27 May 2022 Afternoon Session Analysis

Antipodean surged amid risk-on sentiment in global financial market.

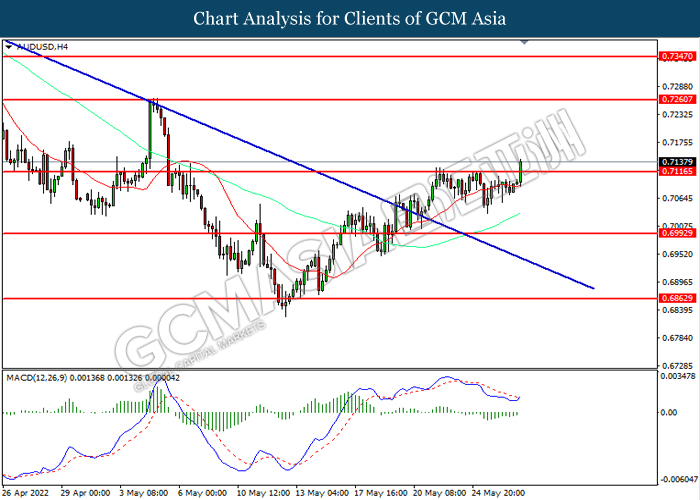

The riskier asset such as the antipodeans (Australia and New Zealand Dollar) surged significantly amid the risk-on sentiment in the global financial market following the bearish economic data eased the rate hike fears from Fed. The US 10-year Treasury yield retreated on yesterday, spurring further bullish momentum on the equity market. Besides, the Chinese-proxy antipodeans extend its gains following the Chinese authorities has pledged to implement expansionary fiscal policy to boost up the economic momentum in China. According to Aljazeera, Beijing will increase annual tax cuts by more than 140 billion yuan to 2.64 trillion yuan, offer tax rebates to more crucial economic sectors. Other measures include 150 billion yuan in emergency bond for aviation sector and another issuance of 300 billion yuan in bonds to fund railway constructions and new projects in energy, transport and water conservation. As of writing, AUD/USD increased by 0.56% to 0.7137 while NZD/USD surged 0.60% to 0.6515.

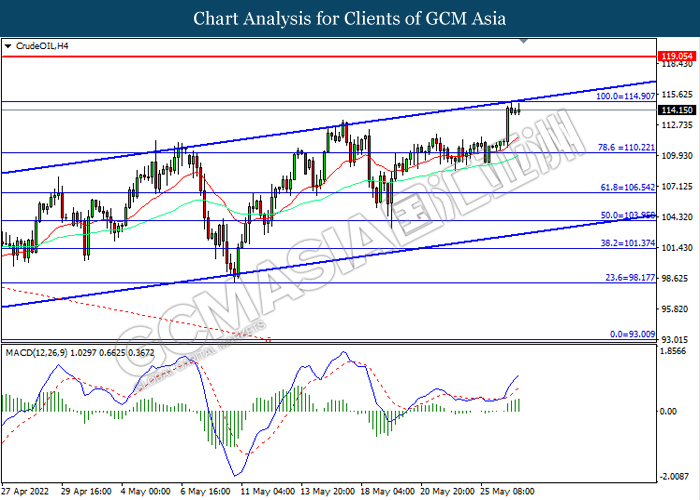

In the commodities market, the crude oil price extends its gains by 0.02% to $114.20 per barrel as of writing. The oil market edged higher amid investors speculated that the European Commission (EU) would continue to seek unanimous support for its proposed new sanction against Russia. On the other hand, the gold price appreciated by 0.14% to $1853.10 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Apr | -0.3% | 0.3% | – |

