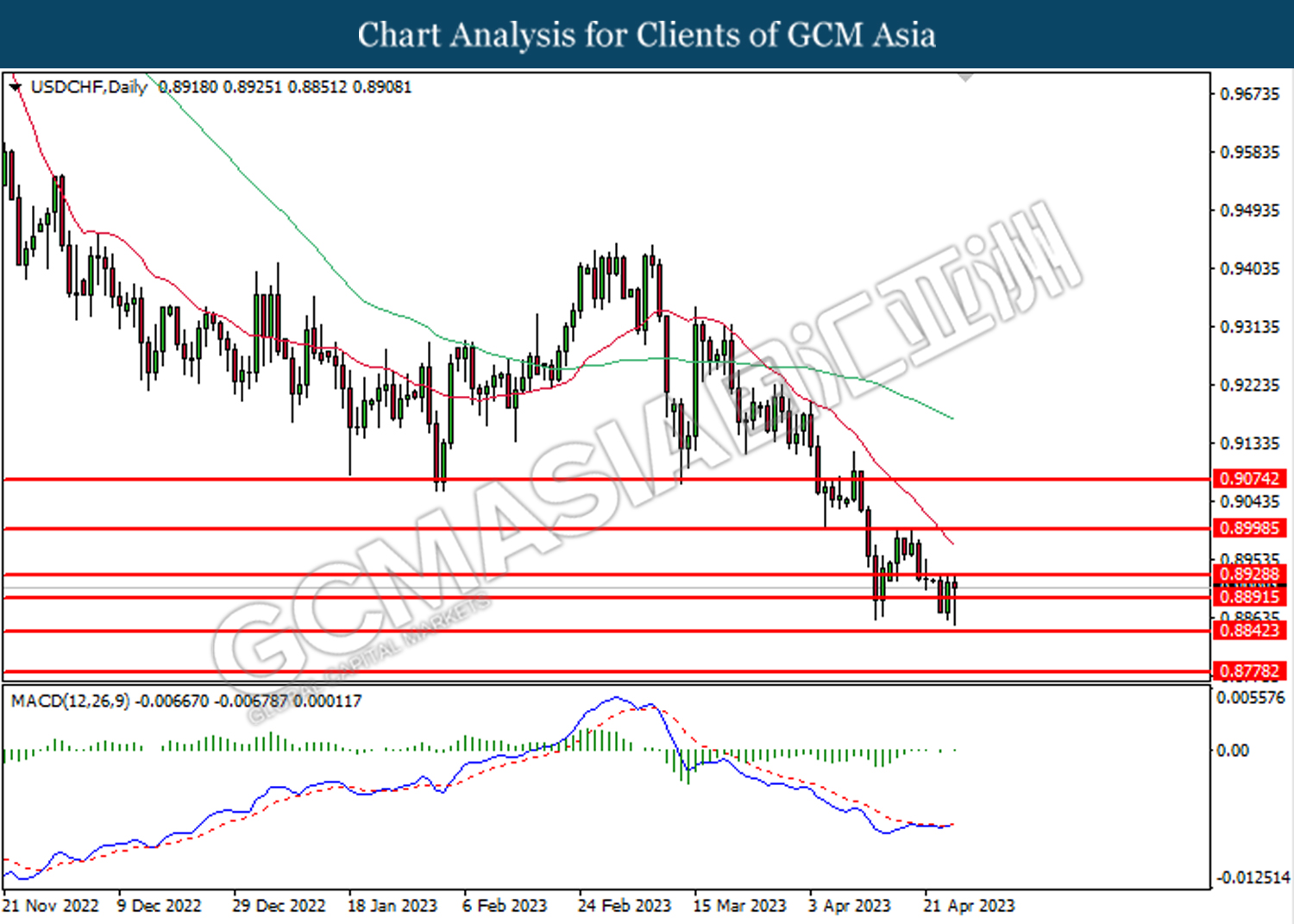

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 79.65, 81.80

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25