Technical Analysis

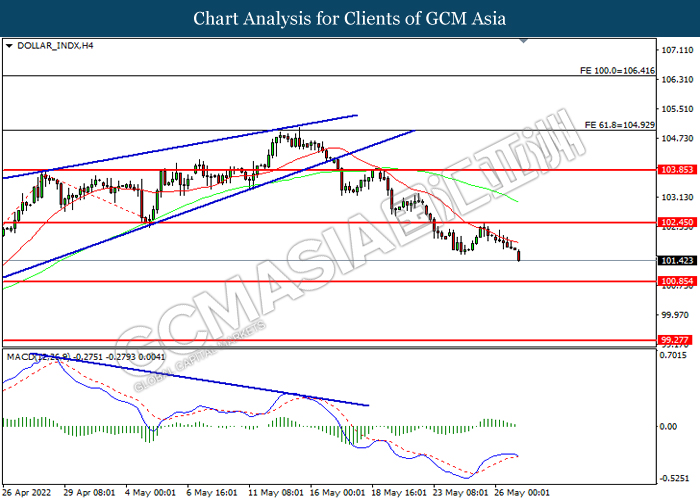

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

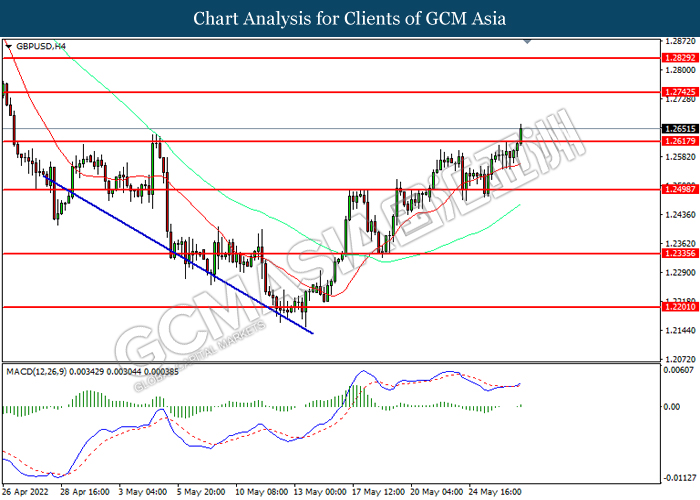

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2745, 1.2830

Support level: 1.2620, 1.2500

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0815, 1.0925

Support level: 1.0660, 1.0585

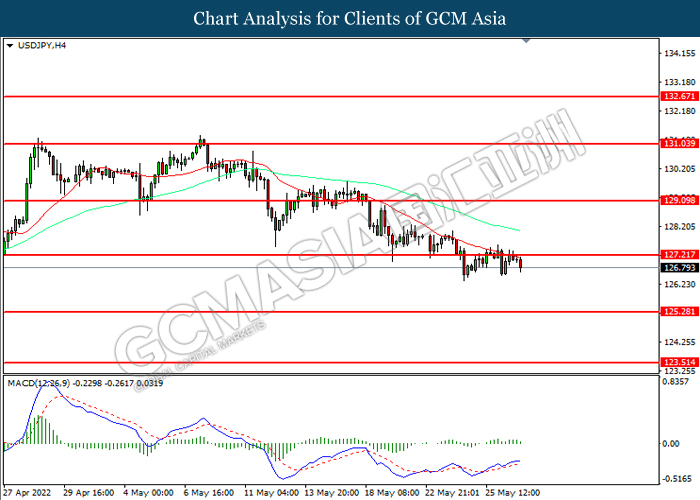

USDJPY, H4: USDJPY was traded within a range while currently near the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 127.20, 129.10

Support level: 125.30, 123.50

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7260, 0.7345

Support level: 0.7115, 0.6995

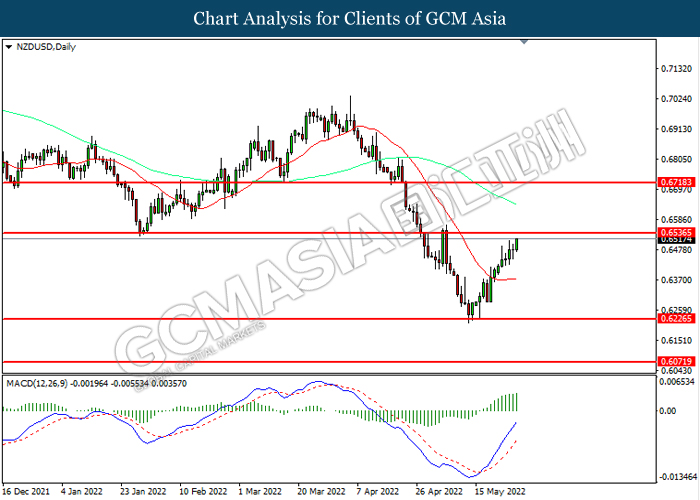

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

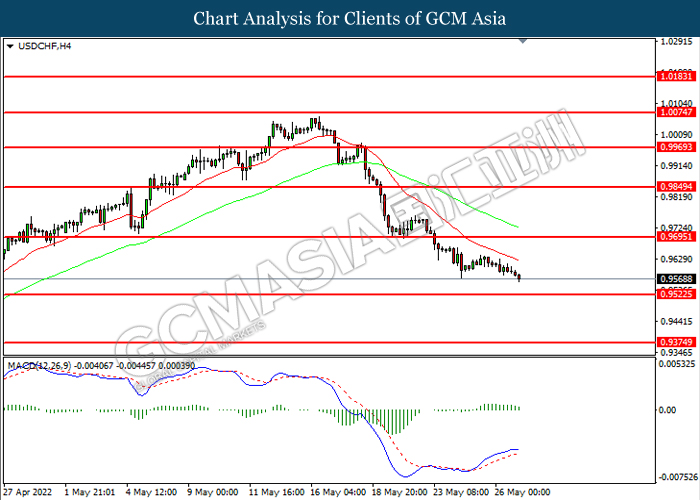

USDCHF, H4: USDCHF was traded lower while currently near the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 114.90, 119.05

Support level: 110.20, 106.55

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1868.70, 1878.95

Support level: 1849.90, 1836.90